Market Overview

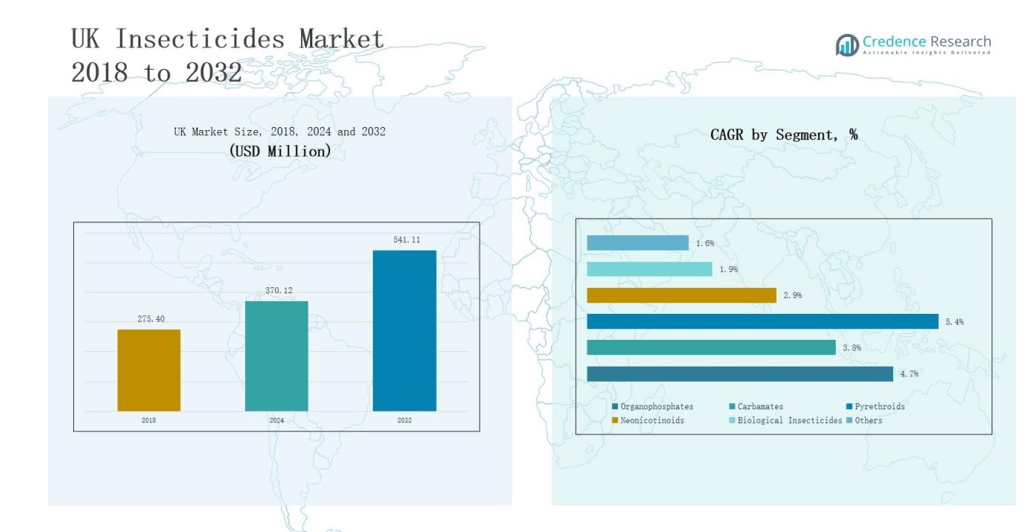

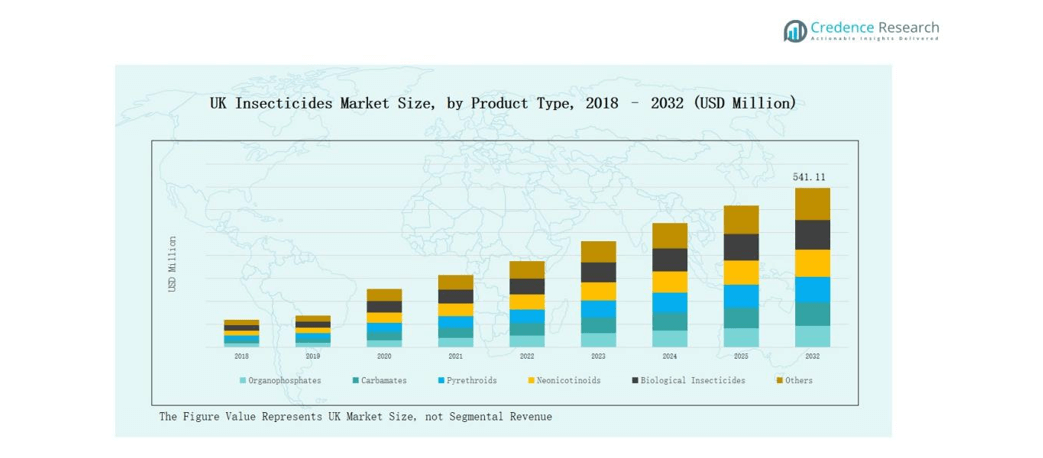

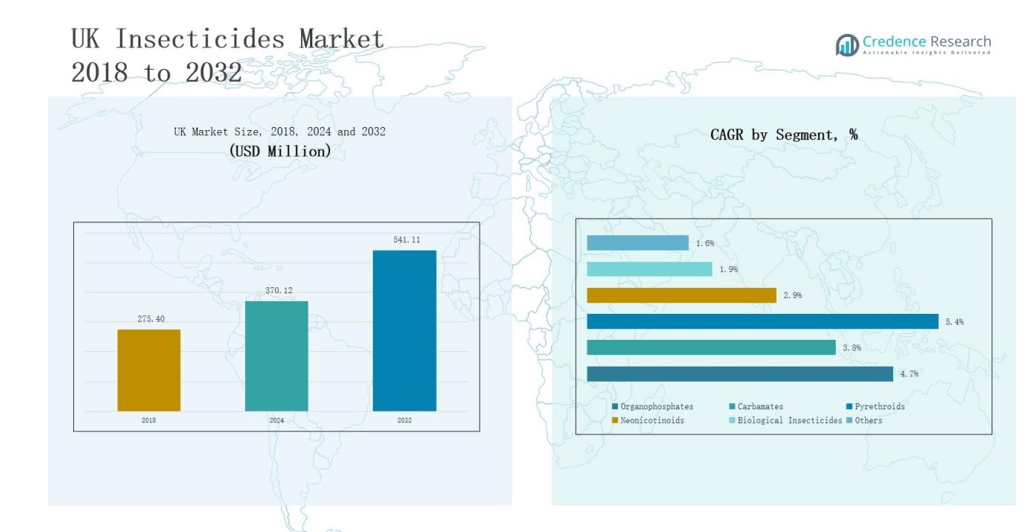

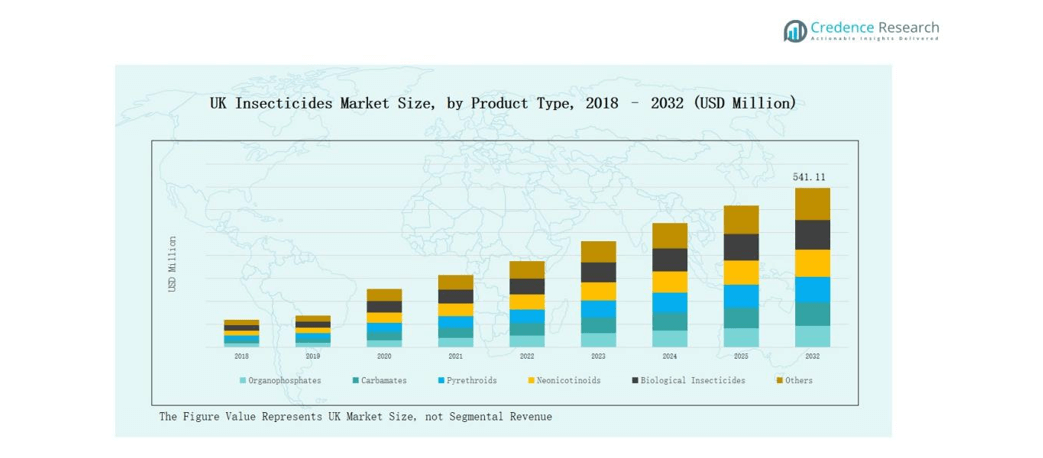

UK Insecticides Market size was valued at USD 275.40 million in 2018 to USD 370.12 million in 2024 and is anticipated to reach USD 541.11 million by 2032, at a CAGR of 4.77% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Insecticides Market Size 2024 |

USD 370.12 million |

| UK Insecticides Market, CAGR |

4.77% |

| UK Insecticides Market Size 2032 |

USD 541.11 million |

The UK Insecticides Market is led by global and regional players including BASF SE, Bayer CropScience, Syngenta, FMC Corporation, ADAMA Agricultural Solutions, Nufarm Limited, UPL Limited, Certis UK, Koppert Biological Systems, and Marrone Bio Innovations. These companies compete through broad product portfolios, investments in sustainable formulations, and strong distribution networks. Multinationals focus on chemical and biological innovations to meet strict regulations, while regional firms emphasize eco-friendly and niche solutions. Among regions, England dominates with 52% market share, driven by intensive agriculture, horticulture, and strong adoption of pest control solutions across both agricultural and public health applications.

Market Insights

- The UK Insecticides Market grew from USD 275.40 million in 2018 to USD 370.12 million in 2024 and is expected to reach USD 541.11 million by 2032, registering 4.77% growth.

- Organophosphates lead product type with 32% share, followed by pyrethroids at 28%, while biological insecticides show strong growth momentum with 7% share due to eco-friendly demand.

- Agriculture dominates applications with 54% share, supported by intensive crop production, while public health holds 20%, reflecting vector control and municipal pest management initiatives nationwide.

- England leads with 52% regional share, benefiting from large-scale agriculture, horticulture, and public health usage, while Scotland, Wales, and Northern Ireland together account for the remaining 48%.

- BASF SE, Bayer CropScience, Syngenta, FMC Corporation, ADAMA Agricultural Solutions, Nufarm Limited, UPL Limited, Certis UK, Koppert Biological Systems, and Marrone Bio Innovations drive competition through innovation and sustainable portfolios.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Organophosphates account for the largest share of the UK insecticides market at 32%, driven by their broad-spectrum effectiveness against a wide range of pests in agriculture. Pyrethroids follow closely with a 28% share, supported by strong adoption in crop protection due to low toxicity to mammals and cost efficiency. Neonicotinoids represent around 18%, with demand sustained in horticulture despite regulatory scrutiny. Carbamates hold 10%, mainly in niche applications. Biological insecticides are expanding rapidly with a 7% share, fueled by demand for eco-friendly alternatives. The remaining 5% belongs to other categories, catering to specialized pest control needs.

- For instance, in July 2023, Syngenta introduced its neonicotinoid-based seed treatment Cruiser for sugar beet in the UK under emergency use authorization, highlighting the continued reliance on neonicotinoids despite regulatory restrictions.

By Application

Agriculture dominates the UK insecticides market with a 54% share, driven by the country’s intensive crop production and need for yield protection against pests. Public health applications hold a 20% share, reflecting government-led initiatives for mosquito, fly, and vector control. Turf and landscape management contributes 12%, supported by the upkeep of sports grounds, golf courses, and urban green spaces. Forestry applications account for 7%, targeting pest outbreaks that threaten timber and biodiversity. The remaining 7% includes other uses such as domestic gardening and pest control in non-agricultural settings, reflecting the market’s diversified demand base.

- For instance, in May 2023, following full UK regulatory approval, ICL UK introduced its turf-specialty insecticide Acelepryn® for use on golf courses and sports grounds. The product is used to address chafer grubs and leatherjackets but is subject to label restrictions to mitigate risk, including a statutory ‘Dangerous to bees’ warning

Market Overview

Rising Agricultural Productivity Needs

The UK insecticides market benefits strongly from the push for higher agricultural productivity. Farmers face increasing pressure to secure crop yields against pest infestations, especially in cereals, fruits, and vegetables. Limited arable land and rising demand for food security encourage reliance on efficient pest control solutions. Chemical insecticides such as organophosphates and pyrethroids remain vital due to their cost-effectiveness and broad-spectrum impact. This reliance sustains steady demand across farming communities, even while eco-friendly alternatives gradually gain acceptance.

- For instance, Bayer introduced its insecticide Sivanto® Prime in the UK to help fruit and vegetable growers control sucking pests while maintaining pollinator safety.

Expansion of Public Health Initiatives

Public health programs in the UK actively drive demand for insecticides aimed at controlling disease vectors. Government campaigns targeting mosquitoes, flies, and ticks highlight the importance of reducing risks associated with vector-borne diseases. Municipal authorities and health agencies deploy insecticides for integrated pest management in urban areas. This consistent institutional demand stabilizes the market, particularly in the non-agricultural segment. Growth in awareness of hygiene and safety standards also strengthens the role of insecticides in safeguarding public health across cities and communities.

- For instance, Sumitomo Chemical’s subsidiary Valent BioSciences announced continued partnerships with UK municipal programs, delivering biological larvicides based on Bacillus thuringiensis israelensis (Bti) for sustainable mosquito control.

Rising Adoption of Biological Insecticides

The market is seeing robust growth in biological insecticides as sustainability gains priority. Farmers and commercial growers are shifting toward eco-friendly solutions that reduce chemical residues and meet EU and UK regulatory standards. Growing consumer demand for organic and residue-free produce supports the trend. Biological insecticides such as microbial and plant-based solutions are gaining ground in horticulture and protected farming. Innovation from global leaders and domestic companies ensures new product launches, further boosting adoption. This segment offers significant long-term growth potential.

Key Trends & Opportunities

Integration of Sustainable Crop Protection

Sustainability has become a defining trend in the UK insecticides market. The shift toward environmentally safe formulations aligns with EU and UK regulations that restrict harmful chemicals. Companies invest in developing biopesticides and hybrid solutions to meet these requirements while maintaining effectiveness. Farmers adopting integrated pest management (IPM) programs create opportunities for insecticide makers to position eco-friendly portfolios. This integration strengthens market credibility and opens pathways for long-term partnerships with both large-scale agriculture and organic farming sectors.

- For instance, Syngenta received UK regulatory approval for its biocontrol product Taegro, a Bacillus-based fungicide and insecticide designed for organic and conventional farming systems.

Technological Advancements in Formulations

Opportunities are emerging from innovation in insecticide formulations designed to improve efficiency and safety. Advances in nano-formulations, slow-release products, and precision application technologies help reduce environmental impact while maintaining pest control effectiveness. Companies introducing user-friendly products with improved residual action attract both professional and small-scale users. These innovations also extend insecticide applicability across forestry, landscaping, and turf management. By addressing regulatory and environmental concerns, advanced formulations position companies for long-term success in the UK market.

- For instance, Bayer launched Vayego® 200 SC in Europe, a second-generation diamide insecticide with long-lasting residual action for crops like potatoes and leafy vegetables, addressing grower demand for efficiency and reduced spraying frequency.

Key Challenges

Stringent Regulatory Framework

The UK insecticides market faces a strong challenge from restrictive regulations on chemical pesticides. Neonicotinoid bans and stricter approval requirements for organophosphates and carbamates limit product availability. Compliance with safety standards demands heavy investment in research, slowing down innovation timelines. Regulatory pressures force companies to continuously reformulate products, raising costs. These limitations particularly impact small manufacturers who lack resources for compliance, creating barriers to entry and consolidation in the market.

Growing Resistance in Pests

Pest resistance to common insecticides is an escalating challenge that undermines product effectiveness. Farmers in the UK increasingly report reduced efficacy of pyrethroids and other widely used formulations. This resistance requires higher application volumes or product switching, raising operational costs for growers. It also forces companies to invest in R&D for novel solutions, delaying market returns. Without effective management strategies, pest resistance could reduce farmer confidence and shift demand toward alternative, non-chemical methods.

High Cost of Biological Alternatives

Although biological insecticides present a strong growth avenue, their high cost limits adoption. Many UK farmers, especially small-scale growers, find biopesticides expensive compared to traditional options like organophosphates and pyrethroids. Limited awareness and lower shelf life also affect usage. While subsidies and sustainability targets may encourage adoption, widespread acceptance requires competitive pricing and proven field effectiveness. These barriers slow down the transition to greener pest control methods, challenging market expansion in the short term.

Regional Analysis

England

England dominates the UK Insecticides Market with a 52% share. It benefits from intensive agricultural activity in regions such as East Anglia, where cereals, vegetables, and horticultural crops drive insecticide demand. The need to protect high-value crops underpins reliance on organophosphates and pyrethroids. Strong demand for biological insecticides is also rising, supported by organic farming initiatives. Public health applications add steady demand across urban areas with municipal pest control programs. England remains the largest and most consistent contributor to overall market growth.

Scotland

Scotland accounts for 18% of the market share, driven by extensive cereal and barley cultivation. Farmers prioritize crop protection due to climatic conditions that encourage pest infestations. Forestry applications form a significant part of demand, particularly in timber production zones. Pyrethroids and neonicotinoids are commonly adopted for effective pest management. Biological solutions are also gaining traction among growers focusing on sustainable production. The Scottish market continues to expand, supported by strong agricultural policy frameworks and government incentives.

Wales

Wales represents 15% of the market share, with demand led by livestock-associated farming and crop protection. Insecticides play a crucial role in ensuring farm productivity and protecting grasslands. Turf and landscape management is also a strong application segment, supported by the region’s sports facilities and green areas. Farmers in Wales show interest in biological insecticides to align with environmental standards. Public health usage further strengthens demand in residential zones. The region shows steady growth prospects within the national market.

Northern Ireland

Northern Ireland holds 15% of the UK Insecticides Market share, supported by its mixed farming practices. The market benefits from strong cereal and potato cultivation, which requires reliable pest control. Farmers actively use organophosphates and pyrethroids for consistent results. Public health applications remain relevant, particularly in vector control for rural communities. Turf and landscape management also adds demand from golf courses and recreational areas. Northern Ireland sustains its role as a stable contributor within the overall market structure.

Market Segmentations:

By Product Type

- Organophosphates

- Carbamates

- Pyrethroids

- Neonicotinoids

- Biological Insecticides

- Others

By Application

- Agriculture

- Forestry

- Turf & Landscape

- Public Health

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK Insecticides Market is highly competitive, with a strong mix of global and regional players shaping industry dynamics. Leading multinational companies such as BASF SE, Bayer CropScience, Syngenta, FMC Corporation, and ADAMA Agricultural Solutions dominate the market with extensive portfolios and advanced R&D capabilities. Their strength lies in offering both chemical and biological solutions that meet evolving regulatory standards. Regional players, including Certis UK and Koppert Biological Systems, focus on sustainable and niche biological products, catering to rising demand for eco-friendly alternatives. UPL Limited and Nufarm Limited strengthen competition through cost-effective formulations and broad distribution networks. Marrone Bio Innovations emphasizes biological innovation, aligning with consumer and regulatory preferences for safer crop protection. Intense rivalry encourages continuous product development, partnerships, and investments in integrated pest management solutions. The market is characterized by consolidation trends, where leading firms expand presence through acquisitions and collaborations to maintain dominance across agriculture, forestry, turf, and public health applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- BASF SE

- Bayer CropScience

- Syngenta

- FMC Corporation

- ADAMA Agricultural Solutions

- Nufarm Limited

- UPL Limited

- Certis UK

- Koppert Biological Systems

- Marrone Bio Innovations

Recent Developments

- In April 2025, Bayer gained approval for its new aphicide Sivanto Prime (flupyradifurone) in Great Britain and Northern Ireland, targeting sugar beet, peas, carrots, and potatoes.

- In January 2025, the UK government rejected emergency use of thiamethoxam (Cruiser SB) on sugar beet due to risks to pollinators, reinforcing the shift toward safer pest control alternatives.

- In April 2025, Bayer expanded its product suite with several new isoflucypram + prothioconazole fungicidal mixtures Caley, Milteo, Resilis, Vivalis, and Scorpio approved for use in Great Britain on cereals like wheat, barley, rye, oats, and triticale.

Report Coverage

The research report offers an in-depth analysis based on Product Type,Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biological insecticides will expand due to stricter regulatory frameworks.

- Public health programs will sustain consistent insecticide usage across urban regions.

- Integrated pest management adoption will grow among commercial and small-scale farmers.

- Technological innovations in formulations will improve product efficiency and safety.

- Resistance management strategies will shape product development and farmer adoption.

- Expansion of organic farming will drive eco-friendly insecticide applications.

- Turf and landscape maintenance will support steady demand from sports and recreational areas.

- Forestry insecticide applications will strengthen with pest outbreaks impacting timber production.

- Consolidation among global and regional players will increase competitive intensity.

- Government incentives for sustainable agriculture will accelerate adoption of alternative pest control solutions.