Market Overview

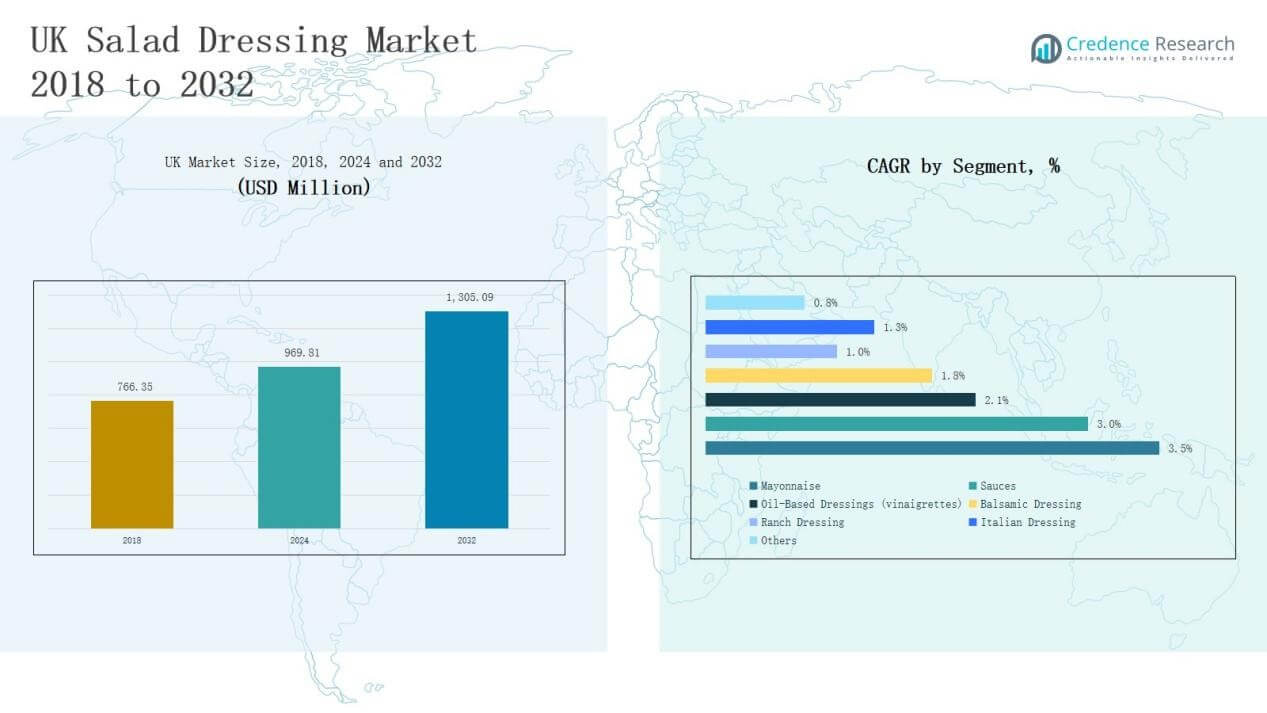

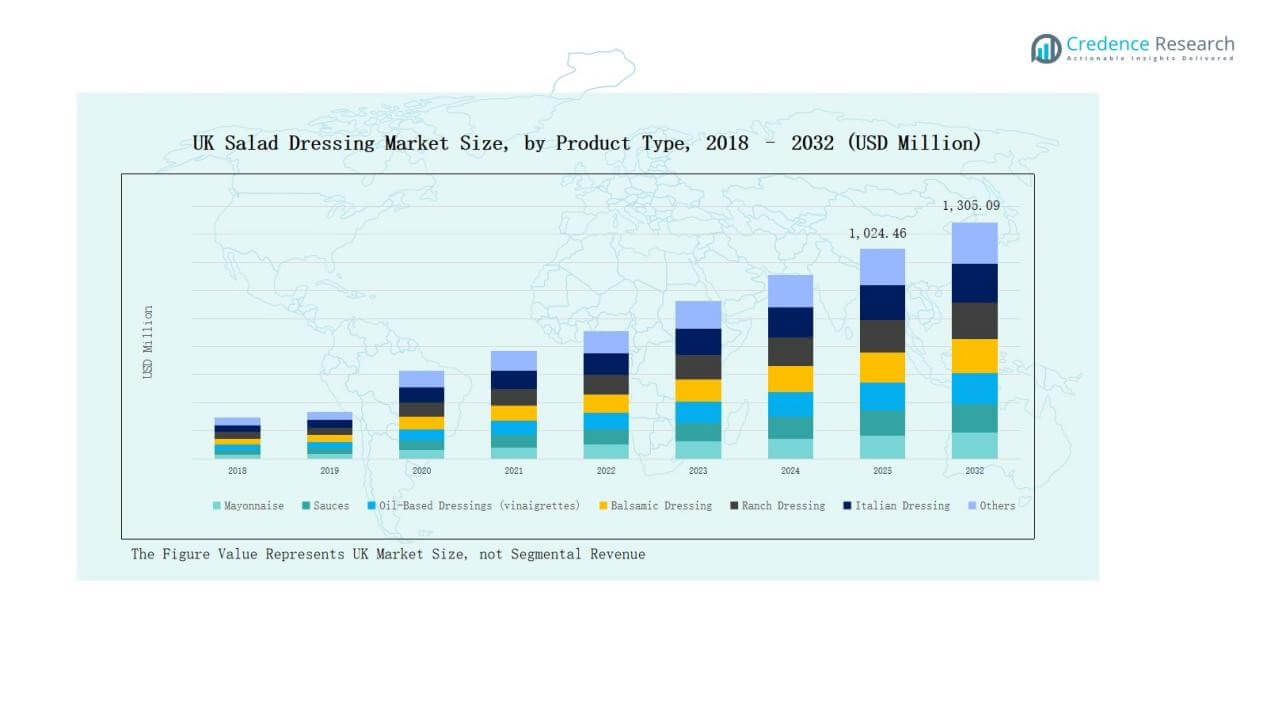

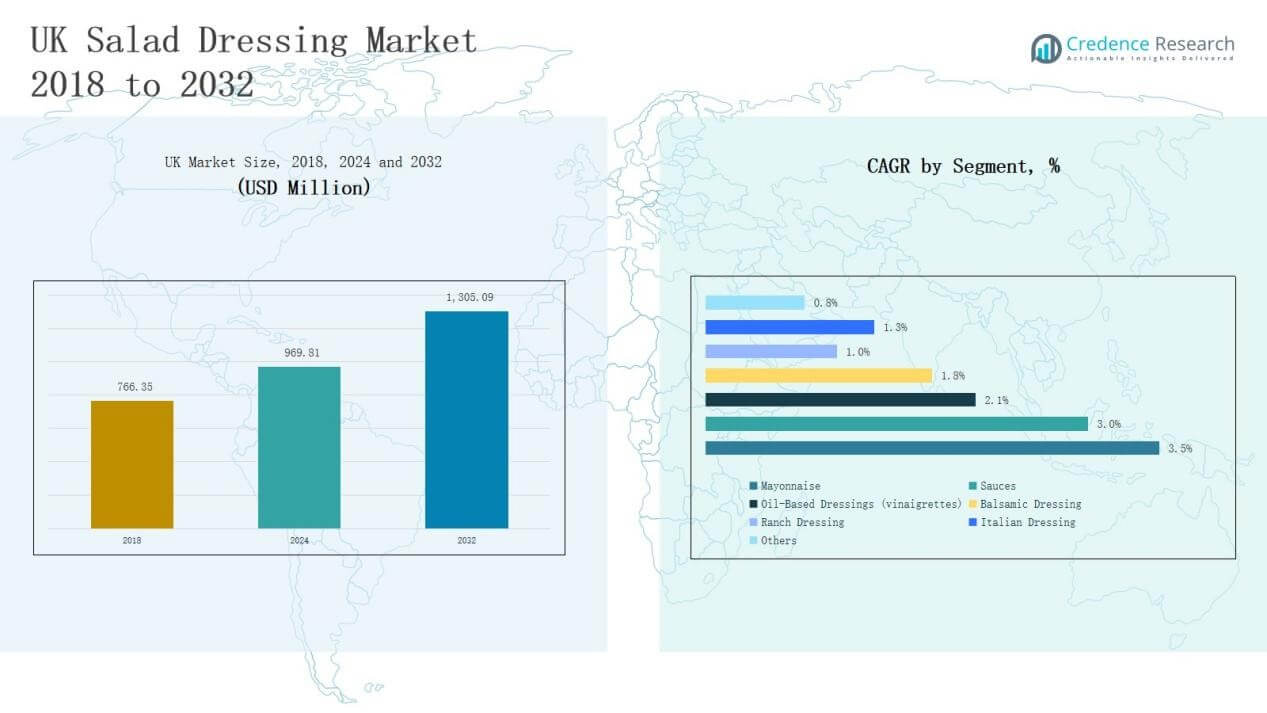

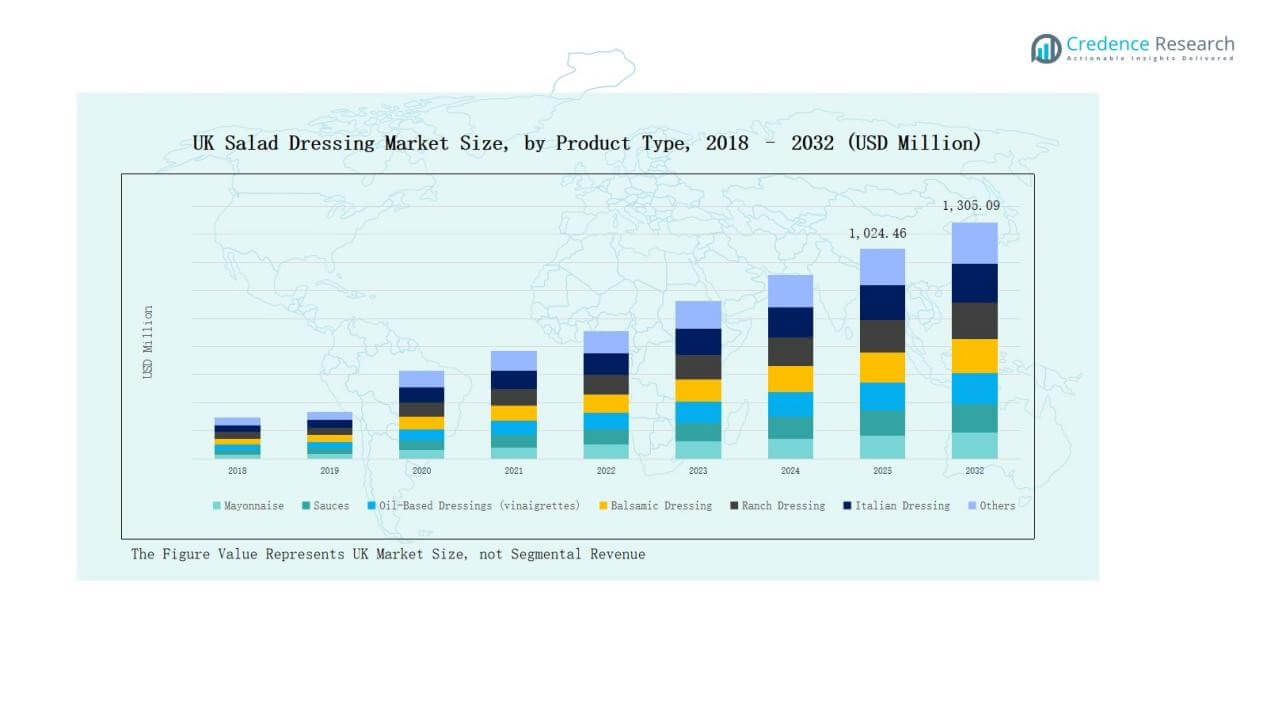

UK Salad Dressing Market size was valued at USD 766.35 million in 2018 to USD 969.81 million in 2024 and is anticipated to reach USD 1,305.09 million by 2032, at a CAGR of 3.52 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Salad Dressing Market Size 2024 |

USD 969.81 Million |

| UK Salad Dressing Market, CAGR |

3.52% |

| UK Salad Dressing Market Size 2032 |

USD 1,305.09 Million |

The UK Salad Dressing Market is shaped by a mix of multinational leaders and regional brands competing across conventional and organic categories. Prominent players include Unilever PLC, Kraft Heinz Company, Ken’s Foods Inc., PepsiCo’s Tostito’s, Best Foods Mayonnaise, Heinz, Mrs. Bector’s Cremica, Oasis Foods Company, Newman’s Own, and Stokes Sauces, all leveraging strong distribution networks, product innovation, and brand recognition. Private labels from major supermarket chains further intensify competition by appealing to price-sensitive buyers. Regionally, England leads with a 61% market share, supported by its large population base, robust retail infrastructure, and growing consumer adoption of organic and clean-label products. This dominance positions England as the primary growth engine within the UK market.

Market Insights

Market Insights

- The UK Salad Dressing Market grew from USD 766.35 million in 2018 to USD 969.81 million in 2024 and is projected to reach USD 1,305.09 million by 2032.

- Mayonnaise dominates with a 34% share, followed by sauces at 23% and vinaigrettes at 15%, reflecting both traditional preferences and growing health-conscious consumer choices.

- Conventional dressings lead with 69% share, while organic products at 31% expand steadily, supported by clean-label demand and increasing presence in supermarket organic aisles.

- Retail stores command 56% of sales, foodservice contributes 30%, and off-trade channels at 14% benefit from online grocery platforms and specialty outlets.

- England leads regionally with a 61% share, followed by Scotland at 15%, Wales at 12%, and Northern Ireland at 12%, highlighting diverse consumption preferences across the UK.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Mayonnaise leads the UK Salad Dressing Market with a 34% share, supported by its versatility in sandwiches, burgers, and ready-to-eat meals. Sauces follow with a 23% share, driven by demand for variety and convenience in home dining. Oil-based dressings, including vinaigrettes, account for 15%, benefiting from rising health awareness and preference for lighter options. Balsamic dressing holds a 9% share, appealing to premium and gourmet consumers. Ranch and Italian dressings together contribute 11%, favored by younger buyers influenced by global cuisines. Other niche varieties make up the remaining 8%, targeting experimental consumers.

For instance, Hellmann’s, a Unilever brand, launched its first vegan mayonnaise in the UK, expanding options for flexitarian and plant-based consumers.

By Category

Conventional salad dressings dominate with a 69% share, driven by affordability, widespread retail availability, and strong consumer loyalty to established brands. This category is reinforced by private label expansion across supermarkets. Organic dressings hold a 31% share and are growing steadily, supported by health-conscious consumers seeking natural, clean-label products. Expansion of organic food aisles and increased focus on transparent labeling strengthen this segment’s appeal.

By Distribution Channel

Retail stores command the largest share at 56%, supported by the dominance of supermarkets, hypermarkets, and private labels offering wide product ranges. Foodservice accounts for 30%, reflecting rising demand in restaurants, cafés, and quick-service outlets where salads and dressings are core offerings. Other off-trade channels hold a 14% share, with online grocery platforms and specialty stores gaining traction. Growth in digital retail and convenience-based shopping continues to push this segment upward.

For instance, in August 2025, Amazon expanded its same-day grocery delivery service to include fresh groceries like produce, meat, and dairy in over 1,000 U.S. cities, with plans to reach over 2,300 by the end of the year. This move contributed to growth in online grocery penetration and overall Prime adoption

Key Growth Drivers

Rising Preference for Convenience Foods

Busy lifestyles and growing demand for ready-to-eat meals drive the use of salad dressings in the UK. Mayonnaise and sauces remain the most popular, offering versatility across sandwiches, burgers, and quick meals. The expansion of convenience stores and supermarket chains boosts accessibility, while promotional offers further encourage consumer purchases. Increasing urbanization and dual-income households strengthen this shift toward quick-preparation food items. This driver supports consistent demand for dressings across retail and foodservice channels, keeping them a staple in everyday consumption.

Health and Wellness Influence

Health-conscious consumers are increasingly favoring lighter, low-fat, and organic salad dressings in the UK. Oil-based vinaigrettes and balsamic options benefit from their perceived nutritional value, while demand for reduced-calorie and clean-label products grows. Rising concerns about obesity and cardiovascular risks push consumers away from high-fat alternatives. Manufacturers are actively reformulating products with natural ingredients, reduced salt, and sugar. This alignment with wellness-focused preferences boosts market growth and strengthens consumer trust in healthier dressing options.

For instance, Unilever expanded its Hellmann’s portfolio in the UK with a new range of plant-based and lower-fat dressings made with natural ingredients to cater to health-conscious consumers.

Expansion of Foodservice Sector

The foodservice industry contributes significantly to salad dressing consumption, supported by restaurants, cafés, and quick-service outlets across the UK. Salads are increasingly featured as main or side meals, encouraging use of diverse dressings. Tourism and multicultural dining trends also enhance the popularity of international flavors like ranch and Italian dressings. Partnerships between foodservice providers and leading brands improve visibility and loyalty. Catering services for events further boost volumes. This sector remains a key growth driver by expanding product exposure beyond retail shelves.

For instance, Nando’s UK added new menu items with peri-peri salad bowls, incorporating house-made dressings to meet rising demand for lighter, flavor-forward dining options.

Key Trends & Opportunities

Growth of Organic and Clean-Label Products

Organic salad dressings are growing in popularity as UK consumers prioritize natural ingredients and transparent sourcing. Supermarkets and specialty stores are expanding organic sections, offering more options to health-conscious buyers. Brands promoting eco-friendly packaging and certified organic claims gain competitive advantages. This trend creates opportunities for premium pricing and stronger consumer trust. Clean-label innovations, emphasizing reduced additives and sustainability, will further drive product differentiation and long-term adoption in the UK market.

For instance, Kerry Group in mid-2025 launched ingredient solutions formulated to reduce environmental impact while supporting clean-label claims, catering to eco-conscious brands.

Expansion of E-commerce and Digital Retail

Online grocery platforms and direct-to-consumer strategies are reshaping salad dressing distribution in the UK. Consumers increasingly prefer the convenience of online shopping for both conventional and premium products. E-commerce allows smaller brands to reach niche audiences and launch innovative dressings more effectively. Subscription models and promotional bundles improve consumer loyalty. Digital marketing campaigns targeting younger, health-conscious buyers create fresh growth opportunities. This channel’s continued expansion is expected to strengthen accessibility and product diversification.

For instance, Tesco expanded its Whoosh rapid delivery service across 1,000 UK stores, enabling faster access to grocery items, including salad dressings and other condiments.

Key Challenges

Key Challenges

Intense Competitive Pressure

The UK Salad Dressing Market is highly competitive, with multinational corporations, regional producers, and private labels vying for share. Price competition is fierce, particularly in retail where private labels dominate shelf space. Established players must continually innovate to retain loyalty and defend margins. Smaller firms face challenges in distribution and brand visibility, limiting their reach. This crowded environment forces companies to invest heavily in marketing, product innovation, and promotional activities to differentiate themselves in a mature market.

Regulatory and Labeling Requirements

Strict UK and EU regulations on food safety, nutrition, and labeling present compliance challenges for manufacturers. Companies must adhere to standards regarding allergens, sugar and salt content, and clean-label claims. Compliance raises operational costs and requires ongoing monitoring to avoid penalties. Smaller producers often face financial strain in meeting these requirements. While regulations help strengthen consumer trust, they also add complexity to market entry and expansion strategies, particularly for emerging and niche brands in the UK.

Evolving Consumer Preferences

Shifting consumer tastes create uncertainty for manufacturers, requiring constant adaptation. Younger consumers seek international flavors like ranch and Italian dressings, while traditional buyers remain loyal to mayonnaise and vinaigrettes. This balance between innovation and heritage products complicates portfolio strategies. Brands failing to keep pace with evolving preferences risk losing relevance. Frequent product updates increase costs and shorten product lifecycles. Successfully managing this challenge is critical for maintaining competitiveness in the dynamic UK Salad Dressing Market.

Regional Analysis

England

England dominates the UK Salad Dressing Market with a 61% share, supported by its large population and strong urban demand. It benefits from widespread supermarket penetration and private label expansion, which enhance accessibility for both premium and budget-conscious consumers. Mayonnaise remains the most popular product, with sauces and vinaigrettes gaining momentum among health-conscious buyers. The foodservice sector also plays a key role, as restaurants, cafés, and quick-service outlets drive consumption. It shows strong adoption of organic and clean-label products, reflecting broader health and sustainability trends. England continues to set the pace for innovation and distribution within the market.

Scotland

Scotland holds a 15% share, influenced by changing consumer preferences and rising health awareness. Oil-based dressings and balsamic varieties are growing in popularity as lighter alternatives to mayonnaise. Retail stores dominate distribution, though foodservice outlets are increasingly adding diverse dressings to menus. Local consumers demonstrate strong interest in clean-label and natural options, creating opportunities for organic brands. It benefits from government initiatives promoting healthy eating, which further supports category diversification. Scotland’s market reflects a steady balance between traditional favorites and emerging premium offerings.

Wales

Wales accounts for a 12% share, with retail stores driving the majority of sales. Mayonnaise continues to dominate, but demand for sauces and vinaigrettes is rising among younger consumers. Foodservice demand is supported by casual dining and quick-service outlets that integrate international flavors such as ranch and Italian dressings. Organic products are gradually gaining traction as awareness of clean-label options increases. It demonstrates a preference for affordable and convenient products, making conventional dressings dominant. Wales remains a steadily growing contributor within the UK Salad Dressing Market.

Northern Ireland

Northern Ireland captures a 12% share, supported by cross-border trade influences and evolving consumer preferences. Retail dominates distribution, but online grocery platforms are expanding access to niche and imported dressings. Mayonnaise leads the product mix, with vinaigrettes and balsamic dressings gradually increasing their share. Foodservice demand is supported by restaurants and hotels catering to both local and tourist populations. It reflects a growing interest in health-oriented dressings, with organic options gaining visibility. Northern Ireland’s market is positioned for steady growth as consumer tastes diversify.

Market Segmentations:

Market Segmentations:

By Product Type

- Mayonnaise

- Sauces

- Oil-Based Dressings (Vinaigrettes)

- Balsamic Dressing

- Ranch Dressing

- Italian Dressing

- Others

By Category

By Distribution Channel

- Foodservice

- Retail Stores

- Other Off-Trade Channels

By Region

- England

- Scotland

- Wales

- Noethern Ireland

Competitive Landscape

The UK Salad Dressing Market is highly competitive, shaped by global corporations, regional producers, and private labels. Leading players such as Unilever PLC, Kraft Heinz Company, Ken’s Foods Inc., PepsiCo’s Tostito’s, Best Foods Mayonnaise, Heinz, Mrs. Bector’s Cremica, Oasis Foods Company, Newman’s Own, and Stokes Sauces dominate through brand recognition, strong distribution networks, and diversified product portfolios. Multinationals leverage economies of scale to expand conventional and organic ranges, while niche brands emphasize clean-label, gourmet, and health-focused options. Private labels from UK supermarkets intensify competition, targeting price-sensitive buyers with affordable alternatives. Innovation in flavors, reduced-fat variants, and eco-friendly packaging strengthens brand differentiation. Companies also partner with foodservice operators to increase visibility and consumer reach. With shifting consumer preferences, competition is centered on innovation, health positioning, and sustainability. This dynamic environment ensures that both established and emerging players continually adapt to capture and retain market share in a maturing industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Unilever PLC

- Kraft Heinz Company

- Ken’s Foods Inc.

- Tostito’s (PepsiCo)

- Best Foods Mayonnaise

- Heinz

- Bector’s Cremica

- Oasis Foods Company

- Newman’s Own

- Stokes Sauces

Recent Developments

- In April 2025, Hidden Valley introduced seven new ranch dressing varieties with a redesigned applicator bottle, including both widely available and retail-exclusive flavors.

- In 2025, Del Monte UK launched Salad Cream and Light Salad Cream in squeezy bottles, rolling out the range into Asda stores.

- In January 2025, Stonewall Kitchen launched classic salad dressings including French, Blue Cheese, Ranch, and Thousand Island, targeting everyday consumer preferences beyond gourmet products.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Category, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for organic and clean-label salad dressings will continue to expand.

- Retailers will strengthen private label offerings to attract price-sensitive consumers.

- Foodservice adoption of diverse dressing types will rise with menu diversification.

- Online grocery platforms will improve accessibility for premium and niche products.

- Innovation in low-fat, reduced-salt, and sugar-free dressings will gain traction.

- Sustainable and recyclable packaging will become a standard industry expectation.

- Regional preferences will influence new flavor developments tailored to local tastes.

- Strategic partnerships with restaurants and cafés will enhance brand visibility.

- Marketing will emphasize health benefits and natural formulations to build consumer trust.

- Competition between multinational brands and local players will drive continuous innovation.

Market Insights

Market Insights Key Challenges

Key Challenges Market Segmentations:

Market Segmentations: