Market Overview:

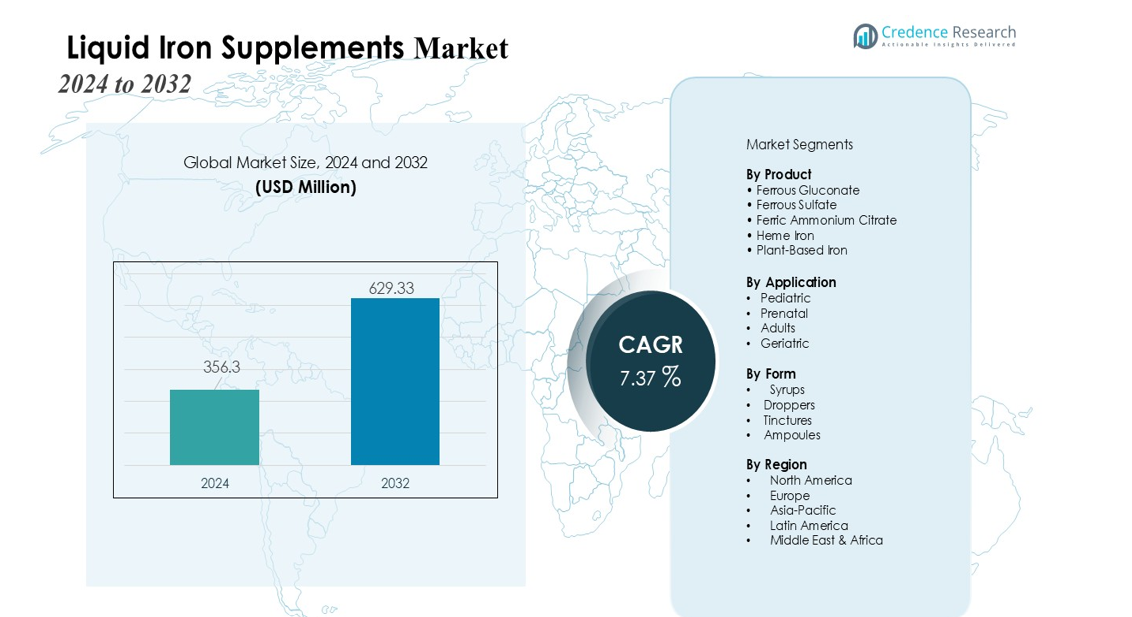

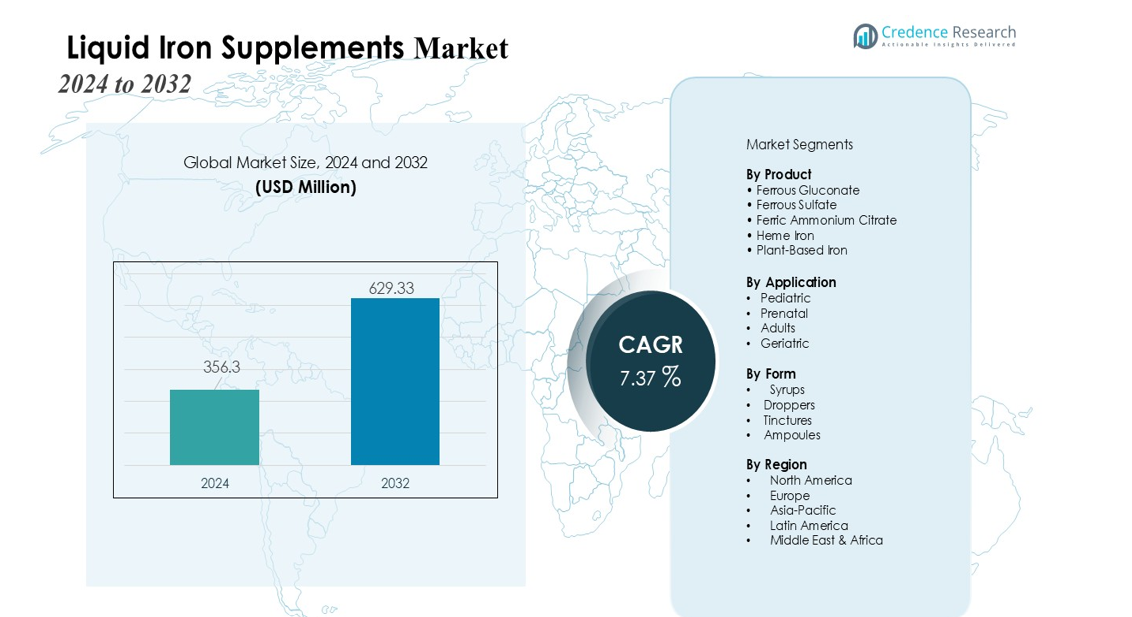

The Liquid Iron Supplements Market size was valued at USD 356.3 million in 2024 and is anticipated to reach USD 629.33 million by 2032, at a CAGR of 7.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquid Iron Supplements Market Size 2024 |

USD 356.3 million |

| Liquid Iron Supplements Market, CAGR |

7.37% |

| Liquid Iron Supplements Market Size 2032 |

USD 629.33 million |

Rising global prevalence of iron-deficiency anemia (IDA) acts as a key catalyst for market expansion. Healthcare professionals recommend liquid iron supplements to improve hemoglobin levels, support maternal health, and address nutritional gaps among individuals with malabsorption disorders. The shift toward preventive healthcare, coupled with growing awareness of micronutrient insufficiency, further drives adoption. Expanding retail penetration through pharmacies, online platforms, and wellness stores also enhances product accessibility.

Regionally, North America leads the market due to strong healthcare awareness, high supplement consumption rates, and robust clinical recommendations for iron intake among pregnant women and children. Europe follows with rising demand for plant-based and clean-label formulations. Asia-Pacific is the fastest-growing region, supported by high IDA prevalence, improving healthcare infrastructure, and increasing adoption of nutritional supplements across India, China, and Southeast Asia.

Market Insights:

- The USD 356.3 million Liquid Iron Supplements Market is set to reach USD 629.33 million by 2032, driven by a strong rise in global iron-deficiency anemia cases.

- Increasing clinical preference for liquid formulations enhances demand due to faster absorption and better tolerance among children, pregnant women, and individuals with malabsorption issues.

- Growing preventive healthcare awareness encourages proactive iron intake, supported by physician recommendations and rising consumer focus on immunity and energy.

- Product accessibility improves through expanding retail channels, including pharmacies, e-commerce, and specialty nutrition stores, boosting overall adoption.

- Innovation in high-absorption, flavored, sugar-free, and gentle-on-stomach formulations enhances user compliance and market differentiation.

- Despite growth, concerns over gastrointestinal side effects, inconsistent absorption, and misconceptions about iron safety pose barriers to consistent usage.

- North America leads market share due to strong healthcare awareness, while Asia-Pacific emerges as the fastest-growing region with rising anemia prevalence and expanding healthcare infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Preference for High-Absorption and Easy-to-Consume Formulations Enhances Adoption

Consumers prefer liquid formats because they offer superior bioavailability compared with traditional tablets or capsules. The Liquid Iron Supplements Market benefits from high demand among children, older adults, and individuals with swallowing difficulties. It enables flexible dosing, which supports personalized nutrition plans. Product manufacturers introduce flavored, sugar-free, and gentle-on-stomach variants that improve adherence.

- For instance, Ferretts IPS liquid iron supplement is clinically proven to have high bioavailability and a gentle formula suitable for sensitive stomachs, with absorption rates optimized for faster iron replenishment.

Expansion of Preventive Healthcare and Nutrition Awareness Drives Consumption

Preventive healthcare trends encourage individuals to address micronutrient gaps before symptoms appear. The Liquid Iron Supplements Market grows as consumers follow physician guidance, wellness recommendations, and digital health insights highlighting iron’s role in energy and immunity. It appeals to fitness-oriented users and women in reproductive age groups who require consistent iron intake. Retail education initiatives and health campaigns expand general awareness.

- For Instance, Active Iron rebranded and updated its existing capsule iron supplement range for pregnant women, including the release of higher-dose products like Active Iron Advance (25mg) and the comprehensive Active Iron Pregnancy Plus.

Wider Retail Availability and Product Diversification Improves Market Penetration

E-commerce platforms, pharmacies, and specialty nutrition stores increase access to liquid iron products. The Liquid Iron Supplements Market advances as brands invest in clean-label, plant-based, and organic ingredient profiles. It benefits from rapid home-delivery systems and subscription-based supplement programs that support consistent use. Companies strengthen distribution networks to reach underserved regions and high-need demographics.

Market Trends:

Shift Toward Clean-Label, Plant-Based, and Gentle Formulations Shapes Product Innovation

Consumers seek iron supplements that align with natural, vegan, and allergen-free expectations, which guides product development across the Liquid Iron Supplements Market. Brands reformulate products with plant-derived iron sources, minimal additives, and bioactive enhancers that support efficient absorption. It appeals to health-conscious users who prioritize transparency, sustainability, and digestive comfort. Companies introduce sugar-free, gluten-free, and preservative-free variants that meet diverse dietary preferences. Flavored liquid formats gain traction because they mask metallic taste concerns that reduce adherence in traditional iron supplements. Digital reviews and wellness influencers elevate demand for clean-label offerings. Manufacturers expand R&D investment to strengthen product appeal across multiple consumer profiles.

- For instance, Floradix® Iron + Herbs Liquid Herbal Supplement delivers 10 mg of iron from ferrous gluconate combined with essential B vitamins and vitamin C, enabling gentle digestion and enhanced bioavailability without artificial additives.

Integration of Personalized Nutrition, Digital Adoption, and Omni-Channel Retail Boosts Market Expansion

Personalized nutrition platforms recommend liquid iron formulations based on biomarker results, lifestyle assessments, and dietary patterns, which elevates precision in supplementation. The Liquid Iron Supplements Market benefits from rising demand for tailored health solutions supported by AI-driven nutrition apps and at-home diagnostic kits. It gains stronger visibility through online pharmacies, D2C brands, and subscription-based services that ensure consistent product use. Omni-channel retail strengthens user engagement by connecting physical stores with digital ecosystems. Health practitioners rely on telehealth consultations to guide dosage selection and product choice with higher accuracy. Brands increase consumer education through digital campaigns that highlight benefits, safety profiles, and usage convenience. E-commerce analytics support faster product optimization and targeted outreach.

- For instance, Lubrizol Life Science Health developed a prototype of iron-fortified, plant-based gummies featuring 10mg elemental iron per serving using LIPOFER™ microencapsulation technology, addressing bioavailability and side effect concerns effectively.

Market Challenges Analysis:

Concerns Over Gastrointestinal Side Effects and Variable Absorption Limit Consistent Usage

Many consumers report nausea, constipation, or metallic taste with certain iron formulations, which reduces long-term adherence and creates hesitation toward supplementation. The Liquid Iron Supplements Market faces challenges when users experience discomfort despite improved bioavailability claims. It requires continuous innovation to develop gentler formulations that maintain therapeutic effectiveness. Healthcare providers emphasize proper dosing, yet inconsistent usage patterns affect treatment outcomes. Competition from fortified foods and alternative iron delivery systems reduces reliance on liquid formats. Some consumers avoid iron supplements altogether due to misconceptions about safety and overconsumption risks.

Regulatory Compliance, Quality Control, and Pricing Pressure Affect Market Stability

Stringent labeling norms and varying global regulatory standards require brands to maintain high product transparency and consistent testing practices. The Liquid Iron Supplements Market must navigate complex stability requirements because liquid products face higher contamination and degradation risks. It demands investment in packaging technology, which increases production costs and impacts pricing strategies. Smaller manufacturers struggle to compete with established brands that dominate distribution channels. Fluctuating raw material costs influence profitability and limit innovation budgets. Supply-chain delays and limited access to high-quality iron sources disrupt product availability across certain regions.

Market Opportunities:

Expansion of Preventive Health, Maternal Nutrition, and Pediatric Supplementation Creates Strong Growth Potential

Preventive health awareness increases demand for iron products that support immunity, energy, and developmental needs across multiple age groups. The Liquid Iron Supplements Market gains opportunities through rising focus on maternal nutrition and early-life micronutrient interventions. It aligns with national health programs that prioritize anemia reduction and prenatal care. Pediatric-friendly liquid formats attract parents who require safe, gentle, and easy-to-dose solutions. Growing interest in women’s wellness further broadens the consumer base. Healthcare professionals recommend routine supplementation, which expands long-term usage potential.

Innovation in Clean-Label, Personalized, and Digital-First Solutions Strengthens Market Expansion

Clean-label and plant-based formulations open new avenues for brands targeting health-conscious consumers seeking transparency and minimal additives. The Liquid Iron Supplements Market can capitalize on personalized nutrition platforms that guide dosing through biomarker insights and lifestyle analytics. It benefits from digital retail environments where subscription-based supply and telehealth guidance improve adherence. Opportunities arise from sugar-free, allergen-free, and bioactive-enhanced variants that meet evolving dietary expectations. Emerging markets experience strong demand due to rising healthcare access and anemia prevalence. Companies that expand distribution into underserved regions gain significant competitive advantage.

Market Segmentation Analysis:

By Product

The Liquid Iron Supplements Market includes ferrous gluconate, ferrous sulfate, ferric ammonium citrate, heme iron, and plant-based iron variants. Ferrous gluconate leads due to its favorable tolerance profile and strong clinician preference for general anemia management. It appeals to users who require gentle formulations that reduce gastrointestinal discomfort. Heme iron gains traction among consumers seeking higher absorption and fewer dietary interactions. Plant-based products attract vegan and clean-label buyers who prioritize natural ingredients. The category benefits from continuous innovation in taste-masking and flavor enhancement.

- For instance, ferrous gluconate is recognized for its high bioavailability and reduced gastrointestinal side effects; clinical studies have demonstrated significant improvement in hemoglobin levels within 12 weeks of supplementation with ferrous gluconate, supporting its use in iron deficiency anemia treatment with an increase in hemoglobin concentration by approximately 1.0 g/dL over the treatment period.

By Application

Key applications cover pediatric care, prenatal nutrition, adult supplementation, and geriatric support. Pediatric usage grows rapidly because liquid formats allow precise dosing and easy ingestion. The Liquid Iron Supplements Market records strong demand in prenatal care where physicians emphasize consistent iron intake for maternal and fetal health. It supports adult users dealing with fatigue, low hemoglobin, or restricted diets. Geriatric adoption rises due to the need for highly absorbable iron that suits individuals with compromised digestion. Healthcare providers influence consumption patterns through structured supplementation protocols.

- For instance, Active Iron offers a clinically proven 25mg iron supplement in capsule form that increases iron and energy levels while being gentle on the stomach, utilizing a patented whey protein formulation to optimize nutrient absorption in adult users

By Form

Primary forms include droppers, syrups, tinctures, and ampoules. Syrups dominate due to wide availability, improved palatability, and suitability for all age groups. Droppers attract parents and caregivers who need controlled dosing for infants and children. It creates opportunities for brands to introduce sugar-free and flavored versions tailored to sensitive users. Tinctures appeal to consumers who prefer concentrated formulations with minimal additives. Ampoules serve clinical settings where precise, single-use dosage improves safety and compliance.

Segmentations:

By Product

- Ferrous Gluconate

- Ferrous Sulfate

- Ferric Ammonium Citrate

- Heme Iron

- Plant-Based Iron

By Application

- Pediatric

- Prenatal

- Adults

- Geriatric

By Form

- Syrups

- Droppers

- Tinctures

- Ampoules

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads with Strong Healthcare Awareness and High Supplement Adoption

North America holds the dominant share due to strong clinical emphasis on early anemia detection and widespread consumer engagement in nutritional supplementation. The Liquid Iron Supplements Market gains traction as healthcare providers recommend liquid formats for children, pregnant women, and older adults. It benefits from well-established retail networks, including pharmacies, online channels, and specialty nutrition stores. High prevalence of iron-deficiency anemia among women of reproductive age supports sustained demand. Brands introduce clean-label, flavored, and gentle-on-stomach variants that align with evolving consumer expectations. Government and clinical guidelines promote consistent iron intake, which strengthens adoption across all age groups.

Europe Shows Steady Demand Supported by Regulatory Standards and Preference for Natural Formulations

Europe records stable growth driven by structured healthcare systems, strong nutrition awareness, and rising interest in plant-based wellness products. The Liquid Iron Supplements Market expands across Germany, France, the UK, and Nordic countries where consumers prioritize safety, transparency, and quality-certified formulations. It benefits from strict regulatory frameworks that promote high product consistency and labeling accuracy. Regional users adopt liquid iron supplements to support energy balance, immune function, and prenatal health. Retailers highlight clean-label and allergen-free products that appeal to environmentally conscious buyers. Public health initiatives address anemia prevalence, which sustains long-term consumption.

Asia-Pacific Emerges as the Fastest-Growing Region Due to Rising Anemia Burden and Expanding Healthcare Access

Asia-Pacific shows the strongest growth momentum driven by high rates of iron-deficiency anemia in India, China, and Southeast Asia. The Liquid Iron Supplements Market grows steadily because consumers gain better access to nutritional products through pharmacies, e-commerce platforms, and community clinics. It aligns with government programs focused on maternal health and child nutrition. Rising disposable incomes support higher spending on preventive wellness solutions. Local and international brands introduce affordable liquid formats that appeal to diverse income segments. Urbanization and lifestyle shifts increase awareness of micronutrient deficiencies, which strengthens long-term market potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AdvaCare Pharma

- Aspen Pharmacare

- Feosol

- Kolinpharma SpA

- Kye Pharmaceuticals, Inc.

- Nemysis Ltd.

- Ortho Molecular Products

- Raffles Medical Group

- Shield Therapeutics plc

- Solvsotrin

Competitive Analysis:

The Liquid Iron Supplements Market features a diverse competitive landscape characterized by global pharmaceutical companies, specialized nutrition brands, and emerging innovators focusing on bioavailable and gentle formulations. Key players include AdvaCare Pharma, Aspen Pharmacare, Feosol, Kolinpharma SpA, Kye Pharmaceuticals, Inc., Nemysis Ltd., Ortho Molecular Products, Raffles Medical Group, Shield Therapeutics plc, and Solvotrin.

These companies invest in R&D to improve absorption, taste, and gastrointestinal tolerance, which strengthens product differentiation. It drives competition toward clean-label, plant-based, and pediatric-friendly formulations that meet evolving consumer expectations. Leading brands expand digital outreach and retail distribution to capture a wider user base across pharmacies, e-commerce platforms, and health clinics. Strategic collaborations allow firms to enhance clinical evidence, regulatory compliance, and geographic presence. Market participants emphasize innovation in formulation stability and packaging to maintain quality and extend shelf life.

Recent Developments:

- In November 2025, AdvaCare Pharma actively participated in the VIV MEA 2025 event in Abu Dhabi during November 25–27, marking its ongoing business development initiatives in the MENA region.

- In November 2024, Nemysis Ltd announced the successful acquisition of TFarma SRL by its wholly-owned subsidiary Enteralia Bioscience SRL, establishing a strong sales and distribution platform in Italy focused on women’s health and gastroenterology.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application, Form and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Rising focus on preventive healthcare will increase long-term demand for liquid iron across all age groups.

- Growing awareness of iron-deficiency anemia will strengthen adoption through physician guidance and public health programs.

- Expansion of clean-label, vegan, and allergen-free formulations will attract health-conscious consumers.

- Digital health platforms will improve adherence through personalized dosing recommendations and virtual consultations.

- E-commerce growth will enhance accessibility across emerging and remote markets.

- Improved taste-masking technologies will increase acceptance among pediatric and sensitive user groups.

- Stronger clinical evidence supporting high-absorption liquid formats will reinforce physician preference.

- Product diversification across flavored, sugar-free, and gentle-on-stomach variants will broaden the consumer base.

- Strategic partnerships between manufacturers and healthcare institutions will expand distribution networks.

- Innovation in packaging stability and shelf-life improvement will support global market competitiveness.