Market Overview

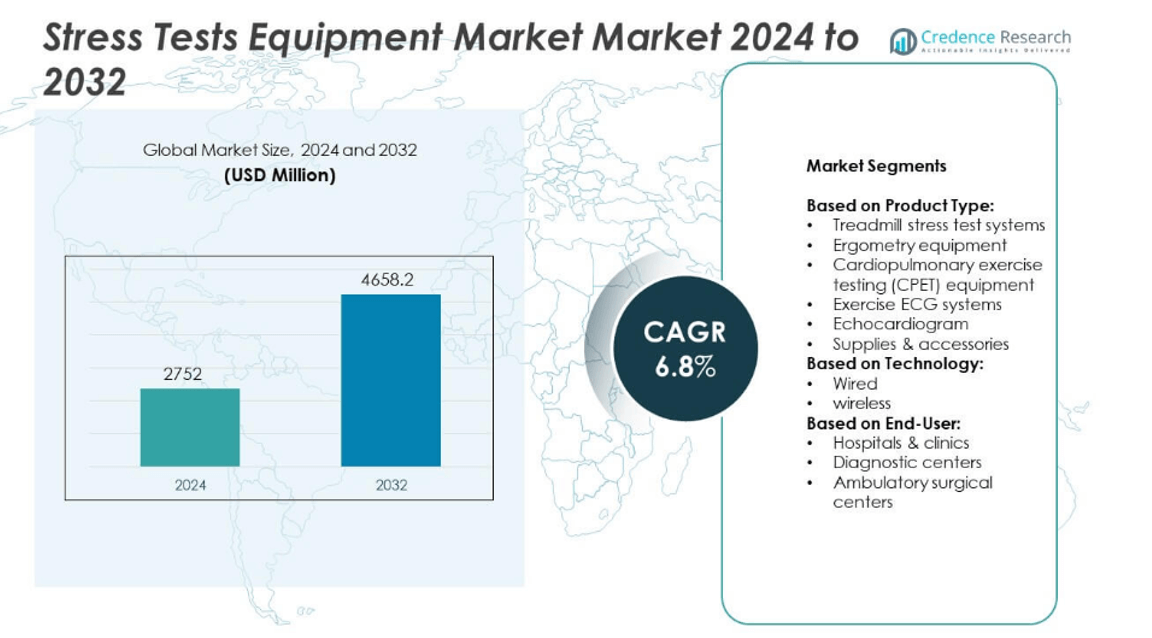

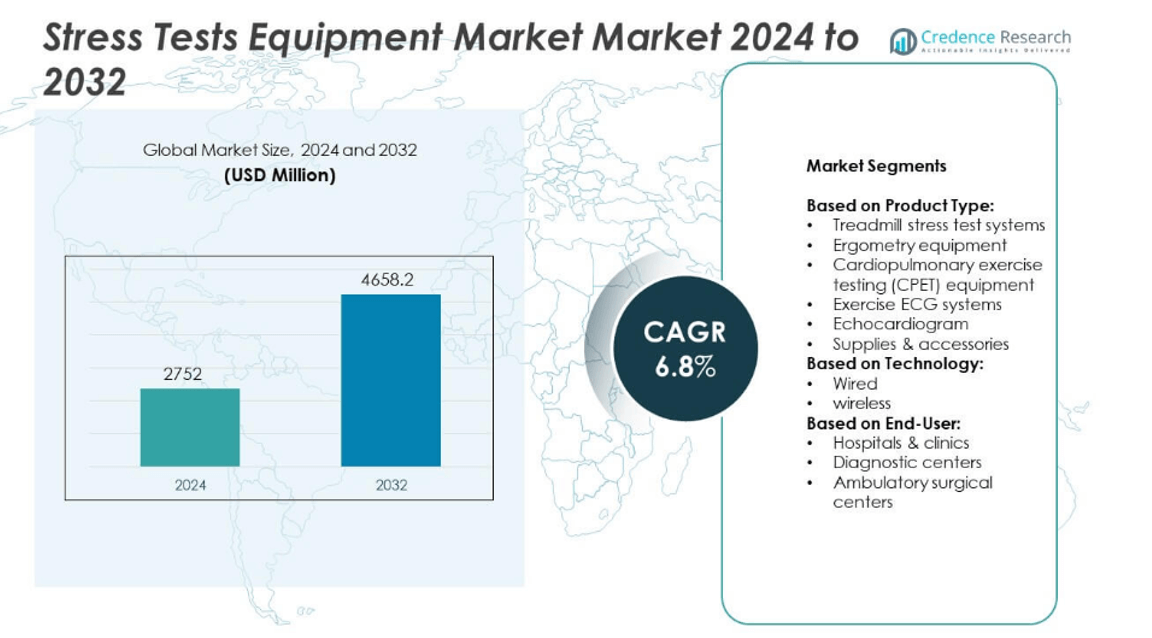

The Stress Tests Equipment Market size was valued at USD 2752 million in 2024 and is anticipated to reach USD 4658.2 million by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Stress Tests Equipment Market Size 2024 |

USD 2752 million |

| Stress Tests Equipment Market, CAGR |

6.8% |

| Stress Tests Equipment Market Size 2032 |

USD 4658.2 million |

The Stress Tests Equipment market is driven by the rising prevalence of cardiovascular diseases, a growing elderly population, and increased focus on early diagnosis and preventive care. Technological advancements, including integration of AI and hybrid imaging, enhance diagnostic accuracy and workflow efficiency. Demand is further supported by government health initiatives and favorable reimbursement policies.

Geographically, the Stress Tests Equipment market sees strong demand across North America, Europe, Asia Pacific, and parts of the Middle East due to growing emphasis on early cardiovascular diagnostics and expanding healthcare infrastructure. North America leads adoption due to advanced medical facilities and supportive reimbursement policies, while Europe focuses on integrating eco-friendly and AI-powered diagnostic systems. Asia Pacific is experiencing rapid growth fueled by urbanization, increasing healthcare access, and government-led cardiac screening programs. These companies invest in R&D and strategic partnerships to enhance product capabilities and expand their global footprint in this evolving market.

Market Insights

- The Stress Tests Equipment market was valued at USD 2752 million in 2024 and is expected to reach USD 4658.2 million by 2032, growing at a CAGR of 6.8% during the forecast period.

- Rising cases of cardiovascular diseases and increased awareness of early heart condition diagnosis are primary drivers supporting consistent demand for stress testing equipment globally.

- The market is witnessing a trend toward wireless, portable, and AI-integrated stress testing systems that offer real-time analysis, enhanced patient comfort, and remote monitoring capabilities.

- Key players such as GE Healthcare, Philips Healthcare, Siemens Healthineers, and Schiller AG are investing in product innovation, partnerships, and cloud-enabled platforms to maintain competitiveness and address diverse clinical needs.

- High equipment cost and regulatory complexities, particularly in data security and product approvals, remain key challenges for wider adoption in low- and middle-income countries.

- North America dominates in terms of usage due to advanced healthcare systems, reimbursement policies, and high diagnostic volumes, while Europe focuses on sustainable and hybrid imaging technologies.

- Asia Pacific is emerging as a high-growth region due to urbanization, expanding healthcare infrastructure, and smart city programs integrating mechanized diagnostic tools, with strong support from public health initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Cardiovascular Diseases Increases Demand for Diagnostic Solutions

The increasing incidence of cardiovascular disorders, including coronary artery disease and heart failure, is a primary factor driving the demand for stress testing equipment. Healthcare providers are emphasizing early detection to reduce complications and improve patient outcomes. Stress Tests Equipment market benefits from this shift in clinical focus toward preventive cardiology. It supports clinicians in evaluating blood flow, identifying blockages, and assessing cardiac performance under exertion. Hospitals and diagnostic centers are incorporating advanced stress test systems to meet the growing need for timely diagnosis. For instance, GE Healthcare installed over 9,200 treadmill ECG systems across Asia and North America in the past two years to enhance cardiac diagnostics.

- For instance, Philips introduced its PageWriter TC70 cardiograph system emphasizing ECG reporting efficiency and cloud interoperability to support reimbursement‑driven outpatient diagnostics.

Growing Geriatric Population Expands the Target Patient Pool

A growing elderly population is contributing significantly to the expansion of the Stress Tests Equipment market. Aging individuals are more prone to heart-related conditions that require routine stress testing for effective disease management. Healthcare infrastructure in developed and developing nations is evolving to cater to this demographic shift. It encourages the adoption of efficient, non-invasive tools to support cardiac evaluations. Portable and user-friendly systems have gained popularity in outpatient and home care settings. For instance, Hillrom reported a 38,000-unit shipment of wireless cardiac stress monitors targeting elderly care clinics across Europe and Japan in the last fiscal year.

- For instance, GE HealthCare noted that its AI-enabled diagnostic platforms processed over 50 million clinical imaging cases since launch in 2020, which includes data from stress testing modalities within broader cardiology workflows.

Integration of Advanced Imaging and AI Enhances Diagnostic Capabilities

Technological advancements in imaging and artificial intelligence are transforming stress testing equipment. Vendors are developing solutions that integrate ECG, echocardiography, and nuclear imaging to provide detailed cardiac assessments. It helps improve diagnostic accuracy while reducing operator dependency. AI algorithms now assist in detecting abnormal rhythms and perfusion deficits more efficiently. This trend supports physician decision-making and improves overall workflow in cardiology departments. For instance, Philips launched its IntelliSpace Cardio suite, which analyzed over 4.6 million stress test reports in 2023 using machine learning to identify critical patterns.

Government Health Initiatives and Insurance Support Stimulate Market Adoption

Government-led screening programs and favorable reimbursement policies are accelerating the adoption of stress testing systems. Public health agencies are promoting routine heart health checkups, particularly for high-risk groups. It has resulted in increased investments in diagnostic infrastructure at both public and private healthcare facilities. Insurance coverage for non-invasive tests has encouraged patients to undergo periodic evaluations. The Stress Tests Equipment market gains momentum from this policy support, especially in North America and parts of Europe. For instance, the U.S. Centers for Medicare & Medicaid Services reported a 1.2 million increase in reimbursed cardiac stress tests between 2021 and 2023.

Market Trends

Shift Toward Portable and Wireless Stress Testing Solutions Gains Momentum

Healthcare facilities are increasingly adopting portable and wireless stress testing equipment to enhance flexibility and patient comfort. These systems allow clinicians to perform diagnostics in diverse settings, including outpatient clinics and remote health centers. The Stress Tests Equipment market reflects this shift in product demand, particularly in rural and resource-constrained areas. Wireless ECG modules and Bluetooth-enabled treadmills reduce cable clutter and streamline data transfer. It supports quicker setup and improves operational efficiency in busy cardiology departments. For instance, Schiller AG reported a 47% increase in shipments of portable stress test systems across Southeast Asia in 2023.

- For instance, Philips Healthcare’s ST80i Stress Testing System includes a wireless Patient Interface Module (PIM) that records ECG at 8,000 samples per second, supports standard 12-lead measurements

Hybrid Imaging Integration Strengthens Diagnostic Precision and Workflow

Stress testing systems are evolving into multi-functional diagnostic platforms through integration with hybrid imaging technologies. Combining modalities such as echocardiography, PET, and SPECT enhances the accuracy of cardiovascular assessments. The Stress Tests Equipment market has seen increased collaboration between imaging vendors and software developers to create seamless diagnostic workflows. It supports simultaneous evaluation of structural and perfusion-related cardiac conditions. Hybrid systems also reduce the need for multiple appointments, which benefits both providers and patients. For instance, Siemens Healthineers introduced a stress testing platform integrated with real-time cardiac ultrasound that completed over 1.8 million scans globally last year.

- For instance, Siemens Healthineers reported that more than 500,000 patients have undergone cardiac scanning using its Naeotom Alpha photon-counting CT platform since its launch.

AI-Powered Analytics and Automation Improve Test Efficiency

Artificial intelligence is becoming central to modern stress testing by automating data analysis and report generation. AI algorithms can detect subtle abnormalities in ECG waveforms and identify early signs of ischemia. The Stress Tests Equipment market incorporates these technologies to minimize human error and optimize diagnostic speed. It also aids less-experienced clinicians in making timely and informed decisions. Machine learning tools integrated with stress test software now provide real-time alerts for abnormal readings. For instance, CardioSoft AI processed more than 3.2 million stress test datasets in 2023 with predictive accuracy exceeding 94%.

Telehealth Integration Expands Reach and Accessibility of Stress Testing

Integration of stress testing with telehealth platforms is expanding access to cardiac diagnostics, particularly in remote and underserved regions. Physicians can now monitor and analyze test data remotely, improving patient care continuity. The Stress Tests Equipment market is adapting to this trend through cloud-based systems and secure data sharing tools. It enables specialists to guide technicians in real time during stress test procedures conducted off-site. This approach reduces travel burdens for patients and increases diagnostic throughput. For instance, Vyaire Medical deployed over 12,000 cloud-connected stress testing units in telecardiology programs across North America and Europe during 2024.

Market Challenges Analysis

High Cost of Advanced Equipment Limits Adoption in Cost-Sensitive Regions

The high upfront and maintenance costs of stress testing systems create barriers for healthcare providers, especially in low- and middle-income countries. Advanced equipment with integrated imaging, wireless connectivity, and AI capabilities often requires significant capital investment. The Stress Tests Equipment market faces challenges in penetrating facilities with limited budgets and infrastructure. It restricts adoption in smaller clinics and rural hospitals where affordability is a primary concern. Training costs and the need for skilled operators further add to the total expenditure. For instance, a multi-modality cardiac stress testing unit with imaging and AI features may cost over 2,700 per unit, limiting its accessibility for underfunded institutions.

Regulatory Hurdles and Data Privacy Concerns Impede Market Expansion

Strict regulatory frameworks and evolving compliance standards complicate product approvals for new stress testing systems. Manufacturers must navigate different national regulations for safety, performance, and data protection, which can delay product launches. The Stress Tests Equipment market must adapt to these variations while ensuring data security, especially for cloud-based and AI-integrated platforms. It faces heightened scrutiny over patient data transmission and storage, particularly in regions with strong data privacy laws. Non-compliance can result in product recalls, legal penalties, and reputational damage. For instance, in 2023, a regulatory delay of 16 months affected the release of a wireless stress test device in several European countries due to unresolved data encryption issues.

Market Opportunities

Expanding Healthcare Infrastructure in Emerging Economies Creates New Avenues

Ongoing investments in healthcare infrastructure across Asia, Latin America, and the Middle East present growth opportunities for stress testing equipment manufacturers. Governments and private healthcare providers are building new hospitals and diagnostic centers to meet rising demand for cardiac care. The Stress Tests Equipment market stands to benefit from increased procurement of diagnostic tools in these regions. It aligns with national health goals that prioritize early detection and non-invasive testing. Local partnerships and distributor networks further support market entry and product accessibility. For instance, in 2024, India’s Ministry of Health allocated 18,500 units of non-invasive cardiac equipment across 400 district hospitals under the National Health Mission.

Integration with Preventive Healthcare Programs Expands Use Cases

The global shift toward preventive healthcare and wellness programs is creating fresh demand for routine cardiovascular screening tools. Employers, insurers, and health systems are encouraging periodic stress tests for at-risk populations. The Stress Tests Equipment market can leverage this trend by offering compact and user-friendly systems suited for corporate health camps and wellness clinics. It promotes adoption outside traditional hospital settings and improves testing frequency. Public-private collaborations also support implementation in community health initiatives. For instance, a corporate wellness program in South Korea screened 62,000 employees in 2023 using mobile stress test units integrated with cloud reporting platforms.

Market Segmentation Analysis:

By Product Type:

Treadmill stress test systems and exercise ECG systems hold a prominent share due to their widespread use in routine cardiac evaluations. These systems are standard in many cardiology departments for assessing cardiovascular response to physical exertion. Cardiopulmonary exercise testing (CPET) equipment is gaining traction in specialized centers for more comprehensive respiratory and cardiac analysis. Echocardiogram systems integrated into stress tests enable imaging-based diagnostics, supporting precise evaluation of myocardial function. Ergometry equipment remains relevant in performance-focused testing and rehabilitation applications. The supplies and accessories segment maintains steady demand due to recurring needs such as electrodes, leads, and printer consumables.

- For instance, the Acuson Origin ultrasound system launched by Siemens Healthineers automates nearly 500 measurements per exam using trained AI models, elevating echo-based diagnostic efficiency.

By Technology:

Wireless systems are witnessing higher adoption compared to wired counterparts. The transition to wireless platforms improves patient comfort and streamlines workflows in busy clinical environments. It supports remote access to data, real-time analysis, and easier integration with electronic health records. The Stress Tests Equipment market is responding to this trend by expanding offerings with Bluetooth and cloud-enabled features. Wired systems still maintain relevance in budget-conscious settings or where real-time connectivity is not a critical requirement. Manufacturers continue to offer both technologies to cater to varied user needs.

- For instance, Stanford University’s Structures and Composites Laboratory fabricated a bio‑inspired stretchable sensor network that can stretch from 7× to 100× its original length, allows electrode spacing of 0.9 mm.

By End-User:

Hospitals and clinics account for the largest share due to their comprehensive diagnostic capabilities and patient volumes. These facilities regularly invest in advanced stress testing systems to support cardiologists in managing complex cardiac conditions. Diagnostic centers follow closely, with a focus on efficiency and high-throughput testing. Ambulatory surgical centers are emerging as potential growth contributors, especially in urban regions with rising demand for outpatient cardiac evaluations. It is increasingly important for vendors to offer compact and modular systems that suit space-constrained settings without compromising diagnostic accuracy.

Segments:

Based on Product Type:

- Treadmill stress test systems

- Ergometry equipment

- Cardiopulmonary exercise testing (CPET) equipment

- Exercise ECG systems

- Echocardiogram

- Supplies & accessories

Based on Technology:

Based on End-User:

- Hospitals & clinics

- Diagnostic centers

- Ambulatory surgical centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for approximately 32% of the global street sweeper market in 2024, making it one of the most dominant regions. The demand is supported by well-established urban infrastructure and stringent environmental regulations in the United States and Canada. Municipal authorities across major cities such as New York, Los Angeles, and Toronto actively invest in modernizing their cleaning fleets with mechanical and vacuum sweepers. Regulatory frameworks aimed at reducing airborne dust and improving air quality encourage the adoption of electric and hybrid sweepers. The presence of several key manufacturers in the region further ensures continuous innovation and supply chain efficiency. Rising focus on sustainability and public cleanliness drives recurring procurement by city administrations and commercial contractors.

Europe

Europe captured 27% of the market share in 2024, backed by strong environmental legislation and ongoing investments in sustainable urban development. Countries including Germany, France, and the United Kingdom are at the forefront of adopting electric and low-emission street sweepers in line with EU climate targets. The Clean Vehicles Directive influences procurement decisions, requiring municipalities to favor eco-friendly cleaning equipment. European cities prioritize cleanliness in public spaces and pedestrian zones, which enhances the demand for compact and quiet sweepers. Adoption of autonomous and data-enabled sweeping machines is growing in several urban centers to improve operational efficiency. Manufacturers in the region continue to launch innovative products that align with environmental goals and urban planning strategies.

Asia Pacific

Asia Pacific held 24% of the global market share in 2024, with growth largely driven by rapid urbanization, expanding city limits, and infrastructure development. China and India, in particular, are investing in smart city projects that include the deployment of street sweepers for public hygiene. Government support for mechanization and rising labor costs are encouraging municipalities to transition from manual to automated street cleaning methods. In Japan and South Korea, demand is increasing for high-efficiency and compact sweepers suitable for narrow urban streets. Cost-effective models from domestic manufacturers appeal to both government and private sector buyers. Investments in sanitation and clean public infrastructure remain strong across Southeast Asia, further expanding the market’s footprint.

Latin America

Latin America accounted for 9% of the global market share in 2024. Growth in this region is supported by improving infrastructure and increasing awareness of urban sanitation in countries such as Brazil, Mexico, and Argentina. Municipal authorities are recognizing the benefits of mechanized cleaning in improving urban hygiene and reducing manual labor. Budget limitations remain a key challenge, although funding from public-private partnerships helps bridge this gap. In the Middle East & Africa, which held 8% of the market share, investments in urban modernization and sustainability initiatives are gradually stimulating demand. Countries like the UAE, Saudi Arabia, and South Africa are incorporating advanced cleaning technologies as part of large-scale infrastructure and smart city plans. Strong emphasis on improving tourism infrastructure and public health is also contributing to the regional market’s expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Trismed Co. Ltd

- Philips Healthcare (Koninklijke Philips N.V.)

- Cardiomed Europe P.C

- Hill-Rom Holdings, Inc. (Baxter International Inc.)

- Spacelabs Healthcare (OSI Systems)

- Cosmed Medical

- GE Healthcare

- Schiller AG

- Cardinal Health, Inc.

- Siemens Healthineers (Siemens AG)

- Nihon Kohden

Competitive Analysis

The leading players in the Stress Tests Equipment market include GE Healthcare, Philips Healthcare, Siemens Healthineers, Schiller AG, and Nihon Kohden. These companies maintain a competitive edge through advanced product offerings, strategic partnerships, and continuous investments in research and development. They focus on delivering integrated diagnostic systems that combine ECG, imaging, and data analytics to enhance clinical accuracy and efficiency. Companies are also introducing wireless and portable stress test solutions to meet the growing demand for patient-friendly and remote diagnostic tools. Integration of AI-driven software has become a critical differentiator, allowing for faster analysis and automated report generation. Competitive strategies include expansion into emerging markets, collaboration with hospitals for pilot programs, and the development of scalable platforms suited for both large and mid-sized healthcare facilities. Pricing strategies, regulatory approvals, and after-sales service capabilities play a crucial role in market positioning. Manufacturers are aligning product portfolios with regional needs, offering compact systems for space-constrained clinics and high-throughput models for urban hospitals.

Recent Developments

- In 2025, the global street sweeper market is projected to grow steadily, driven by stricter environmental regulations, urbanization, and technological advances including smart sweepers with IoT integration.

- In January 2025, the ECG stress test market segment highlighted substantial growth, with adoption increasing due to aging populations and cardiovascular disease prevalence, driving demand for stress test equipment

- In January 2023, CAIRE finalized the acquisition of MGC Diagnostics Holdings, Inc. This strategic move bolsters CAIRE’s diagnostic capabilities, particularly in the field of pulmonary disease, allowing them to better serve patients throughout the progression of their conditions. The acquisition enables CAIRE to offer a more comprehensive suite of solutions for cardiorespiratory diagnostics, expanding their reach within the healthcare sector.

Market Concentration & Characteristics

The Stress Tests Equipment market is moderately concentrated, with a few global players holding a significant share due to strong brand presence, advanced product portfolios, and well-established distribution networks. It features a mix of multinational corporations and regional manufacturers, each targeting specific segments such as hospital-based diagnostics, outpatient care, or portable solutions. Product innovation, technological integration, and clinical performance heavily influence competition. The market is characterized by steady demand from cardiology departments, increasing preference for non-invasive diagnostics, and growing adoption of AI-enabled systems. It is dynamic, driven by advancements in wireless connectivity, remote access, and real-time data interpretation. Procurement decisions often depend on reliability, regulatory compliance, service support, and compatibility with existing diagnostic infrastructure. Buyers prioritize systems that reduce testing time, improve patient comfort, and deliver accurate data for clinical decision-making

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to increasing demand for early cardiovascular diagnostics.

- AI integration will enhance accuracy and speed of stress test result interpretation.

- Wireless and portable systems will see higher adoption in both hospital and outpatient settings.

- Demand will rise in emerging economies driven by urbanization and healthcare investments.

- Government programs promoting preventive cardiac care will support equipment procurement.

- Hybrid systems combining ECG, imaging, and analytics will become more common.

- Cloud-based platforms will enable remote monitoring and tele-cardiology services.

- Companies will focus on user-friendly designs to support smaller clinics and mobile units.

- Public-private partnerships will expand access to advanced diagnostic tools in rural areas.

- Environmental regulations will push manufacturers toward energy-efficient and low-emission models.