Market Overview:

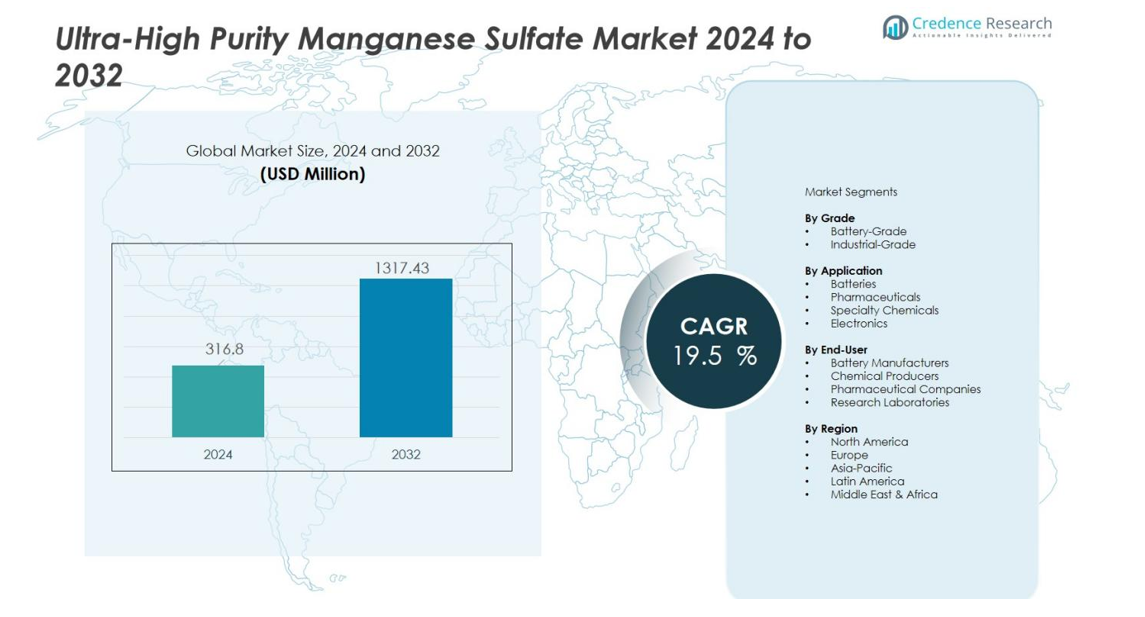

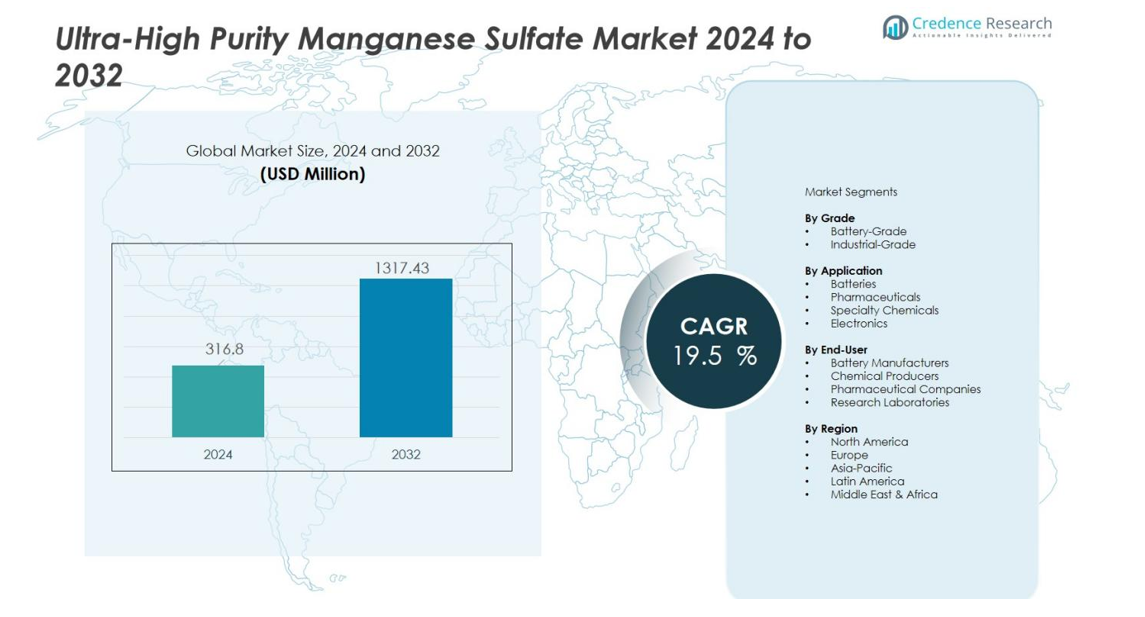

The Ultra-High Purity Manganese Sulfate Market size was valued at USD 316.8 million in 2024 and is anticipated to reach USD 1317.43 million by 2032, at a CAGR of 19.5% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ultra-High Purity Manganese Sulfate Market Size 2024 |

USD 316.8 million |

| Ultra-High Purity Manganese Sulfate Market, CAGR |

19.5% |

| Ultra-High Purity Manganese Sulfate Market Size 2032 |

USD 1317.43 million |

The principal driver of this growth is accelerating demand from the lithium‑ion battery segment — in particular for batteries used in electric vehicles (EVs) and energy‑storage systems. UHP MnSO₄ is a critical precursor for high‑performance nickel‑manganese‑cobalt (NMC) cathodes, offering superior energy density, reliability, and cost‑efficiency compared to less pure alternatives. This shift toward high‑nickel and manganese‑rich cathode chemistries, combined with global electrification and renewable‑energy storage growth, is significantly increasing consumption of battery‑grade manganese sulfate.

Regionally, the market is dominated by the Asia‑Pacific region, driven largely by the extensive battery manufacturing ecosystem and integrated supply chains of countries in East Asia. Asia‑Pacific maintains the largest share of both production and consumption globally, supported by strong industrial infrastructure, mining resources, and demand for EVs and storage systems. Meanwhile, North America and Europe are emerging as important growth regions, spurred by policy support for local battery‑material sourcing, increasing domestic battery production capacity, and growing interest in supply‑chain diversification away from traditional sources.

Market Insights:

- The market was valued at USD 316.8 million in 2024 and is projected to reach USD 1,317.43 million by 2032, growing at a CAGR of 19.5%.

- Rising adoption of electric vehicles and large-scale energy storage drives strong demand for ultra-high purity manganese sulfate.

- Battery-grade manganese sulfate is a critical precursor for NMC, LMFP, and other manganese-rich cathode chemistries, supporting energy density and reliability.

- Asia-Pacific dominates consumption, led by China, Japan, South Korea, India, and Southeast Asia, due to integrated supply chains and battery manufacturing capacity.

- North America and Europe show emerging growth, fueled by domestic battery production, policy support, and expansion of renewable energy storage projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Electric Vehicles and Energy Storage

The expanding adoption of lithium‑ion batteries, especially for electric vehicles (EVs) and large‑scale energy storage systems, drives growth in demand for ultra‑high purity manganese sulfate. High‑purity manganese sulfate serves as a critical precursor for cathode materials in NMC, LMFP, and other manganese‑rich battery chemistries. It underpins performance, energy density, and safety in batteries. As EV production accelerates and renewable‑energy storage capacities increase, usage of ultra‑high purity manganese sulfate rises steadily.

- For Instance, Mayo Clinic is strategically transitioning its extensive healthcare IT infrastructure to a hybrid cloud environment through a 10-year partnership with Google Cloud. This shift is designed to manage a massive volume of data, including over 6 billion medical images and 26 petabytes of clinical information in its data network, to enable advanced data analytics and the development of AI tools for patient care and research.

Preference for Manganese‑Rich Cathodes Over Cobalt or Nickel‑Heavy Alternatives

Cost pressures and ethical concerns over cobalt supply encourage battery manufacturers to shift toward manganese‑rich cathode formulas. Manganese offers a more affordable, abundant, and stable alternative, while maintaining acceptable performance and thermal safety. This trend further boosts consumption of ultra‑high purity manganese sulfate over more expensive or constrained metals.

- For instance, Shanshan Tech reported enhanced cycle life with manganese-rich cathodes capable of maintaining over 80% capacity after 500 charge cycles.

Requirement for High Purity and Quality Assurance in Battery Applications

Battery-grade manganese sulfate must meet stringent purity thresholds—often exceeding 99.9% with minimal impurity levels—to ensure consistent electrochemical behavior and long-term reliability. Producers increasingly focus on refining processes to deliver such high-purity grades. This quality requirement creates a barrier to substitutes and elevates demand for truly high-purity manganese sulfate.

Supply Chain Security and Growing Global Supply Constraints

Though manganese ore remains abundant, conversion into battery‑grade ultra‑high purity manganese sulfate requires advanced refining infrastructure. Analysts warn that supply may not keep pace with accelerating demand beyond 2027, especially as EV adoption grows. This potential supply tightness motivates investments into new refining capacities and sourcing diversification, supporting demand for high‑purity manganese sulfate globally.

Market Trends:

Surging Demand from Battery and Electronics Industries Driving Market Expansion

The Ultra-High Purity Manganese Sulfate Market is witnessing significant growth due to its critical role in lithium-ion battery production and advanced electronics applications. Rapid adoption of electric vehicles and renewable energy storage systems fuels the need for high-purity manganese compounds. Manufacturers are increasingly focusing on producing manganese sulfate with ultra-high purity to meet stringent quality standards required by battery cathodes and specialty chemical applications. It also finds extensive use in semiconductor and pharmaceutical industries, where contamination control is crucial. Rising investments in energy storage infrastructure across Asia-Pacific, Europe, and North America strengthen market demand. Producers are expanding production capacities and optimizing supply chains to ensure consistent quality and timely delivery. This trend supports sustained market growth over the forecast period.

- For Instance, Manufacturers are continuously expanding capacity to meet the surging demand for EV battery materials and are focused on achieving increasingly stringent purity standards in the parts-per-billion (ppb) range for individual heavy metals to ensure optimal battery performance and longevity.

Technological Advancements and Strategic Collaborations Enhancing Market Competitiveness

Technological innovation remains a key trend in the Ultra-High Purity Manganese Sulfate Market, with companies adopting advanced purification and crystallization techniques to improve product consistency. Strategic collaborations and joint ventures between chemical manufacturers and battery producers facilitate better integration into high-demand supply chains. It also benefits from stringent environmental regulations, encouraging the adoption of cleaner production processes. Research and development efforts focus on enhancing yield, reducing impurities, and lowering production costs. Emerging markets in Asia-Pacific provide opportunities for regional expansion due to growing industrialization and renewable energy initiatives. Competitive dynamics revolve around quality differentiation, with companies leveraging certifications and high-performance standards to secure contracts in high-value applications.

- For Instance, Leading chemical producers, such as BASF, utilize advanced purification technologies to produce high-purity manganese sulfate (HPMSM) for lithium-ion battery manufacturing applications.

Market Challenges Analysis:

Constraints in Raw‑Material Supply and Price Volatility Challenge Stability

The Ultra-High Purity Manganese Sulfate Market faces supply constraints due to limited availability of high‑grade manganese ore and heavy reliance on a few mining regions. Volatility in ore price drives unpredictable raw material costs and hinders long-term procurement planning. Variations in ore quality force producers to conduct extensive quality checks before processing. These checks raise operational costs and delay production schedules. Companies must secure dependable feedstock sources and maintain strict inventory buffers to avoid shortages. Such measures increase carry costs and reduce overall profit margins.

High Production Costs and Regulatory Burden Impede Market Penetration

High purification standards demand advanced equipment and strict purification protocols, which increase capital expenditure and energy use. Regulatory and environmental requirements on waste disposal and emissions raise compliance costs and add operational burden for producers. Small manufacturers struggle to meet these standards and often leave the market, reducing supply flexibility. Growth of substitute materials and alternative battery chemistries competes with demand for ultra‑pure manganese sulfate. Strict quality control in battery and pharmaceutical applications forces producers to reject even slightly impure batches. Such rejection increases cost per unit and discourages new entrants.

Market Opportunities:

Rapid Electrification and Energy Storage Expansion Offer Significant Demand

The Ultra‑High Purity Manganese Sulfate Market stands to gain strong momentum from the ongoing shift toward electric vehicles and grid‑scale energy storage projects. Rising lithium‑ion battery production drives demand for ultra‑pure manganese sulfate for cathode materials. It supports stable battery performance and complies with stringent impurity thresholds. Growth of renewable energy infrastructure and battery manufacturing capacity in regions such as Asia‑Pacific and Europe amplifies procurement orders. Suppliers who align production schedules with battery plant timelines can secure long‑term contracts. Firms that invest in regional production capacity near battery hubs will reduce logistics costs and improve supply reliability.

Diversification into Pharmaceutical, Specialty Chemical, and High‑Purity Industrial Segments Broadens Market Reach

The Ultra‑High Purity Manganese Sulfate Market finds new opportunity in pharmaceutical, laboratory reagent, and specialty chemical applications that demand minimal contamination. Manufacturers of cell culture media, high‑precision catalysts, and specialty pigments increasingly require ultrapure manganese sources. It permits producers to command premium pricing for high‑specification grades. Expansion of life‑sciences industries and advanced materials manufacturing in developing regions boosts demand for specialty‑grade chemicals. Companies that secure quality certifications and offer batch traceability will attract these high‑value buyers. Firms able to deliver small but consistent volumes quickly will capture niche segments where purity and reliability matter most.

Market Segmentation Analysis:

By Grade

The Ultra-High Purity Manganese Sulfate Market primarily segments into battery-grade and industrial-grade products. Battery-grade manganese sulfate dominates due to stringent purity requirements in lithium-ion cathodes for electric vehicles and energy storage systems. It ensures stable electrochemical performance and minimal contamination, driving preference among battery manufacturers. Industrial-grade manganese sulfate serves chemical synthesis, pigment production, and laboratory applications where ultra-high purity is less critical but consistency remains essential. Increasing adoption of battery-grade products supports long-term revenue growth for manufacturers focusing on high-specification grades.

- For instance, a research team at Universitas Sebelas Maret (UNS) in Indonesia developed lithium-ion battery cathodes from manganese sulfate fertilizer as a raw material, demonstrating innovation that can enhance production capacity and performance metrics in emerging markets.

By Application

Market applications include batteries, pharmaceuticals, specialty chemicals, and electronics. The battery segment captures the largest share, driven by surging demand for electric vehicles and grid-scale storage. Pharmaceuticals and specialty chemicals consume ultra-high purity manganese sulfate for formulations, reagents, and catalysts requiring minimal impurities. Electronics industries use it in semiconductor manufacturing and high-precision processes. It enables manufacturers to meet regulatory and performance standards across sensitive applications, reinforcing market expansion.

- For instance, CATL, a leading battery manufacturer, actively produces NCM811 cathode batteries, a chemistry that requires ultra-high purity manganese sulfate.

By End-User

End-users consist of battery manufacturers, chemical producers, pharmaceutical companies, and research laboratories. Battery manufacturers dominate due to reliance on manganese sulfate in cathode formulations. Pharmaceutical and research segments show steady growth, fueled by rising investments in life sciences and advanced material development. Chemical producers utilize it for catalysts, pigments, and specialty compounds. It provides these end-users with reliable, high-purity materials to maintain product performance and compliance with industry standards.

Segmentations:

By Grade

- Battery-Grade

- Industrial-Grade

By Application

- Batteries

- Pharmaceuticals

- Specialty Chemicals

- Electronics

By End-User

- Battery Manufacturers

- Chemical Producers

- Pharmaceutical Companies

- Research Laboratories

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia‑Pacific Leads Global Demand with Dominant Consumption

Asia‑Pacific accounts for 52% of the global Ultra‑High Purity Manganese Sulfate Market, driven by China’s extensive battery production and refining capacity. Japan, South Korea, India, and Southeast Asian countries contribute significantly to the remaining regional demand. The region benefits from proximity to raw-material sources, integrated supply chains, and large-scale industrial and chemical applications. Rapid expansion of lithium-ion battery manufacturing boosts demand for ultra-pure manganese sulfate in cathodes. Manufacturers invest in regional facilities to ensure consistent supply and reduce logistics costs. Rising renewable energy storage projects further strengthen consumption and long-term growth prospects.

North America Shows Rising Demand with Policy-Driven Support

North America holds 22% of the global Ultra‑High Purity Manganese Sulfate Market, fueled by domestic battery production and strategic localization of supply chains. Incentives for local sourcing and regulatory support encourage manufacturers to establish refining and processing facilities. Electric vehicle adoption and energy storage expansion drive demand for battery-grade manganese sulfate. The region also leverages its established agriculture and chemical sectors that consume manganese sulfate. Investment in advanced purification technology and compliance with environmental standards increase production reliability. This positioning allows North America to capture high-value supply contracts and steady growth in the forecast period.

Europe Expands Steadily with Regulatory-Driven Demand

Europe contributes 18% of the global Ultra‑High Purity Manganese Sulfate Market, supported by Germany, France, and the United Kingdom. Regulatory frameworks and sustainability mandates promote adoption of high-purity manganese sulfate in battery and specialty chemical applications. The region benefits from increasing electric vehicle production and renewable energy projects. Industrial sectors also maintain steady demand for manganese sulfate in chemical and agricultural applications. Investments in advanced refining infrastructure ensure adherence to strict purity standards. Emerging interest from smaller regions, including Middle East, Africa, and Latin America, indicates potential for future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- American Manganese Inc.

- Element 25 Limited

- Giyani Metals Corp.

- Euro Manganese Inc.

- Mesa Minerals Limited

- Manganese X Energy Corp.

- South32 Limited

- Nippon Denko Co., Ltd.

- Eramet Group

- Compania Minera Autlan, S.A.B. de C.V.

- MOIL Limited

- OM Holdings Limited

- Tosoh Corporation

Competitive Analysis:

The Ultra-High Purity Manganese Sulfate Market features a competitive landscape driven by vertical integration, technological differentiation, and strategic supply-chain partnerships. Leading players like Guizhou Dalong Huicheng New Material Co., Ltd. hold significant production capacity, leveraging integrated ore-to-refinement operations and strong ties with battery manufacturers. Companies such as ISKY Chemicals Co., Ltd. and Guizhou Redstar Developing Co., Ltd. maintain substantial shares through specialized purification capabilities and long-term supply contracts. Western firms, including Prince International Corporation and American Manganese Inc., differentiate with diversified portfolios, alternative raw-material sourcing, and robust distribution networks in North America and Europe. Emerging Chinese and regional competitors intensify competition by offering cost-effective purification technologies and flexible supply options. Competition drives continuous improvement in product purity, operational efficiency, and supply reliability, with firms combining technological investment, vertical integration, and strategic collaborations securing long-term contracts in battery and specialty chemical markets.

Recent Developments:

- In April 2025, Giyani Metals Corp produced its first battery-grade manganese and is shipping samples to potential customers. The company plans a Definitive Feasibility Study completion by early 2026.

Report Coverage:

The research report offers an in-depth analysis based on Grade, Application, End-User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of electric vehicles will continue to drive demand for battery-grade manganese sulfate in lithium-ion cathodes.

- Expansion of renewable energy storage infrastructure will increase consumption of ultra-high purity manganese sulfate in grid-scale batteries.

- Technological advancements in purification and crystallization processes will enhance product quality and production efficiency.

- Growing focus on sustainable and environmentally compliant production methods will influence industry practices.

- Expansion of pharmaceutical and specialty chemical applications will create new high-value markets for ultra-pure manganese sulfate.

- Manufacturers investing in regional production facilities will improve supply reliability and reduce logistics costs.

- Strategic partnerships with battery producers and chemical manufacturers will secure long-term supply agreements.

- Emerging industrial markets in Asia-Pacific, Latin America, and Africa will contribute to incremental demand growth.

- Innovation in high-performance applications, including semiconductors and precision catalysts, will drive demand for specialized grades.

- Competitive pressure will encourage product differentiation, improved traceability, and adherence to strict quality standards, strengthening market position.