| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Switzerland Water Pump Market Size 2023 |

USD 288.72 Million |

| Switzerland Water Pump Market, CAGR |

2.37% |

| Switzerland Water Pump Market Size 2032 |

USD 356.58 Million |

Market Overview:

Switzerland Water Pump Market size was valued at USD 288.72 million in 2023 and is anticipated to reach USD 356.58 million by 2032, at a CAGR of 2.37% during the forecast period (2023-2032).

Several factors contribute to the growth of the water pump market in Switzerland. The country’s stringent environmental regulations and focus on reducing carbon emissions have led to increased adoption of energy-efficient water pumps. Additionally, the modernization of water infrastructure and the need for reliable water supply systems in both urban and rural areas drive the demand for advanced pumping solutions. The integration of smart technologies and automation in water management systems also plays a crucial role in enhancing operational efficiency and monitoring capabilities. Moreover, government initiatives promoting green infrastructure and support for clean energy projects are encouraging the uptake of sustainable pumping systems. The rising demand for effective water handling solutions in sectors such as agriculture, wastewater treatment, and manufacturing further amplifies market expansion.

Within Switzerland, the demand for water pumps is influenced by regional industrial activities and infrastructure development. Urban centers like Zurich and Geneva exhibit higher demand due to ongoing construction projects and the need for efficient water management systems. In contrast, rural areas focus on agricultural applications and the maintenance of existing water infrastructure. The country’s commitment to sustainable development ensures that both regions continue to invest in advanced water pump technologies to meet their specific needs. Additionally, the Alpine regions emphasize pumping systems designed for challenging terrains and climate conditions. Regional water utility companies are also actively adopting advanced pumping technologies to improve service reliability and water conservation efforts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- Switzerland Water Pump Market size was valued at USD 288.72 million in 2023 and is anticipated to reach USD 356.58 million by 2032, at a CAGR of 2.37% during the forecast period (2023-2032).

- The global water pump market was valued at USD 55,454.00 million in 2023 and is projected to reach USD 80,304.96 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Strict environmental regulations and carbon reduction targets are driving demand for energy-efficient water pumps across industries.

- Modernization of aging water infrastructure is boosting the need for advanced and low-maintenance pumping systems in both urban and rural regions.

- The integration of IoT, AI, and automation into pump systems is enabling predictive maintenance and operational optimization.

- Growing activity in construction, agriculture, and manufacturing sectors is generating steady demand for both standard and custom pump solutions.

- High initial investment costs and complex compliance requirements are key challenges limiting adoption among smaller stakeholders.

- Zurich and Geneva lead market demand, while rural and Alpine regions increasingly adopt terrain-specific and solar-powered pump technologies.

Market Drivers:

Emphasis on Energy Efficiency and Environmental Compliance

One of the primary drivers of the Switzerland water pump market is the nation’s strong commitment to energy efficiency and environmental protection. Switzerland enforces rigorous environmental regulations aimed at reducing energy consumption and carbon emissions across various industries. These regulatory frameworks have significantly influenced the adoption of energy-efficient pumping technologies, especially in municipal water treatment plants, commercial infrastructure, and industrial facilities. Manufacturers are investing in the development of advanced water pumps equipped with variable frequency drives (VFDs), which adjust motor speed and reduce energy usage based on actual demand. As Swiss authorities continue to push for compliance with international climate agreements, the demand for high-performance, eco-friendly pumps is expected to increase steadily.

Modernization of Water Infrastructure

Switzerland’s continuous efforts to upgrade its aging water infrastructure play a crucial role in driving the water pump market. The Swiss government and local municipalities are actively investing in water treatment facilities, sewage systems, and distribution networks to ensure long-term sustainability and resilience. For instance, Swiss development programs have provided irrigation infrastructure to approximately 150,000 people over five years, showcasing the nation’s dedication to water management. These infrastructure projects require advanced and reliable pumping systems capable of handling varying flow rates and pressures while minimizing maintenance requirements. As urban areas expand and water consumption patterns evolve, infrastructure modernization becomes essential to maintain operational efficiency. This ongoing transformation generates consistent demand for technologically advanced pumps across municipal and residential applications, supporting overall market expansion.

Technological Advancements and Digital Integration

Technological innovation is another key growth driver shaping the Switzerland water pump market. The integration of smart technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and remote monitoring systems, has transformed conventional pumping solutions into intelligent, automated systems. For instance, Droople, a Swiss start-up, offers AI-driven water-monitoring solutions that provide real-time data on water treatment systems and appliances. These innovations help predict maintenance needs and reduce energy consumption. These modern pumps offer real-time performance data, predictive maintenance capabilities, and remote diagnostics, enabling operators to make informed decisions and reduce operational downtime. Swiss industries, known for adopting high-tech solutions, are increasingly deploying intelligent pumping systems to streamline operations and reduce energy costs. The convergence of mechanical engineering with digital technologies enhances product value and aligns with the country’s broader vision of embracing Industry 4.0.

Growth in Construction, Agriculture, and Industrial Sectors

Switzerland’s expanding construction, agriculture, and industrial sectors also contribute significantly to the growth of the water pump market. The construction industry, particularly in urban areas like Zurich, Basel, and Lausanne, requires efficient dewatering and pressure-boosting systems to support infrastructure development. In agriculture, pumps play a vital role in irrigation systems, especially in regions where precision agriculture is gaining momentum. Additionally, the manufacturing and pharmaceutical industries rely on advanced water pumps for process cooling, chemical handling, and sanitation. As these sectors continue to grow and adopt sustainable practices, the need for durable and efficient water pumping systems rises. This cross-sectoral demand ensures a stable and diversified market for both standard and customized pump solutions.

Market Trends:

Rising Adoption of Renewable Energy-Powered Pumps

A prominent trend shaping the Switzerland water pump market is the growing adoption of solar and renewable energy-powered pumps. With Switzerland’s energy transition policies promoting decarbonization and sustainable energy usage, solar-driven water pumps are gaining traction in both agricultural and remote water supply applications. These pumps offer long-term cost efficiency, reduced dependency on grid power, and lower environmental impact. Farmers and municipalities in off-grid or mountainous regions increasingly prefer solar pumps due to their operational reliability and minimal maintenance requirements. As energy costs continue to rise, the shift toward clean energy-powered pumping systems is expected to intensify in the coming years.

Shift Toward Compact and Modular Pumping Systems

Another significant trend is the increasing demand for compact, modular water pumps that offer greater flexibility and scalability. The Swiss market reflects a growing preference for plug-and-play systems that can be easily integrated into existing infrastructure. Compact designs are especially valued in urban applications where space constraints are common. These systems reduce installation time and enable quicker upgrades or replacements without major structural changes. For example, advancements in digital twin technology enable precise customization and improved performance simulations for modular pumps used in industrial and urban applications. In industrial and commercial sectors, modular pumps facilitate customization for specific tasks, including variable flow operations, cooling, and wastewater management. This trend supports operational efficiency while aligning with Switzerland’s focus on intelligent infrastructure development.

Expansion of Smart Water Networks

Switzerland is experiencing a gradual transformation in water management through the development of smart water networks, which rely heavily on data-driven pump technologies. Water utilities and industrial users are incorporating digitally connected pumps capable of monitoring flow, pressure, energy use, and system faults in real time. These intelligent systems enable predictive maintenance, reduce water losses, and optimize resource allocation. The integration of sensors, cloud-based analytics, and automated controls has become increasingly prevalent in both public and private sectors. This digital transformation enhances system reliability and service continuity, which are critical to ensuring Switzerland’s high standards for water quality and distribution.

Growing Focus on Circular Economy and Sustainable Materials

A notable trend gaining momentum in the Switzerland water pump market is the focus on sustainability through circular economy practices and the use of eco-friendly materials. Manufacturers are increasingly designing pumps with recyclable components and energy recovery systems to minimize their environmental footprint. For instance, Sulzer reports that 95% of its pumps are serviceable by design and made from recyclable materials. Lifecycle cost analysis and environmental impact assessments are becoming standard considerations during procurement. In response to regulatory pressure and shifting consumer preferences, companies are also adopting manufacturing processes that reduce waste and use less energy. This trend aligns with Switzerland’s broader environmental goals and enhances the appeal of sustainable pump solutions across industrial, municipal, and residential segments.

Market Challenges Analysis:

High Initial Investment and Cost Sensitivity

One of the primary restraints in the Switzerland water pump market is the high initial cost associated with advanced and energy-efficient pump systems. For example, entry-level solar water pumps (SWPs) can cost approximately $3,700 for off-grid systems, compared to $200 for basic engine-powered pumps, making them less accessible to small-scale farmers and rural municipalities. While modern pumps offer long-term operational savings, their upfront procurement, installation, and integration expenses can be substantial. This cost factor is particularly challenging for small-scale enterprises, rural municipalities, and budget-constrained agricultural users. Additionally, the incorporation of digital technologies and automation further increases the price point, making it difficult for some end-users to justify immediate investment. As a result, price sensitivity continues to impact adoption rates, particularly in segments where return on investment is not immediately visible.

Complex Regulatory Compliance and Technical Standards

Switzerland’s strict regulatory framework, while beneficial for sustainability goals, presents a challenge for manufacturers and suppliers. Water pump systems must comply with multiple environmental, energy efficiency, and safety standards that can vary across cantonal authorities. Meeting these requirements often involves extended testing, certification processes, and adherence to evolving technical benchmarks. For international manufacturers operating in Switzerland, aligning products with local specifications can increase time-to-market and operational complexity. The dynamic nature of environmental legislation also necessitates frequent design updates, which can disrupt production cycles and limit the scalability of certain models.

Skilled Workforce Shortages and Maintenance Constraints

The growing sophistication of water pump technologies, particularly those integrating smart features, has heightened the need for skilled technicians and maintenance personnel. However, Switzerland faces a limited pool of specialized labor trained in the installation, calibration, and repair of intelligent water pump systems. This shortage can lead to longer response times for servicing and increased operational downtime. For rural and remote regions, access to qualified service providers poses a greater challenge, potentially reducing user confidence in adopting complex pumping solutions. Overcoming this obstacle will require focused investment in technical training and workforce development initiatives.

Market Opportunities:

The Switzerland water pump market presents significant opportunities driven by the nation’s strategic focus on sustainability, infrastructure modernization, and digital transformation. As Switzerland continues to upgrade its water supply, wastewater treatment, and irrigation systems, the demand for advanced and efficient pumping solutions is expected to rise. The country’s commitment to achieving energy transition targets creates a favorable environment for solar-powered and energy-efficient pumps, particularly in remote and rural applications. Furthermore, ongoing investments in smart cities and green building projects create a robust pipeline of opportunities for intelligent pump systems integrated with IoT, real-time monitoring, and automation capabilities.

In addition to public infrastructure, growth in the private and industrial sectors also opens new avenues for market expansion. Switzerland’s pharmaceutical, food processing, and precision manufacturing industries require high-performance water pumps for process control, sanitation, and thermal management. The increasing demand for customized, low-maintenance solutions across these sectors positions manufacturers to innovate and expand their portfolios. Moreover, the rising awareness of circular economy practices enhances the market potential for eco-friendly pump designs built from recyclable materials and supported by lifecycle services. As end-users seek solutions that align with environmental goals and operational efficiency, companies offering tailored, sustainable, and technologically advanced pumping systems will find ample growth opportunities in the Swiss market.

Market Segmentation Analysis:

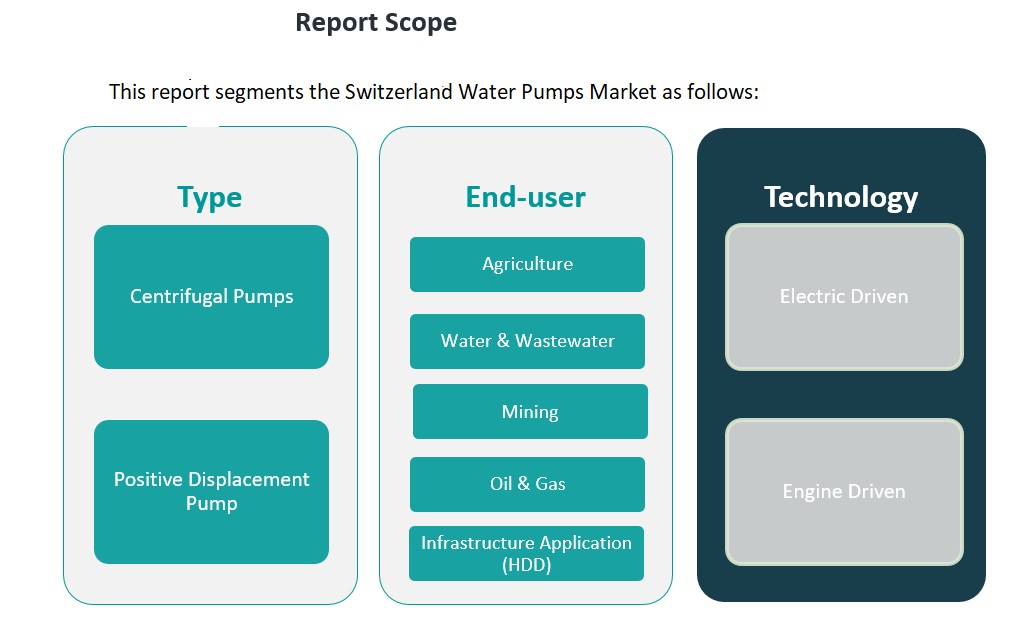

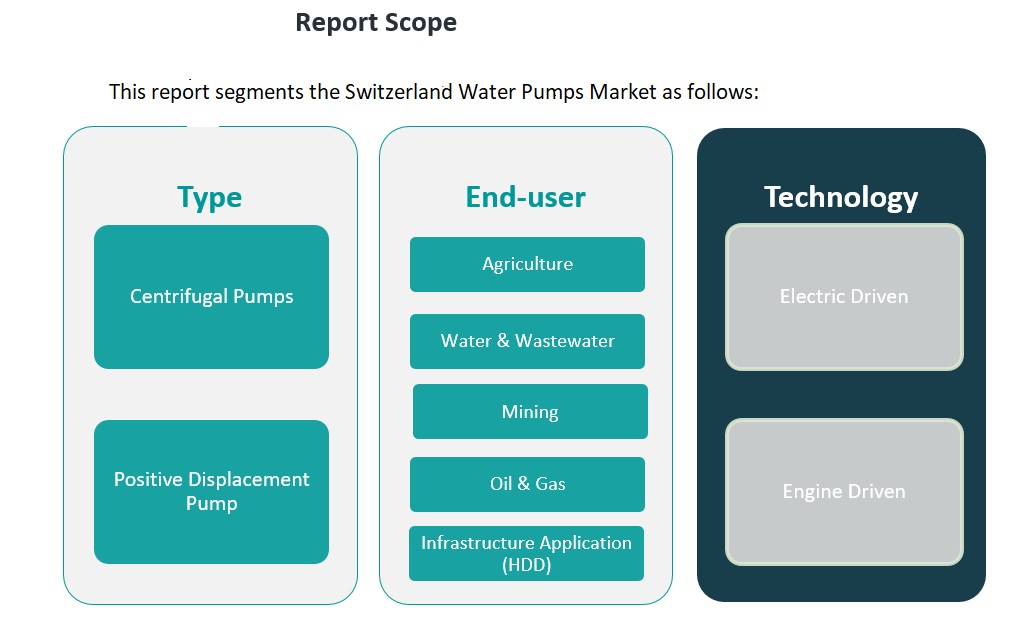

The Switzerland water pump market is segmented by type, end-user, and technology, each playing a critical role in shaping the industry’s growth dynamics.

By type, centrifugal pumps dominate the market due to their high efficiency, simple design, and wide application in water supply, irrigation, and wastewater management. Their ability to handle large volumes of fluids makes them suitable for municipal and industrial usage. Positive displacement pumps, though smaller in market share, are gaining traction in niche applications that require precise flow control and high-pressure delivery, particularly in the oil & gas and pharmaceutical industries.

By end-users, the water and wastewater segment leads demand, supported by Switzerland’s ongoing efforts to modernize municipal water infrastructure and ensure regulatory compliance. The agriculture sector also contributes significantly, with increasing use of pumps for irrigation in rural and mountainous regions. The infrastructure application segment, including horizontal directional drilling (HDD), is experiencing steady growth due to urban development and construction projects. Mining and oil & gas sectors present moderate demand, primarily for dewatering and fluid transfer operations in localized industrial zones.

By technology, electric-driven pumps account for the largest share, owing to Switzerland’s reliable electrical infrastructure and preference for low-emission solutions. These pumps are widely used across residential, municipal, and industrial settings. Engine-driven pumps, while less prevalent, are essential in remote areas and emergency applications where electricity is limited or unavailable. As the market evolves, the demand for more energy-efficient and smart-enabled electric pumps is expected to accelerate, shaping future growth trajectories across all segments.

Segmentation:

By Type Segment:

- Centrifugal Pumps

- Positive Displacement Pumps

By End-User Segment:

- Agriculture

- Water & Wastewater

- Mining

- Oil & Gas

- Infrastructure Application (HDD)

By Technology Segment:

- Electric Driven

- Engine Driven

Regional Analysis:

The Switzerland water pump market exhibits notable regional variation, shaped by differences in infrastructure development, industrial activity, population density, and topography. The country is broadly divided into five main regions: Zurich, Geneva, Basel, Bern, and the Central and Eastern cantons. Each region demonstrates distinct demand patterns for water pump systems, reflecting local needs and investment priorities.

Zurich holds the largest market share, accounting for approximately 28% of the total water pump market. As the financial and economic hub of Switzerland, Zurich has a dense urban infrastructure, advanced water distribution systems, and high construction activity. These factors drive strong demand for centrifugal and electric-driven pumps, particularly in commercial and residential developments. In addition, the region’s emphasis on energy efficiency and sustainable building standards fuels the adoption of intelligent water pump systems.

Geneva follows with a market share of 22%. Known for its international institutions and urban density, the region focuses heavily on environmental management and smart infrastructure. Geneva’s water utilities actively implement modern water treatment and distribution systems, creating consistent demand for energy-efficient and remotely monitored pumping solutions. The region also exhibits growing use of positive displacement pumps in specialized sectors, including pharmaceutical and laboratory applications.

Basel commands approximately 18% of the market, driven primarily by its strong industrial base. Home to a large number of chemical, pharmaceutical, and manufacturing companies, Basel relies on high-performance pumping systems for process applications, cooling, and wastewater treatment. This region shows a notable preference for customized and high-capacity pumps that meet stringent industry standards.

Bern holds a market share of around 16%, with demand fueled by infrastructure upgrades and a balanced mix of urban and rural developments. Agricultural activities in the surrounding cantons also contribute to demand, particularly for engine-driven and solar-powered pumps in irrigation systems. Bern’s municipal water infrastructure projects further support consistent growth in this segment.

The Central and Eastern cantons collectively represent the remaining 16% of the market. These regions, while less urbanized, are significant for their agricultural activities and reliance on decentralized water systems. They show increasing adoption of compact and engine-driven pumps designed for remote and uneven terrains. Government subsidies and sustainability initiatives have also encouraged the uptake of renewable energy-powered pump solutions in these areas.

Key Player Analysis:

- SLB

- Ingersoll Rand

- The Weir Group PLC

- Vaughan Company

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation

- ITT Inc.

- EBARA Corporation

- Swisspump

Competitive Analysis:

The Switzerland water pump market features a competitive landscape dominated by both global manufacturers and well-established regional players. Leading companies such as Grundfos, Xylem Inc., KSB SE & Co. KGaA, Sulzer Ltd., and Wilo Group maintain a strong presence through advanced product portfolios, energy-efficient technologies, and comprehensive service networks. These firms leverage their R&D capabilities to offer smart and sustainable pumping solutions tailored to Switzerland’s regulatory and environmental standards. Domestic suppliers also play a vital role, particularly in providing specialized systems for local applications in agriculture, infrastructure, and small-scale utilities. Strategic partnerships, distribution agreements, and continuous product innovation remain central to maintaining market competitiveness. The emphasis on digital integration, lifecycle services, and sustainable materials is reshaping competitive dynamics, compelling both international and local players to align with evolving customer expectations. Overall, the market reflects a high degree of technological maturity and customer-centric innovation.

Recent Developments:

- In December 2024, Weir Minerals Europe launched the Warman® vortex pump designed to minimize abrasion and clogging. This addition strengthens its portfolio for mining and aggregates applications.

- On February 3, 2025, Ingersoll Rand acquired SSI Aeration, Inc., a global leader in wastewater treatment equipment. This strategic move expands Ingersoll Rand’s capabilities in sustainable wastewater treatment solutions, integrating technologies like low-pressure compressors and aeration systems.

- In October 2024, Sulzer Ltd launched the ZF-RO end-suction pump designed to meet the technical demands of energy recovery device (ERD) booster pump services. This product combines the proven reliability of the ZF range with high efficiency, catering to applications in hydrocarbon and desalination industries.

- In September 2024, Grundfos expanded its European water treatment market presence by acquiring Culligan’s commercial and industrial business in Italy, France, and the UK. This strategic acquisition adds complementary solutions and technologies for industrial and commercial water treatment needs.

Market Concentration & Characteristics:

The Switzerland water pump market exhibits a moderately concentrated structure, with a few dominant international players controlling a significant share of the market. Companies such as Sulzer Ltd., Grundfos, and Xylem Inc. maintain strong positions through well-established distribution networks, advanced product offerings, and ongoing innovation in energy-efficient technologies. Despite the dominance of these global firms, the market also accommodates niche domestic manufacturers that cater to region-specific applications, particularly in agriculture and infrastructure. The market is characterized by a high demand for technologically advanced, durable, and sustainable solutions. Precision engineering, compliance with stringent environmental regulations, and integration of smart technologies are key product attributes influencing purchasing decisions. Additionally, customer preferences lean toward low-maintenance and high-efficiency systems, reflecting Switzerland’s emphasis on operational reliability and sustainability. Overall, the market’s characteristics reflect a sophisticated, quality-driven environment with a clear focus on long-term value and regulatory alignment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, End-User Segment and Technology Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of energy-efficient and smart water pumps will shape future demand across residential and industrial sectors.

- Continued government investment in sustainable infrastructure will drive modernization of water and wastewater systems.

- Expansion of solar-powered pump usage is expected in agriculture and remote locations with limited grid access.

- Integration of IoT and remote monitoring technologies will enhance operational efficiency and predictive maintenance.

- Increased urbanization will lead to greater demand for compact, high-capacity pumps in construction and infrastructure.

- Pharmaceutical and food processing industries will stimulate demand for specialized and high-precision pump systems.

- Advancements in materials and design will support the development of longer-lasting, recyclable pump components.

- Growing emphasis on circular economy principles will encourage adoption of environmentally responsible solutions.

- Regional disparities in infrastructure will create tailored market opportunities in both urban and rural areas.

- Competitive landscape will intensify as global and local players invest in innovation and digital transformation.