Market Overview

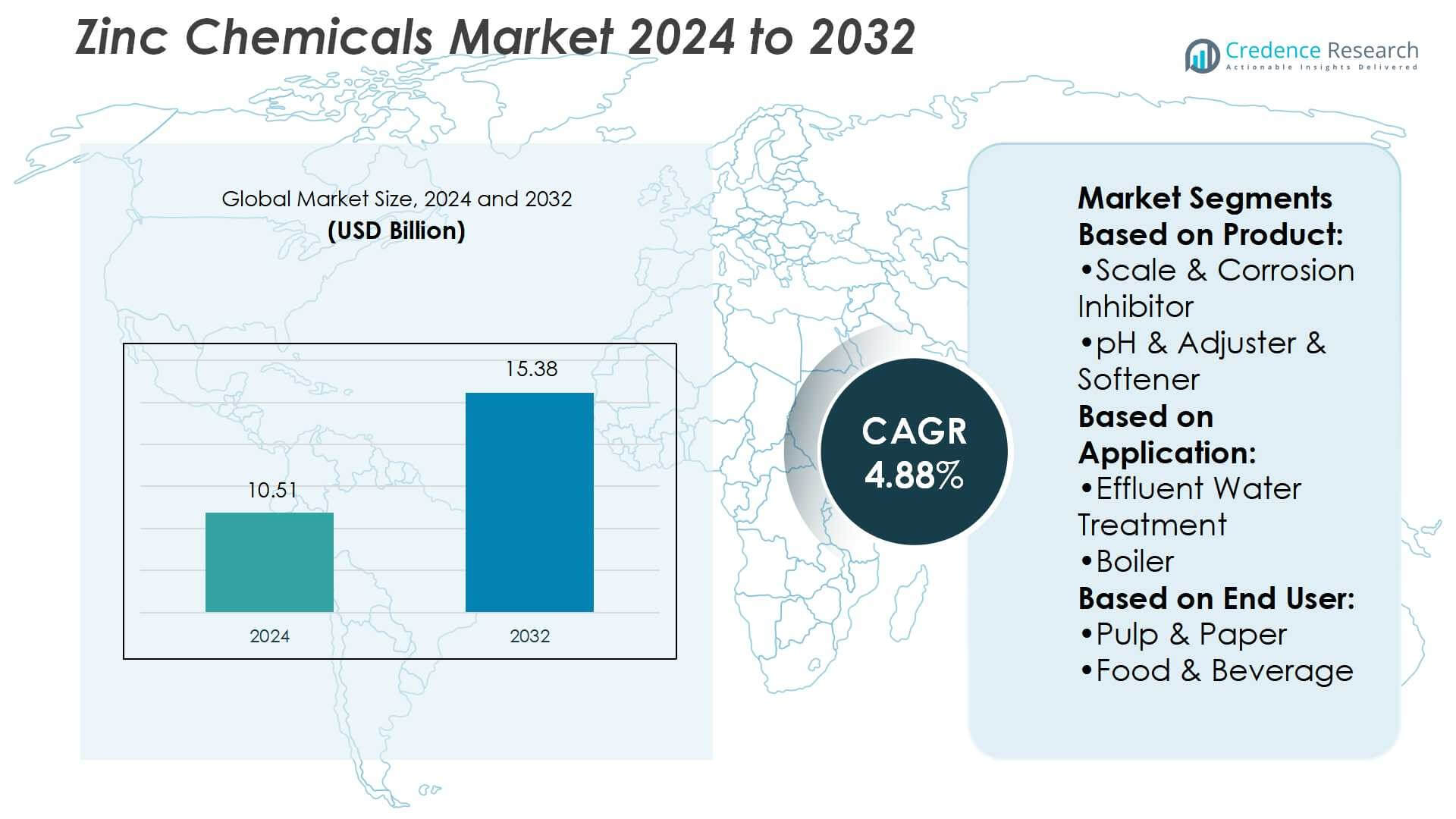

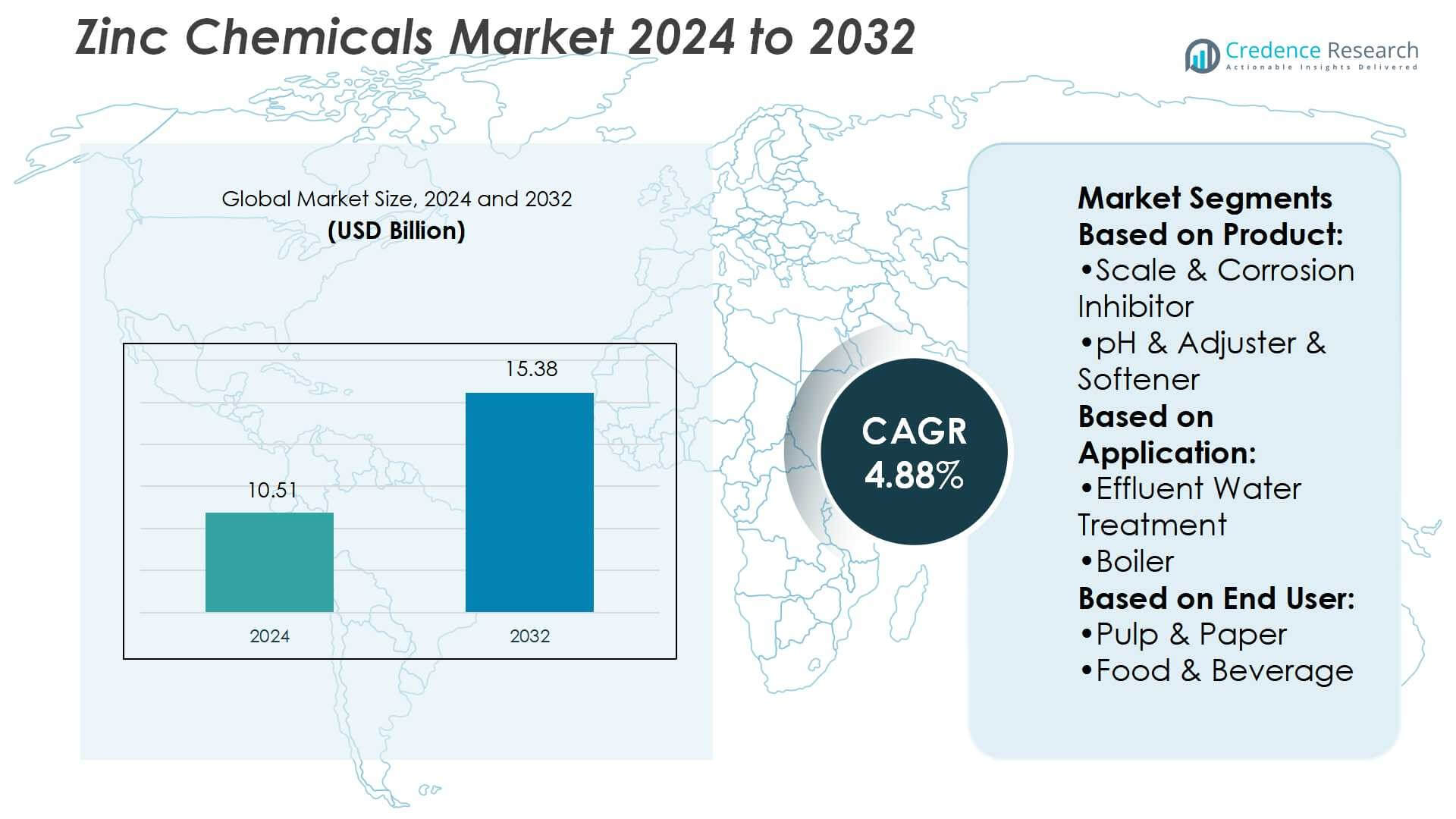

Zinc Chemicals Market size was valued USD 10.51 billion in 2024 and is anticipated to reach USD 15.38 billion by 2032, at a CAGR of 4.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Zinc Chemicals Market Size 2024 |

USD 10.51 Billion |

| Zinc Chemicals Market, CAGR |

4.88% |

| Zinc Chemicals Market Size 2032 |

USD 15.38 Billion |

The zinc chemicals market is highly competitive, with top players such as Cortec Corporation, Kurita Europe GmbH, Johnson Matthey, Bosch Somicon ME FZC, Kemira Oyj, Veolia, Nouryon, Baker Hughes, a GE company LLC, Solvay S.A., and Green Water Treatment Solutions driving industry growth through product innovation and sustainable solutions. These companies focus on strengthening their portfolios in water treatment, industrial applications, and eco-friendly formulations to meet rising global demand. Asia-Pacific leads the market with a 34% share, supported by rapid industrialization, urbanization, and significant investments in municipal water infrastructure and industrial expansion across China, India, and Southeast Asia.

Market Insights

- The Zinc Chemicals Market was valued at USD 10.51 billion in 2024 and is projected to reach USD 15.38 billion by 2032, growing at a CAGR of 4.88%.

- Rising demand for water treatment solutions in municipal and industrial sectors remains a key driver, supported by strict regulations on wastewater management and safe sanitation.

- Growing focus on sustainable and eco-friendly formulations is shaping market trends, with companies investing in advanced solutions to reduce environmental impact.

- The market is highly competitive, with players enhancing portfolios across water treatment, industrial applications, and food processing, while raw material price fluctuations act as a major restraint.

- Asia-Pacific leads with a 34% share due to industrialization and urbanization, followed by North America at 28% and Europe at 25%, while the biocides and disinfectants segment dominates product demand, and the municipal sector holds the highest end-user share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The biocide and disinfectant sub-segment dominates the zinc chemicals market, accounting for the largest share. Its growth is driven by increasing demand for water treatment solutions in industrial and municipal sectors, as these chemicals effectively control harmful microorganisms and improve safety standards. Rising regulatory emphasis on maintaining hygiene in public utilities and food processing further supports adoption. Other sub-segments, such as pH adjusters and softeners, also contribute steadily, but the focus on microbial control ensures biocides remain the leading product segment in revenue contribution.

- For instance, EverZinc processes about 40% zinc units from secondary sources EverZinc states on its website that more than 40% of the zinc units processed come from secondary sources.

By Application

Effluent water treatment represents the dominant application, holding the highest market share in the zinc chemicals industry. This leadership stems from stricter environmental regulations on wastewater discharge and the growing need for sustainable treatment processes. Industrial facilities increasingly rely on zinc-based solutions to neutralize contaminants and meet compliance standards. Rapid urbanization and the expansion of industrial hubs add further momentum. While applications in boiler and cooling systems are expanding, effluent treatment continues to attract the bulk of demand due to its critical environmental role.

- For instance, Zochem furnishes zinc oxide powders and pellets with purities of 99.9% and above, offering specific surface areas in the range of 2.7 m²/g to 10.0 m²/g for tailored application needs.

By End-User

The municipal sector holds the largest market share among end-users, supported by consistent investments in public water infrastructure and sanitation projects. Growing populations in urban centers require advanced water treatment solutions, boosting zinc chemical consumption. Governments focus on safe water supply and compliance with wastewater treatment norms, reinforcing municipal demand. While industries like pulp and paper, mining, and oil and gas also contribute significantly, municipal projects remain the primary revenue generator. This dominance is expected to persist as global emphasis on sustainable urban water management intensifies.

Key Growth Drivers

Rising Demand for Water Treatment

The zinc chemicals market benefits significantly from increasing demand in water treatment applications. Stringent environmental regulations and growing urbanization drive the adoption of zinc-based chemicals for effluent treatment, boiler systems, and municipal water projects. Their role in neutralizing contaminants, controlling microorganisms, and ensuring safe water supply makes them essential in industrial and public utilities. Investments in infrastructure modernization further strengthen growth prospects. As governments enforce stricter wastewater discharge standards, zinc chemicals are positioned as critical solutions for compliance and sustainable water management practices.

- For instance, Zochem, formerly known as Zinc Oxide LLC, produces high-purity French Process zinc oxide powders and pellets with purities of 99.9% and above. The company offers a range of specific surface areas, from 2.7 m²/g to 10.0 m²/g, to meet diverse application needs.

Expanding Industrial Applications

Zinc chemicals are widely utilized across diverse industries, including pulp and paper, mining, oil and gas, and chemical manufacturing. Their functional roles as corrosion inhibitors, pH adjusters, and disinfectants make them integral to industrial operations. Rapid industrialization in emerging economies is fueling demand for these chemicals, particularly in regions with growing infrastructure projects and energy-intensive sectors. Rising adoption of zinc-based products in process optimization and equipment protection continues to boost market revenue. This broad industrial footprint ensures consistent long-term demand growth across multiple verticals.

- For instance, SUEZ detected & repaired more than 120,000 leaks (including 40,000 in France) across 140,000 km of pipes globally, saving 65 million cubic metres of water over a 2-year span.

Growth in Food and Beverage Sector

The food and beverage sector increasingly relies on zinc chemicals for sanitation and process water treatment. Rising global consumption of packaged and processed foods demands higher hygiene standards, which drives the use of zinc-based biocides and disinfectants. The industry’s focus on quality control, safety compliance, and prevention of microbial contamination supports stable demand. Regulatory pressure to ensure food-grade water quality further accelerates adoption. As consumer preferences shift toward convenience foods and beverages, zinc chemicals remain critical to maintaining production efficiency and product safety standards.

Key Trends & Opportunities

Increasing Focus on Sustainable Solutions

Sustainability is emerging as a key trend, with industries and municipalities seeking eco-friendly water treatment chemicals. Zinc chemicals align with this shift by offering effective contaminant control and compatibility with green treatment technologies. Companies are investing in product innovation to enhance biodegradability and reduce environmental impact. This focus creates strong opportunities for market expansion, particularly in regions with strict environmental frameworks. Growing public awareness of water conservation and safe sanitation reinforces zinc chemicals as preferred solutions for sustainable resource management.

- For instance, The company sources over 1,000 megawatts of purchased electricity from renewable energy to power its operations. More than 89% of Dow’s R&D innovation pipeline is dedicated to climate protection, circular economy, and safer materials.

Rising Adoption in Emerging Economies

Emerging economies present major growth opportunities due to rapid industrialization and infrastructure development. Expanding urban centers in Asia-Pacific, Latin America, and Africa face increasing demand for reliable water treatment solutions. Governments in these regions are investing heavily in municipal water projects, boosting zinc chemical consumption. Industrial sectors such as mining, pulp and paper, and chemical processing also rely on zinc-based solutions to meet operational needs. With rising disposable incomes and industrial growth, emerging markets are expected to significantly contribute to the industry’s future revenue.

- For instance, Lenntech’s ultrafiltration plants using hollow-fiber outside-in membranes can treat flows up to 100 m³/h for surface water, achieving turbidity below 50 NTU with flux around 45 LMH.

Key Challenges

Fluctuating Raw Material Prices

The zinc chemicals market faces challenges due to volatile raw material costs, particularly zinc ore. Price instability impacts manufacturing expenses and supply chain predictability, reducing profitability for producers. Global economic uncertainties, mining restrictions, and trade policies further exacerbate fluctuations. Smaller players often struggle to absorb rising costs, leading to competitive pressure and reduced margins. Ensuring stable supply contracts and diversifying sourcing strategies remain critical for manufacturers. This challenge can limit long-term growth potential unless supply chain risks are effectively managed by market participants.

Stringent Environmental Regulations

While demand for water treatment solutions grows, compliance with stringent environmental regulations poses challenges for zinc chemical producers. Concerns over chemical disposal, safe handling, and potential ecological impacts require costly upgrades in production and waste management practices. Manufacturers must invest in advanced technologies to meet evolving standards, which raises operational costs. Failure to comply can result in penalties and reputational risks. Although these regulations create opportunities for sustainable innovation, they also pressure companies to balance compliance with cost efficiency, affecting overall market competitiveness.

Regional Analysis

North America

North America holds a 28% market share in the zinc chemicals market, driven by strong demand across municipal water treatment, oil and gas, and food processing industries. The U.S. leads regional growth, supported by regulatory mandates for wastewater treatment and safe sanitation. Industrial expansion and upgrades in water infrastructure fuel adoption of zinc-based biocides, disinfectants, and corrosion inhibitors. Canada contributes steadily through its pulp and paper industry, while Mexico shows rising demand in food and beverage applications. The region’s mature industrial base and regulatory enforcement ensure sustained consumption of zinc chemicals over the forecast period.

Europe

Europe accounts for a 25% share of the zinc chemicals market, supported by stringent environmental standards and advanced industrial applications. Countries such as Germany, France, and the U.K. drive demand, particularly in municipal water treatment and chemical manufacturing. The pulp and paper sector also contributes significantly, while energy-efficient power generation plants rely on zinc-based corrosion inhibitors. Ongoing EU initiatives on wastewater treatment and sustainability strengthen adoption. Eastern Europe is experiencing growing demand from mining and food industries. With regulatory pressure on water quality, Europe maintains its position as a leading market for zinc chemicals.

Asia-Pacific

Asia-Pacific dominates the zinc chemicals market with a 34% share, led by rapid industrialization, urbanization, and strong investment in water treatment projects. China and India drive demand through large-scale municipal initiatives and industrial sectors such as mining, pulp and paper, and chemical processing. Rising disposable incomes and growth in packaged foods further expand applications in the food and beverage sector. Southeast Asia shows increasing adoption in cooling and boiler systems. Strong government support for sustainable water infrastructure ensures continued growth, making Asia-Pacific the fastest-growing and most influential regional market for zinc chemicals globally.

Latin America

Latin America represents an 8% share of the zinc chemicals market, primarily fueled by mining, pulp and paper, and municipal water treatment. Brazil leads demand, supported by its vast industrial base and investments in wastewater treatment infrastructure. Mexico and Chile also contribute significantly, driven by mining and food processing applications. Although the region faces infrastructure challenges, rising urban populations and government-led sanitation initiatives encourage adoption. Expanding industrial sectors are likely to sustain growth, with opportunities emerging in chemical manufacturing. The region’s increasing focus on water quality and compliance strengthens zinc chemical demand steadily.

Middle East & Africa

The Middle East & Africa account for a 5% market share in the zinc chemicals market, with growth supported by municipal water projects, oil and gas operations, and desalination initiatives. The Gulf countries, particularly Saudi Arabia and the UAE, invest heavily in advanced water treatment and power generation systems, driving demand for zinc-based products. In Africa, South Africa leads adoption through mining and municipal projects, while other nations show gradual uptake due to infrastructure gaps. Growing pressure on water resources and reliance on desalination present opportunities for zinc chemicals in this region’s long-term expansion.

Market Segmentations:

By Product:

- Scale & Corrosion Inhibitor

- pH & Adjuster & Softener

By Application:

- Effluent Water Treatment

- Boiler

By End User:

- Pulp & Paper

- Food & Beverage

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The zinc chemicals market features players including Cortec Corporation, Kurita Europe GmbH, Johnson Matthey, Bosch Somicon ME FZC, Kemira Oyj, Veolia, Nouryon, Baker Hughes, a GE company LLC, Solvay S.A., and Green Water Treatment Solutions. The zinc chemicals market is characterized by intense competition, with companies focusing on innovation, sustainability, and product differentiation to maintain a strong position. Market participants are investing in advanced water treatment solutions, eco-friendly formulations, and process optimization to address rising environmental regulations and growing industrial demand. Expansion into emerging economies is a key strategy, supported by infrastructure development and increasing municipal investments in water treatment. Firms are also emphasizing operational efficiency, cost optimization, and technological advancements to enhance product performance. With demand spanning diverse sectors such as municipal, industrial, and food processing, competition continues to intensify globally.

Key Player Analysis

- Cortec Corporation

- Kurita Europe GmbH

- Johnson Matthey

- Bosch Somicon ME FZC

- Kemira Oyj

- Veolia

- Nouryon

- Baker Hughes, a GE company LLC

- Solvay S.A.

- Green Water Treatment Solutions

Recent Developments

- In March 2025, DuPont Water Solutions today launched WAVE PRO, a powerful online modeling tool for a variety of ultrafiltration (UF) water treatment applications, including drinking water, industrial utility water, wastewater, and seawater desalination.

- In March 2025, Whitewater Management, a market-leading fluid management company, announced its purchase of Orion Water Solutions, a pioneer in advanced wastewater treatment solutions.

- In July 2024, Kurita America, part of the Kurita Group, a leading global provider of industrial water treatment solutions, announced a collaboration with Solugen, a bio-based chemical manufacturer, to develop a suite of new carbon-negative water treatment products.

- In April 2024, Gradiant, a global solutions provider for advanced water and wastewater treatment, announced the launch of CURE Chemicals. Continuing Gradiant’s track record of innovation and commercialization, CURE Chemicals will set new benchmarks in environmental sustainability and operational efficiency for the world’s essential industries.

- In January 2023, Kemira, a chemical solutions provider for water-intensive industries, completed the full acquisition of SimAnalytics. This strategic move enhances Kemira’s ability to provide data-driven predictive services and machine learning solutions to support its customers’ businesses effectively.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The zinc chemicals market will expand steadily with rising demand in water treatment.

- Industrial growth will continue to drive adoption across mining, pulp and paper, and oil and gas.

- Municipal applications will remain the largest consumer due to urban water infrastructure investments.

- Food and beverage sectors will increase usage for sanitation and process water treatment.

- Sustainability will push companies to develop eco-friendly and efficient zinc-based formulations.

- Emerging economies will provide strong growth opportunities through rapid industrialization and urbanization.

- Advanced product innovation will improve performance in corrosion inhibition and microbial control.

- Strategic partnerships and mergers will strengthen global supply chains and market presence.

- Regulatory frameworks will shape production standards and accelerate adoption of compliant solutions.

- Increasing focus on resource efficiency will reinforce zinc chemicals’ role in sustainable industries.