Market Overview

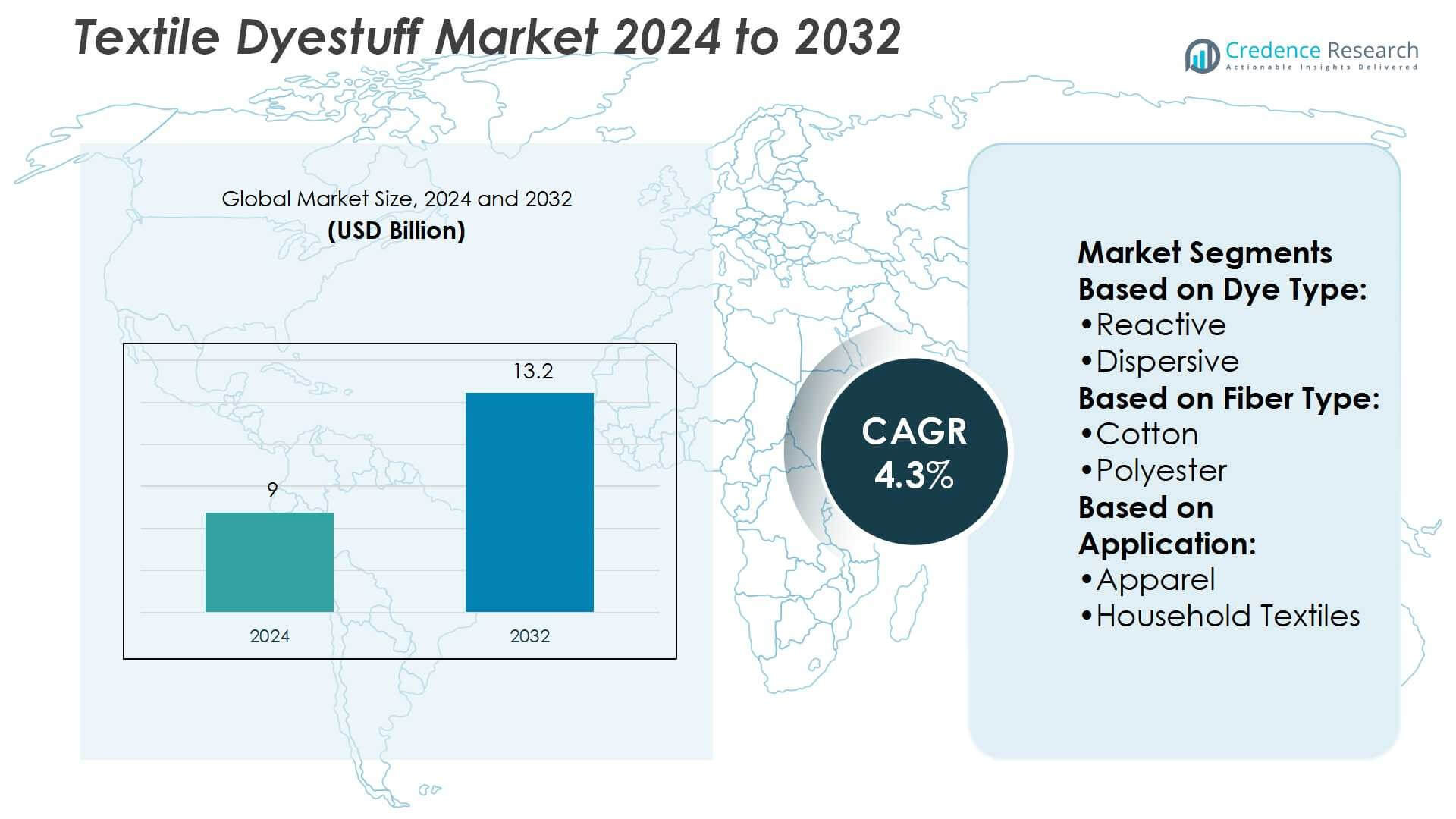

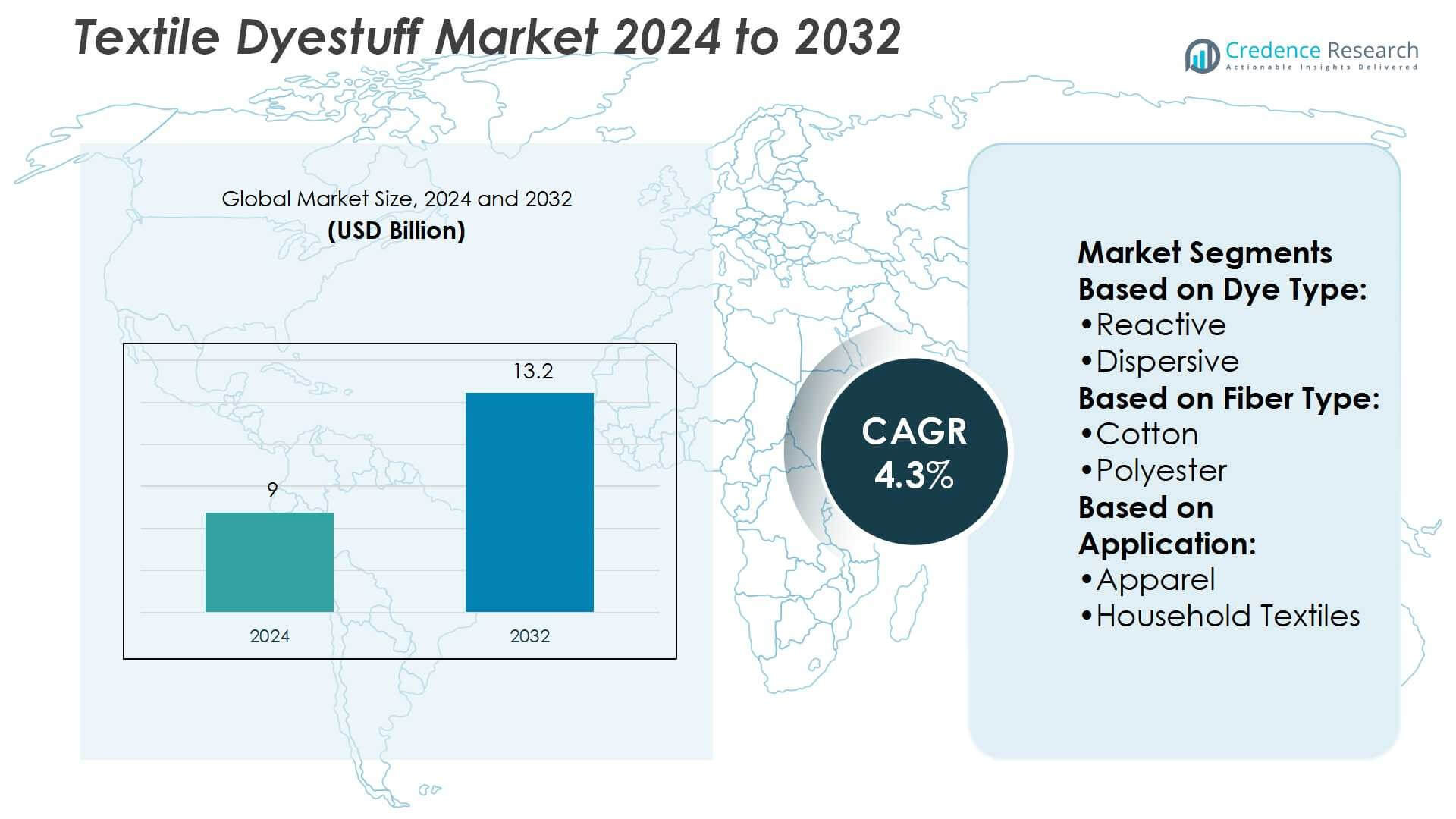

Textile Dyestuff Market size was valued USD 9 billion in 2024 and is anticipated to reach USD 13.2 billion by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Textile Dyestuff Market Size 2024 |

USD 9 Billion |

| Textile Dyestuff Market, CAGR |

4.3% |

| Textile Dyestuff Market Size 2032 |

USD 13.2 Billion |

The textile dyestuff market features strong competition from global leaders including LANXESS AG, Huntsman Corporation, Zhejiang Longsheng Group Co., Ltd., DuPont, Archroma International, Sumitomo Chemical Co. Ltd., Kiri Industries Ltd., BASF SE, Dystar Group, and Allied Industrial Corp., Ltd. These companies focus on innovation, eco-friendly formulations, and advanced dyeing technologies to meet evolving sustainability standards and consumer preferences. Asia-Pacific emerges as the leading region, holding a 42% market share, driven by its extensive textile manufacturing base in China, India, and Bangladesh. Cost advantages, strong export demand, and government support reinforce the region’s dominance, positioning it as the global hub for textile dyestuff production and consumption.

Market Insights

Market Insights

- The Textile Dyestuff Market was valued at USD 9 billion in 2024 and is projected to reach USD 13.2 billion by 2032, growing at a CAGR of 4.3%.

- Market growth is driven by rising demand for eco-friendly dyes, stricter environmental regulations, and increasing use of reactive and dispersive dyes in cotton and polyester applications.

- Key trends include the adoption of digital textile printing, specialty functional dyes, and sustainable formulations, with leading players investing in R&D to align with global sustainability goals.

- The market faces restraints from volatile raw material prices and high compliance costs linked to wastewater treatment and regulatory standards, which pressure smaller manufacturers.

- Asia-Pacific leads with a 42% share due to large-scale textile hubs, while Europe holds 21% and North America 18%; apparel accounts for 50% of application share, followed by household textiles and industrial fabrics, reinforcing strong demand across both consumer and technical textile sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Dye Type

Reactive dyes dominate the textile dyestuff market with the largest share, exceeding 35%. Their popularity stems from high wash fastness, bright shades, and versatility with cellulose fibers like cotton and viscose. Rising demand for eco-friendly and durable clothing drives adoption, as reactive dyes require less water and energy in processing. Expanding textile industries in Asia-Pacific further support this sub-segment, as manufacturers seek cost-effective solutions that align with sustainability standards and provide long-lasting color performance across diverse apparel categories.

- For instance, LANXESS AG operates a Bayferrox inorganic pigments plant in Ningbo, China, which has a production capacity of 25,000 metric tons per year, producing high-performance iron oxide red pigments.

By Fiber Type

Cotton leads the fiber type segment, holding over 40% of the market share. This dominance reflects cotton’s global use in apparel, home furnishings, and industrial fabrics. The natural fiber’s comfort, breathability, and dye absorption capability enhance its compatibility with various dye types, particularly reactive dyes. Growth in fast fashion and casual wear accelerates cotton consumption, especially in emerging markets. Rising consumer preference for natural and sustainable fibers reinforces the need for high-performance dyestuffs that deliver vibrant colors and resist fading in frequent wash cycles.

- For instance, Seiko Epson has advanced digital textile printing with machines like the Monna Lisa ML-24000. The ML-24000 uses 24 PrecisionCore printheads and 12 ink colours to support printing on natural, synthetic, and vegetable-based fibres.

By Application

Apparel is the dominant application segment, accounting for nearly 50% of the textile dyestuff market. Demand stems from rising global fashion trends, increased disposable incomes, and the expansion of e-commerce platforms. Fashion brands emphasize vibrant colors, advanced finishes, and eco-friendly dyes to meet evolving consumer expectations. Activewear and sportswear further fuel growth due to the requirement for durable, colorfast fabrics. The sector benefits from technological innovations in dyeing methods, enabling manufacturers to reduce environmental impact while maintaining high-quality color consistency across mass-produced garments.

Key Growth Drivers

Rising Demand for Sustainable and Eco-Friendly Textiles

Growing environmental awareness and stricter regulations push textile manufacturers to adopt eco-friendly dyes. Reactive and low-impact dyes reduce water usage and chemical discharge, supporting sustainable production. Consumers increasingly prefer fabrics colored with safe, biodegradable dyestuffs, especially in developed markets. Governments also promote green textile initiatives, further accelerating demand. This shift creates opportunities for suppliers to expand eco-certified product lines, positioning sustainable dyestuffs as a long-term growth driver in apparel, home textiles, and industrial fabrics across global markets.

- For instance, Mimaki launched the Tx330-1800 / Tx330-1800B direct textile printers that operate in an “almost waterless” printing mode, eliminating most water usage in the printing process itself.

Expansion of the Apparel and Fashion Industry

The apparel industry remains the largest consumer of dyestuffs, driven by fast fashion, sportswear, and casualwear trends. Rising disposable incomes and e-commerce growth increase demand for vibrant, colorfast fabrics. Brands prioritize innovative designs and rapid color updates to match shifting consumer preferences, boosting dye consumption. Polyester and cotton fabrics, in particular, require advanced dyestuffs to achieve durability and visual appeal. The continuous expansion of global fashion supply chains ensures consistent demand, positioning apparel as a critical growth driver for the textile dyestuff market.

- For instance, Kornit Digital’s the Apollo’s high throughput of up to 400 impressions per hour is achieved using Kornit’s MAX Technology.The maximum print area for the Apollo is explicitly stated as 20″ x 20″ (50.8 cm x 50.8 cm) in the technical specifications on Kornit’s website.

Rapid Growth of Textile Manufacturing in Asia-Pacific

Asia-Pacific dominates textile production, with countries like China, India, Bangladesh, and Vietnam leading exports. Cost advantages, availability of raw materials, and skilled labor strengthen the region’s role in global supply. Rising domestic consumption and foreign investments in textile infrastructure further expand dye usage. The presence of large-scale cotton and polyester processing facilities supports higher demand for reactive and dispersive dyes. As regional governments promote manufacturing and export growth, Asia-Pacific solidifies its position as the central hub driving global textile dyestuff market expansion.

Key Trends & Opportunities

Adoption of Digital and Smart Dyeing Technologies

Technological innovation transforms the dyestuff market, with digital printing and smart dyeing gaining traction. Digital textile printing requires less water, energy, and dye compared to traditional processes, aligning with sustainability goals. It also allows customization, shorter runs, and faster time-to-market, benefiting fashion brands. Smart dyeing technologies enhance process efficiency and reduce resource waste. As textile producers modernize facilities to meet rising efficiency demands, the adoption of these technologies presents a major growth opportunity for dyestuff suppliers catering to advanced manufacturing needs.

- For instance, Roland DG, in a joint venture with Veika (DG Dimense), offers the DA-640 wide-format dimensional surface printer. This printer uses a newly developed structural ink and specialized media which expands up to 2 mm in thickness with heat, producing full-color prints with integrated embossed textures.

Rising Preference for Specialty and Functional Dyestuffs

Demand for specialty dyes, including UV-resistant, antibacterial, and flame-retardant variants, is increasing. These functional dyestuffs cater to industrial textiles, sportswear, medical fabrics, and technical applications requiring performance beyond aesthetics. Growing sectors such as protective clothing and healthcare textiles rely on these specialized formulations. Rising interest in multifunctional fabrics creates opportunities for dyestuff manufacturers to innovate and differentiate offerings. Suppliers investing in advanced R&D to deliver high-performance and application-specific solutions can capture new growth avenues across both developed and emerging textile markets.

- For instance, SPGPrints manufactures the YTTRIUM laser exposure system, which supports a resolution of up to 5080 dpi on RotaMesh screens sized up to 1100 mm in width. This high-precision system is designed for applications requiring very fine detailing, such as printed electronics and high-resolution label printing.

Key Challenges

Volatility in Raw Material Prices

The dyestuff market faces challenges from fluctuations in raw material prices, particularly petrochemical derivatives used in dye production. Price instability increases manufacturing costs and pressures profit margins for producers. Smaller suppliers are more vulnerable, as they lack economies of scale to absorb cost variations. Such volatility disrupts supply chains and raises dye prices, impacting textile manufacturers’ cost structures. Managing raw material procurement and diversifying supply sources remain critical strategies for industry players to maintain stability and competitiveness in volatile markets.

Stringent Environmental Regulations and Compliance Costs

Global regulations addressing water pollution and chemical waste disposal pose significant challenges for dyestuff producers. Traditional dyeing processes generate high effluents, forcing manufacturers to invest in costly treatment facilities and compliance systems. Companies failing to meet environmental standards risk losing certifications and access to key markets. These compliance costs hinder profitability, especially for smaller players. The challenge lies in balancing regulatory adherence with cost efficiency, pushing the industry toward sustainable innovation and greener technologies while maintaining competitiveness in a highly regulated environment.

Regional Analysis

North America

North America leads the textile dyestuff market with an 18% share, supported by strong demand from the United States and Mexico. The region benefits from advanced textile production, particularly in apparel, sportswear, and home furnishings. High-performance fabrics requiring colorfast and durable dyes remain a key driver. Sustainability commitments from global fashion brands accelerate adoption of eco-friendly formulations. Industrial applications, including protective clothing and automotive textiles, also strengthen specialty dye demand. With rising adoption of digital dyeing technologies and innovation-driven suppliers, North America maintains steady growth while aligning with evolving consumer expectations and regulatory standards.

Europe

Europe holds a 21% share of the textile dyestuff market, driven by sustainability-focused regulations and premium textile demand. Germany, Italy, and France anchor regional growth, emphasizing eco-friendly and low-impact dyestuffs. Specialty and functional textiles, such as antibacterial and flame-retardant fabrics, are gaining prominence. The adoption of digital textile printing supports efficiency, customization, and reduced resource consumption. Premiumization in apparel and household fabrics also boosts demand for high-quality dyes. Europe continues to position itself as an innovation hub, setting benchmarks for sustainable practices and advanced dyeing technologies, while maintaining steady growth across apparel and technical textiles.

Asia-Pacific

Asia-Pacific dominates the textile dyestuff market with a 42% share, reflecting its role as the global manufacturing hub. China, India, Bangladesh, and Vietnam drive production, supported by low labor costs and abundant raw materials. Cotton and polyester processing lead to high demand for reactive and dispersive dyes. Rising disposable incomes and urbanization fuel consumption in fast fashion and household textiles. Export-oriented growth strategies and government incentives further strengthen the region’s position. With increasing investment in sustainable and efficient dyeing methods, Asia-Pacific is set to maintain its leadership and expand its global market influence.

Latin America

Latin America accounts for 9% of the textile dyestuff market, led by Brazil and Mexico. Rising urban populations and demand for affordable apparel drive market expansion. Cotton is the dominant fiber, resulting in significant use of reactive dyes. Integration into global fashion supply chains is increasing, supporting higher dye consumption. However, dependence on imports and limited dyeing infrastructure pose challenges for regional producers. Despite these barriers, modernization of textile facilities and rising consumer interest in sustainable fabrics create opportunities for suppliers to strengthen their presence in Latin America’s growing textile industry.

Middle East & Africa

The Middle East & Africa region holds a 10% share of the textile dyestuff market, with Turkey, Egypt, and South Africa contributing significantly. Expanding textile production and growing apparel exports support demand for reactive and dispersive dyes. Polyester and cotton remain the dominant fibers used across regional industries. Government-led diversification and investment initiatives strengthen the sector’s capacity. Yet, reliance on imported dyes and underdeveloped infrastructure present persistent challenges. Despite these factors, rising demand for affordable textiles and adoption of sustainable dyeing technologies highlight the region’s long-term growth potential in the global dyestuff market.

Market Segmentations:

By Dye Type:

By Fiber Type:

By Application:

- Apparel

- Household Textiles

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Textile Dyestuff Market players such as LANXESS AG (Germany), Huntsman Corporation (U.S.), Zhejiang Longsheng Group Co., Ltd. (China), DuPont (U.S.), Archroma International (Switzerland), Sumitomo Chemical Co. Ltd. (Japan), Kiri Industries Ltd. (India), BASF SE (Germany), Dystar Group (Singapore), and Allied Industrial Corp., Ltd. (Taiwan). The textile dyestuff market is highly competitive, characterized by continuous innovation, sustainability initiatives, and global expansion strategies. Companies focus on developing eco-friendly formulations that align with stringent environmental regulations and growing consumer demand for sustainable textiles. Advancements in digital dyeing and specialty dyestuffs enhance efficiency, customization, and performance across diverse applications. Market players emphasize research and development to introduce high-quality, multifunctional solutions that cater to apparel, home textiles, and industrial fabrics. Strong distribution networks and strategic collaborations further support global supply reliability. The competitive landscape reflects a balance between cost-effective large-scale production in Asia and premium, innovation-driven solutions in Europe and North America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LANXESS AG (Germany)

- Huntsman Corporation (U.S.)

- Zhejiang Longsheng Group Co., Ltd. (China)

- DuPont (U.S.)

- Archroma International (Switzerland)

- Sumitomo Chemical Co. Ltd. (Japan)

- Kiri Industries Ltd. (India)

- BASF SE (Germany)

- Dystar Group (Singapore)

- Allied Industrial Corp., Ltd. (Taiwan)

Recent Developments

- In March 2025, Archroma launched AVITERA® RASPBERRY SE dye, offering deeper red shades with up to 50% reduced water and energy use, supporting sustainable textile dyeing practices.

- In January 2025, Roland DG Corporation launched the TY-300 direct-to-film production transfer printer. The TY-300 offers superior image quality, high productivity, and outstanding cost efficiency, delivering vibrant colors and intricate details essential for the apparel industry.

- In January 2024, Epson unveiled a new addition to the SureColor F-Series, a direct-to-garment (DTG) printer. This versatile, entry-level printer is engineered to cater to the needs of garment decorators, entrepreneurs, artisan businesses, and print service providers, offering a variety of DTG and direct-to-film (DTFilm) printing applications.

- In January 2024, Agfa partnered with EFI, a global technology company, to combine their advanced technologies. As part of the collaboration, Agfa integrated EFI’s roll-to-roll system into its product lineup, while EFI incorporated Agfa’s hybrid inkjet printers into its solutions.

Report Coverage

The research report offers an in-depth analysis based on Dye Type, Fiber Type, Appplication and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for eco-friendly and sustainable dye solutions.

- Digital textile printing will drive adoption of advanced and efficient dyestuff formulations.

- Specialty dyes for functional textiles will gain traction across healthcare, automotive, and protective fabrics.

- Asia-Pacific will maintain dominance due to large-scale textile manufacturing and export growth.

- Europe will strengthen its position with premium, sustainable, and innovation-driven dye products.

- North America will see steady growth fueled by sportswear, home textiles, and industrial applications.

- Investments in R&D will accelerate development of low-impact, biodegradable, and high-performance dyestuffs.

- Regulatory pressure will push manufacturers toward greener technologies and closed-loop dyeing systems.

- Strategic partnerships and mergers will reshape competition and expand global distribution networks.

- Consumer preference for vibrant, durable, and ethically produced fabrics will continue to shape market demand.

Market Insights

Market Insights