Market Overview

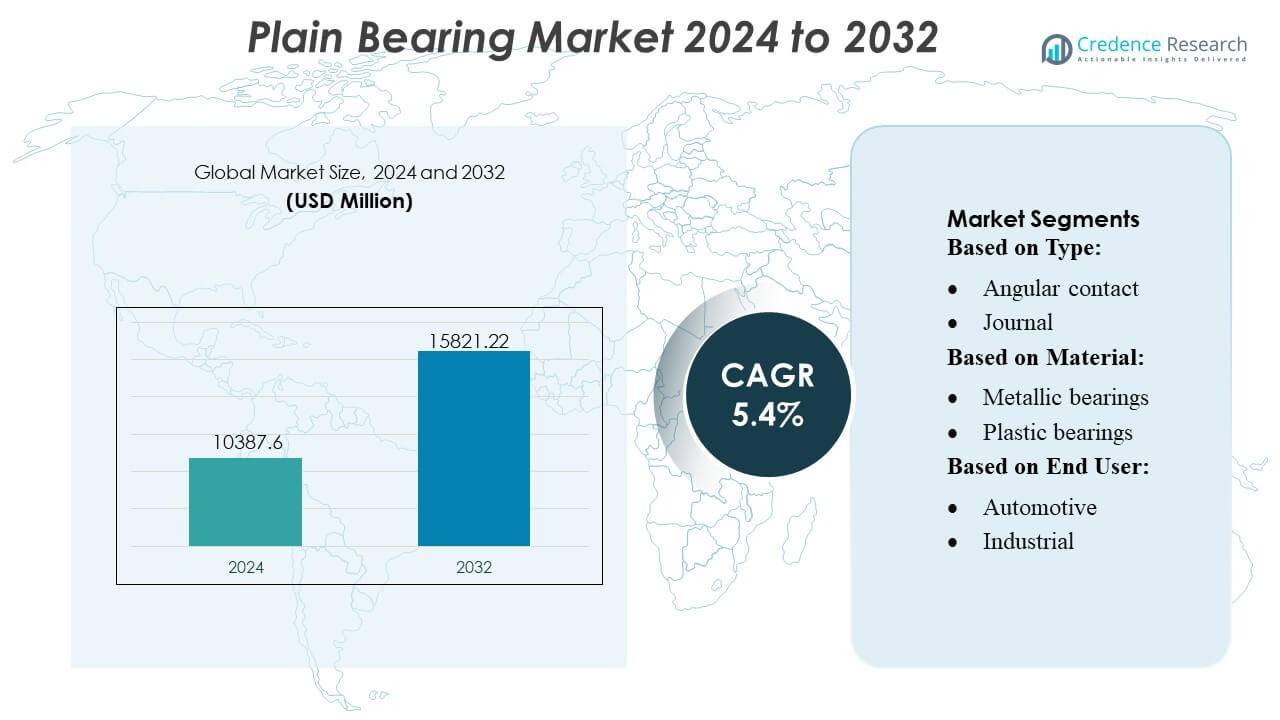

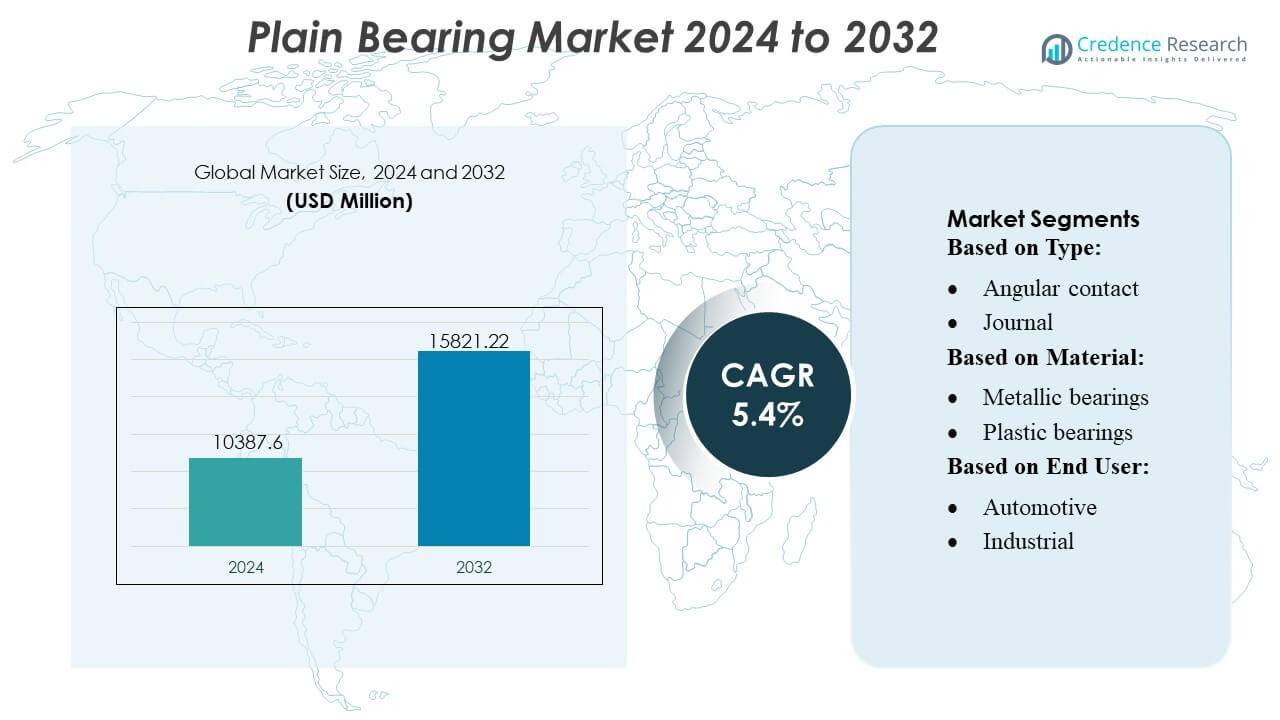

Plain Bearing Market size was valued USD 10387.6 million in 2024 and is anticipated to reach USD 15821.22 million by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plain Bearing Market Size 2024 |

USD 10387.6Million |

| Plain Bearing Market, CAGR |

5.4% |

| Plain Bearing Market Size 2032 |

USD 15821.22 Million |

The Plain Bearing Market is shaped by a mix of global manufacturers that compete through advanced material technologies, precision machining capabilities, and expanded application-specific product lines. Leading companies strengthen their position by focusing on high-load, low-friction, and maintenance-free solutions tailored for automotive, industrial, aerospace, and energy systems. Strategic priorities include OEM partnerships, continuous product innovation, and broader distribution networks to meet rising demand for durable and efficient bearing components. North America leads the global market with an exact 38% share, supported by mature manufacturing infrastructure, strong automotive output, and high adoption of performance-driven industrial machinery.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Plain Bearing Market was valued at USD 10,387.6 million in 2024 and is projected to reach USD 15,821.22 million by 2032, registering a 4% CAGR, reflecting steady demand across automotive, industrial, aerospace, and energy applications.

- Growing need for high-load, low-friction, and maintenance-free bearing solutions drives adoption, supported by advancements in metallic, composite, and engineered plastic materials.

- Market trends emphasize precision machining, lightweight components, and expanding use of self-lubricating bearings, with manufacturers strengthening OEM partnerships and product customization.

- Competitive intensity increases as companies enhance distribution networks, invest in material innovation, and address restraints related to raw material volatility and performance limitations in extreme environments.

- North America leads with 38% share, while Asia-Pacific grows rapidly through rising machinery production; the automotive segment holds the largest share at 34%, supported by increasing vehicle manufacturing and electrification.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Angular contact, journal, linear, thrust, and other bearing types make up the product landscape, with journal bearings dominating the Plain Bearing Market with nearly 42% share due to their high load-carrying capacity, low friction coefficient, and suitability for rotating machinery. Their widespread use in automotive engines, turbines, compressors, and industrial equipment strengthens demand. Growth is primarily driven by rising engine efficiency targets, increased deployment of heavy-duty industrial machinery, and expanding manufacturing output, which requires durable, high-performance rotational support components across multiple end-use settings.

- For instance, Regal Rexnord Corporation’s Duralon® composite bearings, which feature a fiber-reinforced structure with PTFE-lined polymer inserts, are capable of operating continuously at temperatures up to 163°C (325°F) and handling dynamic compressive strength ratings exceeding 207 MPa (30,000 psi), enabling reliable performance in high-load, low-speed industrial motion systems.

By Material

Metallic, plastic, and composite materials define the material segmentation, with metallic bearings accounting for about 55% share, benefiting from superior strength, heat resistance, and long-service reliability. Their dominance is supported by extensive use in automotive engines, aerospace assemblies, construction equipment, and high-load industrial systems. Growth is driven by continuous advancements in alloy formulations, tighter tolerance machining, and rising demand for precision components that withstand harsh operating environments. Meanwhile, composite bearings gain traction in lightweight and corrosion-prone applications due to their self-lubricating properties and reduced maintenance needs.

- For instance, RBC’s self-lubricating bearings (under their “Fiberglide® / Fabroid®” liner systems) are specified with maximum compressive strength of 10,000 psi and an operating temperature range from –250 °F to +200 °F, making them suitable for applications where corrosion resistance and maintenance-free operation are critical.

By End User

Automotive, industrial, aerospace, energy, construction machinery, agriculture and gardening equipment, oilfield machinery, office products, and other sectors participate in the market, with the automotive segment leading at nearly 34% share as it extensively uses plain bearings in engines, transmissions, steering systems, and suspension components. Its dominance is propelled by increased global vehicle production, stricter emission norms requiring efficient friction-reducing components, and growing adoption of hybrid and electric powertrains. Industrial applications follow closely, supported by rising automation, expanding manufacturing capacity, and demand for long-life bearings in high-cycle machinery.

Key Growth Drivers

1. Rising Demand from Automotive and Industrial Machinery

The Plain Bearing Market grows steadily as automotive and industrial machinery manufacturers adopt high-load, low-friction components to improve equipment reliability and efficiency. Bearings support engines, transmissions, pumps, compressors, and heavy-duty rotating systems, enabling longer service life and lower maintenance costs. Increasing global vehicle production, expanding manufacturing capacity, and stricter emission and fuel-efficiency regulations accelerate adoption. Electrification trends further drive demand for lightweight, durable bearings optimized for reduced noise and vibration in EV powertrains and auxiliary systems.

- For instance, Harbin Bearing Manufacturing Co., Ltd. (HRB) produces automotive-grade rolling element bearings (such as deep groove ball and tapered roller units) using high-carbon chromium-alloy steel rings with hardness levels reaching 58–64 HRC and dimensional accuracy up to ISO P5 tolerances, ensuring precision and durability in automotive applications.

2. Expansion of Aerospace, Energy, and Heavy Engineering Sectors

Aerospace, energy, and heavy-engineering industries contribute significantly to market growth due to their need for precision, high-temperature-tolerant, and corrosion-resistant bearing solutions. Plain bearings play crucial roles in turbines, aircraft landing gear, drilling tools, and renewable-energy equipment such as wind turbines. Rising investments in turbine upgrades, aviation modernization programs, and energy transition projects create sustained demand. The shift toward higher-efficiency propulsion systems and advanced materials reinforces market expansion, as manufacturers focus on products with improved wear resistance and enhanced load-bearing performance.

- For instance, Brammer PLC—through the Rubix Group—deploys I-care condition-monitoring technology for heavy industrial sectors, using robust wireless vibration sensors capable of sampling frequencies sufficient for monitoring standard industrial rotating machinery (typically up to 10 kHz frequency range with higher resonance capabilities). The systems generally operate within an industrial temperature range, such as –20 °C to +85 °C, making them suitable for process manufacturing and general industrial applications.

3. Advancements in Materials and Manufacturing Technologies

Manufacturers benefit from rapid advancements in composite materials, engineered plastics, and metal alloys that enhance bearing performance across extreme operating conditions. Improved surface treatments, self-lubricating materials, and precision machining technologies reduce friction, increase heat resistance, and extend operational lifespan. Additive manufacturing further supports customization for niche applications, enabling lighter and more durable components. These innovations lower lifecycle costs and expand suitability for harsh industrial environments. As industries prioritize longer service intervals and predictive maintenance, technologically advanced plain bearings gain wider adoption.

Key Trends & Opportunities

1. Increasing Adoption of Self-Lubricating and Maintenance-Free Bearings

A major trend centers on the growing adoption of self-lubricating and maintenance-free plain bearings that eliminate the need for external lubrication systems. Industries prefer these solutions for their ability to operate reliably in dusty, corrosive, and high-temperature environments, reducing downtime and maintenance labor. Demand rises in industrial automation, renewable energy systems, and automotive components that require long service intervals. Manufacturers capitalize on this opportunity by developing polymer-based and composite solutions with enhanced wear resistance, enabling broader penetration into high-precision and low-noise applications.

- For instance, NSK’s SPACEA™ high-temperature bearings are engineered to operate under extreme thermal conditions: their SJ-series bearings can withstand continuous operating temperatures up to 400 °C (in atmospheric or vacuum environments), while YS-series bearings tolerate up to 350 °C with solid-lubricant spacer joints.

2. Growth in Lightweight and Energy-Efficient Component Design

Lightweighting initiatives across automotive, aerospace, and industrial segments create strong opportunities for advanced bearing materials such as composites and high-performance plastics. These bearings reduce overall component weight while maintaining structural strength, supporting better fuel efficiency and lower emissions. Their corrosion resistance and low-friction properties align with sustainability and energy-efficiency goals. Manufacturers increasingly integrate finite-element simulation, precision casting, and reinforced polymer technologies to offer optimized designs, enabling deeper adoption in electric vehicles, drones, industrial robots, and compact machinery.

- For instance, NBI Bearings Europe engineers lightweight polymer-cage bearing assemblies that reduce cage mass compared with steel equivalents. These polymer cages are generally made from reinforced polyamide materials and are typically suitable for continuous operating temperatures up to 120 °C, making them ideal for standard industrial applications where reduced weight, low friction, and good elasticity are required.

3. Expansion of IoT-Enabled Predictive Maintenance Solutions

The shift toward predictive maintenance offers a strong market opportunity as industries adopt IoT sensors to monitor bearing temperature, vibration, load, and lubrication status. Intelligent plain bearings support early fault detection and reduce unplanned downtime in industrial automation, power generation, and logistics applications. Growth in smart factories and digital-twin technologies accelerates demand for embedded-sensor solutions. Manufacturers invest in data analytics platforms and integrated monitoring systems, meeting customer expectations for reliability and operational transparency across critical mechanical assemblies.

Key Challenges

1. Fluctuating Raw Material Prices and Supply Chain Constraints

Volatile prices of metals, engineered polymers, and composite materials pose a major challenge for manufacturers, directly impacting production costs and margin stability. Supply chain disruptions affecting alloy steel, bronze, and specialty polymers further complicate sourcing, especially in global manufacturing hubs. These uncertainties pressure companies to maintain competitive pricing while ensuring consistent product quality. Small and mid-scale manufacturers face greater risks, prompting the need for strategic supplier diversification, inventory optimization, and investment in material-efficient production technologies.

2. Performance Limitations Under Extreme Operating Conditions

Plain bearings, despite their versatility, face performance limitations in ultra-high-speed, heavy-shock, or extreme-temperature environments where rolling bearings or advanced hybrid solutions may outperform them. Excessive heat, inadequate lubrication, and abrasive contaminants accelerate wear, reducing service life and increasing maintenance frequency. These constraints restrict adoption in certain aerospace, marine, or high-precision industrial systems. Manufacturers must invest in novel materials, advanced coatings, and improved geometry designs to address durability concerns and compete with higher-performance bearing technologies.

Regional Analysis

North America

North America holds about 38% share of the Plain Bearing Market, supported by strong automotive production, advanced industrial machinery usage, and a high concentration of aerospace and defense manufacturers. The region benefits from established OEMs, extensive energy infrastructure, and rising investments in mining, construction equipment, and renewable energy systems that require durable bearing solutions. Demand is reinforced by strict equipment performance standards, rapid adoption of predictive-maintenance technologies, and continuous upgrades in manufacturing automation. Growth remains steady as companies expand high-precision bearing applications in EV platforms, hydraulic systems, and heavy-duty rotating machinery.

Europe

Europe accounts for nearly 28% share, driven by its strong engineering base, growing industrial automation, and the presence of major automotive and aerospace manufacturers. Stringent EU regulations on efficiency, emissions, and reliability accelerate the adoption of advanced plain bearings with low-friction characteristics. The region sees rising demand from machinery, wind energy, and rail transport, supported by investments in lightweight components and expanded use of composite and self-lubricating bearing materials. Germany, France, and the UK dominate consumption due to their high-precision manufacturing capabilities and continuous modernization of industrial and transportation infrastructure.

Asia-Pacific

Asia-Pacific holds about 30% share, emerging as the fastest-growing regional market due to rapid industrial expansion, large-scale automotive manufacturing, and increased spending on construction equipment and energy infrastructure. China, Japan, South Korea, and India drive volume growth through rising machinery production and strong demand for cost-efficient, durable bearings in heavy engineering sectors. Expanding EV manufacturing capacity and ongoing investments in industrial automation strengthen the region’s position. Local suppliers increasingly adopt advanced materials and precision machining technologies, enabling competitive pricing and wider penetration across manufacturing, agricultural machinery, and transportation applications.

Latin America

Latin America represents roughly 3–4% share, supported by gradual growth across automotive assembly, mining operations, and agricultural machinery markets. Countries such as Brazil, Mexico, and Argentina drive demand as manufacturers invest in reliable bearing components to improve equipment uptime in harsh operating environments. Industrial development, expansion of oil and gas projects, and modernized port logistics create additional opportunities. However, market expansion remains moderated by economic fluctuations and uneven industrial investment patterns. Increasing interest in maintenance-free and corrosion-resistant plain bearings strengthens long-term adoption across industrial and off-highway applications.

Middle East & Africa

The Middle East & Africa region captures nearly 4–5% share, driven by extensive oilfield machinery demand, large-scale energy projects, and growing investments in mining and construction. Gulf countries lead consumption as they diversify industrial bases and increase capital expenditure on petrochemical plants, turbines, and heavy-duty machinery that rely on high-performance plain bearings. Africa contributes through rising infrastructure development and agricultural equipment needs. Despite moderate growth, the market faces challenges from limited local manufacturing and reliance on imports. The shift toward durable, high-temperature, and corrosion-resistant bearing solutions supports steady future expansion.

Market Segmentations:

By Type:

By Material:

- Metallic bearings

- Plastic bearings

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Plain Bearing Market is shaped by a diverse group of global and regional manufacturers, including RHP Bearings, Rexnord Corporation, HKT Bearings Ltd., RBC Bearings Inc., Harbin Bearing Manufacturing Co., Ltd., Brammer PLC, NTN Corporation, NSK Global, NBI Bearings Europe, and JTEKT Corporation. the Plain Bearing Market is defined by continuous technological advancements, broad application diversity, and strong emphasis on performance-driven engineering. Manufacturers compete by expanding portfolios of high-load, low-friction, and maintenance-free bearing solutions tailored for automotive, industrial machinery, aerospace, energy, and construction equipment. Companies invest in precision machining, advanced alloys, engineered plastics, and composite materials to improve heat resistance, wear characteristics, and service life. Strategic priorities include strengthening OEM collaborations, enhancing global distribution networks, and leveraging automation to optimize production efficiency. Increasing demand for lightweight components, digital monitoring capabilities, and customized bearing geometries further intensifies competition across established and emerging markets.

Key Player Analysis

- RHP Bearings

- Rexnord Corporation

- HKT Bearings Ltd.

- RBC Bearings Inc.

- Harbin Bearing Manufacturing Co., Ltd.

- Brammer PLC

- NTN Corporation

- NSK Global

- NBI Bearings Europe

- JTEKT Corporation

Recent Developments

- In October 2024, igus introduced iglidur JPF, a new, high-performance, self-lubricating plain bearing material that is free from PTFE (polytetrafluoroethylene), a PFAS chemical, to offer sustainable, compliant alternatives ahead of potential EU regulations, providing similar wear resistance to the popular iglidur J material. This is part of igus’s broader push to replace PTFE in its motion plastics, expanding its range of PFAS-free bearings for various industrial needs.

- In September 2024, The Canadian-based industrial distribution group Ficodis, owned by France-based Descours & Cabaud, acquired Berliss Bearing Company. In its 2nd U.S. acquisition this year, Ficodis added a Whippany, NJ-based company that specializes in manufacturing and distributing mechanical seals and bearing products. Berliss Bearing Company also offers pump seal assemblies and electric motor quality bearings.

- In February 2024, NTN Corporation supplied specialized bearings for the turbo pumps of the H3 rocket’s engines for its second test flight (H3TF2) designed to handle extreme conditions with high-speed rotation and cryogenic temperatures, utilizing proprietary lubricants and strong retainers for reliability in space.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as industries increase adoption of high-load and low-friction bearing solutions.

- Manufacturers will focus on advanced materials, including composites and engineered plastics, to improve durability.

- Demand will rise for maintenance-free and self-lubricating bearings across industrial and automotive applications.

- Electrification in transportation will drive the need for lightweight and low-noise bearing designs.

- Aerospace and energy sectors will adopt more high-temperature and corrosion-resistant bearing technologies.

- Predictive maintenance and IoT integration will gain traction for performance monitoring and lifecycle optimization.

- Automation in manufacturing will accelerate demand for precision-engineered plain bearings.

- Emerging economies will contribute significantly through industrial growth and infrastructure expansion.

- Customization capabilities enabled by additive manufacturing will shape niche and high-performance applications.

- Sustainability requirements will encourage development of energy-efficient designs and recyclable bearing materials.

Market Segmentation Analysis:

Market Segmentation Analysis: