| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UAE Cheese Market Size 2024 |

USD 213.70 Million |

| UAE Cheese Market, CAGR |

2.81% |

| UAE Cheese Market Size 2032 |

USD 266.65 Million |

Market Overview

UAE Cheese Market size was valued at USD 213.70 million in 2024 and is anticipated to reach USD 266.65 million by 2032, at a CAGR of 2.81% during the forecast period (2024-2032).

The UAE cheese market is experiencing steady growth driven by shifting consumer preferences toward Western diets, increased demand for convenience foods, and the rising popularity of international cuisines. Urbanization and a growing expatriate population have contributed to the expanding consumption of diverse cheese varieties, including mozzarella, cheddar, and cream cheese. The foodservice sector, particularly fast-food chains and cafes, plays a crucial role in boosting cheese demand across the country. Additionally, health-conscious consumers are fueling interest in low-fat and organic cheese options, prompting manufacturers to innovate and diversify product offerings. The market also benefits from the strong presence of premium retail outlets and online grocery platforms that enhance product accessibility. Emerging trends include the growing influence of gourmet and artisanal cheeses, sustainable packaging solutions, and strategic product positioning through health and wellness claims. These factors collectively shape a dynamic and evolving landscape for cheese consumption in the UAE.

The geographical landscape of the UAE cheese market is shaped by the diverse consumer preferences across emirates such as Dubai, Abu Dhabi, Sharjah, and Ajman. Urban centers like Dubai and Abu Dhabi lead in demand due to their advanced retail infrastructure, high expatriate populations, and growing hospitality sectors that drive consumption of both traditional and specialty cheeses. Meanwhile, emerging emirates such as Sharjah and Ajman are witnessing steady growth in cheese demand, fueled by changing dietary habits and expanding supermarket chains. Key players operating in the UAE cheese market include Arla Foods, Danone, Savencia Fromage & Dairy, Clover Industries Limited, Hochland SE, Parmalat S.p.A., FrieslandCampina, Al Ain Dairy, and Ruwag Food Industries. These companies focus on product diversification, strategic partnerships, and innovation in dairy alternatives to cater to the evolving preferences of consumers. The market is characterized by strong competition, with both international brands and local producers striving to enhance their presence across the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UAE cheese market was valued at USD 213.70 million in 2024 and is projected to reach USD 266.65 million by 2032, growing at a CAGR of 2.81% during the forecast period.

- The global cheese market was valued at USD 97,440.00 million in 2024 and is projected to reach USD 1,46,171.12 million by 2032, growing at a CAGR of 5.20% during the forecast period.

- Increasing urbanization and a multicultural population are driving demand for diverse and high-quality cheese products.

- Rising popularity of Western diets and premium dairy consumption is encouraging the growth of gourmet and flavored cheese varieties.

- Market players such as Arla Foods, Danone, and Al Ain Dairy are expanding their product portfolios and retail presence to strengthen competitiveness.

- Health concerns related to saturated fats and lactose intolerance pose restraints, slowing down demand in certain consumer segments.

- Dubai and Abu Dhabi lead the market in terms of cheese consumption due to well-developed retail networks and affluent populations.

- Growing interest in plant-based and low-fat cheese alternatives is reshaping innovation and positioning strategies across the UAE market.

Report Scope

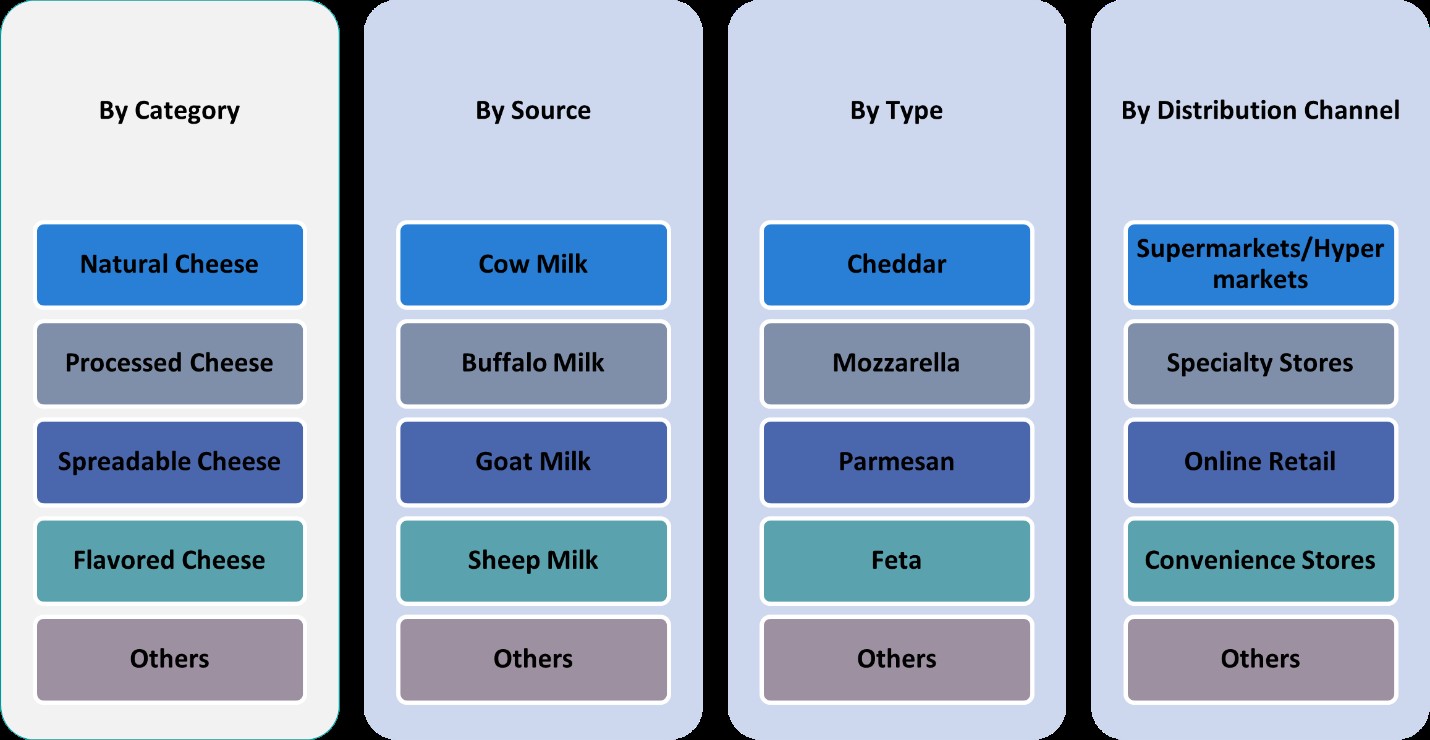

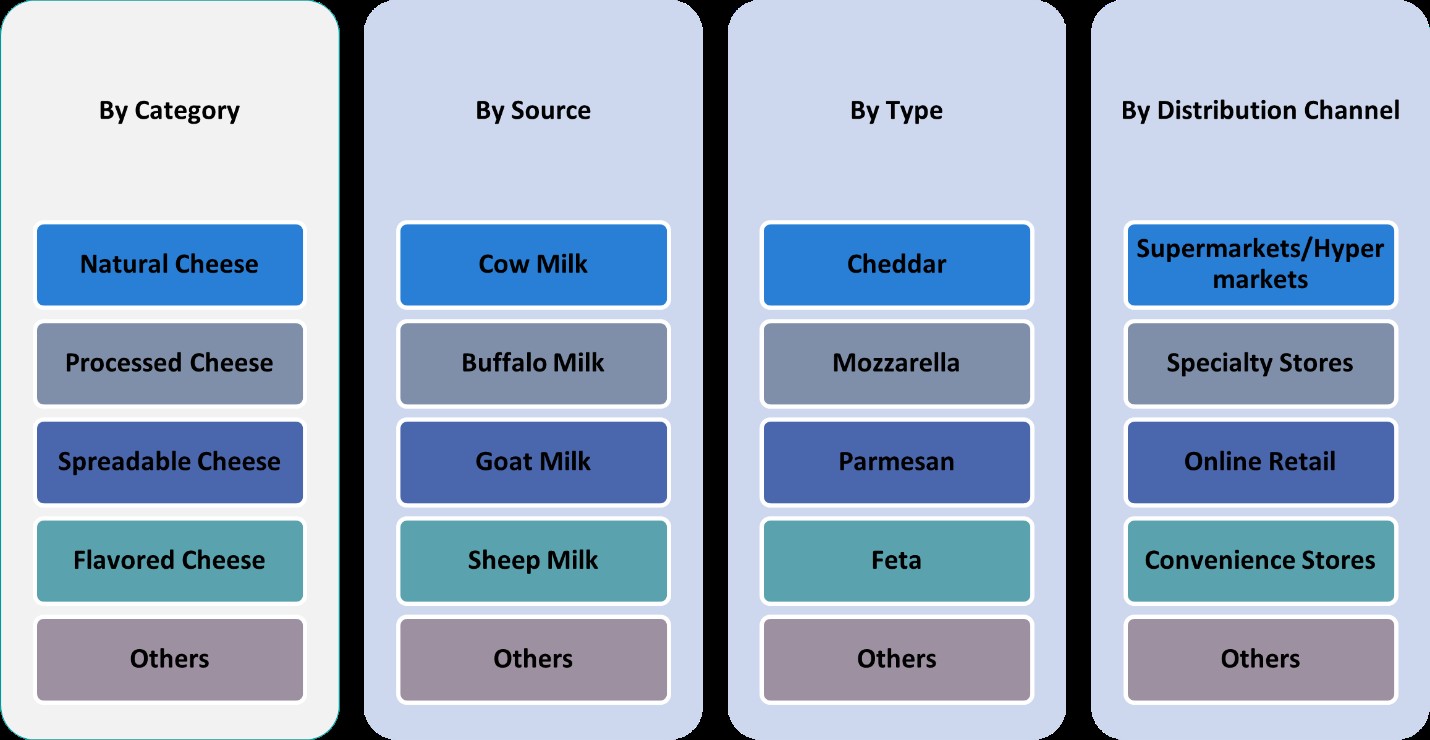

This report segments the UAE Cheese Market as follows:

Market Drivers

Growing Influence of Western and International Cuisines

The increasing exposure to Western dietary habits and international cuisines is a significant driver of the UAE cheese market. For instance, reports from the UAE Ministry of Economy highlight the popularity of cheese-inclusive meals such as pizzas and burgers introduced by global fast-food chains like Domino’s and McDonald’s, which are widely consumed across the expatriate population. These dishes, traditionally associated with American and European diets, are becoming mainstream in the UAE, thereby boosting demand for a variety of cheese types including mozzarella, cheddar, parmesan, and cream cheese. Restaurants and fast-food chains have responded to this trend by expanding cheese-based menu offerings, further enhancing market growth. This culinary transformation has also influenced local households to incorporate cheese in daily cooking, thus increasing retail consumption. The cross-cultural culinary exchange continues to fuel the market, positioning cheese as a staple in both home-cooked meals and foodservice offerings.

Expansion of Foodservice and Quick Service Restaurants (QSRs)

The rapid expansion of the foodservice industry, especially Quick Service Restaurants (QSRs), has significantly contributed to the growth of the cheese market in the UAE. For instance, the Dubai Department of Tourism and Commerce Marketing has reported increased cheese usage in menu items offered by major chains such as Pizza Hut and Starbucks, reflecting the demand for convenient and indulgent meals. The rising disposable income, urbanization, and fast-paced lifestyle of UAE residents have led to a growing preference for on-the-go and ready-to-eat meals. This has created a favorable environment for QSRs, which in turn drives bulk demand for processed and shredded cheese. Moreover, increasing competition among foodservice providers encourages menu innovation, leading to the use of specialty and gourmet cheeses to attract customers. As the hospitality and tourism sectors continue to expand, particularly in cities like Dubai and Abu Dhabi, the consistent demand from restaurants and hotels will remain a critical growth driver for the cheese market.

Health Awareness and Rising Demand for Specialty Cheeses

The evolving consumer awareness regarding health and nutrition is reshaping cheese consumption patterns in the UAE. While traditional cheese products continue to dominate, there is a notable increase in demand for low-fat, organic, and plant-based cheese alternatives. Health-conscious consumers are seeking products that offer nutritional benefits without compromising taste, prompting manufacturers to introduce fortified, reduced-sodium, and lactose-free cheese varieties. Furthermore, specialty cheeses such as goat cheese, feta, and ricotta are gaining traction among niche consumer segments and gourmet food enthusiasts. This shift not only diversifies product portfolios but also opens new avenues for premium and artisanal cheese brands. Retailers are increasingly stocking health-oriented cheese products, and e-commerce platforms have made it easier for consumers to access these specialized offerings. The alignment of product innovation with consumer wellness trends is expected to drive sustained market expansion.

Supportive Retail Infrastructure and Growing E-Commerce Penetration

The robust retail infrastructure in the UAE, including hypermarkets, supermarkets, and premium grocery chains, plays a pivotal role in driving cheese market growth. Leading retailers provide ample shelf space for domestic and imported cheese brands, ensuring product visibility and accessibility across urban centers. The increasing presence of refrigerated sections and dedicated dairy aisles further supports the sale of perishable cheese products. In parallel, the growth of online grocery platforms has made it convenient for consumers to purchase cheese from the comfort of their homes. Features such as home delivery, attractive discounts, and subscription models are attracting tech-savvy and health-aware consumers, particularly post-pandemic. Digital platforms also offer space for niche brands and international imports, contributing to product variety in the market. Together, the combination of traditional and digital retail channels strengthens the supply chain and enhances overall market reach across the UAE.

Market Trends

Rising Popularity of Artisanal and Gourmet Cheeses

One of the prominent trends shaping the UAE cheese market is the growing preference for artisanal and gourmet cheeses. For instance, the UAE Ministry of Economy highlights the increasing demand for premium cheeses like brie, gouda, and blue cheese, particularly among high-income groups and food enthusiasts. This trend is particularly evident in specialty food stores, upscale restaurants, and gourmet sections of premium supermarkets. The rise in food tourism and exposure to global cuisines have also contributed to this shift in consumer preferences. Manufacturers and importers are responding by expanding their premium offerings and introducing limited-edition or region-specific cheese products. As consumers become more adventurous in their culinary choices, the market is likely to witness continued growth in demand for artisanal and specialty cheese options.

Innovation in Product Formats and Flavored Cheese Varieties

Manufacturers in the UAE are increasingly innovating with product formats to cater to evolving consumer needs. For instance, the UAE Dairy Producers Association reports a surge in demand for flavored cheeses infused with herbs, spices, and truffle oil, appealing to both retail and foodservice consumers. Cheese snacks, spreads, cubes, and slices designed for convenience are also in high demand, particularly among busy professionals and families with young children. Ready-to-eat cheese portions and resealable packaging enhance usability and appeal to health-conscious and time-strapped consumers. These innovations not only offer convenience but also align with the snacking culture that is prevalent across the UAE. Additionally, the introduction of functional cheeses enriched with probiotics, proteins, and vitamins reflects a growing emphasis on health and wellness, further diversifying product offerings in the market.

Increasing Demand for Plant-Based and Lactose-Free Alternatives

With rising health awareness and growing instances of lactose intolerance, there is a noticeable surge in demand for plant-based and lactose-free cheese alternatives in the UAE. Veganism and flexitarian diets are gaining momentum, particularly among millennials and expatriates who seek dairy-free options without sacrificing taste and texture. In response, global and local brands are introducing cheese made from nuts, soy, and other plant-based ingredients to meet this emerging demand. These products are often positioned with clean-label claims, such as non-GMO, organic, or gluten-free, attracting health-conscious consumers. The trend reflects a broader shift toward sustainable and ethical consumption, aligning with UAE’s growing focus on environmental consciousness and food innovation.

Growth of Online Retail and Direct-to-Consumer Channels

Digital transformation is reshaping cheese retail in the UAE, with online platforms gaining prominence in product discovery and purchase. Consumers increasingly prefer shopping through e-commerce portals and mobile apps that offer home delivery, exclusive deals, and product comparisons. Cheese brands are leveraging social media and influencer marketing to reach niche audiences and promote new offerings. Subscription models and curated cheese boxes are also emerging, particularly among premium consumers. The convenience and variety offered by online platforms have made it easier for consumers to explore new cheese varieties, further driving market growth. This digital shift is expected to continue, offering brands greater opportunities for expansion and customer engagement.

Market Challenges Analysis

High Dependence on Imports and Supply Chain Vulnerabilities

One of the primary challenges facing the UAE cheese market is its heavy reliance on imports to meet domestic demand. For instance, the UAE Ministry of Climate Change and Environment has highlighted the country’s limited local dairy production due to unsuitable climatic conditions, necessitating significant cheese imports from Europe and North America. This dependency makes the market vulnerable to international trade disruptions, fluctuating currency exchange rates, and geopolitical tensions. Additionally, logistical delays and rising transportation costs can impact product availability, pricing, and shelf life, particularly for perishable cheese varieties. Supply chain disruptions experienced during global events, such as the COVID-19 pandemic, highlighted the fragility of import-dependent markets. While efforts are being made to support local dairy initiatives, scaling up domestic production remains a long-term goal. In the short term, maintaining a stable supply of high-quality cheese will continue to pose a logistical and economic challenge for both retailers and distributors in the UAE.

Health Concerns and Competition from Plant-Based Alternatives

The growing consumer focus on health and wellness is also creating challenges for the traditional cheese segment in the UAE. Full-fat, high-sodium, and processed cheese varieties are increasingly scrutinized for their potential contribution to obesity, hypertension, and other lifestyle-related health issues. This shift in consumer perception is encouraging many to limit or avoid cheese consumption altogether. As a result, plant-based and lactose-free alternatives are gaining ground, particularly among younger, health-conscious, and environmentally aware demographics. The rising popularity of veganism and flexitarian diets is intensifying competition, prompting traditional cheese manufacturers to reformulate products or expand into dairy-free segments. However, achieving the same taste, texture, and nutritional profile in plant-based cheeses remains a challenge. Moreover, regulatory restrictions on labeling and health claims further complicate product positioning. Balancing consumer health concerns with taste expectations and nutritional value is becoming a critical hurdle for traditional cheese producers aiming to retain and grow their market share in the UAE.

Market Opportunities

The UAE cheese market presents considerable growth opportunities driven by evolving consumer preferences and expanding retail infrastructure. With increasing urbanization and rising disposable income, there is a growing demand for premium and value-added cheese products. Consumers are increasingly seeking diverse cheese options, including organic, artisanal, and internationally sourced varieties, offering scope for product differentiation and brand development. Moreover, the multicultural demographic of the UAE supports the introduction of a wide range of cheese types catering to different ethnic tastes and cuisines. This environment provides a fertile ground for global players to enter the market through strategic partnerships, localized branding, and targeted marketing efforts. The foodservice sector, particularly the growing number of Western-style restaurants, cafes, and quick-service outlets, also opens avenues for bulk sales and customized cheese offerings.

Additionally, the rapid growth of digital commerce presents new channels for market expansion. Online grocery platforms and mobile apps enable cheese brands to connect directly with consumers, offering convenience, product variety, and promotional deals. This digital transformation allows companies to collect valuable consumer insights, personalize marketing strategies, and build brand loyalty through subscription-based models and curated cheese boxes. The rising interest in health and wellness also creates an opportunity for manufacturers to innovate with functional cheeses enriched with probiotics, proteins, and reduced-fat formulations. Furthermore, plant-based and lactose-free cheese alternatives are gaining popularity, indicating a promising niche segment. Companies that invest in research and development to create high-quality, plant-based cheeses with improved taste and texture can capitalize on this growing trend. Overall, the combination of shifting dietary habits, expanding distribution networks, and growing consumer awareness positions the UAE cheese market for continued growth and innovation in the coming years.

Market Segmentation Analysis:

By Category:

The UAE cheese market is segmented into cheddar, processed cheese, spreadable cheese, flavored cheese, and others. Among these, cheddar and processed cheese hold a dominant market share due to their widespread use in everyday meals, fast food, and foodservice applications. Processed cheese, known for its extended shelf life and affordability, remains a popular choice among households and restaurants alike. Cheddar, on the other hand, is favored for its sharp flavor and versatility, making it a staple in sandwiches, burgers, and baked dishes. Spreadable cheeses are also gaining traction, especially among urban consumers seeking convenience in breakfast and snacking. Meanwhile, flavored cheeses infused with herbs, spices, and exotic ingredients are carving out a niche in the premium segment, driven by growing interest in gourmet food experiences. The “Others” segment, which includes feta, ricotta, and blue cheese, is supported by the multicultural population and the expanding presence of international cuisine in the UAE. This diversity in cheese categories enables brands to cater to a wide range of taste preferences.

By Source:

Based on the source, the UAE cheese market includes cow milk, buffalo milk, goat milk, sheep milk, and others. Cow milk dominates the segment owing to its widespread availability, cost-effectiveness, and consumer familiarity. Most commercial and processed cheese varieties in retail and foodservice are made from cow milk, making it the preferred choice for large-scale production and consumption. Buffalo milk cheese, although less common, is appreciated for its rich texture and is primarily used in traditional and regional recipes. Goat and sheep milk cheeses are increasingly popular among health-conscious consumers due to their digestibility and distinct flavors. These options also appeal to gourmet and artisanal markets, supporting the growing trend of premium cheese consumption. The “Others” segment includes mixed milk cheeses and vegan cheese alternatives made from plant-based ingredients, reflecting a gradual shift toward inclusive and health-oriented offerings. As consumer awareness continues to grow, cheese sourced from alternative milk types is expected to see increased adoption across retail and hospitality sectors in the UAE.

Segments:

Based on Category:

- Cheddar

- Processed Cheese

- Spreadable Cheese

- Flavored Cheese

- Others

Based on Source:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Sheep Milk

- Others

Based on Type:

- Cheddar

- Mozzarella

- Parmesan

- Feta

- Others

Based on Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Convenience Stores

- Others

Based on the Geography:

- Abu Dhabi

- Dubai

- Sharjah

- Ajman

- Fujairah

- Ras Al Khaimah

- Umm Al Quwain

Regional Analysis

Dubai

Dubai dominates the UAE cheese market with a significant 39% share, owing to its large expatriate population, high-income households, and advanced retail infrastructure. The city hosts numerous hypermarkets, specialty stores, and premium food outlets that cater to diverse consumer preferences, driving consistent demand for various cheese types. Dubai’s hospitality and foodservice sector is also well-established, with international hotel chains and restaurants incorporating a wide range of cheese-based dishes into their offerings. Additionally, Dubai’s openness to global food trends and innovations fosters the introduction of premium, organic, and gourmet cheese varieties. The growing trend of food delivery and e-commerce further strengthens cheese accessibility, with online grocery platforms offering a wide selection of imported and local products. Events such as food festivals and culinary expos also contribute to market visibility and consumer engagement, making Dubai a key growth hub for cheese manufacturers and distributors in the UAE.

Abu Dhabi

Abu Dhabi accounts for approximately 27% of the UAE cheese market, making it the second-largest contributor. The emirate’s strong purchasing power and evolving food culture play pivotal roles in the growth of cheese consumption. Abu Dhabi residents, including both locals and expatriates, are increasingly incorporating cheese into their daily diets, particularly in Western-style meals and healthy snacking routines. Government-led initiatives to boost domestic dairy production also enhance the local supply chain, improving availability and affordability. The presence of high-end retail outlets and international supermarkets in Abu Dhabi facilitates access to a wide variety of cheeses, ranging from affordable processed types to artisanal imports. Furthermore, the emirate’s expanding hospitality sector, which includes fine-dining restaurants and luxury hotels, generates steady demand for specialty and gourmet cheeses. These factors collectively position Abu Dhabi as a vital market for both established and emerging cheese brands seeking regional expansion.

Sharjah

Sharjah represents around 13% of the UAE cheese market, supported by its growing population and expanding retail sector. Although traditionally more conservative in consumption trends, Sharjah has seen a gradual rise in demand for dairy and cheese products due to changing dietary habits and increasing urbanization. Supermarkets and local grocery chains are increasingly stocking a broader range of cheeses to meet the evolving tastes of consumers. Additionally, Sharjah’s affordability compared to neighboring emirates attracts budget-conscious families, which fuels the sale of processed and value-pack cheese products. While premium cheeses have limited penetration, there is a growing interest among younger consumers and expatriates for flavored and spreadable cheese varieties. Educational institutions and food outlets in Sharjah also create demand for cheese as part of quick meals and snacks. As Sharjah continues to modernize its retail ecosystem, cheese brands can capitalize on emerging consumption patterns through tailored marketing and product offerings.

Ajman

Ajman contributes about 9% to the UAE cheese market, driven by steady population growth and the increasing adoption of Western dietary habits. The emirate has witnessed noticeable improvements in its retail landscape, with more supermarkets and convenience stores offering a variety of cheese products to cater to rising consumer demand. While processed cheese remains the most popular category due to affordability and accessibility, there is a gradual uptick in interest toward specialty and flavored cheeses. Ajman’s demographic composition, which includes a sizable number of working-class families and middle-income consumers, supports the market for economical cheese options. Moreover, small foodservice businesses and takeaway outlets incorporate cheese in sandwiches, pizzas, and bakery products, further stimulating local demand. Though Ajman remains a smaller player compared to Dubai and Abu Dhabi, its growing retail presence and changing consumption behavior offer incremental growth opportunities for cheese producers targeting tier-two cities in the UAE.

Key Player Analysis

- Arla Foods

- Savencia Fromage & Dairy

- Clover Industries Limited

- Danone

- Hochland SE

- Parmalat S.p.A.

- Al Ain Dairy

- FrieslandCampina

- Ruwag Food Industries

Competitive Analysis

The UAE cheese market features a competitive landscape marked by the presence of both international and domestic players that continuously innovate to capture consumer interest. Leading companies such as Arla Foods, Danone, Savencia Fromage & Dairy, Clover Industries Limited, Hochland SE, Parmalat S.p.A., FrieslandCampina, Al Ain Dairy, and Ruwag Food Industries are actively shaping the market with a broad range of offerings. These players focus on expanding their product portfolios to include processed, spreadable, flavored, and premium cheese varieties tailored to regional tastes. Strategic initiatives such as local partnerships, retail penetration, and marketing campaigns help these companies maintain strong brand visibility and consumer trust. Moreover, the emphasis on health-focused and organic cheese variants is becoming a key differentiator among top brands. While international brands bring innovation and global appeal, local producers like Al Ain Dairy leverage their deep understanding of consumer preferences and distribution channels to remain competitive. Overall, sustained investment in quality, packaging, and affordability ensures continuous rivalry among leading players in the UAE cheese market.

Recent Developments

- In March 2025, Arla Foods Ingredients partnered with Valley Queen in South Dakota to increase production of Nutrilac® ProteinBoost, a high-protein whey concentrate, to meet growing demand in North America.

- In March 2025, Sargento introduced three innovations—Natural American Cheese, Seasoned Shredded Cheese in collaboration with McCormick, and Shareables snack trays in partnership with Mondelez International.

- In March 2025, Saputo USA debuted its spicy mozzarella cheese at the International Pizza Expo, combining traditional mozzarella with habanero jack for a zesty twist.

- In February 2025, Kraft Heinz emphasized innovation across three platforms—taste elevation, easy-ready meals, and snacking. This includes new product launches like Lunchables Spicy Nachos and value-sized Kraft Mac & Cheese to cater to shifting consumer preferences.

- In November 2024, Lactalis highlighted emerging trends such as premiumization, hot eating cheeses like Président Extra Creamy Brie, and sustainability-focused products like Seriously Spreadable Black Pepper cheese.

Market Concentration & Characteristics

The UAE cheese market exhibits a moderately concentrated structure, with a few dominant players holding a significant share while several regional and niche brands compete for market presence. International dairy giants such as Arla Foods, Danone, and FrieslandCampina contribute to the market’s concentration through extensive distribution networks, strong brand recognition, and diverse product portfolios. However, local producers like Al Ain Dairy and Ruwag Food Industries also play a crucial role, offering regionally tailored products at competitive prices. The market is characterized by a high demand for processed and spreadable cheese, driven by convenience and affordability. Additionally, premium and flavored cheeses are gaining popularity among health-conscious and affluent consumers, further diversifying product offerings. Innovation, branding, and packaging are key strategies adopted by companies to differentiate in this competitive environment. Despite the presence of major global brands, the market remains dynamic, with continuous product development and consumer-driven trends influencing competition and growth patterns.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Category, Source, Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UAE cheese market is expected to experience steady growth driven by rising urbanization and evolving dietary preferences.

- Demand for premium and specialty cheeses will continue to increase among health-conscious and affluent consumers.

- Plant-based and lactose-free cheese alternatives are likely to gain traction as consumers seek healthier options.

- Local dairy producers may expand production capacity to reduce dependence on imports and meet domestic demand.

- E-commerce and online grocery platforms will play a bigger role in cheese distribution and consumer engagement.

- Flavored and gourmet cheese segments are anticipated to attract more innovation and product diversification.

- Strategic partnerships between global brands and regional distributors will enhance market accessibility.

- Foodservice and hospitality sectors will continue to drive bulk demand for processed and cheddar cheese.

- Educational campaigns on nutritional benefits may support broader adoption of dairy products, including cheese.

- Sustainability in packaging and eco-friendly practices will become key focus areas for competitive advantage.