| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Surgical Procedures Volume Market Size 2024 |

USD 2,951.75 million |

| Surgical Procedures Volume Market, CAGR |

6.34% |

| Surgical Procedures Volume Market Size 2032 |

USD 4,999.90 million |

Market Overview

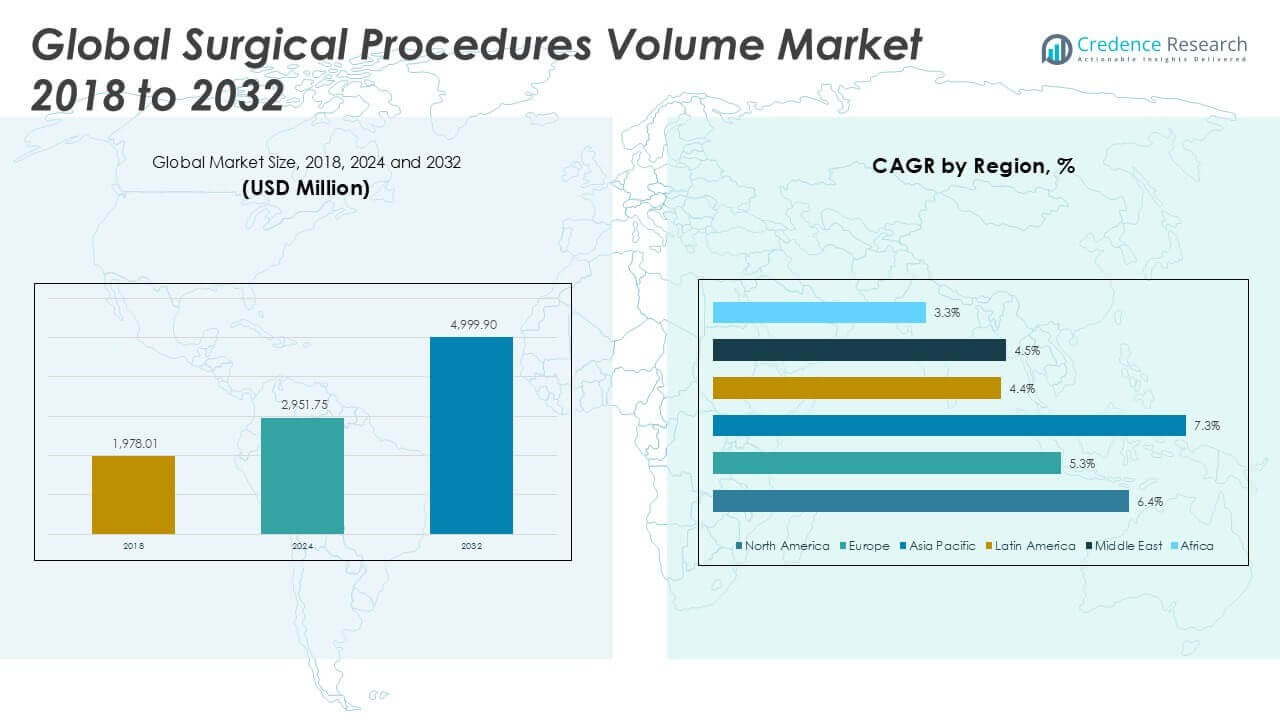

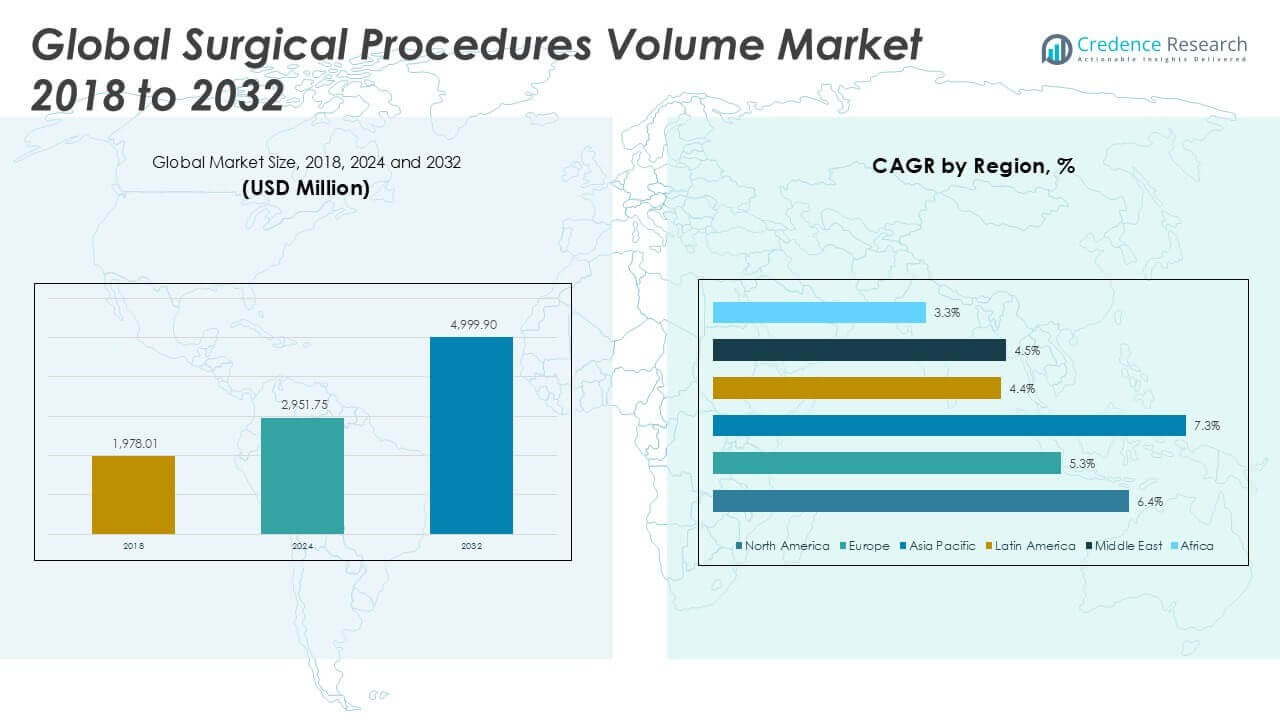

Surgical Procedures Volume Market size was valued at USD 1,978.01 million in 2018 to USD 2,951.75 million in 2024 and is anticipated to reach USD 4,999.90 million by 2032, at a CAGR of 6.34% during the forecast period.

The Surgical Procedures Volume Market is driven by increasing prevalence of chronic diseases and a growing aging population, which boosts demand for surgical interventions. Technological advancements in surgical equipment and techniques, including minimally invasive procedures, significantly enhance procedural efficiency and patient outcomes, fueling market growth. Rising healthcare expenditures and improved access to medical services globally also contribute positively. Additionally, the expanding popularity of outpatient surgeries reduces hospitalization time, offering cost-effective solutions for healthcare systems. Market trends indicate a surge in robotic-assisted surgeries, which provide precision, minimal invasiveness, and rapid patient recovery, further supporting procedural volumes. Moreover, healthcare providers increasingly adopt advanced digital platforms for surgical planning and patient management, improving operational efficiency and procedure accuracy. These technological integrations and evolving patient care practices collectively propel the continuous growth of the surgical procedures volume market.

The geographical analysis of the Surgical Procedures Volume Market reveals substantial growth in North America, Europe, and the Asia-Pacific regions, driven by advanced healthcare infrastructure, rising geriatric populations, and increased prevalence of chronic diseases. North America demonstrates strong market presence, propelled by technological innovations and high patient awareness. Europe benefits from robust healthcare systems and investments in minimally invasive surgical solutions, while Asia-Pacific experiences rapid expansion due to growing healthcare access and medical tourism. Prominent players shaping the market include Johnson & Johnson, known for diverse surgical instruments and minimally invasive devices; Medtronic, renowned for cardiovascular and neurological surgery solutions; Stryker Corporation, prominent in orthopedic and surgical navigation technologies; and Intuitive Surgical, a global leader in robotic-assisted surgery platforms.

Market Insights

- The Surgical Procedures Volume Market was valued at USD 1,978.01 million in 2018 and is projected to reach USD 4,999.90 million by 2032, growing at a CAGR of 6.34%.

- Increasing chronic disease prevalence, rising elderly population, and improved healthcare infrastructure significantly drive market demand globally.

- Key trends include rapid adoption of robotic-assisted surgeries, growing preference for minimally invasive procedures, and increased utilization of ambulatory surgical centers for outpatient surgeries.

- Major market players such as Johnson & Johnson, Medtronic, Stryker Corporation, and Intuitive Surgical lead through technological innovations and extensive surgical product portfolios.

- High costs associated with advanced surgical equipment, limited funding availability, and shortages of skilled surgical professionals pose critical market challenges, restraining faster expansion.

- North America dominates market revenue driven by advanced healthcare services and technology adoption; Asia-Pacific region exhibits highest growth rate supported by increasing healthcare expenditure and growing medical tourism.

- Europe maintains steady market growth, supported by robust healthcare systems and consistent adoption of minimally invasive technologies; meanwhile, Latin America, the Middle East, and Africa offer gradual expansion opportunities through rising investments in healthcare infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Chronic Diseases Boosts Surgical Procedure Demand

The Surgical Procedures Volume Market is primarily driven by a steady increase in chronic diseases such as cardiovascular disorders, cancer, diabetes, and orthopedic conditions. These health issues require frequent and often complex surgical interventions, enhancing market growth potential. Lifestyle-related conditions, including obesity and hypertension, significantly raise surgical requirements globally. The elderly population grows worldwide, demanding more surgical treatments due to age-related ailments. Hospitals and clinics experience higher patient admissions, creating a strong and consistent demand for surgical procedures. This sustained requirement positions healthcare providers to invest extensively in surgical capabilities and infrastructure.

- For instance, the World Health Organization reports that chronic diseases account for over 70% of global deaths, increasing the demand for surgical interventions.

Technological Advancements Enhance Surgical Efficiency and Outcomes

Continuous advancement in medical technology significantly influences the Surgical Procedures Volume Market. Innovative surgical techniques like robotic-assisted and minimally invasive surgeries provide higher precision, reduce procedural time, and improve patient recovery. Adoption of sophisticated imaging systems and digital surgical platforms helps surgeons perform procedures more accurately. Emerging technologies such as augmented reality and artificial intelligence enhance surgical planning, reduce operational risks, and ensure patient safety. Healthcare institutions widely adopt advanced surgical equipment, expanding surgical capabilities and improving procedural outcomes. Such technological progression continuously encourages healthcare providers to increase surgical volumes and efficiency.

- For instance, robotic-assisted surgeries have reduced hospital stays by up to 50%, improving patient recovery rates.

Increasing Preference for Outpatient Surgical Procedures Drives Market Expansion

The shift toward outpatient surgical procedures significantly expands the Surgical Procedures Volume Market. Outpatient surgeries offer shorter hospital stays, cost efficiency, and quicker patient recovery, appealing strongly to healthcare systems worldwide. Patients prefer outpatient surgeries due to convenience and reduced infection risk, driving demand for these procedures. Many healthcare providers actively expand outpatient surgery facilities and invest in ambulatory surgical centers to accommodate this shift. Health insurance companies also favor outpatient procedures due to lower overall healthcare costs. The consistent expansion in outpatient surgical infrastructure directly impacts overall surgical volumes positively.

Growing Healthcare Expenditure and Enhanced Medical Infrastructure Supports Growth

Robust healthcare expenditure and improved medical infrastructure across developed and developing economies strongly support the Surgical Procedures Volume Market. Governments worldwide actively invest in healthcare systems, upgrading hospitals, surgical centers, and medical equipment to meet rising patient demand. Increased private and public funding promotes extensive training for surgeons and medical staff, enhancing procedural capacity. Economic growth and increased per capita income allow broader access to surgical services, further driving market expansion. Better medical infrastructure ensures availability of advanced surgical procedures to a wider population base. These factors collectively contribute to stable market growth and higher volumes of surgical interventions globally.

Market Trends

Increasing Adoption of Robotic-Assisted Surgeries Enhances Precision and Recovery

The rising adoption of robotic-assisted surgeries significantly influences the Surgical Procedures Volume Market. Robotic systems offer superior precision, reduced invasiveness, and enhanced patient recovery times. Hospitals increasingly integrate robotic platforms for complex procedures, including cardiovascular, orthopedic, and oncology surgeries. Surgeons benefit from improved dexterity and greater visualization, reducing procedural complications. Patients experience less post-operative pain, shorter hospital stays, and quicker return to daily activities. Healthcare institutions actively invest in robotic technologies to remain competitive and attract more patients, positively impacting surgical volumes globally.

- For instance, India’s government-backed initiatives are driving robotic surgery adoption, with AIIMS Delhi recently installing a state-of-the-art surgical robot.

Shift Toward Minimally Invasive Procedures Drives Patient Preference

Growing patient preference for minimally invasive procedures steadily shapes the Surgical Procedures Volume Market. These procedures offer smaller incisions, reduced scarring, minimal blood loss, and faster recovery compared to traditional surgeries. Surgeons widely adopt laparoscopic, endoscopic, and catheter-based techniques across various specialties. Hospitals witness an increasing demand from patients seeking less invasive treatments due to quicker rehabilitation. Healthcare providers upgrade infrastructure and training programs to accommodate the growing demand. Medical device companies continuously introduce innovative minimally invasive tools and instruments, further accelerating market expansion.

- For instance, minimally invasive surgeries reduce hospital stays and recovery times, making them the preferred choice for patients.

Expansion of Ambulatory Surgical Centers Increases Outpatient Surgical Volumes

The rapid expansion of ambulatory surgical centers significantly impacts the Surgical Procedures Volume Market. Ambulatory surgical centers offer convenient, cost-effective outpatient procedures in specialized facilities. Patients benefit from efficient scheduling, lower costs, reduced hospital-associated infections, and rapid discharge. Surgeons prefer ambulatory centers due to operational efficiency and streamlined workflows. Insurance providers increasingly favor ambulatory settings for lower reimbursement expenses, further driving outpatient procedural growth. Healthcare organizations strategically invest in developing and expanding these centers, contributing directly to rising surgical volumes.

Integration of Digital Health Technologies Improves Surgical Outcomes

Integration of digital health technologies actively transforms the Surgical Procedures Volume Market. Digital platforms, including telemedicine and remote patient monitoring, enable continuous patient engagement and improve post-operative care management. Advanced data analytics and artificial intelligence support clinical decision-making, enhancing surgical precision and patient outcomes. Hospitals increasingly adopt electronic medical records and digital surgical planning tools, streamlining workflow efficiencies. Surgeons leverage digital simulations for preoperative training and surgical planning, minimizing intraoperative errors. Healthcare facilities embracing these digital advancements experience increased procedural efficiency, positively influencing surgical procedure volumes.

Market Challenges Analysis

Shortage of Skilled Surgical Professionals Restricts Procedural Expansion

The Surgical Procedures Volume Market faces notable constraints due to the shortage of skilled surgical professionals globally. Inadequate numbers of trained surgeons, particularly specialists in robotics or minimally invasive techniques, hinder procedural growth. Training surgical teams on emerging technologies requires substantial resources and extensive time commitments from healthcare institutions. Healthcare systems in developing countries encounter greater difficulty retaining skilled personnel because of limited incentives and competitive compensation. The increasing complexity of surgical procedures necessitates ongoing skill enhancement, posing additional challenges for medical professionals. Workforce shortages result in delayed or canceled surgeries, negatively impacting patient care quality and reducing overall surgical volume growth.

- For instance, India faces an acute demand-supply gap in surgical procedures due to a shortage of trained personnel, particularly in rural health centers.

High Costs of Advanced Surgical Technologies Limit Market Growth Potential

High costs associated with advanced surgical technologies pose significant challenges to the Surgical Procedures Volume Market. Sophisticated surgical equipment, such as robotic systems and minimally invasive instruments, often requires substantial initial investments, limiting adoption among smaller healthcare providers. Budget constraints restrict hospitals, especially in developing regions, from upgrading to advanced surgical infrastructure. Limited availability of funding or reimbursement further discourages healthcare facilities from investing in expensive technologies. Patients without sufficient insurance coverage face financial barriers to accessing advanced surgical procedures, restricting procedural volumes. The high maintenance and operational costs of advanced surgical equipment also strain hospital resources and negatively impact the frequency of surgical interventions.

Market Opportunities

Expansion of Surgical Infrastructure in Emerging Economies Provides Growth Prospects

Expansion of surgical infrastructure in emerging economies presents significant opportunities for the Surgical Procedures Volume Market. Developing regions actively invest in upgrading healthcare facilities, creating greater availability and accessibility of surgical services. Governments and private healthcare providers enhance hospital capacities by building advanced surgical centers and modernizing existing facilities. Improved infrastructure allows healthcare providers to handle increased patient volumes efficiently. Enhanced healthcare delivery models attract international patients seeking affordable surgical treatments, further contributing to procedural growth. Strategic collaborations between global medical device manufacturers and regional healthcare institutions enable quicker adoption of advanced surgical technologies, expanding the market potential.

Increasing Adoption of Telemedicine and Digital Surgical Solutions Enhances Market Potential

Growing adoption of telemedicine and digital surgical solutions offers promising opportunities for the Surgical Procedures Volume Market. Telemedicine platforms facilitate remote surgical consultations, enabling timely care even in underserved regions. Digital surgical solutions, such as virtual surgical planning and remote patient monitoring, optimize surgical workflows and improve patient outcomes. Healthcare providers leverage digital platforms for continuous patient engagement, ensuring effective preoperative and postoperative care. Hospitals benefit from enhanced operational efficiency, better resource management, and reduced patient readmissions. Wider acceptance of digital health tools among healthcare professionals supports seamless integration into surgical practices, driving higher procedural volumes.

Market Segmentation Analysis:

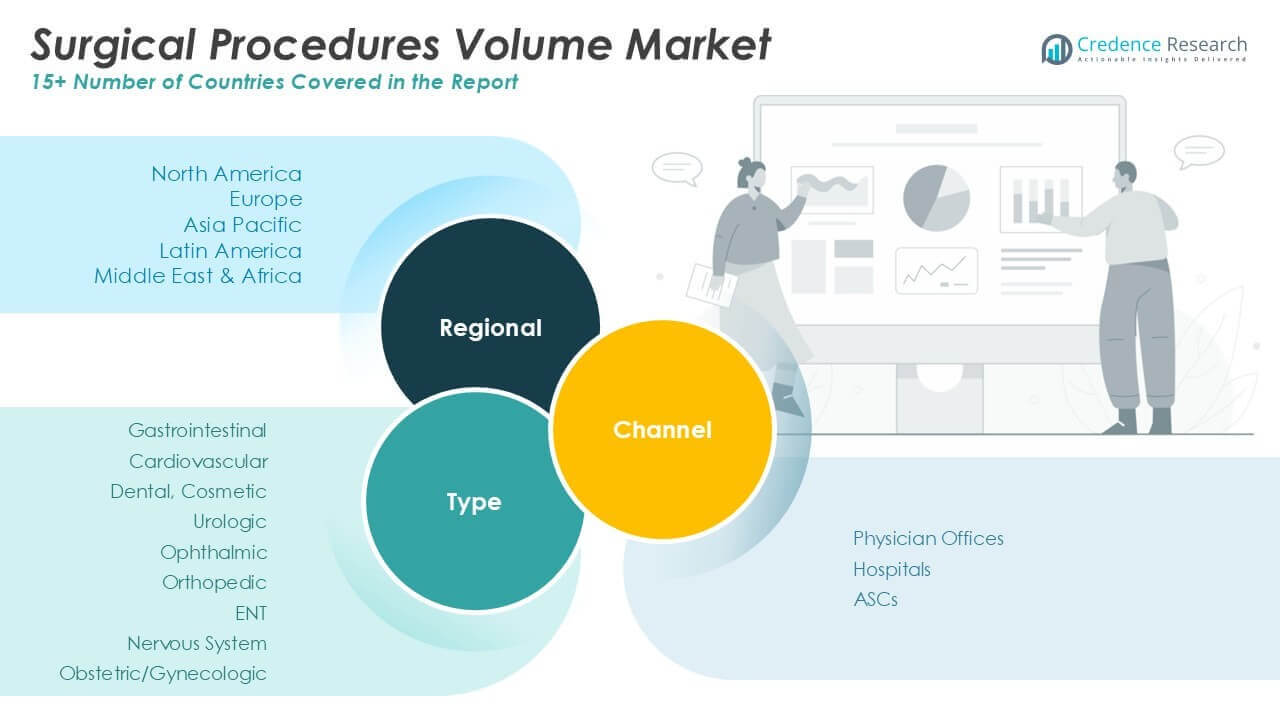

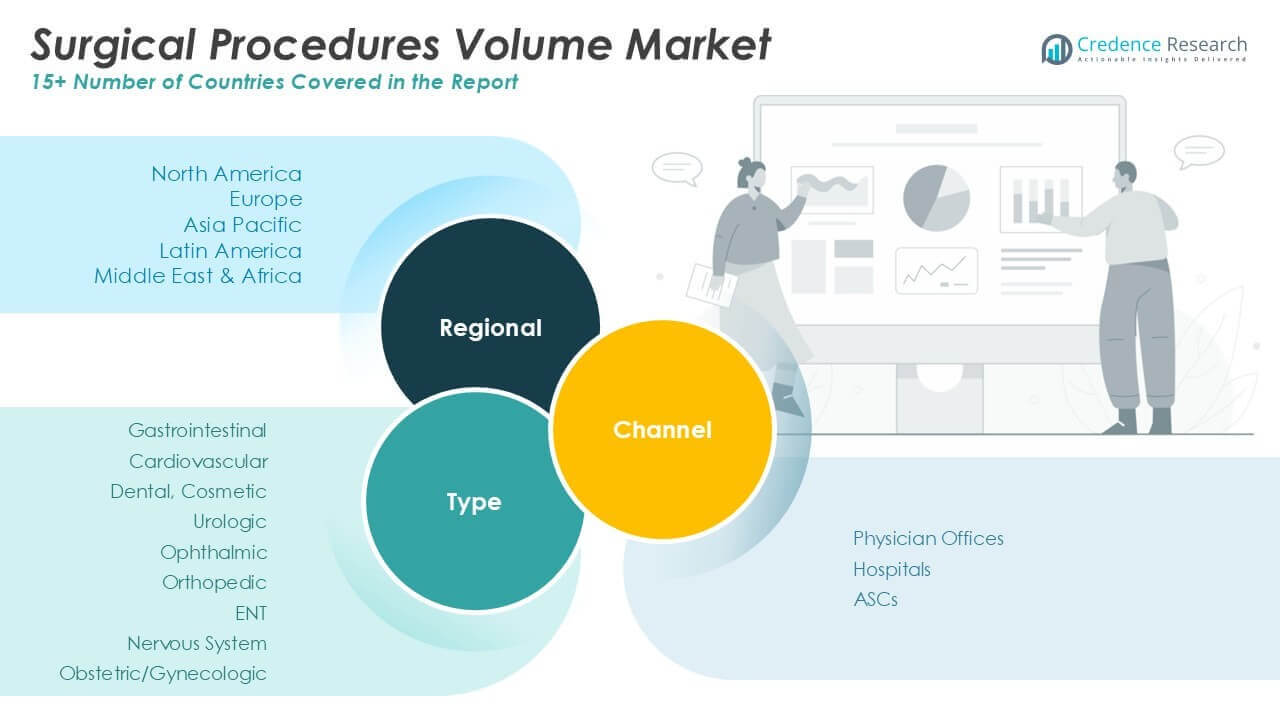

By Type:

The Surgical Procedures Volume Market is segmented into Gastrointestinal, Cardiovascular, Dental and Cosmetic, Urologic, Ophthalmic, Orthopedic, ENT, Nervous System, and Obstetric/Gynecologic procedures. The cardiovascular segment leads in demand due to the rising incidence of heart diseases, requiring frequent interventions like angioplasty, bypass surgeries, and valve replacements. Orthopedic procedures experience substantial growth driven by an aging population, increasing arthritis cases, and sports-related injuries. Ophthalmic surgeries, especially cataract and refractive procedures, also hold considerable market share, owing to improved accessibility and technological advancements. Cosmetic and dental surgeries continue gaining popularity globally due to enhanced aesthetic awareness and increased disposable income. Urologic, gastrointestinal, and ENT procedures see steady demand supported by rising chronic illnesses and better diagnostic capabilities, while nervous system and obstetric/gynecologic surgeries remain essential, driven by enhanced healthcare services and broader insurance coverage.

By Channel:

The Surgical Procedures Volume Market segments into Physician Offices, Hospitals, and Ambulatory Surgical Centers (ASCs). Hospitals dominate this segment due to extensive infrastructure, availability of specialized medical professionals, and comprehensive care capabilities. Hospitals handle complex, high-risk surgeries more effectively, sustaining their leading position. Ambulatory Surgical Centers (ASCs) rapidly expand their presence in the market, driven by patient preference for outpatient care, lower procedure costs, and reduced hospital-associated infection risks. ASCs efficiently accommodate high volumes of minimally invasive and elective procedures, increasing their appeal to insurers and patients alike. Physician offices cater to a significant portion of outpatient procedures, especially in cosmetic, dental, and ophthalmic segments, benefiting from convenience and personalized patient care. Physician offices continue enhancing their surgical capabilities to attract patients preferring accessible, cost-effective treatment settings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Type:

- Gastrointestinal

- Cardiovascular

- Dental, Cosmetic

- Urologic

- Ophthalmic

- Orthopedic

- ENT

- Nervous System

- Obstetric/Gynecologic

Based on Channel:

- Physician Offices

- Hospitals

- ASCs (Ambulatory Surgical Centers)

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Surgical Procedures Volume Market

North America Surgical Procedures Volume Market grew from USD 619.30 million in 2018 to USD 910.79 million in 2024 and is projected to reach USD 1,548.76 million by 2032, reflecting a compound annual growth rate (CAGR) of 6.4%. North America is holding a 31% market share. The U.S. and Canada contribute significantly due to advanced healthcare infrastructure and high prevalence of chronic diseases. Strong investment in healthcare technologies and rising outpatient surgical volumes boost market expansion. High patient awareness and favorable reimbursement policies encourage frequent adoption of advanced surgical procedures. Hospitals and ambulatory surgical centers actively expand capacity, meeting increasing surgical demand effectively.

Europe Surgical Procedures Volume Market

Europe Surgical Procedures Volume Market grew from USD 460.33 million in 2018 to USD 656.76 million in 2024 and is projected to reach USD 1,032.47 million by 2032, reflecting a CAGR of 5.3%. Europe currently holds a market share of approximately 21%. Major countries including Germany, the U.K., and France support growth through advanced medical facilities and skilled professionals. Rising geriatric populations and increasing surgical innovations enhance procedural volumes across the region. Government healthcare investments sustain the expansion of surgical capacities. Demand for minimally invasive surgeries grows consistently, driving market performance positively.

Asia Pacific Surgical Procedures Volume Market

Asia Pacific Surgical Procedures Volume Market grew from USD 721.84 million in 2018 to USD 1,124.81 million in 2024 and is projected to reach USD 2,043.49 million by 2032, reflecting a CAGR of 7.3%. The region accounts for about 36% market share. China, India, Japan, and South Korea drive growth due to rapidly improving healthcare infrastructure and increasing healthcare expenditures. Growing patient awareness and affordability of advanced surgical care significantly expand procedural volumes. Medical tourism and rising prevalence of chronic diseases further stimulate market opportunities. Healthcare providers actively upgrade facilities, boosting patient accessibility and procedural efficiency.

Latin America Surgical Procedures Volume Market

Latin America Surgical Procedures Volume Market grew from USD 80.14 million in 2018 to USD 117.86 million in 2024 and is projected to reach USD 172.85 million by 2032, reflecting a CAGR of 4.4%. It currently holds approximately 3% market share. Brazil, Mexico, and Argentina lead regional growth through increased healthcare spending and infrastructural improvements. Rising prevalence of lifestyle-related chronic illnesses contributes to demand. Expansion of healthcare services and patient education initiatives foster market growth.

Middle East Surgical Procedures Volume Market

Middle East Surgical Procedures Volume Market grew from USD 66.16 million in 2018 to USD 91.63 million in 2024 and is projected to reach USD 135.21 million by 2032, reflecting a CAGR of 4.5%. It holds a market share of approximately 2%. Key countries including Saudi Arabia, UAE, and Qatar drive procedural growth by actively investing in advanced healthcare facilities. Increasing government initiatives for healthcare modernization significantly support market expansion. Medical tourism further contributes to procedural demand.

Africa Surgical Procedures Volume Market

Africa Surgical Procedures Volume Market grew from USD 30.23 million in 2018 to USD 49.90 million in 2024 and is projected to reach USD 67.13 million by 2032, reflecting a CAGR of 3.3%. Africa holds around 1% market share. South Africa, Nigeria, and Egypt lead the regional growth supported by gradual improvements in medical infrastructure. Challenges like limited skilled professionals restrict faster expansion, though rising investments offer potential for steady growth.

Key Player Analysis

- Johnson & Johnson

- Medtronic

- Stryker Corporation

- Becton, Dickinson and Company (BD)

- Olympus Corporation

- Zimmer Biomet

- Abbott Laboratories

- Boston Scientific Corporation

- Intuitive Surgical

- Smith & Nephew

- Cook Medical

- Karl Storz

Competitive Analysis

The Surgical Procedures Volume Market is characterized by intense competition, driven by leading global players Johnson & Johnson, Medtronic, Stryker Corporation, Becton, Dickinson and Company (BD), Olympus Corporation, Zimmer Biomet, Abbott Laboratories, Boston Scientific Corporation, Intuitive Surgical, Smith & Nephew, Cook Medical, and Karl Storz. Johnson & Johnson dominates the market through diverse product offerings and robust investments in minimally invasive surgical technologies. Companies also prioritize expanding their product portfolios to cater to a wide range of procedures across cardiovascular, orthopedic, ophthalmic, and other specialty areas. Strategic partnerships with hospitals and surgical centers help strengthen market presence and enhance distribution capabilities. Market participants actively pursue mergers and acquisitions to gain access to new markets and technologies, reinforcing their competitive positions. Geographic expansion, particularly into high-growth regions such as Asia-Pacific and Latin America, allows firms to capture emerging demand. Competitive advantage in this market is driven by the ability to offer integrated surgical solutions that improve patient outcomes, reduce procedure time, and lower overall healthcare costs, positioning key players to lead in both mature and developing markets.

Recent Developments

- In December 2023, Allergan PLC announced plans to spin off its non-core businesses, including its surgical aesthetics portfolio, into a separate publicly traded company by the end of the year.

- In October 2022, Cutera, Inc. entered into a strategic partnership with Merz Aesthetics to co-market Cutera’s aesthetic devices in select markets.

- In September 2022, Human Med AG launched the ARTAS 9 system, an updated version of its hair restoration system.

- In October 2022, Lumenis Ltd. expanded its presence in the minimally invasive surgery market through acquisitions, including PulseCath.

- In July 2022, Stanford Health Care invested in expanding its robotic surgery program, including acquiring a new da Vinci Xi surgical robot.

Market Concentration & Characteristics

The Surgical Procedures Volume Market shows moderate to high market concentration, with a few global players holding a significant share due to their advanced technologies, broad product portfolios, and strong distribution networks. It is characterized by rapid technological advancement, increasing demand for minimally invasive and robotic-assisted procedures, and growing adoption of outpatient surgical settings. Companies compete on innovation, pricing, and strategic partnerships with healthcare institutions. The market favors firms that offer integrated solutions across multiple specialties, including cardiovascular, orthopedic, ophthalmic, and gastrointestinal procedures. Regulatory compliance, clinical effectiveness, and cost-efficiency play critical roles in purchasing decisions. The market also demonstrates high entry barriers due to stringent regulatory standards, complex product development cycles, and significant capital investment requirements. While developed regions continue to generate strong procedural volumes, emerging markets provide growth potential through expanding healthcare infrastructure and rising surgical access.

Report Coverage

The research report offers an in-depth analysis based on Type, Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Surgical Procedures Volume Market is projected to grow steadily, driven by increasing demand for minimally invasive and robotic-assisted surgeries.

- Technological advancements, including AI integration and enhanced surgical navigation systems, are expected to improve procedural accuracy and patient outcomes.

- The aging global population and rising prevalence of chronic diseases will continue to elevate the need for various surgical interventions.

- Outpatient surgical procedures are anticipated to rise, supported by the expansion of ambulatory surgical centers and cost-effective care models.

- Emerging markets, particularly in Asia-Pacific and Latin America, are likely to experience significant growth due to improving healthcare infrastructure and increased access to surgical care.

- The adoption of digital health technologies, such as telemedicine and remote patient monitoring, will enhance preoperative and postoperative care efficiency.

- Personalized surgical approaches, tailored to individual patient needs, are expected to become more prevalent, improving overall treatment efficacy.

- Strategic collaborations and partnerships among healthcare providers and technology firms will foster innovation and expand service offerings.

- Regulatory frameworks and quality standards will play a crucial role in ensuring patient safety and promoting the adoption of advanced surgical techniques.

- Continuous investment in research and development will be essential for introducing innovative surgical solutions and maintaining competitive advantage in the market.