Market Overview:

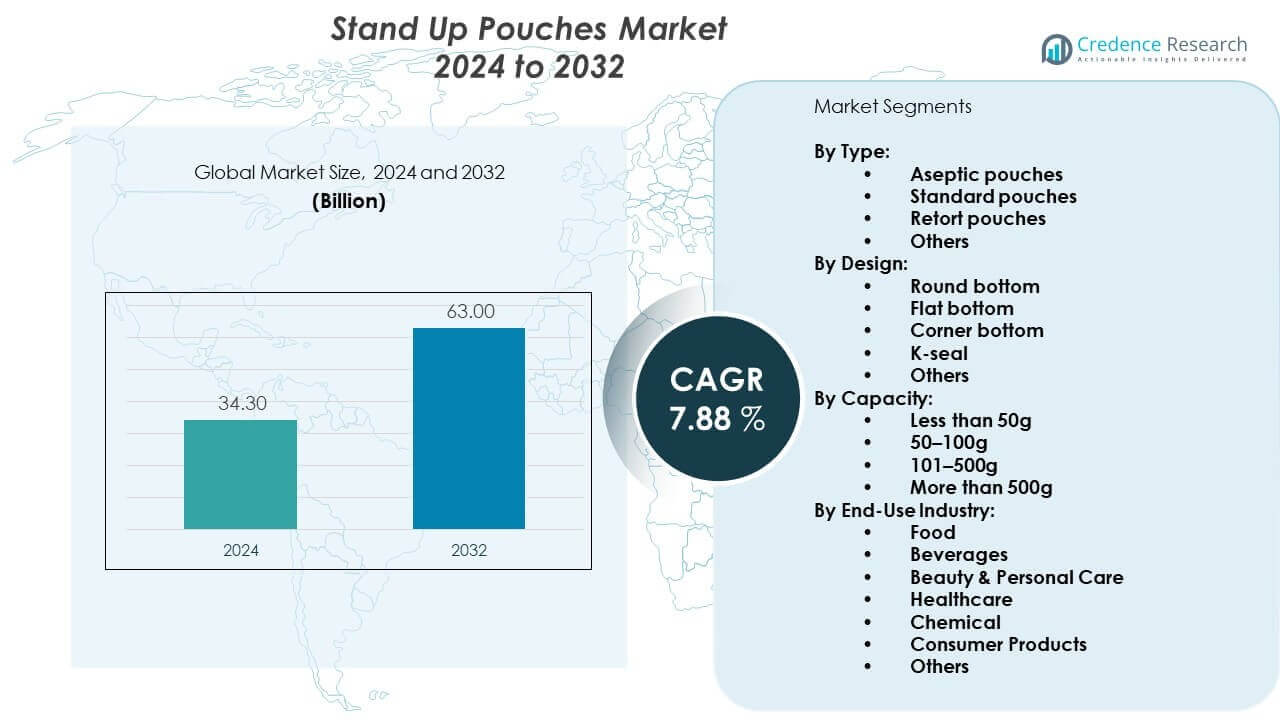

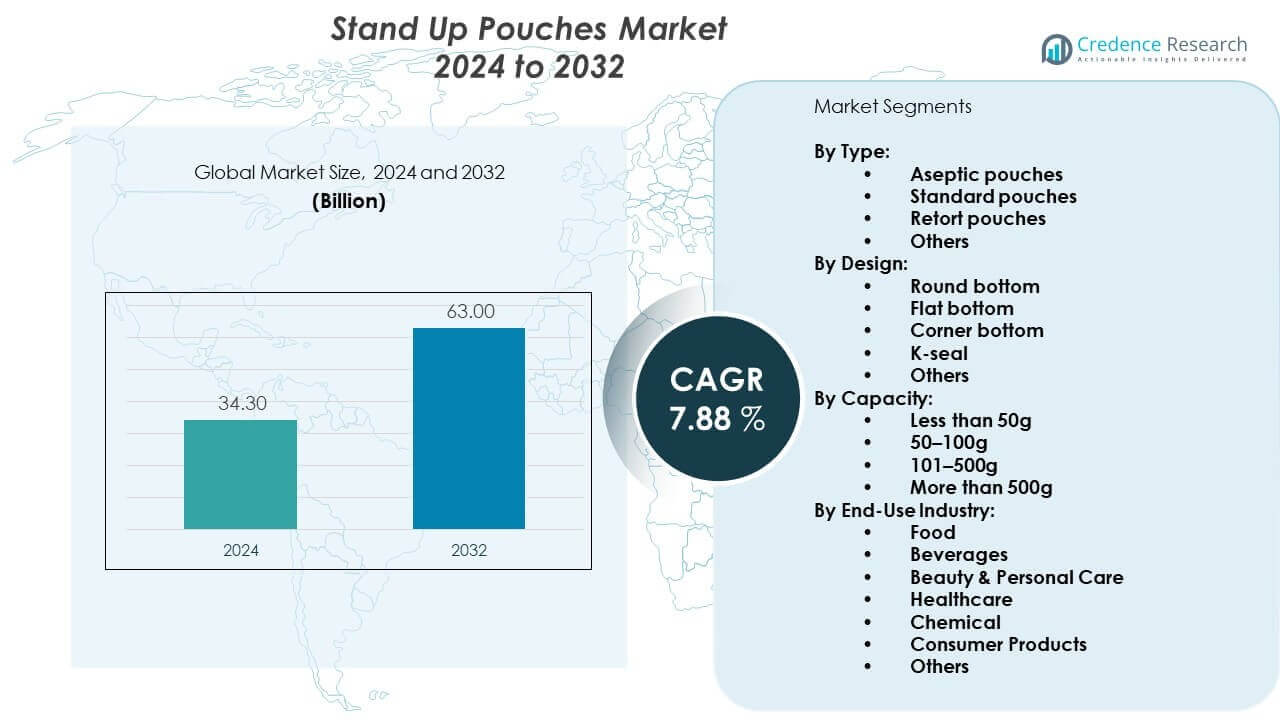

The Stand-up pouches market is projected to grow from USD 34.3 billion in 2024 to an estimated USD 63 billion by 2032, at a compound annual growth rate (CAGR) of 7.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Stand Up Pouches Market Size 2024 |

USD 34.3 billion |

| Stand Up Pouches Market, CAGR |

7.88% |

| Stand Up Pouches Market Size 2032 |

USD 63 billion |

Market drivers include the growing demand for sustainable packaging solutions, as manufacturers focus on recyclable materials and reduced plastic use. Stand-up pouches help lower transportation costs due to their lightweight nature, while their extended shelf life and versatility attract both producers and consumers. Expanding use in packaged foods, ready-to-drink beverages, pet food, and cosmetics supports rapid adoption. Increasing investment in advanced printing technologies also enables customization, branding, and improved shelf appeal, making these pouches a preferred packaging format globally.

Regionally, North America leads the stand-up pouches market due to high packaged food consumption, strong retail presence, and rising demand for eco-friendly packaging. Europe follows with robust regulatory support for sustainable materials and increasing consumer awareness. The Asia Pacific region is expected to register the fastest growth, driven by expanding urbanization, a growing middle-class population, and rising packaged food demand in countries like China and India. Latin America and the Middle East & Africa are emerging markets, supported by increasing retail penetration and gradual adoption of modern packaging formats.

Market Insights:

- The stand-up pouches market is projected to grow from USD 34.3 billion in 2024 to USD 63 billion by 2032, at a CAGR of 7.88% during the forecast period.

- Rising consumer preference for lightweight, resealable, and convenient packaging solutions drives strong adoption across food, beverage, and personal care industries.

- Increasing demand for sustainable packaging formats encourages manufacturers to invest in recyclable and compostable pouch materials.

- Volatility in raw material prices and technological barriers in recycling multi-layered pouches restrain smooth market expansion.

- North America leads the market due to strong packaged food consumption and retail penetration.

- Europe follows with regulatory support for sustainable packaging and rising demand for eco-friendly formats.

- Asia Pacific is expected to register the fastest growth, driven by urbanization, retail expansion, and growing packaged food consumption in China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Preference for Convenient and Flexible Packaging Solutions:

The stand-up pouches market is driven by strong consumer demand for portable and easy-to-use packaging formats. Stand-up pouches offer resealability, lightweight structure, and enhanced convenience, making them ideal for on-the-go lifestyles. Food and beverage industries rely heavily on these features to attract health-conscious and time-constrained customers. It helps manufacturers reduce packaging weight, shipping costs, and storage space compared to rigid formats. Consumers also prefer transparent or windowed pouches that allow product visibility, reinforcing trust and purchase intent. Increasing demand for portion-controlled packaging further enhances the use of stand-up pouches. The growing popularity of single-serve products across snacks, beverages, and ready-to-eat meals drives adoption. These consumer-centric benefits establish stand-up pouches as a dominant choice in packaging.

- For instance, Amcor’s development of spouted stand-up pouches with capacities ranging up to 2.5 liters for side spouts incorporates multiple cap types and enhanced sealing technology that maintains product integrity while supporting consumer convenience and portability.

Expansion of Food, Beverage, and Pet Food Applications Across Global Markets:

The stand-up pouches market benefits significantly from diverse applications across packaged food, beverages, and pet food sectors. It meets industry requirements for durability, extended shelf life, and barrier protection. Stand-up pouches offer excellent sealing properties, which protect against moisture, oxygen, and contamination, ensuring product quality. Food producers adopt these formats for dry foods, frozen products, sauces, and dairy alternatives. Beverage companies use pouches for juices, energy drinks, and alcohol-based beverages, focusing on portability and branding. Pet food manufacturers increasingly shift to pouches due to their ability to handle larger volumes and resealable features. Growing demand for innovative packaging in emerging economies strengthens this application-driven adoption. The wide application base makes stand-up pouches an essential packaging format across industries.

- For instance, API Group and its subsidiary Accredo Packaging introduced a flexible stand-up pouch made with over 50% Post-Consumer Recycled (PCR) content, which fits food packaging needs and exemplifies sustainable innovation in protecting product quality across regions.

Environmental Concerns Driving Adoption of Lightweight and Sustainable Packaging Formats:

Environmental awareness continues to influence packaging decisions, propelling the growth of the stand-up pouches market. It offers an eco-friendly solution with reduced material usage compared to rigid plastic or glass alternatives. Pouches consume less energy and water during production, supporting sustainability goals of major brands. Companies actively invest in recyclable and biodegradable pouch materials to align with consumer and regulatory pressures. Growing global campaigns against single-use plastics create favorable conditions for flexible packaging solutions. Retailers and manufacturers prefer stand-up pouches for minimizing logistics costs while meeting green packaging commitments. Rising adoption of plant-based and compostable materials strengthens the perception of pouches as sustainable choices. This alignment with environmental goals ensures continued demand and regulatory acceptance.

Growth in E-Commerce and Retail Channels Enhancing Packaging Innovation and Efficiency:

The stand-up pouches market benefits from the rapid growth of e-commerce and organized retail networks worldwide. Online sales demand secure, lightweight, and tamper-resistant packaging formats that ensure product integrity during transit. Stand-up pouches provide strong shelf presence, vibrant printing opportunities, and flexibility to handle diverse product categories. It reduces packaging-related damages and enhances brand visibility on digital platforms. Retail chains also favor stand-up pouches for efficient shelf stocking and space utilization. Growing competition among consumer brands encourages innovative pouch designs, spout fittings, and resealable closures. Increasing private-label product launches in supermarkets support pouch adoption at scale. E-commerce growth combined with retail expansion positions stand-up pouches as a key enabler of brand competitiveness.

Market Trends:

Adoption of Smart Packaging Features to Enhance Consumer Engagement:

A major trend shaping the stand-up pouches market is the integration of smart packaging technologies. QR codes, NFC tags, and augmented reality features are increasingly incorporated to improve customer interaction. These elements allow consumers to trace product origins, access recipes, or validate authenticity. It creates stronger brand loyalty by offering transparency and engaging experiences. Producers also adopt intelligent labeling for freshness indicators and tamper evidence. This digital connectivity supports both premium branding and regulatory compliance in sensitive markets. The trend helps brands differentiate in crowded retail spaces where shelf competition is intense. Smart packaging innovation is expected to expand further with the rise of digital-first consumers.

- For example, some producers are implementing freshness indicators integrated with NFC sensors that provide real-time product status, enhancing consumer confidence and reducing waste, although specific company-based metric data are proprietary and result from collaborative R&D innovation.

Premiumization of Packaging Designs for Competitive Differentiation:

The stand-up pouches market is witnessing a trend toward premiumization to strengthen consumer appeal. Brands invest in high-quality printing, metallic finishes, and unique pouch shapes to stand out. It helps businesses position products in the premium segment across food, beverage, and cosmetic industries. Customization options allow packaging to align closely with brand identity and target audience. Attractive pouch designs improve shelf impact, which is critical in competitive retail environments. Transparent windows, matte finishes, and high-definition graphics enhance consumer perception of quality. This premium design trend aligns with rising demand for indulgence and aspirational products. Packaging innovation continues to evolve as a strategic tool for brand recognition and consumer trust.

- For instance, Mondi Group operates over 100 production sites worldwide, focusing on customized flexible bags with premium barrier properties and recyclable materials, supporting high-quality visuals and shelf appeal.

Integration of Functional Closures and Advanced Fitments for User Convenience:

Functional enhancements form a key trend in the stand-up pouches market, supporting consumer convenience. Spouts, zippers, sliders, and easy-tear notches make pouches more practical and user-friendly. It extends usability for multi-serve products across food and beverage categories. Fitments also improve hygiene and product handling, particularly in liquid packaging. Growing demand for refillable packs in personal care and cleaning products encourages the use of advanced closures. The trend also supports sustainability by reducing the need for rigid plastic containers. Innovations in closure technology enhance consumer satisfaction and encourage repeat purchases. This continuous development strengthens pouch adoption in industries prioritizing ease of use.

Growing Popularity of Transparent and Minimalist Designs to Align with Clean Label Products:

The stand-up pouches market is influenced by the rising preference for minimalist packaging designs. Consumers seek clear labelling, simple aesthetics, and transparent pouches that highlight product authenticity. It supports clean-label movements across food and wellness categories where trust is critical. Minimalist designs resonate with modern buyers who value honesty and reduced packaging clutter. Brands adopt natural colors, earthy tones, and straightforward branding to appeal to eco-conscious customers. Transparent windows also promote trust by allowing customers to see the product inside. This design trend strengthens consumer confidence and reflects shifting values toward simplicity and clarity. Packaging design thus plays a crucial role in aligning with evolving consumer expectations.

Market Challenges Analysis:

Regulatory Pressures and Sustainability Demands Affecting Material Choices:

The stand-up pouches market faces significant challenges due to tightening regulations on single-use plastics and waste management. Governments across regions enforce stricter laws on recycling targets, packaging waste, and plastic reduction initiatives. It compels manufacturers to invest heavily in sustainable alternatives, increasing production costs and operational complexity. Recycling infrastructure remains underdeveloped in several emerging economies, creating inconsistencies in adoption. Some sustainable materials compromise durability or shelf-life, leading to performance concerns for sensitive products. The need for compliance with varying regional regulations complicates global supply chains. Market participants struggle to balance cost efficiency with regulatory requirements while maintaining competitive prices. These regulatory dynamics create persistent challenges in scaling pouch adoption sustainably.

Raw Material Volatility and Technological Barriers Restraining Market Growth:

The stand-up pouches market encounters hurdles from fluctuations in raw material prices, especially polymers and aluminum foils. Volatile costs directly impact manufacturing margins, challenging long-term profitability for producers. It also limits the ability of smaller firms to compete with established global brands. Technological limitations in recycling multi-layered pouches further restrict sustainable adoption. While innovation is ongoing, high R&D investments pose financial strain for mid-sized companies. Rising energy costs compound operational expenses, making cost management a critical challenge. Complex supply chains in raw materials create risks of delays and disruptions. These combined issues restrain the market from achieving its full growth potential despite rising demand.

Market Opportunities:

Rising Demand for Customizable and Branding-Oriented Packaging Formats:

The stand-up pouches market presents significant opportunities through increasing demand for customization and branding solutions. Businesses leverage digital printing technologies to create personalized designs and limited-edition packaging. It strengthens brand engagement, supports targeted marketing campaigns, and enhances shelf differentiation. Growing competition in consumer goods accelerates the need for packaging that communicates brand identity effectively. Small and mid-size enterprises benefit from low-cost customization options enabled by flexible packaging formats. Demand for packaging solutions that combine functionality with visual appeal ensures sustained adoption. The ability to deliver both consumer convenience and strong branding positions stand-up pouches as a future-ready solution.

Expansion in Emerging Markets and Sustainable Packaging Innovation:

The stand-up pouches market holds vast opportunities in emerging economies where packaged food and retail growth is accelerating. Expanding middle-class populations and rising urbanization in Asia Pacific, Latin America, and Africa drive demand. It benefits from rapid shifts in consumer lifestyles that prioritize convenience and affordability. Investments in recyclable and compostable materials create opportunities to meet sustainability expectations. Regional players focus on localized solutions that address cultural preferences and regulatory frameworks. Adoption of smart packaging and functional closures strengthens the scope in high-growth industries. The dual demand for eco-friendly materials and innovative designs creates a long-term growth pathway. Expanding presence in developing markets will remain a central opportunity for industry participants.

Market Segmentation Analysis:

By Type

The stand-up pouches market shows notable growth across different product categories. Aseptic pouches lead adoption due to extended shelf-life benefits in beverages and dairy alternatives. Standard pouches hold strong demand in snacks and dry food packaging, offering cost efficiency and versatility. Retort pouches continue to expand in ready-to-eat meals, where heat resistance is critical. Other niche pouch types support specialized applications in both consumer and industrial packaging.

- For instance, ProAmpac has improved retort pouch technology with multi-layer laminate structures that maintain heat resistance while enhancing barrier protection, ensuring product safety and extended shelf life in ready meals markets.

By Design

Flat bottom pouches dominate due to stability, superior shelf visibility, and branding opportunities. Round bottom and corner bottom pouches serve compact packaging needs for lightweight products. K-seal designs remain preferred for heavier or bulk contents, improving strength and durability. Other designs provide flexibility for tailored brand positioning in premium and mass-market applications.

- For instance, Coveris Group developed advanced K-seal pouch designs with enhanced mechanical strength to support bulk food items while improving display aesthetics in retail setups.

By Capacity

The 101–500g pouch category holds the largest share, widely used across packaged foods, snacks, and household products. Pouches below 50g gain attention for trial packs, samples, and single-serve offerings. The 50–100g segment supports smaller lifestyle products, while packs above 500g address bulk items such as pet food and family-sized goods. It enables manufacturers to target both convenience-driven and value-focused consumers.

By End-Use Industry and Material

Food and beverages dominate end-use, supported by rising packaged food consumption and beverage innovation. Beauty and personal care, healthcare, chemicals, and consumer goods represent growing segments adopting flexible packaging. Plastic leads the material segment with strong cost efficiency and versatility. Paper and aluminum gain momentum due to recyclability and premium appeal. The adaptability of the stand up pouches market across industries and materials highlights its long-term growth potential.

Segmentation:

By Type:

- Aseptic pouches

- Standard pouches

- Retort pouches

- Others

By Design:

- Round bottom

- Flat bottom

- Corner bottom

- K-seal

- Others

By Capacity:

- Less than 50g

- 50–100g

- 101–500g

- More than 500g

By End-Use Industry:

- Food

- Beverages

- Beauty & Personal Care

- Healthcare

- Chemical

- Consumer Products

- Others

By Material:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe

North America accounts for 34% of the stand-up pouches market, driven by strong demand for packaged foods, beverages, and pet food products. High consumer preference for convenience, resealable packaging, and eco-friendly formats strengthens adoption across the region. The United States leads with major food and beverage companies actively shifting to flexible packaging for cost efficiency and branding. Canada supports growth with increasing use of recyclable and compostable pouches in retail and e-commerce channels. Europe holds 28% share, supported by strict sustainability regulations and a growing push for circular economy practices. Germany, France, and the United Kingdom drive adoption with well-established food processing industries and innovation in premium packaging. Both regions remain central to innovation and regulatory-driven market expansion.

Asia Pacific

Asia Pacific holds the largest share at 30%, supported by urbanization, expanding middle-class populations, and rising consumption of packaged food and beverages. China leads growth with large-scale production capacity and high consumer demand for affordable packaging. India shows rapid expansion due to rising retail networks and increasing disposable incomes fueling packaged product consumption. Japan and South Korea contribute with premium packaging demand in personal care and healthcare sectors. It benefits from regional cost advantages, flexible supply chains, and significant investments in sustainable materials. The diverse industrial base across Asia Pacific ensures strong growth momentum, making it the fastest-growing region in the forecast period.

Latin America and Middle East & Africa

Latin America represents 5% of the stand-up pouches market, with Brazil and Mexico driving adoption across food, beverage, and personal care industries. Expanding retail chains and the shift to modern packaging solutions strengthen regional demand. The Middle East & Africa accounts for 3%, with growth supported by increasing packaged food consumption and retail modernization in Gulf countries and South Africa. Rising investments in consumer products and healthcare packaging create further opportunities. Both regions are emerging markets where affordability, functionality, and sustainable solutions are becoming important drivers. It highlights strong long-term potential for industry participants seeking untapped growth opportunities in developing economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor plc

- Mondi Group

- Sealed Air Corporation

- Smurfit Kappa

- Sonoco Products Company

- Berry Global, Inc.

- Coveris Group

- ProAmpac

- Huhtamaki

- Constantia Flexibles

- Winpak Ltd.

- Bischof+Klein SE & Co. KG

- Flair Flexible Packaging Corporation

- Glenroy, Inc.

- Uflex Limited

Competitive Analysis:

The stand-up pouches market is highly competitive, with global and regional players focusing on innovation, sustainability, and customization. Leading companies such as Amcor, Mondi Group, Sealed Air, Berry Global, and Huhtamaki emphasize eco-friendly materials, lightweight formats, and advanced printing solutions. It remains a market where strong investments in research and development ensure differentiation through functional closures, barrier properties, and smart packaging features. Competition also intensifies through mergers, acquisitions, and partnerships that expand product portfolios and geographic reach. Companies strengthen market presence by aligning with retailer demands, sustainability regulations, and evolving consumer preferences.

Recent Developments:

- In June 2025, ProAmpac partnered with ScottsMiracle-Gro to launch a spouted pouch for Ortho Home Defense Max. This new packaging integrates ProAmpac’s chemical- and UV-resistant laminating technology, creating a durable and sustainable alternative to rigid containers. The pouch reduces plastic usage by 90%, decreases overall weight, and is optimized for e-commerce distribution, enhancing consumer convenience while supporting environmental goals.

- In January 2025, Amcor plc, in collaboration with Mespack, launched an innovative 2-liter recycle-ready stand-up pouch targeted at the Home Care market. This product offers a durable, recyclable, and consumer-friendly alternative to traditional rigid packaging. The pouch features drop resistance and leak-proof construction, manufactured using Amcor’s AmPrima® recycle-ready solutions, compliant with the European Union’s Packaging and Packaging Waste Regulation (PPWR). This innovation significantly reduces carbon emissions, aligning with global sustainability goals.

- In February 2025, Berry Global partnered with Mars to advance sustainability efforts by transitioning Mars’ pantry jars for M&M’S®, SKITTLES®, and STARBURST® brands to packaging made from 100% recycled plastic (excluding lids). This initiative eliminates over 1,300 metric tons of virgin plastic annually, promoting a circular economy through the use of post-consumer resin.

Market Concentration & Characteristics:

The stand-up pouches market shows moderate to high concentration, with established multinational packaging companies holding significant shares across global regions. It is characterized by continuous product innovation, strong sustainability initiatives, and customization tailored to brand needs. Regional players compete by offering cost advantages and localized solutions, while global leaders focus on strategic expansions and collaborations. The market demonstrates a balance between mass-market applications in food and beverages and premium segments in personal care and healthcare, reflecting its adaptability and long-term growth potential.

Report Coverage:

The research report offers an in-depth analysis based on type, design, capacity, end-use industry, material, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for sustainable pouch formats will drive adoption across industries.

- Innovations in recyclable and compostable materials will strengthen brand competitiveness.

- Digital printing will expand customization opportunities for small and mid-sized businesses.

- E-commerce growth will boost demand for lightweight and tamper-resistant packaging.

- Functional closures such as spouts and zippers will increase product usability.

- Expansion in Asia Pacific will accelerate due to retail and food consumption growth.

- Regulatory pressures will encourage faster transition to eco-friendly packaging.

- Premiumization in personal care and healthcare sectors will create niche opportunities.

- Investments in smart packaging technologies will enhance consumer engagement.

- Consolidation through mergers and partnerships will shape competitive dynamics.