Market Overview:

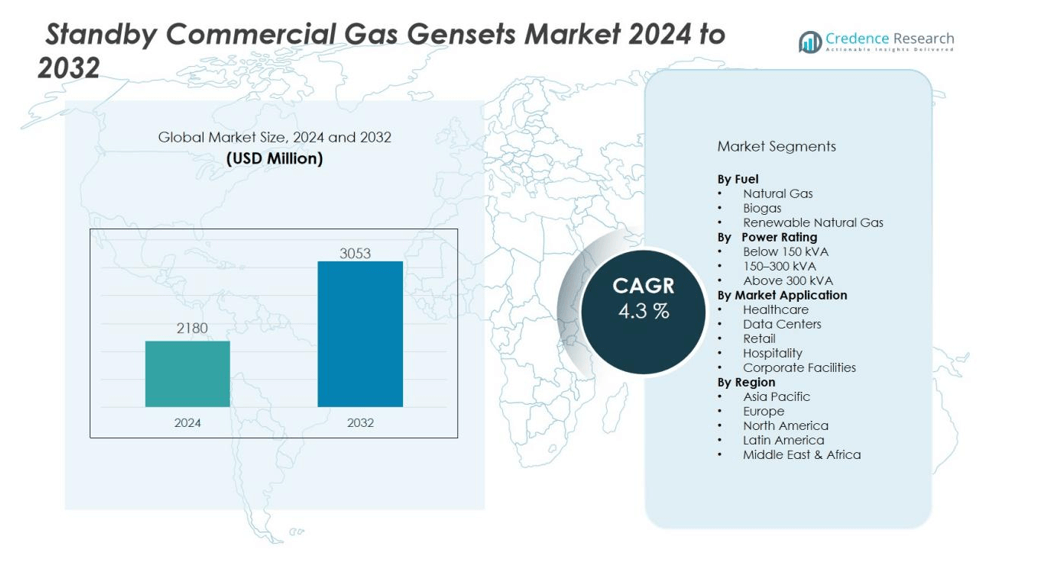

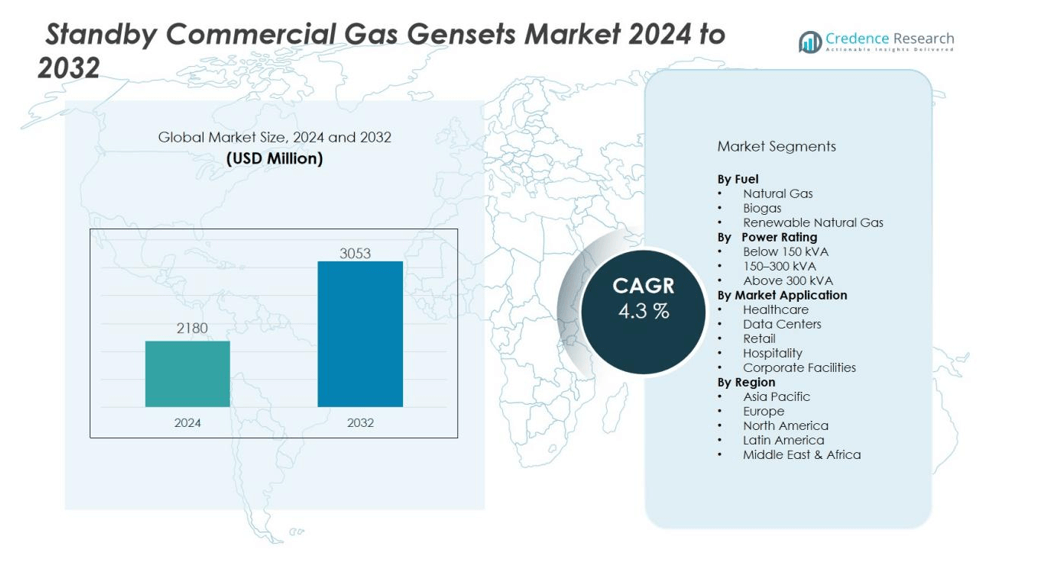

The standby gas fueled power rental market size was valued at USD 2180 million in 2024 and is anticipated to reach USD 3053 million by 2032, at a CAGR of 4.3 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Standby Gas Fueled Power Rental Market Size 2024 |

USD 2180 million |

| Standby Gas Fueled Power Rental Market, CAGR |

4.3% |

| Standby Gas Fueled Power Rental Market Size 2032 |

USD 3053 million |

Market drivers include growing industrialization, rising energy demand, and frequent grid instability across developing regions. Businesses are increasingly opting for gas-fueled rental generators due to their cleaner emissions compared to diesel alternatives. The transition toward sustainable energy solutions, coupled with strict government regulations on carbon emissions, has further accelerated adoption. In addition, the need for temporary power during emergencies, natural disasters, and peak load management strongly supports rental market expansion.

Regionally, North America holds a leading share of the standby gas fueled power rental market, accounting for nearly 38 percent of the global revenue. The dominance stems from high energy demand in industrial hubs, aging grid infrastructure, and frequent power outages. Europe follows with strong adoption across manufacturing and commercial sectors, while Asia Pacific is projected to register the fastest growth, driven by rapid industrial expansion, urbanization, and government-backed infrastructure development.

Market Insights:

- The standby gas fueled power rental market was valued at USD 2180 million in 2024 and is projected to reach USD 3053 million by 2032, growing at a CAGR of 4.3 % .

- Industrialization, rising energy demand, and grid instability drive adoption, with businesses preferring gas-fueled rentals for cleaner emissions compared to diesel alternatives.

- North America leads with 38 % share, supported by high energy demand, aging grid infrastructure, and reliance from data centers and healthcare facilities.

- Europe accounts for 29 % share, driven by strict environmental regulations and strong demand from manufacturing and commercial sectors.

- Asia Pacific holds 24 % share and records the fastest growth, fueled by rapid urbanization, expanding infrastructure, and rising dependence on scalable rental power solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Reliable Backup Power Across Industrial and Commercial Sectors:

The standby gas fueled power rental market is strongly driven by rising demand for dependable backup power. Industries such as oil and gas, construction, and mining often face unstable grid supply and require continuous operations. Rental solutions offer immediate availability without long-term capital investment. This demand is further amplified by large-scale commercial facilities and events requiring temporary power stability.

- For instance, Caterpillar Inc. reported deployment of its C175-20 gas generator sets, capable of delivering 3150-4,000 kW of continuous power, to support critical operations in offshore oil rigs, ensuring zero downtime during grid interruptions.

Shift Toward Cleaner and More Sustainable Energy Alternatives:

Stricter emission regulations and sustainability goals are influencing the preference for gas-based rental systems. It provides lower emissions compared to diesel-powered units, supporting environmental compliance. Many organizations are adopting natural gas and liquefied petroleum gas rental solutions to align with green initiatives. This shift creates new growth opportunities for rental providers offering eco-friendly energy alternatives.

- For instance, Aggreko’s Tier 4 Final 600 kVA canopy generator—capable of running on natural gas—achieves a 98% reduction in particulate matter emissions compared to conventional diesel units.

Growing Need for Emergency and Disaster Recovery Solutions:

The increasing frequency of extreme weather events and natural disasters strengthens demand for standby power rentals. Critical facilities such as hospitals, data centers, and government institutions rely on fast deployment to maintain essential operations. The standby gas fueled power rental market supports rapid restoration of power in disaster-affected regions. Its flexible deployment capability makes it an essential part of emergency planning strategies.

Expansion of Infrastructure Development and Urbanization Projects:

Rapid infrastructure development across emerging economies is creating sustained demand for rental power solutions. Construction projects often operate in remote areas with limited access to stable grid supply. Rental systems provide scalable, cost-effective solutions for powering equipment and site operations. It ensures continuity and efficiency for projects, strengthening the market’s role in supporting global development.

Market Trends:

Integration of Advanced Monitoring and Remote Management Technologies:

A key trend in the standby gas fueled power rental market is the integration of digital technologies for enhanced monitoring and management. Rental providers are adopting IoT-enabled solutions that allow real-time tracking of performance, fuel consumption, and emissions. Remote monitoring ensures quick fault detection, reduces downtime, and supports predictive maintenance. Customers benefit from improved efficiency and reliability, making rental solutions more attractive for critical applications. It strengthens customer confidence and drives higher adoption in industries requiring uninterrupted operations.

- For instance, Aggreko fitted its Remote Monitoring (ARM) system on 45 generators servicing 38 remote oil wells in Egypt and recorded zero unscheduled trips over a 12-month period.

Rising Adoption of Flexible and Scalable Rental Solutions Across Diverse End-Uses:

The market is witnessing strong growth in demand for scalable and customizable rental solutions tailored to specific industry needs. End users prefer short-term and long-term rental contracts that provide operational flexibility without heavy capital investment. The standby gas fueled power rental market is also expanding into emerging segments such as data centers and large event management, where power reliability is non-negotiable. Providers are diversifying their portfolios to include modular units that can be scaled up or down easily. It reflects a broader trend toward flexible energy sourcing that aligns with both cost efficiency and sustainability requirements.

For instance, Aggreko’s modular gas rental units were used extensively in the U.K. for emergency power supply during 2024’s large-scale events, with over 140 units deployed to ensure seamless power backup and a 15% reduction in setup time year-on-year.

Market Challenges Analysis:

High Operational Costs and Fuel Price Volatility Impacting Profitability:

One of the major challenges in the standby gas fueled power rental market is the high cost of operations. Fuel price fluctuations directly impact rental pricing, making it difficult for providers to maintain stable margins. Maintenance and servicing of rental fleets add further cost pressure. Customers in cost-sensitive markets may hesitate to adopt gas-fueled rentals when cheaper alternatives are available. It creates competitive tension and requires providers to balance affordability with quality.

Regulatory Constraints and Infrastructure Limitations Hindering Wider Adoption:

Strict environmental regulations and limited gas infrastructure present significant obstacles for market growth. Many regions lack sufficient gas pipeline networks, which restricts deployment in remote areas. The standby gas fueled power rental market faces compliance requirements related to emissions, noise, and safety standards, increasing operational complexity. Providers must invest in advanced technologies to meet these regulations, raising initial costs. It limits accessibility for small and medium-scale users seeking quick and affordable power rental options.

Market Opportunities:

Growing Demand from Data Centers and Critical Infrastructure:

The increasing reliance on digital services creates strong opportunities in the standby gas fueled power rental market. Data centers, telecom networks, and healthcare facilities require uninterrupted power to safeguard critical operations. Gas-fueled rentals offer a cleaner and more reliable solution compared to diesel alternatives. Providers can expand their services by offering scalable rental units tailored to these high-demand sectors. It positions rental power as a strategic partner for industries where downtime is unacceptable.

Expansion in Emerging Economies and Renewable Integration:

Rapid urbanization and industrialization in Asia Pacific, Latin America, and Africa open new avenues for growth. Construction, mining, and infrastructure projects in these regions require temporary and mobile power solutions. The standby gas fueled power rental market can also benefit from hybrid models that integrate renewable sources with gas systems to reduce emissions. Rental companies adopting green strategies will gain a competitive advantage with governments and corporations seeking sustainable options. It creates long-term opportunities for expanding service networks and capturing new customer segments.

Market Segmentation Analysis:

By Power Rating:

The standby gas fueled power rental market is segmented by power rating into below 100 kW, 100–500 kW, and above 500 kW units. Below 100 kW units find demand in small commercial spaces and events requiring temporary backup. The 100–500 kW segment dominates industrial and mid-sized construction projects where reliability is critical. Above 500 kW systems are preferred for large-scale facilities such as data centers, mining operations, and oilfield activities. It demonstrates strong growth potential across industries seeking scalable and fuel-efficient solutions.

- For instance, Caterpillar’s Cat C175-12 genset provides 400 kW of output with Smart Grid–ready synchronization that reduces grid synchronization time to 2 seconds.

By Application:

Key applications include standby power, peak shaving, and continuous load support. Standby power rental holds the leading share due to rising outages and grid instability. Peak shaving demand is growing in developed regions where businesses manage high electricity costs during peak hours. Continuous load applications are gaining traction in construction and remote operations requiring uninterrupted energy. It highlights the versatility of gas-fueled rentals across temporary and long-term use cases.

- For instance, the Cummins QSK95 C3500 D5e generator delivers a best-in-class standby rating of 2800 kW.

By End Use:

End-use segments include construction, oil and gas, mining, events, and utilities. Construction projects represent a major share driven by expanding infrastructure activity worldwide. Oil and gas operations rely on rentals for remote drilling and refining facilities. Mining applications demand large-capacity systems to maintain equipment performance and site operations. Utilities and large events also depend on rentals for backup and emergency supply, strengthening the overall market outlook.

Segmentations:

By Power Rating:

- Below 100 kW

- 100–500 kW

- Above 500 kW

By Application:

- Standby Power

- Peak Shaving

- Continuous Load

By End Use:

- Construction

- Oil and Gas

- Mining

- Events

- Utilities

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America holds 38 % share of the standby gas fueled power rental market, driven by strong adoption across industrial and commercial sectors. The region benefits from aging grid infrastructure, frequent outages, and rising energy demand in oil, gas, and construction industries. Rental providers are expanding capacity to meet requirements of large-scale projects and emergency backup needs. Data centers and healthcare facilities further drive reliance on gas-fueled rental systems. It positions the region as a consistent revenue generator for market players.

Europe:

Europe accounts for 29 % share of the standby gas fueled power rental market, supported by strict environmental regulations and high energy reliability requirements. Manufacturing hubs across Germany, France, and the UK drive demand for efficient backup power systems. Rental providers emphasize clean energy alternatives that align with EU carbon reduction targets. Events, commercial complexes, and industrial facilities continue to expand demand for temporary and standby rentals. It highlights Europe as a regulated yet profitable region for rental service providers.

Asia Pacific:

Asia Pacific holds 24 % share of the standby gas fueled power rental market, yet records the highest growth rate. Rapid urbanization and infrastructure expansion in China, India, and Southeast Asia are key contributors. Industries such as construction, mining, and telecom increasingly depend on scalable rental power solutions. Providers are investing in regional fleets to capture rising demand from fast-growing economies. It establishes Asia Pacific as the most dynamic market for future expansion opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Aggreko

- Bredenoord

- Ashtead Group

- Byrne Equipment Rental

- Cummins

- Generac Power Systems

- Caterpillar

- GMMCO

- HIMOINSA

- Herc Rentals

- Modern Hiring Service

- Perennial Technologies

- Sudhir Power

- Shenton Group

Competitive Analysis:

The standby gas fueled power rental market is defined by strong competition among global and regional players aiming to expand fleet capacity and service networks. Key participants include Aggreko, Bredenoord, Ashtead Group, Byrne Equipment Rental, Cummins, Generac Power Systems, Caterpillar, GMMCO, and HIMOINSA. These companies focus on product reliability, cleaner fuel technology, and flexible rental models to attract industrial and commercial clients. It is shaped by continuous investments in digital monitoring, hybrid systems, and efficient distribution to strengthen customer engagement. Competitive strategies emphasize long-term contracts with industries such as construction, oil and gas, mining, and data centers. Partnerships, acquisitions, and regional expansions remain central to improving market positioning. It creates a dynamic landscape where companies with advanced technology, broad service coverage, and strong financial capability secure competitive advantage.

Recent Developments:

- In June 2025, Ashtead Group reports record financial performance, achieving a 47% EBITDA margin for the second quarter of 2025.

- In May 2025, Byrne Equipment Rental collaborated with Spacemaker UAE to drive sustainable progress at OPES 2025 in Oman, showcasing innovative solutions for temporary infrastructure and energy management

Market Concentration & Characteristics:

The standby gas fueled power rental market is moderately concentrated, with global and regional players competing to secure long-term contracts and expand rental fleets. Leading companies focus on fleet modernization, cleaner fuel adoption, and digital integration to strengthen competitiveness. It features a mix of multinational providers with strong service networks and local firms catering to regional needs. Customer preference for reliable, scalable, and environmentally compliant solutions drives continuous product innovation. Market characteristics include high capital intensity, regulatory compliance, and demand fluctuation tied to industrial activity and emergency events. It positions established providers with advanced technologies and broad service coverage at a clear advantage over smaller competitors.

Report Coverage:

The research report offers an in-depth analysis based on Power Rating, Application, End Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The standby gas fueled power rental market will expand as industries prioritize reliable backup solutions.

- Demand will rise from data centers, healthcare, and telecom sectors requiring continuous power supply.

- Providers will adopt hybrid models that combine gas rentals with renewable integration to meet sustainability goals.

- Digitalization and IoT-enabled monitoring will transform operations, improving efficiency, fault detection, and fuel management.

- North America will maintain leadership due to strong industrial usage and dependence on temporary power solutions.

- Europe will strengthen adoption driven by regulatory compliance and demand for low-emission rental systems.

- Asia Pacific will record the fastest growth, supported by infrastructure development and rapid industrialization.

- Competitive strategies will focus on fleet expansion, partnerships, and advanced technologies to secure long-term contracts.

- Customers will prefer flexible rental models that reduce capital investments while ensuring scalability of operations.

- The market will evolve into a critical enabler for sustainable and uninterrupted power supply worldwide.