| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Surgical/Operating Tables Market Size 2024 |

USD 1,510.00 Million |

| Surgical/Operating Tables Market, CAGR |

5.34% |

| Surgical/Operating Tables Market Size 2032 |

USD 2,360.08 Million |

Market Overview

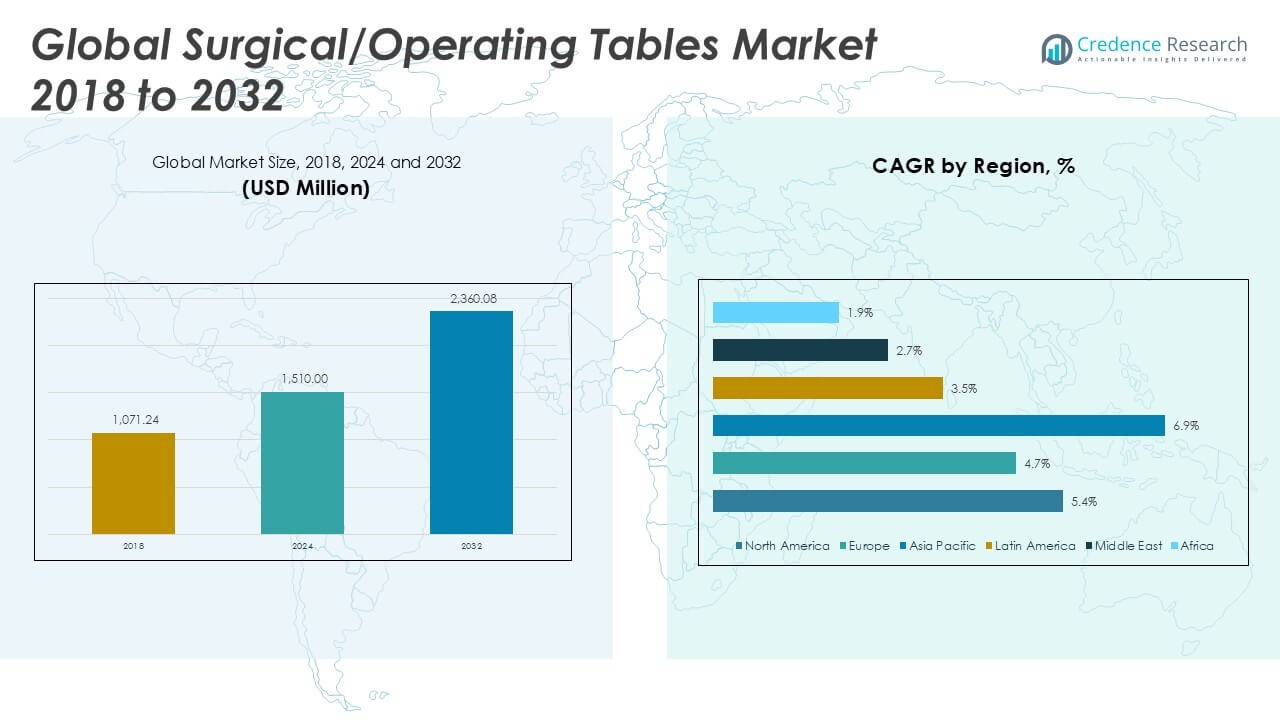

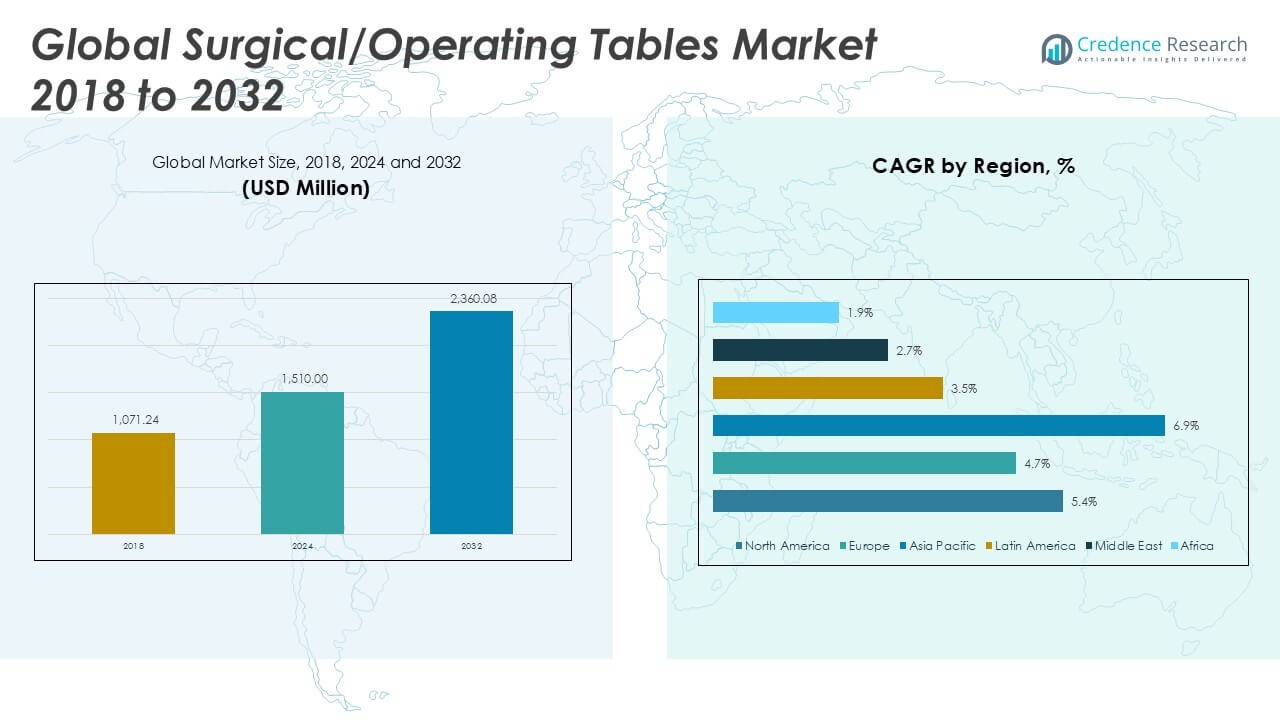

The Surgical/Operating Tables Market was valued at USD 1,071.24 million in 2018 and grew to USD 1,510.00 million in 2024. It is anticipated to reach USD 2,360.08 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.34% during the forecast period.

The Surgical/Operating Tables Market is driven by the rising volume of surgical procedures worldwide, fueled by an aging population and increasing prevalence of chronic diseases. Hospitals and surgical centers are investing in advanced, multifunctional operating tables to enhance procedural efficiency and patient safety. The demand for automated and imaging-compatible tables has increased due to the growing adoption of minimally invasive and robotic-assisted surgeries. Technological advancements, such as integration with imaging systems and improved ergonomics, are reshaping product development. Healthcare infrastructure expansion in emerging economies and rising investments in hospital modernization further support market growth. Additionally, manufacturers are focusing on modular designs and customizable features to meet the diverse clinical requirements across specialties. A growing focus on infection control and patient positioning precision also influences purchasing decisions. These combined factors are transforming the operating environment, making surgical tables a critical component in delivering high-quality surgical care across healthcare systems globally.

Geographically, the Surgical/Operating Tables Market demonstrates strong demand across North America, Europe, and Asia Pacific, driven by advanced healthcare infrastructure, rising surgical procedures, and increasing investments in hospital modernization. North America leads in technological adoption, while Europe benefits from established medical device regulations and widespread hospital upgrades. Asia Pacific shows the fastest growth, supported by expanding healthcare access, a large patient population, and increased government spending in countries like China, India, and Japan. Latin America, the Middle East, and Africa are witnessing steady development, with demand led by public hospital projects and rising awareness of surgical care standards. Key players shaping the global landscape include Hill-Rom Holdings, Inc., known for its broad surgical product portfolio and innovation focus; Getinge AB, a leader in operating room solutions; and Stryker Corp., which emphasizes advanced powered tables and ergonomic features. Skytron LLC also plays a vital role with its focus on customizable and hybrid operating room-compatible systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Surgical/Operating Tables Market was valued at USD 1,510.00 million in 2024 and is projected to reach USD 2,360.08 million by 2032, registering a CAGR of 5.34% during the forecast period.

- The market is driven by the increasing number of surgical procedures worldwide, supported by aging populations, chronic disease prevalence, and a growing focus on patient safety in hospitals and surgical centers.

- Rising adoption of hybrid operating rooms and minimally invasive surgical procedures fuels demand for imaging-compatible, motorized, and modular surgical tables.

- Key players such as Hill-Rom Holdings, Getinge AB, Stryker Corp., and Skytron LLC focus on innovation, ergonomic design, and strategic partnerships to enhance product portfolios and expand global presence.

- High initial costs, long replacement cycles, and compatibility issues between surgical tables and other OR technologies pose significant restraints to market growth, especially in cost-sensitive regions.

- North America leads in demand due to technological adoption and high surgical volumes, while Asia Pacific shows the fastest growth supported by expanding healthcare infrastructure and rising procedural rates in China, India, and Japan.

- European countries maintain strong demand for premium surgical tables, and emerging markets in Latin America, the Middle East, and Africa are investing in basic and mid-range models to improve surgical capacity and healthcare access.

Market Drivers

Growing Number of Surgical Procedures Across the Globe Increases Demand for Advanced Tables

The rising global burden of chronic diseases and age-related conditions has led to a steady increase in surgical procedures. Orthopedic, cardiovascular, and neurological surgeries continue to grow, creating higher demand for stable, reliable, and flexible operating platforms. The Surgical/Operating Tables Market benefits from hospitals expanding their surgical capabilities to meet patient volumes. Complex surgeries often require adaptable tables that can support patient positioning with precision. This demand drives hospitals to replace outdated equipment with technologically advanced tables. It enhances operational efficiency, reduces surgical risks, and improves patient outcomes.

- For instance, Stryker’s Operon D860 surgical table features motorized longitudinal slide of 450 mm and can support patient weight up to 453 kg, allowing safe execution of complex procedures involving high BMI patients.

Technological Advancements in Imaging-Compatible and Automated Surgical Tables

Integration of advanced features into surgical tables is transforming operating room capabilities. The Surgical/Operating Tables Market is witnessing strong adoption of imaging-compatible tables, essential for minimally invasive and image-guided procedures. Tables with motorized adjustments, remote controls, and programmable settings improve workflow and surgeon ergonomics. Hospitals prioritize these innovations to reduce intraoperative delays and improve procedural accuracy. Automated tables also support hybrid operating rooms, which combine surgical and imaging functions. It positions them as essential infrastructure in modern surgical environments.

- For instance, Getinge’s Maquet Magnus table offers a radiolucent carbon fiber table top that delivers up to 360° intraoperative imaging access and supports dynamic CT and C-arm integration with a longitudinal shift capacity of 460 mm.

Increased Investment in Hospital Infrastructure and Modernization Projects

Governments and private healthcare providers are investing in infrastructure upgrades to expand surgical capacity and adopt international standards. The Surgical/Operating Tables Market benefits directly from these modernization projects. Hospitals in both developed and developing regions are replacing aging equipment with advanced, modular surgical tables. These investments support long-term care goals by ensuring safety, flexibility, and compatibility with advanced surgical technologies. Procurement decisions often focus on quality, durability, and adaptability to different surgical specialties. It drives demand for high-performance, cost-efficient systems across healthcare institutions.

Focus on Patient Safety and Infection Control Drives Equipment Standardization

Patient safety protocols and infection prevention measures have become central to equipment selection. The Surgical/Operating Tables Market responds to this need with tables designed using antimicrobial surfaces and easy-to-clean materials. Hospitals standardize equipment to maintain consistent hygiene practices and reduce cross-contamination risks. Ergonomic designs and improved patient positioning features also minimize injury during surgery. These tables support safer outcomes by enhancing access and stability for both surgical teams and patients. It aligns with global trends emphasizing quality care and procedural safety.

Market Trends

Rising Preference for Hybrid Operating Rooms Integrates Surgical Tables with Imaging Technologies

Hospitals are increasingly adopting hybrid operating rooms to support complex and minimally invasive procedures. These environments require surgical tables that integrate seamlessly with imaging systems like C-arms and CT scanners. The Surgical/Operating Tables Market reflects this shift by focusing on radiolucent and mobile table designs. It supports real-time imaging during procedures, improving surgical precision and reducing operating time. Hybrid-compatible tables allow multidisciplinary teams to perform surgeries without patient repositioning. This trend strengthens the need for high-performance tables with advanced mobility and control features.

- For instance, Hillrom’s TruSystem 7500 integrates with hybrid imaging suites and includes an X-ray cassette channel of 576 mm to facilitate intraoperative imaging without repositioning, reducing procedure time.

Growing Demand for Customizable and Multi-Specialty Surgical Tables

Healthcare providers seek versatile tables that can be adapted for various procedures across different specialties. The Surgical/Operating Tables Market is shifting toward modular tables with interchangeable accessories and adjustable configurations. It enables hospitals to maximize equipment utilization and minimize procurement costs. Customizable features help accommodate procedures in orthopedics, gynecology, cardiology, and neurology. Manufacturers are designing tables with programmable positions, memory functions, and quick-release systems to support efficiency. This trend reflects operational flexibility and supports streamlined surgical workflows.

- For instance, Skytron’s 6302 Elite surgical table provides up to 180° top rotation and memory settings for up to 10 table configurations, allowing staff to quickly adapt to different surgical procedures.

Increased Use of Smart Technologies and Digital Interfaces in Operating Tables

Smart surgical tables are gaining traction with features like touchscreen controls, pre-programmed settings, and integration with digital hospital systems. The Surgical/Operating Tables Market incorporates innovations that enhance surgeon control, reduce manual adjustments, and improve procedural flow. It promotes data capture, automation, and remote operation within the operating room. Hospitals benefit from reduced downtime, standardized processes, and improved documentation. Smart features support precision, reduce fatigue, and align with digital transformation goals in surgical care. The adoption of intelligent tables supports a more connected and efficient surgical environment.

Shift Toward Compact, Lightweight, and Mobile Surgical Table Designs

Hospitals with space constraints or high patient turnover prefer mobile and space-efficient equipment. The Surgical/Operating Tables Market is witnessing rising interest in lightweight tables with modular construction. It improves room layout flexibility and allows easy transport between operating areas. Foldable or compact models help optimize storage and reduce setup time. These features appeal to ambulatory surgical centers and outpatient clinics. This trend aligns with the growing demand for scalable and adaptable surgical infrastructure across diverse healthcare settings.

Market Challenges Analysis

High Capital Investment and Limited Replacement Cycles Restrain Market Expansion

The initial cost of advanced surgical tables remains high, limiting accessibility for smaller hospitals and clinics with restricted budgets. Many healthcare facilities delay equipment upgrades due to budget constraints and extended replacement cycles. The Surgical/Operating Tables Market faces slow adoption in cost-sensitive regions where capital-intensive purchases are deprioritized. It challenges manufacturers to offer value-driven models without compromising on functionality. Public hospitals, in particular, face procurement delays due to lengthy approval processes. Long product lifecycles reduce recurring revenue potential for manufacturers and distributors. These financial barriers hinder consistent market penetration across developing economies.

Lack of Standardization and Compatibility Issues Impede Workflow Efficiency

The absence of universal standards for table interfaces and accessories affects compatibility across operating room systems. The Surgical/Operating Tables Market struggles with integration challenges, particularly in hybrid operating environments where multiple technologies must work together. It complicates surgical workflows and increases the learning curve for staff. Incompatibility with imaging systems, patient transfer tools, or surgical instruments reduces operational efficiency. Hospitals are forced to invest in custom solutions or workarounds, which increases overall system costs. These limitations delay decision-making during procurement and reduce the appeal of certain models across multispecialty settings.

Market Opportunities

Rising Demand from Ambulatory Surgical Centers and Emerging Economies Opens New Growth Channels

Ambulatory surgical centers (ASCs) are expanding rapidly due to shorter recovery times and cost-effective outpatient care models. These facilities require compact, mobile, and versatile surgical tables that fit high patient turnover environments. The Surgical/Operating Tables Market can capitalize on this shift by offering space-saving, lightweight designs tailored for ASCs. It creates opportunities for manufacturers to develop products with essential features at lower price points. Growth in emerging economies, driven by healthcare infrastructure development and government investment, further expands the addressable market. Increasing surgical volumes and evolving patient care models across Asia, Latin America, and Africa support demand for adaptable and scalable equipment.

Integration of Smart Technologies and Customization Drives Product Differentiation

Hospitals are adopting digitally connected systems to improve surgical precision, workflow, and data tracking. The Surgical/Operating Tables Market stands to benefit by integrating smart features such as programmable positions, touchscreen controls, and connectivity with electronic health records. It allows hospitals to improve efficiency and comply with digital health mandates. Demand for customizable and modular tables is also increasing across multispecialty hospitals. Manufacturers can provide tailored solutions to support cardiology, neurology, and orthopedic procedures within a single operating platform. These innovations strengthen competitive positioning and open opportunities for strategic partnerships with health-tech providers.

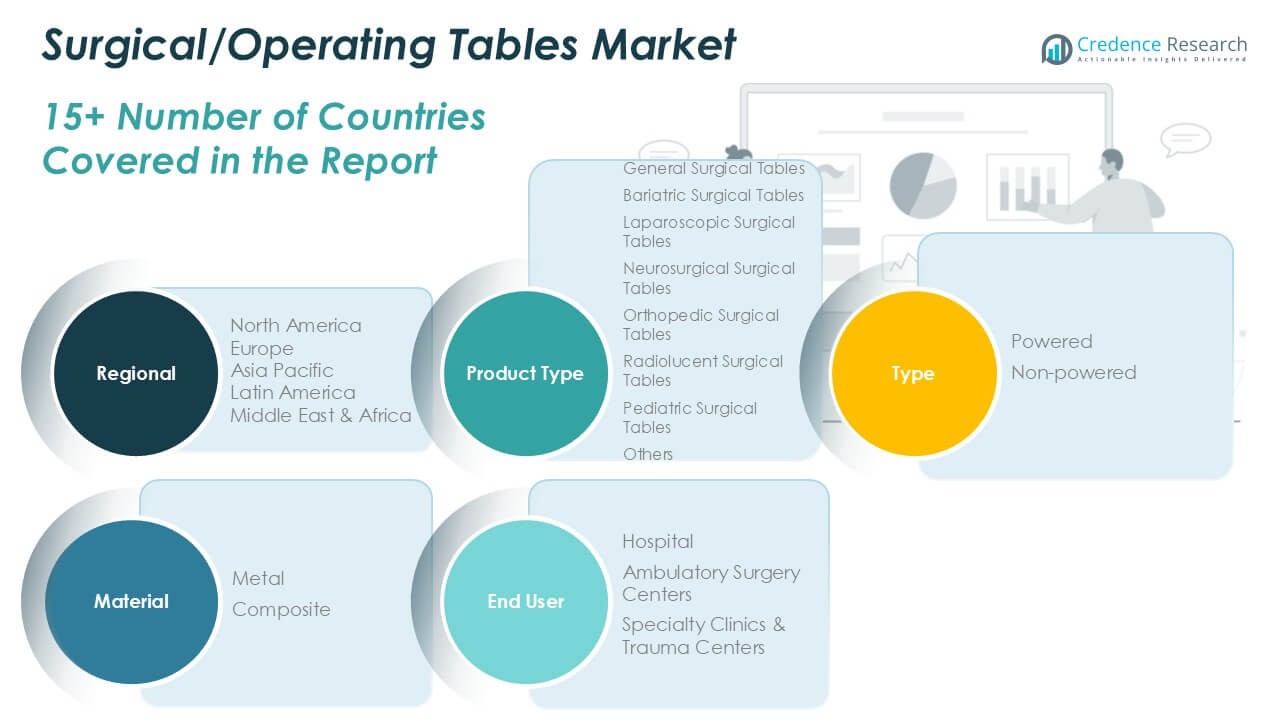

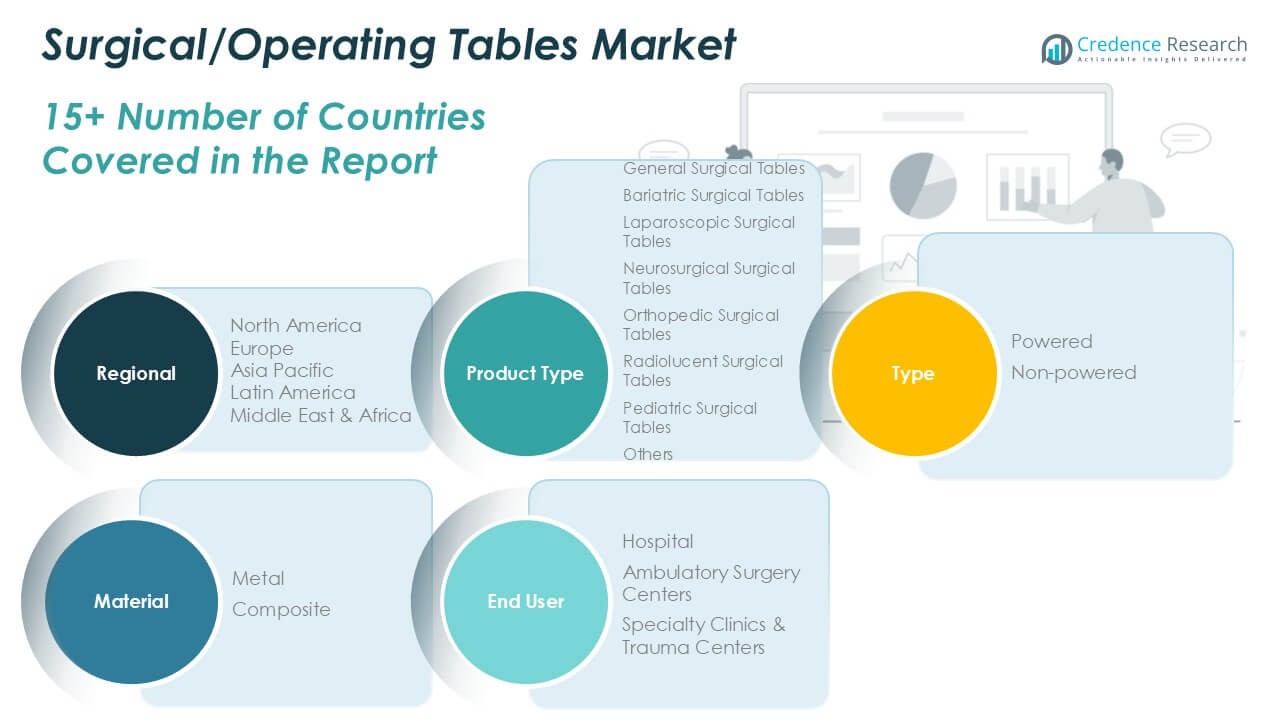

Market Segmentation Analysis:

By Product Type:

General surgical tables hold the largest share due to their versatility and widespread use across various procedures in general surgery, gynecology, urology, and ENT. Orthopedic surgical tables follow closely, driven by rising musculoskeletal procedures and demand for precise patient positioning. Laparoscopic surgical tables continue to gain traction due to increasing adoption of minimally invasive surgeries. Radiolucent surgical tables are growing in demand due to their compatibility with imaging systems, supporting procedures that require real-time diagnostics. Bariatric surgical tables address the rising global obesity burden by providing enhanced weight capacity and safety. Neurosurgical tables are tailored for intricate cranial and spinal operations, while pediatric tables serve specialized needs in children’s hospitals. The “others” segment includes hybrid and specialty tables for niche surgical applications.

- For instance, Mizuho OSI’s Trios Surgical Table System supports a weight capacity of 295 kg and features radiolucent panels ideal for spinal and neurosurgical interventions.

By Type:

Powered surgical tables dominate the Surgical/Operating Tables Market due to their ergonomic benefits, ease of use, and support for complex, multi-position surgeries. Hospitals and ambulatory surgical centers prefer powered models for their ability to improve surgical workflow and reduce manual strain on staff. Non-powered tables maintain relevance in cost-sensitive settings and low-volume surgical facilities. It offers basic functionality with mechanical adjustments and remains a viable option for smaller healthcare providers or those with limited infrastructure.

- For instance, ALVO Medical’s powered surgical tables provide an elevation range from 580 mm to 1,030 mm and include battery operation for up to 50 full cycles, supporting continuity in procedures even during power disruptions.

By Material:

Metal remains the most widely used due to its strength, durability, and ability to support heavy surgical equipment. Stainless steel, in particular, is preferred for its corrosion resistance and ease of sterilization, meeting critical hygiene standards in operating rooms. Composite materials are gaining attention for their lighter weight, radiolucency, and resistance to wear. It allows manufacturers to innovate with modular and mobile designs while maintaining structural integrity. The growing interest in hybrid ORs and advanced imaging further supports the adoption of composite-based surgical tables across both developed and emerging markets.

Segments:

Based on Product Type:

- General Surgical Tables

- Bariatric Surgical Tables

- Laparoscopic Surgical Tables

- Neurosurgical Surgical Tables

- Orthopedic Surgical Tables

- Radiolucent Surgical Tables

- Pediatric Surgical Tables

- Others

Based on Type:

Based on Material:

Based on End-User:

- Hospital

- Ambulatory Surgery Centers

- Specialty Clinics & Trauma Centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Surgical/Operating Tables Market

North America Surgical/Operating Tables Market grew from USD 425.88 million in 2018 to USD 593.47 million in 2024 and is projected to reach USD 930.40 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.4%. North America is holding a 39% market share. The region leads due to high surgical volumes, advanced healthcare infrastructure, and strong adoption of technologically enhanced tables. The United States dominates the regional market, supported by high per capita healthcare spending and rapid integration of hybrid operating rooms. Canada follows with continued investments in outpatient surgical facilities and universal healthcare coverage. Demand for ergonomic and imaging-compatible tables remains strong, driven by robotic-assisted surgeries and hospital modernization initiatives. The focus on operating room efficiency and patient safety continues to push procurement of powered and smart surgical tables.

Europe Surgical/Operating Tables Market

Europe Surgical/Operating Tables Market grew from USD 347.68 million in 2018 to USD 474.64 million in 2024 and is projected to reach USD 704.09 million by 2032, reflecting a CAGR of 4.7%. Europe is holding a 31% market share. Germany, France, and the United Kingdom lead the region with robust healthcare systems and strong presence of medical device manufacturers. Aging populations and rising demand for orthopedic and neurosurgical procedures are fueling market expansion. Hospitals in Western Europe prioritize high-end powered tables, while Eastern Europe shows steady adoption of mid-range solutions. Focus on outpatient care models and rising minimally invasive surgeries continue to influence purchasing trends. Governments support digitization in surgical care, which encourages adoption of integrated surgical platforms.

Asia Pacific Surgical/Operating Tables Market

Asia Pacific Surgical/Operating Tables Market grew from USD 211.63 million in 2018 to USD 322.68 million in 2024 and is projected to reach USD 569.57 million by 2032, reflecting a CAGR of 6.9%. Asia Pacific is holding a 24% market share. China, Japan, and India drive demand due to growing healthcare infrastructure and an expanding patient base. Increased government spending, rising surgical procedures, and growth in medical tourism support the market. Rapid urbanization and the rise of private hospitals create demand for advanced and budget-friendly equipment. Local manufacturers gain ground with cost-effective products, while global companies focus on hybrid OR-compatible tables. Hospitals across the region are gradually upgrading legacy systems to match international standards.

Latin America Surgical/Operating Tables Market

Latin America Surgical/Operating Tables Market grew from USD 45.36 million in 2018 to USD 63.05 million in 2024 and is projected to reach USD 85.89 million by 2032, reflecting a CAGR of 3.5%. Latin America is holding a 4% market share. Brazil and Mexico lead the region, supported by large populations and improving healthcare investments. Public hospitals drive volume purchases, while private facilities target premium, multifunctional tables. Procurement is influenced by budget constraints, driving demand for durable and value-oriented solutions. Growth in ambulatory care and general surgeries boosts sales of general surgical and radiolucent tables. Imports dominate, but regional distribution networks continue to strengthen.

Middle East Surgical/Operating Tables Market

Middle East Surgical/Operating Tables Market grew from USD 26.07 million in 2018 to USD 33.12 million in 2024 and is projected to reach USD 42.32 million by 2032, reflecting a CAGR of 2.7%. The Middle East is holding a 2% market share. The UAE and Saudi Arabia are the primary markets, driven by significant healthcare investments and growing demand for advanced surgical facilities. Governments are prioritizing expansion of medical tourism and specialized surgical centers. Hospitals procure powered and modular tables for complex surgeries, though cost-efficiency remains a key factor. Limited local production results in dependency on imports. Infrastructure development projects continue to shape procurement patterns across the Gulf Cooperation Council countries.

Africa Surgical/Operating Tables Market

Africa Surgical/Operating Tables Market grew from USD 14.61 million in 2018 to USD 23.04 million in 2024 and is projected to reach USD 27.80 million by 2032, reflecting a CAGR of 1.9%. Africa is holding a 1% market share. South Africa and Egypt represent the leading markets due to relatively better healthcare systems. Public hospitals focus on basic non-powered tables, while private hospitals are gradually adopting powered models. Low healthcare spending and import dependency restrict market expansion. International aid programs and health sector reforms may support growth in the long term. The need for surgical capacity development is expected to create gradual but steady demand.

Key Player Analysis

- Hill-Rom Holdings, Inc.

- Mizuho Corporation

- Alvo Medical

- Getinge AB

- Steris Plc.

- Stryker Corp.

- Skytron LLC

- Allengers Medical Systems Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Merivaara Corp.

Competitive Analysis

The Surgical/Operating Tables Market is highly competitive, driven by technological innovation, product differentiation, and strategic expansion. Leading players in the market include Hill-Rom Holdings, Inc., Getinge AB, Stryker Corp., Skytron LLC, Steris Plc., Mizuho Corporation, Alvo Medical, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Merivaara Corp., and Allengers Medical Systems Ltd. These companies focus on enhancing their product portfolios with advanced features such as motorized controls, imaging compatibility, modular designs, and smart integration for hybrid operating rooms. Manufacturers also invest in research and development to deliver customizable and multi-specialty solutions that align with evolving surgical practices. The competitive landscape is shaped by strategic collaborations with healthcare providers, expansion into emerging markets, and the development of cost-effective models tailored for outpatient and ambulatory surgical centers. Market participants increasingly prioritize digital integration, offering smart tables with programmable settings and touchscreen controls to improve operating room efficiency. Firms operating in mature regions focus on technological leadership, while those targeting high-growth regions prioritize scalability, affordability, and compliance with regional regulations to strengthen market presence.

Recent Developments

- In January 2025, Mindray North America launched its first surgical table, the HyBase V6. This versatile, precise table caters to a wide patient population, enhancing surgical innovation and improving clinical and operational workflows for healthcare facilities.

- In August 2024, Getinge launched the Maquet Corin operating table and Maquet Ezea surgical light in India, focusing on user-friendly features, safety, and workflow enhancement, with Corin being the first connected operating table.

- In July 2024, Getinge unveiled the Maquet Corin operating table and Maquet Ezea surgical light at the AORN Conference in Nashville.

- In July 2023, Hospital Products Australia launched the Mindray HyBase V9 Operating Table, equipped with intelligent safety systems such as anti-collision sensors and automatic locking mechanisms to enhance surgical safety and minimize procedural risks.

- In February 2023, Baxter and Intuitive introduced the TS7000dV Surgical Table, an integrated table motion for the Da Vinci Xi Surgical System, available for trials at the Device Technologies Asia Training Center in Singapore. The TS7000dV is the first table to integrate with the Da Vinci Xi system.

Market Concentration & Characteristics

The Surgical/Operating Tables Market exhibits moderate market concentration, with a mix of global leaders and regional manufacturers competing across segments. It features both established multinational companies offering premium, technologically advanced tables and smaller players delivering cost-effective models for local markets. The market is characterized by product differentiation based on functionality, mobility, integration with imaging systems, and specialization for procedures such as orthopedic, bariatric, and neurosurgery. Technological innovation plays a central role, with hospitals favoring tables that improve surgical workflow, patient safety, and compatibility with hybrid operating rooms. Procurement decisions are often influenced by regulatory compliance, total cost of ownership, and service support. The market favors long-term supplier relationships due to high capital investment and limited replacement frequency. It shows a strong inclination toward customization, with hospitals seeking adaptable designs to meet diverse procedural demands. Emerging economies display rising demand for scalable solutions, while developed regions focus on smart, connected systems that support advanced surgical environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Continued adoption of hybrid operating rooms will drive demand for integrated and imaging-compatible surgical tables.

- Rising prevalence of minimally invasive and robotic-assisted surgeries will require tables with high precision and mobility.

- Development of smart tables with programmable positions and digital interfaces will support enhanced workflow and data tracking.

- Growing ambulatory surgical center expansion will increase need for compact, lightweight surgical tables.

- Manufacturers will focus on modular designs to support multi-specialty procedures within a single unit.

- Composite material adoption will rise due to its radiolucent properties and lightweight strength.

- Demand in emerging economies will grow with healthcare infrastructure improvements and governmental support.

- Strategic partnerships between medical device firms and health-tech providers will foster innovation in table functionality.

- Customizable accessories and memory settings will become standard to meet surgeon-specific requirements.

- Eco-friendly materials and energy-efficient motor systems will gain importance in table design.