Market Overview

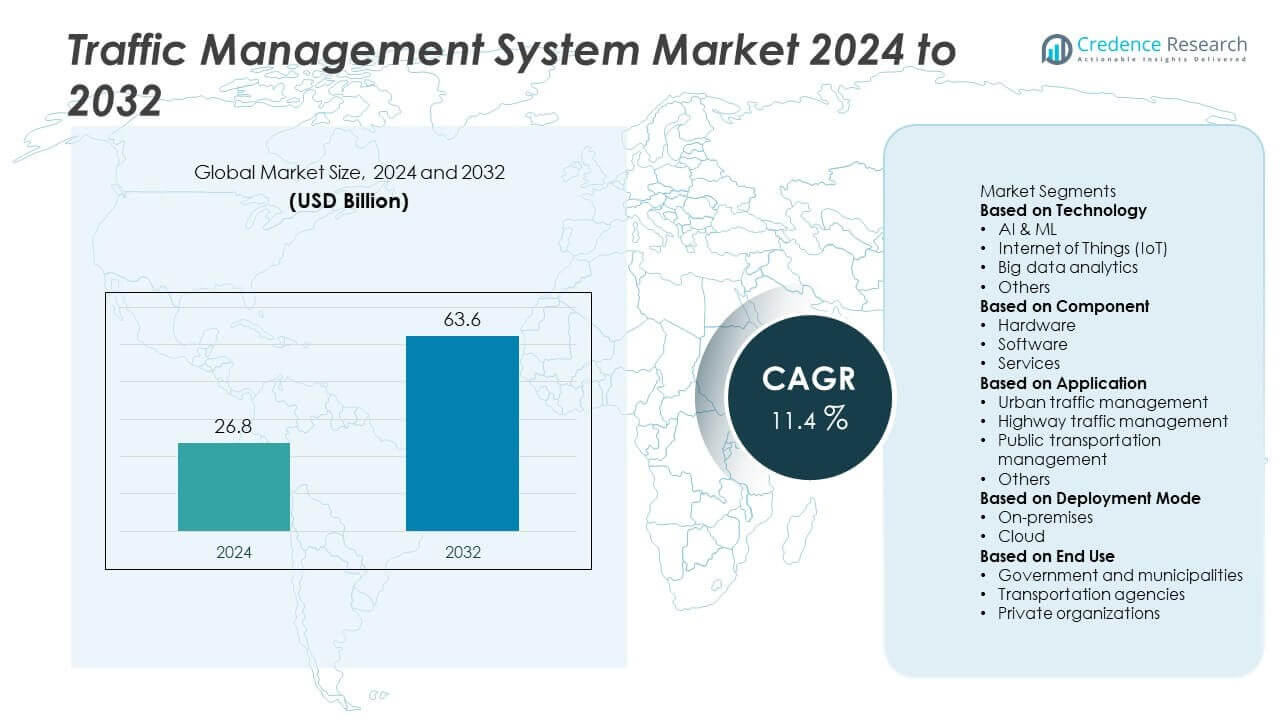

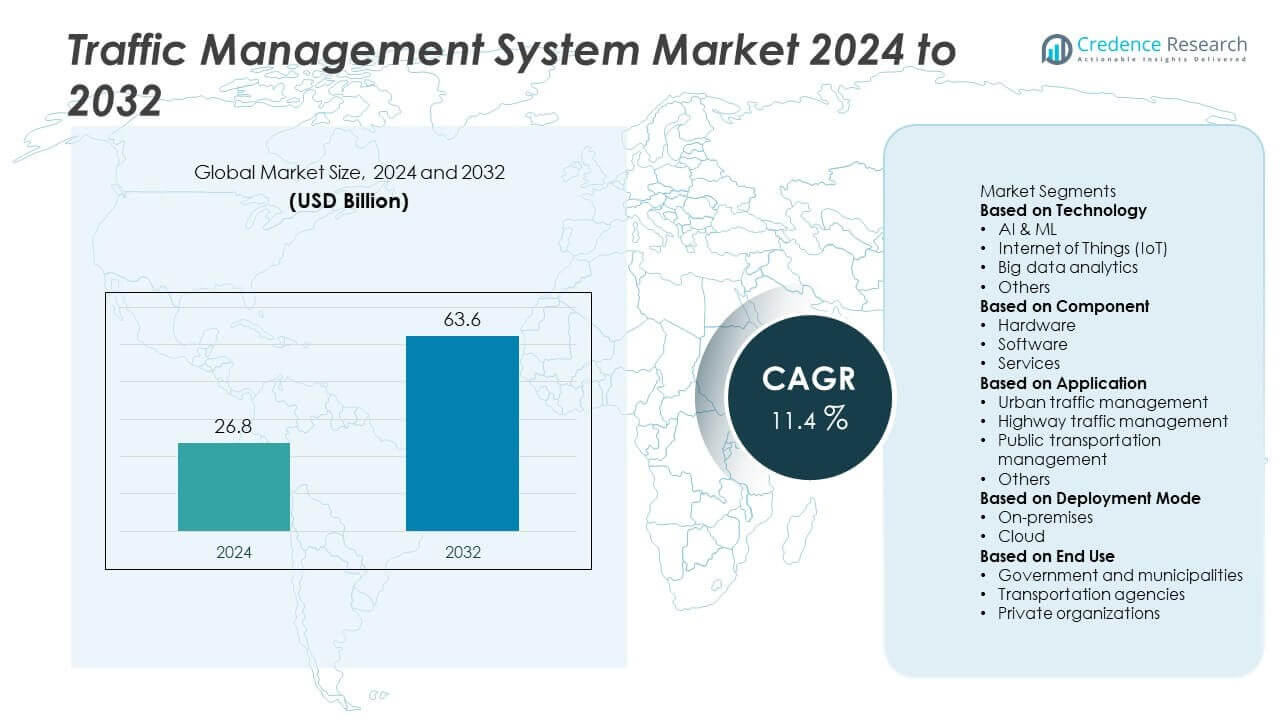

The Traffic Management System Market was valued at USD 26.8 billion in 2024 and is projected to reach USD 63.6 billion by 2032, expanding at a CAGR of 11.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Traffic Management System Market Size 2024 |

USD 26.8 Billion |

| Traffic Management System Market, CAGR |

11.4% |

| Traffic Management System Market Size 2032 |

USD 63.6 Billion |

The Traffic Management System Market grows with rising urbanization, increasing vehicle ownership, and government initiatives focused on reducing congestion and improving safety. Advanced technologies such as AI, IoT, and big data analytics drive adoption of predictive and adaptive traffic control systems.

The Traffic Management System Market shows diverse regional growth patterns driven by infrastructure investments and urbanization. North America demonstrates strong demand with widespread adoption of AI, IoT, and cloud-based platforms that enhance real-time monitoring and congestion management. Europe emphasizes sustainable transport and safety, with countries investing in smart city projects and eco-friendly mobility solutions. Asia-Pacific records rapid expansion as China, Japan, India, and South Korea adopt large-scale intelligent transport networks to handle rising urban populations and vehicle ownership. Latin America and the Middle East & Africa show gradual uptake through modernization of urban infrastructure and growing focus on road safety. Key players such as Cisco, Huawei Technologies, Iteris, and Kapsch strengthen their presence by developing advanced traffic analytics, adaptive control systems, and connected infrastructure. It highlights a competitive environment shaped by innovation, digital transformation, and partnerships with governments to improve mobility and safety across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Traffic Management System Market was valued at USD 26.8 billion in 2024 and is projected to reach USD 63.6 billion by 2032, expanding at a CAGR of 11.4% during the forecast period.

- Rising urbanization and increasing vehicle ownership create strong demand for intelligent traffic control systems that reduce congestion and improve safety.

- AI, IoT, and big data analytics drive adoption of predictive and adaptive solutions, enabling real-time monitoring, incident detection, and efficient traffic flow management.

- Competitive activity is shaped by players such as Cisco, Huawei Technologies, Intel, and Kapsch, who focus on developing connected infrastructure, cloud platforms, and integrated traffic analytics.

- High implementation costs, integration challenges with legacy infrastructure, and concerns over data privacy act as restraints that limit adoption, especially in cost-sensitive regions.

- North America leads adoption with advanced infrastructure and smart mobility programs, while Europe emphasizes sustainability and safety, and Asia-Pacific emerges as the fastest-growing region with large-scale investments in smart city projects.

- Latin America and the Middle East & Africa gradually expand adoption through modernization of transport systems, international collaborations, and increasing urban infrastructure upgrades, creating future opportunities for market players.

Market Drivers

Rising Urbanization and Increasing Vehicle Ownership

The Traffic Management System Market grows with the rapid pace of urbanization and rising vehicle ownership across cities worldwide. Congested roads create delays, accidents, and fuel wastage, demanding smarter solutions. Traffic management systems provide efficient control through real-time monitoring, adaptive signals, and data-driven interventions. It helps reduce travel time while improving safety for drivers and pedestrians. Growing urban density accelerates the deployment of these systems across both developed and emerging economies. Rising pressure on transportation infrastructure reinforces the need for advanced management solutions.

- For instance, Iteris provides traffic management solutions, including its ClearGuide platform and other services, for various projects across Texas. Its technology is used to optimize traffic signal performance, reduce congestion, and improve safety in cities like Burleson and Houston.

Government Initiatives and Investments in Smart Infrastructure

Governments play a crucial role in advancing the Traffic Management System Market. Many regions allocate funds to smart city projects and intelligent transportation networks. These initiatives aim to reduce accidents, improve mobility, and cut carbon emissions. It drives adoption of integrated systems that combine cameras, sensors, and analytics platforms. Public-private partnerships further expand the reach of traffic management solutions. Strong regulatory backing ensures consistent growth across global markets.

- For instance, Kapsch TrafficCom and Vegfinans AS launched a new barrier-free, Multi-Lane Free Flow tolling system on National Road 4 in Norway in July 2025. This initial deployment is the first phase of a project to modernize tolling infrastructure across six counties in southeast Norway.

Technological Advancements in AI, IoT, and Big Data Analytics

Innovation strongly supports the Traffic Management System Market through AI, IoT, and big data analytics. Advanced tools enable predictive traffic modeling, real-time congestion management, and improved incident response. Cloud-based platforms facilitate faster decision-making and scalability for large networks. It enhances system reliability and efficiency while lowering operational costs. Integration with connected and autonomous vehicles further expands use cases. Continuous R&D investment keeps driving adoption of intelligent systems globally.

Growing Focus on Environmental Sustainability and Safety

The Traffic Management System Market benefits from the increasing emphasis on reducing emissions and enhancing road safety. Smart systems minimize idling and fuel consumption by optimizing traffic flow. It directly supports environmental goals linked to climate action plans. Advanced monitoring reduces accidents by detecting violations and alerting authorities in real time. Governments and city planners prioritize sustainable transport solutions to align with global sustainability targets. Rising awareness of road safety further strengthens the demand for these systems worldwide.

Market Trends

Integration of AI and Machine Learning for Smarter Traffic Control

The Traffic Management System Market advances with the integration of AI and machine learning technologies. These tools analyze traffic data to predict congestion and optimize traffic signals. Adaptive algorithms improve real-time decision-making, reducing delays and enhancing road efficiency. It enables cities to respond quickly to incidents and adjust routes dynamically. AI-based systems also support predictive maintenance of traffic infrastructure. Growing adoption of data-driven solutions highlights this trend as a core driver of modernization.

- For instance, Huawei released its upgraded Transportation Operations Coordination Center – Advanced (TOCC-A) solution. The solution advertises the ability to reduce traffic incident handling time by 30% and improve passenger mobility efficiency for new-energy buses by over 15% through precise charging and shift scheduling.

Expansion of IoT-Enabled Sensors and Connected Infrastructure

IoT plays a critical role in reshaping the Traffic Management System Market. Connected sensors, cameras, and road-side units collect continuous traffic data. This real-time visibility helps authorities monitor congestion, detect accidents, and enforce road safety measures. It strengthens coordination between vehicles, infrastructure, and traffic control centers. The increasing rollout of 5G enhances connectivity and response times. IoT-enabled infrastructure continues to transform traffic systems into more responsive and adaptive networks.

- For instance, a major connected highway deployment in Austria involving Cisco technology connected over 70,000 sensors and 6,500 traffic cameras, which helps with routing emergency vehicles and providing real-time traffic feedback.

Adoption of Cloud-Based and Centralized Platforms

The Traffic Management System Market benefits from the shift toward cloud-based platforms. Centralized solutions streamline data processing and allow remote management of traffic operations. Cloud integration reduces costs while offering scalability for both urban and regional networks. It improves system resilience and simplifies upgrades across multiple sites. Cities adopt these platforms to unify control centers and coordinate transportation strategies. The move toward cloud solutions highlights a lasting trend in system modernization.

Growing Role of Autonomous and Connected Vehicles in Traffic Ecosystems

The Traffic Management System Market adapts to the rise of autonomous and connected vehicles. Traffic platforms integrate with vehicle-to-infrastructure communication systems to ensure smooth traffic flow. It creates opportunities for real-time coordination between vehicles and control centers. Pilot projects in smart cities demonstrate the benefits of seamless connectivity. This trend promotes safer driving conditions and reduces congestion. Expanding deployment of connected mobility strengthens the evolution of intelligent traffic ecosystems worldwide.

Market Challenges Analysis

High Implementation Costs and Infrastructure Limitations

The Traffic Management System Market faces challenges linked to high implementation and maintenance costs. Advanced systems require large investments in hardware, software, and communication infrastructure. Many cities, particularly in developing regions, lack the resources to adopt these solutions at scale. It creates disparities in adoption between developed and emerging economies. Integration with legacy infrastructure further increases complexity and project costs. Budget constraints often delay projects, limiting widespread deployment. These financial and technical hurdles remain a barrier to market expansion.

Data Privacy Concerns and Technical Complexity

The Traffic Management System Market also struggles with data privacy and integration challenges. Smart systems collect massive amounts of traffic and personal data, raising security and privacy issues. It increases the risk of cyberattacks that could disrupt critical urban infrastructure. Complex integration of AI, IoT, and cloud platforms demands skilled expertise, which is often in short supply. Inconsistent data standards across regions slow adoption and reduce interoperability. Technical challenges hinder seamless operation and discourage investment in advanced systems. Addressing these concerns is critical for long-term market success.

Market Opportunities

Expansion of Smart City Projects and Digital Infrastructure

The Traffic Management System Market presents strong opportunities through the global rise of smart city initiatives. Governments and municipalities are investing heavily in digital infrastructure to improve mobility and safety. These projects demand advanced traffic monitoring, adaptive signal control, and integrated surveillance systems. It creates opportunities for vendors to deliver scalable, cloud-enabled, and AI-driven platforms. Growing focus on reducing congestion and improving urban air quality further strengthens adoption. Smart city development ensures long-term opportunities for traffic management providers.

Integration with Autonomous Vehicles and Sustainable Mobility Goals

The Traffic Management System Market also benefits from the shift toward autonomous vehicles and sustainable transport. Vehicle-to-infrastructure communication requires advanced traffic platforms to ensure smooth coordination between cars and control systems. It expands opportunities for solutions that integrate predictive analytics, real-time monitoring, and eco-friendly traffic optimization. Adoption of electric vehicles and green mobility strategies reinforces demand for intelligent traffic systems. Urban planners increasingly seek solutions that balance mobility with environmental goals. This transition creates a favorable pathway for innovation-driven providers to expand market presence.

Market Segmentation Analysis:

By Technology

The Traffic Management System Market is segmented by technologies such as adaptive traffic control, predictive analytics, and real-time monitoring systems. Adaptive traffic control dominates due to its ability to optimize traffic lights and reduce congestion dynamically. Predictive analytics gains momentum with AI and machine learning integration, allowing cities to forecast traffic patterns and improve planning. Real-time monitoring systems continue to expand as IoT devices, sensors, and cameras provide continuous data streams. It enhances situational awareness and enables rapid incident response. Growing investment in smart city programs reinforces adoption of these technologies worldwide.

- For instance, The Sydney Coordinated Adaptive Traffic System (SCATS) is a real-time traffic management platform with over 63,000 intersections installed worldwide, including approximately 11,000 in its country of origin, Australia. The New South Wales Government developed SCATS in the 1970s, and it is now used in over 216 cities and 32 countries.

By Component

Components define the structural foundation of the Traffic Management System Market. Hardware, including sensors, cameras, and controllers, holds the largest share due to its critical role in traffic detection and management. Software platforms show rapid growth with the increasing need for data integration, analytics, and centralized control. Services, including installation, maintenance, and system upgrades, also contribute significantly to market expansion. It highlights the growing reliance on long-term operational support for advanced traffic networks. Demand for scalable and cost-efficient solutions across components continues to drive innovation and partnerships.

- For instance, the STREAMS system enabled coordinated ramp metering across a 75-kilometre freeway network in Australia, serving as the core control system for freeway and toll operations.

By Application

Applications extend the utility of the Traffic Management System Market across multiple urban needs. Urban traffic management represents the largest segment, driven by the need to address congestion in fast-growing cities. Highway management grows steadily, supported by demand for real-time incident detection, lane management, and toll operations. Public transport management expands with integration of buses, trams, and metro systems into broader traffic control networks. It supports improved connectivity and enhances commuter experience. Emergency response management also strengthens adoption, ensuring rapid coordination during accidents and natural disasters.

Segments:

Based on Technology

- AI & ML

- Internet of Things (IoT)

- Big data analytics

- Others

Based on Component

- Hardware

- Software

- Services

Based on Application

- Urban traffic management

- Highway traffic management

- Public transportation management

- Others

Based on Deployment Mode

Based on End Use

- Government and municipalities

- Transportation agencies

- Private organizations

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 33% of the Traffic Management System Market in 2024, making it the leading region. The United States dominates due to its advanced infrastructure, strong smart city initiatives, and widespread use of AI-powered traffic control systems. Major cities deploy adaptive traffic signals, real-time monitoring, and connected vehicle platforms to reduce congestion and improve safety. Canada contributes with steady investments in urban mobility projects and emphasis on sustainable transport systems. Mexico adds value through growing adoption in urban centers supported by public-private partnerships. It benefits from robust regulatory frameworks, high government spending on transportation safety, and the presence of global technology providers. Strong R&D capabilities and early adoption of IoT-enabled platforms further reinforce the region’s leadership in this market.

Europe

Europe accounts for 28% of the Traffic Management System Market in 2024, ranking as the second-largest region. Countries such as Germany, France, and the United Kingdom lead adoption with strong commitments to road safety, emission reduction, and smart infrastructure. Germany invests heavily in integrating traffic systems with electric vehicle charging infrastructure and connected car technologies. The UK advances through large-scale smart city projects, focusing on congestion reduction and real-time traffic control. France emphasizes sustainable transport policies and intelligent highway systems. It benefits from the European Union’s climate goals and funding for digital infrastructure. The region also highlights the integration of eco-friendly traffic solutions that align with circular economy principles. Europe’s aging infrastructure creates opportunities for upgrades, ensuring continued demand for modern systems.

Asia-Pacific

Asia-Pacific holds 27% of the Traffic Management System Market in 2024, emerging as the fastest-growing region. China dominates with massive investments in smart cities, AI-driven platforms, and advanced traffic monitoring systems to manage its dense urban populations. Japan contributes with technological leadership, integrating real-time traffic analytics into its advanced urban planning frameworks. South Korea strengthens adoption with high-speed connectivity and nationwide smart infrastructure projects. India records rapid growth as urbanization accelerates and government programs focus on reducing congestion and improving safety. It benefits from cost-efficient manufacturing, growing demand for digital traffic control, and a large urban population. Southeast Asian countries, including Vietnam, Thailand, and Indonesia, invest in urban traffic modernization to support rising vehicle ownership. Asia-Pacific’s combination of scale, government funding, and innovation ensures long-term dominance in market expansion.

Latin America

Latin America represents 7% of the Traffic Management System Market in 2024, reflecting steady but uneven growth. Brazil leads with significant investments in smart transport projects and urban mobility programs. Mexico follows with adoption in major metropolitan areas driven by rising congestion and public investment. Chile and Argentina contribute through targeted infrastructure modernization and deployment of real-time traffic monitoring systems. It faces challenges from budget limitations and inconsistent policy frameworks across countries. However, growing urbanization and rising private sector participation create steady opportunities for deployment. The demand for affordable and scalable solutions makes Latin America a promising region for future expansion.

Middle East & Africa

The Middle East & Africa hold 5% of the Traffic Management System Market in 2024, showing gradual but important growth. Gulf countries such as the UAE and Saudi Arabia lead adoption with large-scale smart city initiatives and advanced transportation projects. These nations invest in AI, IoT, and cloud-based platforms to enhance traffic flow and reduce emissions. South Africa represents a growing market within Africa, supported by urban infrastructure projects and expansion of public transport management systems. It benefits from international partnerships and government programs designed to modernize transportation. However, limited budgets and infrastructure gaps remain significant challenges in several African countries. Despite these hurdles, ambitious development plans and rising urban populations create sustained opportunities for adoption in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Iteris

- Metro Infrasys

- Intel

- Cohda Wireless

- IBM

- Kapsch

- Jenoptik

- Cisco

- Cubic

- Huawei Technologies

Competitive Analysis

Competitive landscape of the Traffic Management System Market is shaped by leading players including Cisco, Cohda Wireless, Cubic, Huawei Technologies, IBM, Intel, Iteris, Jenoptik, Kapsch, and Metro Infrasys. These companies focus on delivering advanced traffic management platforms that integrate AI, IoT, and cloud technologies to optimize traffic flow, reduce congestion, and enhance road safety. Innovation remains central, with heavy investments in predictive analytics, adaptive signal control, and connected vehicle solutions. Global leaders leverage partnerships with governments and smart city projects to expand their reach, while regional firms concentrate on tailored solutions for local infrastructure needs. It is also characterized by strong emphasis on real-time monitoring, big data applications, and sustainability-focused systems that align with climate action goals. Continuous development of integrated platforms for highways, urban roads, and public transport ensures long-term competitiveness. The market remains dynamic, with players balancing scalability, affordability, and technological leadership to capture global opportunities.

Recent Developments

- In July 2025, Iteris Selected by Kane County for its Transportation System Management and Operations Program.

- In June 2025, Kapsch TrafficCom Won contracts to operate two Traffic Management Centers (TMCs) in New York State (Rochester and Hornell), value over $10 million across three years.

- In May 2025, Iteris Awarded $1.7 million contract by the city of Burleson, Texas. The project includes traffic signal upgrades, a new Traffic Management Center.

- In January 2025, Intel At CES 2025, introduced a new adaptive control solution within its whole-vehicle software-defined innovation strategy.

Report Coverage

The research report offers an in-depth analysis based on Technology, Component, Application, Deployment Mode, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for intelligent traffic solutions will increase with rising urbanization and vehicle density.

- AI and machine learning will play a central role in predictive traffic management and congestion control.

- IoT-enabled sensors and 5G connectivity will enhance real-time monitoring and system responsiveness.

- Cloud-based platforms will expand adoption by offering scalable and cost-efficient traffic solutions.

- Integration with autonomous and connected vehicles will create new growth opportunities.

- Governments will strengthen investments in smart city infrastructure and sustainable transport systems.

- Data privacy and cybersecurity measures will become a priority in traffic management platforms.

- Emerging economies will accelerate adoption through urban mobility projects and infrastructure upgrades.

- Competitive intensity will grow as global and regional players focus on partnerships and innovation.

- Sustainability goals will drive adoption of eco-friendly and energy-efficient traffic control systems.