Market Overview

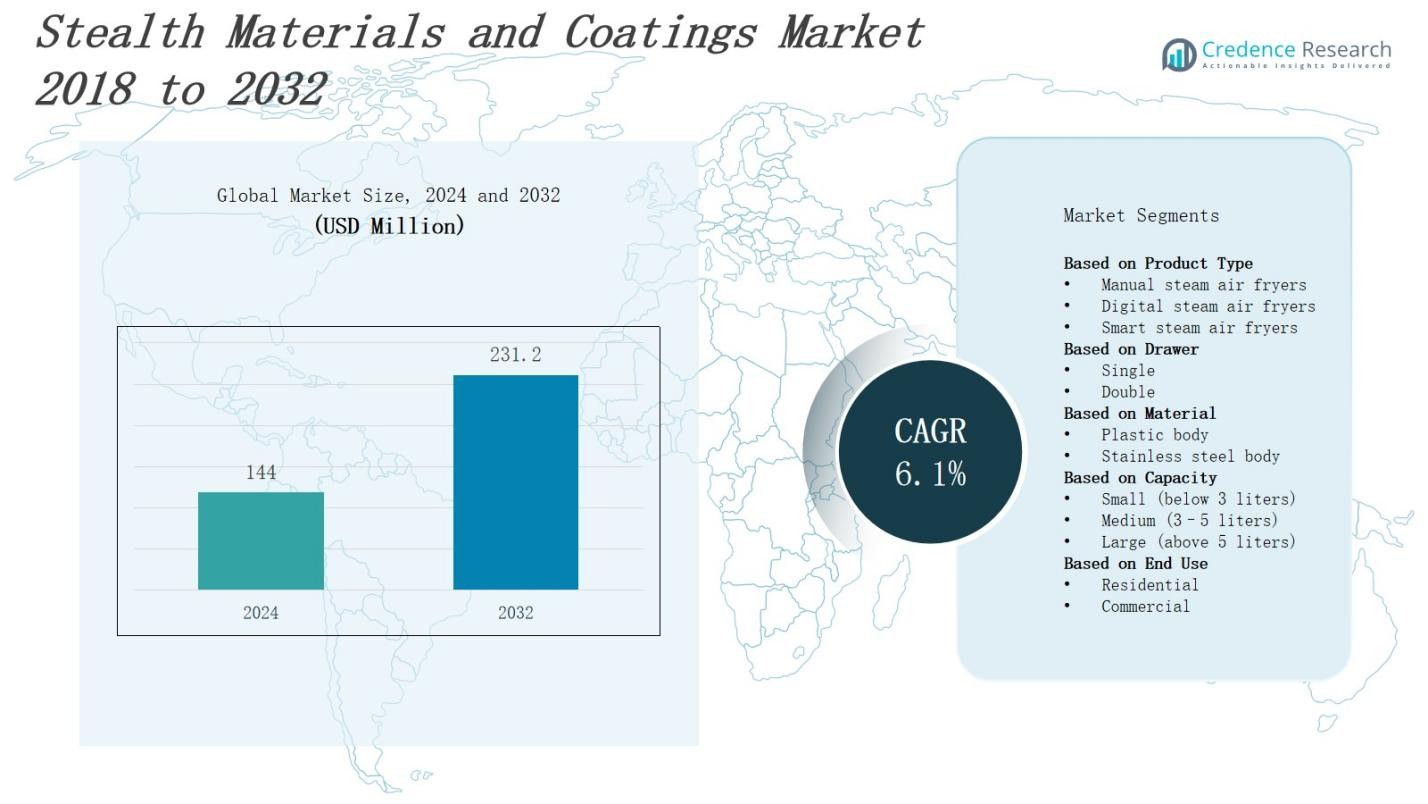

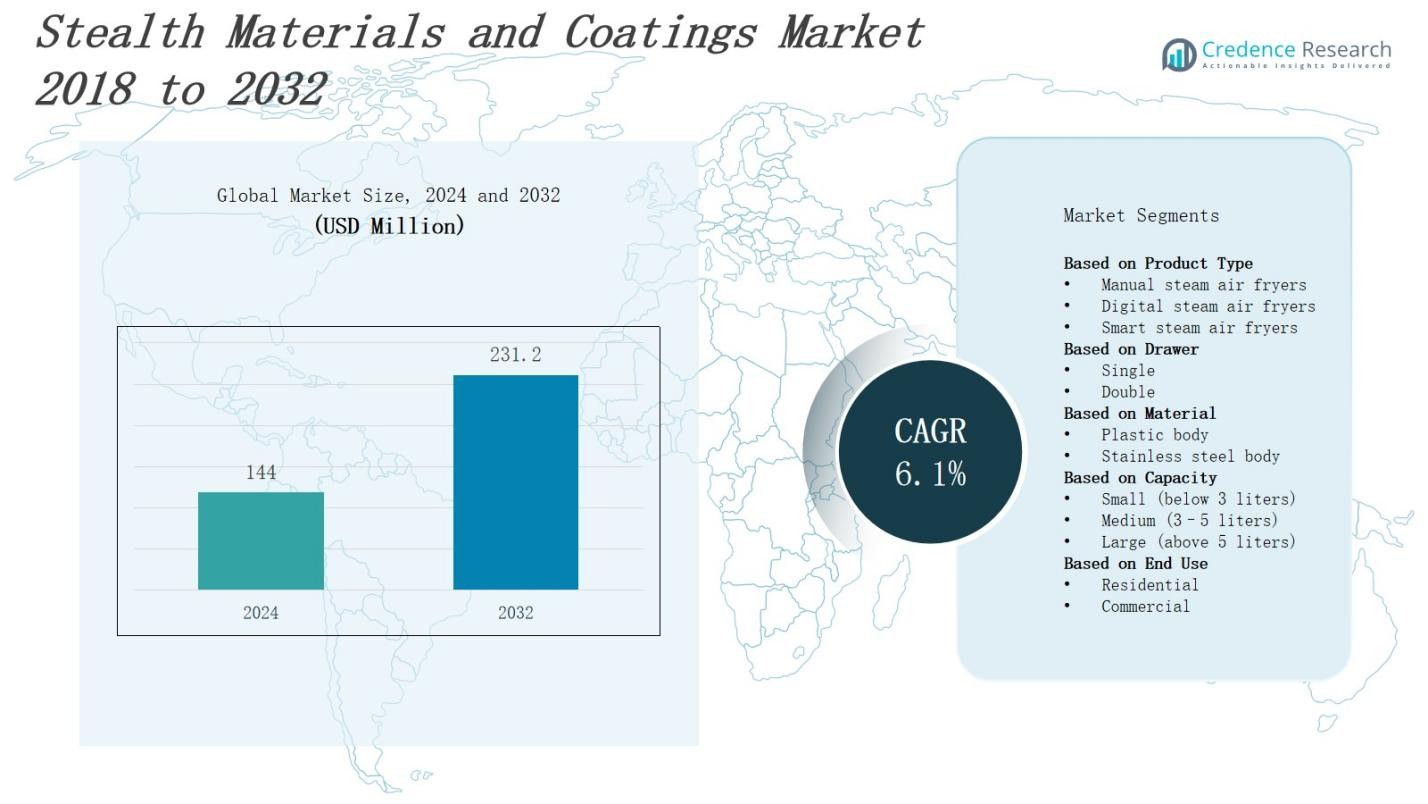

The Stealth Materials and Coatings Market is projected to grow from USD 144 million in 2024 to USD 231.2 million by 2032, registering a compound annual growth rate (CAGR) of 6.1%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Stealth Materials and Coatings Market Size 2024 |

USD 144 Million |

| Stealth Materials and Coatings Market, CAGR |

6.1% |

| Stealth Materials and Coatings Market Size 2032 |

USD 231.2 Million |

The stealth materials and coatings market grows driven by rising defense modernization efforts and increasing demand for advanced radar-absorbing technologies. Governments focus on enhancing military vehicle and aircraft survivability against sophisticated detection systems. Technological advancements in lightweight, durable, and multifunctional coatings improve stealth capabilities while reducing operational costs. The adoption of next-generation materials, such as metamaterials and nanocomposites, supports improved electromagnetic wave absorption and thermal management. Growing geopolitical tensions and expanding defense budgets worldwide further accelerate market growth. Innovations targeting civilian applications, including privacy and security, also contribute to evolving market dynamics.

The stealth materials and coatings market spans key regions including North America, Europe, Asia-Pacific, and the Rest of the World, with North America leading due to high defense spending and advanced R&D. Europe follows, driven by NATO collaborations and modernization efforts. Asia-Pacific shows rapid growth fueled by military modernization in China, India, and others. The Rest of the World expands through rising defense investments in the Middle East, Latin America, and Africa. Leading key players such as Lockheed Martin, BAE Systems, 3M, and Rheinmetall dominate across these regions, driving innovation and market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The stealth materials and coatings market is projected to grow from USD 144 million in 2024 to USD 231.2 million by 2032, registering a compound annual growth rate (CAGR) of 6.1%.

- Rising defense modernization efforts and increasing demand for advanced radar-absorbing technologies drive market growth. Governments focus on enhancing military vehicle and aircraft survivability against sophisticated detection systems.

- Technological advancements in lightweight, durable, and multifunctional coatings improve stealth capabilities while reducing operational costs. Adoption of next-generation materials like metamaterials and nanocomposites supports better electromagnetic wave absorption and thermal management.

- The market spans North America, Europe, Asia-Pacific, and the Rest of the World, with North America leading due to high defense spending and advanced R&D. Europe follows, driven by NATO collaborations and modernization initiatives.

- Asia-Pacific shows rapid growth fueled by military modernization in China, India, and other countries. The Rest of the World expands through rising defense investments in the Middle East, Latin America, and Africa.

- Challenges include high production costs and complex manufacturing processes, which limit adoption among smaller defense contractors and emerging economies. Regulatory compliance and strict military performance standards also pose significant obstacles.

- Geopolitical instability and strategic defense investments continue to create opportunities, with governments prioritizing stealth capabilities to counter sophisticated surveillance and missile detection systems across various platforms.

Market Drivers

Rising Defense Modernization and Military Applications Drive Market Demand

The stealth materials and coatings market experiences strong demand due to widespread defense modernization programs. Militaries worldwide prioritize enhancing the survivability of aircraft, naval vessels, and ground vehicles against advanced radar and infrared detection systems. Governments allocate substantial budgets to develop next-generation stealth technologies that improve mission success and reduce casualties. It supports the development of lightweight, durable coatings that absorb or scatter electromagnetic waves, minimizing visibility. Rising geopolitical tensions push nations to adopt superior stealth solutions for strategic advantage. This demand stimulates continuous innovation and deployment in defense sectors globally.

- For instance, BAE Systems has developed the ADAPTIV camouflage system, which enables military vehicles to blend into their environments and effectively disappear from hostile thermal imaging, demonstrating innovation beyond just radar stealth.

Technological Advancements Enhance Performance and Application Scope

Technological progress in nanotechnology, metamaterials, and composites drives growth in the stealth materials and coatings market. Innovations improve radar-absorbing capabilities while reducing weight and increasing durability under harsh operational conditions. Research efforts focus on multifunctional coatings that provide thermal management and corrosion resistance alongside stealth features. It enables expanded applications beyond traditional military uses, including civil aviation and security infrastructure. Continuous improvements in material science facilitate the development of adaptable, cost-effective solutions that meet evolving defense and commercial requirements, sustaining market momentum.

Increasing Demand from Aerospace and Naval Sectors Supports Expansion

The aerospace and naval sectors remain key end-users fueling the stealth materials and coatings market expansion. Aircraft manufacturers integrate advanced coatings to reduce radar signatures of fighter jets and unmanned aerial vehicles. Naval vessels deploy stealth materials to minimize detection risks in increasingly contested maritime environments. It responds to stringent military specifications requiring enhanced operational stealth while maintaining performance and structural integrity. The growing adoption of unmanned systems and next-generation platforms further propels the need for sophisticated stealth technologies in these sectors, reinforcing market growth.

- For instance, Sweden’s Visby-class corvettes are among the first operational naval vessels designed with stealth in mind, leveraging radar-absorbent materials and shaping techniques.

Geopolitical Instability and Strategic Defense Investments Influence Market Growth

Geopolitical instability and rising security threats drive governments to prioritize investments in stealth capabilities. The stealth materials and coatings market benefits from increasing defense expenditures aimed at countering sophisticated surveillance and missile detection systems. It supports countries in maintaining strategic deterrence and securing borders with advanced military technologies. Heightened focus on asymmetric warfare and electronic countermeasures promotes the adoption of stealth solutions across various platforms. Continued geopolitical tensions and defense alliances ensure sustained demand for innovative stealth materials globally.

Market Trends

Adoption of Advanced Nanomaterials and Metamaterials Transforms Product Capabilities

The stealth materials and coatings market increasingly embraces advanced nanomaterials and metamaterials to enhance radar absorption and thermal management. These innovations allow for precise control over electromagnetic wave interactions, improving stealth effectiveness without compromising weight or durability. It fosters the development of multifunctional coatings that combine stealth with environmental resistance. Manufacturers focus on scalable production techniques to meet growing demand from defense and aerospace sectors. This trend accelerates the transition from traditional materials to high-performance composites.

- For instance, Northrop Grumman advanced the scalable manufacturing of multifunctional, nanostructured skins that combine stealth capability with enhanced weather resistance for next-generation unmanned aerial vehicles.

Integration of Smart and Adaptive Coatings Advances Operational Efficiency

Smart and adaptive coatings gain prominence within the stealth materials and coatings market due to their ability to respond to environmental stimuli and threats. These coatings adjust their properties dynamically to optimize stealth under varying operational conditions such as temperature shifts or radar frequency changes. It supports enhanced survivability for military platforms in complex combat scenarios. Research institutions and defense contractors collaborate to refine these intelligent materials, expanding their applicability and improving cost-efficiency. The shift toward active stealth solutions marks a significant market evolution.

- For instance, PPG Industries launched the Sigma Sailadvance NX, an antifouling smart coating breakthrough aimed at reducing maintenance while protecting marine and other surfaces from corrosion.

Growing Emphasis on Lightweight and Eco-Friendly Materials Shapes Market Direction

Lightweight stealth materials attract increased attention for their ability to reduce overall platform weight and improve fuel efficiency. The stealth materials and coatings market reflects this focus by developing environmentally friendly formulations that minimize hazardous substances and waste during manufacturing. It promotes sustainability in defense procurement policies while maintaining high-performance standards. The demand for green alternatives encourages innovation in bio-based polymers and low-VOC coatings. This trend aligns with global efforts to balance defense capabilities with environmental responsibility.

Expansion of Commercial and Civilian Applications Diversifies Market Reach

The stealth materials and coatings market witnesses diversification through rising adoption in commercial aviation, automotive, and security sectors. These industries leverage stealth technologies to enhance privacy, reduce noise, and improve aesthetic appeal while providing electromagnetic interference shielding. It broadens market potential beyond military domains, encouraging cross-sector innovation and investment. Collaboration between defense and commercial players facilitates technology transfer, accelerating product development cycles. This expansion supports sustained revenue growth and competitive differentiation across multiple markets.

Market Challenges Analysis

High Production Costs and Complex Manufacturing Processes Hinder Market Penetration

The stealth materials and coatings market faces challenges related to the high costs of raw materials and complex fabrication techniques. Advanced composites, nanomaterials, and metamaterials require specialized equipment and stringent quality controls, driving up production expenses. It limits widespread adoption, particularly among smaller defense contractors and emerging economies. The need for precise application methods further complicates manufacturing and increases operational costs. These factors restrict scalability and delay market expansion despite growing demand. Continuous efforts to optimize production efficiency remain essential to overcoming this barrier.

Stringent Regulatory Compliance and Performance Standard Requirements Pose Obstacles

Regulatory frameworks and strict military performance standards create significant hurdles for the stealth materials and coatings market. It must comply with environmental, health, and safety regulations while meeting rigorous durability, radar absorption, and thermal resistance criteria. Certification processes involve extensive testing and validation, prolonging product development timelines. Non-compliance risks project delays and increased costs for manufacturers. Furthermore, evolving defense requirements demand constant innovation, pressuring companies to balance compliance with rapid technological advancement. Managing regulatory complexities remains a critical challenge for sustained market growth.

Market Opportunities

Expansion into Emerging Defense Markets Presents Significant Growth Potential

The stealth materials and coatings market benefits from expanding defense budgets in emerging economies seeking to modernize their military capabilities. Countries in Asia, the Middle East, and Latin America invest heavily in advanced technologies to enhance strategic deterrence and operational effectiveness. It offers opportunities for manufacturers to enter new regional markets with tailored solutions that meet specific defense requirements. Partnerships and joint ventures with local firms can facilitate technology transfer and accelerate market penetration. Growing geopolitical tensions drive demand for sophisticated stealth systems, creating a favorable environment for market expansion.

Diversification into Commercial and Civilian Applications Unlocks New Revenue Streams

The stealth materials and coatings market can capitalize on increasing interest from commercial sectors such as aerospace, automotive, and infrastructure security. These industries seek advanced coatings for electromagnetic interference shielding, noise reduction, and enhanced privacy features. It encourages innovation in multifunctional materials that combine stealth properties with durability and environmental resistance. Collaboration between defense and commercial technology developers can speed product adaptation and reduce costs. Expanding applications beyond military use broadens the market base and supports sustainable long-term growth.

Market Segmentation Analysis:

By Product Type

The stealth materials and coatings market categorizes offerings into radar-absorbing materials, thermal stealth coatings, and multispectral camouflage solutions. It addresses varying defense needs by providing materials optimized for specific detection spectrums. Radar-absorbing materials remain the largest segment due to extensive military applications. Thermal stealth coatings gain traction with the rise of infrared detection systems. Multispectral camouflage solutions combine various stealth properties, expanding application scope. Each product type supports diverse platform requirements and operational environments.

By Application

The market segments into aerospace, naval, and ground vehicle stealth solutions. Aerospace applications dominate due to stringent stealth requirements for fighter jets and unmanned aerial vehicles. Naval coatings reduce radar cross-section and infrared signatures of warships and submarines. Ground vehicle stealth solutions focus on lightweight, durable coatings to protect armored vehicles. It tailors materials to meet platform-specific challenges, ensuring comprehensive stealth capabilities across military domains.

- For instance, for naval stealth, warships like the U.S. Zumwalt-class destroyers employ angled hulls and composite materials to reduce radar visibility and infrared signatures.

By Material Type

The market includes polymer composites, nanomaterials, and metamaterials. Polymer composites provide cost-effective, scalable solutions with moderate stealth performance. Nanomaterials enhance absorption properties and durability while reducing weight. Metamaterials offer advanced control over electromagnetic wave behavior, representing cutting-edge stealth technology. It continuously invests in material innovations to improve performance and operational reliability. Material selection influences product effectiveness and cost-efficiency.

- For instance, Metamaterial Inc. creates engineered metamaterial surfaces that manipulate electromagnetic waves to reduce radar signatures, advancing stealth technology capabilities.

Segments:

Based on Product Type

- Manual steam air fryers

- Digital steam air fryers

- Smart steam air fryers

Based on Drawer

Based on Material

- Plastic body

- Stainless steel body

Based on Capacity

- Small (below 3 liters)

- Medium (3–5 liters)

- Large (above 5 liters)

Based on End Use

Based on Distribution Channel

-

- E-commerce

- Brand websites

-

- Specialty appliance store

- Consumer electronics stores

- Supermarkets/hypermarkets

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America leads the stealth materials and coatings market with a market share of 38%. The region benefits from high defense spending, advanced research infrastructure, and presence of key military technology manufacturers. It supports continuous innovation in stealth technologies driven by the U.S. Department of Defense and allied military programs. The focus on modernizing air, naval, and ground platforms boosts demand for advanced stealth coatings and materials. It also attracts collaborations between defense contractors and research institutions to develop next-generation solutions. Strong government support and stringent defense standards sustain North America’s dominance.

Europe

Europe holds a 26% share of the stealth materials and coatings market, driven by increasing defense modernization initiatives among NATO member countries. It focuses on enhancing the stealth capabilities of aircraft and naval vessels in response to evolving geopolitical threats. The region benefits from advanced manufacturing capabilities and cross-border defense collaborations that accelerate technology development. It actively invests in research to develop multifunctional materials that meet strict environmental and performance standards. Growing export opportunities also contribute to Europe’s significant market presence.

Asia-Pacific

Asia-Pacific commands a 24% market share in the stealth materials and coatings market, supported by rapid military modernization in countries like China, India, Japan, and South Korea. It experiences rising investments in indigenous defense manufacturing and technology adoption to strengthen strategic deterrence. The region encourages partnerships between global technology providers and local defense firms to advance stealth material capabilities. Increasing geopolitical tensions and expanding naval and aerospace platforms drive robust market growth. It also explores diversification into civilian applications to expand market reach.

Rest of the World

The Rest of the World accounts for 12% of the stealth materials and coatings market, reflecting growing defense expenditure in the Middle East, Latin America, and Africa. Emerging economies in these regions invest in modernizing their military fleets, increasing demand for advanced stealth solutions. It faces challenges related to technology transfer and production capacity but benefits from strategic alliances with leading defense manufacturers. The focus remains on enhancing tactical advantages through improved radar and thermal signature management. Market expansion continues alongside rising security concerns and defense collaborations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Geepas

- Cuisinart

- Instant Brands

- Philips

- Anova

- Ninja

- Midea Group

- Duronic

- Breville

- Gourmia

- Cosori

- Ciarra

Competitive Analysis

The stealth materials and coatings market features intense competition among established defense contractors, innovative material manufacturers, and emerging technology providers. Leading companies invest significant resources in research and development to enhance radar-absorbing properties, thermal management, and multifunctionality of their products. It fuels continuous advancements that improve stealth performance, durability, and cost-effectiveness. Collaboration between defense agencies and private firms accelerates the commercialization of cutting-edge solutions, helping companies maintain technological superiority. Market players focus on expanding their global footprint and securing strategic government contracts to strengthen their competitive positions. The presence of multinational corporations with broad defense portfolios and specialized firms with niche expertise creates a dynamic environment. It faces the challenge of meeting stringent military standards while delivering customized solutions for aerospace, naval, and ground vehicle applications. Efforts to optimize supply chains and reduce manufacturing costs further influence market dynamics.

Recent Developments

- In April 2024, BASF’s Coatings division launched a new range of eco-friendly clearcoats and undercoats aimed at improving performance and environmental compliance, with potential applications in defense and aerospace stealth coatings.

- In August 2023, BAE Systems Australia partnered with the Commonwealth of Australia to establish a new Aircraft Coating Facility at the Williamtown aerospace precinct, focusing on advanced stealth coatings to support the Royal Australian Air Force’s F-35 fleet.

- On November 26, 2024, IIT Kanpur introduced ‘Anālakṣhya,’ a meta-material microwave absorber that improves stealth capabilities against radar-guided missiles and synthetic aperture radar imaging.

- In September 2024, Rheinmetall and Honeywell signed a memorandum of understanding to collaborate on developing new visual systems and auxiliary power units for military vehicles, potentially integrating advanced stealth coatings to enhance operational effectiveness.

Market Concentration & Characteristics

The stealth materials and coatings market exhibits a moderately concentrated structure dominated by a few key global players with strong defense portfolios and advanced research capabilities. It features a mix of large multinational corporations and specialized firms focused on innovation in radar-absorbing materials, nanocomposites, and metamaterials. Market leaders leverage extensive government contracts and strategic partnerships to secure long-term revenue streams while investing heavily in R&D to maintain technological superiority. It faces high entry barriers due to stringent regulatory standards, complex manufacturing processes, and the need for rigorous performance validation. This concentration enables market players to control pricing and influence technological trends. However, emerging companies continuously seek opportunities through niche innovations and collaborations. It demands agility to adapt to evolving defense requirements and geopolitical dynamics, ensuring sustained competitiveness and growth within this specialized segment.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Drawer, MaterialEnd-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The stealth materials and coatings market will experience steady growth driven by increasing defense modernization efforts worldwide.

- Adoption of advanced materials like metamaterials and nanocomposites will enhance stealth performance across military platforms.

- Manufacturers will focus on developing multifunctional coatings combining radar absorption with thermal management and corrosion resistance.

- Aerospace and naval sectors will continue to drive demand due to stringent stealth requirements for aircraft and warships.

- Emerging economies will invest heavily in indigenous stealth technologies to strengthen strategic deterrence.

- Research collaborations between defense agencies and private firms will accelerate innovation and product development.

- Regulatory compliance and certification processes will shape product design and market entry timelines.

- Expansion into civilian applications, such as privacy and electromagnetic interference shielding, will diversify market opportunities.

- Supply chain optimization and cost reduction will remain key priorities for manufacturers to increase market accessibility.

- Geopolitical tensions and evolving security threats will sustain the demand for advanced stealth solutions globally.