Market Overview:

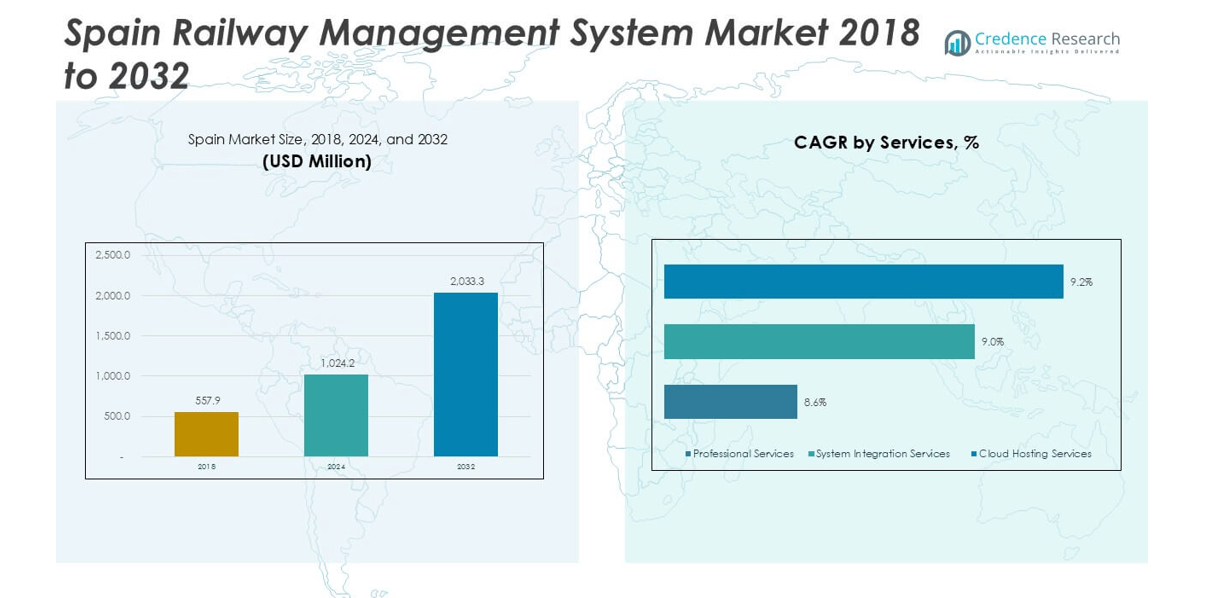

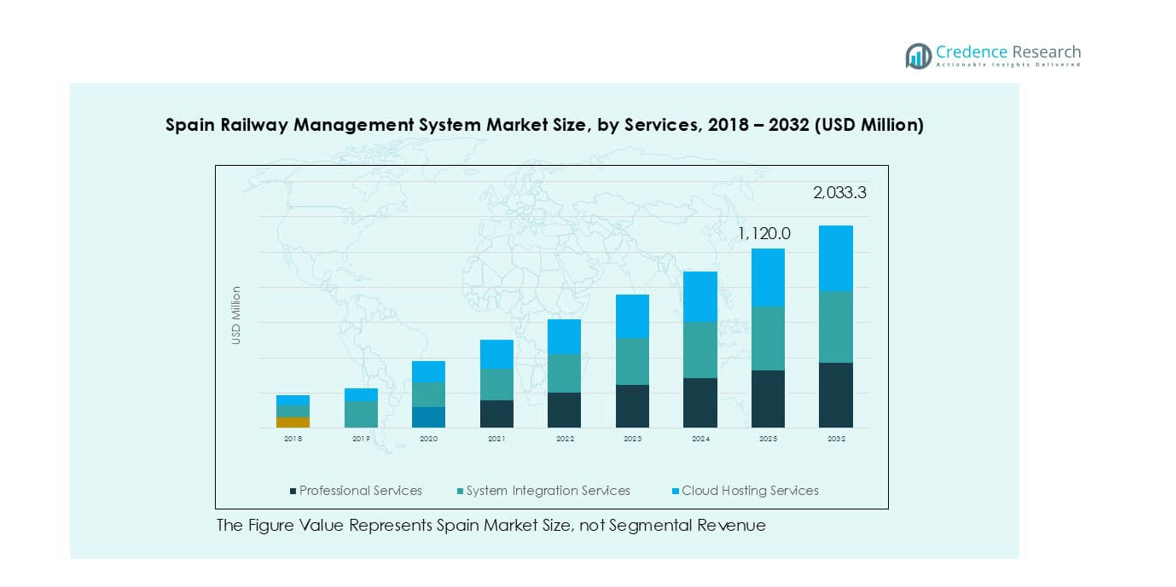

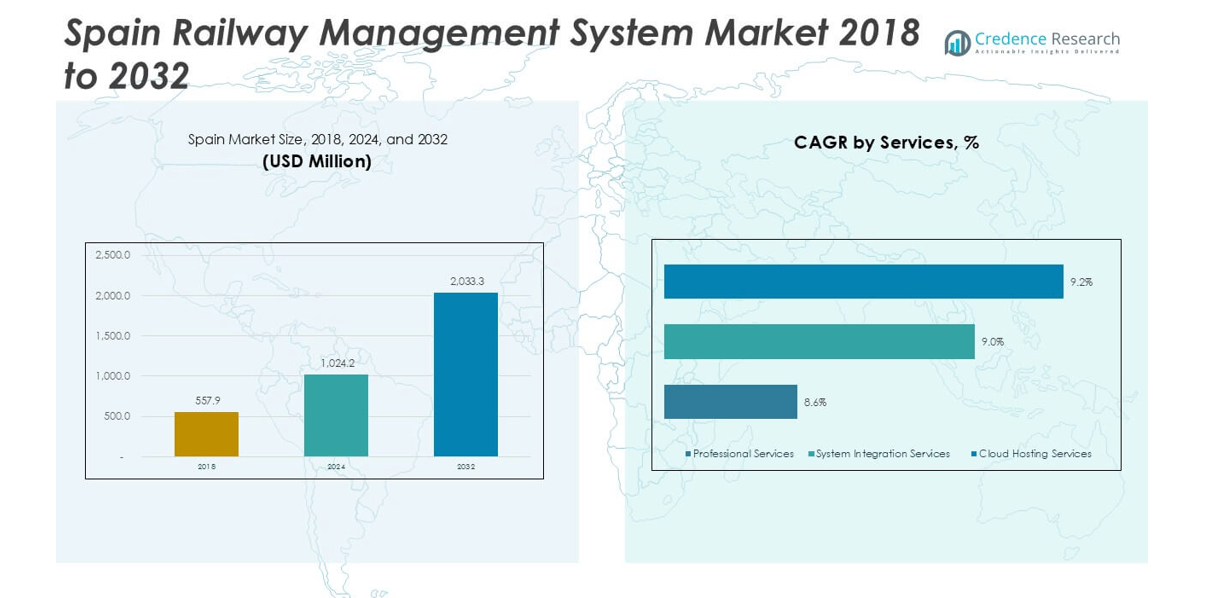

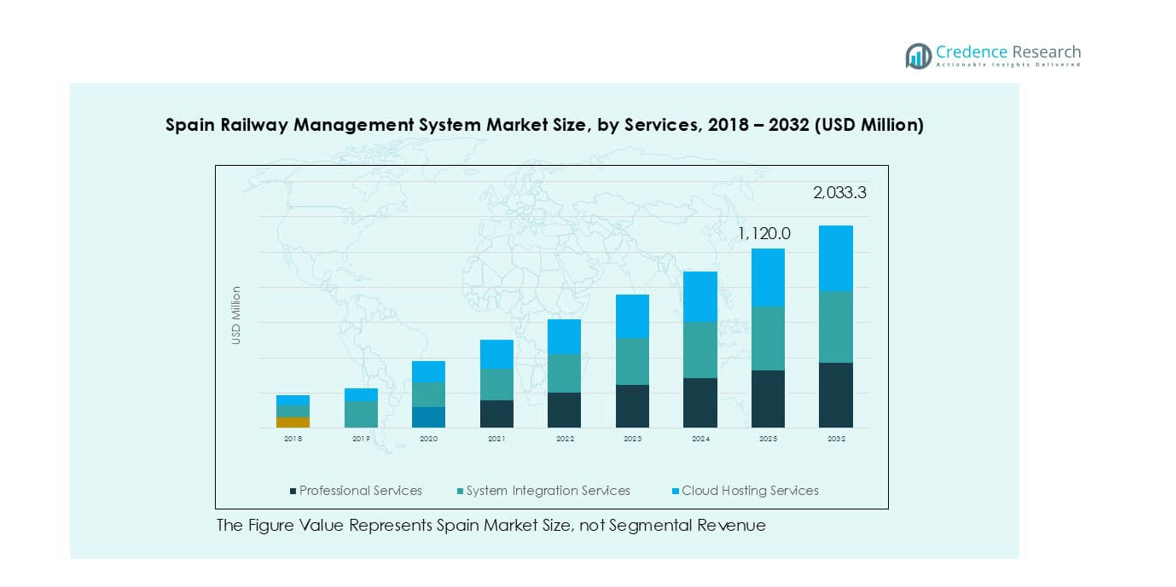

The Spain Railway Management System market size was valued at USD 557.9 million in 2018 and reached USD 1,024.2 million in 2024. It is anticipated to reach USD 2,033.3 million by 2032, growing at a CAGR of 8.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Railway Management System Market Size 2024 |

USD 1,024.2 million |

| Spain Railway Management System Market, CAGR |

8.7% |

| Spain Railway Management System Market Size 2032 |

USD 2,033.3 million |

The Spain Railway Management System market is led by major players such as IBM, Hitachi Ltd., Siemens, Alstom, Construcciones y Auxiliar de Ferrocarriles (CAF), ADIF, DB InfraGO, Segula Technologies, and Indra Sistemas. These companies dominate through advanced service portfolios, digital platforms, and integrated rail management solutions that improve safety, efficiency, and passenger experience. Among regions, Central Spain accounted for the largest share at nearly 35% in 2024, supported by Madrid’s role as the hub of high-speed and intercity rail operations. North Spain followed with 25% share, while East and South Spain captured around 20% each, reflecting strong passenger and freight growth.

Market Insights

- The Spain Railway Management System market was valued at USD 1,024.2 million in 2024 and is projected to reach USD 2,033.3 million by 2032, registering a CAGR of 8.7%.

- Key drivers include expansion of the high-speed rail network, rising investments in digitalization, and increasing focus on passenger safety and operational efficiency across Spain’s rail infrastructure.

- Major trends include the adoption of cloud hosting services, integration of AI and IoT for predictive maintenance, and rising demand for real-time traffic and asset management solutions.

- The competitive landscape features leading players such as IBM, Hitachi Ltd., Siemens, Alstom, CAF, ADIF, Indra Sistemas, and DB InfraGO, focusing on service innovation, digital signaling, and integrated platforms.

- Regionally, Central Spain led with 35% share in 2024, followed by North Spain at 25%, while East and South Spain accounted for 20% each. By services, professional services dominated with over 40% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Services

Professional services accounted for the largest share of the Spain railway management system market in 2024, holding over 40% of total revenue. Their dominance is linked to the strong demand for consulting, training, and maintenance support across both passenger and freight networks. The complexity of integrating advanced digital platforms in legacy rail infrastructure has further fueled demand for these services. System integration services follow closely, driven by the need for unified platforms enabling seamless coordination across rail operations. Cloud hosting services, while smaller in share, are gaining traction as operators shift toward scalable, cost-efficient, and secure digital environments.

- For instance, Indra Sistemas supported Adif in deploying its Da Vinci traffic control platform across 2,300 km of high-speed lines, integrating real-time data from 25 control centers.

By System & Solution

Rail traffic management systems held the leading share in 2024, contributing nearly 35% of the Spain market. This dominance comes from rising investments in real-time monitoring, advanced signaling, and scheduling platforms that improve passenger safety and operational efficiency. Rail operations management systems also registered significant growth, as Spain’s rail operators focus on enhancing ticketing, scheduling, and passenger information systems. Asset management systems are expanding steadily, driven by the need to track rolling stock and infrastructure health. Rail control systems accounted for around 30% of market revenue in 2024, making them a dominant sub-segment within system and solution offerings. Their adoption is fueled by increasing automation, integration of signaling technologies, and requirements to meet EU rail safety regulations. These systems enhance speed regulation, minimize collision risks, and ensure compliance with interoperability standards across cross-border networks. Rail maintenance management systems, although smaller in share, are showing strong growth potential.

- For instance, Alstom signed a contract to upgrade the signaling on Line 6 of the Madrid Metro to enable driverless operation. This project is unrelated to the high-speed Madrid–Seville line.

Key Growth Drivers

Rising Investments in Railway Digitalization

Spain has been steadily increasing investments in railway digitalization, which is a major driver for the growth of the railway management system market. Government support and European Union funding programs encourage the adoption of advanced rail technologies. Digital platforms improve passenger experience by integrating ticketing, scheduling, and passenger information systems into a single network. Operators are also investing in real-time monitoring, data analytics, and predictive maintenance solutions to enhance operational efficiency. These advancements reduce delays and operational costs, while also meeting rising passenger expectations. Growing emphasis on smart mobility solutions further strengthens the role of digitalization as a core growth factor.

- For instance, Spanish rail operator Adif is making significant investments in the digitalization of its network, with funding from the EU’s Recovery, Transformation, and Resilience Plan, as part of a multi-year effort to modernize its infrastructure. In 2024, Adif announced and awarded numerous contracts for upgrades to signaling, traffic control, and communications systems.

Expansion of High-Speed Rail Network

Spain operates one of the largest high-speed rail networks in Europe, and its expansion continues to drive demand for railway management systems. With ongoing projects to extend connections between major cities and regional hubs, there is an increasing need for advanced traffic control and operations management systems. High-speed rail requires precise scheduling, signaling, and control solutions to ensure safety at higher operating speeds. Demand for automation and interoperability solutions is also growing to meet EU standards. The network’s growth also boosts associated services, such as asset management systems and maintenance management tools, ensuring long-term efficiency and reliability.

- For instance, in 2024, Renfe enhanced its high-speed offerings by launching new AVE services to Galicia and Asturias using the new S106 “Avril” trains, which enabled shorter journey times.

Focus on Passenger Safety and Operational Efficiency

Passenger safety and system efficiency remain central to Spain’s rail strategy. Railway management systems play a crucial role in minimizing accidents, preventing collisions, and ensuring regulatory compliance. Increasing adoption of real-time monitoring, communication-based train control, and advanced signaling systems addresses these concerns. Operators also rely on predictive analytics to identify maintenance needs before failures occur, reducing service disruptions and improving passenger trust. Safety-driven investments further expand demand for integrated traffic management and rail control systems. With railways considered an essential part of sustainable transport, ensuring safe, reliable, and efficient operations directly boosts market growth.

Key Trends & Opportunities

Adoption of Cloud-Based Railway Management Solutions

The transition toward cloud-based systems is reshaping Spain’s railway management market. Operators increasingly use cloud hosting services to streamline data storage, analytics, and system integration. Cloud platforms offer scalability, cost savings, and flexibility, making them highly attractive for both large networks and smaller regional operators. Additionally, cloud solutions facilitate real-time communication between multiple systems, ensuring seamless coordination across passenger services, asset management, and maintenance operations. This trend is expected to continue as Spain modernizes its infrastructure and aligns with EU digitalization initiatives. Growing reliance on cloud technology creates strong opportunities for providers offering secure and compliant hosting platforms.

- For instance, Indra Sistemas is a long-term technology partner for Adif, developing crucial railway management systems like the Da Vinci traffic management platform for Spain’s high-speed rail lines and the newer Sitra+ system for the entire Spanish rail network.

Integration of IoT and AI in Railway Operations

The use of IoT and AI technologies is emerging as a transformative trend in the Spain railway management system market. IoT-enabled sensors and connected devices allow operators to monitor track conditions, rolling stock health, and passenger flows in real-time. AI-powered analytics help predict failures, optimize train schedules, and enhance safety measures. The integration of these technologies improves efficiency while reducing operational costs. Spain’s commitment to smart mobility initiatives and sustainable transportation makes AI and IoT critical enablers. These innovations open opportunities for technology providers to deliver intelligent, data-driven solutions that align with the needs of modern railway networks.

Key Challenges

High Implementation and Integration Costs

Despite strong growth potential, the high cost of implementing advanced railway management systems remains a major challenge. Integrating new digital solutions into existing infrastructure requires significant capital investment. System integration, training, and long-term maintenance also add financial pressure, especially for regional operators with limited budgets. Legacy systems still in use across parts of Spain’s network complicate the integration process. While funding support from the EU helps, the financial burden can delay adoption. Cost barriers particularly impact smaller projects, slowing overall digitalization progress and creating uneven adoption across different regions of the country.

Cybersecurity and Data Privacy Concerns

As Spain’s railway network becomes increasingly digital and connected, cybersecurity risks grow significantly. Cloud hosting, IoT devices, and real-time monitoring systems create multiple access points for potential cyberattacks. Data breaches or system failures could disrupt passenger services, compromise safety, and damage operator reputation. The challenge lies in ensuring strong cybersecurity frameworks while balancing cost and operational efficiency. Compliance with EU data protection and cybersecurity regulations further adds complexity for operators. Building resilient, secure railway management systems is essential, but it requires sustained investment, advanced technologies, and skilled workforce, making it a persistent challenge for the market.

Regional Analysis

North Spain

North Spain held around 25% of the railway management system market share in 2024, supported by strong investments in regional connectivity and cross-border links with France. High passenger traffic routes such as Bilbao–San Sebastián and Pamplona are driving adoption of traffic management and asset monitoring systems. The emphasis on integrating digital ticketing and operations platforms has further boosted demand in this region. Growing freight activity across Basque industrial hubs also creates opportunities for advanced control and predictive maintenance solutions, ensuring both efficiency and safety in operations.

Central Spain

Central Spain accounted for the largest share at nearly 35% of the market in 2024, led by Madrid as the country’s primary rail hub. The concentration of high-speed rail operations, intercity routes, and long-distance services places heavy demand on traffic control and operations management systems. Investments in digital signaling and asset lifecycle management are crucial here to manage high passenger density. Central Spain’s role as the logistical heart of the network continues to attract government and private investment in cloud hosting, predictive maintenance, and safety-driven rail control systems.

East Spain

East Spain represented about 20% of the railway management system market share in 2024, driven by the dense passenger flows between Barcelona, Valencia, and other Mediterranean cities. The region’s high-speed corridors and commuter lines demand advanced traffic management and operations platforms to ensure punctuality and efficiency. Port-related freight activity in Valencia and Tarragona further strengthens demand for rail asset management systems. Adoption of digital passenger information systems and integrated ticketing continues to grow as urban populations expand. Strong tourism inflows also highlight the importance of reliable digital platforms in this region.

South Spain

South Spain contributed close to 20% of the market share in 2024, fueled by ongoing high-speed rail expansion linking Seville, Málaga, and Granada. The Andalusian region places emphasis on improving passenger experience and safety, which drives adoption of rail control and traffic management solutions. Freight corridors connecting agricultural and industrial hubs with ports in Cádiz and Algeciras also support demand for asset monitoring and predictive maintenance systems. Rising urbanization and tourism in the south further reinforce the need for modern railway management solutions, aligning with Spain’s broader smart mobility and sustainability goals.

Market Segmentations:

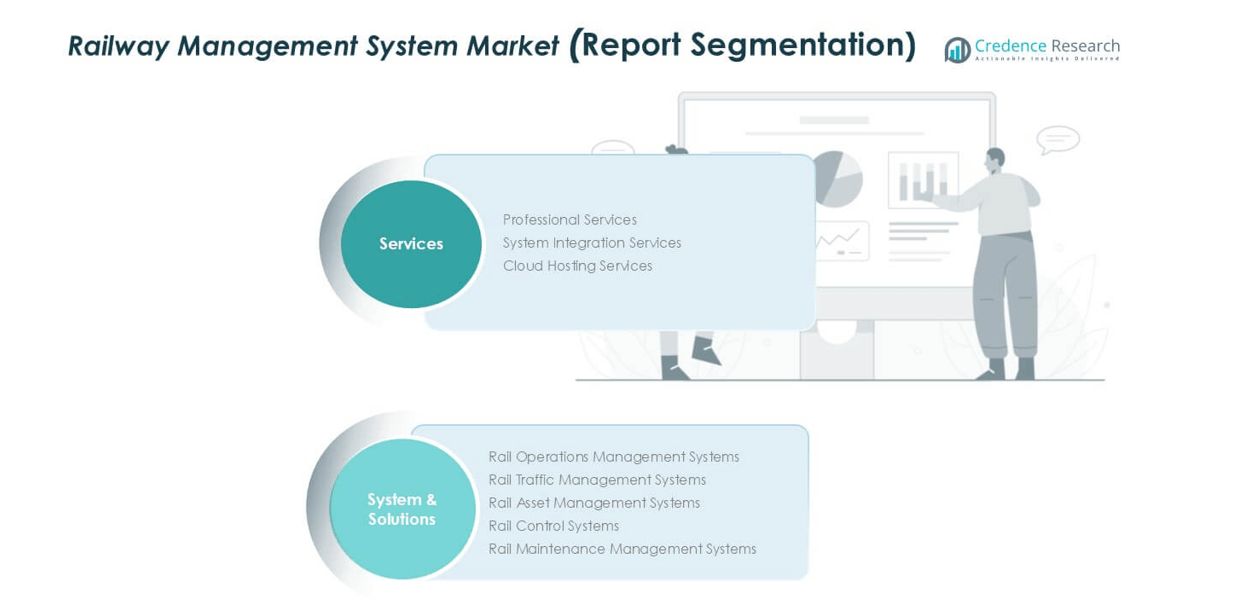

By Services

- Professional Services

- System Integration Services

- Cloud Hosting Services

By System & Solution

- Rail Operations Management Systems

- Rail Traffic Management Systems

- Rail Asset Management Systems

- Rail Control Systems

- Rail Maintenance Management Systems

By Geography

- North Spain

- Central Spain

- East Spain

- South Spain

Competitive Landscape

The competitive landscape of the Spain Railway Management System market is defined by the presence of global technology leaders and domestic operators driving innovation and modernization. Companies such as IBM, Hitachi Ltd., Siemens, and Alstom hold strong positions due to their expertise in digital platforms, signaling systems, and rail automation solutions. Local firms including Construcciones y Auxiliar de Ferrocarriles (CAF), ADIF, and Indra Sistemas play a crucial role in supplying region-specific solutions and infrastructure management. Emerging players like Segula Technologies also contribute by offering engineering and integration services. Partnerships between international vendors and domestic operators are expanding to meet the rising demand for cloud hosting, predictive maintenance, and intelligent traffic management. Financial stability, continuous innovation, and regulatory compliance remain key factors shaping competition. As Spain continues expanding its high-speed and regional rail networks, companies focus on strengthening service portfolios, adopting sustainable practices, and aligning strategies with EU transport modernization goals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IBM

- Hitachi Ltd.

- Siemens

- Alstom

- Construcciones y Auxiliar de Ferrocarriles, S.A

- ADIF

- DB InfraGO

- Segula Technologies

- Indra Sistemas

- Other Key Players

Recent Developments

- In June 2025, Network Rail and partners launched Project Reach to install 1,000 km of fiber along major UK routes, alleviating coverage gaps and improving backhaul for digital applications.

- In May 2025, Nokia and Alstom secured a EUR 106 million (USD 120 million) private-wireless order for India’s Delhi–Meerut high-speed corridor, validating LTE/5G traction for train-to-ground connectivity.

- In October 2024, Hitachi Rail was selected to implement a Mobility-as-a-Service (MaaS) solution for Etihad Rail, which is responsible for developing and operating the UAE’s National Railway Network. This initiative will cover a 900-kilometer railway stretching from Ghuweifat, near the Saudi border, to Fujairah, providing an integrated digital platform aimed at enhancing passenger mobility. The MaaS solution will serve as a unified access point for passengers, managing various services such as ticket booking, journey planning, and payment processing.

- In September 2024, Indra entered into a collaboration with Lithuanian Railways to develop a pioneering digital signalling interlocking system. The primary goal is to create a digital interlocking device that adheres to open standards and is compatible with the European ERTMS Level-2 signalling system. This compatibility aims to enhance safety and efficiency across railway networks in Europe.

Report Coverage

The research report offers an in-depth analysis based on Services, System & Solution and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Spain railway management system market will expand steadily with digital transformation initiatives.

- High-speed rail projects will continue to drive demand for advanced traffic management solutions.

- Cloud-based platforms will gain wider adoption due to scalability and cost efficiency.

- Predictive maintenance systems will see strong growth as operators reduce downtime.

- AI and IoT integration will enhance real-time monitoring and operational efficiency.

- Passenger-centric solutions such as smart ticketing and digital information systems will increase.

- Regional rail upgrades will fuel investments in control and asset management systems.

- Cybersecurity measures will become critical as digital connectivity expands across networks.

- Public-private partnerships will strengthen modernization and innovation efforts in the sector.

- Sustainable mobility goals will align the market with EU regulations and funding programs.