Market Overview:

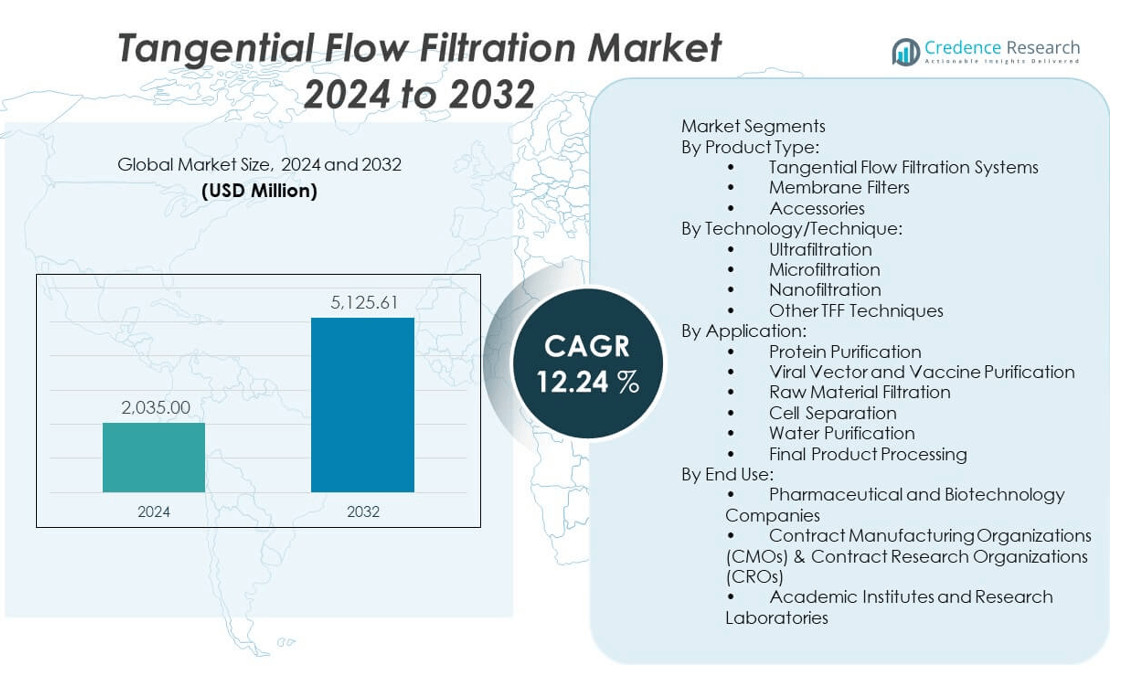

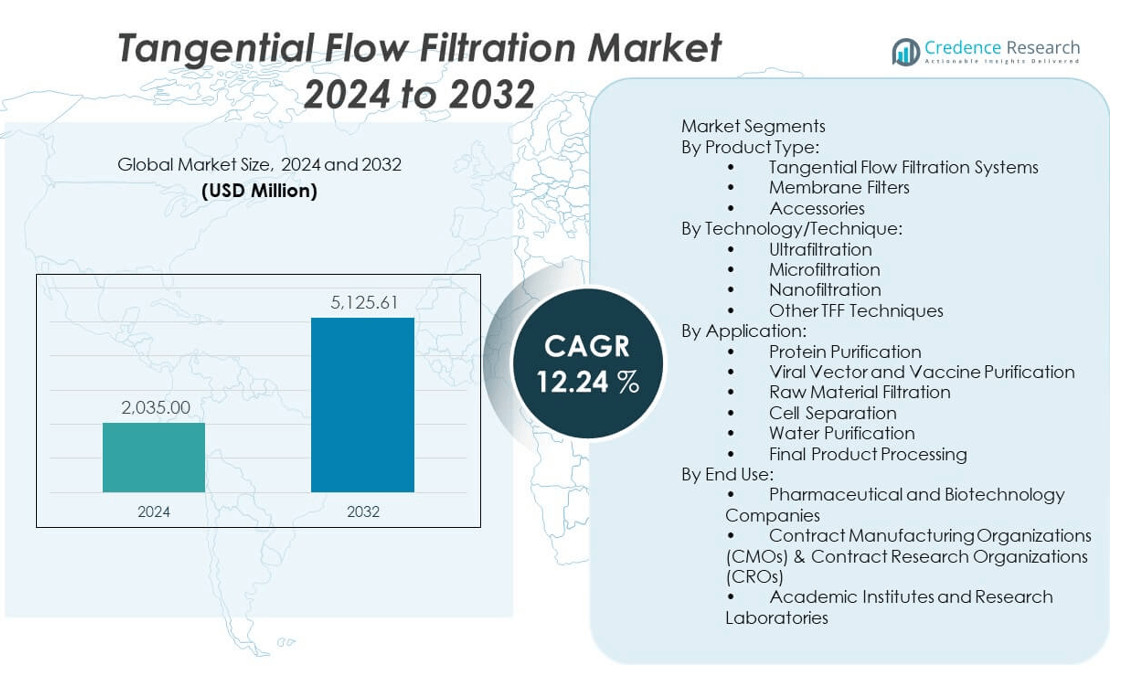

The Tangential Flow Filtration (TFF) market is projected to grow from USD 2,127.87 million in 2024 to an estimated USD 5,125.61 million by 2032, at a compound annual growth rate (CAGR) of 12.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tangential Flow Filtration Market Size 2024 |

USD 2,127.87 million |

| Tangential Flow Filtration Market, CAGR |

12.24% |

| Tangential Flow Filtration Market Size 2032 |

USD 5,125.61 million |

The market is primarily driven by the expanding biopharmaceutical sector, where TFF systems are widely used for vaccine development, monoclonal antibody production, and cell therapy processing. Increasing R&D investment in biologics, growing demand for efficient downstream processing technologies, and the shift toward single-use systems further fuel adoption. In addition, regulatory emphasis on product purity and process validation compels pharmaceutical companies to integrate advanced filtration methods, reinforcing TFF’s importance across production workflows.

North America leads the tangential flow filtration market due to its advanced biotechnology infrastructure, strong presence of biopharma companies, and high investment in R&D. Europe follows closely with steady growth, driven by favorable regulatory support and innovation in biologics. Meanwhile, the Asia-Pacific region is emerging as a high-potential market, fueled by growing pharmaceutical manufacturing, rising healthcare expenditure, and government support for biotech expansion in countries like China, India, and South Korea.

Market Insights:

- The Tangential Flow Filtration Market was valued at USD 2,127.87 million in 2024 and is anticipated to reach USD 5,125.61 million by 2032, growing at a CAGR of 12.24% during the forecast period.

- Growth is primarily driven by the rising demand for biologics, vaccines, and cell therapies, which require high-efficiency filtration solutions for purification and concentration.

- Increasing adoption of single-use technologies in bioprocessing is boosting the use of disposable tangential flow filtration systems for enhanced flexibility and contamination control.

- High initial capital investment and membrane fouling issues act as significant restraints, especially for small and mid-sized manufacturers.

- North America leads the market due to advanced biopharmaceutical infrastructure and strong R&D investment, particularly in the United States.

- Asia-Pacific is emerging rapidly with growing pharmaceutical production, favorable government initiatives, and expansion of healthcare infrastructure in China, India, and South Korea.

- Europe holds a steady share, driven by stringent regulatory standards, biosimilar adoption, and well-established biotech clusters in countries such as Germany and the UK.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rapid Expansion of the Biopharmaceutical Industry Elevates Filtration Demand:

The tangential flow filtration market benefits significantly from the growth of the global biopharmaceutical industry. Companies are increasingly adopting TFF systems to improve yield and consistency in manufacturing biologics, including monoclonal antibodies and vaccines. The demand for precise and scalable filtration technologies drives integration of TFF in drug development pipelines. It supports downstream processing with reduced product loss and enhanced purity. Regulatory agencies mandate high-quality standards for biologics, which necessitates efficient filtration processes. The scalability of TFF suits both pilot-scale and full-scale production, reinforcing its role across production stages. Contract manufacturing organizations also rely on TFF systems to meet flexible production requirements. The tangential flow filtration market maintains steady momentum as biotech innovation continues to accelerate.

- For instance, Genentech reported implementing advanced TFF membrane systems that increased monoclonal antibody concentrate throughput by over 30% without compromising protein integrity, directly impacting production yield efficiency.

Rising Adoption of Single-Use Technologies in Bioprocessing:

Single-use systems have become a preferred solution in modern bioprocessing due to reduced cross-contamination risks and quicker turnaround times. The tangential flow filtration market is experiencing growing traction from the shift toward disposable TFF modules. These systems offer cost-efficiency and operational flexibility for biomanufacturers aiming to streamline operations. It eliminates cleaning validation steps, improving compliance with GMP requirements. Small and mid-sized biotechs benefit from the lower capital investment and modular scale-up capabilities. Increasing demand for personalized therapies and small-batch biologics further promotes single-use TFF deployment. Companies are launching tailored disposable solutions to address niche requirements. The integration of single-use technology continues to be a strategic priority in facility design and retrofitting projects.

- For instance, Pall Corporation’s single-use TFF modules have enabled a 25% reduction in processing cycle times for personalized cell therapies by minimizing system cleaning and sterilization steps, accelerating batch turnaround.

Increased Focus on High-Throughput Processing in Research and Production:

Biotech and pharmaceutical companies are focusing on improving processing throughput without compromising product quality. The tangential flow filtration market supports this demand through high-efficiency membrane designs and automation-compatible systems. It enables continuous filtration with minimal operator intervention and consistent product recovery. The development of high-flux membranes enhances separation speed while maintaining selectivity. Advanced TFF systems offer real-time monitoring, enabling adaptive control during production. This capability supports the growing interest in continuous bioprocessing models. Labs and production units can reduce process cycle times, leading to faster development and lower costs. High-throughput TFF applications are also expanding into diagnostic and gene therapy fields.

Regulatory and Quality Compliance Requirements Drive Adoption:

Global regulatory bodies such as the FDA and EMA impose strict requirements for biologics manufacturing, including product purity, yield consistency, and contamination control. The tangential flow filtration market aligns well with these regulatory demands by offering robust and validated solutions. It ensures effective separation and concentration of critical components while meeting cGMP standards. Companies rely on validated TFF protocols to pass audits and accelerate product approvals. The use of qualified TFF systems simplifies documentation and risk mitigation strategies. Integration of advanced analytics within TFF units enhances data traceability and quality control. As audits become more rigorous, manufacturers continue to prioritize investment in compliant filtration systems. The regulatory landscape reinforces the importance of TFF in bioprocess validation.

Market Trends:

Integration of Automation and Process Analytics into TFF Systems:

Automation is reshaping the tangential flow filtration market, enabling real-time process control and data-driven decision-making. Manufacturers now offer TFF systems embedded with smart sensors and advanced control software. These upgrades enhance filtration precision and reduce human error. It allows users to monitor flow rates, pressure, and membrane integrity in real time. Integration with SCADA and MES platforms supports broader digital transformation strategies. Automated systems enable faster product changeovers and improved consistency across batches. Biopharma companies gain better process insight, contributing to more efficient scale-up and troubleshooting. The trend toward automation in TFF systems is accelerating across both R&D and commercial operations.

- For instance, Hamilton Company integrated smart digital pH and conductivity sensors directly into their TFF Solaris Process Control System, decreasing calibration times by 50% and delivering real-time diagnostic alerts that prevent batch losses.

Emergence of Continuous Manufacturing in Bioprocessing:

Continuous manufacturing is gaining traction in the pharmaceutical industry as a method to improve process efficiency and reduce production costs. The tangential flow filtration market is evolving to support this trend by delivering systems designed for uninterrupted filtration cycles. These continuous TFF systems facilitate inline concentration and diafiltration during manufacturing. It ensures steady-state operation, minimizing product hold times and contamination risks. Pharmaceutical firms are integrating TFF into end-to-end continuous workflows, especially for monoclonal antibodies and cell therapies. The transition toward continuous processing improves resource utilization and enhances operational agility. TFF equipment vendors are tailoring solutions to align with these requirements. Demand for continuous TFF setups is rising across both large-scale and niche product manufacturing.

- For instance, Merck KGaA deployed continuous TFF systems enabling uninterrupted concentration steps that sustained a constant throughput of biologics, improving process yield stability by up to 15% over batch processing.

Growing Role of TFF in Emerging Gene and Cell Therapy Applications:

Gene and cell therapies require precise separation and concentration of viral vectors, plasmids, and cellular materials. The tangential flow filtration market is witnessing increased application in these advanced therapies due to its gentle processing and high recovery rates. TFF enables scalable purification of lentiviral and adeno-associated vectors used in gene delivery. It also helps in concentrating and washing therapeutic cells without affecting viability. Vendors are customizing TFF modules for small-volume, high-value applications. It supports the shift toward personalized medicine, where batch sizes are limited but regulatory standards remain stringent. The versatility and efficiency of TFF make it a key enabler in clinical and commercial manufacturing of gene-modified products.

Customization of Membrane Materials and Configurations:

Manufacturers are focusing on developing specialized membrane materials and configurations to enhance TFF system performance. The tangential flow filtration market reflects this shift through the launch of application-specific membrane technologies. Custom membranes improve separation accuracy for complex or sensitive biomolecules. It provides better chemical compatibility, reduced fouling, and improved cleaning cycles. Hollow fiber, cassette, and flat sheet formats are being optimized for particular workflows. Companies are tailoring membrane pore sizes and surface chemistries to match emerging bioprocess needs. These developments ensure broader applicability across different types of biologics. The trend toward membrane innovation enhances the operational efficiency and reliability of TFF systems in demanding environments.

Market Challenges Analysis:

High Capital Investment and Maintenance Costs Limit Adoption in Small Facilities:

Small and mid-sized biopharmaceutical firms often face budget constraints that delay or limit the adoption of advanced TFF systems. The tangential flow filtration market must address the high upfront investment and ongoing maintenance costs associated with these technologies. It includes expenses for system setup, membrane replacement, calibration, and compliance validation. While large manufacturers can absorb these costs, smaller facilities must evaluate return on investment carefully. Complex system configuration and the need for specialized operators further increase operational burden. In some cases, firms opt for less sophisticated or alternative filtration methods. Market penetration remains uneven, particularly in emerging regions where infrastructure is still developing. These financial and operational limitations slow widespread adoption.

Membrane Fouling and Product Loss Remain Technical Obstacles:

Membrane fouling continues to be a persistent challenge in tangential flow filtration, impacting filtration efficiency and product recovery. The tangential flow filtration market encounters difficulties in maintaining long-term membrane performance across multiple cycles. It faces issues with protein aggregation, clogging, and chemical incompatibility, which lead to reduced throughput and increased downtime. Regular membrane cleaning protocols extend system availability but may still fall short in preventing degradation. Product losses during filtration or diafiltration steps can be significant, especially for high-value biologics. These technical drawbacks require ongoing R&D to develop more resilient membranes and optimized operating protocols. Addressing these issues is critical to maximizing TFF system reliability and performance.

Market Opportunities:

Growing Demand for Biologics and Biosimilars Creates Expansion Potential:

The global rise in demand for biologics and biosimilars offers a strong growth opportunity for the tangential flow filtration market. Pharmaceutical companies are expanding pipelines focused on targeted therapies, which require robust and scalable filtration systems. It supports critical steps in purification, polishing, and formulation. The growing accessibility of biosimilars in emerging economies further extends the market’s reach. Governments and healthcare providers are encouraging local production, opening new avenues for TFF adoption in domestic manufacturing setups. Market players that offer cost-effective and high-efficiency filtration solutions can tap into this expanding demand base.

Strategic Collaborations and Innovation Fuel Market Differentiation:

Companies operating in the tangential flow filtration market are increasingly engaging in partnerships and innovation to strengthen market positioning. Collaborations with biotech start-ups, research institutions, and CMOs help accelerate solution development and broaden application scope. It allows technology providers to customize offerings based on end-user feedback and application specificity. New product development in membrane materials, automation software, and compact modules gives companies a competitive edge. These strategic moves enhance product accessibility while meeting diverse client needs across geographies.

Market Segmentation Analysis:

By Product Type

The tangential flow filtration market is categorized into tangential flow filtration systems, membrane filters, and accessories. Tangential flow filtration systems hold the largest market share due to their widespread use in downstream bioprocessing and large-scale production. Membrane filters follow in demand, fueled by continuous improvements in pore size control, material durability, and compatibility with various biomolecules. Accessories support customization and operational efficiency, contributing to workflow optimization in both research and manufacturing settings.

- For instance, Sartorius developed ultrafiltration membranes with enhanced chemical resistance, demonstrating membrane lifespan increases of 20-30% in multiple biotherapeutic applications.

By Technology/Technique

Ultrafiltration dominates the technology segment owing to its extensive application in protein concentration, antibody purification, and buffer exchange. It enables efficient separation of macromolecules while maintaining product integrity. Microfiltration holds relevance in cell harvesting and clarification of fermentation broths. Nanofiltration is gaining traction in applications requiring selective removal of small molecules. Other TFF techniques, though limited in use, serve specialized purposes across custom bioprocessing workflows.

- For instance, EMD Millipore’s ultrafiltration modules have been shown to consistently retain 99.9% of monoclonal antibody products while allowing efficient buffer exchange with minimal protein aggregation.

By Application

Protein purification is the leading application, driven by the increasing production of monoclonal antibodies and recombinant proteins. Viral vector and vaccine purification has expanded rapidly due to growing investments in gene therapy and immunization programs. Raw material filtration ensures removal of contaminants from inputs, while cell separation supports harvesting and clarification processes. Water purification and final product processing, including API filtration and formulation, emphasize the versatility of TFF systems in maintaining high-quality standards.

By End Use

Pharmaceutical and biotechnology companies form the core customer base, using TFF systems for both clinical and commercial-scale production. Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) adopt TFF to enhance operational flexibility and meet diverse client needs. Academic institutes and research laboratories contribute to early-stage adoption, applying TFF in R&D, pilot studies, and proof-of-concept experiments.

Segmentation:

By Product Type:

- Tangential Flow Filtration Systems

- Membrane Filters

- Accessories

By Technology/Technique:

- Ultrafiltration

- Microfiltration

- Nanofiltration

- Other TFF Techniques

By Application:

- Protein Purification

- Viral Vector and Vaccine Purification

- Raw Material Filtration

- Cell Separation

- Water Purification

- Final Product Processing (including API filtration, vaccine & antibody processing, formulation, and filling solutions)

By End Use:

- Pharmaceutical and Biotechnology Companies

- Contract Manufacturing Organizations (CMOs) & Contract Research Organizations (CROs)

- Academic Institutes and Research Laboratories

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads with Strong Infrastructure and Innovation

North America dominates the tangential flow filtration market, accounting for approximately 41.8% of the global market share in 2024. The region benefits from advanced biopharmaceutical infrastructure, robust R&D funding, and a concentration of key players, including Danaher Corporation, Repligen, and Parker Hannifin. The United States leads in biopharma innovation, driving sustained demand for high-performance TFF systems in both commercial and clinical settings. Strong regulatory frameworks and adoption of continuous manufacturing support consistent investment in filtration technologies. Canada contributes through expanding biotech hubs and academic research institutes focused on biologics and cell therapy. The region’s mature healthcare and manufacturing ecosystem continues to anchor its leading position in the global market.

Europe Maintains a Competitive Edge through Quality and Regulation

Europe holds the second-largest share in the tangential flow filtration market, with around 28.6% of the total market in 2024. Germany, the United Kingdom, and France drive regional growth, supported by strong pharmaceutical manufacturing bases and rigorous regulatory standards. The presence of major players such as Sartorius AG and Merck KGaA enhances innovation and access to advanced membrane technologies. European firms prioritize product purity and validation, aligning well with the capabilities of TFF systems. The region also sees steady adoption in academic and contract research sectors, where precision and efficiency are essential. Government-backed biosimilar initiatives and expanding biotech clusters further stimulate market growth across Western and Central Europe.

Asia-Pacific Emerges as the Fastest-Growing Region

Asia-Pacific is the fastest-growing region in the tangential flow filtration market, expected to increase its market share from 20.4% in 2024 to over 25% by 2032. China, India, Japan, and South Korea are driving demand through rapid pharmaceutical expansion, rising healthcare investment, and localization of biologics manufacturing. Governments in these countries support biotechnology with funding, tax incentives, and streamlined regulatory pathways. It gains traction in both domestic production and contract manufacturing activities, particularly for vaccines and monoclonal antibodies. Increasing awareness of single-use technologies and higher adoption among emerging biotech start-ups accelerate the market’s regional growth. Asia-Pacific’s large patient pool and rising demand for affordable biologics position it as a key contributor to future global revenue.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Danaher Corporation (US)

- Sartorius AG (Germany)

- Parker Hannifin Corporation (US)

- Merck KGaA (Germany)

- Repligen Corporation (US)

- Thermo Fisher Scientific

- Cytiva

- Stonington Partners

- Sterlitech Corporation

- Synder Filtration, Inc.

- Novasep

- Micro Filt India Pvt. Ltd.

- BIONET

- Alfa Laval AG

- FUJIFILM Wako Pure Chemical Corporation

- Meissner Filtration Products, Inc.

- ABEC, Inc.

Competitive Analysis:

The tangential flow filtration market is highly competitive, driven by technological innovation, product differentiation, and strategic collaborations. Leading players such as Danaher Corporation, Sartorius AG, Merck KGaA, Thermo Fisher Scientific, and Repligen Corporation maintain strong market positions through broad product portfolios and global distribution networks. It sees continuous investment in R&D to enhance membrane performance, automation capabilities, and single-use systems. Smaller companies like Synder Filtration, ABEC Inc., and Sterlitech compete by offering specialized solutions tailored to niche applications. Companies focus on expanding manufacturing capacity and forming partnerships with CMOs and CROs to reach emerging markets. Competitive intensity remains high due to constant advancements in bioprocessing technologies and the need for regulatory-compliant, high-efficiency filtration solutions.

Recent Developments:

- In June 2025, Danaher Corporationannounced the launch of new advanced tangential flow filtration (TFF) systems designed to enhance throughput and membrane longevity for biopharmaceutical applications, integrating smart sensor technology for real-time process monitoring.

- Repligen Corporation unveiled a single-use TFF cassette system in 2025 that significantly lowers system cleaning requirements and improves scalability for gene therapy and vaccine manufacturing applications.

- Thermo Fisher Scientific expanded its bioprocessing solutions in 2025 by integrating advanced TFF modules with automation and digital analytics for enhanced filtration consistency and easier regulatory compliance.

- Cytiva partnered with a leading biopharma manufacturer in 2025 to implement modular TFF solutions enabling faster purification cycles and reduced product loss in antibody production.

Market Concentration & Characteristics:

The tangential flow filtration market exhibits moderate-to-high market concentration, with a few global players dominating overall revenue. It features a mix of multinational corporations and mid-sized innovators, with barriers to entry including high capital requirements, IP ownership, and regulatory compliance. The market is characterized by rapid technological evolution, high customization demand, and growing preference for disposable systems. Strategic partnerships and vertical integration are common as companies aim to streamline workflows and enhance end-to-end solutions. Product differentiation is key, especially in membrane technology and modular system design.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Technology, Application, and End Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The tangential flow filtration market will expand steadily, supported by strong demand for biopharmaceutical products globally.

- Growth in monoclonal antibody and vaccine production will continue to drive adoption of TFF systems in commercial-scale manufacturing.

- Rising investments in research and development will increase the need for scalable, high-efficiency filtration in early-stage drug discovery.

- Single-use TFF systems will gain popularity due to operational flexibility, reduced contamination risk, and simplified validation processes.

- Continuous bioprocessing will become more mainstream, with TFF playing a key role in integrating upstream and downstream operations.

- Regulatory pressures for product purity and process validation will boost demand for advanced filtration technologies.

- Academic and research institutions will adopt TFF systems for pilot-scale studies, driving innovation and training.

- Contract manufacturers will increasingly invest in TFF to offer flexible and compliant production capabilities to biotech firms.

- Technological advancements in membrane materials and automation will enhance performance, reliability, and ease of use.

- Emerging markets in Asia-Pacific will witness rapid growth, supported by government incentives and pharmaceutical capacity expansion.