Market Overview:

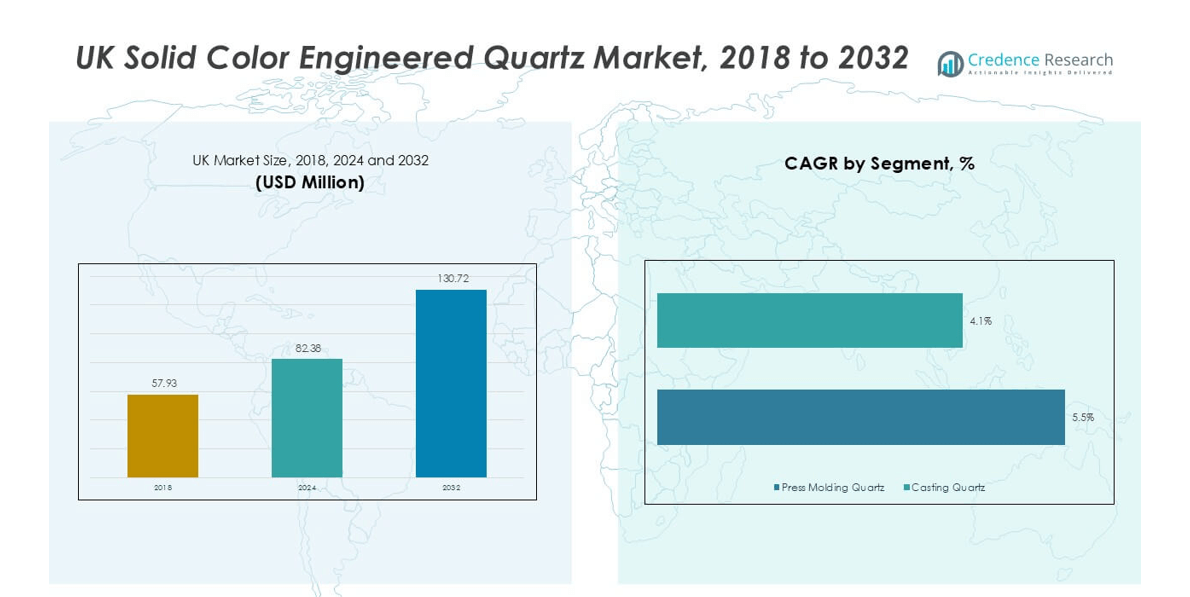

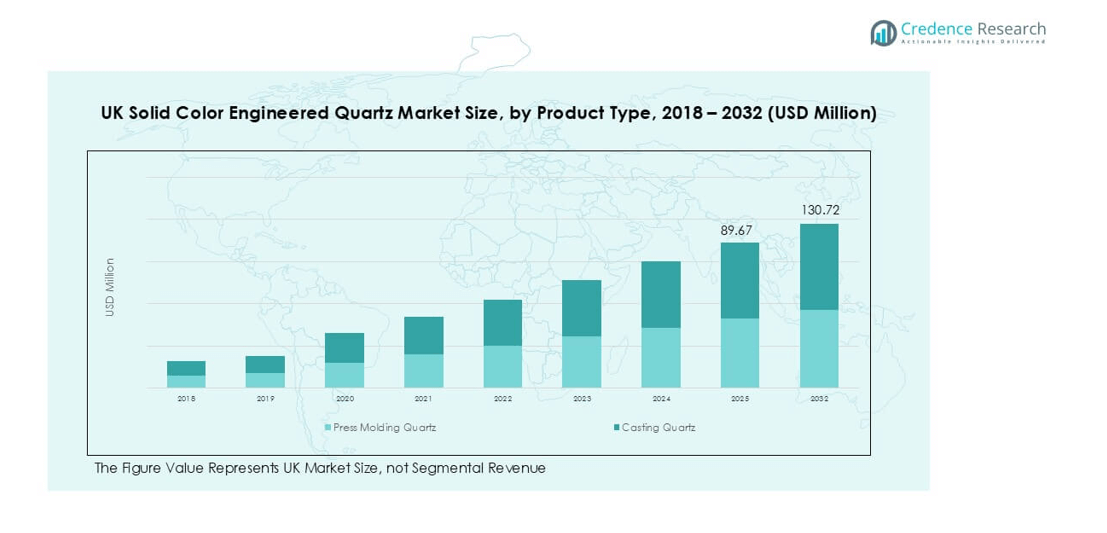

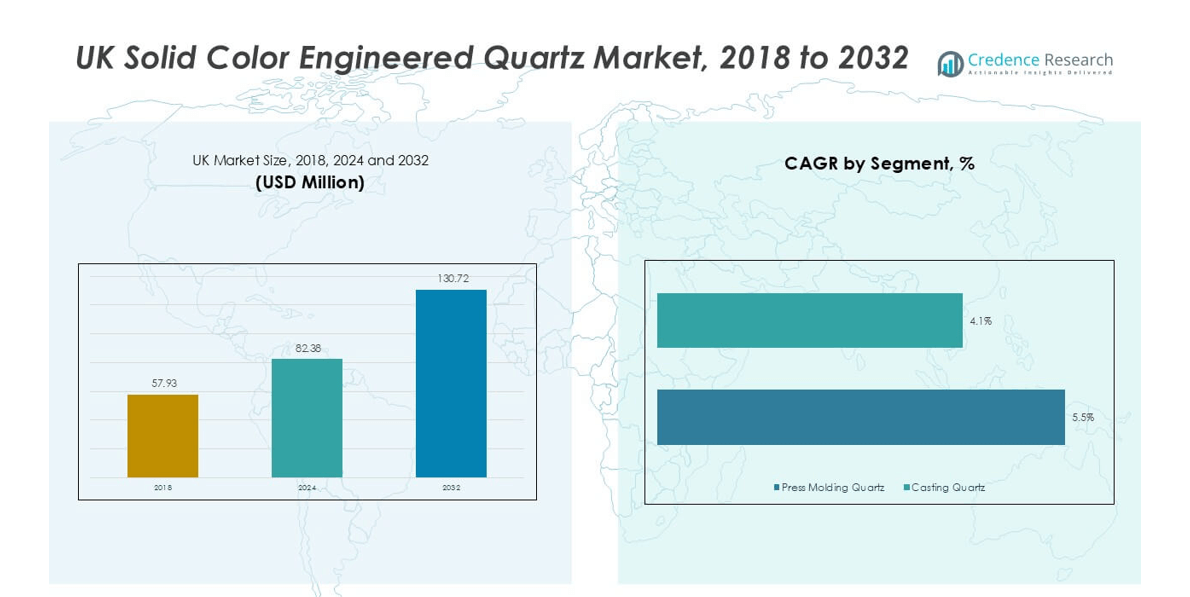

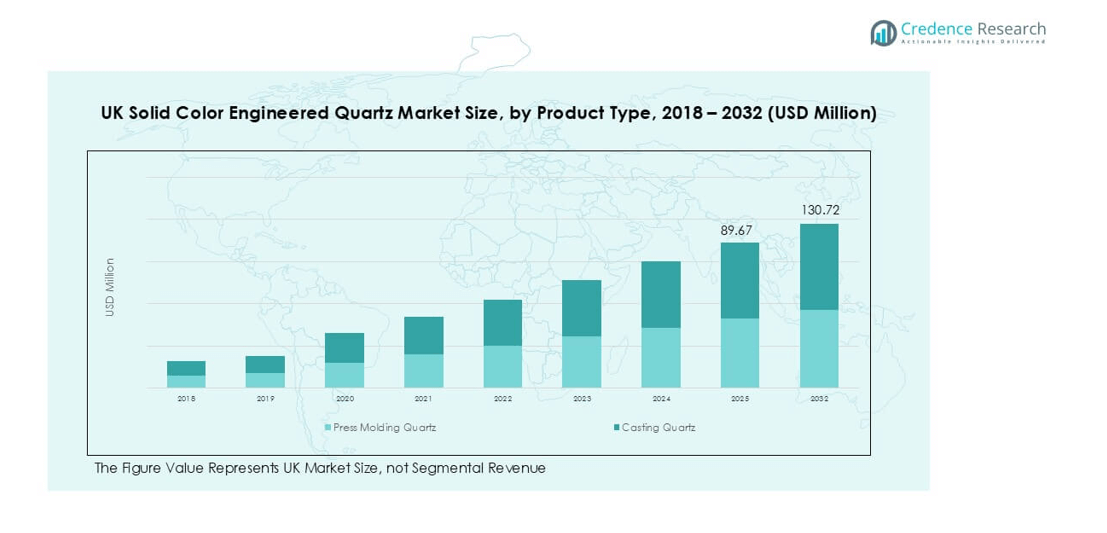

The UK Solid Color Engineered Quartz market size was valued at USD 57.93 million in 2018 and grew to USD 82.38 million in 2024. It is anticipated to reach USD 130.72 million by 2032, at a CAGR of 5.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Solid Color Engineered Quartz Market Size 2024 |

USD 82.38 million |

| UK Solid Color Engineered Quartz Market, CAGR |

5.53% |

| UK Solid Color Engineered Quartz Market Size 2032 |

USD 130.72 million |

The UK solid color engineered quartz market is shaped by key players including Caesarstone, Silestone, Compac, Unistone, Dekton, Stone Italiana, Cambria, Wilsonart, Cimstone, and Quartzforms. These companies compete on product innovation, sustainability, and distribution strength to capture demand across residential and commercial projects. England leads the market with 65% share, supported by high urban housing demand and large-scale commercial developments in London and other cities. Scotland accounts for 15%, driven by premium residential upgrades and hospitality projects, while Wales and Northern Ireland hold 10% each, benefiting from steady residential construction and selective commercial investments.

Market Insights

- The UK Solid Color Engineered Quartz market was valued at USD 82.38 million in 2024 and is projected to reach USD 130.72 million by 2032, registering a CAGR of 5.53%.

- Rising residential renovations and demand for modern kitchens and bathrooms drive adoption, with countertops holding the dominant 55% share among applications due to their durability and aesthetic appeal.

- Market trends highlight growing use of eco-friendly quartz surfaces with recycled content, alongside increasing premiumization in interior design across both residential and commercial projects.

- Competition is intense, led by players such as Caesarstone, Silestone, Compac, Cambria, Wilsonart, and Dekton, focusing on sustainability, product variety, and retail network expansion.

- Regionally, England leads with 65% share, followed by Scotland at 15%, while Wales and Northern Ireland account for 10% each, reflecting steady growth in housing projects, hospitality, and selective commercial developments across the UK.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Press molding quartz dominated the UK market in 2024 with a share exceeding 60%. Its dominance is driven by superior durability, consistent texture, and cost efficiency compared to casting quartz. Manufacturers increasingly adopt press molding for large-scale production, ensuring uniform slabs for residential and commercial projects. Casting quartz holds a smaller share but attracts demand in customized and decorative designs due to flexibility in shaping. The preference for press molding quartz is also reinforced by its lower maintenance requirements and growing use in standardized product lines across construction and renovation projects.

- For instance, LX Hausys, the rebranded successor to LG Hausys as of 2021, manufactures and supplies materials such as HIMACS solid surfaces for bespoke interior projects in the UK.

By Application

Countertops emerged as the leading application in 2024, capturing more than 55% share of the UK market. Strong growth stems from rising demand in kitchens and bathrooms, where aesthetics, stain resistance, and durability are critical. The trend of premium home renovation, coupled with the commercial preference for long-lasting surfaces in hotels and restaurants, sustains dominance. Flooring and walls follow, supported by the material’s resilience in high-traffic spaces. Door jambs and other applications remain niche segments but expand slowly due to adoption in luxury architectural features and bespoke interior solutions.

- For instance, Cosentino’s Silestone Jumbo slabs measure 327 × 159 cm and come in 2 cm and 3 cm thicknesses, enabling large, seam-reduced countertops.

By End User

The residential sector accounted for nearly 65% share in 2024, making it the dominant end-user segment. Rising urban housing demand, coupled with consumer inclination toward modern kitchen and bathroom aesthetics, drives widespread adoption. Homeowners increasingly prefer quartz surfaces for easy maintenance and wide color options, boosting installations in both new builds and renovations. The commercial segment, while smaller, shows steady growth fueled by hospitality, office, and retail projects seeking durable, attractive, and hygienic surfaces. Expanding investments in high-end property development further support opportunities across both residential and commercial sectors.

Key Growth Drivers

Rising Residential Renovation and Remodeling Activities

The UK’s solid color engineered quartz market is strongly driven by the surge in residential renovation and remodeling activities. Homeowners increasingly prioritize modern kitchen and bathroom designs where quartz countertops are widely preferred for their durability, low maintenance, and aesthetic appeal. According to national housing improvement statistics, kitchen upgrades account for over 30% of UK home renovation projects, fueling quartz adoption. The preference for seamless, stain-resistant, and color-consistent surfaces makes quartz a practical alternative to natural stone. The growing do-it-yourself (DIY) culture, coupled with online retail expansion, has also boosted consumer access to quartz products. Furthermore, rising disposable incomes and the willingness to invest in premium home interiors continue to drive market growth.

- For instance, Caesarstone produces quartz slabs in standard dimensions of 3050 × 1440 mm and jumbo slabs of 3240 × 1640 mm, giving homeowners flexibility for seamless countertop installations.

Expansion of the Commercial Real Estate Sector

Commercial real estate development plays a vital role in expanding demand for solid color engineered quartz in the UK. Hotels, offices, and retail outlets increasingly install quartz surfaces in lobbies, restrooms, and hospitality areas for their elegant appearance and long lifecycle. The UK’s pipeline of office refurbishments and hotel expansions, particularly in London and other metropolitan cities, strengthens this demand. Quartz’s resistance to wear and staining makes it ideal for high-traffic commercial environments compared to traditional marble or granite. Additionally, architectural firms specify quartz in commercial projects for design uniformity and sustainability compliance. With developers emphasizing durable and hygienic surfaces, quartz continues to gain preference in projects aligned with modern interior trends. This expansion of the commercial property market creates consistent growth momentum for quartz suppliers and manufacturers.

- For instance, Cambria’s commercial super-jumbo slabs measure 136″ × 80″ (approx. 345 × 203 cm), covering about 76 ft² per slab, allowing single-piece lobby counters in office and hotel projects.

Technological Advancements in Quartz Manufacturing

Technological innovations in manufacturing processes act as a key growth driver for the UK solid color engineered quartz market. Modern production techniques such as vibro-compression and advanced resin systems enhance material performance, enabling higher strength, improved consistency, and a broader range of colors. Automated production lines also improve efficiency and scalability, reducing costs for manufacturers while maintaining quality. The integration of sustainable binders and recycled raw materials aligns with the UK’s growing environmental regulations, further driving acceptance. These advancements support the production of quartz surfaces that mimic natural stone while offering superior functionality. Manufacturers also leverage digital technologies for design customization, enabling consumers to select specific finishes and textures tailored to their projects. Such continuous improvements position engineered quartz as a versatile, high-performance material across residential and commercial applications.

Key Trends & Opportunities

Sustainability and Eco-Friendly Materials

The rising emphasis on sustainable construction materials presents significant opportunities for engineered quartz in the UK market. Consumers and builders increasingly prefer surfaces manufactured with recycled materials and low-VOC resins to align with green building certifications such as BREEAM and LEED. Several leading manufacturers now promote eco-friendly quartz collections containing up to 40% recycled content. The demand is particularly strong among commercial projects seeking sustainability credits, which boost property valuation and tenant attraction. This eco-friendly positioning allows quartz producers to cater to environmentally conscious buyers while differentiating themselves from traditional stone and laminate alternatives. The integration of renewable energy in production processes further reinforces the sustainability trend, creating long-term opportunities for market players.

- For instance, Caesarstone, which produces its Solaris collection using special resins for outdoor UV resistance, has other product lines that feature significant recycled content. For example, the company has stated that as of its 2023 ESG report, 31% of its entire portfolio contained at least 40% recycled materials.

Growing Premiumization in Interior Design

Premiumization trends in the UK’s interior design sector drive fresh opportunities for solid color engineered quartz. Consumers, especially in urban areas, are willing to invest in high-end, aesthetically appealing finishes for kitchens, bathrooms, and living spaces. Solid color quartz, with its sleek uniformity, fits the demand for modern, minimalistic, and luxury interiors. Developers of high-end apartments, boutique hotels, and retail outlets specify quartz for its elegant look and long-term performance. Digital visualization tools that allow clients to preview design outcomes also increase adoption. As luxury real estate expands and lifestyle-driven home upgrades gain momentum, premium quartz surfaces are set to capture more demand. This shift positions quartz as not just a functional material but also a lifestyle-oriented design choice.

Key Challenges

Competition from Alternative Surface Materials

The UK engineered quartz market faces intense competition from alternative surface materials such as granite, marble, laminates, and emerging sintered stone. Granite and marble retain strong popularity among traditional buyers due to their natural appeal, while laminates offer cost-effective solutions for budget-conscious consumers. Recently, sintered stone has gained attention as an innovative substitute with high durability and design flexibility, intensifying competition. This wide material availability challenges quartz suppliers to differentiate through design, quality, and sustainability. Market players must emphasize quartz’s low maintenance, durability, and aesthetic consistency to maintain share in a competitive landscape. Without effective positioning strategies, alternative materials may slow quartz adoption in certain consumer segments.

Volatility in Raw Material and Energy Costs

Fluctuations in raw material prices and energy costs present a significant challenge for engineered quartz manufacturers in the UK. Quartz production relies heavily on resins, pigments, and silica, all subject to international supply chain disruptions. Rising energy costs, particularly in Europe, directly affect production expenses, squeezing profit margins for manufacturers. Import dependencies on specific raw materials further heighten exposure to price volatility. These cost pressures may force producers to pass increases onto customers, reducing competitiveness against cheaper alternatives. Addressing this challenge requires supply chain diversification, energy efficiency upgrades, and sustainable sourcing initiatives. Managing these fluctuations effectively will be critical for maintaining profitability and stability in the UK market.

Regional Analysis

England

England dominated the UK solid color engineered quartz market in 2024, accounting for nearly 65% share. The strong presence of residential and commercial construction projects, especially in London and other metropolitan areas, drives demand for quartz surfaces in kitchens, bathrooms, and office spaces. High disposable incomes and the trend of luxury home renovation further support adoption. Large-scale commercial real estate developments, including hotels and retail complexes, strengthen market growth. Manufacturers also benefit from strong distribution networks and established design firms in England, making it the central hub for quartz consumption across the UK.

Scotland

Scotland held around 15% share of the UK market in 2024, driven by rising demand in both residential housing upgrades and hospitality projects. Cities such as Edinburgh and Glasgow lead adoption due to expanding high-end apartments, boutique hotels, and commercial refurbishments. The popularity of durable and low-maintenance surfaces aligns with Scotland’s growing preference for modern interiors. Additionally, government-led housing initiatives and urban development programs provide opportunities for quartz suppliers. While smaller in size compared to England, Scotland’s emphasis on premium design and sustainable building practices continues to boost the adoption of engineered quartz surfaces.

Wales

Wales represented close to 10% share of the UK solid color engineered quartz market in 2024. Demand is supported by ongoing residential construction, especially new housing projects and kitchen renovations in urban centers such as Cardiff and Swansea. Rising interest in energy-efficient and eco-friendly homes further stimulates adoption of quartz surfaces that complement sustainable building practices. The hospitality industry, particularly small hotels and restaurants, also contributes to market growth. Though relatively smaller in volume, Wales demonstrates steady expansion driven by government-backed housing programs and the shift toward durable, modern materials in residential interiors.

Northern Ireland

Northern Ireland accounted for nearly 10% share of the UK solid color engineered quartz market in 2024. Growth is supported by urban redevelopment projects in Belfast and surrounding regions, where commercial and residential construction has increased. Quartz surfaces are favored for their durability and modern aesthetic, making them popular in new housing developments and retail projects. The rising adoption of premium home interiors, coupled with a gradual increase in hospitality investments, supports steady growth. Despite being the smallest regional market, Northern Ireland presents niche opportunities for suppliers targeting residential upgrades and specialized commercial projects.

Market Segmentations:

By Product Type

- Press Molding Quartz

- Casting Quartz

By Application

- Flooring

- Walls

- Countertops

- Door Jambs

- Others

By End User

By Geography

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK solid color engineered quartz market is highly competitive, with both global leaders and regional suppliers driving innovation and market penetration. Prominent players include Caesarstone, Silestone, Compac, Unistone, Dekton, Stone Italiana, Cambria, Wilsonart, Cimstone, and Quartzforms, each competing through differentiated product portfolios, design versatility, and distribution strength. Caesarstone and Silestone maintain strong brand presence through extensive color ranges and advanced surface technologies. Cambria and Wilsonart focus on premium collections tailored to luxury residential and commercial applications, while Compac and Quartzforms emphasize sustainability by integrating recycled materials into production. Dekton and Stone Italiana gain attention with cutting-edge designs suitable for high-performance applications, including hospitality and retail spaces. Local distributors and importers further intensify competition by offering cost-effective alternatives to international brands. Continuous product innovation, eco-friendly manufacturing, and expanding retail networks remain central strategies as players seek to strengthen positioning in a market increasingly shaped by design trends and sustainability demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Caesarstone launched ICON™, a revolutionary crystalline silica-free solid surface (less than 1% silica) with approximately 80% recycled content, prioritizing both safety for fabricators and sustainability for consumers.

- In July 2025, Vicostone launched 10 new quartz colors for the fall season, focusing on inspirations from natural elements and aesthetics.

- In May 2025, RAK Ceramics commissioned its new next-generation slab production facility using Continua+ PCR 2180 technology, marking a significant technological leap in large-format engineered quartz and ceramic surfaces.

- In May 2024, WK Stone partnered with Eight Homes to offer Quantum Zero, a recycled surface as a safe alternative to high-silica engineered stone.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, supported by rising demand in residential renovations.

- Countertops will remain the leading application segment due to durability and design appeal.

- Flooring and wall applications will expand with the popularity of modern interiors.

- England will continue to dominate regional demand with more than half of the market share.

- Scotland, Wales, and Northern Ireland will grow steadily through hospitality and housing projects.

- Manufacturers will focus on eco-friendly production and recycled material integration.

- Premiumization will drive greater adoption in luxury residential and commercial developments.

- Competition will intensify as global brands expand retail and distribution networks.

- Technological advances will improve product durability, color consistency, and design flexibility.

- Long-term opportunities will come from sustainability-focused building regulations and consumer preferences.