Market Overview:

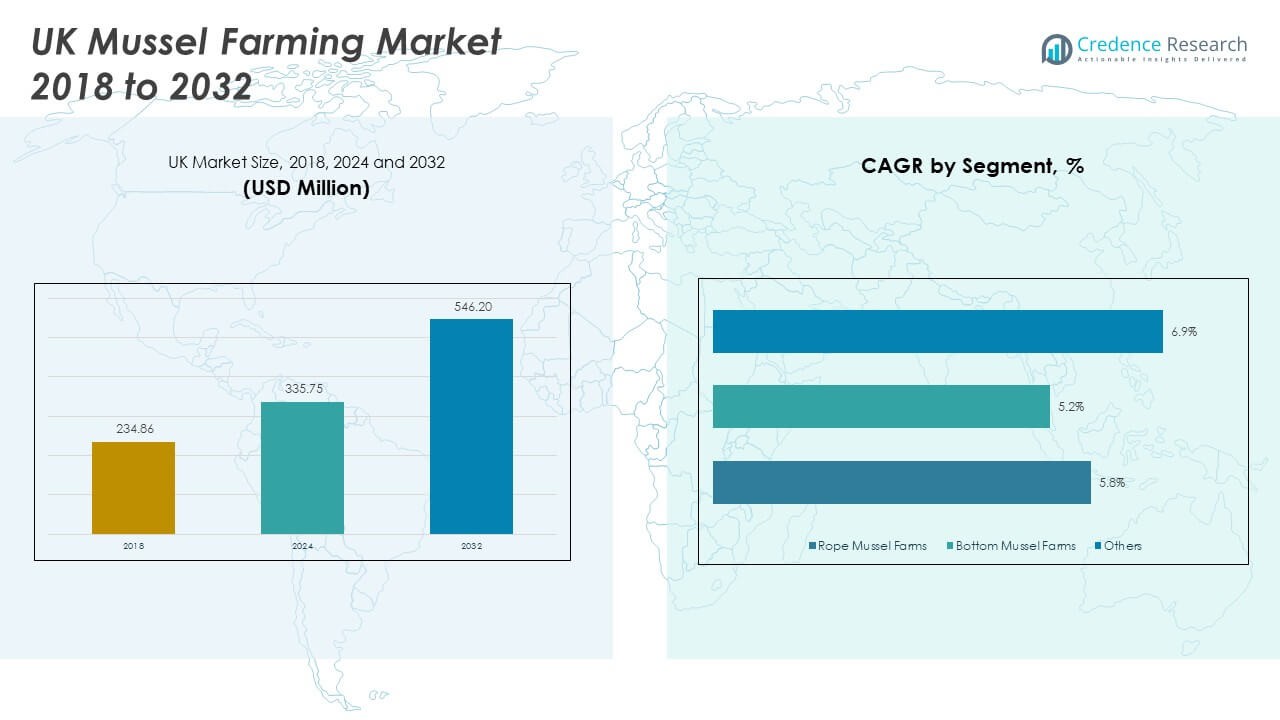

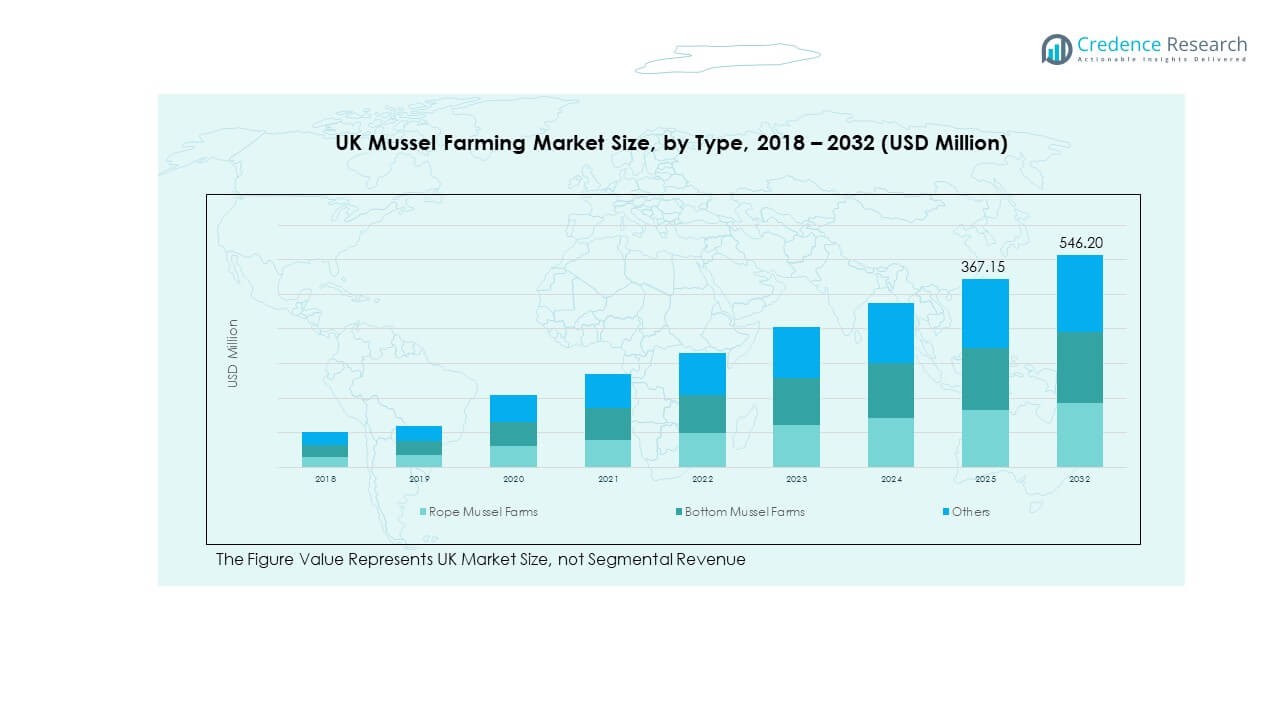

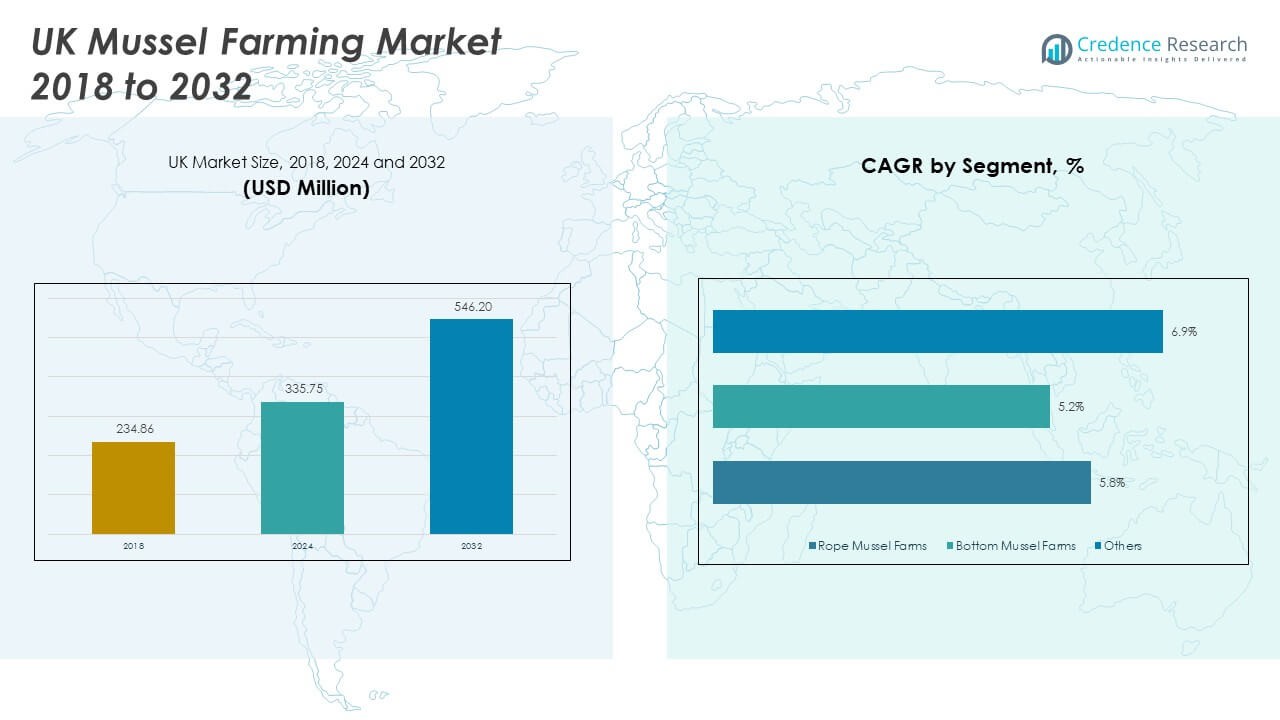

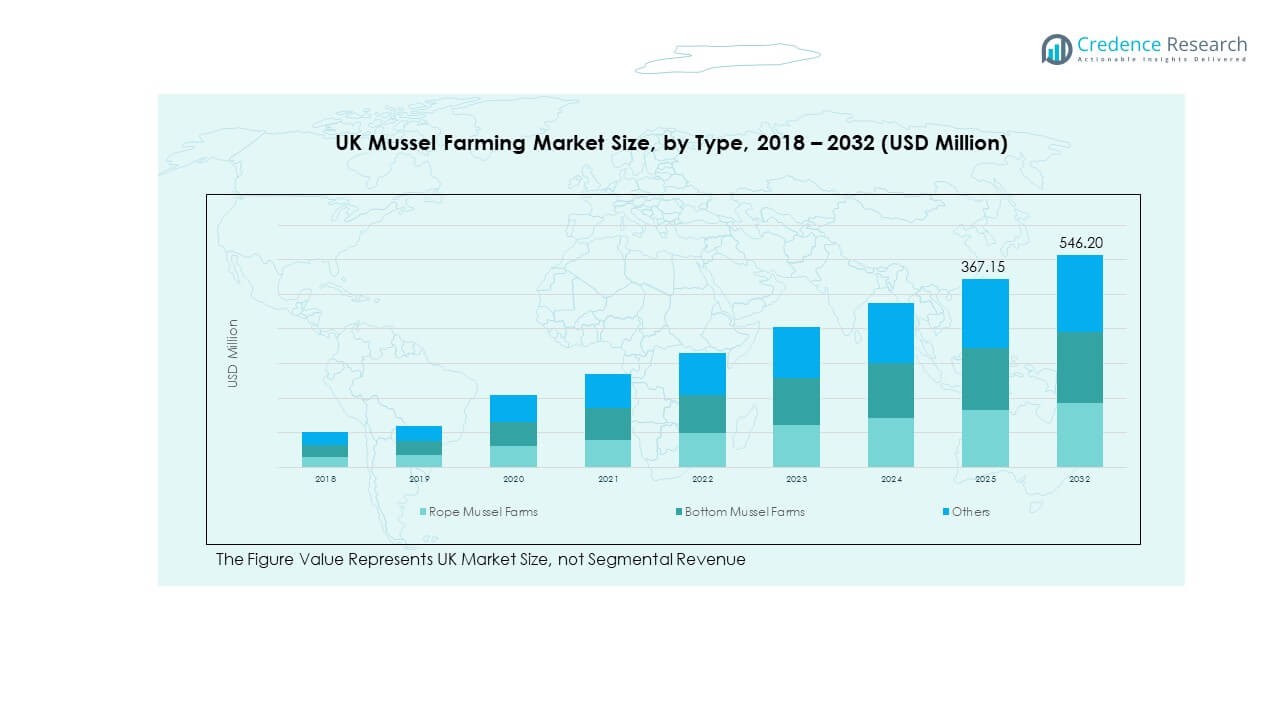

The UK Mussel Farming Market size was valued at USD 234.86 million in 2018 to USD 335.75 million in 2024 and is anticipated to reach USD 546.20 million by 2032, at a CAGR of 5.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Mussel Farming Market Size 2024 |

USD 335.75 Million |

| UK Mussel Farming Market, CAGR |

5.84% |

| UK Mussel Farming Market Size 2032 |

USD 546.20 Million |

Growth in the UK mussel farming market is supported by strong demand for sustainable seafood, rising consumer preference for protein-rich diets, and government backing for aquaculture expansion. Improved aquaculture technologies, better water quality management, and certifications for sustainable practices are helping farmers increase yields. Demand from restaurants and retail chains continues to boost production, while health-conscious consumers are driving awareness of mussels as a nutritious, low-fat, and eco-friendly seafood option.

Regionally, Scotland leads the UK mussel farming market due to its favorable coastal waters and established aquaculture practices. Wales and Northern Ireland are emerging regions, with increasing investment in small-scale and community-based mussel farming projects. England shows steady growth, supported by demand from urban centers and strong distribution networks. The geographic advantage of sheltered bays, supportive policies, and access to European and global markets continue to strengthen the regional dynamics of mussel farming in the UK.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK Mussel Farming Market size was USD 234.86 million in 2018, USD 335.75 million in 2024, and is projected to reach USD 546.20 million by 2032, growing at a CAGR of 5.84%.

- Scotland holds the largest share at 45% due to favorable coastal waters and established aquaculture infrastructure. Wales follows with 28% share, supported by government initiatives and community-led projects. England accounts for 17%, driven by steady consumer demand and strong retail networks.

- Northern Ireland represents the fastest-growing region with 10% share, supported by small-scale aquaculture expansion, sustainable practices, and rising export opportunities to European markets.

- Rope mussel farms dominate with nearly 60% share, supported by higher yields and efficient cultivation methods in sheltered bays.

- Bottom mussel farms contribute about 30% share, while the remaining 10% comes from other farming methods, including experimental and hybrid systems.

Market Drivers:

Rising Consumer Preference for Sustainable and Nutritious Seafood Driving Expansion of Mussel Farming:

The UK Mussel Farming Market is strongly influenced by consumer demand for sustainable seafood choices. Mussels are widely recognized as a nutritious, protein-rich, and low-fat option with high levels of essential minerals. Consumers view mussels as an environmentally friendly seafood because farming them requires no feed and supports water purification. Rising health awareness and interest in seafood diets are increasing retail and foodservice demand across the UK. It is supported by campaigns promoting aquaculture as a climate-friendly alternative to land-based protein sources. Major retailers and restaurants highlight mussels in their menus to meet consumer expectations. Certifications such as MSC labeling further encourage consumer trust. Growing awareness of both nutritional and environmental benefits continues to drive the long-term expansion of mussel farming.

- For instance, The Lyme Bay offshore mussel farm managed by Offshore Shellfish Ltd produces more than 2,000 tons of high-quality rope-grown mussels in an environmentally sustainable way, supporting biodiversity and water purification.

Government Support and Aquaculture Policies Stimulating Market Development Across Regions:

Government initiatives and policies play a critical role in the UK Mussel Farming Market by enabling sustainable growth. Authorities actively promote aquaculture through grants, licensing support, and research funding. Strategic plans highlight aquaculture as essential for future food security and rural economic development. It benefits from favorable regulations designed to expand marine farming in coastal areas. Policy-driven efforts help streamline permits and improve the infrastructure required for efficient mussel production. Coastal communities gain jobs and economic activity from aquaculture expansion, reinforcing policy priorities. The presence of supportive marine spatial planning strengthens production stability. Collaboration between regulators, researchers, and producers ensures that growth aligns with sustainability standards.

- For instance, The UK’s Marine Management Organisation (MMO) under Defra provided a £6.1 million funding round to oyster and mussel farmers to support sustainable growth, infrastructure improvements, and adaptation to new trading conditions with individual grants capped at £150,000.

Technological Advancements in Farming Practices Enhancing Productivity and Efficiency:

The introduction of advanced farming technologies is driving higher yields and cost efficiency in the UK Mussel Farming Market. Farmers adopt automated monitoring systems that measure water quality, plankton levels, and growth rates. These tools reduce uncertainty and improve harvest cycles. Innovations in rope culture and longline systems allow greater stocking density without harming ecosystems. It benefits from improved biosecurity and disease management practices. Automation in harvesting and grading reduces labor reliance while increasing product consistency. Research partnerships support the adoption of new breeding techniques for faster-growing mussels. Sustainable equipment and renewable-powered farming systems further lower operational costs. These innovations collectively increase competitiveness and ensure resilience against supply fluctuations.

Strong Market Demand from Hospitality, Retail, and Export Channels Boosting Sales Growth:

Rising demand from foodservice chains, restaurants, and retail supermarkets drives the UK Mussel Farming Market forward. Chefs increasingly promote mussels due to their versatility and alignment with consumer health trends. Supermarkets enhance visibility by offering pre-packaged and value-added mussel products. It benefits from seasonal promotions and seafood campaigns that highlight affordability. Export demand in European markets such as France, Spain, and Italy also supports expansion. Trade agreements and strong logistics infrastructure provide farmers with reliable overseas opportunities. Domestic and international buyers seek consistent, high-quality mussels from UK producers. This growing demand across channels reinforces production investments and secures long-term market growth.

Market Trends:

Increasing Focus on Ready-to-Cook and Value-Added Mussel Products for Retail Expansion:

A major trend in the UK Mussel Farming Market is the growth of ready-to-cook and value-added products. Consumers prefer convenience-driven seafood options that reduce preparation time while maintaining nutritional quality. Mussel producers are offering vacuum-packed, pre-seasoned, or marinated products that cater to retail buyers. It benefits from innovation in packaging technology that extends shelf life without preservatives. Supermarkets highlight mussels in meal kits, driving household adoption. Value-added options align with lifestyle changes and busy consumer habits. This trend expands beyond urban centers into regional markets with rising convenience demand. Growth in ready-to-eat seafood strengthens mussel sales within retail supply chains.

Adoption of Digital Technologies and Data Analytics in Aquaculture Operations:

Digitalization is becoming a defining trend within the UK Mussel Farming Market, reshaping how producers manage farms. Data-driven aquaculture platforms allow real-time monitoring of water parameters and biomass growth. It helps farmers optimize feeding, stocking, and harvesting decisions with greater precision. Integration of remote sensing, drones, and IoT tools improves transparency across farming operations. Predictive analytics forecasts yield and disease risks more accurately. Mobile applications provide farmers with instant updates on environmental conditions. Cloud-based systems also enable regulators to track compliance and sustainability outcomes. Adoption of these digital solutions strengthens efficiency and reduces operational risks for mussel producers.

- For instance, Advances in technology in mussel farming include non-destructive monitoring with underwater cameras, acoustic telemetry, remote sensing, and 3D reconstruction for real-time farm management and environmental impact assessments. These tech innovations optimize production efficiency and sustainability monitoring.

Growing Emphasis on Eco-Certification and Transparent Supply Chains for Market Positioning:

The UK Mussel Farming Market is experiencing rising adoption of eco-certifications and transparent supply chain practices. Consumers demand assurance of environmental sustainability and ethical sourcing. It encourages farmers to obtain certifications such as MSC or organic labeling. Certified products gain premium positioning in retail and hospitality channels. Traceability platforms allow buyers to track mussels from farm to plate. Digital labeling and QR codes are increasingly used for consumer engagement. Export buyers in Europe emphasize eco-certified seafood, reinforcing UK competitiveness. Eco-certification strengthens trust and promotes wider acceptance of mussel farming as a sustainable aquaculture sector.

Expanding Culinary Innovation and Growing Role of Mussels in Modern Food Culture:

The increasing role of mussels in modern culinary culture is shaping the UK Mussel Farming Market. Chefs introduce innovative recipes and cuisines highlighting mussels as versatile ingredients. Mussels are featured in fusion menus that combine global flavors. It is boosted by television cooking shows and digital food platforms showcasing mussel dishes. Culinary festivals and seafood events expand public interest in mussels. Health-conscious consumers respond positively to mussels being positioned as a clean, protein-rich choice. Restaurants use mussels to promote seasonal, locally sourced menus. This culinary momentum strengthens demand consistency across the hospitality sector.

Market Challenges Analysis:

Environmental Vulnerabilities and Climate-Related Risks Impacting Farming Productivity:

The UK Mussel Farming Market faces challenges linked to environmental factors and climate variability. Rising sea temperatures and harmful algal blooms reduce yields and disrupt farming operations. It is affected by ocean acidification, which alters mussel shell formation and growth. Increased storm frequency damages infrastructure such as longlines and rafts. Farmers also face restrictions when coastal ecosystems face degradation risks. Regulatory limits on water quality can delay or restrict production licenses. Marine pollution from plastics and runoff reduces overall cultivation areas. These environmental challenges create uncertainty and require significant investments in monitoring and adaptation.

Supply Chain Pressures, Labor Issues, and Competitive Pressures Restraining Market Growth:

Another challenge for the UK Mussel Farming Market is supply chain pressure combined with labor shortages. Rising transportation costs and logistics disruptions affect timely delivery to retail and export markets. It suffers when workforce availability declines due to the seasonal and physically demanding nature of mussel farming. Limited skilled labor reduces efficiency during harvest peaks. Competition from imported mussels creates price pressure for domestic producers. Certification and compliance costs add financial strain on small-scale farmers. Lack of investment in cold storage and processing facilities limits capacity growth. These combined challenges reduce profitability and delay scaling opportunities in the industry.

Market Opportunities:

Rising Global Demand for Sustainable Aquaculture Products Creating Growth Prospects:

The UK Mussel Farming Market benefits from rising global demand for sustainable aquaculture products. Mussels are recognized as low-impact seafood with positive environmental benefits. It positions UK producers well in markets seeking certified and eco-friendly products. European countries present strong import opportunities due to sustainability preferences. Premium restaurants and foodservice buyers look for traceable and consistent supply. Trade agreements expand cross-border opportunities for producers. Favorable branding of mussels as climate-friendly strengthens competitiveness in both domestic and international markets.

Expansion into Value-Added Processing and Innovation in Product Offerings:

Opportunities in the UK Mussel Farming Market are expanding through value-added processing and product innovation. Pre-cooked, marinated, and packaged mussels meet growing retail demand. It supports farmers by enabling higher margins compared to raw product sales. Collaborations with retailers and foodservice operators create space for product differentiation. Export markets favor innovative seafood offerings from established aquaculture systems. Investments in new processing facilities strengthen capacity to meet changing consumer preferences. Diversification into ready-to-cook and meal-kit integration offers scalable opportunities. Product innovation ensures the market remains resilient against price competition and shifting consumption patterns.

Market Segmentation Analysis:

By Type

The UK Mussel Farming Market is segmented by type into rope mussel farms, bottom mussel farms, and others. Rope mussel farms dominate due to their ability to deliver high yields and consistent quality in sheltered coastal waters. It benefits from modern aquaculture practices that improve efficiency and reduce environmental impacts. Bottom mussel farms retain a steady share, supported by traditional methods and suitability in specific coastal regions. The “others” category includes experimental and hybrid farming approaches that explore innovative cultivation techniques. These diversified methods ensure that production remains resilient to environmental and market pressures while supporting regional employment.

- For instance, certain specialized rope mussel farms, such as Offshore Shellfish Ltd’s offshore farm in Lyme Bay, England, successfully use suspended rope culture to deliver high yields and significant environmental benefits. It is important to note, however, that while a major producer in Europe, this farm does not dominate global production, which is led by countries like China. The specific location is offshore, not in coastal waters, which benefits water quality and reduces ecological impacts compared to some inshore farms.

By Product

By product, the market is classified into marine water and fresh water segments. Marine water farming leads the UK Mussel Farming Market, driven by favorable conditions along the Scottish and Welsh coasts where natural ecosystems support high-quality mussel cultivation. It gains strength from established infrastructure, strong export links, and government-backed sustainability programs. Fresh water mussel farming, though smaller, presents growth potential through niche applications and research-driven projects. This segment benefits from increasing interest in diversifying aquaculture practices and tapping into untapped inland resources. Together, both marine and fresh water segments provide a balanced foundation for growth, ensuring the industry continues to meet rising domestic and international demand for sustainable, protein-rich seafood.

- For instance, Marine water farming leads mussel production in Scotland and Wales, benefiting from natural ecosystems and strong export infrastructure.

Segmentation:

By Type

- Rope Mussel Farms

- Bottom Mussel Farms

- Others

By Product

By Country

Regional Analysis:

Scotland

Scotland leads the UK Mussel Farming Market with nearly 45% share, supported by extensive coastlines, favorable water quality, and established aquaculture infrastructure. The region benefits from well-developed rope mussel farms that consistently deliver high yields. It also holds strong export ties with European markets, particularly France, Spain, and Italy, which value Scottish mussels for their quality. Government policies encouraging sustainable aquaculture provide stability and growth opportunities. The presence of leading mussel farming companies further strengthens Scotland’s dominance. Strong logistics networks and supportive regulatory frameworks maintain its leading role in production and exports.

Wales

Wales accounts for about 28% share of the UK Mussel Farming Market, driven by community-based aquaculture projects and favorable coastal conditions in North Wales. Rope mussel farming is prominent, especially in the Menai Strait, which has long been recognized for sustainable production. It benefits from local government initiatives and partnerships with research institutions that promote innovation. Welsh mussels are known for high quality and sustainability certifications, which improve their positioning in both domestic and export markets. The region contributes significantly to local employment while building a strong reputation for environmentally friendly aquaculture practices. Demand from restaurants and retail buyers continues to support market expansion in Wales.

England and Northern Ireland

England holds around 17% share of the UK Mussel Farming Market, supported by steady demand from major urban centers and strong retail networks. It relies on smaller-scale mussel farms but benefits from proximity to consumer markets and established distribution channels. Northern Ireland represents the fastest-growing region with about 10% share, supported by its clean coastal waters and increasing export opportunities to Europe. It is investing in small-scale and sustainable aquaculture methods that diversify supply. Both regions are strengthening their role through government support, certification programs, and integration with local seafood supply chains. Growth in these areas ensures broader geographic participation in the UK market and supports future resilience.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Offshore Shellfish Ltd

- West Country Mussels of Fowey Limited

- Coombe Fisheries Ltd

- Viking Aquaculture

- Scottish Shellfish Ltd

- Abalon Shellfish Ltd

- Lochfyne Ltd

- Seahaven Shellfish Ltd

- Scottish Sea Farms

- Others

Competitive Analysis:

The UK Mussel Farming Market is highly competitive with a mix of established companies and regional players. Offshore Shellfish Ltd and Scottish Shellfish Ltd maintain strong positions due to large-scale production and established export channels. It benefits from investments in rope farming systems that deliver consistent quality and supply. Smaller players such as West Country Mussels of Fowey and Coombe Fisheries Ltd compete by emphasizing premium, sustainably certified mussels. Partnerships with restaurants, retailers, and distributors create stable demand channels. Companies strengthen competitiveness through eco-certification, traceability, and technological adoption. The market remains dynamic with increasing product innovation, value-added processing, and export opportunities shaping long-term strategies.

Recent Developments:

- In June 2025, Offshore Shellfish Ltd, in collaboration with the University of Plymouth, received the Collaboration Award at the Aquaculture UK Awards. This accolade recognized their 13-year partnership and the impactful Ropes to Reefs project, which demonstrated notable environmental benefits of offshore mussel farming, including reef restoration and enhanced marine biodiversity. These achievements highlight the company’s commitment to sustainable aquaculture practices and marine ecosystem enhancement.

- In February 2025, Offshore Shellfish Ltd appointed Piers Mudd as its new head of strategy, assigning him the responsibility of leading a strategic fundraise aimed at expanding the company’s mussel production from 3,000 tonnes to a mid-term target of 5,000 tonnes and beyond. This move positions Offshore Shellfish Ltd for significant growth in the coming years.

Report Coverage:

The research report offers an in-depth analysis based on type and product segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising consumer demand for sustainable seafood will continue to support industry expansion.

- Technological innovations in farming and processing will enhance productivity.

- Eco-certifications will play a key role in gaining consumer trust and market access.

- Exports to European countries are expected to strengthen long-term revenue streams.

- Value-added products will gain popularity in retail and foodservice channels.

- Coastal community engagement will expand small-scale and regional farming initiatives.

- Climate adaptation measures will remain essential for maintaining consistent yields.

- Digitalization and data monitoring will optimize efficiency across farming operations.

- Government support for aquaculture will encourage investment and sector stability.

- Strategic partnerships will strengthen distribution networks and market presence.