Market Overview:

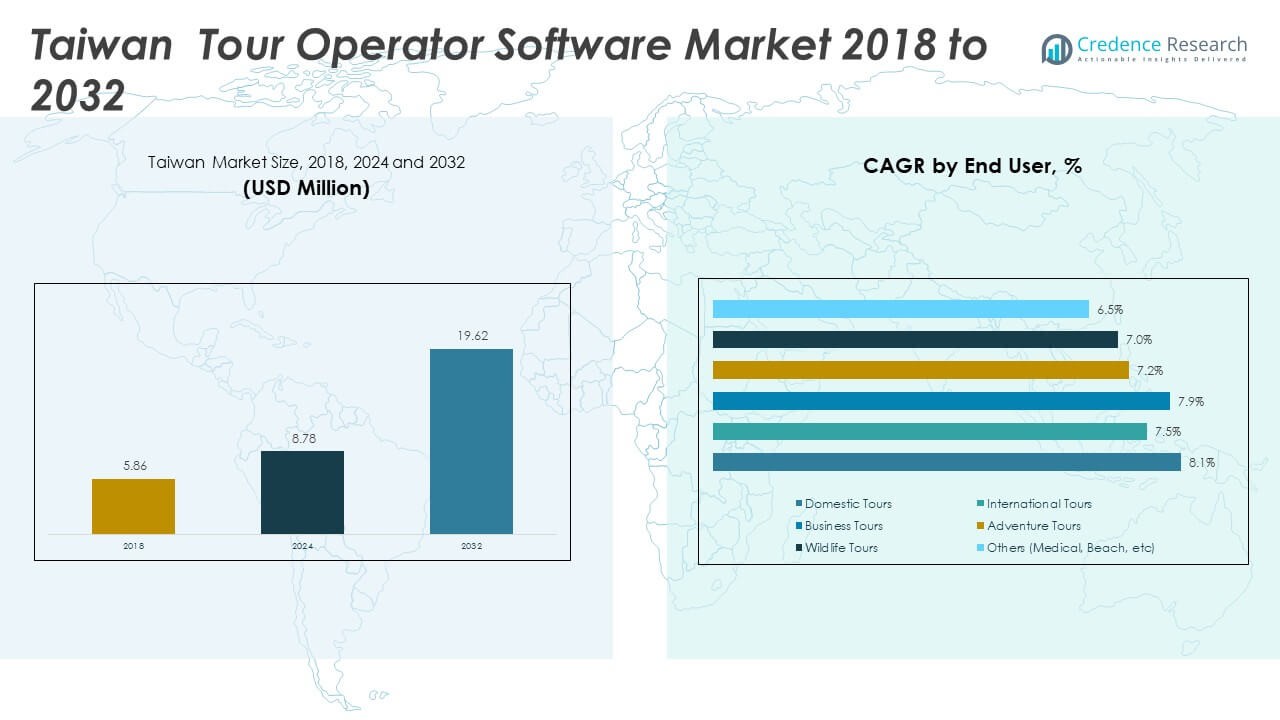

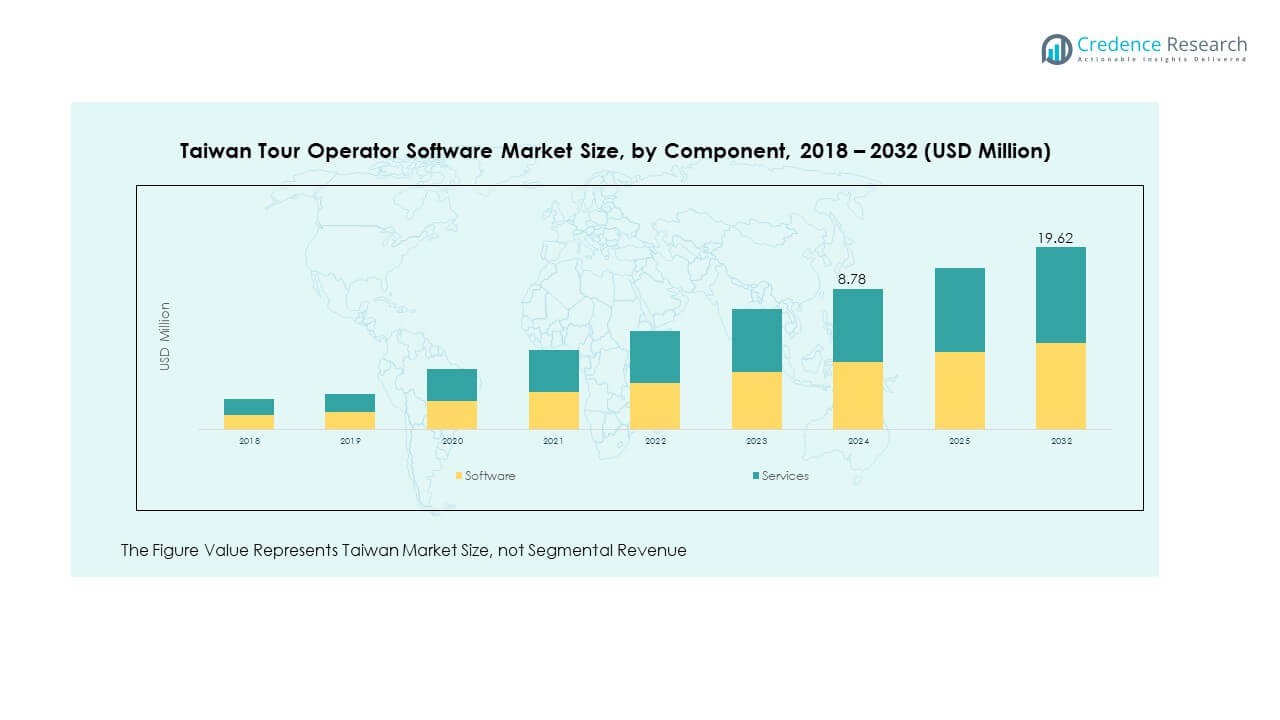

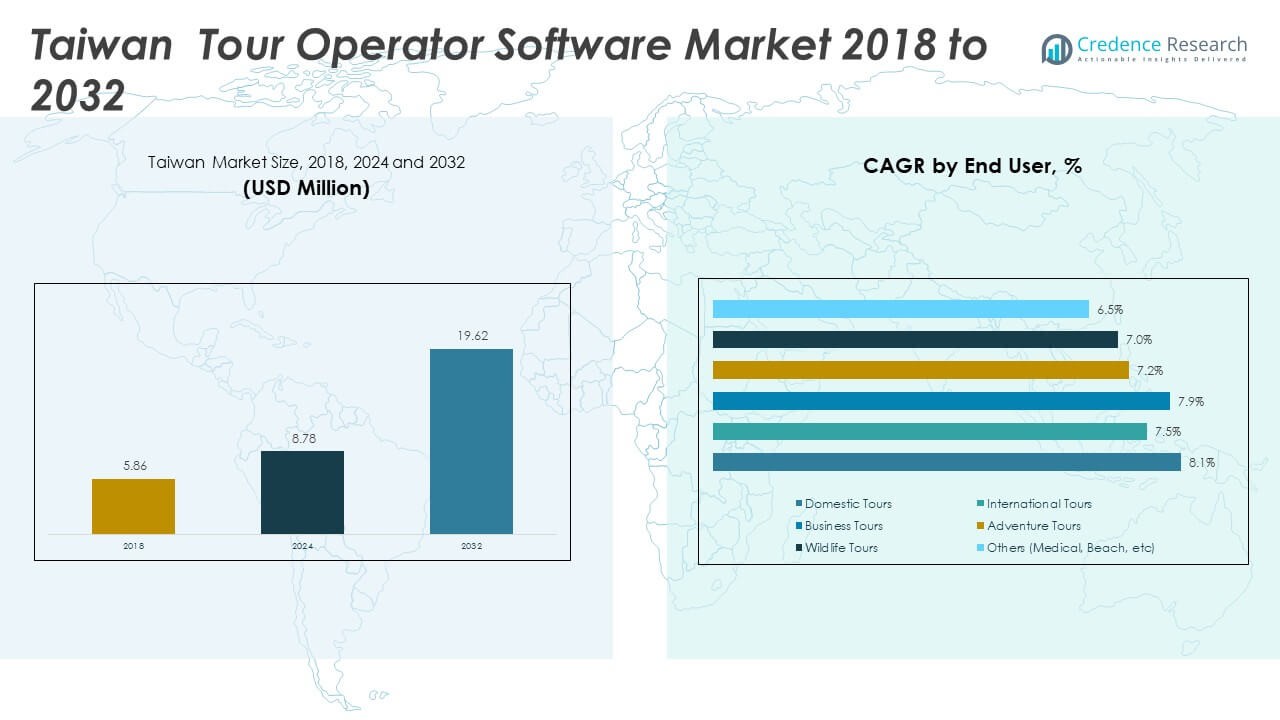

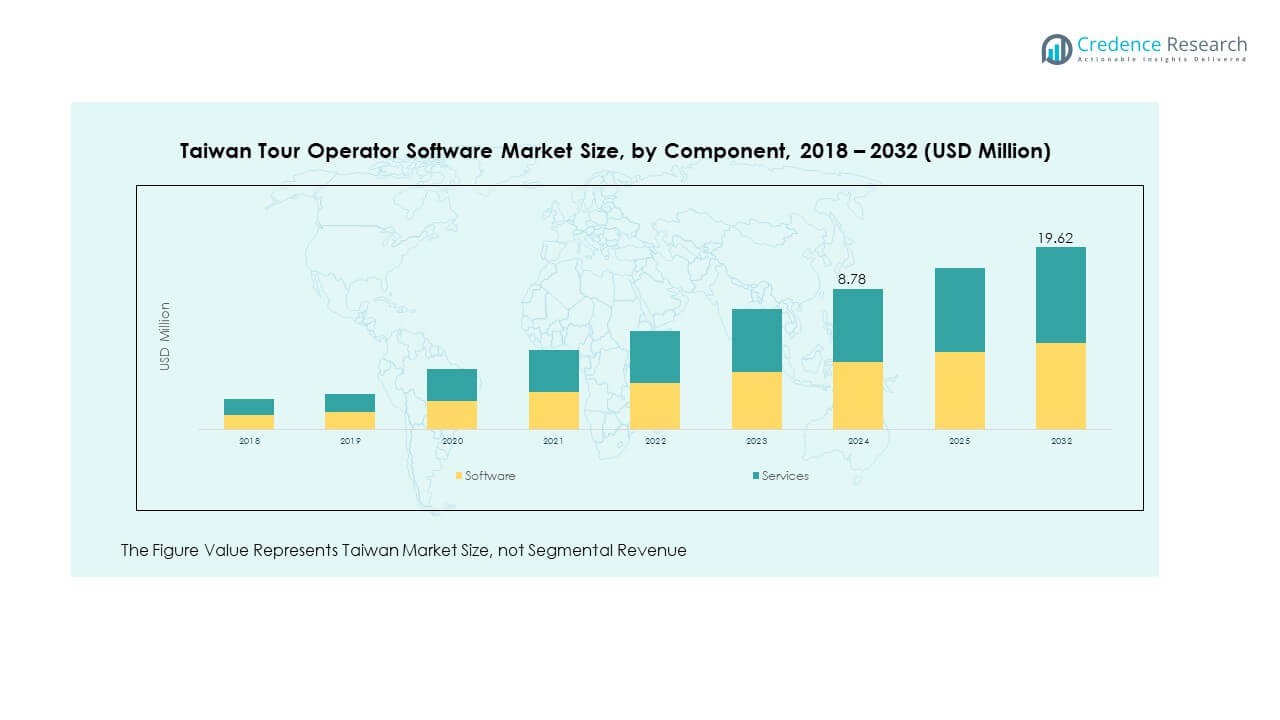

The Taiwan Tour Operator Software Market size was valued at USD 5.86 million in 2018 to USD 8.78 million in 2024 and is anticipated to reach USD 19.62 million by 2032, at a CAGR of 10.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Taiwan Tour Operator Software Market Size 2024 |

USD 8.78 Million |

| Taiwan Tour Operator Software Market, CAGR |

10.57% |

| Taiwan Tour Operator Software Market Size 2032 |

USD 19.62 Million |

Strong growth in tourism demand, coupled with higher expectations for digital booking, is driving adoption. Operators are investing in software that supports automation, itinerary planning, payment systems, and customer engagement. The market benefits from improved user experience, cost savings, and rising integration with cloud platforms. Mobile-first booking solutions, combined with secure payment gateways, are shaping product development. Growing government tourism initiatives encourage operators to adopt modern tools. Rising disposable incomes are leading to increased domestic and outbound travel demand. It is helping vendors secure stable growth opportunities. Strong demand for simplified booking workflows is also improving vendor competitiveness.

In the Taiwan Tour Operator Software Market, regional dynamics highlight both strengths and emerging opportunities. North America and Europe dominate through advanced adoption of software tools and mature digital infrastructure. Asia-Pacific is rapidly expanding due to rising tourism activities in Taiwan, Japan, and Southeast Asia. Latin America demonstrates moderate growth supported by increasing travel investments. The Middle East shows potential through strong inbound tourism demand. Africa is still emerging, with gradual adoption across select hubs. Regional collaboration between operators and technology firms is helping enhance service quality. Global interest in Taiwan tourism also strengthens local software adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Taiwan Tour Operator Software Market was USD 5.86 million in 2018, USD 8.78 million in 2024, and is projected to reach USD 19.62 million by 2032, expanding at a CAGR of 10.57%.

- North America led with around 36% share, driven by advanced digital infrastructure and strong SaaS adoption; Europe followed with 30%, supported by multilingual needs and regulatory compliance; Asia-Pacific held 24%, fueled by tourism growth in Taiwan, Japan, and Southeast Asia.

- Asia-Pacific is the fastest-growing region, supported by rising disposable incomes, government-led tourism campaigns, and demand for mobile-first booking systems.

- In 2024, software accounted for about 45% of the market, reflecting demand for booking engines, CRM, and payment integration.

- Services represented around 55%, supported by customization, implementation, and managed solutions that address the needs of operators with limited IT capacity.

Market Drivers:

Rising Digital Transformation in Travel and Tourism:

The Taiwan Tour Operator Software Market is expanding due to rapid digital transformation in tourism. Operators rely on software for better itinerary management, bookings, and real-time updates. Customers expect seamless and personalized experiences, pushing operators to adopt digital solutions. Growing reliance on cloud and mobile tools supports integration across multiple channels. It is ensuring cost savings while improving customer satisfaction. Automation reduces administrative burden and strengthens efficiency for travel operators. Government tourism campaigns further encourage adoption of digital booking platforms. These factors collectively accelerate long-term market penetration.

- For instance, Sabre Corporation’s suite of solutions adopted by Richmond International Travel & Tours in Taipei aims to enhance efficiency and personalization, showing how software improves operational workflows and customer services. Customers today expect seamless, personalized experiences, driving operators to adopt advanced digital tools.

Growing Focus on Customer Experience and Personalization:

Travelers demand personalized itineraries, flexible bookings, and multi-channel support. Operators adopt advanced software to meet these expectations effectively. Real-time updates, chatbots, and self-service portals enhance customer engagement. Operators use CRM-driven analytics for better insight into traveler preferences. It is improving loyalty and repeat bookings for tour companies. Seamless mobile integration ensures stronger customer reach and faster decision-making. Tour operators benefit from improved retention and long-term customer satisfaction. Personalization remains a critical growth driver for the industry.

- For instance, Automation reduces the administrative burden and strengthens operational efficiency, with AI technologies like chatbots and machine learning cutting operational costs and improving workflow speed by providing real-time customer support and dynamic travel recommendations.

Increasing Government Support and Tourism Growth:

Taiwan’s government actively promotes tourism through campaigns and regional collaborations. Strong policy initiatives encourage adoption of advanced operator tools. Growing international arrivals and domestic tourism further expand demand. Operators use technology to manage group tours and complex itineraries efficiently. It is strengthening operational reliability and cost efficiency. Infrastructure investments, including airports and digital systems, support smoother tourist flow. Industry players benefit from coordinated government support. This driver highlights strong alignment between policy and technology adoption.

Integration of Cloud and Mobile-Based Solutions:

Cloud-based solutions simplify access, scalability, and real-time data management for operators. Growing preference for mobile applications improves traveler interaction. Operators benefit from cost reduction and flexible software models. It is creating strong demand for subscription-based platforms. Travelers prefer mobile bookings, secure payments, and instant itinerary updates. Vendors respond with user-friendly mobile-first designs. The rise in internet penetration supports faster adoption. Integration of mobile and cloud ensures long-term competitive edge for operators.

Market Trends:

Adoption of Artificial Intelligence and Automation:

Operators use AI to improve itinerary design, pricing, and predictive analysis. Chatbots offer customer support with real-time answers. It is reducing operational cost and improving efficiency. Machine learning supports data-driven travel recommendations. AI helps operators detect trends and optimize resources. Automation ensures smoother workflow and faster booking management. Tour companies invest in predictive technologies for better forecasting. AI and automation remain central to evolving travel experiences.

- For instance, Automation reduces the administrative burden and strengthens operational efficiency, with AI technologies like chatbots and machine learning cutting operational costs and improving workflow speed by providing real-time customer support and dynamic travel recommendations.

Expansion of Cross-Border Travel and Regional Packages:

Regional travel demand is expanding among Taiwanese and international visitors. Operators design multi-country packages to serve diverse travelers. It is driving higher demand for integrated booking platforms. Software supports multi-currency, language, and compliance needs. Cross-border collaborations strengthen operator competitiveness. Vendors add modules for rail, cruise, and group tours. Strong demand for cultural and regional experiences fuels package development. This trend highlights software flexibility and adaptability.

- For instance, Chatbots provide 24/7 customer service, reducing operational costs and increasing efficiency. Machine learning supports data-driven travel recommendations, enabling operators to detect trends and optimize resource allocation.

Growth of Subscription and SaaS Models:

SaaS platforms dominate due to scalability and cost-effectiveness. Operators prefer subscription-based pricing to manage expenses. It is attracting small and medium-sized tour operators. Vendors expand offerings with modular features for flexibility. SaaS enables continuous updates and smooth integration. Cloud storage ensures secure handling of customer data. Operators benefit from lower upfront investment and easier maintenance. SaaS-driven growth continues to strengthen the market.

Rising Adoption of Data Analytics and Reporting Tools:

Operators increasingly rely on advanced reporting tools for insights. Analytics support better decision-making on pricing, customer needs, and destinations. It is improving profitability and business planning. Dashboards help monitor booking trends in real time. Vendors offer integration with CRM and ERP systems. Data-driven insights ensure optimized marketing strategies. Strong reliance on analytics drives vendor innovation. This trend is shaping smarter operator ecosystems.

Market Challenges Analysis:

High Cost of Advanced Implementation and Training Needs:

In the Taiwan Tour Operator Software Market, high costs of advanced software act as barriers. Smaller operators struggle with affordability, limiting adoption across the sector. Training requirements create challenges for teams without digital expertise. It is slowing down seamless integration of software tools. Ongoing updates and maintenance increase total ownership cost. Limited budgets prevent some companies from accessing advanced features. Vendors face the challenge of designing cost-effective models. This restraint impacts overall market expansion.

Cybersecurity Risks and Data Privacy Concerns:

Operators handle sensitive traveler data including payments and personal details. Cybersecurity threats raise risks of data theft and fraud. It is creating hesitation among operators and customers. Strong compliance with data protection laws is necessary. Breaches damage customer trust and company reputation. Vendors invest heavily in encryption and security tools. Ongoing risks still pose challenges for adoption. This remains a key issue for the industry.

Market Opportunities:

Expansion of Niche and Customized Travel Packages:

Operators design niche packages for adventure, cultural, and wellness tourism. Customers demand unique experiences tailored to personal preferences. It is driving adoption of flexible booking software. Niche tours require advanced scheduling, route planning, and customer management. Vendors offer features supporting small group management. Growing preference for sustainable and eco-tourism also supports new opportunities. Operators leverage software to differentiate services. This expansion strengthens long-term growth potential.

Partnerships with Airlines, Hotels, and Travel Aggregators:

Strategic partnerships enhance visibility and customer access. Operators integrate software with airline and hotel booking systems. It is creating seamless end-to-end travel solutions. Multi-platform integration increases competitiveness. Vendors benefit from broader service networks. Collaborations support loyalty programs and bundled packages. Operators gain stronger customer retention through strategic alliances. Such opportunities expand revenue streams effectively.

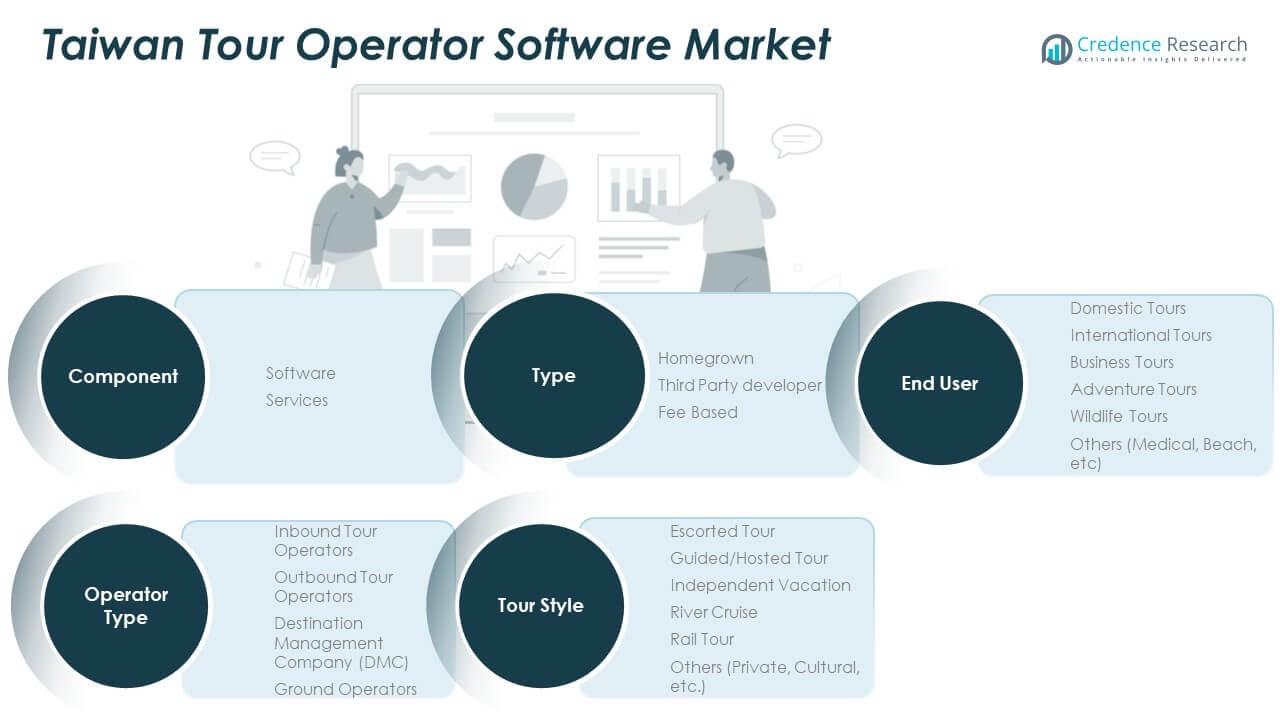

Market Segmentation Analysis:

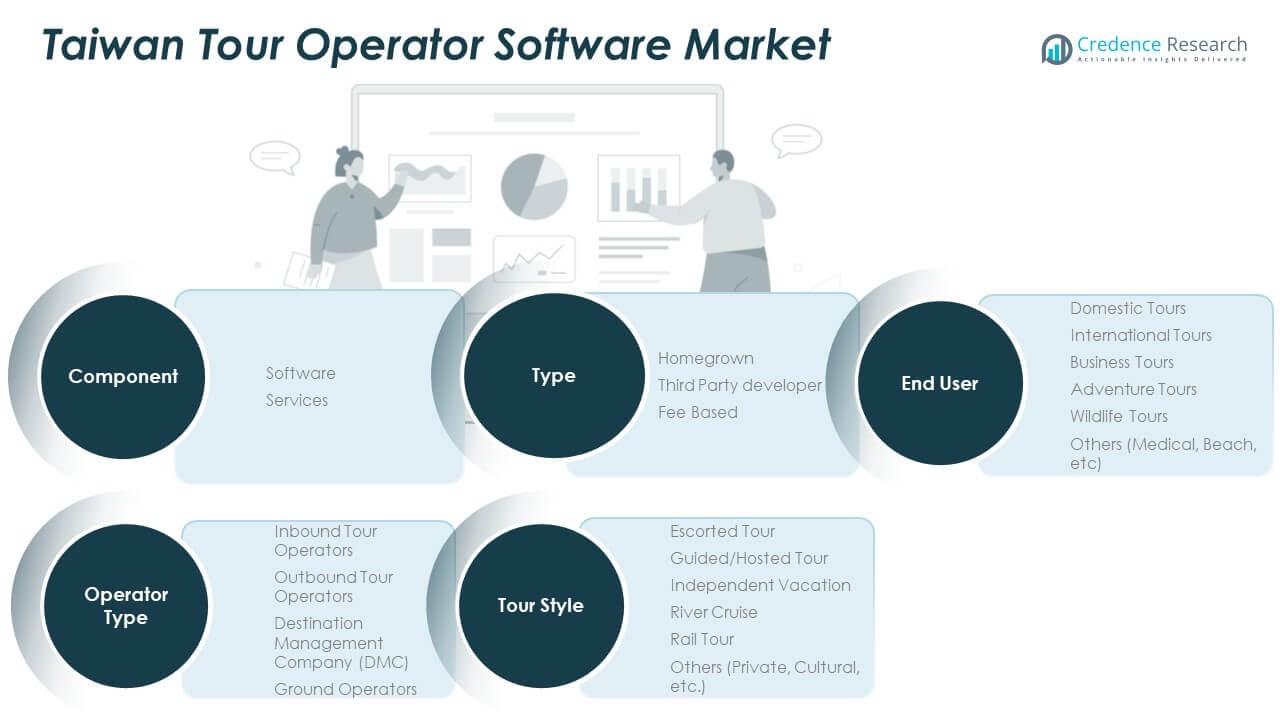

By Type

The Taiwan Tour Operator Software Market segments by type into homegrown, third party developer, and fee-based models. Homegrown solutions suit local operators that prefer control and customization for language and cultural alignment. Third party developer platforms deliver standardized systems with broad integrations for payments, content, and global supplier networks. Fee-based solutions dominate as they provide stable updates, premium support, and scalable infrastructure for operators of all sizes. It is this diversity that ensures every operator finds a suitable model.

- For instance, Cross-border collaborations enhance competitiveness, with additional software modules supporting rail, cruise, and group tours. The trend towards cultural and regional experience packages is well illustrated by industry offers of Taiwan ‘plus’ tours that combine Taiwan travel with other Asian destinations at competitive pricing.

By Component

The market divides into software and services. Software includes booking engines, customer relationship management, itinerary planning, and secure payment processing. It drives efficiency by reducing manual errors and enhancing customer satisfaction. Services focus on training, customization, implementation, and ongoing support. These services are vital for small and medium operators lacking IT resources. It is this combination of software and services that supports seamless operations and customer retention.

- For instance, Software covers booking engines, CRM, itinerary planning, and secure payment processing, reducing manual errors and improving customer satisfaction. Essential services include training, customization, implementation, and ongoing support, especially vital for smaller operators with limited IT resources.

By Operator Type

Key operator types include inbound tour operators, outbound operators, destination management companies (DMCs), and ground operators. Inbound operators use platforms to manage local experiences for international visitors with real-time availability. Outbound operators rely on software to connect with global distribution systems, handle visas, and manage cross-border compliance. DMCs emphasize contracting, rates, and local supplier coordination. Ground operators need tools to manage transfers, guides, and activities. It is this segmentation that supports diverse business models within the travel ecosystem.

By Tour Style

Tour styles include escorted, guided, independent vacations, river cruises, rail tours, and others. Escorted tours require robust group management and resource allocation tools. Guided or hosted tours demand scheduling features for guides and multi-day planning. Independent vacations rely heavily on mobile apps, self-service portals, and personalized options. River and rail tours need software integration with carriers for seat and cabin management. Private and cultural tours emphasize customization and flexibility. It is this variety that drives software versatility and innovation.

By End User

End users include domestic, international, business, adventure, wildlife, and other specialized tours. Domestic tours favor platforms with local content, language support, and local payment systems. International tours require currency conversion, compliance with foreign regulations, and integration with airlines. Business tours emphasize scheduling, cost control, and reporting for corporate clients. Adventure and wildlife tours depend on features for safety compliance, risk waivers, and flexible logistics. Other categories such as cultural or niche tours highlight the demand for personalized, high-value experiences. It is this wide demand base that ensures sustainable growth.

Segmentation:

- By Type:

- Homegrown

- Third Party developer

- Fee Based

- By Component:

- By Operator Type:

- Inbound Tour Operators

- Outbound Tour Operators

- Destination Management Company (DMC)

- Ground Operators

- By Tour Style:

- Escorted Tour

- Guided/Hosted Tour

- Independent Vacation

- River Cruise

- Rail Tour

- Others (Private, Cultural, etc.)

- By End User:

- Domestic Tours

- International Tours

- Business Tours

- Adventure Tours

- Wildlife Tours

- Others

Regional Analysis:

Northern Taiwan – 48% Share

Northern Taiwan leads the Taiwan Tour Operator Software Market with 48% share in 2024. Taipei serves as the country’s major hub for inbound tourism, corporate travel, and outbound packages. Strong infrastructure, high internet penetration, and international airport connectivity make this region the most digitally advanced. Operators here adopt comprehensive platforms for group management, dynamic pricing, and payment integration. It is also home to larger operators with higher budgets, driving demand for premium SaaS models. Government tourism campaigns further boost adoption. Northern Taiwan continues to dominate due to its role as the country’s primary travel gateway.

Central Taiwan – 28% Share

Central Taiwan holds a 28% share of the Taiwan Tour Operator Software Market, with Taichung and nearby areas driving growth. This region balances cultural tourism, eco-tourism, and adventure travel, attracting both domestic and international visitors. Operators increasingly adopt cloud-based and mobile-first solutions to manage group tours and itineraries. It is an area with a strong presence of mid-sized operators, which rely on cost-effective subscription-based models. Vendors see opportunity in servicing operators that prioritize flexibility and easy customization. Ongoing regional development projects enhance adoption. Central Taiwan remains a steady growth contributor with a diverse tourism mix.

Southern and Eastern Taiwan – 24% Share

Southern and Eastern Taiwan collectively account for 24% of the Taiwan Tour Operator Software Market. Kaohsiung and Tainan lead the south with strong demand from cultural and port-related tourism. Eastern Taiwan’s eco-tourism destinations and wildlife tours attract niche operators focused on customized packages. It is a region where software demand is rising steadily, particularly for tools enabling multilingual support and flexible itineraries. Adoption rates are lower than the north, but government-backed initiatives are closing the gap. Vendors target these regions with cost-efficient, mobile-driven solutions to support smaller operators. Southern and Eastern Taiwan show strong long-term potential for expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Trawex

- TBO Holidays (TBO.com)

- TravelCarma (Avani Travel Technologies)

- QuadLabs Technologies

- Amadeus IT Group

- Sabre Corporation

- Lemax

- Open Destinations

- TrekkSoft

- FareHarbor

Competitive Analysis:

In the Taiwan Tour Operator Software Market, competition is shaped by both global and regional players. Companies such as Amadeus, Sabre, and Trawex dominate with strong product portfolios. Smaller vendors like TrekkSoft and FareHarbor provide niche and flexible solutions. It is marked by rapid innovation in SaaS and cloud-based services. Vendors compete through customer experience, affordability, and integration features. Strategic partnerships with airlines, hotels, and aggregators strengthen competitiveness. Market concentration is moderate, with opportunities for new entrants. Continuous upgrades and partnerships remain key strategies for success.

Recent Developments:

- In March 2025, Trawex Technologies highlighted its powerful travel platform that supports over 1000 customers globally with services including ERP, payment gateway, mobile app development, and booking systems. Their offerings feature instant supplier integrations, travel APIs for custom solutions, white-label travel websites, and B2C/B2B booking engines aimed at faster go-to-market capabilities.

- In September 2025, TBO Holidays (TBO.com) announced the acquisition of US luxury travel firm Classic Vacations for approximately $125 million. This strategic move combines TBO’s technology and global inventory with Classic Vacations’ luxury travel advisor network, enhancing TBO’s position in the premium outbound travel market while Classic Vacations continues as an independent brand leveraging TBO’s technology.

- TravelCarma, owned by Avani Cimcon Technologies, was selected by the Thai Hotel and Hospitality Management Association (THMA) as their technology partner for their travel portal, emphasizing TravelCarma’s growing presence in Asia’s travel technology sector.

- QuadLabs Technologies partnered with Kanoo Travel in the Middle East to launch a corporate travel solution called “eo,” leveraging QuadLabs’ advanced “Travog” platform to streamline corporate travel management. This move is aimed at enhancing the efficiency and cost-effectiveness of travel services for corporate clients.

Report Coverage:

The research report offers an in-depth analysis based on type, component, operator type, tour style, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing adoption of AI and automation in booking systems

- Stronger government support for tourism modernization

- Rising demand for niche and customized travel packages

- Expansion of SaaS platforms across small and mid-size operators

- Strong integration of mobile-first booking systems

- Increasing partnerships between software vendors and hospitality groups

- Steady growth in regional tourism collaborations

- Rising cybersecurity investment to build customer trust

- Expansion into untapped emerging markets

- Higher customer loyalty driven by personalization features