Market Overview

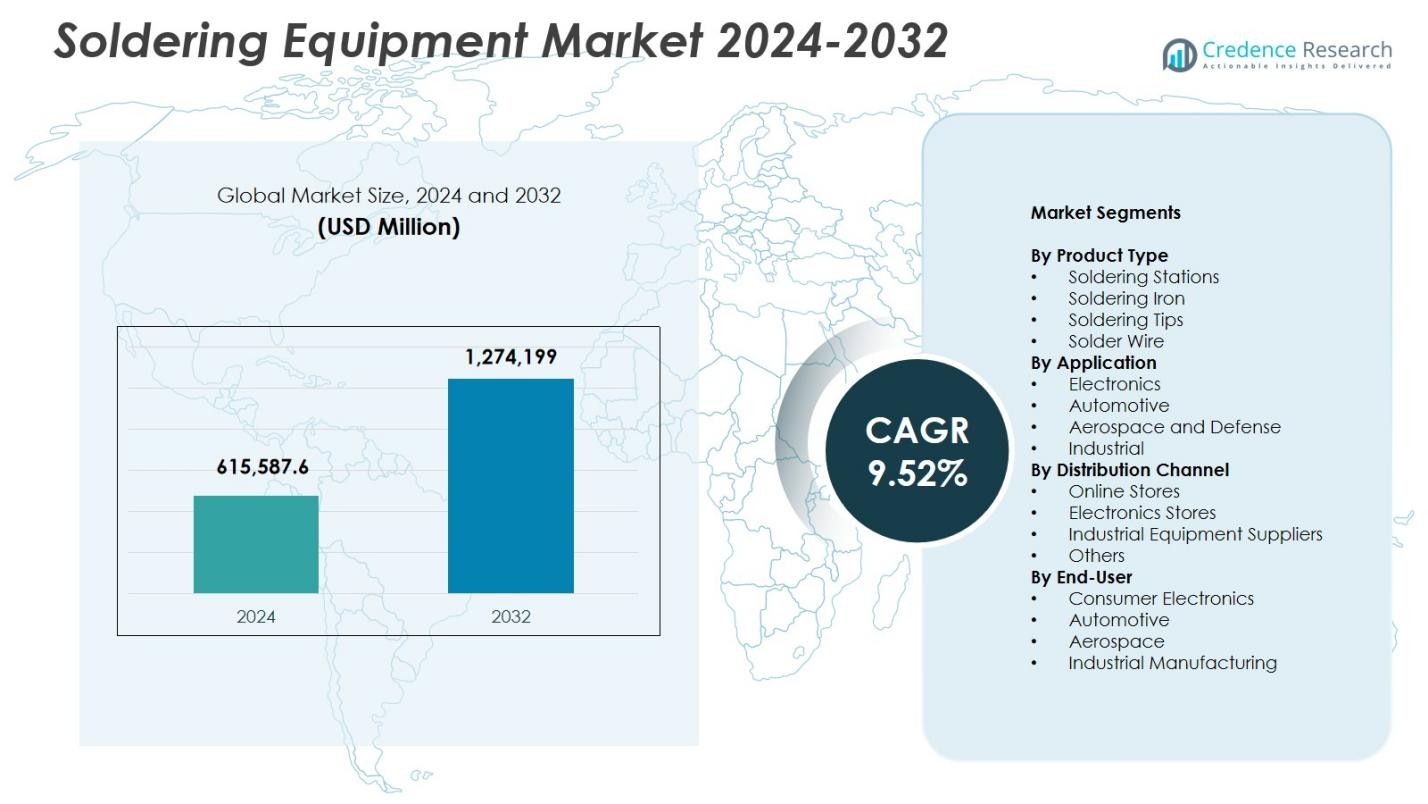

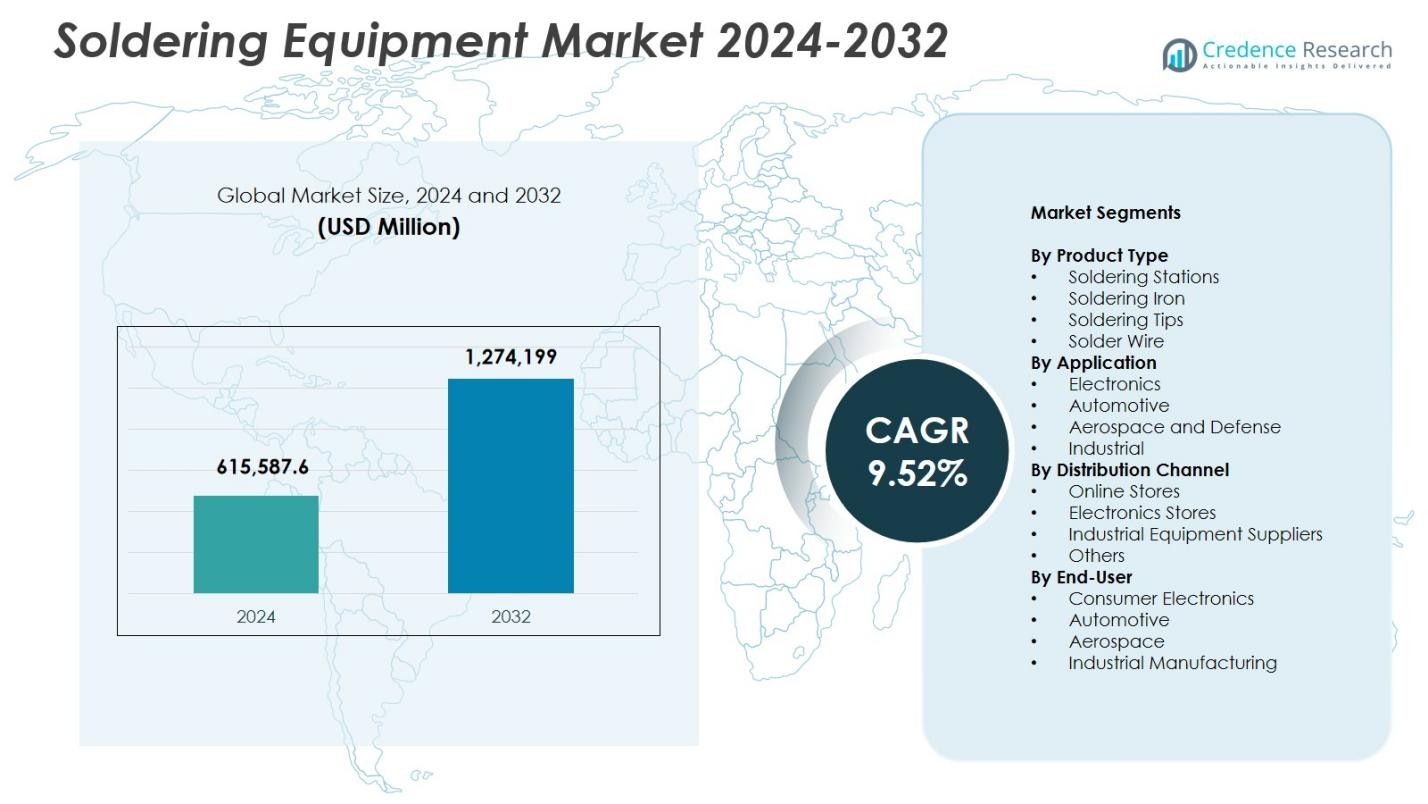

Soldering Equipment Market size was valued at USD 615,587.6 Million in 2024 and is anticipated to reach USD 1,274,199 Million by 2032, at a CAGR of 9.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Soldering Equipment Market Size 2024 |

USD 615,587.6 Million |

| Soldering Equipment Market, CAGR |

9.52% |

| Soldering Equipment Market Size 2032 |

USD 1,274,199 Million |

Soldering Equipment Market features leading players such as Hakko Corporation, Metcal, Apex Tool Group, Koki Company Limited, JBC Tools, American Hakko Products, Inc., PACE Worldwide, Kurtz Ersa, Weller Tools GmbH, and Ersa GmbH, who drive technological innovation through advanced soldering stations, automated platforms, and lead-free solutions. These companies strengthen industry adoption by focusing on precision, energy efficiency, and AI-enabled process control. Regionally, Asia-Pacific leads the Soldering Equipment Market with a 34.9% share, supported by extensive electronics manufacturing, widespread SMT adoption, and expanding semiconductor production, making it the dominant hub for high-volume soldering equipment demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Soldering Equipment Market reached USD 615,587.6 Million in 2024 and will grow at a 52% CAGR through 2032.

- Rising adoption of precision soldering stations, holding a 7% share, along with strong demand from electronics, which leads applications with a 42.3% share, drives sustained market expansion.

- Automation, AI-enabled soldering platforms, and lead-free compliance shape key trends as manufacturers invest in micro-soldering, thermal profiling, and sustainable alloy technologies.

- Key players such as Hakko Corporation, Metcal, Apex Tool Group, JBC Tools, and Ersa GmbH focus on advanced systems, digital control, and improved reliability to strengthen technological positioning.

- Asia-Pacific leads regional demand with a 9% share, followed by North America at 31.4% and Europe at 27.6%, reflecting strong electronics production, SMT adoption, and EV component manufacturing across major global markets.

Market Segmentation Analysis:

By Product Type

The Soldering Equipment Market by product type is dominated by Soldering Stations, holding a 34.7% share in 2024 due to their precision temperature control, modular configurations, and suitability for high-density PCB assembly. Demand strengthens as electronics manufacturers adopt automated and ESD-safe workstations to improve solder quality and throughput. Soldering irons account for steady consumption in repair operations, while soldering tips and solder wire gain traction from ongoing miniaturization and high-reliability applications. Increasing production of consumer electronics, EV components, and advanced semiconductor packaging drives strong adoption across industrial and professional workflows.

- For instance, Hakko’s FX-888D soldering station delivers 70W power consumption with a temperature range of 50 to 480°C and stability of ±1°C at idle, enabling precise control for PCB rework without tip changes.

By Application

Within applications, Electronics leads the Soldering Equipment Market with a 42.3% share in 2024, supported by rapid expansion in PCB assembly, semiconductor packaging, and surface-mount technology processes. High-volume production of smartphones, wearables, EV power modules, and IoT devices accelerates demand for precision soldering systems. The automotive segment grows as EV propulsion systems and ADAS electronics require high-reliability joints, while aerospace and defense favor advanced, lead-free soldering for mission-critical components. Industrial applications continue contributing stable demand as automation equipment, sensors, and control modules increasingly rely on robust solder interconnects.

By Distribution Channel

Industrial Equipment Suppliers dominate the distribution landscape with a 38.6% share in 2024, driven by their ability to provide professional-grade soldering systems, technical guidance, after-sales support, and bulk procurement options for manufacturing facilities. Online stores experience accelerating traction as small workshops and individual technicians seek cost-effective and quick-delivery tools, while electronics stores retain strong demand for consumer and light-industrial soldering products. The “Others” category, including specialized distributors, benefits from rising adoption of advanced, automated, and ESD-controlled systems across electronics and automotive production lines.

- For instance, Fancort Industries supplies the UNIX-VFR, a 6-axis vertical inline robotic soldering system ideal for point soldering on irregularly shaped components in high-volume automotive and electronics lines.

Key Growth Drivers

Rising Demand for High-Density Electronics and Miniaturization

The proliferation of compact consumer electronics, IoT devices, and advanced semiconductor packaging drives strong demand for precision soldering equipment capable of handling micro-components and fine-pitch assemblies. Manufacturers increasingly adopt temperature-controlled soldering stations, micro-soldering irons, and automated rework systems to achieve high accuracy and defect-free joints. As miniaturization becomes essential for smartphones, wearables, and medical electronics, investment in advanced soldering technologies accelerates, establishing a strong growth pathway for equipment providers focused on precision, consistency, and reliability.

- For instance, JBC offers the CD series compact stations and T210-A handles with over 400 cartridge shapes designed for rapid temperature recovery in electronics rework, supporting fine-pitch soldering on high-density PCBs common in IoT modules.

Expanding Automotive Electronics and EV Manufacturing

The accelerated shift toward electric vehicles and intelligent automotive systems significantly boosts demand for high-reliability soldering solutions used in battery packs, power electronics, ADAS modules, and in-vehicle infotainment. Automakers and Tier-1 suppliers prioritize robust solder joints capable of withstanding thermal stress, vibration, and high current loads. This drives adoption of automated soldering robots, induction soldering, and lead-free solder technologies. As EV production scales globally, manufacturers increasingly invest in high-throughput and precision soldering equipment to improve safety, performance, and long-term durability.

- For instance, Kurtz Ersa’s VERSAFLOW selective soldering systems use multi-wave technology with electromagnetic pumps for inverters in e-mobility, achieving soldering times of 2-3 seconds per assembly regardless of component count while minimizing dross and thermal stress.

Increasing Industrial Automation and Smart Manufacturing Adoption

Industries are rapidly integrating smart production lines, boosting demand for soldering systems compatible with robotics, AI analytics, and real-time quality monitoring. Automated soldering equipment enhances repeatability, reduces cycle times, and ensures process consistency for high-volume PCB assembly and industrial electronics. The rise of Industry 4.0 encourages manufacturers to deploy connected soldering platforms with predictive maintenance and advanced thermal profiling capabilities. This shift improves yield rates, reduces manual errors, and positions advanced soldering tools as essential assets for digitally transformed manufacturing environments.

Key Trends & Opportunities

Growth of Lead-Free and Environmentally Compliant Soldering Solutions

Stricter global regulations such as RoHS and WEEE continue pushing manufacturers toward lead-free soldering materials and environmentally sustainable processes. This trend opens significant opportunities for suppliers offering eco-friendly solder wire, high-temperature soldering stations, and advanced alloy formulations. Industries shift toward greener manufacturing practices, increasing demand for precision temperature control to achieve reliable joints with lead-free materials. Companies that innovate in compliant alloys, low-residue flux, and energy-efficient soldering systems gain additional market traction as sustainability becomes a core purchasing criterion.

- For instance, Kester offers Ultrapure® K100 lead-free bar solder, a near-eutectic SnCu alloy with controlled metallic dopants that improves joint reliability by minimizing defects like icicling and bridging while ensuring low dross rates.

Integration of Automated, AI-Enabled, and Smart Soldering Platforms

Advanced automation technologies are transforming the sector, creating strong opportunities for AI-assisted soldering robots, automated optical inspection integration, and sensor-driven thermal management. These systems enhance defect detection, optimize solder flow, and enable precise control over heating cycles. Manufacturers in electronics, automotive, and aerospace increasingly adopt smart soldering stations with digital calibration, wireless connectivity, and cloud-enabled dashboards. As smarter production environments evolve, equipment providers offering AI-based quality analytics and closed-loop process control benefit from a rapidly expanding customer base.

- For instance, Optris infrared pyrometers monitor PCB temperatures in reflow soldering ovens for high-volume assembly. These non-contact sensors enable real-time heating zone adjustments, ensuring consistent solder joint quality without test boards or production interruptions.

Key Challenges

High Initial Investment and Integration Costs for Advanced Equipment

Adopting automated and AI-enabled soldering systems requires substantial capital expenditure, particularly for small and mid-sized manufacturers. Integration with existing production lines, training requirements for new technologies, and ongoing maintenance further increase operational costs. These financial barriers limit widespread adoption, especially in cost-sensitive markets. Companies struggling to justify upfront investment may continue relying on legacy manual systems, slowing technological transition. Vendors must address the affordability gap by offering modular upgrades, flexible financing, and scalable solutions to support broader adoption.

Complexity in Achieving Consistent Quality with Lead-Free Materials

Although lead-free soldering is now a regulatory requirement, achieving consistent joint quality poses significant challenges due to higher melting points, narrower process windows, and increased susceptibility to thermal stress. Manufacturers often face issues such as void formation, poor wetting, and component overheating. These challenges demand advanced thermal profiling, precise temperature control, and skilled operators. Industries lacking robust process optimization risk higher defect rates and rework costs. Overcoming these complexities requires investment in high-performance soldering stations, enhanced alloy formulations, and improved operator training programs.

Regional Analysis

North America

North America holds a 31.4% share of the Soldering Equipment Market in 2024, driven by strong electronics manufacturing, widespread automation, and growing adoption of advanced soldering systems across aerospace, defense, and automotive electronics. The region benefits from significant investment in semiconductor fabrication and EV component production, increasing demand for high-precision soldering stations and automated soldering robots. U.S.-based technology integrators emphasize smart manufacturing and AI-enabled process control, further accelerating equipment upgrades. Additionally, the presence of leading tool manufacturers and strong R&D capabilities supports continuous innovation and market expansion.

Europe

Europe accounts for a 27.6% share of the Soldering Equipment Market, supported by robust automotive production, advanced industrial electronics, and stringent regulatory standards driving adoption of lead-free and energy-efficient soldering systems. Germany, the UK, and France lead regional demand due to high deployment of automated soldering lines in EV power electronics, aerospace systems, and industrial automation. The region’s focus on precision engineering and sustainability encourages investment in next-generation soldering materials and eco-friendly workstations. Growing semiconductor initiatives and expansion of electronics packaging facilities further strengthen Europe’s position as a key technology-driven market.

Asia-Pacific

Asia-Pacific dominates the Soldering Equipment Market with a 34.9% share, driven by extensive electronics manufacturing clusters in China, Japan, Taiwan, and South Korea. High-volume production of smartphones, PCs, consumer electronics, EV batteries, and semiconductor assemblies fuels significant demand for precision soldering equipment. The region’s rapid adoption of SMT production lines, automation technologies, and AI-enabled quality control tools accelerates market growth. India and Southeast Asia emerge as fast-growing hubs for PCB assembly and automotive electronics manufacturing. Strong government incentives, expanding manufacturing capacity, and rising export activities reinforce APAC’s leadership.

Latin America

Latin America holds a 3.8% share of the Soldering Equipment Market, with growth supported by expanding electronics assembly operations in Mexico and Brazil. The region benefits from increasing demand for automotive electronics, consumer appliances, and industrial automation equipment, prompting manufacturers to adopt more reliable and efficient soldering tools. Mexico’s role as a nearshoring destination for North American electronics production strengthens equipment sales. Although the market remains smaller than major global regions, rising investment in industrial modernization and growing interest in EV component assembly drive steady expansion across key Latin American economies.

Middle East & Africa

The Middle East & Africa region captures a 2.3% share of the Soldering Equipment Market, driven by emerging electronics manufacturing, infrastructure modernization, and rising demand for industrial automation tools. GCC countries invest heavily in defense electronics, renewable energy systems, and smart city technologies, increasing adoption of precision soldering equipment. Africa sees growing activity in industrial electronics repair, telecommunications installations, and small-scale manufacturing, strengthening baseline demand. Although the region is in early growth stages, increasing localization strategies, supportive government programs, and rising technical workforce development contribute to long-term market potential.

Market Segmentations:

By Product Type

- Soldering Stations

- Soldering Iron

- Soldering Tips

- Solder Wire

By Application

- Electronics

- Automotive

- Aerospace and Defense

- Industrial

By Distribution Channel

- Online Stores

- Electronics Stores

- Industrial Equipment Suppliers

- Others

By End-User

- Consumer Electronics

- Automotive

- Aerospace

- Industrial Manufacturing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Soldering Equipment Market features key players such as Hakko Corporation, Metcal, Apex Tool Group, Koki Company Limited, JBC Tools, American Hakko Products, Inc., PACE Worldwide, Kurtz Ersa, Weller Tools GmbH, and Ersa GmbH, who collectively shape innovation and market expansion. These manufacturers focus on advanced temperature-controlled systems, automated soldering platforms, and lead-free compatible technologies to meet the evolving needs of electronics, automotive, aerospace, and industrial sectors. Companies actively invest in R&D to enhance precision, reduce thermal stress, and integrate AI-enabled process monitoring. Strategic partnerships with OEMs, expansion of distribution networks, and continuous product upgrades strengthen their global footprints. Additionally, rising demand for miniaturized electronics and high-reliability solder joints pushes market leaders to introduce more efficient soldering stations, smart tips, and energy-optimized systems, intensifying technology-driven differentiation across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hakko Corporation

- Metcal

- Apex Tool Group

- Koki Company Limited

- JBC Tools

- American Hakko Products, Inc.

- PACE Worldwide

- Kurtz Ersa

- Weller Tools GmbH

- Ersa GmbH

Recent Developments

- In July 2025, Hakko Corporation released a new standard version of its FX-971 soldering station series.

- In February 2024, Kurtz Ersa launched the VERSAFLOW ONE selective soldering system, expanding its portfolio for cost-efficient inline production in automotive and industrial electronics.

- In June 2024, PACE Worldwide launched the ADS200 AccuDrive Soldering System upgrade, featuring new cartridge technology for improved heat delivery and durability.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth as demand rises for precision soldering solutions in advanced electronics and semiconductor packaging.

- Automation and AI-enabled soldering platforms will gain wider adoption to improve accuracy, repeatability, and production efficiency.

- Lead-free and environmentally compliant soldering technologies will continue expanding due to strict global regulatory standards.

- EV manufacturing and automotive electronics will drive increased investment in high-reliability soldering systems.

- Miniaturization of devices will push manufacturers to adopt micro-soldering tools and advanced thermal control technologies.

- Integration of smart sensors and digital connectivity will enhance real-time monitoring and predictive maintenance capabilities.

- The shift toward Industry 4.0 will accelerate demand for connected, data-driven soldering workstations.

- PCB assembly units in Asia-Pacific will expand, strengthening regional dominance in high-volume production.

- Robotics-based soldering will witness greater deployment across automotive, aerospace, and industrial electronics.

- Continuous R&D advancements will enable more energy-efficient, user-friendly, and high-performance soldering equipment.