| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Luxury Interior Design Market Size 2024 |

USD 3381.31 Million |

| India Luxury Interior Design Market, CAGR |

5.82% |

| India Luxury Interior Design Market Size 2032 |

USD 5316.51 Million |

Market Overview:

The India Luxury Interior Design Market is projected to grow from USD 3381.31 million in 2024 to an estimated USD 5316.51 million by 2032, with a compound annual growth rate (CAGR) of 5.82% from 2024 to 2032.

Several factors are driving the expansion of the luxury interior design market in India. The increasing number of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) has heightened demand for personalized and opulent interior designs. This affluent demographic seeks exclusive and sophisticated living environments, fueling market growth. Additionally, rapid urbanization and the proliferation of luxury real estate developments in metropolitan areas have created a fertile ground for luxury interior design services. Cities like Mumbai, Delhi, and Bengaluru are witnessing a surge in upscale residential and commercial projects, further boosting the demand for high-end interior design solutions. Furthermore, the growing interest in modern and sustainable design elements is influencing the preferences of wealthy consumers, driving the market further. The availability of advanced technologies, such as augmented reality and virtual reality, is also enhancing the design process, offering a more immersive and tailored experience for clients.

Geographically, the luxury interior design market in India is predominantly concentrated in urban centers with substantial affluent populations. Metropolitan cities such as Mumbai, Delhi, and Bengaluru are at the forefront, offering a plethora of luxury residential and commercial projects. These cities serve as hubs for luxury interior design services, attracting both domestic and international designers. Moreover, emerging urban centers are gradually contributing to market growth, driven by increasing disposable incomes and a growing appreciation for luxury living. Other cities such as Hyderabad and Pune are also witnessing a rise in luxury real estate developments, diversifying the demand for high-end interior design services beyond the traditionally dominant markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The India Luxury Interior Design Market is projected to grow from USD 3,381.31 million in 2024 to USD 5,316.51 million by 2032, with a CAGR of 5.82%.

- The increasing number of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) is a key driver, leading to rising demand for personalized, luxurious designs.

- Rapid urbanization and the growth of luxury real estate developments in cities like Mumbai, Delhi, and Bengaluru have created fertile ground for luxury interior design services.

- Younger demographics, particularly millennials and Gen Z, are contributing to market growth by seeking modern, minimalist, and sustainable design solutions.

- Technological advancements, such as augmented reality (AR) and virtual reality (VR), are enhancing the design process and providing a more immersive client experience.

- Despite its growth, the market faces challenges due to the high costs of luxury design services, limiting accessibility to a broader consumer base.

- Regional preferences and cultural differences pose challenges, requiring designers to balance local tastes with global luxury trends in their offerings.

Market Drivers:

Increase in High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs)

The rising number of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) in India is one of the key drivers propelling the luxury interior design market. As disposable incomes increase, more individuals are able to invest in premium and customized living spaces that reflect their status and aspirations. This affluent demographic demands not only functional but also visually stunning and personalized interiors. The increasing wealth among India’s top-tier population has led to a higher demand for sophisticated, exclusive design services tailored to the specific needs and desires of wealthy clientele. As a result, interior designers are capitalizing on this trend by offering bespoke services that combine luxury, style, and innovation.

Urbanization and Growth of Luxury Real Estate

India’s rapid urbanization is another significant factor contributing to the growth of the luxury interior design market. As cities expand and modernize, the demand for upscale residential and commercial properties has surged. The rise of luxury real estate developments in metropolitan areas such as Mumbai, Delhi, and Bengaluru has created a strong demand for high-end interior design services. For instance, Delhi saw a 6.7% year-on-year rise in luxury residential prices in 2024, improving its global ranking in Knight Frank’s Prime International Residential Index from 37th to 18th. New, large-scale residential complexes, upscale commercial spaces, and luxury villas are being constructed with an emphasis on premium interiors. These developments often require unique and sophisticated design concepts that align with global luxury standards. As urban centers continue to grow, the need for luxury interior designs will remain strong, further driving the market’s expansion.

Rising Affluence of Younger Demographics

A noteworthy trend in the Indian luxury interior design market is the rising affluence among younger generations, including millennials and Gen Z. These groups, often well-traveled and highly influenced by global design trends, are increasingly investing in high-end interior designs for their homes and offices. Their preferences often lean towards modern, minimalist aesthetics, sustainable materials, and advanced technological integration. As these younger affluent consumers become a dominant force in the market, interior designers are adapting their offerings to cater to this demographic’s specific needs, blending traditional luxury with contemporary and tech-savvy elements. This shift in consumer preferences is boosting the demand for innovative and contemporary design solutions, driving the growth of the luxury interior design market.

Technological Advancements and Digitalization

Technological advancements have also played a crucial role in driving the luxury interior design market. The integration of virtual reality (VR), augmented reality (AR), and 3D visualization tools has transformed the way design concepts are presented and experienced by clients. These technologies allow potential buyers to visualize their living spaces before implementation, making it easier for them to invest in custom luxury designs. For instance, Amenify India offers VR previews that allow clients to “walk through” their future interiors in a realistic 3D environment. The use of digital platforms for showcasing portfolios and engaging with clients has become an essential part of the industry. Designers can now offer a more immersive and tailored experience through advanced digital tools, which has led to a higher demand for luxury interior services. The combination of design expertise and technology is enhancing client satisfaction and accelerating the growth of the market.

Market Trends:

Integration of Global Design Influences

Indian luxury interior design is increasingly characterized by the seamless blending of traditional elements with contemporary styles. This fusion creates spaces that are both culturally rich and globally relevant. Designers are incorporating traditional motifs, materials, and craftsmanship into modern layouts, resulting in unique and personalized interiors. For instance, designs inspired by historical Indian elements such as Mughal-era carvings and Rajput palace frescoes are seamlessly blended with modern layouts, creating culturally rich yet globally relevant interiors. This trend reflects a broader appreciation for cultural heritage while embracing modern aesthetics. The influence of international design movements is also contributing to the sophistication of luxury interiors, pushing boundaries and allowing for more innovative and diverse design solutions. This global perspective allows Indian luxury design to stand out in a competitive market.

Emphasis on Sustainable and Eco-Friendly Practices

Sustainability has become a significant focus in the Indian luxury interior design market. There is a growing preference for eco-friendly materials, energy-efficient lighting, and designs that minimize environmental impact. This shift towards green interiors aligns with global environmental concerns and appeals to consumers’ increasing awareness of ecological issues. Incorporating sustainable practices not only enhances the aesthetic appeal of spaces but also contributes to environmental preservation. For example, reclaimed wood is often repurposed into bespoke furniture pieces that add character to interiors while minimizing deforestation. Many luxury interior designers are also partnering with eco-conscious manufacturers and suppliers to ensure that their designs meet sustainability standards. This growing emphasis on sustainability is reshaping the luxury market and influencing consumer purchasing decisions.

Technological Integration in Interior Spaces

The incorporation of advanced technologies is transforming luxury interiors in India. Smart home systems, automated lighting, and state-of-the-art appliances are becoming standard features in upscale designs. This technological integration enhances convenience, security, and energy efficiency, meeting the demands of modern lifestyles. Consumers’ growing comfort with technology and a desire for sophisticated living environments drive this trend. Moreover, advancements in virtual reality (VR) and augmented reality (AR) are providing clients with interactive design experiences, allowing them to visualize and refine their interior concepts before actual implementation. The growing importance of technology is reshaping how luxury spaces are designed and experienced.

Rise of Theme-Based and Personalized Designs

There is a notable shift towards theme-based and personalized interior designs in the luxury segment. Homeowners and businesses are increasingly seeking designs that reflect their individual tastes, cultural backgrounds, and personal stories. Themes such as Mediterranean, European, and ethnic Indian styles are gaining popularity, allowing for creative expression and a deeper connection to the spaces. This trend highlights a departure from generic designs towards more meaningful and customized interiors. Personalization extends to the use of bespoke furniture and unique artwork, allowing clients to inject their identity into the spaces they inhabit. As a result, luxury interior design is becoming more about creating one-of-a-kind environments that tell a story.

Market Challenges Analysis:

High Cost of Luxury Interior Design Services

One of the significant challenges in the Indian luxury interior design market is the high cost associated with premium design services. Luxury interior designs often require the use of high-quality materials, bespoke furnishings, and highly skilled professionals, which increases the overall cost of the service. This makes luxury interior design inaccessible to a large segment of the population, limiting the market’s potential growth to high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs). For many consumers, the cost factor can be a significant deterrent, restricting the widespread adoption of luxury interior design services.

Lack of Skilled Professionals

Another key restraint in the market is the shortage of skilled professionals capable of executing luxury interior designs at the highest level. While India has a growing pool of talented interior designers, the demand for highly specialized expertise in luxury design often exceeds the supply. Luxury interior design requires a unique blend of creativity, technical knowledge, and an understanding of global design trends. The limited number of designers with experience in this niche sector can result in delays, inconsistent quality, and challenges in meeting client expectations, hindering market growth and development.

Cultural Preferences and Regional Differences

India’s diverse cultural and regional landscape also presents challenges to the luxury interior design market. Preferences for interior design styles vary significantly across different regions, and this diversity can complicate the development of a unified approach for designers. For example, regional styles such as Rajasthani jharokhas or Kerala’s minimalist woodwork are often integrated into designs to reflect local traditions. Clients in various parts of India may prefer distinct aesthetic elements, making it challenging to cater to a broad audience with uniform design offerings. Designers must balance local tastes and traditional influences while integrating global luxury trends, which can be difficult to achieve seamlessly. This cultural variability may limit the reach of luxury interior design services in certain markets.

Economic Uncertainty

Economic volatility and uncertainty also pose challenges to the luxury interior design market. Economic slowdowns, fluctuations in disposable incomes, and rising inflation can affect consumer spending patterns. In times of economic uncertainty, discretionary spending on luxury goods and services, including interior design, tends to decrease. As a result, demand for luxury interior design services can become unpredictable, posing a challenge to market stability and long-term growth.

Market Opportunities:

The India luxury interior design market presents several promising opportunities, particularly as the country continues to experience rapid urbanization and a growing affluent population. With a significant rise in high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs), there is an increasing demand for exclusive, high-end residential and commercial properties that require sophisticated and personalized design solutions. Cities like Mumbai, Delhi, Bengaluru, and other emerging urban centers are seeing a surge in luxury real estate developments, creating ample opportunities for interior designers to offer tailored, opulent services. As India’s economic growth continues to rise, so does the purchasing power of its affluent class, which drives the need for custom-designed interiors that reflect personal style and status.

Additionally, the increasing interest in sustainability and eco-friendly designs offers a unique market opportunity in the luxury segment. Affluent consumers are becoming more environmentally conscious and are increasingly seeking sustainable, energy-efficient solutions for their homes and offices. The demand for green materials, energy-efficient systems, and environmentally responsible practices is reshaping the luxury interior design landscape. Designers who can incorporate these sustainable elements into their offerings will be well-positioned to cater to this growing segment. As technological advancements in smart homes and automation gain traction, integrating cutting-edge technology into luxury interior design also presents a lucrative opportunity, allowing designers to offer modern, innovative solutions to meet evolving consumer preferences.

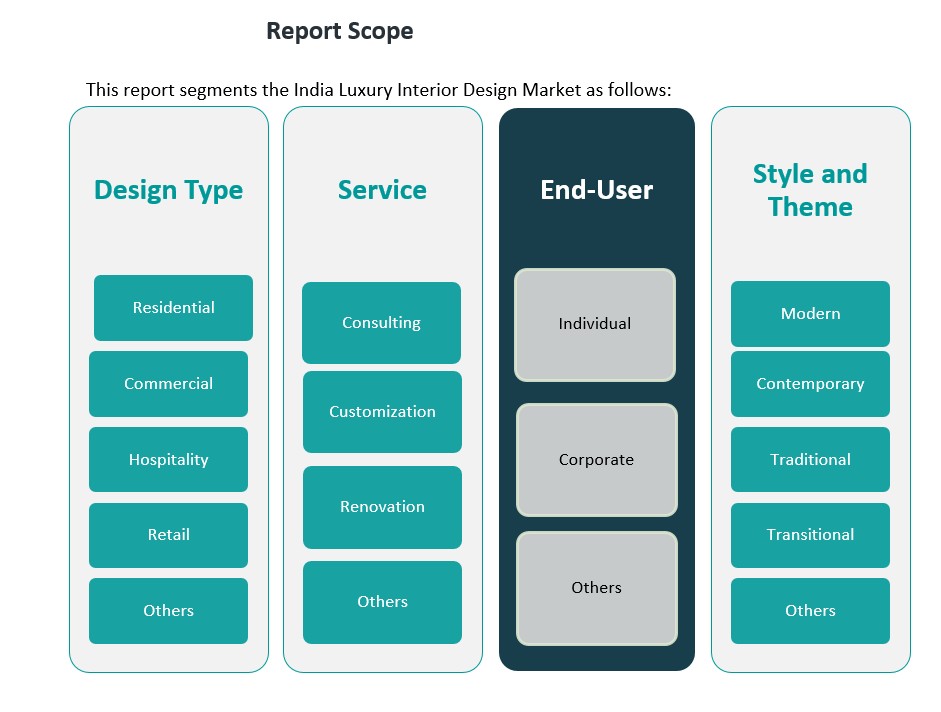

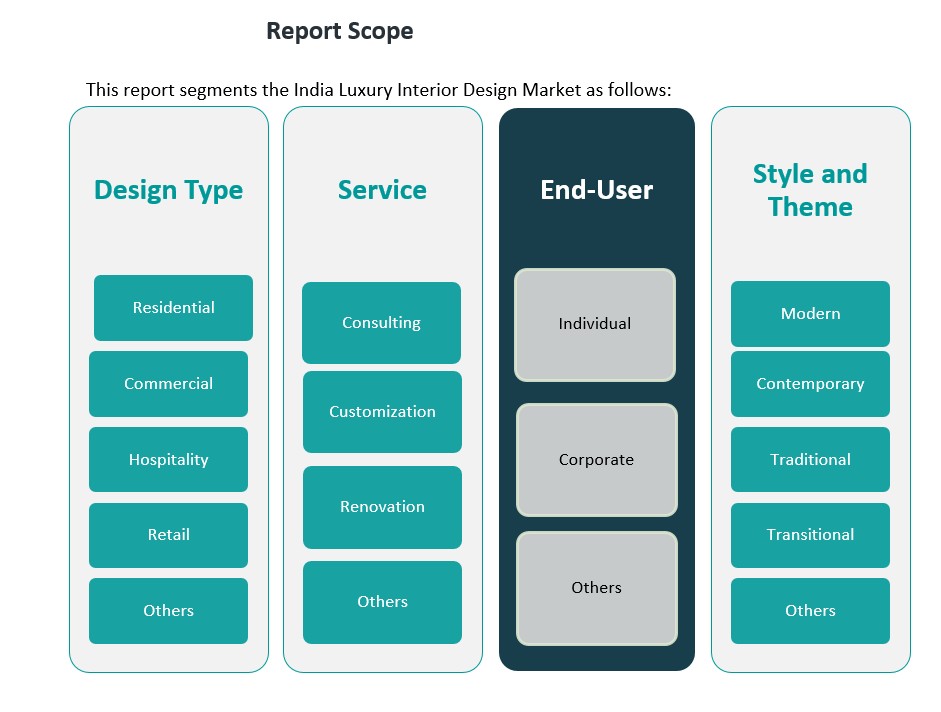

Market Segmentation Analysis:

The India luxury interior design market is diverse, with several key segments driving its growth.

By Design Type Segment, the market is primarily categorized into residential, commercial, hospitality, retail, and others. The residential segment holds a significant share due to the rising number of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) seeking customized, luxurious living spaces. Commercial and hospitality sectors are also growing rapidly, driven by an increase in high-end office spaces, hotels, and resorts in metropolitan cities. Retail design is gaining traction as luxury brands require exclusive, visually appealing stores to enhance customer experience.

By Services Segment, the market is segmented into consulting, customization, renovation, and others. Consulting services are critical for luxury interior design, as clients often seek expert guidance for personalized, sophisticated designs. Customization is a growing trend, with consumers demanding bespoke interiors that reflect their unique preferences. Renovation services are in high demand as affluent clients look to upgrade their existing spaces to maintain their luxurious standards.

By End-User Segment, the market is divided into individual, corporate, and others. Individuals, particularly HNWIs and UHNWIs, drive the demand for luxury interior design in their personal spaces. Corporate clients seek high-end office interiors to align with their prestigious brand image.

By Style and Theme Segment, modern, contemporary, traditional, transitional, and others represent the various design preferences. Modern and contemporary styles are popular among younger, affluent consumers, while traditional and transitional themes attract those who appreciate classic and timeless aesthetics.

Segmentation:

By Design Type Segment:

- Residential

- Commercial

- Hospitality

- Retail

- Others

By Services Segment:

- Consulting

- Customization

- Renovation

- Others

By End-User Segment:

- Individual

- Corporate

- Others

By Style and Theme Segment:

- Modern

- Contemporary

- Traditional

- Transitional

- Others

Regional Analysis:

The luxury interior design market in India is experiencing significant growth, propelled by urbanization, economic development, and an expanding affluent population. This growth is distinctly reflected across various regions, each contributing uniquely to the market’s expansion.

North India

North India leads the luxury interior design market, primarily due to the prominence of the National Capital Region (NCR), encompassing Delhi and its surrounding areas. The region’s market dominance is attributed to substantial investments in real estate, the establishment of numerous corporate headquarters, and a burgeoning demand for upscale residential projects. While exact market share percentages are not publicly disclosed, North India’s significant influence is evident through its extensive luxury developments and high-end design projects.

South India

South India is a rapidly growing segment of the luxury interior design market, with cities like Bengaluru, Hyderabad, and Chennai witnessing a surge in upscale residential and commercial projects. The region’s market share is substantial, reflecting its economic growth and urban development. The increasing affluence of the population and a growing appreciation for luxury living contribute to the rising demand for luxury interior design services.

West and Central India

West and Central India, including cities like Mumbai, Pune, and Ahmedabad, also play a crucial role in the luxury interior design market. Mumbai, in particular, stands as a hub for luxury design, hosting events like Design Mumbai, which showcases a blend of international and Indian creativity. The city’s status as a financial and entertainment capital drives the demand for sophisticated interior designs. While specific market share data is limited, the presence of numerous luxury developments indicates a significant market contribution.

East India

East India, encompassing cities such as Kolkata and Bhubaneswar, is emerging as a noteworthy market for luxury interior design. The region is experiencing growth in luxury residential projects, driven by increasing disposable incomes and a shift towards modern living. Although its market share is comparatively smaller than that of North and South India, East India’s potential is on the rise, with more consumers investing in high-end interior designs.

Key Player Analysis:

- Pinakin Design

- HomeLane

- Godrej Interio

- ANSA Interiors

- Ace Interiors

Competitive Analysis:

The India luxury interior design market is highly competitive, with several key players offering premium design services to affluent clients. Leading interior design firms like Gauri Khan Designs, Livspace, and AA Living are at the forefront, capitalizing on their reputation for delivering high-quality, customized design solutions. These firms differentiate themselves through exclusive, tailored services, often integrating global design trends with Indian aesthetics to cater to the diverse tastes of luxury consumers. Additionally, several smaller boutique firms are carving out a niche by focusing on personalized, artisanal designs and leveraging technology like virtual reality and 3D visualization to enhance client experiences. Competition is also intensifying as international design firms expand into the Indian market, bringing global expertise and innovative solutions. The market is witnessing increased investment in sustainability and smart home technologies, further driving the need for firms to stay ahead by offering cutting-edge, eco-conscious, and tech-integrated interior design services.

Recent Developments:

- In September 2024, HomeLane acquired DesignCafe in a landmark deal through a 100% share swap. This acquisition was accompanied by Rs 225 crore in fresh funding from investors like Hero Enterprise. The merger positions HomeLane as a leader in India’s home interiors market.

- In September 2024, Creaticity partnered with Konfor Furniture, a Turkish brand, to introduce premium space-saving designs tailored for urban Indian homes. This collaboration focuses on affordable luxury furniture that blends European elegance with Indian sensibilities.

- In June 2023, Asian Paints launched its “Beautiful Homes Studio” and the “Soft Decor 2023 Collection,” marking a significant step in luxury interior design. This initiative aims to redefine home aesthetics by offering a curated blend of premium design services and products tailored to modern consumer preferences.

Market Concentration & Characteristics:

The India luxury interior design market exhibits a moderate level of concentration, with a mix of established industry leaders and emerging boutique firms. Large, well-established firms like Gauri Khan Designs, Livspace, and AA Living dominate the market, commanding significant market share due to their extensive portfolios, brand recognition, and ability to deliver high-end, customized services to affluent clients. These firms often focus on providing complete design solutions, from concept to execution, incorporating global design trends and sophisticated technology. At the same time, the market also features numerous smaller, niche players that cater to specific client needs, such as sustainable design, heritage-inspired interiors, or innovative tech integration. These boutique firms are carving out unique positions by offering personalized, artisanal designs and focusing on local market trends. The market characteristics highlight a blend of innovation, luxury, and exclusivity, with an increasing emphasis on sustainability and the integration of smart home technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Design Type Segment, By Services Segment, By End-User Segment and By Style and Theme Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The India luxury interior design market is expected to continue growing, driven by an expanding affluent consumer base.

- Increasing demand for personalized, bespoke designs will lead to more tailored and exclusive services.

- Technological integration, including smart home features and automation, will become a key trend in luxury interiors.

- Sustainable and eco-friendly designs will gain traction, with more clients seeking environmentally conscious solutions.

- Rising urbanization and luxury real estate developments in tier-2 cities will broaden the market’s reach beyond metropolitan areas.

- The influence of global design trends will continue to shape the Indian market, with international firms expanding their presence.

- Increased use of augmented reality (AR) and virtual reality (VR) will enhance the design experience for clients.

- Demand for high-end office and commercial interior designs will grow as businesses prioritize employee experience and luxury environments.

- The luxury market will see greater regional diversity as preferences evolve across India’s cultural landscapes.

- The role of interior designers as lifestyle consultants will expand, with clients seeking comprehensive solutions beyond just design.