Market Overview:

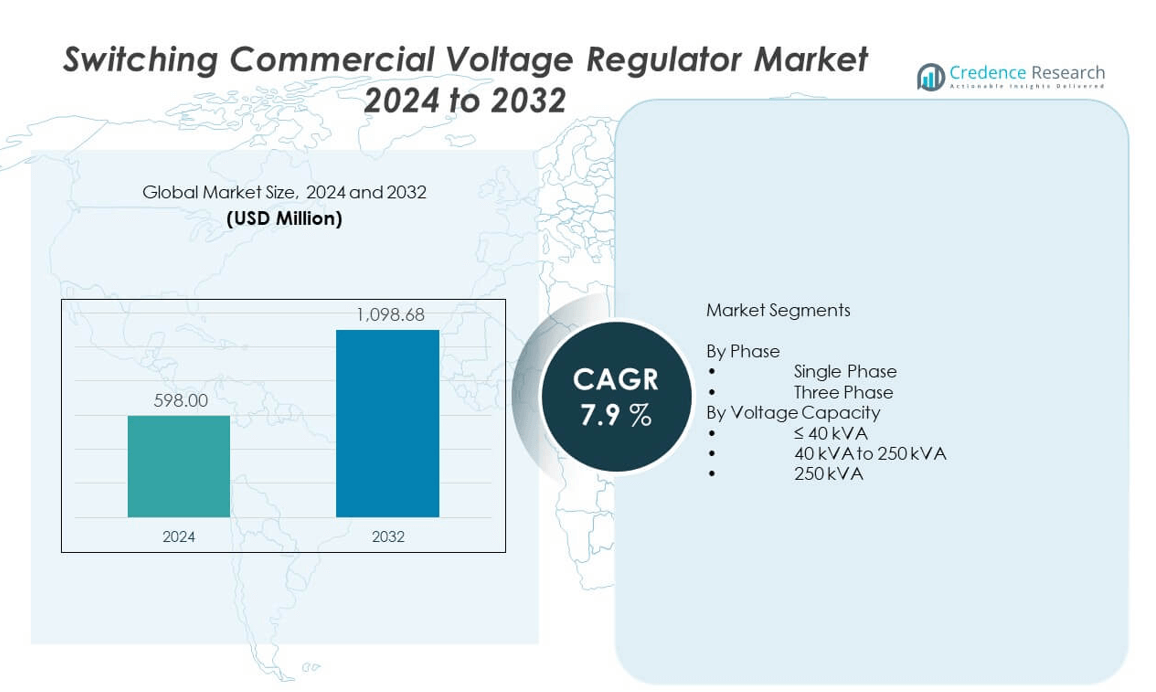

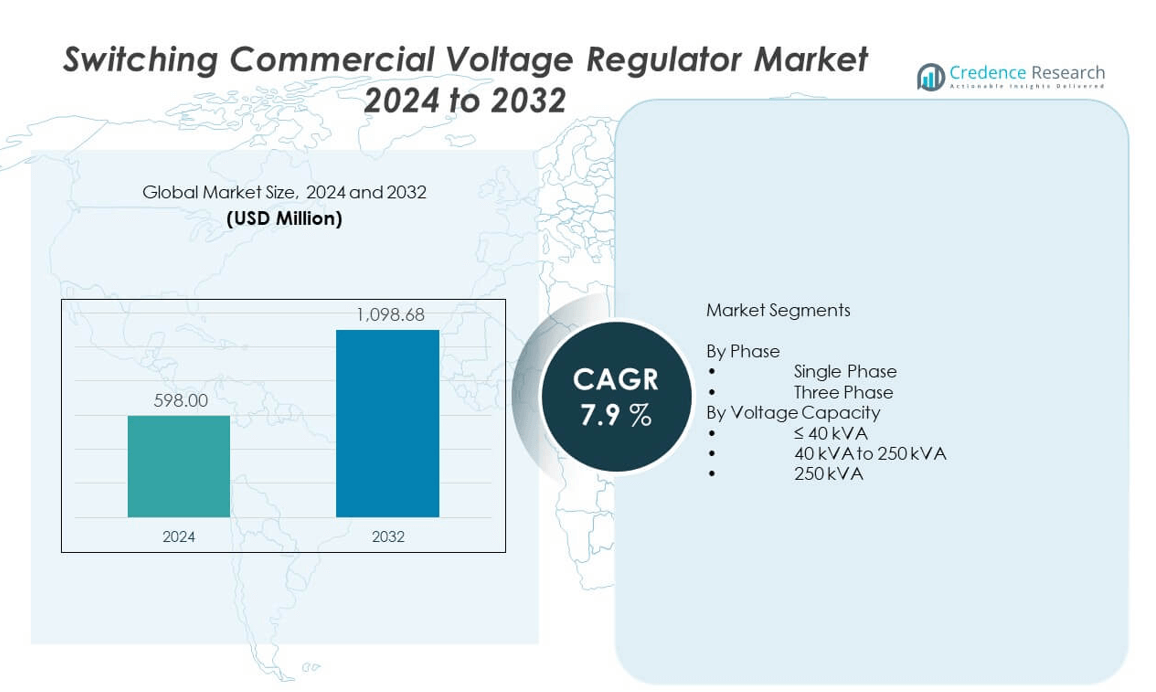

The switching commercial voltage regulator market is projected to grow from USD 598 million in 2024 to an estimated USD 1,098.68 million by 2032, registering a compound annual growth rate (CAGR) of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Switching Commercial Voltage Regulator Market Size 2024 |

USD 598 million |

| Switching Commercial Voltage Regulator Market, CAGR |

7.9% |

| Switching Commercial Voltage Regulator Market Size 2032 |

USD 1,098.68 million |

Market expansion is fueled by the rising deployment of electronics in commercial applications such as data centers, telecommunications, and industrial automation. Businesses are prioritizing voltage regulators that offer compact designs, superior thermal management, and enhanced conversion efficiency to meet stringent performance and energy standards. The integration of smart control features and compatibility with renewable energy systems is also driving demand, enabling end-users to achieve improved operational stability and reduced energy costs while supporting sustainability objectives.

Regionally, North America dominates the switching commercial voltage regulator market due to its advanced infrastructure, high technology adoption rate, and significant presence of key manufacturers. Europe follows closely, supported by strict energy efficiency regulations and strong industrial demand. The Asia-Pacific region is emerging as the fastest-growing market, driven by rapid industrialization, expanding commercial infrastructure, and increasing investments in smart grid and renewable energy projects in countries such as China, India, and Japan. Latin America and the Middle East & Africa are gradually adopting these technologies, propelled by growing urbanization and modernization of electrical systems.

Market Insights:

- The switching commercial voltage regulator market was valued at USD 598 million in 2024 and is projected to reach USD 1,098.68 million by 2032, growing at a CAGR of 7.9% during the forecast period.

- Rising demand for high-efficiency power management in commercial facilities, including data centers, telecommunications, and industrial automation, is driving market expansion.

- Advancements in semiconductor technologies, such as GaN and SiC materials, are enabling higher performance, better thermal management, and compact regulator designs.

- High initial costs and supply chain disruptions for semiconductor components remain key restraints, particularly in cost-sensitive markets.

- North America leads the market, supported by advanced infrastructure, regulatory initiatives, and strong manufacturer presence.

- Europe shows steady growth, driven by energy-efficiency mandates and industrial modernization efforts.

- Asia-Pacific is the fastest-growing region due to rapid industrialization, infrastructure development, and increasing renewable energy integration in commercial sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for High-Efficiency Power Management Solutions Across Commercial Applications:

The switching commercial voltage regulator market is witnessing substantial growth due to increasing demand for high-efficiency power management solutions in commercial environments. Industries such as data centers, telecommunications, and industrial automation rely on these regulators to ensure stable and reliable power delivery. Rising electricity costs and stringent energy-efficiency regulations are prompting businesses to adopt advanced solutions that reduce operational expenses. Compact designs with superior thermal management are making them suitable for integration into space-constrained systems. Enhanced conversion efficiency is reducing energy losses, improving system reliability. The proliferation of IoT-enabled devices in commercial facilities further necessitates stable power regulation. Voltage regulators with built-in monitoring features are gaining preference to ensure real-time performance optimization. These factors collectively strengthen the market’s adoption and growth trajectory.

- For instance, Infineon Technologies’ integrated POL (Point of Load) voltage regulators support load currents up to 40 A and reduce PCB space usage by up to 80% through integration of inductors and capacitors, enabling high power density in compact server and telecom applications while delivering benchmark efficiency and reliability.

Advancements in Semiconductor Technology Driving Performance Improvements:

Technological advancements in semiconductor manufacturing are significantly improving the performance and design of switching commercial voltage regulators. The use of advanced materials such as gallium nitride (GaN) and silicon carbide (SiC) is enabling higher energy efficiency and better thermal performance. Miniaturization of components allows integration into more compact devices without sacrificing output capacity. Digital control features are enhancing accuracy and enabling adaptive performance based on load requirements. Manufacturers are focusing on developing programmable regulators with smart monitoring capabilities. These innovations are expanding the application range from small-scale electronics to complex industrial machinery. Increased R&D investments are accelerating the availability of next-generation regulators. This technological evolution is positioning the market for sustained long-term growth.

- For example, Infineon’s latest OptiMOS™ TDM2454xx quad-phase power modules for AI data centers deliver peak currents up to 280 A with industry-leading power density of 2.0 A/mm² and incorporate proprietary inductor-on-top designs that improve thermal and electrical performance in high-demand computing environments.

Integration of Renewable Energy Sources into Commercial Power Infrastructure:

The adoption of renewable energy systems is creating strong opportunities for the switching commercial voltage regulator market. Commercial facilities are incorporating solar, wind, and hybrid energy systems, requiring advanced voltage regulation to maintain stability. Switching regulators efficiently manage fluctuating input voltages while delivering consistent output levels. Their role is critical in protecting sensitive equipment from irregular power supply. Integration with renewable systems supports sustainability goals while ensuring operational reliability. These devices are also compatible with energy storage solutions, allowing optimized energy usage. Growing government support for green energy adoption is further encouraging market uptake. The trend is expected to expand as commercial facilities pursue energy independence and carbon reduction.

Rising Demand for Smart and Programmable Power Management Solutions:

The transition toward smart commercial infrastructure is boosting demand for intelligent switching voltage regulators. Advanced designs now include real-time monitoring, remote configuration, and automated load balancing features. These capabilities enhance system responsiveness and allow predictive maintenance. The growing complexity of commercial electrical networks requires precise voltage control to prevent downtime. Programmable regulators are enabling customization for specific operational requirements. Integration with IoT and AI-based control systems is becoming a standard feature in modern installations. Businesses are prioritizing solutions that offer both efficiency and adaptability. This shift toward smarter systems is driving innovation and competitive differentiation in the market.

Market Trends:

Shift Toward Ultra-Low Power Consumption Designs:

Manufacturers in the switching commercial voltage regulator market are increasingly focusing on ultra-low power designs to meet the growing demand for energy-efficient commercial systems. These regulators reduce standby power consumption and improve overall system efficiency, aligning with global sustainability goals. Advances in circuit design are enabling reduced power losses without compromising voltage stability. Such innovations are particularly relevant in applications with extended operating hours, such as data centers and communication hubs. The adoption of low-power architectures also helps meet stringent international energy regulations. Market players are launching new models optimized for low-load efficiency to address this trend. These designs are also compatible with renewable and hybrid power systems. The shift is expected to play a central role in long-term adoption strategies.

- For instance, Infineon’s OPTIREG™ linear high-performance LDO (low dropout) regulators achieve ultra-low quiescent currents down to 5 µA, offering stable performance with minimal power draw for automotive and industrial applications, thus reducing energy consumption during idle states while complying with harsh environment requirements.

Growing Adoption of Modular and Scalable Voltage Regulation Systems:

A key trend in the switching commercial voltage regulator market is the move toward modular and scalable architectures. These systems allow businesses to expand capacity or reconfigure their power systems without replacing the entire infrastructure. Modular designs support flexibility in commercial facilities with fluctuating power demands. They also improve system maintenance by enabling quick replacement or upgrades of specific modules. This adaptability is increasingly valued in industries like telecommunications and industrial automation. Scalable solutions are also beneficial for integrating renewable energy sources and advanced energy storage systems. Manufacturers are responding by offering configurable regulator modules for various voltage and current requirements. This trend supports both operational efficiency and cost optimization.

- For instance, Infineon’s XDP™ digital multiphase controllers paired with OptiMOS™ power stages provide configurable dual- and quad-phase power modules that reduce solution footprint by approximately 40%, allowing precise power scaling and fast transient response for networking and industrial power management systems.

Integration of Advanced Monitoring and Predictive Maintenance Features:

Advanced monitoring and predictive maintenance capabilities are becoming standard in modern switching commercial voltage regulators. These features allow real-time tracking of voltage, current, and thermal conditions, enabling proactive system management. Integration with IoT platforms enhances the visibility and control of power systems in commercial operations. Predictive maintenance capabilities help identify potential failures before they impact performance, reducing downtime. These tools are particularly valuable in mission-critical applications where uninterrupted power supply is essential. Cloud-based dashboards and analytics are increasingly being used for remote management. This integration also supports data-driven optimization of power systems. The trend is pushing manufacturers to prioritize connectivity and intelligent diagnostics in product development.

Rising Use of Wide-Bandgap Semiconductor Materials for Enhanced Efficiency:

The use of wide-bandgap semiconductor materials, such as GaN and SiC, is rapidly transforming the switching commercial voltage regulator market. These materials enable higher efficiency, faster switching speeds, and improved thermal management compared to traditional silicon-based components. Regulators incorporating wide-bandgap technology are capable of handling higher voltages and temperatures, making them ideal for demanding commercial applications. They also allow for smaller form factors, which benefit compact system designs. Adoption is growing in high-performance applications like advanced manufacturing facilities and large-scale data centers. Market leaders are investing in R&D to expand their wide-bandgap product portfolios. The trend aligns with industry efforts to improve energy efficiency and reduce operational costs. This technological shift is expected to remain a defining factor in competitive differentiation.

Market Challenges Analysis:

Complexity in Design and Integration Across Diverse Applications

One of the significant challenges in the switching commercial voltage regulator market is the complexity involved in designing solutions that cater to varied commercial applications. Each industry sector has unique voltage, current, and thermal management requirements, making standardization difficult. High-performance applications such as data centers demand precise regulation under fluctuating loads, while industrial systems require rugged designs to withstand harsh operating environments. Integration with renewable energy systems and hybrid grids adds another layer of complexity. Achieving compatibility with existing infrastructure without extensive modifications is a technical hurdle. Designers must balance performance, cost, and form factor constraints to meet market expectations. The growing need for customization increases design cycles and development costs for manufacturers. This complexity often slows product adoption, particularly in cost-sensitive markets.

High Initial Costs and Sensitivity to Component Supply Chain Disruptions:

The high upfront cost of advanced switching commercial voltage regulators is a persistent barrier for small and mid-sized commercial users. Incorporating premium materials like GaN or SiC, along with advanced monitoring features, drives manufacturing expenses. While these costs can be offset by long-term efficiency gains, budget constraints delay adoption in certain regions. Supply chain volatility, especially for semiconductor components, further impacts production schedules and pricing stability. Global shortages of critical materials can lead to delayed deliveries and inflated costs for end-users. Price sensitivity in emerging markets makes it challenging for premium products to achieve rapid penetration. Manufacturers face the added difficulty of managing inventory while keeping production agile. The challenge is magnified when competing against low-cost alternatives that compromise on performance and longevity.

Market Opportunities:

Growing Demand for Energy-Efficient Solutions in Commercial Infrastructure:

The increasing emphasis on energy efficiency in commercial facilities is creating significant opportunities for the switching commercial voltage regulator market. Businesses are adopting advanced power regulation systems to reduce operational costs and comply with tightening energy regulations. These regulators help optimize energy consumption while maintaining performance across a wide range of load conditions. Integration with building energy management systems further enhances operational control. The adoption of high-efficiency models is also being supported by government incentives in many regions. Companies seeking sustainable power solutions are increasingly prioritizing switching regulators over linear counterparts. This shift presents growth potential for manufacturers offering eco-friendly, high-performance designs.

Rising Adoption in Renewable and Distributed Energy Applications:

The expansion of renewable energy generation and distributed energy systems is opening new avenues for the switching commercial voltage regulator market. Commercial buildings incorporating solar panels, wind turbines, or hybrid energy systems require precise voltage regulation to ensure system stability. Switching regulators excel in managing variable input conditions, making them essential in such setups. The growth of microgrids and off-grid commercial operations further amplifies demand. These opportunities are particularly strong in regions with unreliable grid infrastructure or high renewable energy penetration. The ability of advanced regulators to integrate with battery storage systems adds another layer of market potential. Manufacturers targeting this niche stand to benefit from sustained growth.

Market Segmentation Analysis:

By Phase

The switching commercial voltage regulator market is divided into single-phase and three-phase systems. Single-phase regulators are deployed in lower-capacity applications such as small businesses, commercial buildings, and residential setups, where simplicity and cost-effectiveness are priorities. Three-phase regulators address higher-capacity requirements, serving manufacturing facilities, large commercial complexes, and data centers. This segment holds the largest revenue share due to its essential role in energy-intensive and mission-critical environments.

- For instance, These single-phase units typically operate over voltage ranges from 2.4 kV to 34.5 kV and are designed for long operational lifetimes, offering up to 2 million switching operations with a maintenance-free expectancy of around 20 years.

By Voltage Capacity

The market is segmented into ≤ 40 kVA, 40 kVA to 250 kVA, and 250 kVA and above. The ≤ 40 kVA category is recording strong growth, driven by demand from small-scale commercial and residential applications seeking efficient voltage control. The 40 kVA to 250 kVA segment accounts for the largest share of revenue, supported by widespread adoption in medium to large-scale commercial facilities such as hospitals, shopping centers, and educational institutions. The 250 kVA and above segment serves specialized industrial operations and large-scale data centers that require substantial and stable power output for continuous operations.

- For instance, These units are engineered for robust energy-intensive environments, with voltage ratings typically spanning from 13.2 kV to over 34 kV and capacity ranges scaling above 40 kVA. Advanced three-phase regulators, such as Siemens Energy’s type SFR models, incorporate vertically integrated designs with separate tap-changer compartments that substantially increase regulator life by reducing arcing damage.

Segmentation:

By Phase

By Voltage Capacity

- ≤ 40 kVA

- 40 kVA to 250 kVA

- 250 kVA

Regional Analysis:

North America: Market Leader with Strong Technological Base

North America holds the largest share of the switching commercial voltage regulator market, supported by advanced commercial infrastructure and high adoption of power management technologies. The presence of leading manufacturers and technology innovators strengthens the region’s dominance. Strong investment in data centers, telecommunication networks, and industrial automation drives consistent demand. Government energy-efficiency regulations further encourage the adoption of advanced regulators. The region’s early adoption of renewable energy integration also supports market expansion. With a robust supply chain and advanced R&D capabilities, North America is well-positioned to maintain its leadership.

Europe: Steady Growth Driven by Energy Regulations and Industrial Modernization

Europe is a significant market, driven by stringent energy-efficiency directives and modernization of industrial power systems. Countries such as Germany, the UK, and France are leading adopters, benefiting from strong manufacturing sectors and advanced commercial infrastructure. The shift toward smart building solutions is increasing demand for high-efficiency regulators. Renewable energy integration, particularly in Northern and Western Europe, further drives adoption. The presence of well-established power electronics manufacturers adds competitive strength to the region. Sustainability goals and carbon reduction targets will continue to shape demand patterns.

Asia-Pacific: Fastest-Growing Market with Expanding Commercial Infrastructure

The Asia-Pacific region is emerging as the fastest-growing market for switching commercial voltage regulators, fueled by rapid industrialization and urbanization. Countries like China, India, and Japan are investing heavily in smart cities, data centers, and advanced manufacturing facilities. The expansion of commercial renewable energy projects is also boosting adoption. Growing middle-class consumer bases and increasing commercial energy demand create a favorable environment for market growth. Competitive manufacturing costs in the region are attracting global players to establish production hubs. Government initiatives promoting energy efficiency further accelerate the market’s momentum.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The switching commercial voltage regulator market is characterized by a mix of established global players and emerging regional manufacturers. Competition is driven by product performance, energy efficiency, technological innovation, and cost-effectiveness. Leading companies invest heavily in R&D to integrate advanced semiconductor materials, digital control features, and compact designs. The market favors firms that can offer both high-quality standard products and customized solutions for specific applications. Strategic partnerships with component suppliers and distributors enhance market reach. Continuous innovation in wide-bandgap technology and IoT-enabled monitoring solutions is setting apart top competitors. Pricing remains a key factor, particularly in cost-sensitive markets. The ability to maintain supply chain resilience is increasingly critical for sustaining competitive advantage.

Recent Developments:

- In April 2025, Infineon Technologies AG announced the acquisition of Marvell Technology’s Automotive Ethernet business for $2.5 billion in cash. This strategic acquisition strengthens Infineon’s position in the automotive microcontroller market and expands its system capabilities for software-defined vehicles.

- In February 2025, Infineon Technologies AG entered a strategic partnership with SkyWater Technology for the sale of its 200 mm fab in Austin, Texas. The partnership aims to expand U.S. foundry capacity for foundational chips, transition Fab 25 to a foundry business model, and maintain about 1,000 manufacturing jobs. This move supports U.S. domestic semiconductor supply chain resilience and aligns with Infineon’s strategy to partner with foundries for competitive manufacturing advantages. The transaction closed in June 2025, with SkyWater taking over operations and entering a long-term supply agreement with Infineon.

- Texas Instruments Incorporated announced in July 2025 a $60 billion investment to expand semiconductor manufacturing capacity in the U.S., including seven fabs across Texas and Utah. This large-scale investment supports the production of analog and embedded processing chips vital for various applications including vehicles, smartphones, and data centers. The expansion will create over 60,000 U.S. jobs and underlines TI’s leadership in foundational semiconductor manufacturing.

- ROHM Co., Ltd. in October 2024 announced a strategic partnership with Denso Corporation aimed at semiconductor development for vehicle electrification. This collaboration targets growing demand for electronic components essential for the transition to electric vehicles and carbon neutrality.

Market Concentration & Characteristics:

The switching commercial voltage regulator market is moderately concentrated, with a few leading manufacturers holding a significant share. It is technology-intensive, requiring continuous innovation in semiconductor design and integration. The market is characterized by a blend of standardized mass-produced units and highly customized solutions for niche applications. Product differentiation is largely based on efficiency, thermal performance, programmability, and size. Barriers to entry include high R&D costs, complex design requirements, and the need for strong distribution networks. Long-term contracts with industrial and commercial clients provide stability for established players. Rapid technological advancements and evolving regulatory standards continue to shape market dynamics.

Report Coverage:

The research report offers an in-depth analysis based on phase and voltage capacity segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise sharply with the expansion of data centers and telecommunication infrastructure.

- Adoption of GaN and SiC semiconductors will accelerate efficiency gains.

- Renewable energy integration will remain a key growth driver in commercial applications.

- Asia-Pacific will record the highest growth rate due to infrastructure development.

- IoT-enabled monitoring features will become standard in high-end models.

- Modular and scalable designs will gain traction in flexible commercial setups.

- Supply chain resilience will be a decisive factor for competitive success.

- Cost optimization will be critical to penetrating emerging markets.

- Advanced thermal management solutions will differentiate premium products.

- Regulatory alignment with global energy-efficiency standards will shape innovation.