| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Industrial Fasteners Market Size 2024 |

USD 4085.64 million |

| UK Industrial Fasteners Market, CAGR |

6.04% |

| UK Industrial Fasteners Market Size 2032 |

USD 6529.92 million |

Market Overview

The UK Industrial Fasteners Market is projected to grow from USD 4085.64 million in 2024 to an estimated USD 6529.92 million by 2032, with a compound annual growth rate (CAGR) of 6.04% from 2024 to 2032.

Key drivers of this market include robust demand from the construction and automotive industries, which utilize fasteners such as bolts, screws, nuts, and rivets extensively. Additionally, the aerospace sector’s need for high-performance fasteners contributes to market expansion. Trends such as the adoption of lightweight, corrosion-resistant materials and customized fastening solutions are also influencing market dynamics.

Geographically, the UK market is characterized by a mix of large and small-scale manufacturers, with companies like Arconic Fastening Systems and Rings, Acument Global Technologies, LISI Group, Nifco Inc., and Hilti Corporation playing pivotal roles. These companies are focusing on product innovation and strategic collaborations to enhance their market presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Industrial Fasteners Market is projected to grow from USD 2,783.68 million in 2024 to USD 3,609.48 million by 2032, with a CAGR of 3.30% from 2025 to 2032.

- Key drivers include strong demand from the construction, automotive, and aerospace sectors, with a focus on high-performance and corrosion-resistant fasteners.

- Fluctuating raw material prices and intense competition are significant challenges facing the market, impacting pricing and profit margins.

- England holds the largest market share, driven by manufacturing, automotive, and aerospace industries, with notable contributions from Scotland and Wales.

- The adoption of lightweight materials and advancements in 3D printing for custom fastener solutions are driving innovation in the market.

- Growing emphasis on eco-friendly and recyclable fasteners as industries increasingly prioritize sustainability in manufacturing.

- Major players like Arconic Fastening Systems, LISI Group, and Nifco Inc. dominate the market through product innovation and strategic collaborations.

Report scope

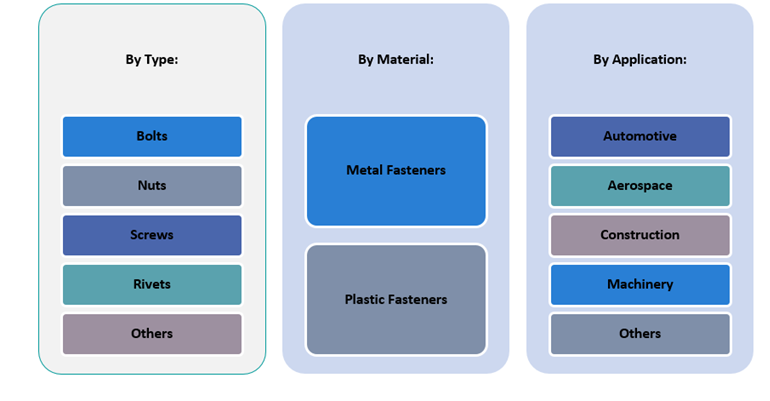

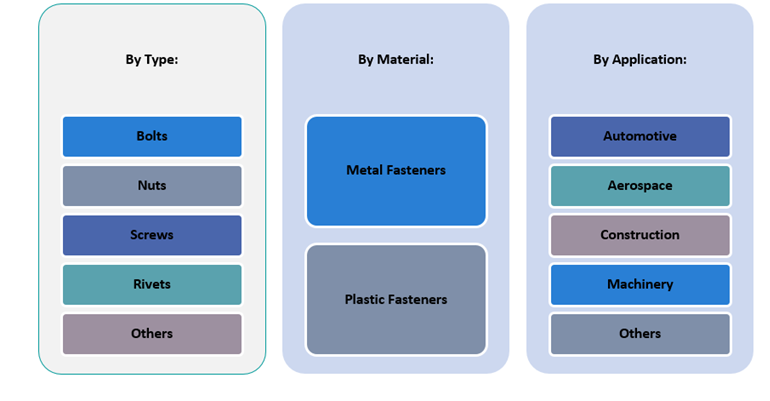

This report segments the UK Industrial Fasteners Market as follow:

Market Drivers

Aerospace Industry Advancements and Innovations

The aerospace sector is another major contributor to the growth of the UK industrial fasteners market. The increasing demand for new aircraft, both for commercial and military use, has led to an expansion in the use of high-performance fasteners that can withstand extreme temperatures, pressures, and environmental conditions. Aerospace fasteners must meet stringent safety, reliability, and performance standards, making this segment a key area of innovation. As the UK seeks to strengthen its aerospace capabilities and increase its role in space exploration and satellite technology, there is a growing demand for specialized fasteners. Fasteners used in the aerospace industry are often designed for specific applications, such as structural assemblies, propulsion systems, and avionics. The market is also seeing increased interest in lightweight materials that reduce the overall weight of aircraft while maintaining strength and durability. As a result, fasteners made from advanced materials, including titanium alloys and composites, are becoming more prevalent in the aerospace sector, further driving market growth.

Technological Advancements and Customization

Technological advancements in manufacturing processes and the increasing demand for customized fastener solutions are driving innovation in the UK industrial fasteners market. Companies are now focusing on the development of fasteners with enhanced properties, such as improved tensile strength, corrosion resistance, and lightweight designs, to meet the specific requirements of various industries. Additive manufacturing (3D printing) is also playing a growing role in the production of fasteners, allowing for the creation of complex designs that were previously difficult or impossible to produce with traditional manufacturing techniques. The demand for bespoke fasteners tailored to the needs of particular industries is another key driver of the market. For example, in the automotive and aerospace sectors, fasteners may need to meet specific weight, performance, and environmental standards, prompting manufacturers to provide customized solutions. Additionally, automation and robotics in production lines are helping fastener manufacturers achieve higher precision and efficiency, reducing costs and enhancing the quality of the end product. These technological advancements ensure that industrial fasteners can meet evolving market demands and contribute to the market’s overall growth.

Robust Demand from the Construction Sector

The UK construction sector significantly influences the demand for industrial fasteners, as components like bolts, screws, nuts, rivets, and anchors are crucial for assembling and securing materials in both residential and commercial projects. For instance, government initiatives such as the National Infrastructure Strategy highlight the importance of infrastructure development and housing projects, which necessitate high-quality fastening solutions. The trend towards modern construction techniques, such as modular and prefabricated building methods, also fuels the demand for specialized fasteners designed for easy assembly and disassembly. Furthermore, the emphasis on sustainability in construction encourages the use of corrosion-resistant and environmentally friendly fasteners, further boosting the market. Surveys from construction companies indicate a growing preference for fasteners that meet stringent environmental standards, aligning with the broader shift towards sustainable building practices.

Growth in the Automotive Industry

The UK automotive industry is a major driver of the industrial fasteners market due to the critical role fasteners play in vehicle assembly. Fasteners are extensively used in assembling car components, including engines, chassis, body panels, and interior systems. For instance, as electric vehicles (EVs) and hybrid vehicles gain prominence, there is an increasing demand for fasteners designed to handle high-performance, lightweight, and corrosion-resistant materials. Automotive manufacturers emphasize the need for fasteners that meet strict safety and durability standards, driving innovation and product development in this segment. Government surveys highlight the UK’s commitment to reducing carbon emissions and promoting sustainable transport solutions, which aligns with the rising demand for electric vehicles. This, in turn, drives the demand for specialized types of fasteners. The growth of the automotive sector in the UK will continue to drive the industrial fasteners market, particularly as the industry focuses on expanding EV production and enhancing vehicle safety.

Market Trends

Increasing Adoption of Advanced Materials

The UK industrial fasteners market is witnessing a significant shift towards advanced materials that enhance performance across various industries. Traditional fasteners made from steel and aluminum are increasingly being complemented or replaced by innovative materials such as titanium alloys, carbon fiber composites, and high-performance polymers. These materials offer superior strength, durability, and resistance to extreme environmental conditions, making them ideal for demanding sectors like aerospace, automotive, and energy. For instance, the aerospace industry benefits from titanium fasteners that withstand high temperatures and pressures while reducing weight, contributing to fuel efficiency. Similarly, the automotive sector is adopting lightweight, high-strength fasteners to support the development of electric and fuel-efficient vehicles. This trend aligns with the growing emphasis on sustainability and efficiency in manufacturing processes. Advanced materials also facilitate the creation of customized fasteners tailored to specific applications, further enhancing their utility in complex designs. As industries continue to innovate and prioritize high-performance solutions, the adoption of advanced materials in fastener production is set to drive market growth and technological advancements.

Focus on Sustainability and Eco-Friendly Fasteners

Sustainability is emerging as a pivotal focus in the UK industrial fasteners market, driven by environmental concerns and regulatory pressures. Manufacturers are increasingly adopting eco-friendly practices by utilizing recyclable materials such as stainless steel and aluminum, which reduce resource depletion and environmental impact. Innovations in material science have also led to the development of biodegradable polymers and reusable fasteners that align with circular economy principles. For instance, the construction sector is integrating sustainable fasteners to meet green building standards like LEED certification. Additionally, energy-efficient production processes such as additive manufacturing are minimizing waste while optimizing efficiency. In industries like automotive, sustainable fasteners are being incorporated into green manufacturing practices to reduce vehicle lifecycle emissions. Moreover, supply chain transparency is becoming a priority, with manufacturers collaborating with ethical suppliers to uphold sustainability standards throughout production. These efforts not only address environmental concerns but also enhance competitiveness by appealing to eco-conscious consumers. As demand for environmentally friendly solutions grows across sectors, sustainable fastener innovations will play a critical role in shaping future market trends.

Customization and Tailored Fastening Solutions

The growing need for customized and tailored fastening solutions is another important trend in the UK industrial fasteners market. As industries such as automotive, aerospace, and construction become more specialized and technologically advanced, there is a rising demand for fasteners that are specifically designed to meet the unique requirements of different applications. This includes custom sizes, shapes, and materials that offer superior performance in specific conditions, such as high-pressure, high-temperature, or corrosive environments. The automotive and aerospace industries, in particular, require fasteners that are not only durable but also lightweight and capable of withstanding extreme conditions. Manufacturers are increasingly offering bespoke solutions for clients that demand precision engineering and tailored fastener designs to fit specific needs. This trend is particularly noticeable in sectors with stringent quality standards, such as the aerospace industry, where a slight deviation in specifications can result in failure or catastrophic issues. Moreover, advances in 3D printing and additive manufacturing are enabling the production of highly customized fasteners with intricate designs, which further supports this trend of customization and flexibility in the market. The ability to deliver tailored fastening solutions is becoming a key competitive differentiator in the UK market.

Automation and Digitalization in Fastener Manufacturing

Automation and digitalization are transforming the production processes within the UK industrial fasteners market. The use of advanced manufacturing technologies such as robotics, artificial intelligence (AI), and machine learning is improving the efficiency, precision, and quality of fastener production. These technologies allow manufacturers to optimize their production lines, reduce operational costs, and enhance product quality through precise control over the manufacturing process. For example, robotic systems are increasingly being used in assembly lines to ensure consistency and reduce human error, while AI is helping in the prediction and management of production schedules, maintenance, and inventory. Additionally, the integration of digital technologies in manufacturing enables faster design iterations and product innovations, allowing manufacturers to respond more quickly to market demands. The rise of Industry 4.0 is encouraging the adoption of smart factories, where interconnected machines communicate with each other, ensuring seamless production workflows and real-time data collection. This level of digital integration not only improves operational efficiency but also enhances product traceability, quality control, and supply chain management. As a result, digitalization is enabling UK industrial fastener manufacturers to produce high-quality, cost-effective products more efficiently, further driving the market’s growth.

Market Challenges

Fluctuating Raw Material Prices

Fluctuating raw material prices present a significant challenge for the UK industrial fasteners market, which heavily relies on metals such as steel, aluminum, and titanium. These materials account for a substantial portion of production costs, and their price volatility can disrupt manufacturers’ cost structures and profitability. Factors such as global supply chain disruptions, geopolitical tensions, and shifts in demand across industries like automotive and construction contribute to these fluctuations. For instance, the post-pandemic recovery has led to supply shocks and increased demand for metals, further exacerbating price instability. Manufacturers face difficulties in long-term planning and pricing strategies due to unpredictable input costs. Sudden price hikes often compel producers to pass increased costs onto customers, potentially dampening market demand.Additionally, reliance on imported materials amplifies the impact of global economic factors on local production costs. Brexit-related trade uncertainties have further complicated procurement processes for UK manufacturers. To mitigate these challenges, companies are adopting flexible procurement strategies, diversifying supplier bases, and exploring alternative materials such as high-performance plastics or stainless steel. Investments in supplier relationships and advanced manufacturing technologies are also helping manufacturers manage costs while maintaining quality and compliance with stringent industry standards. Despite these efforts, fluctuating raw material prices remain a critical issue for the sector.

Intense Competition and Price Pressure

Another significant challenge in the UK industrial fasteners market is the intense competition among both local and international manufacturers. The market is highly fragmented, with a mix of well-established players and smaller, niche companies competing for market share. This has resulted in price pressure, as manufacturers strive to offer competitive pricing while maintaining quality. The increasing demand for low-cost solutions in industries such as automotive and construction is exacerbating this challenge. As companies look to optimize their cost structures, they may be tempted to cut corners in production processes or material quality, which can undermine the integrity and performance of fasteners. Furthermore, with the rise of global players entering the UK market, domestic manufacturers face stiff competition, especially in the context of product innovation and value-added services. Companies must continually invest in research and development, customer service, and technological upgrades to differentiate themselves from competitors. This intense competition, coupled with the pressure to reduce prices, forces manufacturers to find ways to streamline operations, improve efficiency, and deliver value without compromising on product quality or safety standards.

Market Opportunities

Expansion in Electric Vehicle (EV) Production

The rapid growth of the electric vehicle (EV) sector presents a significant opportunity for the UK industrial fasteners market. As the automotive industry shifts towards electric mobility, the demand for specialized fasteners used in EVs is expected to rise substantially. These fasteners must meet stringent requirements for lightweight, strength, and corrosion resistance, as well as accommodate the specific needs of electric powertrains, battery packs, and other components unique to EVs. The UK government’s commitment to achieving net-zero carbon emissions by 2035 and its ongoing efforts to promote electric vehicle adoption are likely to further drive this demand. As automakers ramp up EV production, they will require advanced fastener solutions to ensure the safety, reliability, and performance of these vehicles. This shift towards EV manufacturing offers a significant market opportunity for fastener manufacturers to develop tailored solutions that address the evolving needs of the automotive industry.

Growth in Infrastructure and Construction Projects

The UK’s ongoing infrastructure development initiatives and housing projects present another promising opportunity for the industrial fasteners market. With the government’s focus on revitalizing infrastructure and meeting housing demands, there is an increased need for fasteners in construction, particularly for residential, commercial, and public infrastructure projects. Fasteners are essential in structural assemblies, electrical installations, and mechanical systems. The push towards green building practices and energy-efficient construction further adds to the demand for high-quality, sustainable fasteners. Manufacturers that can provide innovative, eco-friendly, and durable fastening solutions will find significant growth opportunities within the growing construction sector, positioning themselves as key suppliers in this expanding market.

Market Segmentation Analysis

By Product

The market is categorized into externally threaded fasteners, internally threaded fasteners, non-threaded fasteners, and aerospace-grade fasteners. Externally threaded fasteners, such as bolts and screws, dominate the segment due to their widespread use across automotive, construction, and machinery applications. Internally threaded fasteners, including nuts and inserts, also hold a significant share, particularly in precision assembly tasks. Non-threaded fasteners like rivets and pins are preferred for their ease of installation in permanent joints, especially in heavy equipment. Aerospace-grade fasteners are a niche but high-growth segment, driven by increasing investments in aviation and space technologies, requiring lightweight and corrosion-resistant fasteners that meet rigorous safety standards.

By Raw Material

The market is divided into metal and plastic fasteners. Metal fasteners account for the majority share due to their strength, durability, and high-temperature resistance, making them ideal for demanding industrial applications. Steel, stainless steel, and titanium are commonly used. However, plastic fasteners are gaining traction in applications requiring lightweight, non-conductive, and corrosion-resistant solutions, especially in the automotive and electronics sectors.

Segments

Based on Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

Based on Raw Material

- Metal fasteners

- Plastic Fasteners

Based on Application

- Automotive

- Aerospace

- Oil & Gas

- Building & Construction

- Others

Based on Distribution Channel

Based on Region

- England

- Scotland

- Wales

- Northern Ireland

Regional Analysis

England (60%)

England dominates the UK industrial fasteners market, accounting for the largest market share of approximately 60%. This dominance is attributed to the concentration of major manufacturing industries, including automotive, aerospace, and construction, which are key consumers of industrial fasteners. The region’s strong industrial infrastructure, technological advancements, and presence of major automotive manufacturers, such as Jaguar Land Rover and Rolls-Royce, contribute to a high demand for fasteners. Additionally, England is home to significant aerospace activity, particularly in areas like Gloucestershire and Derby, further driving demand for specialized aerospace-grade fasteners. The region also benefits from large-scale construction projects and infrastructure developments, further cementing its role as the largest market for fasteners in the UK.

Scotland (20%)

Scotland follows as the second-largest market, contributing around 20% to the total market share. Scotland’s strong presence in the oil & gas industry, particularly in Aberdeen, is a key factor driving demand for industrial fasteners. Fasteners used in oil rigs, pipelines, and offshore platforms require materials that can withstand harsh environments, which provides substantial growth potential for the market. The aerospace sector in Scotland, particularly around Glasgow, also contributes to the demand for high-performance fasteners. With a growing focus on renewable energy, the region’s increasing emphasis on wind turbine manufacturing is further boosting the demand for specialized fasteners.

Key players

- LISI Aerospace

- Baco Enterprises Ltd.

- Total Bolt & Nut Ltd.

- The Nutty Company Ltd.

- CHS Fasteners Ltd.

Competitive Analysis

The UK industrial fasteners market is highly competitive, with key players focusing on expanding their product offerings, improving manufacturing capabilities, and leveraging strategic partnerships to strengthen their market position. LISI Aerospace stands out with its specialized fasteners for the aerospace sector, offering high-performance products that meet rigorous safety and quality standards. In contrast, companies like Baco Enterprises Ltd. and Total Bolt & Nut Ltd. focus on providing a broad range of fasteners for automotive and construction industries, emphasizing cost-effective and reliable solutions. The Nutty Company Ltd. and CHS Fasteners Ltd. differentiate themselves through innovation and a strong customer service focus, catering to a wide range of applications. These companies are investing in advanced manufacturing processes, such as automation and 3D printing, to stay competitive in a price-sensitive market. Overall, the competitive landscape is characterized by a balance of innovation, customization, and cost efficiency.

Recent Developments

- In December 2024, Nitto Seiko reported progress under its medium-term business plan “Mission G-second,” focusing on automation and electrification demands. Despite economic slowdowns in regions like the U.S. and Thailand, the company improved operating income through price adjustments for screw fastening machines.

- In December 2024, ARP launched an upgraded high-strength fastener kit for DART LS Next engine blocks. This kit uses 8740 chromoly steel, offering improved fatigue strength and reliability, catering to high-performance automotive applications.

- In February 2024, ITW reported its financial results for 2023, highlighting a 2% organic growth and a 130 basis point increase in operating margin to 25.1%. While the report emphasizes customer-focused innovation, it does not specifically detail advancements in fastener product lines.

- In January 2025, Arconic undertook a project to relocate a 10,000-ton forging press from overseas to a new facility in Rancho Cucamonga, California. This expansion aimed to enhance their aeronautics operations by integrating advanced manufacturing capabilities.

- In February 2025, Nifco has focused on sustainability by developing plastic products that enhance workability and reduce weight in automotive applications, contributing to better fuel efficiency and reduced environmental impact.

Market Concentration and Characteristics

The UK industrial fasteners market exhibits moderate concentration, with a mix of large, well-established players and smaller, specialized companies. Major players like LISI Aerospace, Baco Enterprises Ltd., and Total Bolt & Nut Ltd. hold significant market share, driven by their extensive product portfolios and ability to cater to diverse industries such as automotive, aerospace, construction, and oil & gas. However, the market also features numerous smaller, niche players that focus on customization and specialized solutions, particularly in sectors requiring high-performance fasteners. The market is characterized by a competitive landscape, where innovation, product differentiation, and customer service are crucial factors. While larger companies benefit from economies of scale and broader distribution channels, smaller players thrive by offering tailored solutions and maintaining strong relationships with specific industry segments. This balance of competition and specialization helps maintain a dynamic and evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Raw Material, Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The increasing adoption of electric vehicles will drive demand for specialized fasteners in the automotive sector. Manufacturers will focus on lightweight, corrosion-resistant fasteners for EVs.

- The growing aerospace sector, including both commercial and military applications, will fuel demand for high-performance fasteners. This will result in a need for advanced materials and precision engineering in fastener production.

- As industries increasingly prioritize sustainability, the demand for eco-friendly fasteners will rise. Manufacturers will focus on developing fasteners made from recyclable or biodegradable materials.

- The integration of Industry 4.0 technologies, such as AI and automation, will enhance manufacturing efficiency and precision. This will help fastener manufacturers meet the increasing demand for customized and high-quality solutions.

- Ongoing infrastructure projects, including housing, transportation, and public works, will drive steady demand for industrial fasteners. The UK government’s focus on infrastructure will significantly impact fastener market growth.

- The shift towards renewable energy sources, particularly wind and solar power, will create demand for durable fasteners. Wind turbine manufacturers, in particular, will rely on specialized fasteners for robust and long-lasting installations.

- The growing need for customized fastening solutions in industries like automotive and aerospace will spur innovation in product development. Companies will increasingly offer bespoke designs to meet specific industry requirements.

- The volatility in raw material prices, particularly metals like steel and aluminum, will continue to challenge manufacturers. Companies will seek cost-effective solutions and optimize supply chains to mitigate this issue.

- The entry of new players, especially from emerging markets, will intensify competition in the UK. Established players will focus on innovation and customer service to maintain their market position.

- Digital transformation will lead to the growth of e-commerce platforms for industrial fasteners. Online distribution channels will become increasingly important for manufacturers to reach a wider customer base.