Market Overview

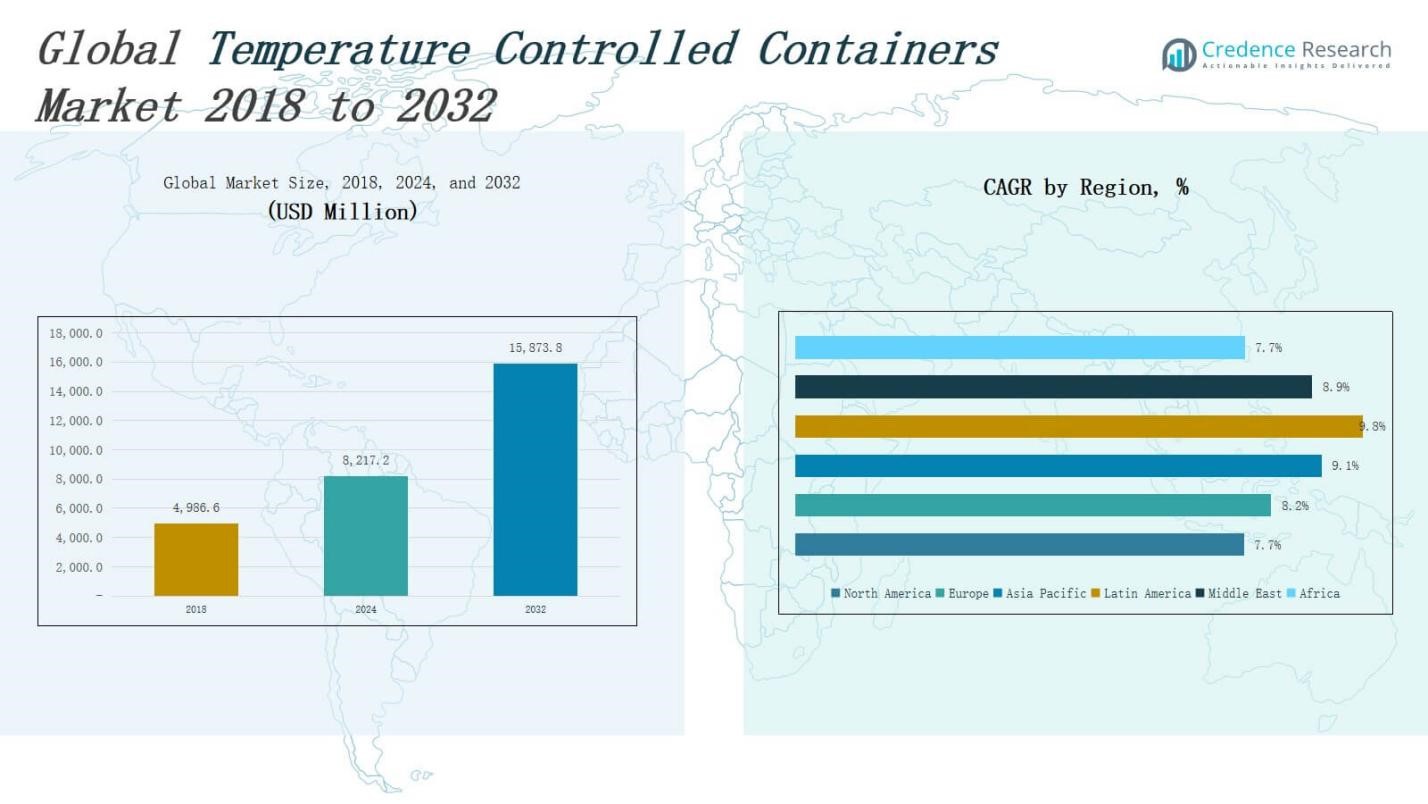

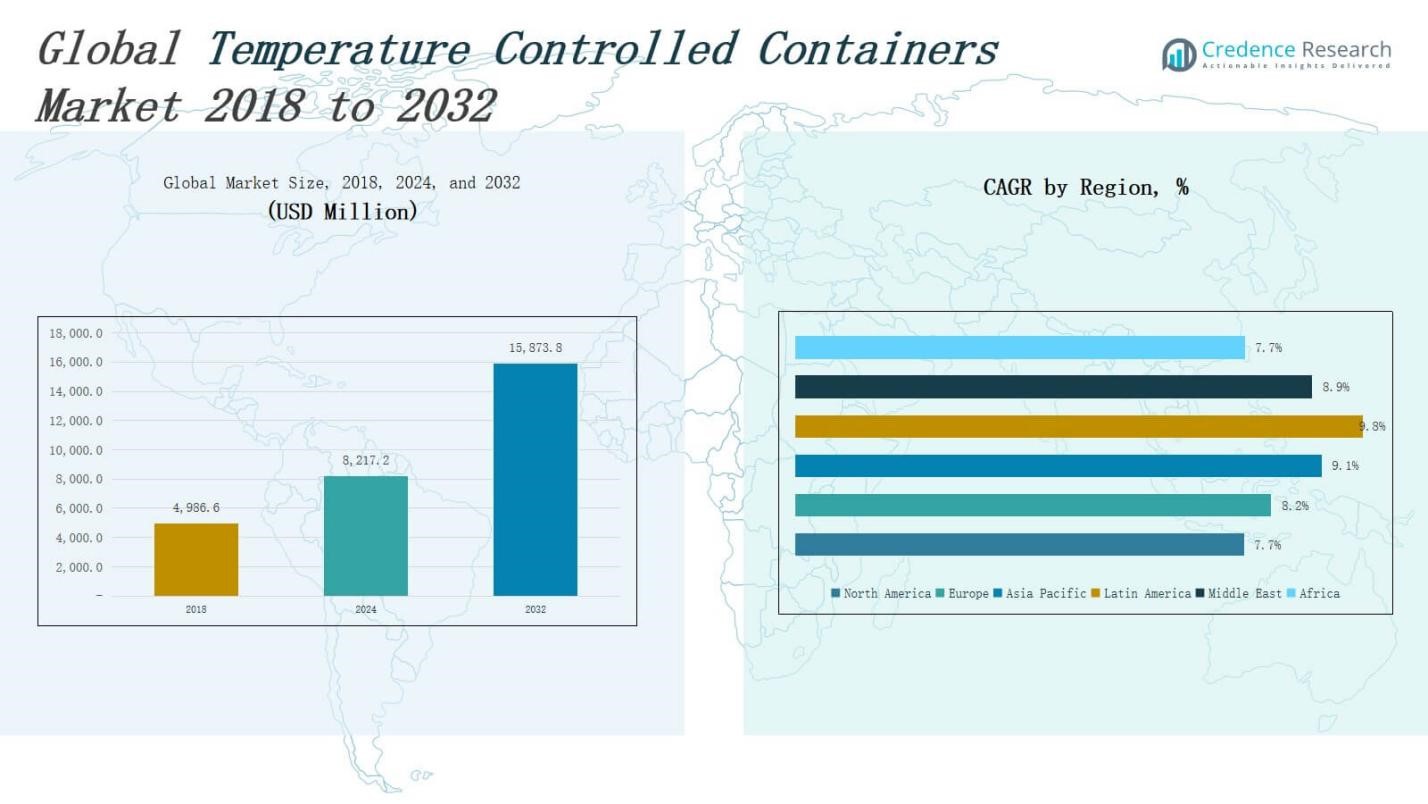

The Temperature Controlled Containers Market size was valued at USD 4,986.59 million in 2018 to USD 8,217.15 million in 2024 and is anticipated to reach USD 15,873.78 million by 2032, at a CAGR of 8.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Temperature Controlled Containers Market Size 2024 |

USD 8,217.15 Million |

| Temperature Controlled Containers Market, CAGR |

8.61% |

| Temperature Controlled Containers Market Size 2032 |

USD 15,873.78 Million |

The Temperature Controlled Containers Market is driven by the growing demand for safe and efficient transportation of temperature-sensitive products across the pharmaceutical, food, and chemical industries. Increasing global trade in perishable goods, coupled with stringent regulatory requirements for cold chain logistics, is accelerating the adoption of temperature-controlled solutions. The rising prevalence of biologics, vaccines, and specialty drugs further underscores the need for reliable thermal packaging, especially in emerging markets with expanding healthcare infrastructure. Key trends shaping the market include the integration of IoT and real-time tracking technologies for enhanced visibility, the shift toward reusable and sustainable container systems to reduce environmental impact, and the development of advanced phase change materials and vacuum insulation panels to maintain thermal integrity. Companies are also focusing on modular container designs and multi-temperature configurations to support diverse product requirements, while the growth of e-commerce and direct-to-patient delivery models is creating new opportunities for innovation in last-mile cold chain logistics.

The Temperature Controlled Containers Market demonstrates strong geographic expansion across North America, Europe, Asia Pacific, Latin America, Middle East, and Africa. Asia Pacific holds the largest share, driven by rapid industrial growth and expanding cold chain infrastructure in China and India. North America and Europe follow, supported by advanced logistics networks and high pharmaceutical demand. Latin America and the Middle East show steady growth due to rising food exports and healthcare logistics investments. Africa remains an emerging market with growing demand for passive systems in medical and food sectors. Key players operating globally include Cold Chain Technologies, Envirotainer AB, Pelican BioThermal, Va-Q-Tec AG, Softbox Systems, Sofrigam, Cryopak, and Tempack. These companies focus on innovation, reusable container systems, and compliance with global cold chain standards to strengthen their presence across developed and emerging regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Temperature Controlled Containers Market was valued at USD 4,986.59 million in 2018 and is projected to reach USD 15,873.78 million by 2032, growing at a CAGR of 8.61%.

- Rising demand for biologics, vaccines, and specialty drugs is driving container adoption in pharmaceutical supply chains to ensure temperature stability and regulatory compliance.

- Stringent global regulations and food safety standards from agencies like FDA and WHO are pushing manufacturers to adopt validated and certified container systems.

- Integration of IoT, GPS, and real-time monitoring technologies is enhancing shipment visibility, operational efficiency, and audit readiness.

- High upfront cost, maintenance, and validation procedures pose challenges, particularly for small and mid-sized logistics providers in cost-sensitive regions.

- Asia Pacific leads the global market, followed by North America and Europe, while Latin America, the Middle East, and Africa show rising demand driven by exports and healthcare logistics.

- Key players include Cold Chain Technologies, Envirotainer AB, Pelican BioThermal, Va-Q-Tec AG, Softbox Systems, Sofrigam, Cryopak, and Tempack, all focusing on reusable systems and regulatory compliance.

Market Drivers

Rising Demand for Biopharmaceuticals and Specialty Drugs

The Temperature Controlled Containers Market is witnessing strong growth due to the increasing global demand for biologics, vaccines, and cell and gene therapies. These high-value pharmaceutical products require strict temperature stability during transit to maintain efficacy. The complexity and sensitivity of biologics drive the need for advanced cold chain infrastructure. It supports pharmaceutical manufacturers in ensuring compliance with regulatory standards. Expanding clinical trials and global vaccine distribution campaigns also contribute to this demand. Pharmaceutical companies prefer container systems offering precise thermal performance and validated transport data.

Stringent Regulations Across Pharmaceutical and Food Logistics

The Temperature Controlled Containers Market is influenced by strict regulatory frameworks enforced by agencies such as the FDA, EMA, and WHO. These bodies require end-to-end cold chain compliance for perishable and temperature-sensitive goods. It compels manufacturers and logistics providers to adopt certified, validated temperature-controlled packaging solutions. In the food sector, rising food safety concerns and global exports drive adoption. Compliance with HACCP, GDP, and ISO standards further promotes container upgrades. Non-compliance risks product rejection, recalls, and brand damage.

- For instance, Pfizer uses advanced packaging systems—such as specially designed thermal containers with real-time GPS and temperature tracking—to ship COVID-19 vaccines globally, ensuring compliance with WHO-mandated temperature standards and preventing spoilage during transit.

Expansion of Global Trade in Perishable Commodities

The Temperature Controlled Containers Market benefits from the rapid growth of international trade in perishable goods, including fresh produce, seafood, and dairy. Longer transportation distances and multi-modal logistics increase the complexity of maintaining product integrity. It places higher demand on reliable and robust thermal container solutions. Emerging economies are boosting exports, driving container demand in regions like Asia-Pacific and Latin America. Seasonal imbalances in food production further expand year-round shipping needs. High-value food exports depend on consistent cold chain performance.

- For instance, Maersk introduced its “Captain Peter” remote container management system to monitor temperature and humidity for fresh produce exports, helping global food companies reduce spoilage during extended transit.

Technology Integration for Visibility and Operational Efficiency

The Temperature Controlled Containers Market is driven by the integration of IoT, GPS, and real-time monitoring technologies. These innovations enhance shipment visibility, temperature control, and data logging for compliance and audit trails. It allows logistics managers to respond quickly to excursions or disruptions. Predictive analytics help optimize routes and reduce spoilage risks. Smart containers are becoming essential for pharmaceutical and perishable supply chains. Investment in digital cold chain infrastructure continues to grow, supported by logistics automation trends.

Market Trends

Growing Adoption of Reusable and Sustainable Container Solutions

The Temperature Controlled Containers Market is experiencing a shift toward reusable and eco-friendly containers. Companies are replacing single-use systems with durable, recyclable alternatives to reduce environmental impact and total cost of ownership. It helps businesses meet sustainability goals and comply with evolving environmental regulations. Leading manufacturers now offer reusable containers with validated thermal performance and extended lifespans. Demand for circular logistics solutions continues to rise, especially in pharmaceutical and food supply chains. Sustainability now drives procurement decisions across industries.

Increased Integration of Smart Monitoring and Tracking Technologies

The Temperature Controlled Containers Market is embracing IoT-enabled containers equipped with real-time temperature, location, and humidity sensors. These smart systems support full shipment traceability and improve risk management. It enables proactive intervention during transit disruptions, minimizing product loss. Data-driven insights help optimize operations and improve cold chain performance. Real-time visibility also supports compliance with Good Distribution Practices (GDP) and auditing requirements. Technology adoption is becoming a key differentiator in container system selection across healthcare and food logistics.

- For instance, Maersk has deployed over 380,000 IoT-enabled “Reefer” smart containers, which provide continuous temperature tracking and real-time location updates, enhancing cargo safety for pharmaceutical and food shipments by allowing immediate responses to temperature deviations.

Surge in Demand from Direct-to-Consumer and E-Commerce Channels

The Temperature Controlled Containers Market is evolving to meet the needs of e-commerce and direct-to-consumer delivery models. Rising demand for home delivery of temperature-sensitive pharmaceuticals and gourmet food products is accelerating innovation in small-format, last-mile container systems. It creates opportunities for lightweight, reusable packaging with extended cooling performance. Retailers and logistics companies are investing in cold chain solutions tailored for urban distribution. Shorter delivery windows and customer expectations for freshness raise performance benchmarks. E-commerce is reshaping container design and deployment strategies.

- For instance, Pfizer ships millions of COVID-19 vaccine doses globally using temperature-controlled containers packed with dry ice, ensuring that vials maintain efficacy throughout direct-to-pharmacy and direct-to-patient deliveries.

Modular and Multi-Temperature Container Designs Gaining Traction

The Temperature Controlled Containers Market is seeing rising interest in modular container solutions with the ability to manage multiple temperature zones. These designs allow shippers to consolidate shipments of various products within a single unit. It helps reduce logistics complexity and optimize transportation costs. Industries with diverse product profiles—such as pharmaceuticals and specialty foods—benefit most. Modular containers improve flexibility in both long-haul and regional deliveries. Manufacturers are focusing on customizable configurations to match specific route and storage needs.

Market Challenges Analysis

High Initial Investment and Operational Costs

The Temperature Controlled Containers Market faces significant challenges due to the high upfront cost of advanced container systems. Reusable, IoT-enabled, and phase-change technology-equipped containers require substantial capital investment. It poses a barrier for small and medium logistics providers and shippers operating on thin margins. Maintenance, cleaning, and validation procedures further add to recurring operational expenses. High costs may discourage adoption despite long-term savings. Companies must balance performance requirements with budget constraints, especially in cost-sensitive regions.

Infrastructure Limitations and Handling Inconsistencies

The Temperature Controlled Containers Market is also constrained by gaps in global cold chain infrastructure and inconsistent handling practices. Limited access to temperature-controlled warehouses and transport hubs in emerging markets increases the risk of temperature excursions. It affects shipment integrity and regulatory compliance. Variability in training, handling procedures, and equipment standards across regions compounds this challenge. Logistics providers must invest in specialized training and robust protocols. These limitations restrict container performance and reduce overall supply chain reliability.

Market Opportunities

Rising Demand in Emerging Healthcare and Food Markets

The Temperature Controlled Containers Market has strong growth potential in emerging economies with expanding healthcare infrastructure and food export industries. Demand for vaccines, biologics, and specialty drugs is increasing in Latin America, Southeast Asia, and Africa. It creates a need for reliable cold chain solutions tailored to regional conditions. Governments and private players are investing in logistics upgrades to meet global standards. Cold chain expansion supports food exports such as seafood, dairy, and exotic produce. These regions offer long-term revenue opportunities for container manufacturers and service providers.

Advancement of Smart and Connected Container Systems

The Temperature Controlled Containers Market can benefit from the integration of AI, blockchain, and cloud analytics into smart container platforms. These technologies enable predictive maintenance, automated reporting, and improved shipment security. It helps companies reduce spoilage risks, enhance efficiency, and meet compliance requirements with greater ease. Rising interest in data-driven logistics supports adoption of intelligent container systems. Pharmaceutical and high-value food segments are early adopters of connected technologies. Vendors offering integrated solutions can gain competitive advantage and expand market share.

Market Segmentation Analysis:

By Type

The Temperature Controlled Containers Market is segmented into Active System Containers and Passive System Containers. Active systems use powered mechanisms to regulate internal temperatures and are ideal for long-haul shipments of sensitive pharmaceuticals and biologics. These systems offer precise control and are preferred for critical cold chain applications. Passive containers rely on insulation and phase change materials without external power. They provide cost-effective solutions for short to medium-distance transport. It enables flexibility across healthcare and food supply chains where infrastructure or power access is limited.

- For instance, Haier Biomedical’s RKN Active Temperature Controlled Containers are used for international air transportation of drugs, vaccines, and biological materials, with features such as rapid recharging (up to 10 hours fast charging) and robust temp control even during extreme outdoor conditions.

By End Use

The Temperature Controlled Containers Market serves a wide range of industries, with Healthcare leading due to the need for secure transport of vaccines, biologics, and temperature-sensitive drugs. Pharmaceutical companies rely on validated, GDP-compliant containers to prevent thermal excursions. Food & Beverages follows closely, driven by growing exports of seafood, dairy, and frozen goods that require uninterrupted cold chain logistics. The Chemical Industry also contributes to market demand, especially for temperature-sensitive solvents, reagents, and specialty chemicals. Other End-Use Industries, such as cosmetics and biotechnology, continue to adopt these containers to maintain product integrity throughout distribution.

- For instance, Hellmann Healthcare Logistics managed the export of active pharmaceutical ingredients (API) from the US to India by implementing a validated temperature-controlled shipping solution, using real-time 5G tracking loggers to maintain a strict 2°C–8°C range and comply with GDP standards throughout the journey.

Segments:

Based on Type

- Active System Containers

- Passive System Containers

Based on End Use

- Healthcare

- Food & Beverages

- Chemical Industry

- Other End-Use Industries

Based on Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis

North America

The North America Temperature Controlled Containers Market size was valued at USD 935.48 million in 2018 to USD 1,471.81 million in 2024 and is anticipated to reach USD 2,663.62 million by 2032, at a CAGR of 7.7% during the forecast period. North America holds a significant share of the global market, supported by advanced cold chain infrastructure and strong demand from the pharmaceutical and food sectors. The United States dominates the region due to its large-scale vaccine distribution, high biologics output, and established logistics players. It benefits from regulatory emphasis on GDP-compliant systems and innovation in container technology. Healthcare remains the leading end-use segment, followed by food exports and specialty chemicals. Investments in real-time monitoring and reusable container systems continue to rise across major supply chains.

Europe

The Europe Temperature Controlled Containers Market size was valued at USD 1,366.32 million in 2018 to USD 2,202.20 million in 2024 and is anticipated to reach USD 4,127.18 million by 2032, at a CAGR of 8.2% during the forecast period. Europe contributes a substantial share to the global market, driven by stringent regulatory requirements and a strong pharmaceutical manufacturing base. Countries like Germany, France, and the UK are at the forefront of cold chain adoption. It sees growing usage of reusable containers and smart tracking solutions. Food exports, particularly dairy and meat, also rely on reliable temperature control. The region promotes sustainability through circular packaging systems and energy-efficient container designs.

Asia Pacific

The Asia Pacific Temperature Controlled Containers Market size was valued at USD 1,728.85 million in 2018 to USD 2,923.19 million in 2024 and is anticipated to reach USD 5,838.38 million by 2032, at a CAGR of 9.1% during the forecast period. Asia Pacific holds the largest market share, supported by rapid industrialization, rising healthcare access, and expanding food trade. China, India, and Japan lead the region with growing demand for cold chain logistics across biopharma and F&B sectors. It benefits from rising government investment in infrastructure and cold storage capacity. Urbanization and e-commerce growth further boost last-mile cold transport needs. Market players are focusing on cost-effective, scalable solutions tailored for diverse regional climates.

Latin America

The Latin America Temperature Controlled Containers Market size was valued at USD 498.66 million in 2018 to USD 880.53 million in 2024 and is anticipated to reach USD 1,852.47 million by 2032, at a CAGR of 9.8% during the forecast period. Latin America represents a growing market, fueled by rising exports of perishable foods and increasing pharmaceutical imports. Brazil and Mexico are major contributors, driven by expanding healthcare systems and food logistics investments. It faces infrastructure gaps, yet container manufacturers are addressing local challenges through passive systems and hybrid models. Regional trade agreements support cross-border cold chain expansion. Demand for smart containers is rising to improve traceability and reduce spoilage.

Middle East

The Middle East Temperature Controlled Containers Market size was valued at USD 192.98 million in 2018 to USD 323.29 million in 2024 and is anticipated to reach USD 638.13 million by 2032, at a CAGR of 8.9% during the forecast period. The region is witnessing growing demand from pharmaceutical re-exports, halal food exports, and temperature-sensitive chemical trade. The UAE and Saudi Arabia lead investments in healthcare and logistics infrastructure. It increasingly adopts temperature-controlled containers to meet international compliance and maintain supply chain integrity. Harsh climatic conditions drive the need for advanced insulation and long-duration cooling systems. Cross-border healthcare supply and food imports boost container usage across the Gulf region.

Africa

The Africa Temperature Controlled Containers Market size was valued at USD 264.29 million in 2018 to USD 416.14 million in 2024 and is anticipated to reach USD 754.00 million by 2032, at a CAGR of 7.7% during the forecast period. Africa holds emerging potential in cold chain development, supported by healthcare outreach programs and rising agricultural exports. South Africa, Egypt, and Kenya are key hubs investing in containerized cold storage and transport. It faces infrastructure limitations, yet the need for reliable vaccine and medicine delivery is accelerating container adoption. Passive systems dominate due to affordability and simplicity. Food security programs and donor-funded initiatives also contribute to cold chain expansion across the continent.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cold Chain Technologies, Inc.

- Envirotainer AB

- Inmark, Inc.

- Intelsius – A DGP Company

- Pelican BioThermal LLC

- Sofrigam

- Tempack Packaging Solutions, S.L.

- TKT GmbH

- Inno Cool Pvt. Ltd.

- Other Key Players

Competitive Analysis

The Temperature Controlled Containers Market features a competitive landscape driven by technological innovation, strategic partnerships, and expanding global cold chain demand. Key players such as Cold Chain Technologies, Envirotainer AB, Pelican BioThermal, and Va-Q-Tec AG focus on offering high-performance containers with real-time monitoring, longer hold times, and reusable designs. It supports their positioning in pharmaceutical, food, and chemical logistics. Companies invest in R&D to enhance thermal insulation, reduce weight, and improve sustainability. Strategic collaborations with logistics firms and healthcare distributors help expand geographic presence and strengthen service offerings. Emerging players from Asia and Latin America are entering the market with cost-effective passive systems, intensifying competition. Market participants also compete on compliance, reliability, and customization, aiming to meet diverse regulatory and operational needs. Continuous product upgrades and global network expansion remain core to maintaining market share and customer loyalty.

Recent Developments

- In April 2025, Cold Chain Technologies introduced the CCT Tower Elite pallet shipper at LogiPharma. The reusable system supports various temperature ranges, offers IoT tracking, and accommodates both Euro and US pallets.

- In March 2025, Cold Chain Technologies acquired Global Cold Chain Solutions to strengthen its footprint in the Asia-Pacific region, specifically expanding operations in Australia and India.

- In February 2025, Envirotainer launched its new RelEye RKN container, designed for pharmaceutical air cargo. The unit features real-time monitoring, enhanced autonomy, and has received operational approval from six major airlines.

- In 2025, Peli BioThermal introduced its Crēdo Vault bulk shipper, a reusable container offering temperature stability for up to 168 hours. The unit includes IoT-enabled tracking and is engineered for higher payload efficiency and lightweight transport.

Market Concentration & Characteristics

The Temperature Controlled Containers Market is moderately concentrated, with a mix of global leaders and regional players competing on performance, compliance, and innovation. Major companies such as Cold Chain Technologies, Envirotainer AB, Pelican BioThermal, and Va-Q-Tec AG hold significant market share due to their advanced product portfolios and strong distribution networks. It features high entry barriers driven by regulatory requirements, specialized R&D, and the capital-intensive nature of container validation and certification. The market is characterized by rapid technological advancements, including IoT-enabled tracking, phase change materials, and reusable systems designed for long-term cost efficiency. Demand is largely driven by the pharmaceutical and food industries, where thermal stability and supply chain integrity are critical. Customer preference is shifting toward modular, sustainable, and smart containers that support real-time monitoring and reduce environmental impact. Regional differentiation is strong, with product customization and infrastructure alignment influencing vendor competitiveness across North America, Europe, Asia Pacific, and emerging markets.

Report Coverage

The research report offers an in-depth analysis based on Type, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for reusable and sustainable containers will increase across pharmaceutical and food logistics.

- Companies will invest more in IoT-enabled smart containers for real-time monitoring and compliance.

- Growth in biologics and vaccine distribution will drive the need for high-performance thermal packaging.

- Expansion of cold chain infrastructure in emerging markets will create new business opportunities.

- Regulatory focus on GDP and HACCP compliance will push adoption of certified container systems.

- E-commerce and direct-to-patient delivery models will accelerate the demand for small-format cold containers.

- Manufacturers will develop modular containers to support multi-temperature shipping requirements.

- Logistics providers will prioritize predictive analytics to reduce spoilage and optimize delivery routes.

- Industry players will form partnerships to strengthen regional supply chain capabilities.

- Adoption of energy-efficient and lightweight materials will influence container design innovations.