Market Overview

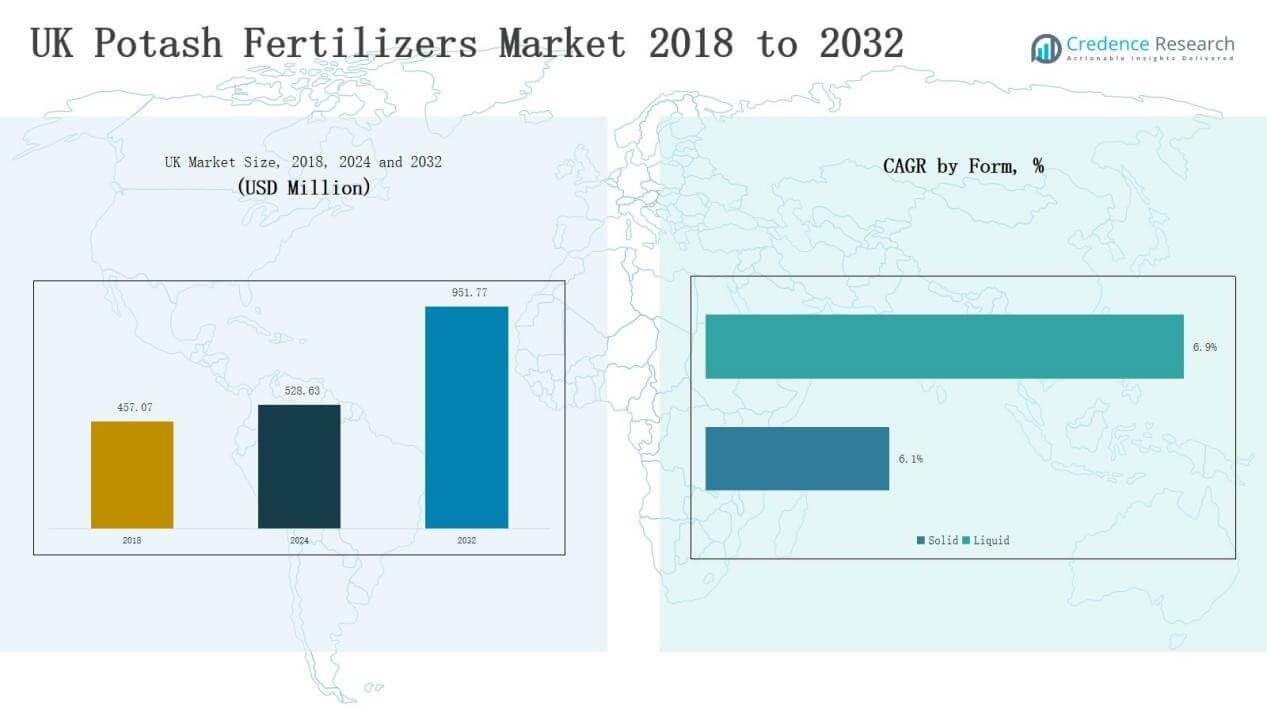

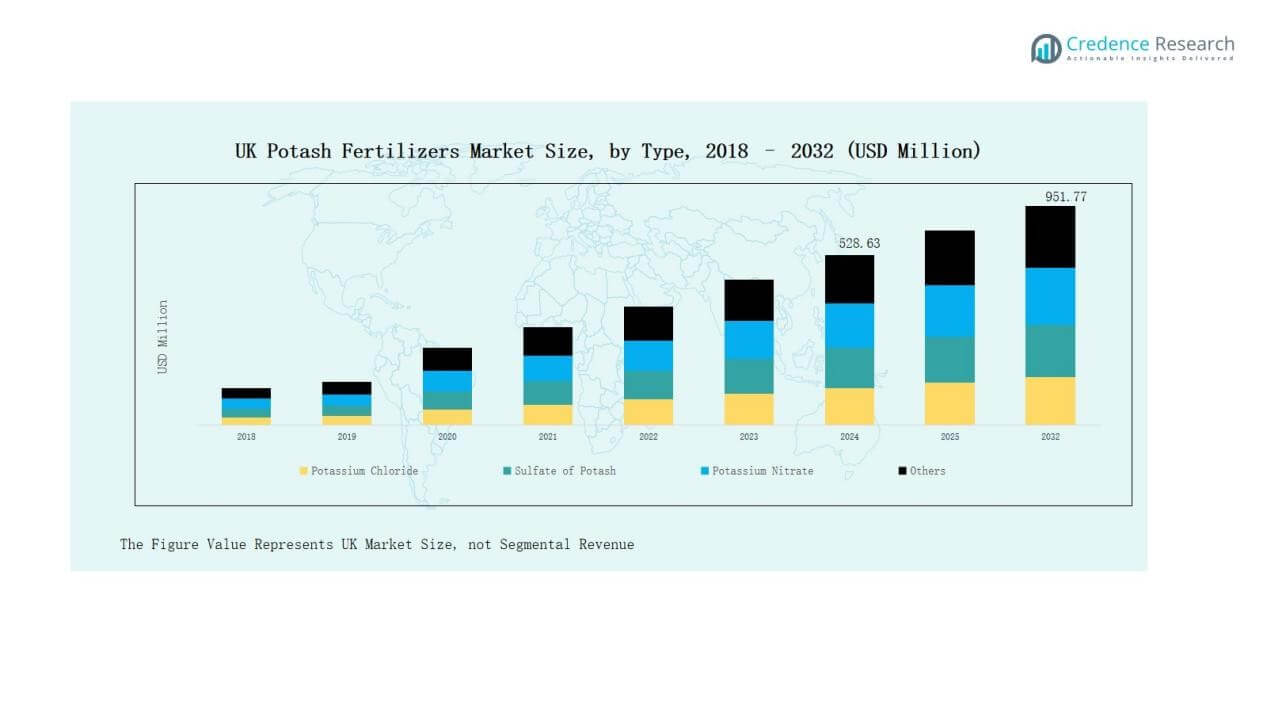

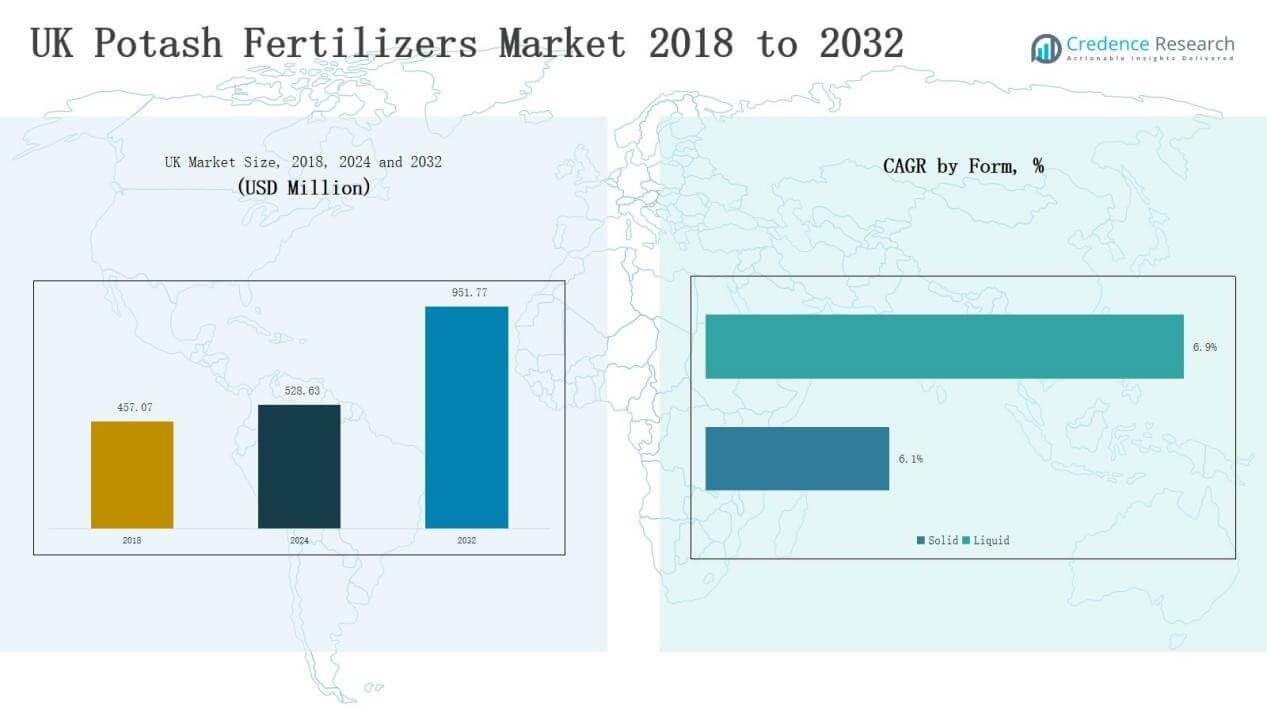

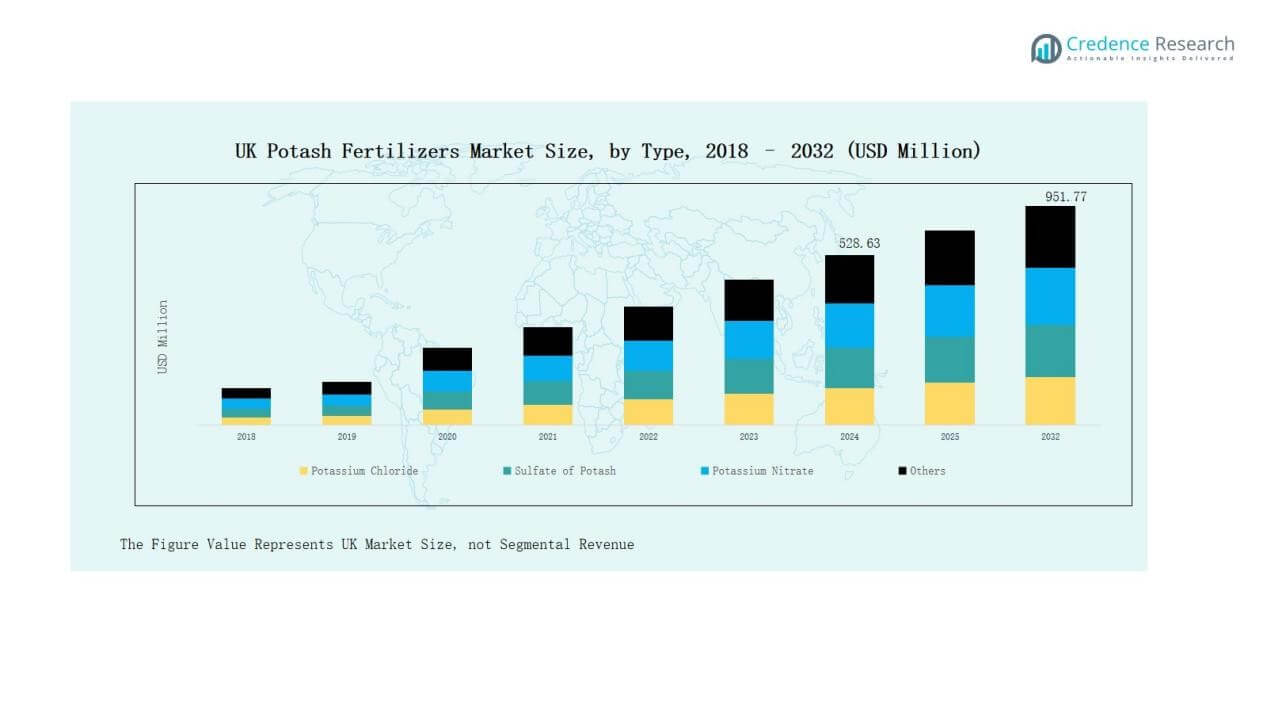

UK Potash Fertilizers Market size was valued at USD 457.07 million in 2018 to USD 528.63 million in 2024 and is anticipated to reach USD 951.77 million by 2032, at a CAGR of 7.63 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Potash Fertilizers Market Size 2024 |

USD 528.63 Million |

| UK Potash Fertilizers Market, CAGR |

7.63% |

| UK Potash Fertilizers Market Size 2032 |

USD 951.77 Million |

The UK Potash Fertilizers Market is shaped by the presence of global leaders and domestic suppliers focusing on product innovation, sustainable formulations, and efficient distribution. Key players include Yara International ASA, The Mosaic Company, Uralkali PJSC, Israel Chemicals Ltd. (ICL), Agrovista UK Limited, and Bionature UK, each strengthening their positions through diverse product portfolios and tailored solutions for cereals, grains, and horticultural crops. Competition is driven by rising demand for chloride-free and specialty formulations, particularly in high-value farming. England emerged as the leading region with a 45% share in 2024, supported by large-scale cereal cultivation, mechanized farming, and expanding greenhouse production. This dominance highlights England’s central role in driving the market’s overall growth trajectory.

Market Insights

- The UK Potash Fertilizers Market grew from USD 457.07 million in 2018 to USD 528.63 million in 2024 and is projected to reach USD 951.77 million by 2032, registering 7.63% growth.

- Potassium Chloride held a 52% share in 2024, driven by its cost efficiency and strong adoption in large-scale cereal and grain cultivation across the UK.

- Broadcasting led with 47% share in 2024, reflecting its simplicity and extensive use in cereal and oilseed farming, while fertigation gained traction in greenhouse production.

- Solid fertilizers commanded 66% share in 2024 due to longer shelf life and cost-effectiveness, while liquid formulations advanced with rising adoption in fertigation and foliar spraying.

- England dominated with 45% share in 2024, supported by extensive cereal farming, advanced mechanization, and greenhouse horticulture, making it the leading regional contributor to market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

Potassium Chloride dominated the UK potash fertilizers market with a 52% share in 2024, driven by its affordability and suitability for large-scale cereal and grain cultivation. Sulphate of Potash held strong traction in fruit and vegetable farming, where chloride-free formulations improve crop quality and resistance. Potassium Nitrate gained steady adoption in high-value horticulture for supplying both potassium and nitrogen, while mixed or specialty blends in the Others category remained limited to niche applications.

For instance, Yara UK introduced its Krista-K Plus potassium nitrate solution for protected greenhouse horticulture, targeting growers of tomatoes and peppers with integrated potassium and nitrogen delivery.

By Application Method

Broadcasting led the application method segment with a 47% share in 2024, supported by its simplicity and widespread use in cereal and oilseed farms. Foliar spraying gained momentum in vineyards and horticulture, where targeted nutrient delivery improves yields and reduces waste. Fertigation expanded in greenhouse and irrigated farming systems, particularly for fruits and vegetables. The Others category contributed marginally, focused on localized application in specialized crop systems.

By Form

Solid fertilizers accounted for a 66% share in 2024, reflecting their longer shelf life, ease of transport, and cost effectiveness for field crops. Liquid fertilizers captured growth through adoption in fertigation and foliar methods, where quick nutrient uptake and uniform application support greenhouse and high-value crop production. Rising mechanization and precision farming practices are expected to further strengthen the role of liquid formulations in modern UK agriculture.

For instance, ICL Group introduced its Solinure FX liquid formulations targeted at high-value horticultural crops, emphasizing compatibility with fertigation systems.

Key Growth Drivers

Key Growth Drivers

Rising Demand for High-Yield Crops

The UK potash fertilizers market is driven by the need to increase agricultural productivity amid limited arable land. Farmers rely on potassium-based fertilizers to enhance root strength, crop resistance, and yield, particularly in cereals, grains, and horticultural crops. Growing food security concerns, coupled with consumer demand for consistent quality, fuel adoption across both large farms and greenhouse systems. This demand is supported by government-backed initiatives promoting efficient nutrient use and sustainable farming practices across the agricultural sector.

For instance, ICL Group expanded its Polysulphate® fertilizer distribution in the UK, highlighting its multi-nutrient benefits (including potassium and sulfur) for cereal and oilseed farmers.

Expansion of Greenhouse and Horticultural Farming

Greenhouse cultivation and horticultural farming are expanding rapidly across the UK, supported by rising demand for fruits, vegetables, and ornamental crops. Chloride-free formulations such as sulphate of potash and potassium nitrate are increasingly preferred to enhance crop quality and shelf life. The controlled environment of greenhouses requires precision nutrient management, which potash fertilizers effectively provide. This expansion strengthens market demand, particularly among high-value crop producers aiming to balance quality, productivity, and profitability.

Growing Focus on Sustainable Agriculture

Sustainability is a key growth driver as UK farmers adopt eco-friendly practices to align with regulatory frameworks and consumer preferences. Potash fertilizers that support efficient water use, soil fertility, and reduced nutrient loss gain importance in modern farming systems. Suppliers are introducing innovative formulations, including low-chloride and water-soluble options, to cater to this shift. The increasing integration of precision agriculture tools further boosts potash fertilizer use, ensuring targeted application and minimizing environmental impact while maintaining productivity.

For instance, Yara International reported expanding trials of its potassium-based fertigation solutions with UK growers, showcasing up to 20% reduction in nutrient runoff compared to conventional field application methods.

Key Trends & Opportunities

Key Trends & Opportunities

Adoption of Precision Farming Technologies

The adoption of precision agriculture technologies creates strong opportunities for potash fertilizer providers in the UK. Farmers are using digital tools, sensors, and GPS-based systems to optimize fertilizer application, reduce waste, and enhance yields. This trend aligns with broader industry goals of efficiency and sustainability. Fertilizer manufacturers are expected to partner with technology providers to deliver customized solutions, integrating real-time soil and crop data to maximize nutrient efficiency and farm profitability.

For instance, CF Fertilisers UK introduced precision application trials using N-Sensor technology, helping cereal farmers adjust real-time potash and nitrogen application rates to boost yield and reduce input costs.

Increasing Shift Toward Specialty Fertilizers

The UK market is witnessing a clear shift toward specialty and chloride-free fertilizers such as sulphate of potash and potassium nitrate. These products are increasingly adopted in horticulture, greenhouse farming, and vineyards where crop quality and nutrient balance are crucial. Rising consumer demand for premium fruits and vegetables creates further opportunities for suppliers. Specialty fertilizers also support export competitiveness by meeting strict international quality standards, encouraging continued product innovation and market penetration.

For instance, Mosaic Company reported expanding availability of its Performance Potash solutions for European greenhouse producers, including the UK, ensuring sustainable nutrient supply with reduced chloride levels.

Key Challenges

Volatile Raw Material Prices

The UK potash fertilizers market faces challenges from fluctuating global potash prices, heavily influenced by supply dynamics in key producing countries. Price volatility creates uncertainty for farmers, affecting affordability and purchasing decisions. It also impacts supplier margins, particularly for companies reliant on imports. Sustained fluctuations may limit adoption among smaller farms, slowing overall market growth.

Environmental and Regulatory Pressures

Tightening environmental regulations in the UK challenge the use of conventional fertilizers, with increasing scrutiny on nutrient runoff and soil degradation. Farmers are required to adopt sustainable nutrient management practices, which raises compliance costs. Suppliers must innovate with eco-friendly formulations, but this transition demands significant R&D investment. Balancing productivity with environmental responsibility remains a persistent challenge for the industry.

Competition from Alternative Practices

Alternative soil management practices, including organic fertilizers and crop rotation techniques, present competition to potash fertilizers in the UK. With growing consumer preference for organic food and government support for sustainable agriculture, some farmers are shifting away from chemical fertilizers. This trend creates market pressure, particularly in the fruits and vegetables segment where organic adoption is higher. Potash fertilizer providers must adapt strategies to counter this shift and highlight the role of balanced nutrition.

Regional Analysis

England

England led the UK Potash Fertilizers Market with a 45% share in 2024, supported by extensive cereal and grain farming. Large agricultural regions such as East Anglia drive fertilizer demand through mechanized and high-intensity cultivation. Greenhouse and horticultural production further strengthens the use of chloride-free formulations like sulphate of potash and potassium nitrate. Farmers adopt broadcasting methods widely for cereals, while fertigation is expanding in horticulture. England remains the dominant contributor, combining scale, advanced farming, and modern infrastructure.

Scotland

Scotland held a 25% share in 2024, supported by its strong focus on barley, wheat, and oilseed production. The country’s cool climate favors cereal farming, where potash fertilizers improve soil fertility and crop resilience. Broadcasting is the most common application method due to expansive farmland. Rising demand for sustainable agriculture practices and niche horticultural crops is gradually increasing specialty fertilizer adoption. It continues to emerge as a critical regional market with consistent fertilizer demand.

Wales

Wales accounted for a 15% share in 2024, reflecting steady demand across mixed farming systems. Potash fertilizers play a vital role in supporting cereals, pasture management, and fruit crops. The region’s focus on sustainable practices encourages the use of chloride-free formulations for higher quality produce. Foliar application is gaining popularity among horticultural farmers aiming to improve crop quality. Wales shows stable fertilizer adoption, with growth opportunities in high-value horticulture and greenhouse farming.

Northern Ireland

Northern Ireland represented a 15% share in 2024, with a balanced reliance on cereals, potatoes, and horticultural crops. Potash fertilizers support both yield improvement and soil health in the region’s diverse cropping systems. Fertigation is gaining momentum in protected farming, particularly for fruits and vegetables. Strong export-oriented farming practices encourage adoption of specialty formulations. Northern Ireland plays a consistent role in the market, supported by efficient farming methods and growing attention to crop quality.

Market Segmentations:

Market Segmentations:

By Type

- Potassium Chloride

- Sulphate of Potash

- Potassium Nitrate

- Others

By Application Method

- Broadcasting

- Foliar

- Fertigation

- Others

By Form

By Crop Type

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK Potash Fertilizers Market is characterized by the presence of both global leaders and domestic suppliers competing on product quality, distribution reach, and innovation. Key companies such as Yara International ASA, The Mosaic Company, Uralkali PJSC, and Israel Chemicals Ltd. (ICL) maintain strong positions through extensive product portfolios and integrated supply chains. Local players including Agrovista UK Limited and Bionature UK contribute by catering to region-specific farming needs and offering tailored solutions for horticulture and greenhouse crops. Competition is shaped by rising demand for chloride-free and specialty formulations, pushing companies to expand their offerings in sulphate of potash and potassium nitrate segments. Partnerships with distributors, investment in R&D, and digital advisory services enhance competitiveness. With sustainability regulations tightening, companies focus on eco-friendly formulations and precision farming support to secure long-term market presence. It remains a moderately concentrated market with both global and regional firms actively influencing growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In August 2024, ICL signed a five-year agreement valued at approximately USD 170 million with AMP Holdings Group Co. Ltd., a major agricultural distributor in China, to expand its Growing Solutions product offerings globally.

- In September 2025, ERM was hired by EBRD and IFA to develop a low-carbon roadmap for the global potash and phosphate fertiliser industry.

- In September 2025, the UK and Brazil signed a memorandum of understanding (MoU) to partner on sustainable fertiliser production and environmental impact reduction.

- In November 2024, Anglo American and the IAEA launched a research project under the Atoms4Food partnership. It aims to study use of polyhalite and other additives to fight soil salinization.

Report Coverage

The research report offers an in-depth analysis based on Type, Application Method, Form, Crop Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for potash fertilizers will rise with expanding cereal and grain cultivation.

- Greenhouse and horticultural farming will drive adoption of chloride-free formulations.

- Precision agriculture practices will increase targeted fertilizer application across farms.

- Liquid formulations will gain share due to fertigation and foliar applications.

- Sustainability regulations will push innovation in eco-friendly fertilizer solutions.

- Specialty fertilizers will expand in fruits, vegetables, and vineyard production.

- Import dependence will shape pricing strategies and supply chain resilience.

- Local distributors will strengthen their role through customized crop advisory services.

- Digital platforms will support farmers with real-time nutrient management solutions.

- Global and domestic players will intensify competition through R&D and partnerships.

Key Growth Drivers

Key Growth Drivers Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: