Market Overview:

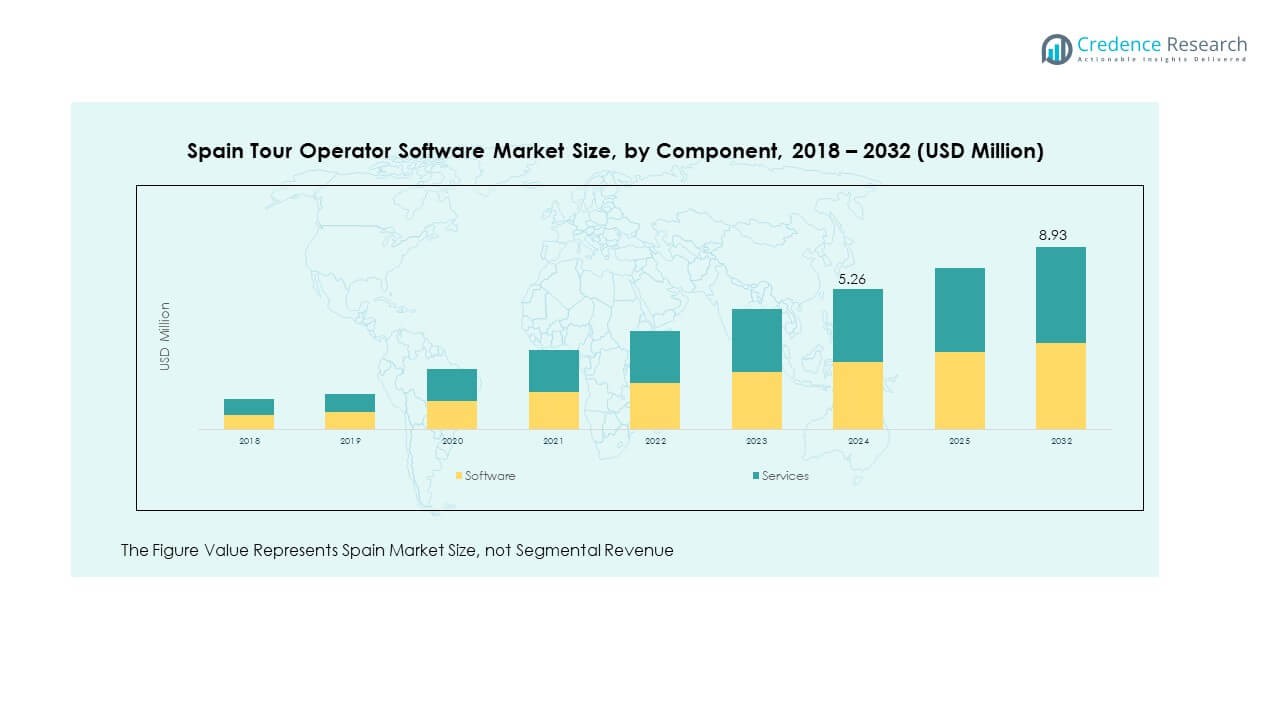

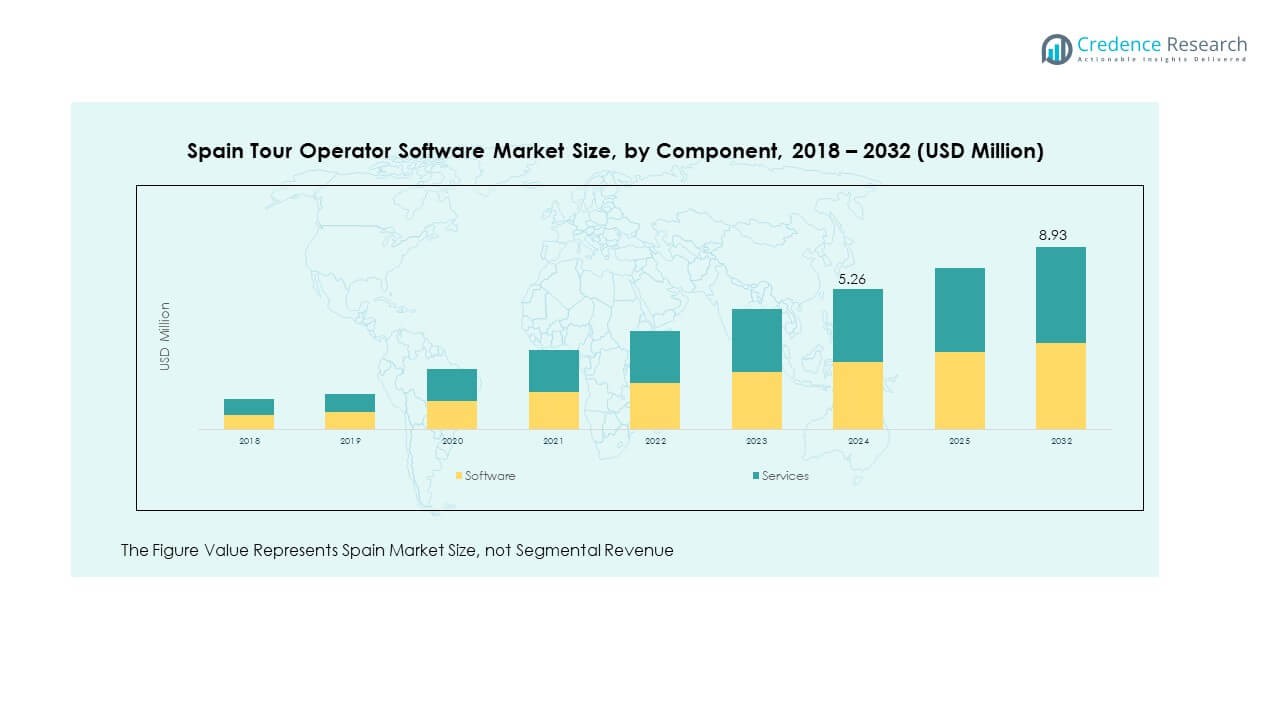

The Spain Tour Operator Software Market size was valued at USD 4.46 million in 2018 to USD 5.26 million in 2024 and is anticipated to reach USD 8.93 million by 2032, at a CAGR of 6.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Tour Operator Software Market Size 2024 |

USD 5.26 Million |

| Spain Tour Operator Software Market, CAGR |

6.84% |

| Spain Tour Operator Software Market Size 2032 |

USD 8.93 Million |

The market is driven by rising demand for streamlined travel management solutions, personalized booking systems, and automated back-office processes. Companies are adopting cloud-based platforms to enhance efficiency, reduce manual errors, and improve customer satisfaction. Increasing penetration of mobile applications is also transforming customer experiences by offering real-time access, itinerary updates, and secure payment systems. Spain’s flourishing tourism industry, combined with growing digital transformation, continues to create robust demand for advanced operator software.

Geographically, Spain holds a strong position within Europe as a tourism hub. The market shows strong adoption in regions with high inbound and outbound travel flows, including Barcelona, Madrid, and coastal areas. Western Europe remains a leader due to well-established travel infrastructures, while Central and Eastern Europe are emerging due to increased adoption of digital solutions. Global linkages through outbound operators further strengthen Spain’s role in international tour management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Spain Tour Operator Software Market was USD 4.46 million in 2018, reached USD 5.26 million in 2024, and is expected to reach USD 8.93 million by 2032, at a CAGR of 6.84%.

- Europe commanded the largest share in 2024, led by Spain’s tourism infrastructure; North America followed with strong outbound links, while Asia Pacific ranked third due to rising digital adoption.

- Asia Pacific is the fastest-growing region, supported by increasing disposable incomes, digital-first travel adoption, and strong outbound tourism flows to Spain.

- Software accounted for around 43% of the total market in 2024, reflecting its core role in booking, CRM, and payments.

- Services contributed nearly 57% in 2024, driven by demand for customization, support, and integration across operator platforms.

Market Drivers:

Rising Tourism Growth Driving Strong Software Demand:

The Spain Tour Operator Software Market benefits from Spain’s strong tourism sector, with millions of international arrivals each year. Growing demand for personalized travel packages and seamless booking drives operators to adopt advanced solutions. It supports operators in offering improved customer engagement and integrated services. Digital adoption in the travel industry is rapidly increasing due to changing traveler expectations. Tour operators rely on advanced platforms to simplify operations and manage diverse offerings. Cloud-based software enables flexibility, scalability, and cost efficiency. Mobile adoption further accelerates the use of travel applications. It fuels strong growth prospects for software providers in Spain.

- For instance, Cloud-based software adoption is rising rapidly, supporting operational flexibility and scalability, while mobile app usage in travel surged, with top apps like Ryanair and Vueling seeing active users of 500,000+ and 460,000+, respectively, in Q2 2025. Mobile platforms enable on-the-go booking and payments, fueling digital adoption growth among travelers and operators alike.

Growing Need for Operational Efficiency Among Operators:

The Spain Tour Operator Software Market experiences growth due to operators seeking enhanced operational efficiency. Traditional manual methods are being replaced by advanced automated systems. It helps operators manage reservations, customer databases, and supplier relationships effectively. Automation reduces errors, cuts operational costs, and improves speed. Tour operators use integrated solutions for accounting, itinerary planning, and payment processing. The trend supports faster response times and better decision-making. Demand is also supported by rising competition among tour operators. Advanced platforms give businesses a strategic edge in service quality and profitability.

- For instance, Integrated tools that cover accounting, itinerary planning, and payment processing assist quicker response times and better resource allocation. Competitive pressure has made such solutions vital, providing operators with strategic advantages in efficiency and profitability.

Expanding Adoption of Cloud-Based Travel Solutions:

The Spain Tour Operator Software Market gains traction from cloud-based platforms that deliver flexibility and scalability. Operators are increasingly adopting SaaS solutions due to lower upfront costs. It enables access from multiple devices, improving convenience for travel companies. Cloud platforms provide real-time updates and secure payment integration. Operators benefit from automated data storage and backup systems. The solutions also allow easier collaboration among teams and global partners. Growing trust in data security strengthens cloud adoption in Spain. Continuous upgrades from vendors make cloud-based software highly attractive to the tourism industry.

Increasing Customer Expectations for Personalization and Flexibility:

The Spain Tour Operator Software Market expands due to travelers seeking personalized and flexible booking experiences. Operators use advanced systems to deliver customized itineraries. It helps companies manage diverse tour packages catering to unique traveler needs. Software integrates features such as multiple payment options, language preferences, and tailored promotions. Real-time communication tools enhance customer interaction and trust. Rising use of AI and analytics improves personalization further. Customers prefer operators offering smooth digital experiences. This push for personalization continues to shape software adoption across Spain.

Market Trends:

Growing Integration of AI and Data Analytics in Tour Software:

The Spain Tour Operator Software Market is experiencing rapid integration of AI and analytics for better decision-making. It helps operators understand customer behavior and design more targeted packages. Predictive analytics enhances demand forecasting and inventory planning. AI chatbots improve customer service by offering 24/7 support. Smart algorithms recommend travel packages based on past behavior. Operators adopt data-driven tools to increase efficiency and customer engagement. The trend also supports competitive pricing strategies. Advanced analytics will continue to reshape operator offerings in Spain.

- For instance, Operators increasingly use predictive analytics for demand forecasting and inventory management, while AI-powered chatbots offer 24/7 customer support and personalized travel package recommendations based on historical behavior. Data-driven insights enable smarter pricing and engagement strategies, advancing competitiveness in the evolving market.

Mobile-First Platforms Transforming Traveler Experience:

The Spain Tour Operator Software Market is shaped by rising adoption of mobile-first platforms. Operators use mobile apps to provide real-time booking and itinerary management. It enables customers to access services on-the-go. Push notifications and alerts enhance customer interaction and engagement. Mobile-first solutions allow secure and quick payments. Operators also integrate loyalty programs and promotions through apps. The trend creates stronger connections with tech-savvy travelers. Mobile-first adoption is expected to dominate Spain’s tour operator software landscape.

- For instance, recent data from Sensor Tower shows that in the second quarter of 2025, the mobile app travel market in Europe continued to show positive trends.

Increasing Demand for API and Multi-Channel Integration:

The Spain Tour Operator Software Market trends toward strong adoption of API-based and multi-channel systems. Operators integrate software with global distribution systems and online travel agencies. It allows seamless connectivity with hotels, airlines, and local service providers. Multi-channel integration supports customers across online portals, social media, and mobile apps. Operators enhance revenue by targeting diverse digital channels. It provides flexibility in managing bookings and supplier networks. Demand for interoperability is pushing software vendors to expand integration features. It creates stronger ecosystem partnerships across the tourism value chain.

Sustainability and Green Tourism Influencing Software Adoption:

The Spain Tour Operator Software Market is increasingly influenced by sustainability initiatives. Operators incorporate eco-friendly packages into their offerings. Software platforms support transparency by tracking carbon footprints of trips. Customers demand sustainable travel options, driving innovation in software systems. It helps operators showcase green credentials and improve brand loyalty. Integration of sustainability metrics improves package differentiation. The trend aligns with Spain’s broader focus on sustainable tourism growth. Travel technology vendors continue to embed green practices into software solutions. It positions operators competitively in an eco-conscious travel market.

Market Challenges Analysis:

High Competition Among Domestic and Global Vendors:

The Spain Tour Operator Software Market faces intense competition from both local and international vendors. It creates pricing pressures and forces continuous innovation. Smaller operators struggle to compete with established global software providers. High marketing expenses limit growth for emerging companies. Operators face difficulty in selecting cost-effective solutions. The market demands advanced features, but budget constraints hinder adoption for smaller firms. Vendor consolidation adds another challenge. Sustaining competitiveness requires consistent investment in product upgrades and customer service.

Regulatory Compliance and Data Security Concerns:

The Spain Tour Operator Software Market faces challenges linked to compliance and data protection regulations. Operators must ensure GDPR compliance when managing customer data. It raises the need for advanced security features in software. Failure to meet regulatory requirements risks fines and reputational loss. High costs of cybersecurity measures affect small operators. Growing cyber threats increase concerns around customer trust. Vendors must adapt systems quickly to evolving regulations. Maintaining data security while ensuring system efficiency becomes a significant challenge. Operators must balance compliance with operational goals effectively.

Market Opportunities:

Rising Demand for Integrated and All-in-One Platforms:

The Spain Tour Operator Software Market offers opportunities through demand for integrated, all-in-one solutions. Operators seek software that combines booking, accounting, CRM, and marketing functions. It simplifies operations and reduces reliance on multiple platforms. Integrated systems support small and medium operators aiming for cost efficiency. They also improve user experience with seamless workflows. Vendors offering modular and scalable platforms capture strong growth. Demand is rising in both inbound and outbound tour operations. The opportunity supports significant expansion in Spain.

Growth in Tech-Driven Tourism Experiences:

The Spain Tour Operator Software Market finds opportunity in tech-driven experiences. Virtual reality and AI-based travel planning enhance customer engagement. It allows travelers to explore destinations before booking. Software integration with advanced tools helps operators attract new audiences. Personalization and immersive experiences improve satisfaction levels. Companies adopting these innovations gain competitive advantage. Demand for tech-enabled travel continues to increase across Spain. This creates strong opportunities for vendors to expand offerings.

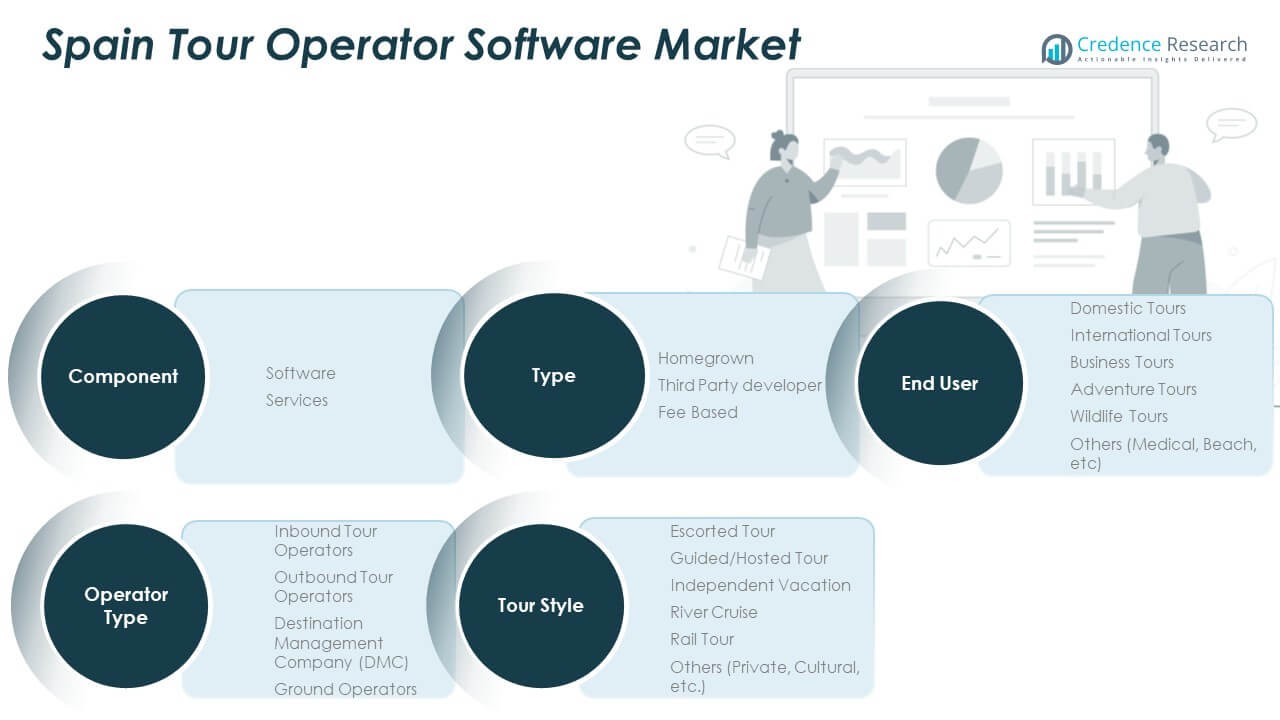

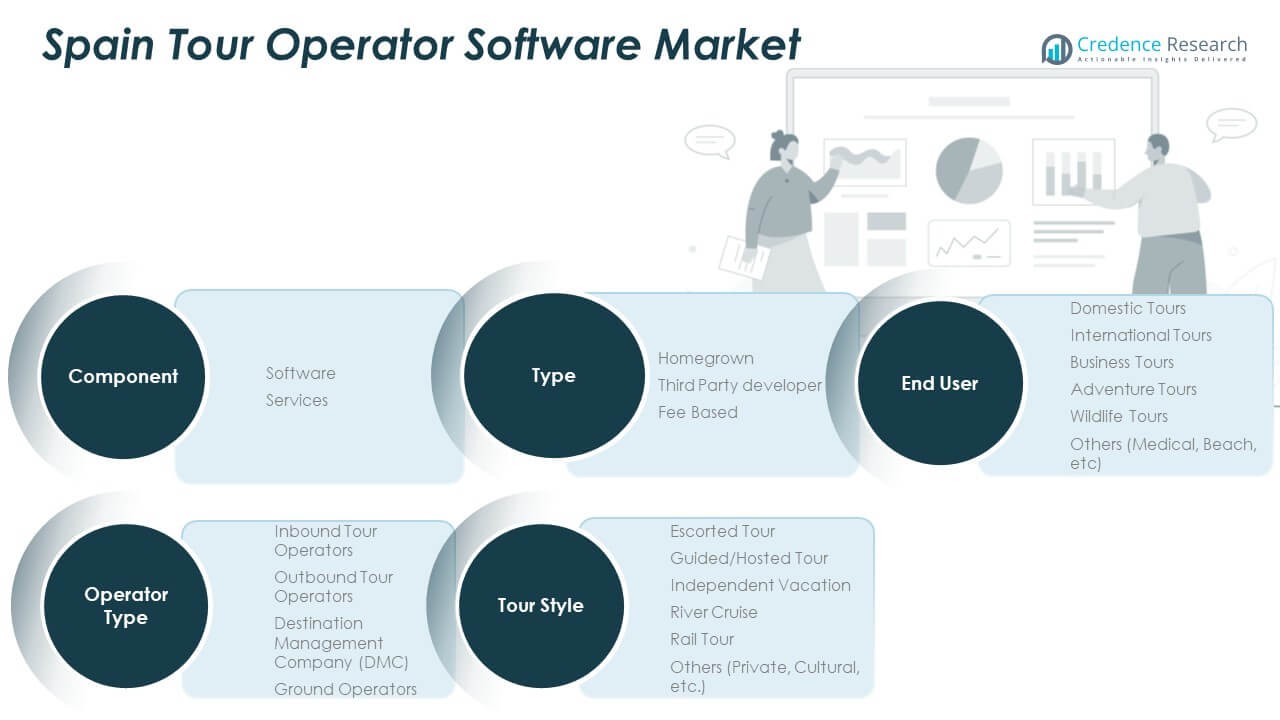

Market Segmentation Analysis:

By Type

The Spain Tour Operator Software Market shows strong adoption of third-party developer solutions due to their scalability and feature-rich platforms. Homegrown solutions remain relevant for niche operators seeking tailored systems, while fee-based models continue to attract businesses that prefer predictable costs. This segmentation reflects the diversity of operator needs and budget capacities.

- For instance, Bókun, a leading third-party developer, supports tens of thousands of tour operators globally with scalable APIs, integrated booking engines, channel management, and CRM systems, enabling operators to manage multi-channel bookings and automate customer communications efficiently.

By Component

Software platforms form the backbone of the market, offering booking engines, CRM, and integrated payment systems. Services, including customization, training, and technical support, complement the software segment, ensuring smooth adoption. Vendors focusing on end-to-end service models are gaining traction.

- For instance, Roiback has been recognized as the world’s best hotel booking solutions provider for four consecutive years (2021–2024) at the World Travel Tech Awards. This exemplifies excellence in seamless booking and payment processing for hotels and hotel chains worldwide.

By Operator Type

Inbound and outbound tour operators dominate adoption, reflecting Spain’s dual role in global tourism flows. Destination management companies use software to handle complex itineraries and multi-service offerings. Ground operators adopt solutions for efficiency in transport and local package management.

By Tour Style

Escorted and guided tours represent major revenue streams, supported by growing interest in curated experiences. Independent vacations gain popularity among younger travelers seeking flexibility. Specialized styles such as river cruises, rail tours, and cultural trips highlight the diversity of Spanish tourism offerings.

By End User

Domestic tours show steady adoption as Spanish travelers seek convenient digital solutions. International tourism drives strong demand for advanced software capabilities. Business, adventure, and wildlife tours represent niche segments but add significant value, pushing operators to integrate versatile features.

Segmentation:

- By Type

- Homegrown

- Third Party Developer

- Fee Based

- By Component

- By Operator Type

- Inbound Tour Operators

- Outbound Tour Operators

- Destination Management Company (DMC)

- Ground Operators

- By Tour Style

- Escorted Tour

- Guided/Hosted Tour

- Independent Vacation

- River Cruise

- Rail Tour

- Others (Private, Cultural, etc.)

- By End User

- Domestic Tours

- International Tours

- Business Tours

- Adventure Tours

- Wildlife Tours

- Others

Regional Analysis:

Northern Spain

Northern Spain accounted for the largest share of the Spain Tour Operator Software Market with 35% in 2024. Strong inbound tourism in regions such as Basque Country, Galicia, and Asturias drives software adoption. Operators here rely on digital solutions to manage cultural tours, nature-based trips, and heritage-focused packages. The popularity of Camino de Santiago and coastal tourism strengthens demand for advanced booking platforms. Software vendors benefit from collaborations with local agencies to offer integrated services. It continues to expand due to steady tourist inflows and rising adoption of cloud-based platforms. Northern Spain remains a leading hub for software usage.

Central Spain

Central Spain represented 32% of the Spain Tour Operator Software Market in 2024, led by Madrid as the country’s capital and major travel hub. The concentration of corporate travel, inbound tourism, and business tours fuels high adoption of operator platforms. Companies integrate advanced CRM systems to manage large volumes of bookings and customized itineraries. Domestic travel is also significant, with Madrid serving as a starting point for regional tours. The demand for multi-channel integration supports the market. It shows steady growth, driven by government initiatives to boost tourism and modernize travel infrastructure. Central Spain continues to play a strategic role in the market.

Southern Spain

Southern Spain accounted for 21% of the Spain Tour Operator Software Market in 2024, supported by high tourist activity in Andalusia, Seville, and Granada. The region benefits from strong cultural and heritage tourism demand. Operators increasingly adopt mobile-first and AI-driven solutions to personalize travel experiences. Beach destinations and adventure tourism create rising demand for digital systems. Small and mid-sized operators in this region depend on third-party developed platforms for scalability. The adoption of services such as customer support and integration tools is growing. It remains one of the fastest-developing regions due to expanding domestic and international arrivals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Spain Tour Operator Software Market is competitive, with domestic and global players striving for market share. It features companies like Travel Compositor, Amadeus IT Group, Lodgify, Amenitiz, and TrekkSoft alongside global vendors such as Rezdy, Peek Pro, and FareHarbor. Intense competition encourages continuous innovation, particularly in mobile integration, automation, and cloud-based solutions. Companies differentiate themselves through pricing models, scalability, and support services. It faces strong rivalry, with vendors focusing on partnerships and regional expansion. Established firms leverage their global reach, while emerging players emphasize flexibility and niche offerings. The competitive environment promotes innovation and customer-centric strategies.

Recent Developments:

- In February 2025, Travel Compositor launched “:Dora”, an AI-powered smart booth for tourism sales, at ITB Berlin, combining AI, virtual avatars, and voice recognition. Designed for use in travel agencies and tourism venues, this booth delivers automated, interactive booking experiences and exemplifies Spain’s leadership in digital tourism transformation.

- On May 22, 2025, Amadeus formed a landmark partnership with Google Cloud, aimed at propelling cloud-based operations and AI innovation in the travel industry. Amadeus will migrate part of its technical platform to Google Cloud, using advanced AI infrastructure to improve operational efficiency, security, and customer responsiveness, ensuring leadership in travel technology.

- In May 2025, Lodgify was recognized as an Airbnb Preferred+ Partner, highlighting its deep and reliable integration with Airbnb and status among the world’s top 18 property and channel management software providers. The company also received Booking.com Premier Connectivity Partner status, demonstrating excellence in supporting hosts across major booking platforms—a testament to its innovation and prominence in the vacation rental software market.

- In June 2025, Rezdy was part of a high-profile merger with Checkfront, followed by another strategic alliance with Regiondo two months later. This three-way merger created the world’s largest private, independently-owned reservation technology company, combining expertise from Asia-Pacific, North America, and Europe to expedite digitization in the fragmented tours and activities market.

Report Coverage:

The research report offers an in-depth analysis based on type, component, operator type, tour style, and end-user segmentation. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of mobile-first travel platforms will reshape operator engagement.

- AI and analytics adoption will improve forecasting and customer insights.

- Integrated platforms will dominate as demand grows for all-in-one solutions.

- Cloud-based software will strengthen scalability for both SMEs and large operators.

- Sustainability metrics will gain prominence in software features.

- Cross-border collaborations will expand Spain’s influence in international markets.

- API-based integration will enhance interoperability with global travel systems.

- Personalization will remain central to customer acquisition strategies.

- Security and GDPR compliance will be key in maintaining customer trust.

- Investments in emerging regions will create new revenue opportunities.