Market Overview

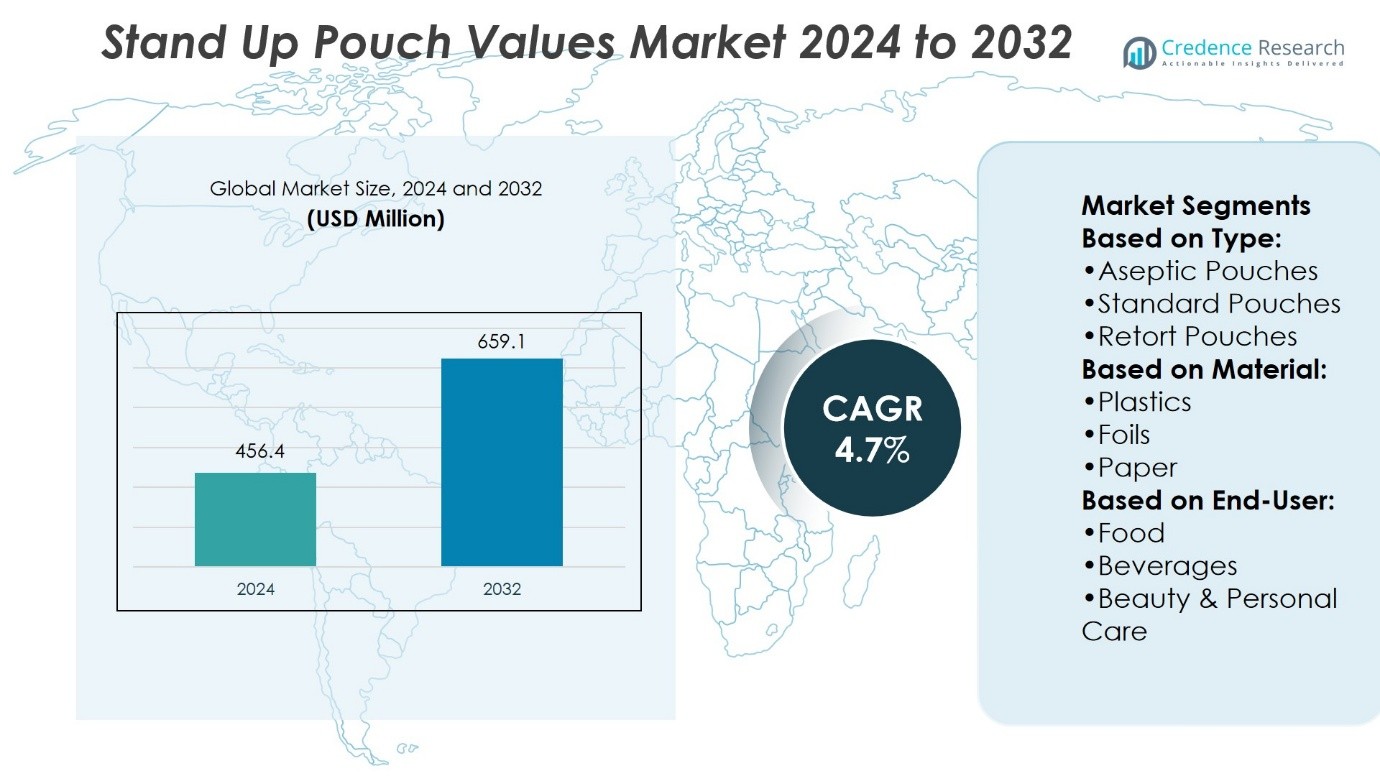

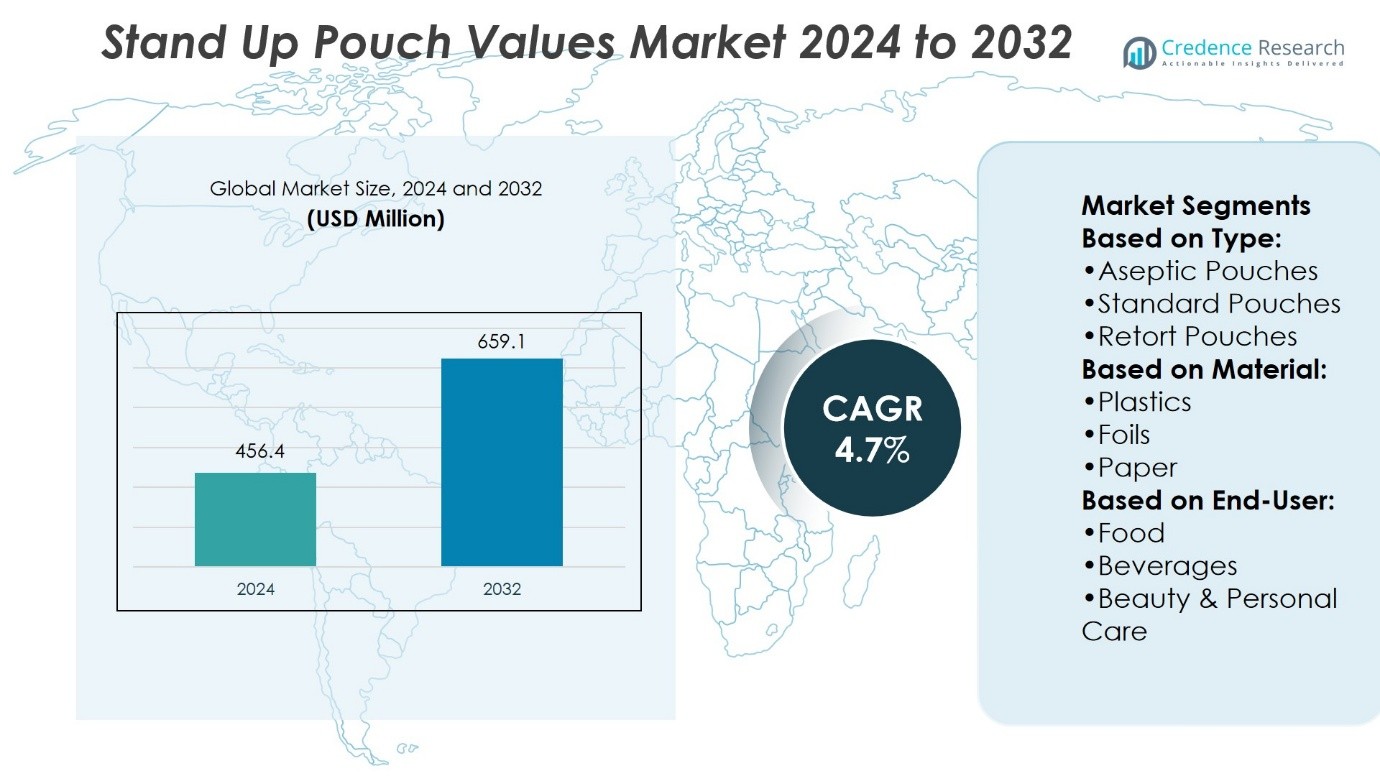

Stand-Up Pouch Values Market size was valued at USD 456.4 million in 2024 and is anticipated to reach USD 659.1 million by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Stand-Up Pouch Values Market Size 2024 |

USD 456.4 Million |

| Stand-Up Pouch Values Market, CAGR |

4.7% |

| Stand-Up Pouch Values Market Size 2032 |

USD 659.1 Million |

The Stand-Up Pouch Values Market advances through strong drivers and evolving trends that shape its long-term relevance. Rising demand for lightweight, flexible, and convenient packaging solutions fuels adoption across food, beverage, and personal care sectors. It gains further momentum from sustainability initiatives that encourage recyclable mono-material pouches and bio-based films. Growing e-commerce accelerates the need for durable and cost-efficient packaging that protects products during distribution. Technological innovations such as resealable closures, spouts, and digital printing enhance consumer convenience and brand visibility. These drivers and trends collectively reinforce the market’s role as a dynamic segment in global packaging.

The Stand-Up Pouch Values Market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific holding the largest share due to rapid industrialization and rising packaged food demand. North America and Europe maintain steady growth driven by sustainability regulations and advanced retail networks. Key players shaping the market include Amcor, Mondi Group, Sealed Air Corporation, Smurfit Kappa, Sonoco, Coveris Group, ProAmpac, Berry Global, Huhtamaki, and Constantia Flexibles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Stand-Up Pouch Values Market was valued at USD 456.4 million in 2024 and is expected to reach USD 659.1 million by 2032, growing at a CAGR of 4.7%.

- Rising demand for lightweight, flexible, and convenient packaging supports growth across food, beverage, and personal care industries.

- Sustainability initiatives encourage adoption of recyclable mono-material pouches and bio-based films.

- Competitive players focus on innovation, with investments in resealable closures, spouts, and digital printing for consumer convenience and brand visibility.

- Market restraints include regulatory pressures on non-recyclable laminates and raw material price fluctuations that affect cost management.

- Asia-Pacific holds the largest share due to industrialization and packaged food demand, while North America and Europe benefit from sustainability regulations and modern retail.

- Leading companies include Amcor, Mondi Group, Sealed Air Corporation, Smurfit Kappa, Sonoco, Coveris Group, ProAmpac, Berry Global, Huhtamaki, and Constantia Flexibles.

Market Drivers

Rising Consumer Preference for Lightweight and Convenient Packaging Formats

The Stand-Up Pouch Values Market gains traction through increasing consumer demand for portable, lightweight, and easy-to-use packaging. It offers clear advantages over rigid containers by reducing storage space, lowering transportation weight, and improving handling convenience. Food and beverage companies adopt stand-up pouches to meet consumer expectations for resealable and portion-controlled formats. The packaging also supports busy lifestyles where single-serve and ready-to-use products are in high demand. It ensures product freshness while minimizing material use. This combination of functionality and practicality reinforces its acceptance across mass-market and premium categories.

- For instance, Amcor developed its AmLite Ultra Recyclable stand-up pouch technology, which reduced packaging weight by up to 64 tons of plastic annually in a single European client’s product line, while cutting logistics-related CO₂ emissions by 35% across a distribution volume of over 120 million units.

Expanding Role of Sustainability and Eco-Friendly Packaging Solutions

The industry benefits from the rising emphasis on sustainable packaging aligned with corporate environmental goals. The Stand-Up Pouch Values Market strengthens its position by adopting recyclable films, biodegradable laminates, and reduced resin consumption. Companies actively invest in solutions that lower carbon emissions during production and logistics. It enables brands to communicate eco-friendly credentials directly to environmentally conscious consumers. The focus on sustainability encourages regulatory compliance and enhances consumer loyalty. This shift creates consistent demand for innovative materials that balance performance with ecological responsibility.

- For instance, Huhtamaki introduced its recyclable mono-material PE pouch solution in 2021, which enabled the elimination of aluminum foil layers and cut material usage by 25%, leading to an annual reduction of 1,200 metric tons of mixed plastic waste across its European customer base.

Growing Adoption Across Food, Beverage, and Non-Food Applications

The versatility of stand-up pouches drives demand across multiple industries, extending beyond food and beverages into personal care, household products, and pet food. The Stand-Up Pouch Values Market benefits from its adaptability to both dry and liquid contents with excellent barrier properties. It ensures extended shelf life while protecting against moisture, oxygen, and light exposure. Non-food categories leverage pouches for compact storage and appealing shelf presentation. It provides design flexibility that supports branding through high-quality printing and labeling. The expansion into varied applications strengthens its presence in diverse consumer markets.

Technological Advancements in Packaging Machinery and Value-Added Features

Continuous improvement in pouch-making equipment and filling technology fuels market efficiency and innovation. The Stand-Up Pouch Values Market gains value through faster production cycles, advanced sealing techniques, and integration of smart packaging features. It enhances consumer convenience with spouts, zippers, and easy-tear notches. Automation reduces downtime and improves accuracy in filling, cutting operational costs for manufacturers. The incorporation of digital printing and customizable designs ensures brand differentiation. It secures a competitive advantage by combining technology-driven efficiency with consumer-focused packaging solutions.

Market Trends

Increasing Shift Toward Premiumization and Enhanced Shelf Appeal

The Stand-Up Pouch Values Market shows a clear movement toward premium designs that elevate product presentation. Brands invest in high-quality graphics, metallic finishes, and transparent windows that highlight freshness and quality. It provides strong visual impact in retail environments where competition for consumer attention is intense. The shift supports premium product lines in categories such as snacks, coffee, and nutraceuticals. It enhances perceived value and strengthens brand loyalty. The combination of functionality and upscale aesthetics positions pouches as a preferred choice for modern retail strategies.

- For instance, Mondi developed its BarrierPack Recyclable pouch with high-gloss printing and transparent windows, enabling over 200 stock-keeping units (SKUs) for a European snack producer.

Rising Demand for E-Commerce-Compatible Packaging Solutions

The acceleration of online retail drives the need for flexible packaging formats that ensure durability during shipping and handling. The Stand-Up Pouch Values Market aligns with this trend by delivering lightweight yet resilient structures that protect against damage. It minimizes shipping costs while maintaining an attractive appearance upon delivery. The integration of resealable closures supports multiple uses after purchase, catering to consumer convenience. It reinforces the role of pouches in omnichannel strategies where physical and digital retail converge. The growth of e-commerce pushes manufacturers to design formats optimized for direct-to-consumer distribution.

- For instance, Sealed Air launched its Autobag® 850S pouch system for e-commerce, enabling throughput of up to 2,200 packages per hour, and its lightweight protective stand-up pouches reduced product damage rates by 18% across 50 million shipped units for a U.S. apparel retailer.

Adoption of Smart and Functional Packaging Features

The industry adopts functional enhancements that expand the role of packaging beyond containment. The Stand-Up Pouch Values Market incorporates features such as resealable zippers, spouts, and laser-scored tear lines. It supports portion control, reduces product waste, and improves ease of use. Smart technologies, including QR codes and NFC tags, enable consumer engagement and product authentication. It strengthens transparency by providing traceability across supply chains. These innovations increase consumer trust and create differentiated experiences in competitive product categories.

Transition to Mono-Material and Recyclable Packaging Designs

Sustainability trends encourage brands to adopt recyclable mono-material structures without compromising performance. The Stand-Up Pouch Values Market advances by shifting away from complex laminates that are difficult to recycle. It reduces environmental impact while aligning with circular economy principles. Brands highlight recyclable claims directly on packaging to build credibility with eco-conscious consumers. It accelerates research and development in barrier films that match the protective qualities of traditional laminates. The trend reinforces the long-term role of stand-up pouches in sustainable packaging ecosystems.

Market Challenges Analysis

Regulatory Pressures and Material Complexity Restraining Growth

The Stand-Up Pouch Values Market faces significant challenges from evolving regulatory frameworks and material requirements. It must adapt to stringent packaging waste directives that demand recyclability and reduced environmental impact. Complex laminates that combine plastic and aluminum layers create recycling difficulties and limit compliance with circular economy initiatives. Manufacturers invest heavily in research to develop mono-material solutions that maintain barrier performance, yet cost and scalability remain obstacles. It complicates supply chains and slows adoption across industries that rely on traditional laminates. These pressures create operational and compliance risks for companies seeking long-term competitiveness.

Supply Chain Volatility and Cost Management Constraints

The industry encounters persistent challenges linked to raw material price fluctuations and supply chain instability. The Stand-Up Pouch Values Market depends on reliable access to polymers, films, and specialty resins, but disruptions inflate costs and delay production schedules. It forces manufacturers to balance affordability with quality while meeting customer demand for sustainable solutions. Transportation bottlenecks and geopolitical risks further strain procurement strategies across global networks. It exposes brands to pricing pressures and reduces margins in highly competitive markets. These uncertainties limit the pace of innovation and influence investment decisions in new technologies and production capacity.

Market Opportunities

Expansion Through Functional Innovation and Customization

The Stand-Up Pouch Values Market holds strong opportunities in advancing functional features that enhance consumer convenience and product differentiation. It benefits from demand for resealable closures, spouts, and easy-tear designs that improve usability across food, beverage, and personal care applications. Customization through digital printing and advanced labeling allows brands to communicate directly with consumers and strengthen loyalty. It creates value for premium product launches where packaging design influences purchase decisions. The ability to incorporate unique formats supports market expansion in both developed and emerging economies. Brands that leverage innovation in design and functionality gain competitive advantage in high-growth segments.

Growth Potential in Sustainable Packaging and Emerging Sectors

Sustainability presents a major opportunity for companies investing in recyclable, compostable, and mono-material pouches. The Stand-Up Pouch Values Market aligns with government initiatives and consumer expectations by promoting eco-friendly alternatives that maintain barrier protection. It opens doors for partnerships with material innovators developing bio-based resins and advanced films. Non-food sectors such as pharmaceuticals, home care, and agriculture represent untapped areas where pouches can replace rigid formats. It provides cost savings, flexibility, and improved logistics efficiency for companies entering these markets. The convergence of sustainability and sector diversification creates long-term potential for steady growth.

Market Segmentation Analysis:

By Type

The Stand-Up Pouch Values Market divides into aseptic pouches, standard pouches, retort pouches, and others. Standard pouches dominate widespread use due to versatility and cost efficiency across food and consumer products. Aseptic pouches expand strongly in dairy, juices, and ready-to-drink segments where long shelf life without preservatives is essential. Retort pouches gain preference in ready meals and pet food because they withstand high-temperature sterilization while maintaining product quality. It reflects steady diversification where packaging performance is aligned with end-user needs. The presence of specialized categories such as spouted or shaped pouches further broadens opportunities in niche segments.

- For instance, Tetra Pak reported delivering over 192 billion aseptic pouches and cartons globally in 2022, with its Tetra Prisma® Aseptic pouch enabling ambient distribution of 23 billion liters of liquid dairy products, reducing the need for refrigerated storage across more than 170 countries.

By Material

Material choice plays a critical role in defining performance and sustainability outcomes. Plastics remain the most widely used material in the Stand-Up Pouch Values Market due to flexibility, sealing strength, and barrier protection. Foils support sensitive food, healthcare, and chemical applications where oxygen and light protection is mandatory. Paper-based formats gain attention in markets emphasizing sustainability and eco-friendly alternatives. It creates a balance between performance, environmental goals, and consumer expectations. Research investments focus on recyclable mono-material plastics and paper-foil hybrids that retain durability while supporting regulatory compliance. This transition reshapes procurement strategies across the packaging value chain.

- For instance, Constantia Flexibles introduced its EcoLamPlus mono-material PE pouch, which reduced aluminum foil usage by 1,600 metric tons annually across European confectionery and dairy clients, while maintaining oxygen transmission rates (OTR) below 1 cc/m²/day for over 250 million packaged units.

By End-user

The Stand-Up Pouch Values Market serves a broad set of end-users including food, beverages, beauty and personal care, healthcare, chemicals, consumer products, and others. Food applications account for high demand due to extensive use in snacks, frozen items, and dry goods. Beverages such as juices, energy drinks, and dairy leverage pouches for portability and extended freshness. Beauty and personal care brands use pouches for lotions, refills, and sample packs that reduce waste and promote convenience. Healthcare applications adopt them for medical nutrition, supplements, and sterile solutions, while chemical sectors utilize durable formats for detergents and fertilizers. It enables consumer product companies to replace rigid containers with lightweight solutions that save space and transportation costs.

Segments:

Based on Type:

- Aseptic Pouches

- Standard Pouches

- Retort Pouches

Based on Material:

Based on End-User:

- Food

- Beverages

- Beauty & Personal Care

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a market share of 28% in the Stand-Up Pouch Values Market, supported by strong demand for packaged food, beverages, and personal care products. It demonstrates steady adoption of premium and functional packaging formats as consumer expectations focus on convenience and sustainability. The United States leads growth with investments in recyclable pouches and digital printing technologies that enhance branding capabilities. Canada follows closely with high usage in frozen foods, pet food, and dairy applications. The region emphasizes eco-friendly solutions to comply with packaging waste regulations and sustainability initiatives. It also benefits from advanced manufacturing capabilities and a mature retail network that supports innovation. Strong partnerships between brand owners and packaging suppliers continue to reinforce North America’s position as a leader in technological adoption and product diversification.

Europe

Europe accounts for 25% of the Stand-Up Pouch Values Market, shaped by stringent environmental policies and consumer preference for sustainable packaging. The region drives innovation in recyclable mono-material structures and paper-based pouches as part of its transition toward circular economy principles. Countries such as Germany, France, and the United Kingdom lead adoption across food and beverage segments. It reflects the balance between sustainability demands and high-quality packaging performance in both premium and mainstream categories. Healthcare and personal care markets also contribute to growth as pouches replace traditional rigid formats. European manufacturers invest in high-barrier films and advanced laminates that meet strict safety and recyclability standards. The regulatory environment creates challenges but also opportunities for companies that innovate quickly.

Asia-Pacific

Asia-Pacific secures the largest market share at 32%, driven by rapid urbanization, rising disposable incomes, and expansion of modern retail. It shows strong demand for cost-effective and versatile packaging across food, beverage, and household products. China and India lead the market with increasing consumption of packaged snacks, ready-to-eat meals, and dairy products. Japan and South Korea emphasize technological sophistication with high-quality barrier films and innovative pouch designs. The region benefits from large-scale manufacturing capabilities that reduce costs and increase availability. It aligns with growing sustainability awareness as countries explore recyclable and bio-based pouch solutions. Asia-Pacific’s size and growth potential ensure its role as the key driver of global demand.

Latin America

Latin America represents 8% of the Stand-Up Pouch Values Market, influenced by expanding middle-class consumption and growth in packaged goods. Brazil and Mexico lead adoption in snacks, coffee, and pet food segments. It reflects the shift from rigid to flexible packaging due to cost savings and storage convenience. Manufacturers target Latin American markets with innovative resealable features and smaller pack sizes that suit local consumption habits. The beverage sector, particularly juices and dairy-based drinks, also supports pouch demand. It remains an emerging region where sustainable packaging initiatives are gradually shaping consumer choices. Despite economic fluctuations, Latin America presents growth opportunities for global and regional players.

Middle East & Africa

The Middle East & Africa contributes 7% of the Stand-Up Pouch Values Market, supported by rising consumption of packaged food, beverages, and personal care products. Gulf countries such as the United Arab Emirates and Saudi Arabia lead adoption through modern retail and premium product categories. It reflects consumer preference for convenience, portability, and shelf appeal in fast-growing urban centers. Africa shows gradual adoption, primarily in snacks, dairy, and basic household goods. The region faces challenges such as underdeveloped recycling infrastructure, yet manufacturers explore eco-friendly packaging to align with international trade standards. Investment in local production facilities and distribution networks supports long-term market potential. It remains a region with significant opportunities as consumption patterns shift toward modern packaged goods.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Stand-Up Pouch Values Market such as Amcor (Switzerland), Mondi Group (U.K.), Sealed Air Corporation (U.S.), Smurfit Kappa (Ireland), Sonoco (U.S.), Coveris Group (U.K.), ProAmpac (U.S.), Berry Global, Inc. (U.S.), Huhtamaki (Finland), and Constantia Flexibles (Austria). The Stand-Up Pouch Values Market is characterized by intense competition where global packaging companies prioritize innovation, sustainability, and operational efficiency. Leading manufacturers invest heavily in recyclable materials, mono-material structures, and bio-based films to meet regulatory standards and consumer demand for eco-friendly solutions. Advanced features such as resealable closures, spouts, and high-barrier films enhance product performance while supporting convenience and shelf appeal. Companies focus on expanding regional production facilities, strengthening supply chains, and adopting digital printing technologies to deliver customization and faster turnaround. Strategic mergers, acquisitions, and partnerships remain central to consolidating market share and extending presence across food, beverage, personal care, and healthcare sectors. Competitive advantage depends on balancing cost efficiency with technological innovation, ensuring packaging aligns with both sustainability goals and evolving consumer lifestyles.

Recent Developments

- In May 2025, the stand-up pouches market, including valves, is highly fragmented with many global players continuously upgrading product portfolios through new product launches, collaborations, and acquisitions to dominate the market.

- In February 2025, ValvPak® introduced a self-sealing, pressure-engaged valve for stand-up pouches. The innovative design automatically reseals after dispensing, ensuring an air-tight, mess-free experience. It handles various viscosities and is easily added to standard pouch lines, ideal for refills and on‑the‑go packaging.

- In January 2024, API Group and its subsidiary Accredo Packaging, which produces more sustainable packaging solutions for the food and consumer goods markets, announced that they are collaborating with Reynolds Consumer Products’ Presto Products Fresh-Lock team.

- In March 2023, COLINES and TotalEnergies partnered to create unlaminated recyclable stand-up pouches for food contact applications. The companies have developed full PE recyclable unlaminated stand-up pouches to decrease the packaging thickness.

Market Concentration & Characteristics

The Stand-Up Pouch Values Market demonstrates moderate to high concentration, led by a group of global packaging manufacturers with strong technological expertise and extensive distribution networks. It is characterized by continuous innovation in materials, designs, and barrier technologies that enhance product protection and consumer convenience. Competition focuses on sustainability, with companies advancing recyclable mono-material solutions and bio-based films to comply with evolving regulations. It reflects a balance between global leaders driving large-scale innovation and regional players addressing localized demand with cost-effective and customized solutions. Product differentiation is achieved through advanced closures, resealable features, spouts, and high-quality graphics that strengthen brand positioning. The market exhibits dynamic characteristics, including fast adoption in food and beverage segments, growing penetration into healthcare and personal care, and expansion across emerging economies where flexible packaging increasingly replaces rigid formats. It relies on strong supply chain integration, efficient logistics, and ongoing investments in production capacity to meet rising global demand.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with greater adoption of recyclable and mono-material pouches.

- Sustainability regulations will accelerate investment in bio-based and compostable packaging.

- Demand will grow in food and beverage sectors with rising consumption of ready-to-eat and on-the-go products.

- Digital printing will strengthen brand differentiation through faster customization and high-quality graphics.

- Healthcare and personal care applications will increase use of pouches for sterile and refillable solutions.

- E-commerce growth will drive demand for durable, lightweight, and protective pouch formats.

- Advanced barrier technologies will enhance shelf life and product safety across multiple categories.

- Emerging economies will adopt stand-up pouches rapidly due to cost efficiency and retail modernization.

- Automation and smart machinery will improve production efficiency and reduce operational costs.

- Strategic collaborations and acquisitions will shape market consolidation and global competitiveness.