| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| United Arab Emirates (UAE) Biomaterials Market Size 2024 |

USD 1,477.00 Million |

| United Arab Emirates (UAE) Biomaterials Market, CAGR |

13.64% |

| United Arab Emirates (UAE) Biomaterials Market Size 2032 |

USD 4,107.15 Million |

Market Overview

United Arab Emirates (UAE) Biomaterials Market size was valued at USD 1,477.00 million in 2024 and is anticipated to reach USD 4,107.15 million by 2032, at a CAGR of 13.64% during the forecast period (2024-2032).

The growth of the United Arab Emirates (UAE) biomaterials market is driven by increasing investments in healthcare infrastructure, rising demand for advanced medical technologies, and the growing prevalence of chronic diseases and age-related conditions. The government’s strong focus on fostering medical tourism and expanding specialized treatment centers further supports market expansion. Additionally, advancements in biomaterials science, including the development of smart and regenerative biomaterials, are enhancing the effectiveness of implants, prosthetics, and drug delivery systems. The rising adoption of minimally invasive surgical procedures and personalized medicine also contributes to the market’s momentum. Collaborative efforts between research institutions and biotech firms in the region are accelerating innovation and commercialization of novel biomaterials. Furthermore, favorable regulatory frameworks and initiatives to promote domestic manufacturing are strengthening the local biomaterials ecosystem. These trends collectively position the UAE as a key player in the regional biomedical landscape, with significant potential for sustained growth and technological advancement.

The geographical landscape of the United Arab Emirates (UAE) biomaterials market is shaped by the presence of advanced healthcare infrastructure and strategic investments across key emirates such as Abu Dhabi, Dubai, Sharjah, and Ajman. These regions serve as focal points for innovation, research, and clinical application of biomaterials in various medical fields, including orthopedics, cardiology, dentistry, and plastic surgery. The UAE’s commitment to healthcare modernization has attracted prominent industry players who contribute to the market’s competitive environment. Leading companies such as Al Zahrawi Medical, Gulf Medical Company, Medtronic UAE, UAE Medical Supplies, and BioLife Medical play pivotal roles in supplying a wide range of biomaterials and advanced medical devices. These key players support the growing demand through strong distribution networks, strategic partnerships, and continuous product innovation. Their presence enhances the accessibility of high-quality biomaterials and reinforces the UAE’s position as a regional hub for medical technology and specialized healthcare solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UAE biomaterials market was valued at USD 1,477.00 million in 2024 and is expected to reach USD 4,107.15 million by 2032, growing at a CAGR of 13.64% during the forecast period (2024-2032).

- The global biomaterials market was valued at USD 2,03,827.80 million in 2024 and is projected to reach USD 6,19,828.57 million by 2032, growing at a CAGR of 14.91% during the forecast period.

- Increasing investments in healthcare infrastructure and advanced medical technologies are driving market growth.

- Growing demand for personalized medicine, orthopedic implants, and dental solutions is contributing to the expansion of the biomaterials sector.

- Technological advancements, such as 3D printing and regenerative biomaterials, are transforming the industry with more customized and efficient solutions.

- The market faces challenges related to regulatory complexities and a high dependency on imported biomaterials.

- Abu Dhabi and Dubai dominate the market with advanced healthcare facilities and a strong medical tourism sector.

- Key players like Al Zahrawi Medical, Medtronic UAE, and BioLife Medical are leading the market with strong distribution channels and continuous innovation.

Report Scope

This report segments the United Arab Emirates (UAE) Biomaterials Market as follows:

Market Drivers

Expanding Healthcare Infrastructure and Government Support

The UAE government’s strategic focus on enhancing healthcare infrastructure has significantly driven the demand for advanced biomaterials. The country’s Vision 2031 emphasizes innovation-led growth, particularly in healthcare, prompting massive investments in state-of-the-art hospitals, research centers, and medical universities. For instance, the UAE Ministry of Health and Prevention has outlined national health indicators that prioritize infrastructure expansion. These developments increase the need for high-performance biomaterials used in surgical implants, prosthetics, and diagnostic systems. Moreover, government initiatives to attract global healthcare providers and establish public-private partnerships are fueling the demand for innovative biomaterials that support advanced medical procedures and improve patient outcomes.

Medical Tourism and Growing Demand for Elective Procedures

The UAE is positioning itself as a global destination for medical tourism, offering world-class healthcare services and attracting international patients seeking high-quality treatment. For instance, Dubai alone received 674,000 medical tourists in 2022, spending nearly Dh992 million on healthcare services. The increase in elective procedures such as cosmetic surgery, dental implants, and orthopedic interventions has created a robust demand for premium biomaterials. The availability of skilled professionals, combined with modern medical facilities and minimal waiting times, strengthens the country’s appeal as a healthcare hub. Biomaterials play a crucial role in supporting this growth, as they are essential for delivering safe, effective, and aesthetically pleasing outcomes in various medical disciplines.

Rising Burden of Chronic Diseases and an Aging Population

A growing incidence of lifestyle-related and chronic diseases—such as cardiovascular disorders, orthopedic conditions, and diabetes—has led to an increased demand for biomaterials used in medical implants, tissue engineering, and drug delivery systems. Additionally, the aging population in the UAE is more susceptible to degenerative diseases, driving the need for biomaterials in treatments like joint replacements and dental implants. As the population continues to age, the healthcare system requires more biocompatible and durable materials that improve the quality of life for elderly patients. This demographic trend is expected to sustain long-term growth in biomaterials demand.

Technological Advancements and Innovation in Biomaterials

Continuous innovation in material science is expanding the functional capabilities of biomaterials, making them more adaptable for a wide range of medical applications. The integration of nanotechnology, 3D printing, and regenerative medicine is resulting in the development of next-generation biomaterials with enhanced biocompatibility, strength, and regenerative properties. These advancements are particularly important for customized prosthetics and patient-specific implants, aligning with the global shift toward personalized healthcare. The UAE, with its rising number of research institutions and innovation hubs, is becoming a regional leader in medical technology, thus accelerating the adoption and development of cutting-edge biomaterials.

Market Trends

Surge in Demand for Regenerative and Smart Biomaterials

One of the most prominent trends in the UAE biomaterials market is the increasing demand for regenerative and smart biomaterials. These advanced materials are engineered to interact with biological systems to support tissue regeneration, stimulate healing, or deliver targeted therapies. The UAE’s commitment to adopting cutting-edge healthcare solutions has led to a growing focus on biomaterials that go beyond structural support to offer functional integration with living tissues. For instance, the UAE Ministry of Health and Prevention has outlined national health indicators that prioritize regenerative medicine, with initiatives supporting stem cell research and tissue engineering. As hospitals and research centers invest in regenerative medicine and tissue engineering, the adoption of smart biomaterials in orthopedic, cardiovascular, and dental applications is rapidly expanding.

Integration of 3D Printing in Biomaterial Applications

The integration of 3D printing technology with biomaterials is revolutionizing the customization of medical devices and implants in the UAE. Medical professionals and engineers are increasingly using 3D printing to produce patient-specific implants and prosthetics using biocompatible materials. This trend is aligned with the UAE’s broader innovation agenda, which promotes digital transformation across all sectors, including healthcare. For instance, United Arab Emirates University has conducted research on AI-enhanced 3D bioprinting of natural biomaterials, highlighting the potential for sustainable and customized medical solutions. The ability to rapidly prototype and manufacture customized medical solutions using biomaterials not only enhances treatment precision but also reduces surgical time and post-operative complications, driving greater acceptance across hospitals and clinics.

Growing Emphasis on Sustainability and Biodegradable Materials

As environmental awareness increases globally, the UAE is witnessing a growing trend toward the development and use of biodegradable and sustainable biomaterials. Researchers and manufacturers are focusing on eco-friendly alternatives derived from natural sources, such as collagen, chitosan, and polylactic acid. These materials offer significant advantages in terms of biocompatibility and reduced environmental impact. The UAE’s proactive stance on sustainability, reflected in national strategies like the UAE Green Agenda and Net Zero 2050, is encouraging the adoption of environmentally responsible materials in medical applications, particularly in single-use devices and drug delivery systems.

Increased Collaboration and Investment in R&D

Another key trend shaping the UAE biomaterials market is the rise in research and development (R&D) collaborations between universities, biotechnology firms, and healthcare providers. These partnerships are accelerating the discovery and commercialization of innovative biomaterials tailored to local and regional healthcare needs. With dedicated free zones like Dubai Science Park and Abu Dhabi’s Hub71 offering favorable environments for biotech startups and research labs, investment in biomaterials innovation is steadily increasing. This collaborative ecosystem is enhancing the UAE’s capability to produce high-value biomaterials domestically and reduce reliance on imports.

Market Challenges Analysis

Regulatory Complexities and Limited Standardization

Despite the UAE’s progressive approach to healthcare innovation, regulatory complexities pose a significant challenge to the biomaterials market. The lack of harmonized standards for the approval, testing, and quality control of biomaterials can create hurdles for manufacturers and developers looking to introduce new products. For instance, the UAE Ministry of Health and Prevention (MOHAP) provides annual reports outlining healthcare regulations and compliance requirements, but the absence of a unified framework across the Gulf Cooperation Council (GCC) continues to limit scalability. Inconsistent regulatory pathways and evolving compliance requirements increase the time and cost associated with market entry, particularly for international players unfamiliar with regional norms. Moreover, the absence of a unified regulatory framework across the Gulf Cooperation Council (GCC) limits scalability and slows the cross-border expansion of biomaterial technologies. While the UAE continues to refine its healthcare regulations, the current lack of standardization and transparency in approval processes remains a barrier to rapid commercialization and widespread adoption.

High Dependence on Imports and Limited Local Production Capacity

Another pressing challenge in the UAE biomaterials market is the country’s high dependence on imported materials and technologies. Although the government encourages innovation and local manufacturing, the domestic production of high-grade biomaterials remains limited. Most advanced biomaterials, especially those used in orthopedic, cardiovascular, and dental applications, are sourced from established international suppliers. This reliance exposes the market to global supply chain disruptions, foreign exchange fluctuations, and increased procurement costs. Additionally, the lack of local expertise and infrastructure for large-scale biomaterials production restricts the UAE’s ability to meet growing demand independently. While efforts are underway to boost research and attract foreign direct investment in the life sciences sector, building a self-sustaining biomaterials ecosystem will require sustained investment in talent development, manufacturing capabilities, and R&D infrastructure over the coming years.

Market Opportunities

The United Arab Emirates (UAE) biomaterials market presents significant growth opportunities driven by the nation’s ongoing commitment to becoming a global healthcare and innovation hub. With substantial investments in healthcare infrastructure, research institutions, and biotechnology zones, the UAE is well-positioned to foster advancements in biomaterials science. Opportunities lie in the growing demand for innovative medical devices, regenerative therapies, and patient-specific implants, particularly in orthopedics, cardiovascular treatment, and dentistry. As the country continues to attract medical tourism and expand its specialized care offerings, the need for high-performance, biocompatible materials will increase. Furthermore, the UAE’s support for advanced technologies such as 3D printing and nanotechnology creates a favorable environment for the development of next-generation biomaterials tailored to local patient demographics and healthcare needs.

In addition to domestic demand, the UAE’s strategic geographic location and strong logistics infrastructure provide an excellent base for regional export and distribution. Emerging opportunities exist in localizing the production of high-value biomaterials to reduce reliance on imports and enhance supply chain resilience. The government’s encouragement of foreign direct investment and the availability of tax-free zones create attractive conditions for international biomaterials companies to establish research and manufacturing operations within the UAE. Collaborations between academia, healthcare providers, and private sector innovators can further accelerate the commercialization of homegrown biomaterial solutions. As sustainability becomes an increasingly important consideration, there is also potential to lead in the development of biodegradable and environmentally responsible biomaterials, aligning with the UAE’s broader sustainability goals. Collectively, these factors position the UAE biomaterials market for robust expansion and long-term strategic significance in the Middle East and beyond.

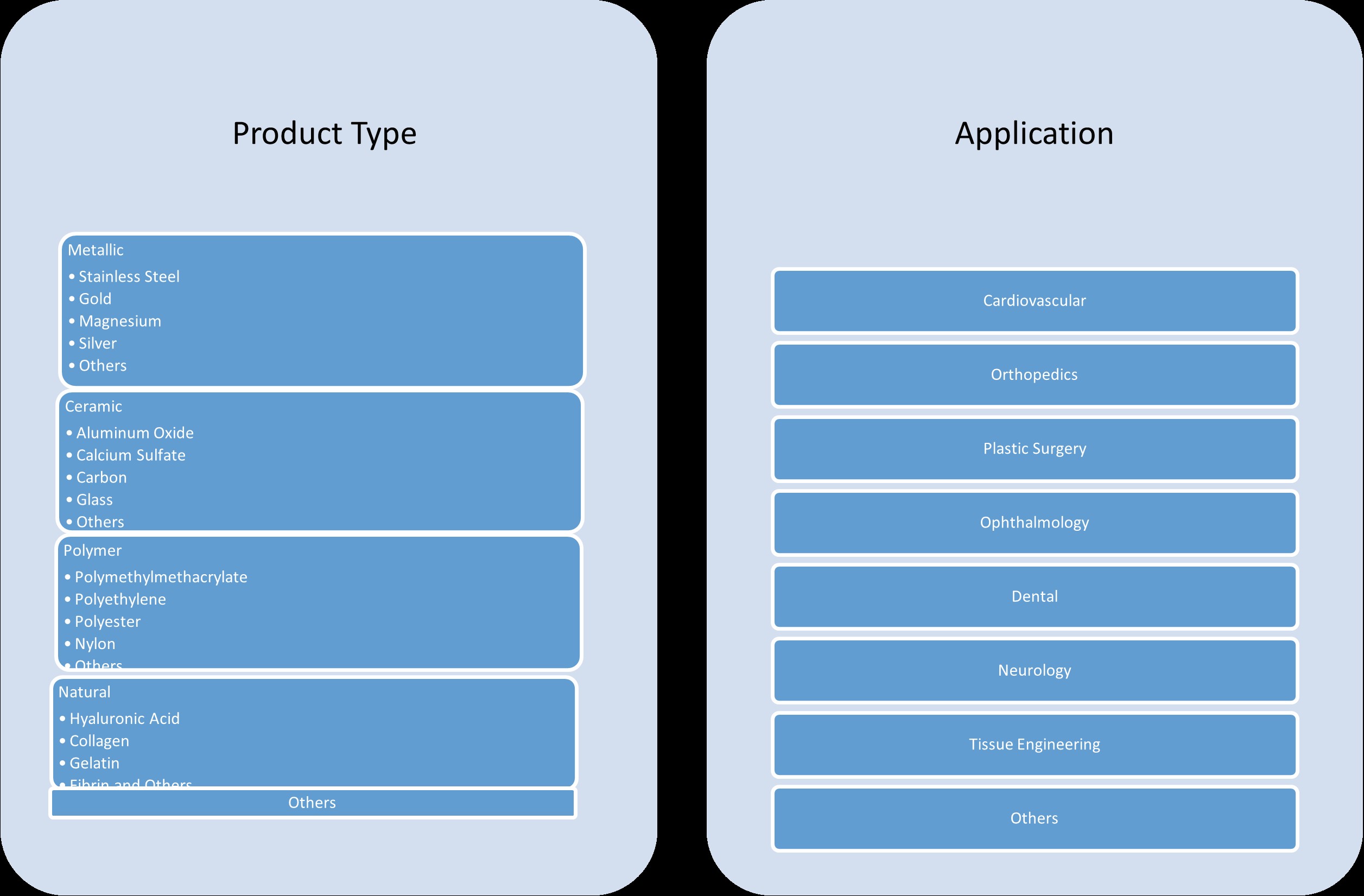

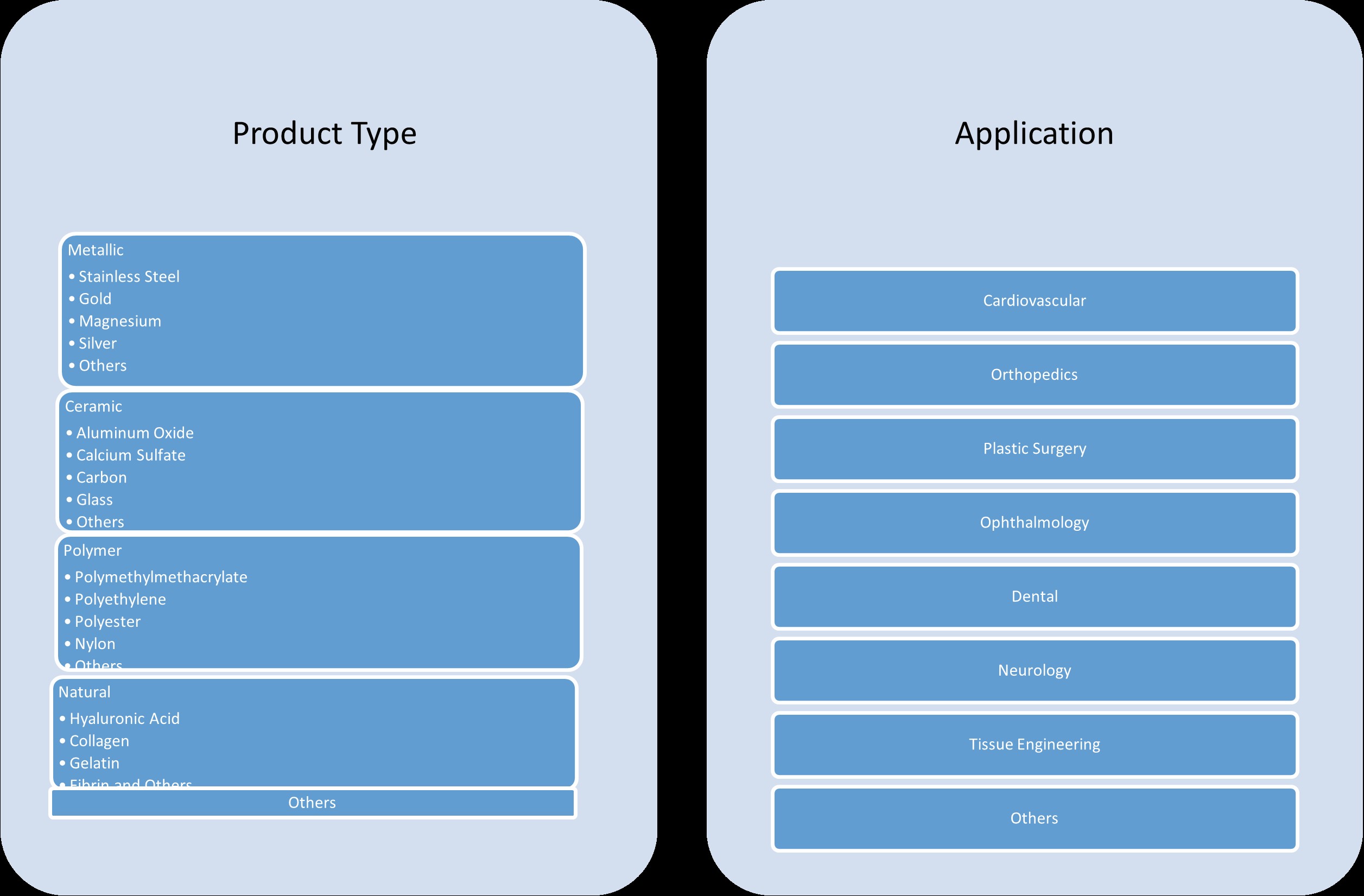

Market Segmentation Analysis:

By Product Type:

The UAE biomaterials market is segmented into metallic, ceramic, polymer, natural, and other biomaterials, each serving specific medical needs. Metallic biomaterials, such as stainless steel, magnesium, silver, gold, and other alloys, are widely used in orthopedic implants and cardiovascular devices due to their strength and durability. Among them, stainless steel and magnesium alloys are gaining traction for their cost-effectiveness and corrosion resistance. Ceramic biomaterials, including aluminum oxide, calcium sulfate, carbon, and glass, are primarily used in dental and orthopedic applications for their excellent biocompatibility and wear resistance. Polymeric biomaterials, such as polymethylmethacrylate (PMMA), polyethylene, polyester, and nylon, are widely adopted due to their versatility and adaptability across various surgical applications. Additionally, natural biomaterials—such as hyaluronic acid, collagen, gelatin, and fibrin—are gaining prominence in wound healing, tissue engineering, and cosmetic procedures owing to their low toxicity and regenerative potential. Each of these segments is poised for growth as demand for advanced and biocompatible materials increases across the UAE’s expanding healthcare landscape.

By Application:

By application, the UAE biomaterials market spans cardiovascular, orthopedics, plastic surgery, ophthalmology, dental, neurology, tissue engineering, and other medical fields. Orthopedic applications dominate the market, driven by the rising incidence of joint-related disorders and the aging population, necessitating joint replacements and bone grafts. Cardiovascular biomaterials are also in high demand due to the prevalence of heart disease and increased usage of stents, pacemakers, and vascular grafts. Dental and ophthalmic biomaterials are gaining momentum with the growth of cosmetic and corrective procedures. Moreover, plastic surgery and tissue engineering are experiencing robust adoption of biomaterials for reconstructive and aesthetic enhancements, supported by medical tourism and rising demand for elective procedures. Neurology, while still emerging, presents long-term opportunities through innovations in neural implants and bioelectronic devices. The widespread application of biomaterials across these disciplines reflects the UAE’s focus on high-tech, patient-centric healthcare solutions and supports the sector’s continued diversification and expansion.

Segments:

Based on Product Type:

- Metallic

- Stainless Steel

- Gold

- Magnesium

- Silver

- Others

- Ceramic

- Aluminum Oxide

- Calcium Sulfate

- Carbon

- Glass

- Others

- Polymer

- Polymethylmethacrylate

- Polyethylene

- Polyester

- Nylon

- Others

- Natural

- Hyaluronic Acid

- Collagen

- Gelatin

- Fibrin and others

- Others

Based on Application:

- Cardiovascular

- Orthopedics

- Plastic Surgery

- Ophthalmology

- Dental

- Neurology

- Tissue Engineering

- Others

Based on the Geography:

- Abu Dhabi

- Dubai

- Sharjah

- Ajman

- Fujairah

- Ras Al Khaimah

- Umm Al Quwain

Regional Analysis

Abu Dhabi

Abu Dhabi leads the UAE biomaterials market, accounting for approximately 35% of the total market share. As the capital of the UAE, Abu Dhabi has made substantial investments in healthcare infrastructure and medical research, positioning itself as a center for advanced medical care. The emirate is home to some of the country’s most sophisticated hospitals, including Cleveland Clinic Abu Dhabi and Sheikh Shakhbout Medical City, which frequently utilize high-grade biomaterials in orthopedic, cardiovascular, and dental procedures. Abu Dhabi’s focus on innovation, backed by its Department of Health’s strategic initiatives, is also fostering the development of locally sourced and customized biomaterial solutions. The establishment of specialized research clusters and biotech incubators is further propelling demand and innovation in the biomaterials sector.

Dubai

With an estimated 32% market share, Dubai is a strong contender in the UAE biomaterials market, benefiting from its vibrant healthcare ecosystem and emphasis on medical tourism. Dubai’s extensive network of private hospitals and specialty clinics drives substantial demand for advanced biomaterials used in aesthetic surgery, dental implants, ophthalmology, and orthopedic treatments. The presence of Dubai Healthcare City and Dubai Science Park supports clinical research and international collaborations, accelerating the adoption of cutting-edge biomaterials and related technologies. Moreover, Dubai’s diverse and tech-savvy population, coupled with a steady flow of international patients, fosters a dynamic market for personalized and high-performance biomaterials. As Dubai continues to promote healthcare innovation through government-led initiatives like the Dubai Health Strategy 2026, its biomaterials segment is expected to expand further.

Sharjah

Sharjah holds around 13% of the UAE biomaterials market, driven by its focus on academic research and public healthcare initiatives. The emirate has emerged as a growing healthcare hub, supported by institutions like the University of Sharjah’s medical and research centers, which are actively involved in biomaterials science and biotechnology. Sharjah’s investments in public hospitals and healthcare accessibility create steady demand for cost-effective and biocompatible materials, especially in orthopedics, ophthalmology, and wound care. The Sharjah Research, Technology and Innovation Park (SRTIP) also provides a platform for startups and R&D organizations to explore innovative biomaterials, enhancing the region’s role in the national healthcare innovation landscape.

Ajman

Ajman accounts for approximately 8% of the UAE’s biomaterials market, supported by a growing network of healthcare institutions and medical colleges. While smaller in scale compared to Abu Dhabi and Dubai, Ajman is steadily building its healthcare capabilities, with hospitals and clinics increasingly incorporating modern biomaterials in dental and surgical procedures. The presence of Gulf Medical University contributes to the development of healthcare professionals and ongoing research in biomaterial applications. Ajman’s focus on improving healthcare standards and expanding access is gradually creating opportunities for biomaterials manufacturers, especially those offering affordable and regionally adaptable solutions. Continued growth in private healthcare services is likely to bolster Ajman’s market position in the coming years.

Key Player Analysis

- Al Zahrawi Medical

- Gulf Medical Company

- UAE Medical Supplies

- Medtronic UAE

- BioLife Medical

Competitive Analysis

The UAE biomaterials market is highly competitive, with several key players contributing to its growth and innovation. Leading companies such as Al Zahrawi Medical, Gulf Medical Company, UAE Medical Supplies, Medtronic UAE, and BioLife Medical are at the forefront, each bringing unique strengths to the market. These companies are leveraging advancements in technology, such as 3D printing, regenerative biomaterials, and nanotechnology, to develop customized solutions that cater to the growing need for personalized medicine. Additionally, many players are enhancing their distribution networks to ensure timely availability of products across the UAE’s healthcare facilities. The competition is further intensified by the increasing demand for minimally invasive procedures and the shift towards patient-specific implants. With the UAE government’s push towards fostering medical tourism, the demand for advanced biomaterials is expected to rise. Companies are also investing in R&D to create biomaterials that are not only biocompatible but also sustainable, as there is an increasing emphasis on eco-friendly products. To maintain a competitive edge, companies are collaborating with research institutions and healthcare providers, driving continuous innovation in the biomaterials sector. However, challenges such as regulatory complexities and the high dependency on imported materials continue to influence the competitive landscape.

Recent Developments

- In April 2025, BASF expanded its EcoBalanced portfolio for Care Chemicals in North America, introducing the first EcoBalanced personal care products in the region. These include Dehyton® PK 45 and Dehyton® KE UP, both certified as EcoBalanced grades using a biomass balance (BMB) approach to reduce carbon footprint. Additionally, six U.S. Care Chemicals production sites are now powered entirely by renewable electricity, saving approximately 33,000 tons of CO₂ annually.

- In November 2024, Covestro began production of Desmophen® CQ NH, a partially bio-based polyaspartic resin (at least 25% bio-based content), at its Foshan, China site. The facility is powered entirely by renewable energy, and the product is used in wind turbine and flooring coatings, supporting both local supply and sustainability goals.

- In January 2025, BASF’s Performance Materials division transitioned all European sites to 100% renewable electricity, covering engineering plastics, polyurethanes, thermoplastic polyurethanes, and specialty polymers.

- In June 2023, Invibio announced a collaboration with Paragon Medical to scale up manufacturing of PEEK-OPTIMA Ultra-Reinforced composite trauma devices in China, responding to growing global demand for high-performance biomaterials in trauma fixation.

- In February 2023, Celanese introduced ECO-B, more sustainable versions of Acetyl Chain materials, incorporating mass balance bio-content to provide chemically identical, bio-based alternatives for engineered materials.

Market Concentration & Characteristics

The market concentration of the UAE biomaterials sector is relatively moderate, with a mix of established global players and regional companies dominating the landscape. While international companies lead in advanced biomaterials technologies, several local players are increasingly gaining market share by focusing on specific niches such as orthopedic implants, dental solutions, and tissue engineering. This combination of global and local competition fosters innovation and drives the development of customized, high-performance materials tailored to the needs of the UAE healthcare sector. The market is characterized by rapid technological advancements, with a growing focus on biocompatibility, sustainability, and personalized medicine. As the UAE continues to position itself as a hub for medical tourism, the demand for premium, innovative biomaterials is expected to rise. Companies are also leveraging strategic partnerships with healthcare providers and research institutions to enhance their market presence. However, the market is still influenced by regulatory complexities and a reliance on imported materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UAE is likely to continue its investment in biotechnological advancements, including biomaterials, as part of its strategic diversification plans.

- Increased demand for sustainable biomaterials will drive innovation in the UAE’s research and development sector.

- Partnerships with global biomanufacturers and research institutions will accelerate the growth of the UAE’s biomaterials industry.

- The UAE’s strong healthcare sector will foster the application of biomaterials in medical devices and implants.

- With its growing focus on green technologies, the UAE is expected to lead in the development of eco-friendly biomaterials.

- The government’s support for the medical and biotechnology industries will enhance the UAE’s position as a hub for biomaterial production.

- Advances in personalized medicine will stimulate the demand for biomaterials tailored to individual patient needs.

- The UAE’s regulatory environment will evolve to support the commercialization of advanced biomaterials.

- Innovations in nanotechnology and 3D printing will open new opportunities for biomaterials in various industries.

- As the UAE strengthens its position in the global supply chain, the biomaterials sector is expected to play a significant role in its economic future.