Market Overview

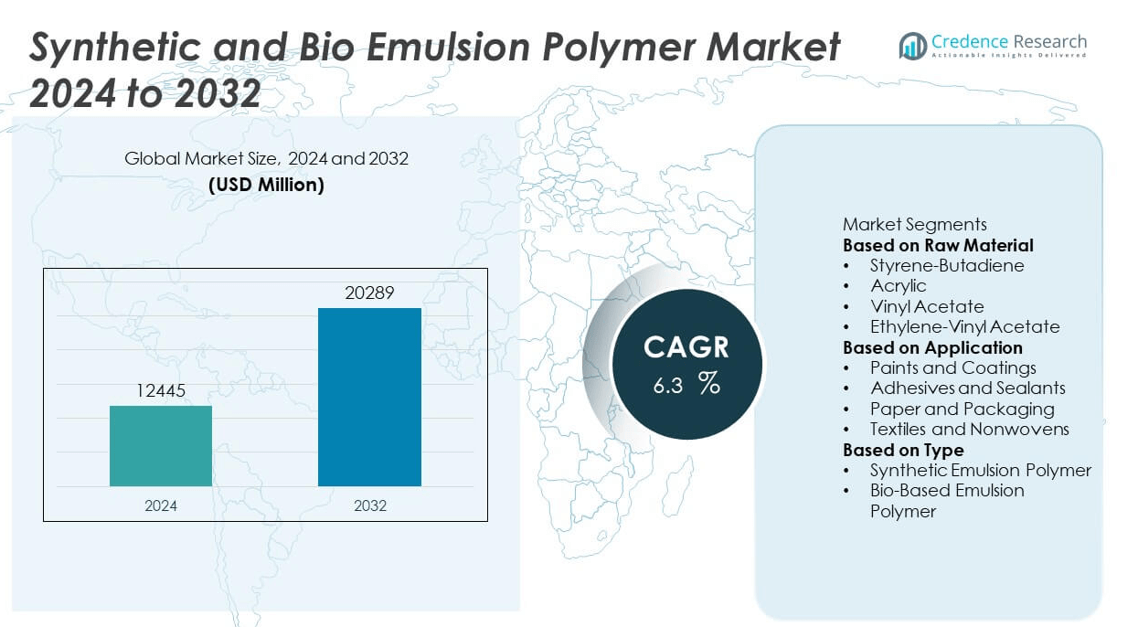

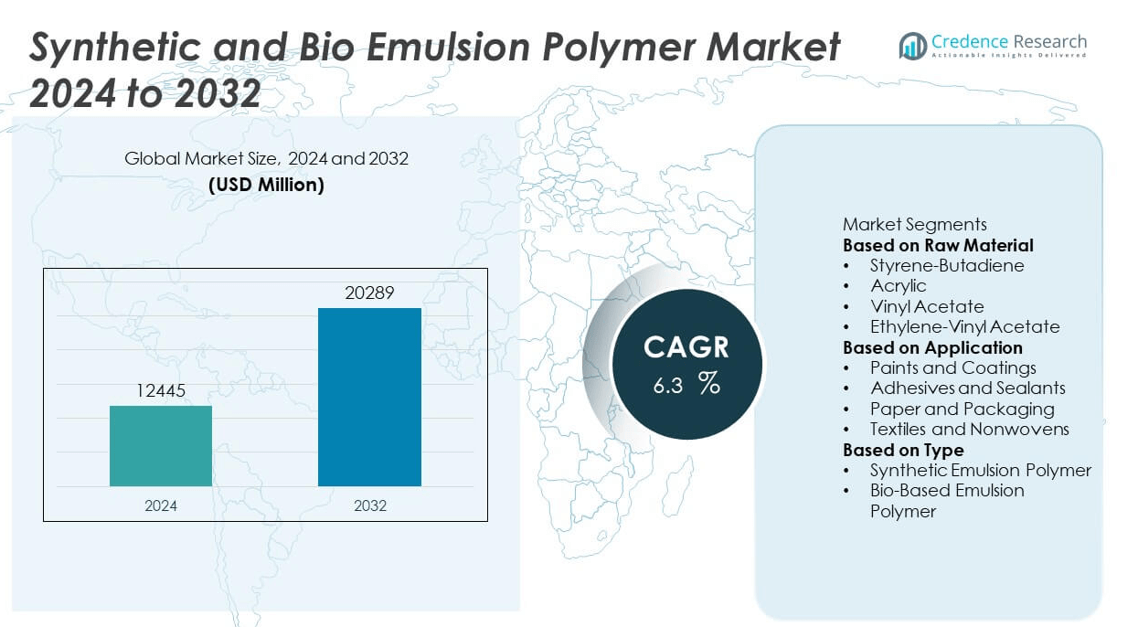

The Synthetic and Bio Emulsion Polymer Market was valued at USD 12,445 million in 2024 and is projected to reach USD 20,289 million by 2032, growing at a compound annual growth rate (CAGR) of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Synthetic and Bio Emulsion Polymer Market Size 2024 |

USD 12,445 million |

| Synthetic and Bio Emulsion Polymer Market, CAGR |

6.3% |

| Synthetic and Bio Emulsion Polymer Market Size 2032 |

USD 20,289 million |

The Synthetic and Bio Emulsion Polymer Market is driven by rising demand for low-VOC, water-based solutions across industries such as paints, coatings, adhesives, and construction. Regulatory pressure to reduce environmental impact and consumer preference for non-toxic, sustainable products fuel market expansion. Emerging economies contribute to strong demand through infrastructure growth and industrialization. Trends include increased adoption of bio-based raw materials, technological advancements in smart and hybrid coatings, and growing customization of polymer formulations.

The Synthetic and Bio Emulsion Polymer Market exhibits strong growth across key regions including Asia Pacific, North America, and Europe. Asia Pacific leads in demand due to rapid industrialization, infrastructure development, and expanding manufacturing sectors in countries like China, India, and South Korea. North America follows with robust applications in automotive, packaging, and architectural coatings, supported by strict environmental regulations and strong R&D capabilities. Europe emphasizes sustainability, driving the adoption of bio-based and waterborne polymers in construction and specialty applications. Latin America and the Middle East & Africa are witnessing gradual growth driven by rising environmental awareness and construction activities.

Market Insights

- The Synthetic and Bio Emulsion Polymer Market was valued at USD 12,445 million in 2024 and is projected to reach USD 20,289 million by 2032, growing at a CAGR of 6.3% during the forecast period.

- Rising demand for low-VOC, water-based coatings, adhesives, and sealants across construction, packaging, and automotive industries is a major driver fueling market expansion.

- The market is witnessing a clear trend toward bio-based raw materials, smart coating formulations, and increased customization for performance-specific applications.

- Leading companies such as Arkema, Evonik Industries AG, Henkel AG Co. KGaA, and LG Chem Ltd. are investing in innovation, expanding product portfolios, and targeting sustainable, high-performance solutions to maintain competitive advantage.

- Fluctuations in raw material prices and technical limitations of some bio-based alternatives pose key restraints, especially in high-performance applications where synthetic options remain dominant.

- Asia Pacific remains the most dynamic region in terms of consumption and production due to rapid industrialization, followed by North America and Europe where regulatory compliance and sustainability initiatives drive growth.

- Emerging markets in Latin America and the Middle East & Africa present moderate growth opportunities, with rising awareness of environmental standards and growing construction and industrial activities supporting future demand

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Eco-Friendly and Low-VOC Solutions Fuels Market Growth

The growing awareness of environmental sustainability is driving the demand for low-VOC and water-based products across various industries. Governments across North America, Europe, and Asia-Pacific have enforced strict regulations on the use of solvent-based polymers, prompting manufacturers to adopt synthetic and bio emulsion alternatives. The Synthetic and Bio Emulsion Polymer Market benefits directly from this regulatory push, with increased adoption in coatings, adhesives, and sealants. It supports industries aiming to reduce carbon emissions and improve indoor air quality. Consumer preference for non-toxic, odorless, and safer products further accelerates the market’s shift toward emulsion technologies. These factors are expanding the footprint of sustainable polymer applications across commercial and industrial sectors.

- For instance, Henkel introduced its LOCTITE LINA 88™ adhesive that delivers bond strength up to four times higher than industry standards while maintaining zero VOC content.

Construction and Infrastructure Expansion Drives Product Utilization

Rapid urbanization and infrastructure investments are increasing the demand for construction materials that offer durability and performance with lower environmental impact. The market for synthetic and bio emulsion polymers sees strong traction in architectural coatings, waterproofing systems, and cement modification. It enables improved performance in terms of adhesion, flexibility, and water resistance in construction-grade formulations. The growing need for cost-efficient and high-performance coatings in emerging economies contributes to sustained product demand. Governments investing in green building initiatives further encourage the use of emulsion polymers. This expansion across the construction sector underpins steady revenue growth for market participants.

- For instance, Henkel’s TECHNOMELT SUPRA adhesive series, including SUPRA 100 LE and SUPRA 106M LE, are designed to reduce environmental impact while maintaining thermal stability and bonding strength in packaging and construction applications.

Packaging and Automotive Industries Accelerate Adoption of Advanced Polymers

The packaging and automotive sectors continue to adopt innovative materials to meet performance, cost, and environmental benchmarks. The Synthetic and Bio Emulsion Polymer Market sees growing demand for flexible packaging adhesives and automotive coatings designed for durability and sustainability. It supports the industry trend toward lightweight, recyclable, and high-performance materials. Manufacturers in both sectors are integrating emulsion-based polymers to meet evolving regulatory and functional requirements. Bio-based variants also gain popularity among brands seeking renewable and biodegradable solutions. These applications ensure consistent product relevance and support market penetration into new value chains.

Technological Advancements Strengthen Application Versatility and Efficiency

Ongoing innovations in polymer chemistry and manufacturing processes are expanding the performance capabilities of emulsion polymers. The Synthetic and Bio Emulsion Polymer Market benefits from research focused on improving mechanical strength, UV resistance, and process efficiency. It supports broader application across textiles, paper, and specialty coatings. Emerging hybrid formulations, combining synthetic and bio-based properties, help meet specific customer needs across end-user industries. Process optimization also reduces production costs, making advanced formulations more accessible to small and mid-sized manufacturers. These technological improvements enhance the commercial viability and long-term competitiveness of emulsion polymer products.

Market Trends

Shift Toward Bio-Based Emulsion Polymers Gains Momentum Across Industries

The demand for sustainable and renewable raw materials is accelerating the development of bio-based emulsion polymers. Industries are increasingly investing in formulations derived from plant oils, starch, and other natural sources to reduce environmental impact. The Synthetic and Bio Emulsion Polymer Market reflects this shift, with manufacturers launching products that offer lower carbon footprints without compromising performance. It aligns with global sustainability goals and supports brand positioning among eco-conscious consumers. Regulatory frameworks favoring biodegradable and renewable content further encourage this transition. Market players are expanding R&D activities to improve the scalability and cost efficiency of bio-based alternatives.

- For instance, Arkema reports a carbon footprint of 1.3 kg CO2e per kilogram for its Rilsan® PA11 bio-based polyamide—produced entirely from castor oil feedstock and renewable electricity—meeting ISO‑certified cradle-to‑gate lifecycle standards starting in 2025

Increased Integration of Smart Coating Technologies Drives Innovation

Smart coatings incorporating emulsion polymer technologies are emerging across various applications, including construction, automotive, and electronics. These advanced materials respond to environmental stimuli like temperature, light, and moisture, offering enhanced functionality. The Synthetic and Bio Emulsion Polymer Market supports this trend by providing flexible formulations suitable for such intelligent systems. It enables manufacturers to offer value-added products with self-healing, anti-corrosive, or thermochromic properties. End users benefit from extended service life and reduced maintenance costs. The development of such innovative coating systems is opening new avenues for growth and differentiation.

- For instance, NEI Corporation launched its NANOMYTE® TC-5001 product, a transparent, anti-corrosion coating based on nanotechnology that has shown over 1,000 hours of salt spray resistance under ASTM B117 testing conditions.

Waterborne Formulations Continue to Outpace Solvent-Based Alternatives

The preference for waterborne over solvent-based systems is strengthening due to stricter environmental regulations and workplace safety norms. Emulsion polymers serve as the key component in waterborne paints, adhesives, and sealants, offering low-VOC and non-flammable characteristics. The Synthetic and Bio Emulsion Polymer Market gains significant traction from this global shift, supported by evolving formulation technologies. It facilitates compliance with VOC standards while maintaining high performance across diverse substrates. Manufacturers are optimizing waterborne systems for faster drying times, improved adhesion, and long-term durability. This trend is redefining industry benchmarks in environmental responsibility and product innovation.

Customization and Specialty Grades Expand Application Scope

End users increasingly seek tailored polymer solutions that meet specific performance and process needs. Specialty grades of emulsion polymers are being developed to meet unique criteria such as high gloss, abrasion resistance, and thermal stability. The Synthetic and Bio Emulsion Polymer Market is evolving to support these demands through advanced customization capabilities. It enables manufacturers to serve niche applications across textiles, medical devices, and specialty packaging. Flexible production systems and close client collaboration allow rapid response to changing market needs. This focus on customization strengthens customer loyalty and enhances product value across industries.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Disruptions Impact Production Costs

The Synthetic and Bio Emulsion Polymer Market faces ongoing challenges from fluctuating raw material prices, particularly petroleum-based feedstocks used in synthetic variants. Limited availability of key bio-based raw materials such as natural oils or starch further complicates procurement for manufacturers. It often leads to inconsistent pricing and margin pressures, especially for small to mid-sized companies. Global supply chain disruptions caused by geopolitical tensions, trade barriers, or logistic bottlenecks can delay production schedules and affect customer delivery timelines. Companies must invest in risk management strategies and diversified sourcing models to ensure uninterrupted operations. These issues raise the cost of production and limit the ability to offer competitive pricing in price-sensitive markets.

Technical Limitations and Performance Trade-offs Restrict Broader Adoption

While bio-based emulsion polymers offer environmental benefits, they sometimes fall short in terms of mechanical strength, durability, or processing ease when compared to synthetic alternatives. The Synthetic and Bio Emulsion Polymer Market encounters technical hurdles when trying to balance sustainability with performance in demanding applications such as industrial coatings or automotive finishes. It requires significant R&D investment to enhance product capabilities and ensure consistent quality across use cases. End users in performance-critical sectors often hesitate to transition without proven equivalency. This slows down the adoption rate and prolongs dependency on conventional polymers. Overcoming these limitations remains essential for market expansion and customer confidence.

Market Opportunities

Growing Demand in Emerging Economies Unlocks New Revenue Streams

Rapid industrialization and urban development across Asia-Pacific, Latin America, and the Middle East are driving demand for paints, coatings, adhesives, and construction materials. These regions present substantial opportunities for the Synthetic and Bio Emulsion Polymer Market due to rising infrastructure investments and expanding manufacturing bases. It supports local industries seeking cost-effective, durable, and environmentally responsible polymer solutions. Increasing consumer awareness of low-VOC products and regulatory momentum toward sustainable materials create a favorable environment for market expansion. Manufacturers can capitalize by establishing regional production hubs and distribution networks to reduce costs and improve market access. Strong construction activity and packaging demand in these economies provide a solid foundation for long-term growth.

Product Innovation and Application Diversification Expand Market Reach

Innovations in hybrid polymer technologies and functional additives are enabling emulsion polymers to serve new and specialized applications. The Synthetic and Bio Emulsion Polymer Market has opportunities to penetrate segments such as medical textiles, smart coatings, and sustainable packaging. It benefits from the rising need for high-performance, lightweight, and recyclable materials in sectors like automotive and electronics. Collaborative research and customer-driven customization open doors for tailored solutions with enhanced functionality. Companies focusing on R&D, eco-certifications, and end-user engagement can differentiate their offerings and capture untapped market segments. This strategic diversification strengthens product relevance and promotes higher value applications across industries.

Market Segmentation Analysis:

By Raw Material:

The Synthetic and Bio Emulsion Polymer Market is segmented by raw material into synthetic and bio-based sources. Synthetic variants are primarily derived from petroleum-based feedstocks such as styrene, butadiene, vinyl acetate, and acrylics. These materials dominate the market due to their established performance in durability, flexibility, and cost-effectiveness. However, bio-based raw materials like starch, natural rubber, and plant-derived oils are gaining traction due to rising sustainability concerns and regulatory pressure to reduce carbon emissions. Companies are investing in the development of renewable feedstock alternatives that match or exceed the performance of synthetic options. This shift is encouraging raw material diversification and innovation across the market.

- For instance, Arkema inaugurated its Jurong Island facility in Singapore in 2022, boosting its production capacity for Rilsan® polyamide 11 by 50 percent with over 61 production units globally and deploying 21,150 employees to support integrated operations across specialty materials, coatings, and adhesives lines.

By Application:

Key applications of the Synthetic and Bio Emulsion Polymer Market include paints and coatings, adhesives and sealants, paper and paperboard coatings, textiles, and construction additives. Paints and coatings hold the largest market share, driven by increasing demand for low-VOC, water-based systems in both architectural and industrial sectors. Adhesives and sealants represent another significant segment, fueled by the growth of the packaging and automotive industries. In paper coatings, emulsion polymers offer improved printability and surface properties, making them integral to premium packaging solutions. Construction applications benefit from the material’s waterproofing, bonding, and weather resistance capabilities. The market continues to diversify with growth in textiles and specialty applications.

- For instance, Evonik introduced INFINAM® eCO PA12 powder in late 2023, replacing 100 percent of fossil feedstock with bio-circular raw material sourced from waste cooking oil, and offering full reusability of structure-support powder with 70/30 refresh cycles over multiple print runs in Additive Manufacturing systems.

By Type:

Based on type, the market is categorized into acrylics, vinyl acetate polymers, styrene-butadiene latex, polyurethane dispersions, and others. Acrylic emulsion polymers lead the segment due to their excellent resistance to UV light, water, and chemicals, making them suitable for exterior coatings and sealants. Styrene-butadiene latex is widely used in paper, carpet backing, and construction materials due to its low cost and favorable mechanical properties. Vinyl acetate-based polymers provide good adhesion and flexibility, especially in packaging and textile applications. Polyurethane dispersions are emerging in high-performance coatings and automotive finishes. The availability of diverse polymer types enables manufacturers to address a broad spectrum of performance and regulatory requirements.

Segments:

Based on Raw Material

Based on Application

Based on Type

- Synthetic Emulsion Polymer

- Bio-Based Emulsion Polymer

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

Asia Pacific

Asia Pacific holds the largest share in the Synthetic and Bio Emulsion Polymer Market, accounting for approximately 41.2% of global revenue in 2024. The region benefits from strong manufacturing bases in China, India, South Korea, and Japan, where the demand for water-based coatings, adhesives, and sealants continues to rise. Rapid industrialization, urbanization, and infrastructure development contribute to growing consumption of emulsion polymers in construction, automotive, and packaging sectors. It supports domestic industries looking to comply with emerging environmental regulations while maintaining cost efficiency. Government investments in sustainable infrastructure projects and eco-friendly materials further boost regional adoption. Asia Pacific remains a key production hub for both synthetic and bio-based polymers, with manufacturers expanding capacities to meet both local and export demand.

North America

North America captures a 24.5% share of the Synthetic and Bio Emulsion Polymer Market, driven by stringent environmental policies and the strong presence of advanced end-use industries. The U.S. leads the region, with robust demand from the paints and coatings, automotive, and packaging sectors. It benefits from well-established research and development infrastructure, enabling rapid innovation in eco-friendly formulations. The growing preference for low-VOC, high-performance coatings aligns with EPA regulations and LEED-certified construction trends. The market also sees rising interest in bio-based alternatives due to consumer and industrial demand for sustainable solutions. Manufacturers continue to invest in localized production and advanced polymer technology to strengthen their market presence and meet changing application needs.

Europe

Europe accounts for 18.3% of the global Synthetic and Bio Emulsion Polymer Market, supported by regulatory initiatives under REACH and the European Green Deal. The region emphasizes the adoption of non-toxic, recyclable, and low-emission materials in industrial and consumer applications. Countries such as Germany, France, and the U.K. are leading the shift toward bio-based and waterborne emulsion polymers, especially in architectural coatings and packaging. It faces high raw material and labor costs, but innovation and strong sustainability policies continue to drive adoption. The construction sector remains a primary end user, followed by automotive coatings and paper applications. European manufacturers focus on circular economy practices and renewable feedstocks to remain competitive and compliant.

Latin America

Latin America holds an 8.1% share of the Synthetic and Bio Emulsion Polymer Market, with Brazil and Mexico leading regional demand. Construction and packaging industries drive the consumption of emulsion polymers across residential, commercial, and industrial projects. It faces challenges such as price sensitivity and limited availability of advanced formulations, but urban development and growing environmental awareness create opportunities for water-based and bio-based variants. Governments are gradually implementing environmental regulations that encourage the transition from solvent-based to emulsion-based systems. Market participants are targeting growth through partnerships, local manufacturing, and tailored product offerings that align with regional application needs.

Middle East & Africa

The Middle East and Africa region contributes 7.9% to the Synthetic and Bio Emulsion Polymer Market, with the UAE, Saudi Arabia, and South Africa being key contributors. The market is supported by large-scale infrastructure and real estate developments, especially in the Gulf Cooperation Council (GCC) countries. It also sees increasing demand for low-VOC materials due to rising environmental regulations and green building certifications. The limited domestic production of polymers creates a dependency on imports, but investments in manufacturing and industrial diversification are improving supply capabilities. Water-based coatings and adhesives are gaining popularity in both commercial and public infrastructure projects. The market shows steady growth potential as awareness of sustainable materials spreads across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Synthetic and Bio Emulsion Polymer Market is highly competitive, with key players including Arkema, SABIC, Henkel AG Co. KGaA, Nippon Shokubai Co., Ltd., LG Chem Ltd., PolyOne Corporation, Evonik Industries AG, ShinEtsu Chemical Co., Ltd., Eastman Chemical Company, and Rohm and Haas Company. These companies compete on the basis of product innovation, sustainability, regional expansion, and application-specific performance. Arkema and Evonik focus on bio-based emulsion polymer development and advanced formulations to meet growing demand for eco-friendly alternatives. Henkel and LG Chem lead in adhesives and sealants, leveraging strong R&D and distribution networks. SABIC and ShinEtsu emphasize chemical versatility and global production capacities, while Nippon Shokubai and Eastman target specialty coatings and water-based systems for industrial applications. PolyOne (now Avient) continues to strengthen its position through material innovation and acquisitions. Strategic initiatives such as partnerships, mergers, and green technology investments define the competitive landscape, with most players prioritizing regulatory compliance and sustainability-driven product portfolios to secure long-term market presence.

Recent Developments

- In 2025, LG Chem significantly expanded its bio-based materials portfolio by mass-producing the world’s first bio-circular balanced superabsorbent polymer (SAP) and launching Asia’s first bio-based ABS.

- In November 2024, Henkel partnered with Celanese to produce water-based adhesives from captured CO2 emissions. This collaboration utilizes vinyl acetate monomer derived from CCU (carbon capture and utilization) methanol, marking a significant step towards circularity in emulsion polymer manufacturing.

Market Concentration & Characteristics

The Synthetic and Bio Emulsion Polymer Market displays a moderately concentrated structure, with a mix of multinational corporations and regional players competing across diverse end-use sectors. It features strong participation from key global manufacturers with advanced R&D capabilities, broad distribution networks, and established customer relationships. Leading players focus on sustainable innovation, product differentiation, and capacity expansion to strengthen their market positions. The market is characterized by high demand for customization, low-VOC formulations, and application-specific performance in sectors such as paints, coatings, adhesives, textiles, and paper. It maintains a dynamic competitive landscape where regulatory compliance, cost efficiency, and feedstock availability play critical roles in shaping strategic decisions. While synthetic variants dominate in volume, bio-based alternatives continue to gain traction due to increasing environmental regulations and consumer awareness. Regional disparities in raw material access, environmental standards, and infrastructure development influence competitive dynamics and entry barriers. The market continues to evolve with a growing emphasis on circular economy principles and renewable material integration

Report Coverage

The research report offers an in-depth analysis based on Raw Material, Application, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for low-VOC and eco-friendly emulsion polymers will increase due to stricter environmental regulations.

- Bio-based emulsion polymers will gain wider acceptance in packaging, adhesives, and textile applications.

- Manufacturers will invest in advanced polymerization technologies to enhance product performance and efficiency.

- The coatings and paints industry will remain a major consumer, driven by construction and automotive growth.

- Strategic mergers and acquisitions will rise as key players seek to expand market reach and capabilities.

- Asia-Pacific will continue to lead in production and consumption due to rapid industrialization and infrastructure development.

- Customization and product innovation will become key differentiators among global and regional competitors.

- Water-based formulations will replace solvent-based systems across several industries to meet safety standards.

- Investment in R&D for bio-emulsion polymers will intensify to meet sustainability targets and regulatory norms.

- Digital technologies and automation will streamline production and enhance supply chain transparency.