Market Overview

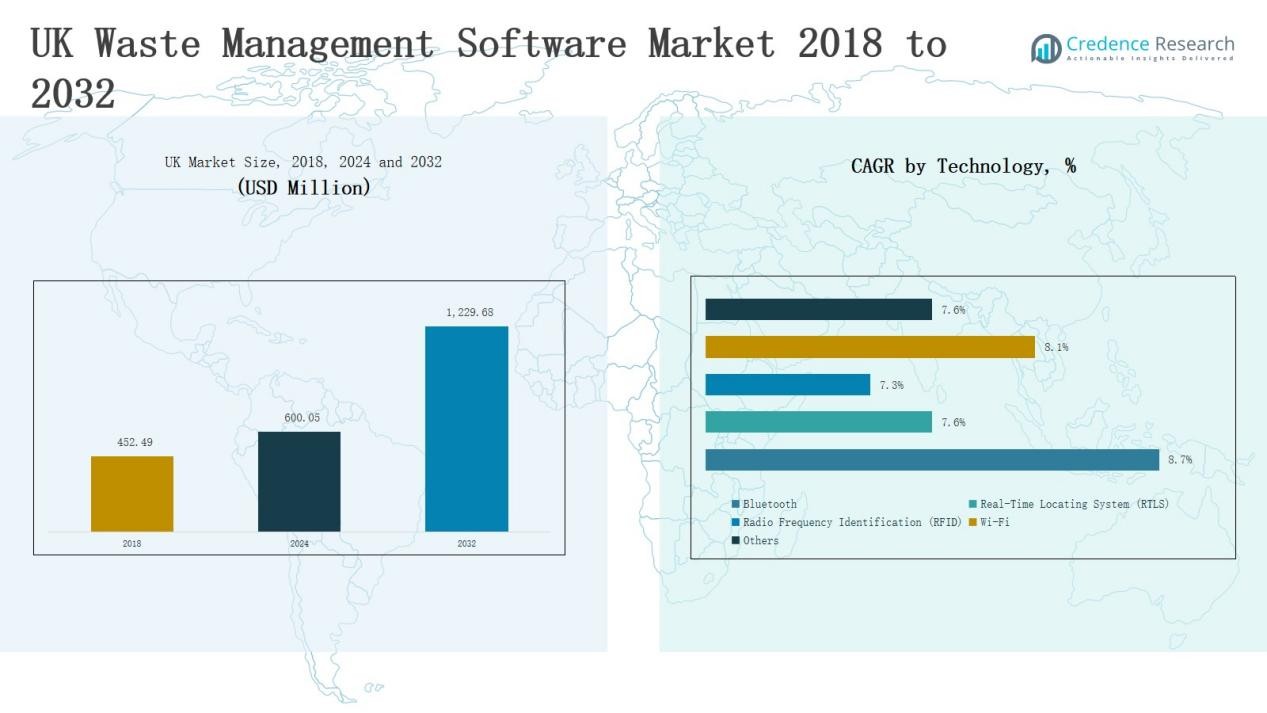

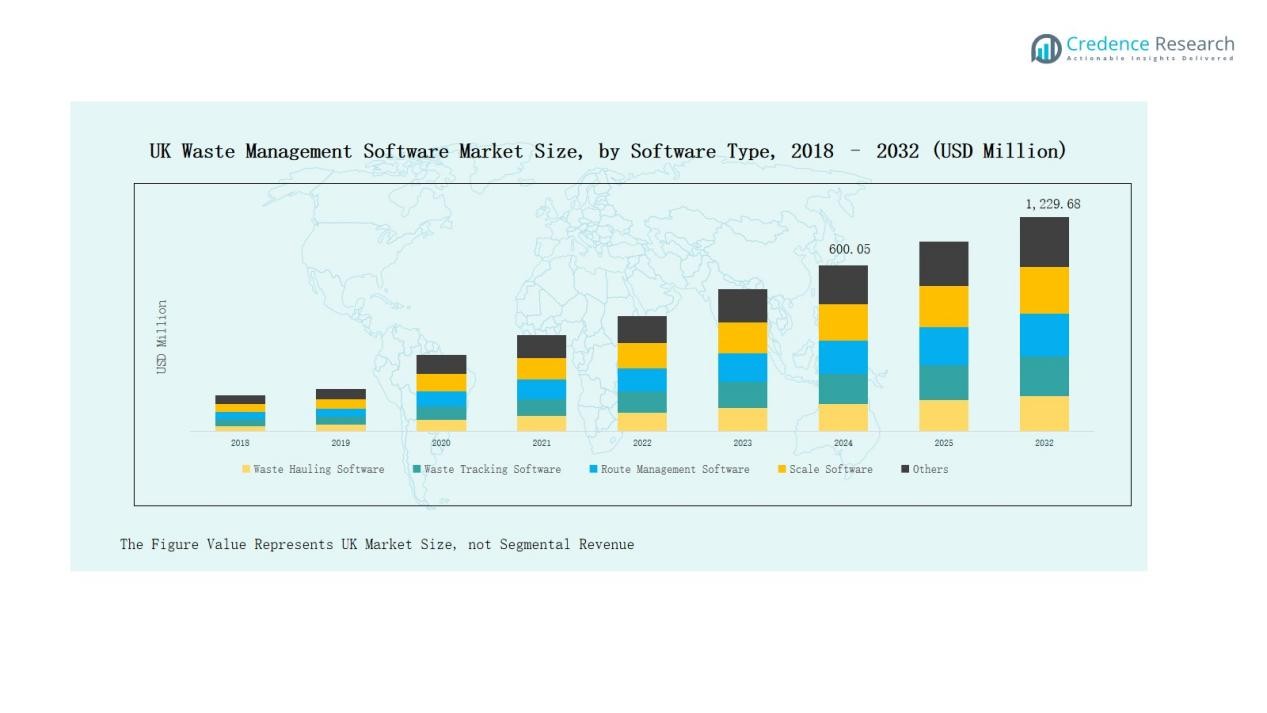

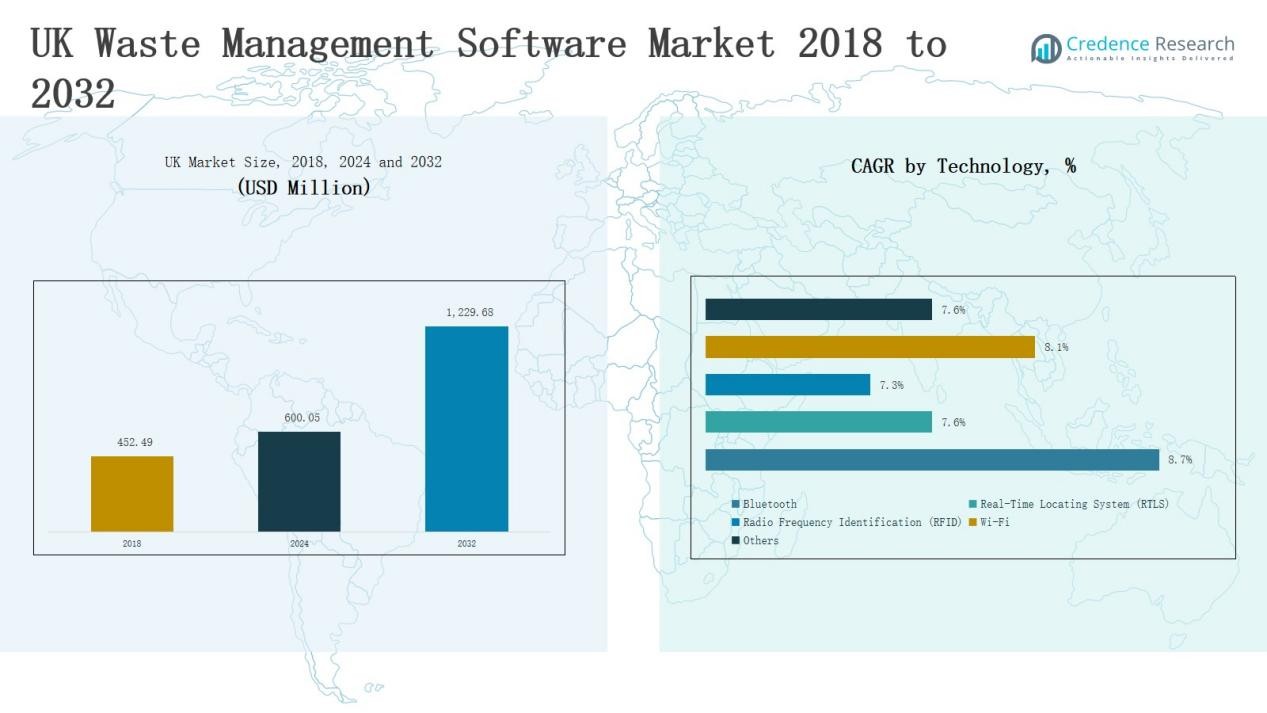

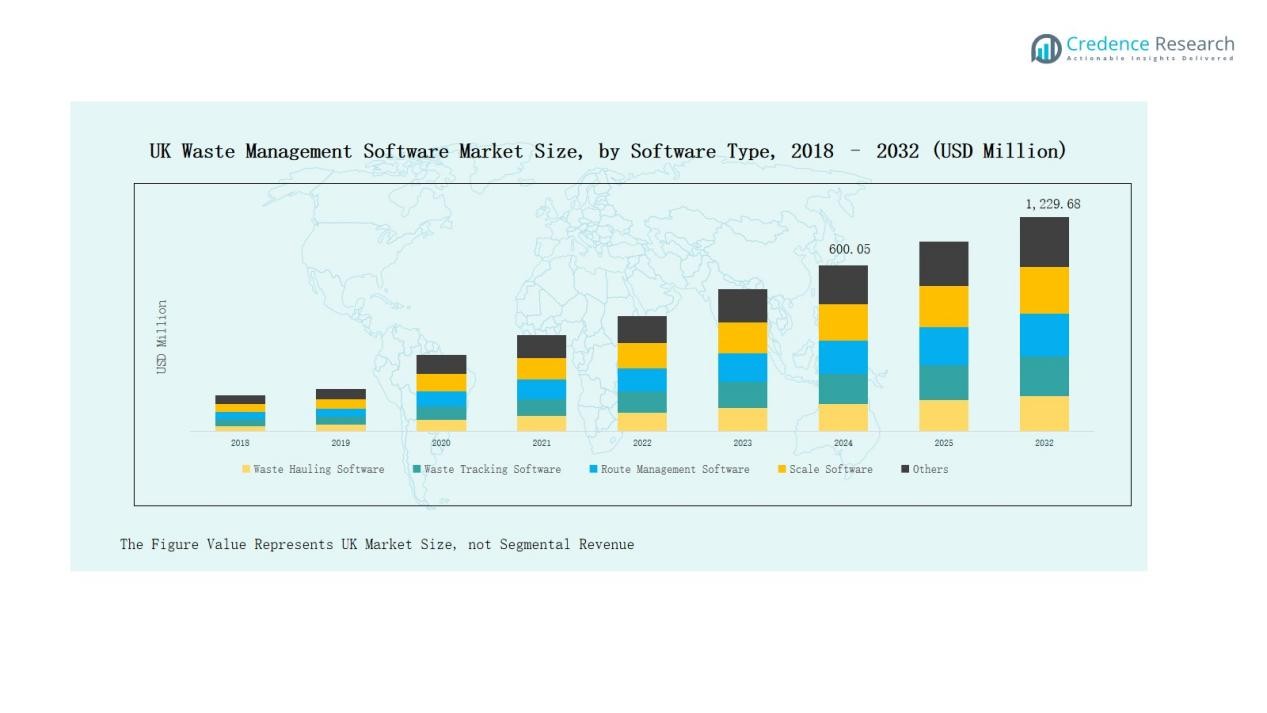

UK Waste Management Software Market size was valued at USD 452.49 million in 2018 to USD 600.05 million in 2024 and is anticipated to reach USD 1,229.68 million by 2032, at a CAGR of 9.38 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Waste Management Software Market Size 2024 |

USD 600.05 Million |

| UK Waste Management Software Market, CAGR |

9.38 % |

| UK Waste Management Software Market Size 2032 |

USD 1,229.68 Million |

The UK Waste Management Software Market is shaped by a strong mix of domestic and specialized providers delivering tailored digital solutions for municipalities and enterprises. Key players include Wastebits, Whitespace Work Software, Waste Logics Software Limited, ISB Global, Midsoft (SkipTrak, RoadTrak, BinRound), Terinea (WasteMetrix), Bartec Municipal Technologies, Quick Consign, and fissara, each focusing on waste hauling, route optimization, recycling, compliance, and mobile-first deployment models. These companies drive adoption through cloud-based integration, IoT connectivity, and sustainability reporting features that align with regulatory mandates. Regionally, England led the market with a 58% share in 2024, supported by its advanced municipal infrastructure, smart city projects, and strong government investments in digital waste management systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Waste Management Software Market grew from USD 452.49 million in 2018 to USD 600.05 million in 2024 and is projected to reach USD 1,229.68 million by 2032.

- Waste Hauling Software led with 27% share in 2024, driven by strong municipal and private adoption, while Recycling Software and Route Management Software gained momentum through circular economy and smart city initiatives.

- The Municipal application segment held 44% share in 2024, supported by government-backed digital transformation and landfill reduction goals, while retail, manufacturing, and healthcare adoption steadily increased.

- Cloud-Based Software dominated with 61% share in 2024, fueled by IoT integration, mobile accessibility, and GDPR compliance, while On-Premise Software remained relevant for enterprises needing in-house control.

- England led with 58% share in 2024, followed by Scotland at 17%, Wales at 14%, and Northern Ireland at 11%, reflecting strong regional adoption patterns.

Market Segment Insights

By Software Type

Waste Hauling Software held the dominant share of 27% in 2024, supported by high adoption among municipal and private waste collection operators. The segment benefits from its ability to optimize collection schedules, reduce fuel costs, and improve operational efficiency. Recycling Software followed closely, driven by the UK’s strong focus on circular economy practices and compliance with EU recycling mandates. Demand for Route Management Software is also expanding as smart city projects encourage digital tracking and route optimization.

- For instance, in April 2024, AMCS Group enhanced its enterprise waste software suite with advanced automation and IoT features, enabling clients to cut fuel consumption by up to 15% while improving scheduling efficiency.

By Application

The Municipal segment led the market with a 44% share in 2024, driven by government investments in digital transformation of waste services. Local authorities rely on software to track compliance, improve reporting accuracy, and support landfill reduction goals. Retail and Manufacturing segments are emerging contributors, supported by the need for transparent waste auditing and sustainable packaging compliance. Healthcare adoption is growing due to stricter regulations on medical waste handling and safety.

- For instance, in March 2023, Veolia launched its “GreenPath Zero Carbon” offer, which includes the GreenPath Digital Platform, to help industrial, municipal, and commercial clients worldwide measure their overall environmental performance and design decarbonization roadmaps.

By Component

Cloud-Based Software dominated with a 61% share in 2024, reflecting the UK’s accelerated shift toward digital and scalable platforms. Cloud deployment supports real-time tracking, mobile accessibility, and easy integration with IoT devices used in waste management. This segment also benefits from lower upfront costs and stronger data security frameworks aligned with GDPR compliance. On-Premise Software remains relevant for large enterprises and municipalities requiring tighter control over in-house systems and sensitive operational data.

Key Growth Drivers

Rising Government Regulations and Compliance Needs

The UK Waste Management Software Market is propelled by strict government regulations around recycling, emissions, and landfill reduction. Compliance with the EU Waste Framework Directive and national sustainability targets pushes municipalities and enterprises to adopt digital platforms for accurate reporting and tracking. Software solutions help automate documentation, minimize compliance risks, and meet evolving environmental standards. This regulatory pressure creates a steady demand for advanced waste management systems, especially those equipped with real-time monitoring and reporting features.

- For instance, Enevo UK has partnered with local councils to deploy its sensor-based waste management software, which helps optimize collection efficiency and can provide actionable insights for improving overall waste operations.

Increasing Adoption of Cloud-Based Platforms

Cloud-based waste management solutions dominate the market due to their scalability, cost-effectiveness, and ease of integration. In the UK, organizations are prioritizing cloud deployment to enable mobile access, real-time updates, and IoT connectivity. Vendors leverage this demand by offering subscription-based models that reduce upfront costs for municipalities and enterprises. With the rise of smart city projects and digital transformation initiatives, cloud-based platforms are becoming the preferred choice, boosting adoption rates and driving long-term growth across industries.

- For instance, Evreka launched its cloud-based Smart Waste Management Platform in the UK, enabling real-time monitoring and route optimization through IoT sensor integration.

Expansion of Circular Economy Practices

The UK government’s push for circular economy practices fuels demand for software that supports recycling, reuse, and resource optimization. Enterprises and municipalities use digital platforms to track recyclable materials, optimize collection routes, and measure sustainability metrics. Rising consumer awareness of environmental impact further motivates businesses to invest in recycling software modules. This shift enhances operational efficiency while strengthening corporate social responsibility. The focus on circularity creates a growth pathway for software providers specializing in recycling and compliance-driven modules.

Key Trends & Opportunities

Integration of IoT and Smart Technologies

A major trend shaping the UK Waste Management Software Market is the integration of IoT devices and smart sensors. These technologies enable real-time waste tracking, automated route optimization, and predictive maintenance of collection vehicles. Vendors are developing solutions that connect with RFID and GPS-enabled systems, providing end-to-end visibility. This trend offers opportunities for providers to differentiate through data analytics and smart-city aligned solutions, appealing to both municipalities and large enterprises seeking sustainable waste handling methods.

- For instance, Tata Consultancy Services used IoT-driven solutions for PostNord to enhance sorter capacity, streamline collection, and improve distribution plans, demonstrating optimized waste flow in Europe.

Growing Focus on Data-Driven Sustainability Reporting

Companies in the UK are increasingly using waste management software to generate sustainability and ESG reports. The demand arises from investors, regulators, and consumers requiring transparent data on waste handling and carbon impact. Software providers offering advanced analytics and customizable reporting tools are gaining traction. This trend provides opportunities for vendors to design compliance-ready solutions tailored to industry-specific requirements, especially in retail, healthcare, and manufacturing sectors. It strengthens the role of waste management systems as critical tools for sustainability governance.

- For instance, KEY ESG software helps NHS providers manage clinical waste more effectively, centralizing ESG data while ensuring legal compliance with hazardous waste regulations, improving transparency and operational efficiency.

Key Challenges

High Implementation and Transition Costs

Adoption of waste management software faces resistance due to high initial implementation costs and system migration challenges. Smaller enterprises and local councils often lack budgets for sophisticated platforms. Integration with legacy systems, staff training, and customization add to expenses, slowing widespread adoption. Despite long-term savings, upfront financial barriers remain a significant challenge for vendors to overcome.

Data Security and Privacy Concerns

Cloud-based deployment, while dominant, raises concerns about data security and compliance with GDPR standards in the UK. Municipalities and enterprises handling sensitive operational data worry about breaches and unauthorized access. Vendors must invest in robust cybersecurity measures to build trust among clients. Ensuring reliable encryption and compliance frameworks remains an ongoing challenge that influences procurement decisions across both public and private sectors.

Limited Awareness in Small and Medium Enterprises

Many small and medium enterprises (SMEs) in the UK remain unaware of the benefits of waste management software. Traditional manual tracking methods are still prevalent, limiting the market’s expansion beyond large municipalities and corporations. Vendors face the challenge of educating smaller organizations about cost savings, compliance advantages, and sustainability improvements enabled by digital platforms. Bridging this awareness gap is crucial to unlocking the full growth potential of the market.

Regional Analysis

England

England held the largest share of 58% in 2024, supported by its strong municipal infrastructure and early adoption of digital platforms. The region benefits from smart city projects in London, Birmingham, and Manchester, which encourage IoT-enabled waste tracking and recycling initiatives. Municipal authorities lead investments in compliance-driven solutions to meet landfill reduction targets. Enterprises in retail and healthcare also rely on cloud-based modules for efficient reporting. The UK Waste Management Software Market in England continues to expand, supported by sustainability commitments and government-backed circular economy policies.

Scotland

Scotland accounted for 17% of the market share in 2024, with demand driven by national sustainability goals and strict recycling mandates. Local councils increasingly adopt software for waste hauling and tracking to meet zero-waste targets. The region invests in cloud-based systems to enhance service delivery across urban and rural areas. Enterprises in the manufacturing sector also deploy software for compliance and resource efficiency. It shows steady growth as smart technology adoption aligns with Scotland’s environmental strategies and green initiatives.

Wales

Wales captured 14% of the market in 2024, reflecting its proactive stance on recycling and municipal digitalization. Local authorities prioritize waste tracking and route management platforms to improve efficiency. The healthcare sector drives further adoption with stricter biomedical waste regulations. Vendors are forming partnerships with councils to expand system coverage across urban and semi-urban regions. The UK Waste Management Software Market in Wales benefits from policy-driven adoption and increasing awareness of sustainability reporting.

Northern Ireland

Northern Ireland held 11% of the market share in 2024, supported by gradual adoption of cloud-based and on-premise solutions. Municipal organizations rely on software for compliance and operational reporting. Growth is also fueled by rising industrial and retail sector demand for transparent waste auditing. Route management and recycling modules gain popularity in urban centers, while smaller councils adopt scaled solutions. It continues to present opportunities for vendors focusing on cost-effective, compliance-ready systems tailored to smaller markets.

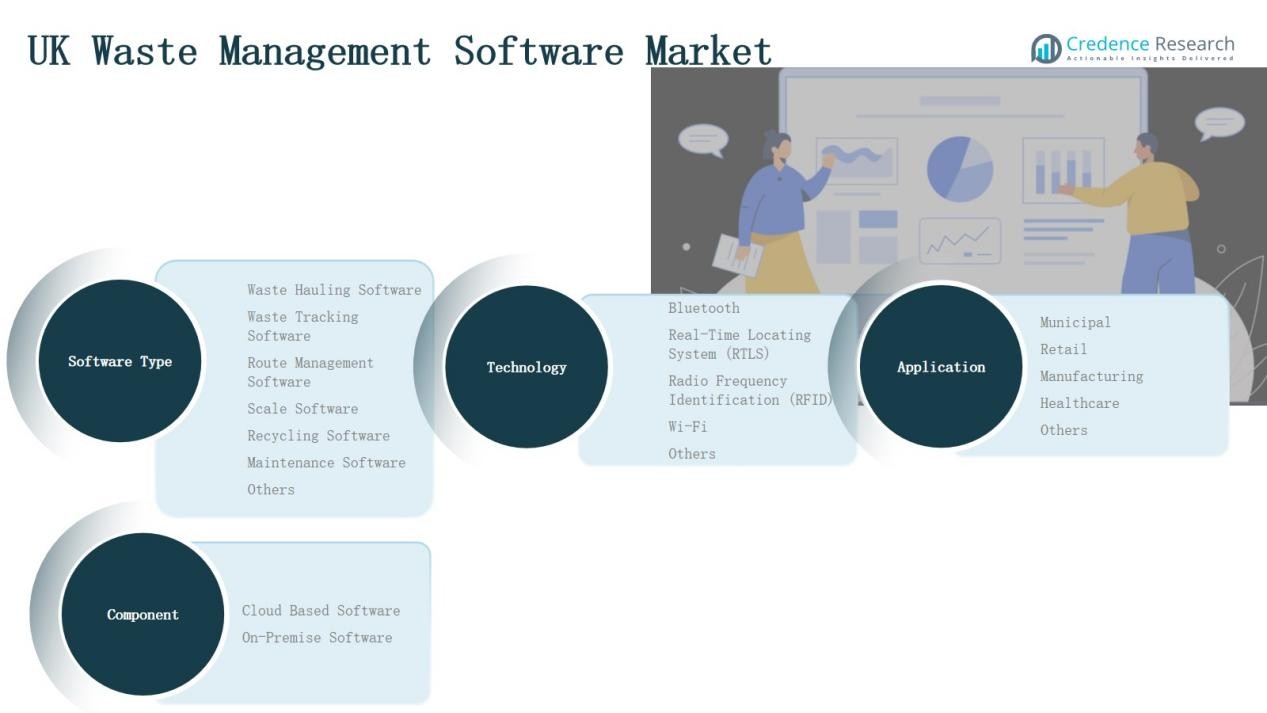

Market Segmentations:

By Software Type

- Waste Hauling Software

- Waste Tracking Software

- Route Management Software

- Scale Software

- Recycling Software

- Maintenance Software

- Others

By Application

- Municipal

- Retail

- Manufacturing

- Healthcare

- Others

By Component

- Cloud-Based Software

- On-Premise Software

By Technology

- Bluetooth

- Real-Time Locating System (RTLS)

- Radio Frequency Identification (RFID)

- Wi-Fi

- Others

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The UK Waste Management Software Market is highly competitive, with a mix of domestic providers and international vendors offering tailored solutions for municipalities and enterprises. Key players such as Wastebits, Whitespace Work Software, Waste Logics Software Limited, and ISB Global emphasize product diversification with modules for waste hauling, tracking, recycling, and compliance management. Companies like Midsoft and Terinea strengthen their presence with specialized offerings such as route optimization and reporting platforms, while Bartec Municipal Technologies focuses on large-scale municipal systems. Fissara and Quick Consign target flexible deployment models, enabling cloud-based and mobile-first adoption. Competition is shaped by advancements in IoT, RFID, and data analytics, which enhance efficiency and regulatory compliance. Vendors pursue strategic partnerships with local councils and private enterprises to expand adoption. The market demonstrates moderate concentration, with leading firms leveraging technology integration and service scalability to maintain competitive advantage and address rising sustainability demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Wastebits

- Whitespace Work Software

- Waste Logics Software Limited

- Midsoft (SkipTrak, RoadTrak, BinRound)

- ISB Global (Waste & Recycling One)

- Terinea (WasteMetrix)

- Bartec Municipal Technologies (Collective / FleetRoute)

- Quick Consign

- fissara

Recent Developments

- In May 2025, AMCS announced the acquisition of Selected Interventions, a London-based provider of municipal resource management software.

- In March 2025, CIRQLR completed the acquisition of Chambers Waste Management, later announcing the deal in August 2025 to expand its UK recycling operations.

- In May 2024, Reconomy acquired Circle Waste, a digital-first outsourced waste management platform in the UK, strengthening its circular economy service portfolio.

- In February 2025, BRE launched an AI-powered upgrade to its SmartWaste platform. This tool helps the construction industry monitor and reduce environmental impacts like carbon emissions, material use, and energy consumption.

Report Coverage

The research report offers an in-depth analysis based on Software Type, Application, Component, Technology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Municipalities will increase adoption of cloud-based platforms to support digital waste management.

- Recycling software demand will rise as circular economy practices gain stronger policy backing.

- IoT-enabled systems will expand, enhancing route optimization and real-time waste tracking.

- Data analytics will become essential for sustainability and ESG reporting across industries.

- Healthcare facilities will invest more in compliance-focused platforms for biomedical waste.

- Retail and manufacturing sectors will adopt software to improve resource efficiency and reporting.

- Cybersecurity features will grow in importance with higher cloud-based software penetration.

- Public-private partnerships will strengthen digital transformation in local councils.

- Mobile-first solutions will see wider use among field operators and service providers.

- Vendors will focus on cost-effective solutions to increase adoption among small enterprises.