Market Overview

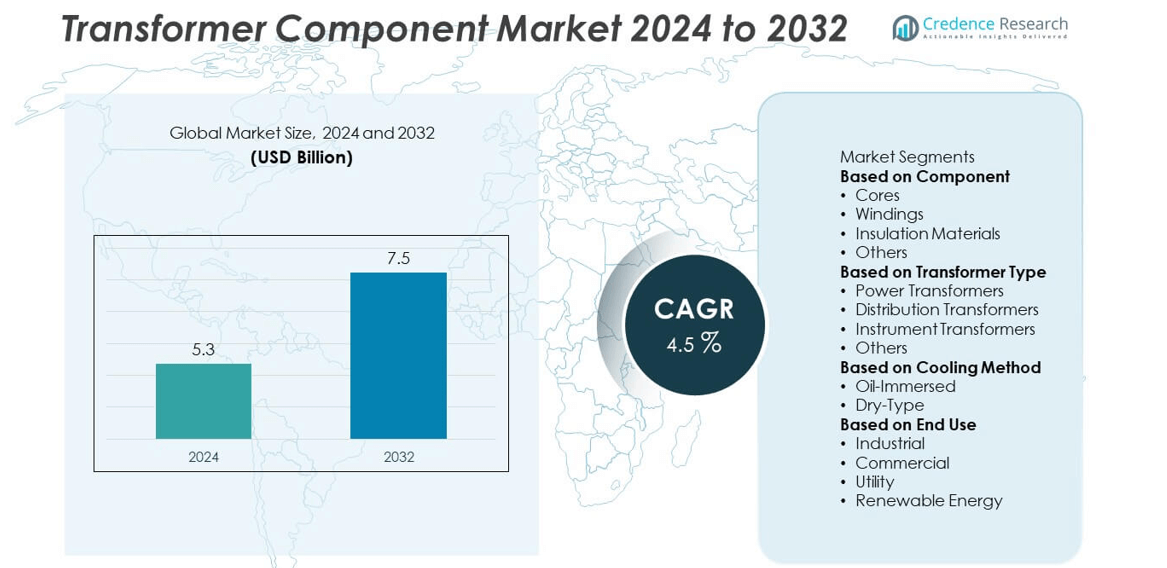

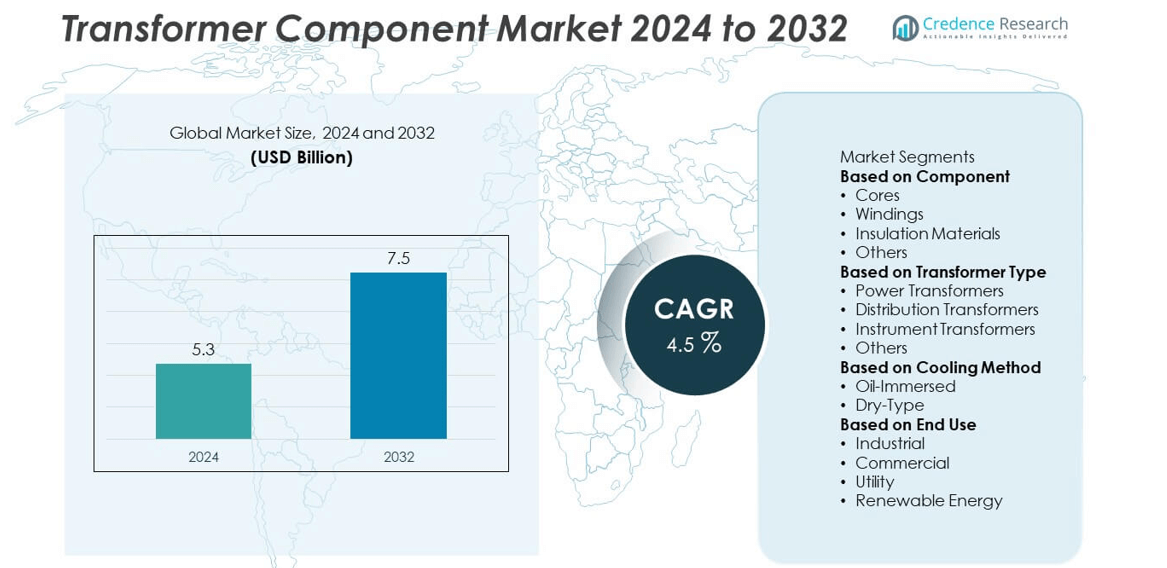

Transformer Component Market size was valued at USD 5.3 billion in 2024 and is projected to reach USD 7.5 billion by 2032, growing at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Transformer Component Market Size 2024 |

USD 5.3 billion |

| Transformer Component Market, CAGR |

4.5% |

| Transformer Component Market Size 2032 |

USD 7.5 billion |

The Transformer Component Market grows through rising demand for grid modernization, renewable integration, and industrial expansion. Utilities adopt advanced cores, bushings, and tap changers to ensure reliability and efficiency in evolving networks. It benefits from urban infrastructure projects that require compact, safe, and energy-efficient solutions.

The Transformer Component Market demonstrates strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America advances with grid modernization projects and digital monitoring integration, while Europe emphasizes renewable adoption and strict efficiency regulations. Asia-Pacific shows rapid growth supported by industrialization, urbanization, and large-scale smart grid investments. Latin America and the Middle East & Africa expand steadily through utility upgrades, renewable projects, and infrastructure development. Key players driving this market include Hitachi Energy, Eaton, BHEL, and Howard Industries, all of which focus on delivering reliable, efficient, and sustainable transformer components. These companies invest in advanced insulation materials, low-loss cores, and IoT-enabled monitoring solutions that support modern grid requirements. Their global strategies also include expanding presence in emerging economies where infrastructure investments are accelerating. Together, these players strengthen innovation, compliance, and regional growth, shaping the competitive dynamics of the transformer component industry.

Market Insights

- The Transformer Component Market was valued at USD 5.3 billion in 2024 and is projected to reach USD 7.5 billion by 2032, growing at a CAGR of 4.5%.

- Growth is driven by grid modernization needs, renewable integration, and rising electricity demand across industrial and urban sectors.

- Key trends include the adoption of IoT-enabled monitoring systems, eco-friendly insulation materials, and low-loss cores to improve efficiency.

- Competitive analysis highlights leading players such as Hitachi Energy, Eaton, BHEL, and Howard Industries, who invest in advanced technologies and expand presence in emerging markets.

- Market restraints include high installation costs, complex retrofitting of aging infrastructure, and shortage of skilled workforce in developing regions.

- Regional analysis shows North America advancing with smart grid upgrades, Europe focusing on renewable and efficiency standards, Asia-Pacific expanding rapidly with industrialization, while Latin America and the Middle East & Africa grow steadily through infrastructure and utility projects.

- The market remains resilient by aligning with sustainability goals, smart city initiatives, and renewable adoption, positioning transformer components as critical enablers of reliable and efficient power distribution worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Grid Modernization and Reliability

The Transformer Component Market grows strongly with global investment in modern grid infrastructure. Aging power networks require upgrades to improve stability and reduce outages. It supports utilities in enhancing grid reliability through advanced cores, bushings, and tap changers. Governments emphasize modernization projects to meet increasing electricity consumption in urban and rural areas. The deployment of smart grids further boosts demand for efficient components. This driver positions transformer components as critical assets for reliable electricity distribution.

- For instance, Hitachi Energy announced a $106 million expansion of its Alamo, Tennessee facility, adding 60,000 sq ft to boost production of HVDC and dry-type bushings rated up to 800 kV, strengthening North America’s transformer component supply.

Expanding Renewable Energy Integration into Power Systems

The shift toward renewable energy significantly drives the Transformer Component Market. Solar and wind projects require efficient transformers equipped with durable components to handle variable loads. It ensures smooth integration of renewable generation with conventional grids. International commitments to reduce carbon emissions accelerate investment in renewable-friendly transformer technologies. Components designed to improve efficiency under fluctuating conditions gain priority in procurement. The growth of renewable energy infrastructure worldwide underpins steady demand for high-performance transformer components.

- For instance, Hitachi Energy and SMA celebrated the delivery of their 3,000th transformer customized for solar inverter applications, engineered to handle variable renewable loads and deployed across multiple utility-scale projects.

Rising Industrialization and Urban Infrastructure Projects

Industrial growth and urban expansion create strong demand for transformer components. The Transformer Component Market benefits from rising electricity needs in manufacturing zones, metro networks, airports, and high-rise buildings. It supports continuous power flow and safe load management across large projects. Rapid urbanization in Asia-Pacific and Africa contributes to higher installation rates. Real estate developers and industrial operators seek reliable transformer solutions that maximize safety and efficiency. Expanding infrastructure pipelines worldwide secure long-term opportunities for component suppliers.

Technological Advancements in Materials and Efficiency Standards

Continuous innovation in transformer design strengthens the Transformer Component Market. Manufacturers adopt advanced insulation, low-loss cores, and smart monitoring devices to improve operational efficiency. It enables transformers to perform reliably under higher loads while minimizing energy losses. Governments enforce stricter efficiency standards, driving adoption of next-generation components. Digital monitoring and IoT integration further enhance predictive maintenance and fault detection. The evolution of transformer technology creates sustained demand for innovative and compliant components worldwide.

Market Trends

Integration of Smart Monitoring and Digital Solutions

The Transformer Component Market is shaped by the increasing adoption of smart monitoring systems. Utilities and industries seek IoT-enabled sensors, digital relays, and advanced diagnostics to improve performance. It allows operators to detect failures early and reduce costly downtime. Smart monitoring also enables predictive maintenance, which enhances the lifespan of critical components. Real-time data collection supports efficient load management across complex grids. This trend strengthens the role of digitalization in transformer component design and deployment.

- For instance, Siemens began equipping its transformers with its Sensformer digital monitoring platform in 2018, and by the end of 2019, it had delivered the 500th unit. The sensors on these units capture essential operational data points such as oil temperature, oil level, and winding current, which is sent to a cloud service for real-time monitoring and analytics.

Shift Toward Eco-Friendly and Low-Loss Materials

Sustainability commitments influence the adoption of environmentally friendly transformer components. The Transformer Component Market benefits from advanced insulation materials, low-loss cores, and biodegradable oils that reduce environmental impact. It ensures compliance with global energy-efficiency and emission standards. Manufacturers design components that minimize heat generation and energy losses, improving operational cost savings. Eco-friendly products appeal to utilities aiming to meet strict regulatory frameworks. This trend highlights the growing alignment between energy transition goals and transformer innovation.

- For instance, Hitachi Energy introduced its EconiQ transformers in 2021, which replace mineral oil with biodegradable natural ester fluids for safe and environmentally responsible operation across high-voltage networks. The natural ester fluid offers a significantly higher flash point and self-extinguishing properties, which greatly enhances fire safety compared to mineral oil.

Rising Demand from Renewable Energy Integration Projects

Renewable expansion drives steady demand for durable and efficient transformer components. The Transformer Component Market supports solar and wind projects that require specialized designs to manage variable inputs. It ensures smooth integration of renewable energy into conventional grids. Components such as bushings, tap changers, and cores must adapt to frequent fluctuations in load. Governments prioritize renewable infrastructure, which creates consistent demand for advanced transformer solutions. This trend underscores the critical role of components in enabling clean energy distribution.

Growing Investment in Urbanization and Industrial Applications

Rapid industrial development and urbanization continue to influence component demand globally. The Transformer Component Market benefits from rising installation in industrial plants, high-rise buildings, and commercial complexes. It supports safe and efficient power distribution across dense and energy-intensive environments. Infrastructure expansion in emerging regions creates new opportunities for suppliers. Growing reliance on uninterrupted power supply in healthcare and IT facilities increases demand for robust transformer systems. This trend reflects the strong connection between infrastructure growth and transformer component adoption.

Market Challenges Analysis

High Costs and Complexities in Modernization Projects

The Transformer Component Market faces challenges linked to high costs of advanced components and complex integration into aging grid infrastructure. Retrofitting older systems with modern components requires redesign and often disrupts operations. It creates financial strain for utilities and industries operating under limited budgets. The adoption of eco-friendly oils, low-loss cores, and smart monitoring devices further adds to cost concerns. Many stakeholders delay replacement cycles due to cost-benefit uncertainty, despite long-term efficiency advantages. These financial and operational barriers restrict faster adoption in both developed and emerging markets.

Shortage of Skilled Workforce and Maintenance Constraints

Another significant challenge for the Transformer Component Market is the shortage of trained professionals required to manage advanced systems. Modern components demand technical knowledge in installation, diagnostics, and predictive maintenance. It limits deployment in regions with inadequate training and workforce development programs. Utilities in developing countries often rely on external expertise, which increases costs and delays. Maintenance challenges also grow when systems are not properly supervised, leading to premature failures. This shortage of expertise restricts efficiency and slows the pace of large-scale market expansion.

Market Opportunities

Expansion of Smart Grid and Digital Energy Infrastructure

The Transformer Component Market presents strong opportunities with the global shift toward smart grids and digital energy networks. Governments and utilities invest in IoT-enabled systems, automated substations, and advanced monitoring platforms. It creates demand for intelligent components such as smart bushings, tap changers, and insulation systems that support real-time diagnostics. Adoption in smart cities and industrial hubs strengthens the role of advanced transformer components in ensuring reliability. Compact, digitally connected products also enable predictive maintenance, reducing operational risks. This growing focus on digital infrastructure secures long-term prospects for component manufacturers worldwide.

Rising Investments in Renewable Energy and Sustainable Power Projects

The global energy transition generates opportunities for the Transformer Component Market through renewable integration. Solar, wind, and hydro projects require specialized components capable of handling fluctuating loads and grid balancing. It ensures transformers remain efficient under variable input while supporting decarbonization targets. Governments allocate significant funding toward clean energy infrastructure, which increases component demand. Manufacturers introducing eco-friendly insulation and low-loss cores gain competitive advantage in sustainable projects. These opportunities highlight the importance of advanced transformer components in building a resilient and green power distribution network.

Market Segmentation Analysis:

By Component

T

he Transformer Component Market is segmented into cores, windings, bushings, tap changers, insulation materials, and others. Cores account for a major share as they directly influence transformer efficiency and energy loss reduction. It supports improved magnetic performance and energy transfer in both power and distribution transformers. Windings hold strong demand in utility and industrial applications due to their role in carrying electrical load with minimal resistance. Bushings and tap changers also gain importance as they enable safe current transfer and voltage regulation under varying load conditions. Insulation materials remain critical for maintaining safety and preventing breakdowns in high-voltage environments. Each component type is central to performance, safety, and long-term durability, securing consistent demand across applications.

- For instance, Toshiba Energy Systems manufactures amorphous metal cores that reduce no-load losses by up to 70%, with more than 30,000 units installed globally in distribution transformers.

By Transformer Type

The Transformer Component Market covers power transformers, distribution transformers, instrument transformers, and others. Power transformers dominate demand from large-scale transmission and renewable energy projects that require robust and high-capacity designs. It supports cross-border power exchange and integration of high-voltage networks. Distribution transformers account for strong growth due to rising urban development, commercial construction, and industrial operations that need reliable medium-voltage supply. Instrument transformers hold niche but important demand in monitoring, protection, and measurement applications in utilities and industries. Each transformer type drives specialized component requirements, pushing manufacturers to diversify portfolios. Growing infrastructure investments worldwide continue to strengthen opportunities for all transformer categories.

- For instance, Hitachi Energy supplied 30 units of 765 kV, 500 MVA power transformers to India’s Power Grid Corporation in June 2025, to strengthen the national grid. While 765 kV transmission is used for bulk long-distance power transfer, the record for India’s longest line is held by a different project: a multi-terminal ±800 kV HVDC link spanning approximately 1,800 km.

By Cooling Method

The Transformer Component Market segments by cooling method into oil-immersed and dry-type transformers. Oil-immersed transformers remain dominant due to their efficiency in managing high loads and wide use in utilities. It ensures longer lifespan and reliability in transmission and distribution projects. Dry-type transformers gain traction in urban commercial buildings, hospitals, and renewable plants due to their safety and low-maintenance benefits. They are particularly preferred in indoor installations where fire resistance and environmental compliance are priorities. Both cooling methods continue to find relevance, with oil-immersed dominating traditional grids while dry-type expands through urbanization and renewable adoption. This balance reflects evolving end-user needs and regulatory requirements worldwide.

Segments:

Based on Component

- Cores

- Windings

- Insulation Materials

- Others

Based on Transformer Type

- Power Transformers

- Distribution Transformers

- Instrument Transformers

- Others

Based on Cooling Method

Based on End Use

- Industrial

- Commercial

- Utility

- Renewable Energy

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 30% of the Transformer Component Market in 2024, making it one of the largest regions. The region benefits from strong investment in grid modernization, renewable integration, and advanced transmission networks. The United States leads adoption, supported by federal funding for upgrading outdated power infrastructure. It also benefits from the expansion of renewable projects such as solar and wind farms that require reliable transformer components. Canada contributes through utility-scale grid projects and industrial expansion, while Mexico adds demand from manufacturing hubs. Growing focus on energy efficiency and digital monitoring drives the adoption of high-performance cores, bushings, and insulation materials. North America’s advanced regulatory framework and strong utility budgets ensure consistent demand for advanced transformer components.

Europe

Europe represents 27% of the global Transformer Component Market in 2024, supported by strict regulatory compliance and strong renewable integration targets. Countries such as Germany, France, and the UK lead adoption through investments in green energy, sustainable grids, and industrial modernization. It benefits from growing demand for eco-friendly components, including biodegradable oils and low-loss cores. The European Union’s decarbonization goals and commitment to energy efficiency push utilities and industries to modernize equipment. Southern and Eastern Europe also contribute by upgrading outdated networks to meet modern performance and safety standards. Widespread adoption of smart monitoring and IoT-enabled transformer systems highlights the region’s focus on digital transformation. Europe’s commitment to sustainability and innovation positions it as a leader in next-generation transformer components.

Asia-Pacific

Asia-Pacific accounts for 29% of the Transformer Component Market in 2024, marking it as the fastest-growing region. Rapid urbanization, industrialization, and large-scale infrastructure development drive extensive demand for transformer components. China dominates with significant investments in renewable energy projects, ultra-high-voltage networks, and manufacturing industries. It also benefits from India’s rapid expansion of metro systems, industrial corridors, and smart city projects. Japan, South Korea, and Southeast Asian countries invest heavily in efficient transformer systems to support modern grids. The region shows rising adoption of both oil-immersed and dry-type transformer components depending on application. Asia-Pacific’s growing energy demand and focus on modernizing distribution systems ensure sustained growth opportunities.

Latin America

Latin America holds 7% of the Transformer Component Market in 2024, supported by gradual expansion of urban infrastructure and utility modernization. Brazil and Mexico lead adoption, driven by industrial zones, metro projects, and renewable integration. It also benefits from rising investments in commercial projects such as airports and real estate developments. Smaller economies in the region show emerging demand for modernized grid infrastructure, though limited budgets slow adoption. Energy security goals encourage governments to prioritize investments in efficient transformer technologies. Despite economic constraints, demand for reliable transformer components is expected to grow steadily.

Middle East & Africa

The Middle East & Africa account for 7% of the Transformer Component Market in 2024, marking it as the smallest but steadily expanding region. GCC countries such as Saudi Arabia, the UAE, and Qatar drive growth through mega infrastructure projects, airports, and renewable plants. It also gains support from Africa’s utility expansion projects in South Africa, Nigeria, and Egypt. Solar and wind power initiatives increase demand for specialized transformer components in both regions. While infrastructure challenges and skill shortages persist, governments prioritize reliable and efficient grid development. Investments in smart cities and energy diversification will continue to support market expansion in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Howard Industries

- Emerald Transformer

- Eaton

- EIS Legacy, LLC

- BHEL

- Alamo Transformer Supply Company (ATSCO)

- ERMCO

- ELSCO Transformers

- Hitachi Energy

- Amran Inc.

Competitive Analysis

The competitive landscape of the Transformer Component Market is shaped by leading players such as Hitachi Energy, Eaton, BHEL, Howard Industries, ERMCO, Emerald Transformer, Amran Inc., Alamo Transformer Supply Company (ATSCO), ELSCO Transformers, and EIS Legacy, LLC. These companies focus on delivering advanced transformer components that enhance efficiency, reliability, and safety across diverse applications in power distribution and renewable integration. They prioritize research and development to introduce low-loss cores, improved insulation materials, and IoT-enabled monitoring solutions that meet evolving grid requirements. Strategic initiatives such as partnerships, acquisitions, and regional expansions strengthen their competitive positions and allow them to serve both developed and emerging markets. Many of these players align with global sustainability goals by producing eco-friendly materials and energy-efficient designs that comply with strict regulatory standards. Their ability to innovate while adapting to infrastructure upgrades and renewable energy projects ensures strong growth potential and positions them as key influencers in shaping the industry’s future.

Recent Developments

- In August 2025, Hitachi Energy announced a $106 million expansion in Alamo, Tennessee, adding 60,000 sq ft (35,000 manufacturing + 20,000 warehouse + 5,000 office) to its facility. This expansion will bolster production of HVDC and dry-type bushings up to 800 kV, making it North America’s largest bushing manufacturing site.

- In July 2025, Hitachi Energy, in collaboration with SMA, achieved a milestone by delivering 3,000 transformer units specially engineered for solar inverter applications—demonstrating its competence in renewable-energy-specific transformer solutions.

- In February 2025, Eaton committed $340 million to convert its South Carolina facility in Jonesville into a major manufacturing site for three-phase transformers. The initiative will create 700 jobs and is slated to begin production in 2027.

- In 2025, Hitachi Energy unveiled two innovation at CWIEME Berlin: the GARIP® Eco bushing for SF₆-free GIS applications and the space-saving VUBB Compact on-load tap-changer (OLTC), designed for modern, compact transformer systems

Report Coverage

The research report offers an in-depth analysis based on Component, Transformer Type, Cooling Method, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with increasing demand for modern and reliable transformer components.

- Smart grid development will accelerate adoption of IoT-enabled and digitally monitored components.

- Renewable energy integration will create steady demand for durable and efficient transformer parts.

- Industrial automation will increase reliance on advanced cores, bushings, and tap changers.

- Sustainability targets will drive use of eco-friendly insulation materials and low-loss designs.

- Technological advancements will enhance transformer efficiency and operational safety worldwide.

- Utilities will invest in components that support predictive maintenance and grid reliability.

- Emerging economies will offer strong opportunities through infrastructure and energy expansion.

- Competitive pressure will encourage global players to expand portfolios and regional presence.

- The market will remain resilient by aligning with energy transition and digital innovation.