Market Overview

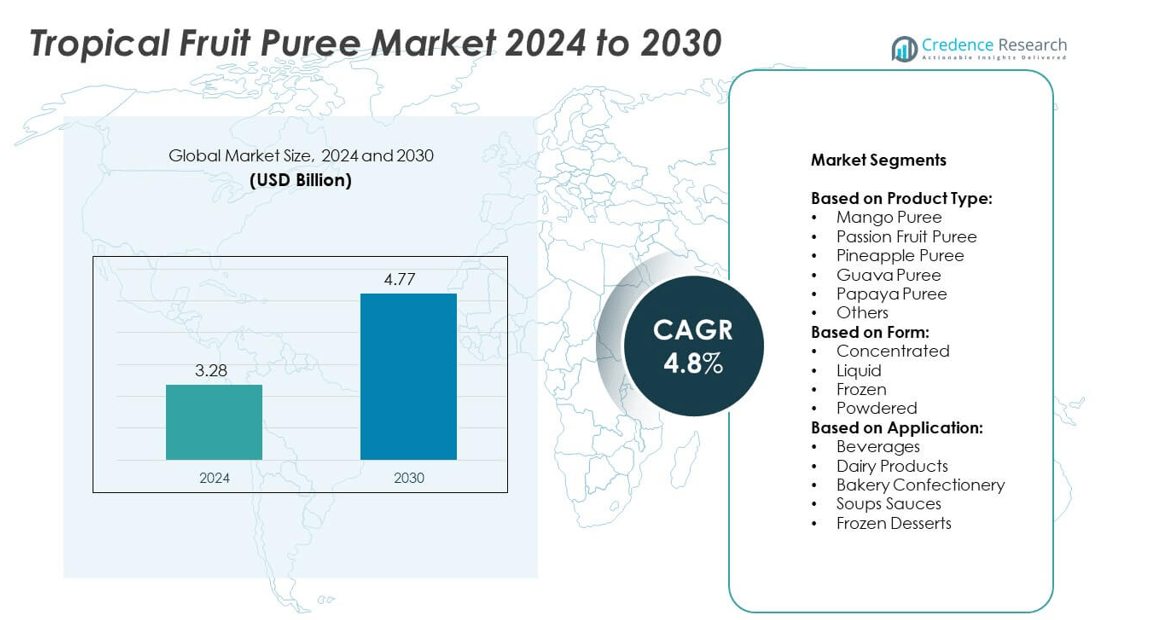

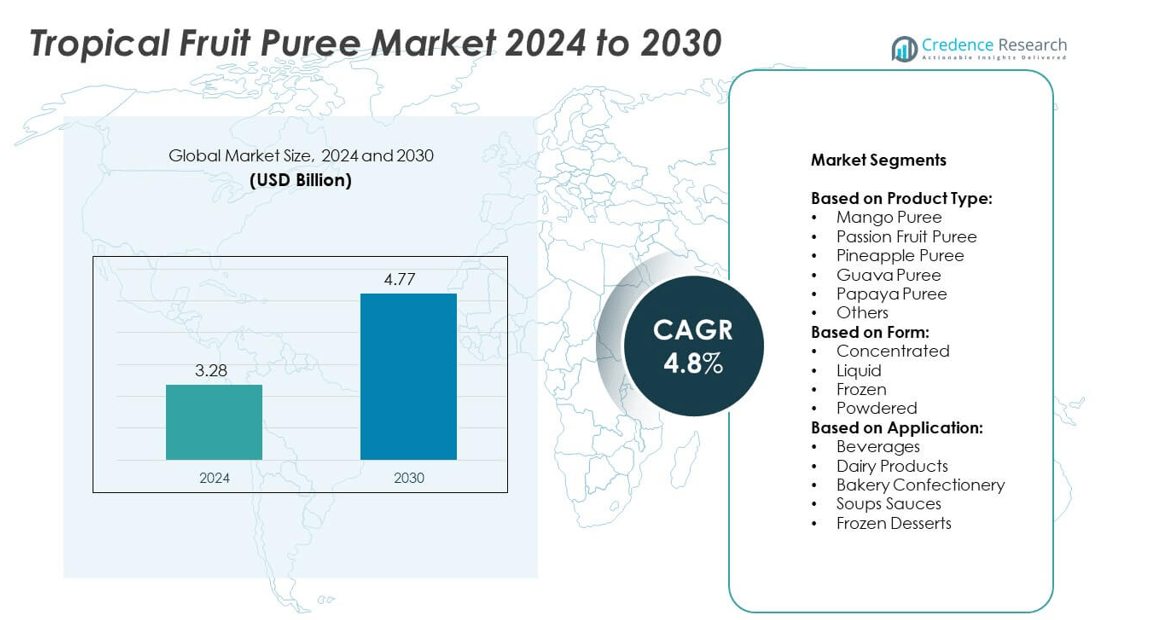

The tropical fruit puree market size was valued at USD 3.28 billion in 2024 and is expected to reach USD 4.77 billion by 2032, growing at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tropical Fruit Puree Market Size 2024 |

USD 3.28 billion |

| Tropical Fruit Puree Market, CAGR |

4.8% |

| Tropical Fruit Puree Market Size 2032 |

USD 4.77 billion |

The tropical fruit puree market grows with rising demand for natural, clean-label ingredients and health-focused products. Consumers favor mango, pineapple, and guava purees for beverages, dairy, and desserts. Strong interest in plant-based diets and functional foods drives product innovation. Technological advancements in processing improve shelf life and quality, supporting global trade. Expanding retail and e-commerce channels make purees more accessible. Sustainability initiatives and traceable sourcing strengthen consumer trust and encourage adoption across foodservice and packaged food sectors worldwide.

North America leads the tropical fruit puree market due to strong demand for natural beverages and baby food products. Europe follows with high adoption of organic and sustainably sourced purees for premium applications. Asia-Pacific shows the fastest growth, supported by abundant raw material availability and rising consumption of ready-to-drink products. Key players include Pristine Global Co., Dohler GmbH, ITC Limited, and Quicornac S.A., who focus on innovation, regional expansion, and partnerships to strengthen their global presence and meet evolving consumer preferences.

Market Insights

- The tropical fruit puree market was valued at USD 3.28 billion in 2024 and is projected to reach USD 4.77 billion by 2032 at a CAGR of 4.8%.

- Rising demand for natural, clean-label, and minimally processed ingredients drives consistent market growth.

- Innovation in exotic blends, organic certifications, and sustainable sourcing strengthens product differentiation.

- Leading players focus on advanced processing, extended shelf life, and partnerships with food manufacturers.

- Supply chain volatility, seasonal production risks, and strict quality regulations remain key challenges.

- North America leads demand, Europe follows with strong focus on organic compliance, and Asia-Pacific grows fastest.

- Expanding e-commerce channels, plant-based product launches, and fortified beverages create new opportunities globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Demand for Natural and Healthy Food Ingredients

The tropical fruit puree market benefits from increasing consumer preference for natural and minimally processed foods. Growing awareness of the health benefits of tropical fruits drives their use in beverages, baby food, and desserts. Manufacturers favor fruit puree for its clean-label appeal and absence of artificial additives. Rising disposable incomes in emerging economies expand demand for premium fruit-based products. Health-conscious consumers seek alternatives to refined sugar, and fruit puree provides natural sweetness. It supports innovation in functional foods and wellness-focused product launches worldwide.

- For instance, a study at Xihua University showed that mango smoothies treated with 500 MPa pressure for 8 minutes significantly reduced microbial load while preserving carotene content and flavour, compared to heat treatment at 90 °C for 20 minutes.

Expanding Applications Across Food and Beverage Industry

The tropical fruit puree market grows with diverse applications in beverages, bakery, dairy, and confectionery sectors. Juice and smoothie producers incorporate fruit puree to enhance flavor and nutritional value. Frozen dessert manufacturers prefer puree for consistent taste and smooth texture. Bakery brands use it to improve moisture and extend product shelf life. It also supports the development of plant-based and vegan product lines, aligning with shifting dietary trends. Growing product variety strengthens market presence across multiple food categories.

- For instance, SRAML’s puree processing technology, which includes equipment for sorting, washing, destoning, and pulping, enables producers to create high-quality, single-strength mango puree. The final Brix value of the puree depends on the mango variety and ripeness at the time of processing. Purees derived from popular industrial varieties can naturally yield single-strength Brix values ranging from 14–16°, which are commonly used in premium beverages and desserts.

Strong Growth of Ready-to-Drink and Convenience Products

The tropical fruit puree market gains momentum from rising demand for convenience-oriented food and drinks. Urban consumers prefer ready-to-drink juices and smoothies that use fruit puree for natural taste. Busy lifestyles encourage quick meal solutions, boosting use of puree in breakfast bowls and snacks. It helps brands create shelf-stable products with longer storage life. Increasing popularity of cold-pressed and clean-label beverages strengthens market penetration. Global café and restaurant chains use puree for premium drink formulations and dessert toppings.

Supportive Government Policies and Export Opportunities

The tropical fruit puree market benefits from trade incentives and government-backed agricultural programs. Exporters receive support to promote tropical fruits in international markets, boosting supply. Sustainable farming practices encouraged by authorities improve yield quality and traceability. It helps producers meet stringent safety and labeling standards in importing countries. Investment in cold chain logistics reduces post-harvest losses and improves product availability. Favorable trade agreements open new markets for suppliers, encouraging long-term industry growth.

Market Trends

Increasing Adoption of Organic and Clean-Label Fruit Purees

The tropical fruit puree market sees rising adoption of organic and clean-label products. Consumers prefer purees free from pesticides, synthetic colors, and preservatives. Brands highlight traceability and certifications to meet strict retail standards. It supports growth in premium segments and appeals to health-focused buyers. Organic mango, pineapple, and guava purees lead demand in developed markets. Food manufacturers invest in transparent sourcing to strengthen brand trust and market share.

- For instance, The Teragro Benfruit Plant in Nigeria’s Benue State, previously owned and operated by Teragro Commodities Limited, an agribusiness subsidiary of Transcorp, was established with the capacity to process up to 26,500 metric tonnes of orange, mango, and pineapple fruit concentrates per annum.

Rising Popularity of Exotic Blends and Flavor Innovation

The tropical fruit puree market grows with innovation in exotic fruit combinations. Producers mix mango, passion fruit, and papaya to create unique flavor profiles. Beverage brands launch seasonal and limited-edition products using blended purees. It drives experimentation in cocktails, smoothies, and desserts across foodservice channels. Culinary professionals explore tropical ingredients for gourmet and fusion cuisines. Innovative blends help attract younger consumers seeking novelty and diverse taste experiences.

- For instance, a study published in the journal Foods by S. Sharma et al. (2019) demonstrated that high-pressure processing (HPP) at 500 MPa for 3 minutes could be used with mango puree fortified with 2–5% whey protein isolate. The study found that while HPP treatment increased the rheological properties (gel-like behavior), acceptable mouthfeel and texture could be achieved at these lower protein concentrations without the addition of other stabilizers. The authors also noted that higher protein levels (e.g., 8%) resulted in negative sensory attributes like bitterness.

Technological Advancements in Processing and Packaging

The tropical fruit puree market benefits from improved processing technologies. High-pressure processing and aseptic packaging extend shelf life without compromising taste. Automation enhances production efficiency and reduces contamination risks. It enables large-scale supply to meet global demand consistently. Lightweight, recyclable packaging supports sustainability goals and lowers transportation costs. Producers adopt smart logistics systems to ensure faster and safer deliveries.

Growing Penetration in Plant-Based and Functional Food Segments

The tropical fruit puree market expands with the surge of plant-based diets and functional foods. Purees add natural nutrients and appealing flavors to dairy alternatives and wellness drinks. Health brands use fruit puree to fortify products with vitamins and antioxidants. It helps create low-sugar snacks that meet regulatory guidelines. Rising interest in gut health boosts demand for fruit-based probiotic products. Functional product launches strengthen market visibility and consumer engagement.

Market Challenges Analysis

Volatility in Raw Material Supply and Price Fluctuations

The tropical fruit puree market faces challenges from unstable fruit supply and price volatility. Seasonal variations, climate change, and extreme weather events disrupt production cycles. It creates inconsistency in raw material availability and impacts processing costs. Small farmers struggle with infrastructure gaps, leading to post-harvest losses. Price fluctuations affect profit margins for manufacturers and exporters. Companies invest in contract farming and cold chain systems to stabilize supply. Long-term planning is required to maintain steady production and pricing.

Stringent Quality Standards and Logistics Constraints

The tropical fruit puree market encounters hurdles due to strict international quality and safety standards. Importing nations enforce rigorous pesticide residue limits and labeling requirements. It increases compliance costs for exporters and small-scale processors. Poor logistics infrastructure in developing regions leads to delays and product spoilage. Cold storage and transportation gaps limit access to distant markets. Companies adopt advanced packaging and monitoring systems to reduce losses. Overcoming these barriers is essential for competitive participation in global trade.

Market Opportunities

Expansion into Emerging Economies and Untapped Markets

The tropical fruit puree market holds strong opportunities in rapidly growing economies. Rising urbanization and higher disposable incomes boost demand for premium fruit-based products. It supports growth in foodservice, retail, and online distribution channels. Emerging markets in Asia-Pacific, Africa, and Latin America offer large consumer bases. Local processing facilities reduce import dependency and strengthen supply chains. Companies that invest in regional partnerships gain early market advantages and secure long-term growth potential.

Innovation in Product Development and Health-Focused Offerings

The tropical fruit puree market benefits from opportunities in functional and fortified food segments. Consumers seek products with added vitamins, antioxidants, and natural sweetness. It drives development of low-sugar and clean-label formulations for health-conscious buyers. Food brands experiment with new textures, blends, and flavor profiles to attract diverse demographics. Growth in plant-based beverages and vegan desserts creates new avenues for puree use. Strategic innovation and R&D investment enhance brand competitiveness and customer loyalty.

Market Segmentation Analysis:

By Product Type

The tropical fruit puree market is segmented into mango, passion fruit, pineapple, guava, papaya, and others. Mango puree holds the largest share due to its wide use in beverages, baby food, and desserts. Passion fruit puree gains traction for its unique tangy flavor in smoothies and sauces. Pineapple puree supports bakery and confectionery applications with its sweet and tropical profile. Guava puree finds demand in jams and nectars for its high vitamin C content. Papaya puree is favored in health-focused products for its digestive enzymes. It sees growing use of mixed fruit purees to develop innovative blends and premium offerings.

- For instance, ABC Fruits’ organic Alphonso mango puree has a minimum 16° Brix and is used for baby foods and beverages. The acidity range is variable depending on the specific product batch and specification document. For example, some specifications for organic Alphonso puree indicate an acidity of 0.45% to 0.90% citric acid, while others have shown a range of 0.45% to 0.80%.

By Form

The tropical fruit puree market includes concentrated, liquid, frozen, and powdered forms. Concentrated puree dominates due to easier transport, longer shelf life, and cost efficiency. Liquid puree is preferred for ready-to-drink beverages and high-quality foodservice applications. Frozen puree ensures freshness and maintains nutrient content, supporting premium dessert and smoothie products. Powdered puree serves niche markets, including instant beverage mixes and bakery products. It helps manufacturers maintain consistent flavor and reduce storage requirements. Growing demand for shelf-stable formats strengthens investments in advanced processing technologies.

- For instance, Ghousia Food’s yellow papaya concentrate (aseptic form) shows Brix at 20 °C of at least 25°, acidity of 0.70-1.20%, and pH between 3.80-4.00.

By Application

The tropical fruit puree market covers beverages, dairy products, bakery confectionery, soups sauces, and frozen desserts. Beverages remain the leading application segment, driven by high demand for juices, smoothies, and cocktails. Dairy producers use puree for flavored yogurt, ice creams, and milkshakes to enhance consumer appeal. Bakery and confectionery applications include cakes, fillings, and toppings for improved taste and texture. Soups and sauces use puree to deliver consistent flavor in processed food manufacturing. Frozen desserts benefit from natural sweetness and vibrant color, attracting health-conscious consumers. It supports growing use of puree in plant-based and functional product formulations.

Segments:

Based on Product Type:

- Mango Puree

- Passion Fruit Puree

- Pineapple Puree

- Guava Puree

- Papaya Puree

- Others

Based on Form:

- Concentrated

- Liquid

- Frozen

- Powdered

Based on Application:

- Beverages

- Dairy Products

- Bakery Confectionery

- Soups Sauces

- Frozen Desserts

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 32% of the tropical fruit puree market, making it a leading regional contributor. The region benefits from strong demand for natural and clean-label food products across the United States and Canada. Consumers increasingly prefer beverages, baby foods, and desserts that use fruit puree for natural flavor and nutritional value. It supports the adoption of mango, pineapple, and passion fruit purees in premium product segments. The growth of plant-based diets and functional beverages drives demand for vitamin-rich purees. Foodservice operators, including smoothie chains and quick-service restaurants, invest in innovative menu items featuring tropical flavors. Government support for healthy eating initiatives and improved cold chain logistics strengthens market growth in this region.

Europe

Europe holds 28% of the tropical fruit puree market, supported by a mature food and beverage industry. Demand is driven by health-conscious consumers seeking low-sugar, natural ingredients in their daily diet. The region witnesses high usage of mango and guava purees in smoothies, yogurts, and premium ice creams. It encourages local processors to expand imports and work with certified suppliers to ensure quality. European Union regulations favor organic and sustainably sourced products, boosting demand for certified purees. Manufacturers focus on transparent labeling and allergen-free formulations to meet strict compliance standards. Growth in vegan desserts and clean-label bakery items contributes to steady demand across major European countries.

Asia-Pacific

Asia-Pacific represents 24% of the tropical fruit puree market and shows the fastest growth potential. Rising disposable incomes, urbanization, and changing dietary habits drive demand for fruit-based beverages and snacks. The region is a leading producer of mango, guava, and papaya, allowing strong raw material availability. It helps local manufacturers supply both domestic and export markets efficiently. Demand for convenient, ready-to-drink products expands rapidly in India, China, and Southeast Asia. International players invest in joint ventures and local processing facilities to strengthen their presence. E-commerce channels boost distribution, making fruit puree-based products accessible to a wider consumer base.

Latin America

Latin America contributes 10% of the tropical fruit puree market, supported by its rich production base for tropical fruits. The region is a major exporter of mango and passion fruit purees to North America and Europe. It leverages its favorable climate and agricultural expertise to ensure high-quality output. Local consumption rises with growing middle-class incomes and expanding retail networks. It encourages processors to invest in advanced packaging and processing facilities for longer shelf life. Governments promote agricultural development programs that improve farm productivity and export competitiveness. Strategic collaborations with global food brands create opportunities for regional producers.

Middle East & Africa

The Middle East & Africa region accounts for 6% of the tropical fruit puree market and shows gradual but steady growth. Rising demand for healthy beverages and smoothies in urban centers supports market expansion. It benefits from increasing imports of mango and pineapple purees to meet growing demand. Regional foodservice chains introduce tropical fruit flavors to cater to younger consumers. Limited local production creates reliance on international suppliers, driving collaboration with global exporters. Government initiatives to improve cold storage and distribution infrastructure help reduce post-import losses. Expanding retail formats and rising health awareness contribute to a positive market outlook.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pristine Global Co.

- Dohler GmbH

- ITC Limited

- KLT Fruits Incorporated

- Quicornac S.A. (Ecuador)

- iTi Tropicals, Inc.

- Agrana Beteiligungs-AG

- Grofresh Agrofoods Pvt. Ltd.

- Citrofrut

- Pure Indian Foods

- Mother India Farms

- Kerr by Ingredion Inc.

- Inborja S.A.

- Abc Fruits

- Lemonconcentrate SL

Competitive Analysis

The tropical fruit puree market features strong competition with key players including Pristine Global Co., Dohler GmbH, ITC Limited, KLT Fruits Incorporated, Quicornac S.A. (Ecuador), iTi Tropicals, Inc., Agrana Beteiligungs-AG, Grofresh Agrofoods Pvt. Ltd., Citrofrut, Pure Indian Foods, Mother India Farms, Kerr by Ingredion Inc., Inborja S.A., Abc Fruits, and Lemonconcentrate SL. These companies compete through product innovation, quality certifications, and expanded distribution networks. They focus on offering a wide range of fruit purees such as mango, pineapple, guava, and passion fruit to cater to diverse applications. Investments in advanced processing technologies help maintain consistent taste, texture, and safety standards. Strategic partnerships with food and beverage manufacturers enhance market reach and customer loyalty. Many players emphasize sustainability by sourcing fruits through contract farming and supporting traceability initiatives. They also target the growing demand for organic and clean-label products with certified and preservative-free offerings. Regional expansion and export growth remain priorities, with strong presence in Asia-Pacific, Europe, and North America. Continuous R&D efforts focus on improving shelf life and developing blended purees to meet evolving consumer preferences. Competitive pricing and supply chain efficiency are critical to maintain market share and profitability in this evolving industry.

Recent Developments

- In 2025, Döhler promoted new functional ingredient solutions at this trade show, including powder meal drinks and super powder supplement blends.

- In 2024, ABC Fruits provided an update on its product offerings and production capacity. The company offers premium-quality tropical fruit purees including mango, guava (white and pink), banana, papaya, pineapple, and others.

- In 2024, Grofresh launched a new range of frozen tropical fruit purees targeting Indian and Middle Eastern markets

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The tropical fruit puree market will see steady growth driven by rising health-focused consumption.

- Demand for clean-label and organic fruit purees will expand across food and beverage sectors.

- Technological advancements in processing will improve quality, shelf life, and supply consistency.

- Functional and fortified product launches will create new opportunities in wellness-focused categories.

- Growth in plant-based diets will boost usage of purees in dairy alternatives and vegan desserts.

- E-commerce and direct-to-consumer channels will strengthen distribution and reach.

- Emerging markets in Asia-Pacific and Africa will witness the fastest consumption growth.

- Strategic partnerships between global brands and local producers will secure raw material supply.

- Investment in cold chain and logistics infrastructure will reduce losses and ensure year-round availability.

- Sustainability initiatives will drive demand for certified, traceable, and eco-friendly puree production.