Market Overview

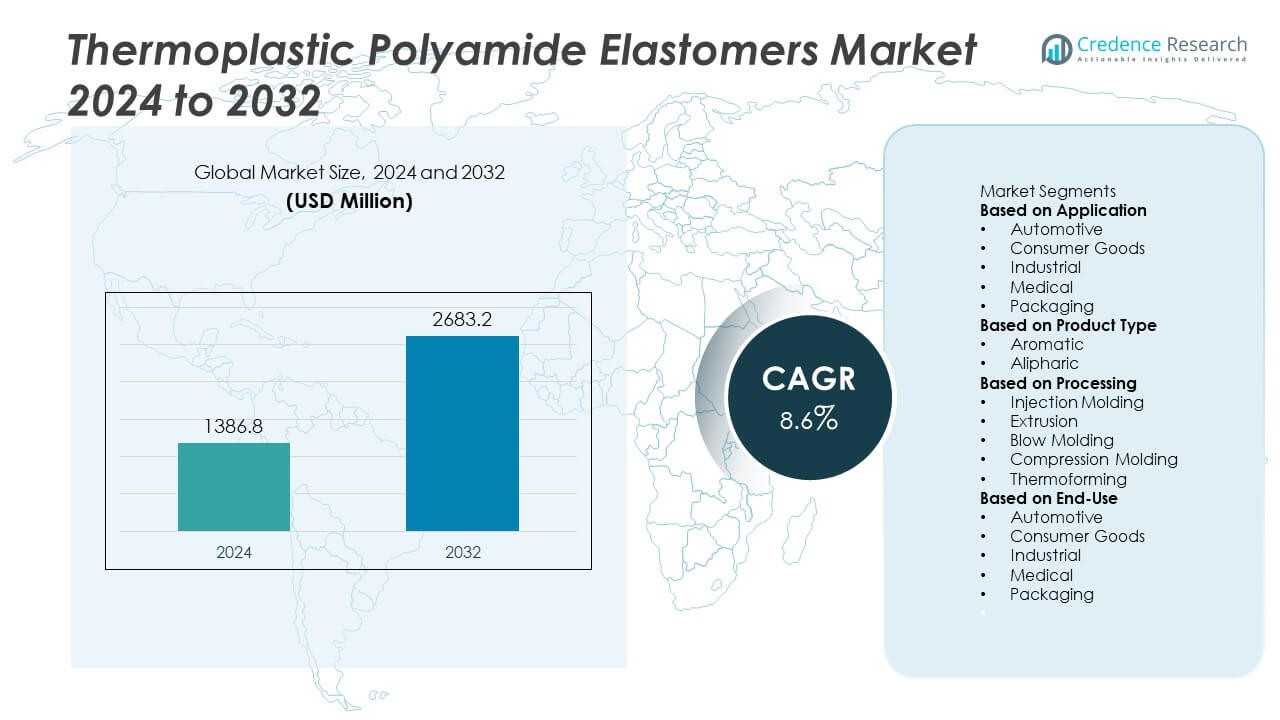

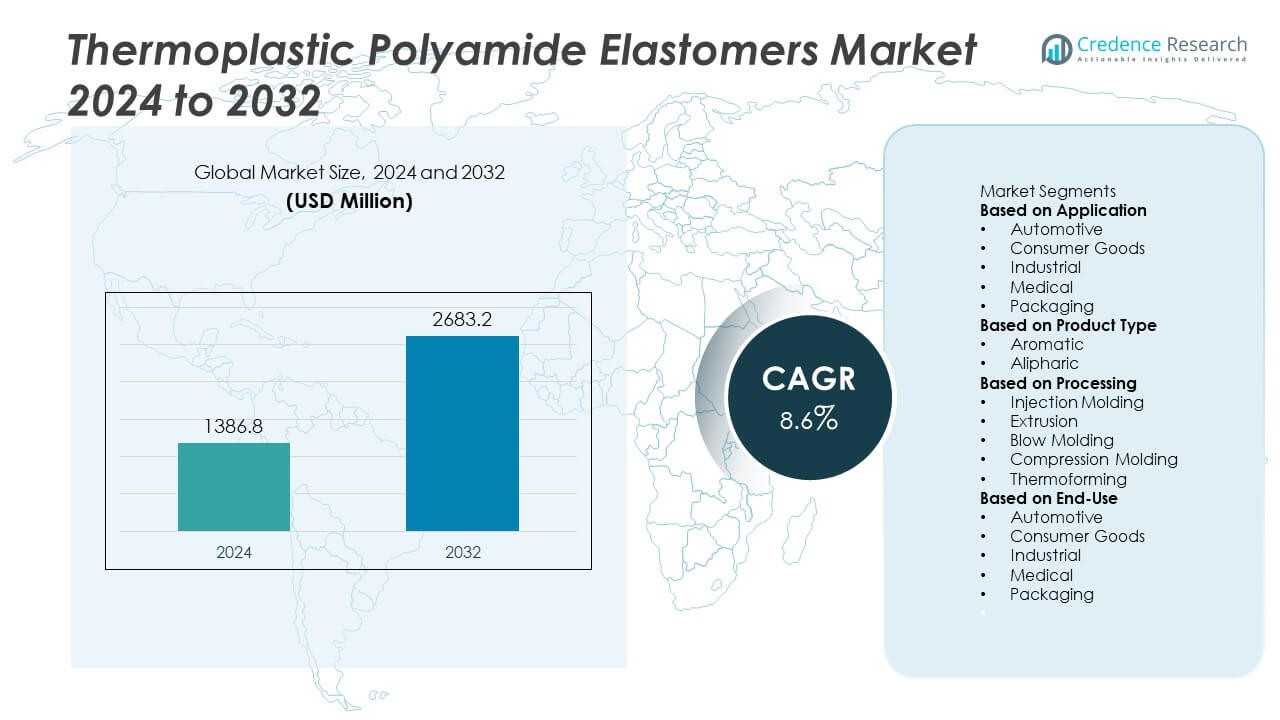

The global thermoplastic polyamide elastomers market was valued at USD 1,386.8 million in 2024 and is projected to reach USD 2,683.2 million by 2032, expanding at a CAGR of 8.6% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Thermoplastic Polyamide Elastomers Market Size 2024 |

USD 1,386.8 Million |

| Thermoplastic Polyamide Elastomers Market, CAGR |

8.6% |

| Thermoplastic Polyamide Elastomers Market Size 2032 |

USD 2,683.2 Million |

The Thermoplastic Polyamide Elastomers Market grows on rising demand for lightweight, durable, and chemical-resistant materials in automotive, electronics, and industrial applications. Regulatory pressure for fuel efficiency and sustainability drives adoption in vehicle components, EV systems, and recyclable product designs.

The Thermoplastic Polyamide Elastomers Market shows strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each driven by distinct industrial strengths and end-user demand. North America benefits from advanced automotive, aerospace, and medical sectors with high adoption of performance polymers. Europe emphasizes sustainable materials and high-precision manufacturing in automotive, sports equipment, and electronics. Asia-Pacific leads in large-scale production, driven by expanding automotive, consumer goods, and electronics manufacturing hubs in China, Japan, and South Korea. Latin America and the Middle East & Africa experience growing usage in automotive modernization, industrial equipment, and infrastructure projects. Key players shaping the market include Mitsubishi Chemical, known for advanced material innovations, Solvay, recognized for specialty polymer expertise, and LG Chem, leveraging large-scale production capabilities. SABIC also remains influential with its diversified polymer portfolio and strong presence in multiple high-growth regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Thermoplastic Polyamide Elastomers Market was valued at USD 1,386.8 million in 2024 and is projected to reach USD 2,683.2 million by 2032, growing at a CAGR of 8.6% during the forecast period.

- Demand rises on the back of lightweight, chemical-resistant, and durable materials for automotive, electronics, consumer goods, and industrial applications, supported by sustainability-focused regulations and EV adoption.

- Key trends include the shift toward bio-based and recyclable grades, integration into electric mobility platforms, use in high-precision medical components, and advancements in processing such as hybrid material compatibility and 3D printing.

- The competitive landscape features global players like Mitsubishi Chemical, Solvay, LG Chem, and SABIC, all investing in R&D to enhance performance properties, expand product lines, and strengthen regional manufacturing capabilities.

- Market restraints include high production costs, raw material price volatility, performance limitations in extreme environments, and the need for specialized processing expertise.

- North America shows strong demand from automotive and medical industries; Europe focuses on sustainable innovation and high-precision manufacturing; Asia-Pacific dominates production and export; Latin America and the Middle East & Africa display emerging growth in automotive, industrial, and infrastructure sectors.

- Future growth opportunities lie in EV systems, renewable energy infrastructure, advanced medical devices, premium consumer goods, and industrial sealing solutions, with innovations in material engineering and processing expanding application potential.

Market Drivers

Rising Adoption in Automotive Light weighting and Performance Applications

The Thermoplastic Polyamide Elastomers Market benefits from growing automotive sector demand for lightweight materials that maintain structural integrity and durability. Automakers use it in under-the-hood components, air ducts, fuel lines, and vibration control systems to reduce vehicle weight and improve fuel efficiency. Its high resistance to chemicals, oils, and temperature fluctuations supports performance in demanding environments. Regulatory pressure to lower CO₂ emissions accelerates the shift toward advanced polymer solutions. The material’s recyclability strengthens its appeal for sustainable manufacturing. Increasing integration into electric vehicle systems further expands its role in modern automotive design.

- For instance, Mitsubishi Chemical’s Trexprene® TPV is a series of Vulcanized PP/EPDM based thermoplastic elastomers (TPEs) that are heat and UV stabilized, ranging in harnesses from 45 Shore A to 50 Shore D.

Expanding Use in High-Performance Consumer Goods and Electronics

Consumer goods and electronics industries drive demand for thermoplastic polyamide elastomers due to their flexibility, abrasion resistance, and aesthetic finish. It serves in wearable devices, sports equipment, and high-durability appliance parts. Manufacturers value its ability to combine soft-touch surfaces with high mechanical strength. Growth in portable electronics production supports broader adoption in protective casings and flexible connectors. The material’s resistance to repeated stress extends product lifespan. Design flexibility enables brand differentiation in competitive consumer markets.

- For instance, TEFABLOC™ incorporates several technologies including TPE-S, TPO, TPE-E, as well as the newly developed non-food bio based TPU.

Growth in Industrial Applications Requiring Chemical and Mechanical Resilience

Industrial sectors such as oil and gas, construction, and machinery adopt thermoplastic polyamide elastomers for seals, gaskets, and tubing. It withstands harsh chemicals, extreme pressures, and temperature variations without performance degradation. Demand for reliable sealing materials in fluid handling and hydraulic systems supports steady consumption. Infrastructure development projects in emerging economies drive requirements for long-life components. Its ease of processing into complex geometries reduces manufacturing costs. The combination of resilience and versatility positions it as a preferred choice in critical applications.

Advancements in Processing Technologies and Sustainability Initiatives

Continuous improvements in extrusion, injection molding, and compounding techniques enhance the processing efficiency of thermoplastic polyamide elastomers. It now offers better consistency, reduced cycle times, and enhanced bonding with other materials. Manufacturers develop bio-based grades to align with sustainability goals and regulatory standards. Recycling initiatives in automotive and electronics industries reinforce material demand. Its adaptability to hybrid material systems broadens design possibilities across sectors. Strategic R&D investments focus on expanding temperature resistance and mechanical performance ranges. These innovations ensure its relevance in evolving industrial and consumer landscapes.

Market Trends

Increasing Shift Toward Bio-Based and Sustainable Material Grades

The Thermoplastic Polyamide Elastomers Market witnesses a steady transition toward bio-based formulations that reduce reliance on fossil-derived feedstocks. It aligns with corporate sustainability targets and regulatory frameworks promoting eco-friendly materials. Manufacturers introduce plant-derived polyamide building blocks without compromising mechanical performance. Brands in automotive, electronics, and consumer goods integrate these sustainable grades to strengthen environmental credentials. Demand rises for closed-loop production systems that enable end-of-life material recovery. This shift positions the material as a viable alternative in circular economy models.

Integration into Electric Vehicle and Advanced Mobility Platforms

Electrification trends create new opportunities for thermoplastic polyamide elastomers in battery housings, cooling lines, and flexible connectors. It delivers high electrical insulation and resistance to thermal cycling critical for EV systems. Lightweight components enhance vehicle efficiency and range performance. Growth in autonomous vehicle development increases requirements for durable sensor housings and flexible wiring protection. The material’s chemical resistance supports long-term reliability in diverse climatic conditions. These factors reinforce its importance in next-generation transportation solutions.

- For instance, LG Chem’s Nexula™ TB aerogel, used as a thermal barrier in EV batteries, withstands temperatures above 1,000 °C, ensuring material stability in extreme thermal environments

Adoption in High-Precision Industrial and Medical Applications

Manufacturers expand the use of thermoplastic polyamide elastomers in medical devices, fluid delivery systems, and precision-engineered parts. It meets stringent biocompatibility and sterilization requirements in healthcare applications. In industrial settings, demand grows for flexible yet robust tubing, gaskets, and diaphragms. The material supports miniaturization trends in equipment without sacrificing strength or durability. Advancements in cleanroom processing enhance quality consistency. Its role in regulated environments underscores its adaptability and reliability.

- For instance, Evonik’s bonding grade VESTAMID® Care ME-B grades cover a range of polyether-block-amides (PEBA) with different flexibility & hardness, which were specially modified to adhere to Daikin Neoflon® EFEP RP-5101 without the need for any adhesive.

Advances in Processing Technology for Complex Geometries and Hybrid Systems

Ongoing innovation in processing techniques allows thermoplastic polyamide elastomers to form intricate designs with consistent mechanical properties. It bonds effectively with metals and other polymers, enabling hybrid material systems. Shorter production cycles improve manufacturing efficiency across industries. Enhanced melt flow properties expand possibilities in thin-wall applications. 3D printing compatibility opens pathways for rapid prototyping and low-volume production runs. These technical advancements broaden its reach into custom-engineered solutions and niche market segments.

Market Challenges Analysis

High Production Costs and Limited Raw Material Availability

The Thermoplastic Polyamide Elastomers Market faces challenges from high production costs linked to specialized polymerization processes and premium raw materials. It requires precise formulation controls, advanced equipment, and energy-intensive manufacturing steps, which elevate overall expenses. Fluctuations in crude oil prices and limited availability of bio-based feedstocks add volatility to material sourcing. Smaller manufacturers encounter barriers in scaling production while maintaining quality consistency. Competitive pressure from lower-cost elastomers limits market penetration in price-sensitive segments. These factors collectively impact profitability and expansion potential.

Technical Performance Limitations in Specific Applications

While thermoplastic polyamide elastomers deliver high performance in many uses, they face constraints in extreme temperature or prolonged UV exposure environments. It may require additives or blending with other polymers to meet stringent performance standards in certain industrial or aerospace applications. Incompatibility with some processing methods restricts design flexibility for specific manufacturers. End-users in regulated industries demand extensive testing and certification, increasing time-to-market for new grades. The need for specialized expertise in processing can slow adoption in emerging markets. These technical and operational barriers influence long-term growth dynamics.

Market Opportunities

Rising Demand from Electric Vehicles and Renewable Energy Systems

The Thermoplastic Polyamide Elastomers Market holds strong potential in electric mobility and renewable energy infrastructure. It offers lightweight, durable, and chemically resistant solutions for battery cooling lines, electrical connectors, and sealing systems in EV platforms. Rapid expansion of charging infrastructure creates demand for high-performance cable protection and insulation materials. Renewable energy projects require robust components for wind turbine housings, solar panel mounts, and energy storage units. The material’s adaptability to harsh outdoor conditions enhances its value in these applications. Expanding adoption in these high-growth sectors positions it for sustained market gains.

Expansion into Medical, Consumer, and Industrial Niche Applications

Advancements in processing and material engineering create opportunities for thermoplastic polyamide elastomers in specialized medical and consumer products. It meets the need for biocompatible, sterilizable components in surgical tools, wearable devices, and fluid delivery systems. In consumer markets, demand grows for premium, durable materials in sports equipment, footwear, and electronics accessories. Industrial sectors seek it for precision tubing, vibration dampers, and chemical-resistant seals. The ability to integrate with hybrid materials expands its reach into complex, high-performance designs. These diverse end-use opportunities support long-term revenue diversification and technological innovation.

Market Segmentation Analysis:

By Application

The Thermoplastic Polyamide Elastomers Market spans applications in automotive, consumer goods, industrial machinery, medical devices, and electronics. Automotive remains a key revenue driver due to the demand for lightweight, chemical-resistant components such as fuel lines, air ducts, and sealing systems. It also finds growing use in electric vehicles for cable insulation, battery protection, and cooling systems. Consumer goods utilize the material for flexible, abrasion-resistant, and aesthetically appealing components in sports gear, footwear, and home appliances. Industrial applications benefit from its resistance to oils, solvents, and wear, making it suitable for tubing, gaskets, and diaphragms. In medical devices, it supports biocompatibility requirements in surgical tools, fluid management systems, and wearable health monitors.

By Product Type

Product types in this market include polyether-based and polyester-based thermoplastic polyamide elastomers. Polyether-based grades offer excellent flexibility at low temperatures and superior hydrolysis resistance, making them ideal for outdoor and marine applications. It performs well in dynamic environments where repeated bending or movement is expected. Polyester-based grades provide higher tensile strength, abrasion resistance, and better chemical stability, which suits industrial machinery, automotive under-the-hood components, and heavy-duty consumer products. Specialty blends combine both chemistries to achieve tailored performance characteristics for specific applications.

- For instance, Evonik’s VESTAMID® E PEBA foam reports ball resiliency of 73% at 82 kg/m³ density, pairing light weight with rebound in impact-damping components and sporting goods that face repeated flexing.

By Processing

Processing methods for thermoplastic polyamide elastomers include injection molding, extrusion, and blow molding. Injection molding dominates due to its ability to produce precise, complex parts with high repeatability in automotive, electronics, and medical applications. It allows integration of soft-touch surfaces with structural elements in a single component. Extrusion is widely used for continuous profiles such as tubing, cables, and hoses, offering consistent wall thickness and dimensional stability. Blow molding supports hollow and thin-walled structures, enabling lightweight fluid handling components. Advances in processing technology improve melt flow properties, cycle times, and bonding with other materials, expanding design flexibility.

- For instance, Arkema’s Pebax® elastomers exhibit a lower energy loss factor when relaxed after being stressed compared to TPU

Segments:

Based on Application

- Automotive

- Consumer Goods

- Industrial

- Medical

- Packaging

Based on Product Type

Based on Processing

- Injection Molding

- Extrusion

- Blow Molding

- Compression Molding

- Thermoforming

Based on End-Use

- Automotive

- Consumer Goods

- Industrial

- Medical

- Packaging

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 28% of the global Thermoplastic Polyamide Elastomers Market, driven by strong adoption in automotive, aerospace, consumer goods, and medical sectors. The U.S. leads the region with advanced manufacturing capabilities and a robust presence of automotive OEMs and Tier-1 suppliers. It benefits from stringent environmental and fuel-efficiency regulations, which accelerate the shift toward lightweight materials in vehicle production. Demand from the medical device industry remains high, supported by the material’s biocompatibility, sterilization capability, and mechanical resilience. The electronics sector incorporates thermoplastic polyamide elastomers in connectors, housings, and protective casings, taking advantage of their durability and design flexibility. Regional research institutions and industry leaders continue to invest in bio-based and high-performance grades, strengthening market competitiveness.

Europe

Europe holds 26% of the global market share, underpinned by its strong automotive production base, industrial manufacturing expertise, and commitment to sustainable material innovation. Germany, France, and Italy dominate usage in high-performance automotive applications, including fuel systems, air ducts, and EV battery components. The region enforces strict environmental standards, encouraging adoption of recyclable and bio-based thermoplastic polyamide elastomers. It also shows significant demand from footwear and sporting goods industries, where lightweight yet durable materials are essential. Electronics manufacturers in the region integrate the material into precision components requiring chemical resistance and long service life. Collaborative R&D efforts between polymer producers and OEMs focus on expanding functional performance while meeting circular economy goals.

Asia-Pacific

Asia-Pacific leads with 34% of the global market share, driven by rapid industrialization, expanding automotive production, and growth in electronics manufacturing. China, Japan, and South Korea serve as major hubs for large-scale production and export of automotive components, consumer electronics, and industrial equipment utilizing thermoplastic polyamide elastomers. It benefits from lower production costs and increasing investment in advanced polymer processing facilities. Demand in consumer goods, footwear, and sporting equipment manufacturing remains strong due to the region’s large population base and rising disposable incomes. Local manufacturers increasingly develop high-performance grades to meet both domestic and export market requirements. The expansion of electric vehicle production in China and India further accelerates consumption in battery systems, wiring protection, and cooling solutions.

Latin America

Latin America accounts for 6% of the market, with Brazil and Mexico driving consumption in automotive, construction, and industrial manufacturing. It experiences growing demand for lightweight and chemical-resistant materials in fuel systems, flexible tubing, and industrial sealing applications. The footwear industry in Brazil incorporates thermoplastic polyamide elastomers for high-durability, comfortable designs. Expansion of local manufacturing capabilities improves supply chain resilience and reduces dependency on imports. Government initiatives supporting automotive modernization and renewable energy infrastructure create additional growth opportunities. The region’s emerging consumer electronics sector also begins to adopt the material in protective casings and connectors.

Middle East & Africa

The Middle East & Africa holds 6% of the global share, supported by demand from oil and gas, construction, and industrial equipment sectors. It is valued for its ability to withstand high temperatures, aggressive chemicals, and mechanical stress in sealing, tubing, and gasket applications. Countries such as the UAE and Saudi Arabia invest in advanced manufacturing and industrial diversification, which drives usage in automotive and infrastructure projects. The footwear and sports equipment markets in parts of Africa adopt the material for lightweight and durable designs. Gradual development of regional polymer processing capabilities is expected to improve availability and reduce import dependence. Ongoing infrastructure expansion and industrial modernization programs create steady opportunities for market penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mitsubishi Chemical

- Solvay

- Sumitomo Chemical

- LG Chem

- ExxonMobil

- Toray Industries

- SABIC

- Lanxess

- Mitsui Chemical

- Asahi Kasei

Competitive Analysis

The competitive landscape of the Thermoplastic Polyamide Elastomers Market is characterized by the presence of established global manufacturers with strong R&D capabilities, diverse product portfolios, and expansive distribution networks. Leading players include Mitsubishi Chemical, Solvay, LG Chem, SABIC, Lanxess, Toray Industries, Mitsui Chemical, Asahi Kasei, Sumitomo Chemical, and ExxonMobil. These companies focus on developing advanced grades that offer enhanced chemical resistance, thermal stability, and mechanical performance to meet evolving industry requirements. Strategic priorities include expanding bio-based product lines, improving processing efficiency, and integrating hybrid material solutions for specialized applications in automotive, electronics, and medical sectors. Players invest heavily in innovation to differentiate through unique formulations tailored for electric vehicle components, high-durability consumer products, and industrial sealing systems. Regional expansion strategies involve setting up manufacturing plants close to end-user markets, ensuring supply chain resilience and reduced lead times. Collaboration with OEMs and industrial partners allows customization of performance characteristics, strengthening long-term supply agreements. Competitive pressure drives continuous improvement in sustainability practices, including recyclability and reduced carbon footprint in production. This dynamic market environment rewards companies that combine technical expertise with the agility to adapt to regulatory changes, shifting customer demands, and emerging high-growth application areas.

Recent Developments

- In November 2024, Toray Industries Expanded its continuous fibre reinforced thermoplastic composite materials portfolio through the acquisition of Gordon Plastics assets and technology in Englewood, Colorado.

- In September 2023, Mitsubishi Chemical Developed a plant-derived polycarbonate thermoplastic elastomer with up to 70% biomass content, high heat resistance, wide temperature flexibility, excellent transparency, alkaline resistance, and non-yellowing characteristics

- In July 2023, Solvay Launched a specialized Rhodianyl® grade composed of 100% pre-consumer recycled polyamide 6.6, produced at its Santo André plant in Brazil.

Market Concentration & Characteristics

The Thermoplastic Polyamide Elastomers Market exhibits a moderately concentrated structure, with a mix of multinational corporations and specialized regional producers competing through product innovation, quality differentiation, and application-specific solutions. Leading companies such as Mitsubishi Chemical, Solvay, LG Chem, SABIC, Lanxess, and Toray Industries hold significant influence due to their advanced R&D capabilities, diversified portfolios, and global distribution networks. It is characterized by high-performance material requirements, strict regulatory compliance, and growing demand from automotive, electronics, industrial, and medical sectors. Competitive strategies focus on developing bio-based grades, enhancing processing efficiency, and improving compatibility with hybrid materials to address sustainability and design flexibility needs. Technological advancements in injection molding, extrusion, and compounding further define market dynamics by enabling complex part geometries and reduced production cycles. Regional manufacturing hubs in Asia-Pacific, Europe, and North America strengthen supply chain resilience while supporting tailored solutions for local industries. The market continues to evolve toward greater specialization and sustainable innovation, creating opportunities for players with strong technical and application expertise.

Report Coverage

The research report offers an in-depth analysis based on Application, Product Type, Processing, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow in automotive lightweighting and electric vehicle component manufacturing.

- Bio-based and recyclable grades will gain wider adoption to meet sustainability goals.

- Advanced processing technologies will enable complex part designs with higher precision.

- Use in medical devices will expand due to biocompatibility and sterilization capability.

- Integration into renewable energy systems will create new industrial opportunities.

- Hybrid material applications will increase for performance optimization in multiple sectors.

- Asia-Pacific will maintain its position as the leading production and consumption hub.

- Collaborations between manufacturers and OEMs will drive customized material development.

- Regulatory pressures will encourage innovation in low-emission and recyclable material solutions.

- Competition will intensify, with global players investing heavily in R&D and regional expansion.