| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK RFID Market Size 2024 |

USD 594.67 Million |

| UK RFID Market, CAGR |

10.1% |

| UK RFID Market Size 2032 |

USD 1,415.42 Million |

Market Overview

The UK RFID Market is projected to grow from USD 594.67 million in 2024 to an estimated USD 1,415.42 million by 2032, with a compound annual growth rate (CAGR) of 10.1% from 2025 to 2032. This growth is driven by the increasing adoption of RFID technology across multiple industries, including retail, logistics, and healthcare, as companies look to improve efficiency and enhance supply chain management.

Several factors are driving the growth of the UK RFID Market, including the rising demand for automation in logistics and retail operations. The ability of RFID systems to provide real-time tracking and enhance inventory accuracy is a significant trend. Additionally, increasing investments in smart supply chains and automation technologies further accelerate the market’s growth. The healthcare industry is also benefiting from RFID technology, with applications ranging from patient tracking to pharmaceutical inventory management, thus contributing to the market’s expansion.

Geographically, the UK holds a strong position in the European RFID Market, with a growing demand for advanced technologies. The market is highly competitive, with key players such as Zebra Technologies, Honeywell International, and Impinj driving innovations and expanding their product offerings. The presence of these major companies, alongside continuous technological advancements, positions the UK as a prominent player in the RFID market within Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK RFID Market is projected to grow from USD 594.67 million in 2024 to USD 1,415.42 million by 2032, at a CAGR of 10.1%. The growth is driven by increasing adoption across industries like retail, logistics, and healthcare.

- The Global RFID Market is projected to grow from USD 14,378.18 million in 2024 to an estimated USD 34,461.82 million by 2032, with a compound annual growth rate (CAGR) of 10.2% from 2025 to 2032.

- Key drivers include the rising demand for automation in logistics and retail operations, as well as the need for improved inventory accuracy and real-time tracking in various sectors.

- High initial implementation costs, particularly for small and medium-sized enterprises, and concerns about data privacy and security may limit the widespread adoption of RFID technology.

- The UK holds a prominent position in the European RFID market, driven by strong demand from the retail and healthcare sectors. The South East of England and London are major hubs for RFID adoption.

- RFID technology is increasingly used in the healthcare sector for patient safety, asset management, and inventory control, with significant potential for growth in the coming years.

- Advancements in UHF RFID technology and the integration of RFID with IoT and AI are expected to drive further market innovation, especially in supply chain and logistics management.

- The market is competitive, with key players such as Zebra Technologies, Honeywell International, and Impinj driving innovations and expanding product portfolios in the RFID sector.

Report Scope

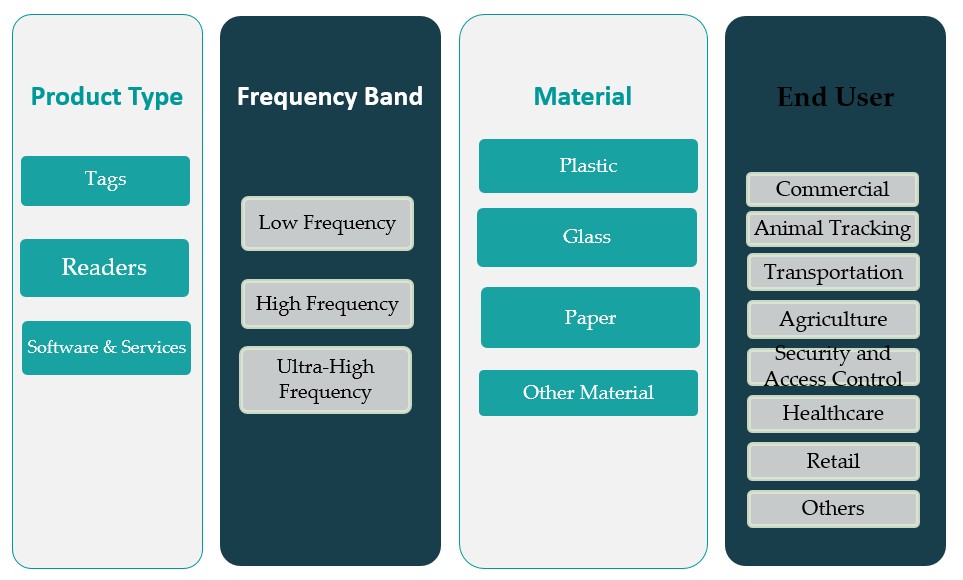

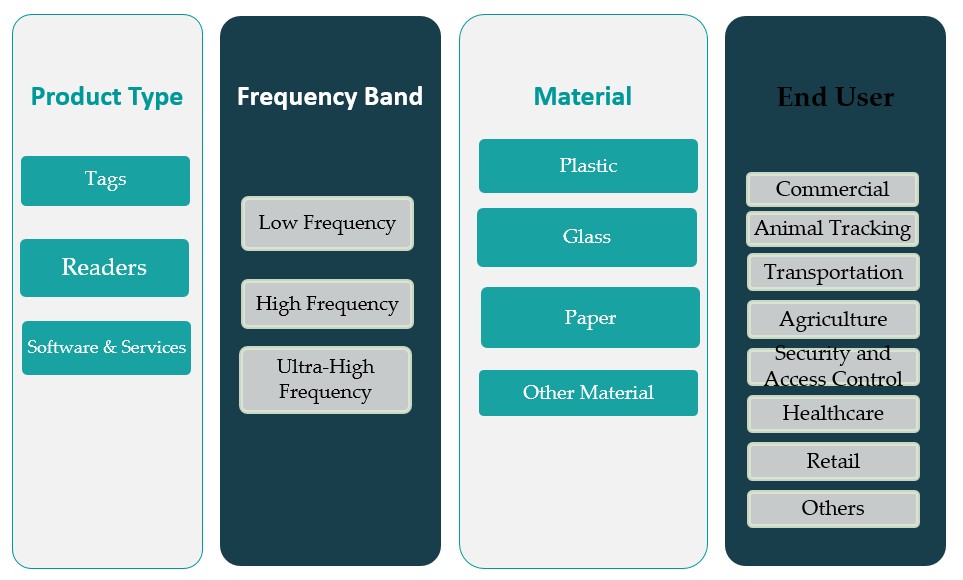

This report segments the UK RFID Market as follows:

Market Drivers

Increased Demand for Automation in Retail and Logistics

The UK RFID Market is primarily driven by the growing demand for automation in retail and logistics operations. RFID technology plays a pivotal role in enhancing operational efficiency by streamlining inventory management, reducing human errors, and improving the accuracy of stock control. Retailers and logistics companies in the UK have widely adopted RFID to automate processes such as inventory tracking, product categorization, and stock replenishment. For instance, Marks & Spencer implemented RFID across 750 stores, improving inventory accuracy from 65% to 98.9% within six months. This resulted in a £2.8M reduction in stock holding costs and a 9.2% increase in sales through improved availability. Moreover, the rise in e-commerce and omnichannel retailing has led to a surge in inventory management complexities. The demand for faster and more accurate fulfillment has created a need for systems that provide seamless integration between warehouses, distribution centers, and retail locations. Tesco’s RFID-enabled supply chain transformation reduced costs by 23% while improving on-shelf availability by 92%. As the UK continues to see growth in e-commerce and online shopping, the demand for RFID solutions to streamline processes such as order fulfillment, inventory accuracy, and customer service will continue to increase.

Advancements in Healthcare Applications

Another key driver fueling the growth of the UK RFID Market is the adoption of RFID technology within the healthcare sector. Healthcare organizations are increasingly leveraging RFID systems to improve patient safety, streamline operations, and optimize asset management. For instance, leading hospitals in the UK have deployed RFID-enabled wristbands for over 1 million patients to ensure accurate identification and minimize medical errors. Additionally, healthcare facilities are leveraging RFID to track medical equipment, with over 500,000 medical assets monitored using RFID systems. RFID technology plays a vital role in the management of medical equipment and pharmaceuticals. Hospitals and clinics are increasingly using RFID tags to track medical devices, ensuring that equipment is available when needed and properly maintained. RFID is also used to monitor the expiration dates of pharmaceuticals, helping healthcare facilities maintain inventory integrity and avoid administering expired medications. These applications contribute to the overall efficiency, safety, and cost-effectiveness of healthcare operations, making RFID technology an essential tool for the sector. As the UK’s healthcare system continues to digitize and move toward more patient-centered care, RFID adoption is expected to grow significantly in the coming years.

Government Support and Regulatory Initiatives

The UK government plays a vital role in driving the adoption of RFID technology through regulatory frameworks and initiatives aimed at fostering innovation and technological advancements. Several government-backed initiatives focus on enhancing supply chain efficiency, improving public sector operations, and facilitating the digital transformation of industries. RFID is a key enabler of these efforts, particularly in areas such as inventory management, asset tracking, and transportation. The government’s push for smart city initiatives and digital infrastructure development creates an environment that fosters the adoption of RFID systems across various sectors, including public transportation, logistics, and healthcare. Furthermore, regulatory requirements around asset traceability and transparency are increasing in industries such as food safety and pharmaceuticals. For instance, stringent regulations on food labeling and product traceability have driven the adoption of RFID technology to track goods from production to distribution, ensuring compliance with safety standards and regulations. In the healthcare industry, government mandates on the traceability of drugs and medical devices have further propelled the use of RFID for tracking and managing medical assets. These regulatory drivers are expected to continue influencing the UK RFID market, as organizations seek to meet compliance requirements and improve operational efficiency.

Growing Awareness of the Environmental and Economic Benefits

The increasing focus on sustainability and environmental responsibility is another significant driver of the UK RFID market. RFID technology provides a valuable solution for companies aiming to reduce waste, improve resource management, and minimize their environmental footprint. In retail and logistics, RFID allows for more precise inventory management, reducing overstocking and understocking, which in turn minimizes waste. For example, RFID enables better demand forecasting and real-time tracking, leading to optimized stock levels and fewer product disposals. This contributes to more sustainable supply chains and lower operational costs, aligning with the growing demand for environmentally conscious business practices. Additionally, RFID’s role in energy efficiency is becoming more recognized. In manufacturing and industrial sectors, RFID systems help optimize the use of resources, monitor energy consumption, and improve supply chain visibility. By improving the accuracy of inventory tracking and reducing operational inefficiencies, RFID contributes to both economic savings and environmental sustainability. As more companies in the UK recognize these benefits, there will likely be an increase in RFID adoption, particularly among businesses seeking to meet sustainability goals and reduce their carbon footprints. The combination of environmental and economic advantages is positioning RFID technology as a key driver of operational transformation in the UK market.

Market Trends

Integration of RFID with IoT and AI for Smarter Supply Chains

The UK RFID Market is witnessing a growing trend of integrating RFID technology with the Internet of Things (IoT) and Artificial Intelligence (AI) to create smarter, more efficient supply chains. By combining RFID with IoT, businesses can achieve real-time tracking of assets and inventory, providing deeper insights into operations. For instance, over 5,000 UK-based logistics and retail companies have integrated RFID with IoT to enhance supply chain visibility and automate inventory management. RFID tags embedded in IoT devices enable automatic data collection, while AI-powered analytics help businesses forecast demand, monitor stock levels, and predict potential disruptions. This integration allows businesses to reduce operational costs, minimize inventory errors, and enhance decision-making through data-driven insights. The fusion of RFID with IoT and AI is particularly prominent in sectors like retail, logistics, and healthcare, where speed, accuracy, and efficiency are crucial. As the need for smarter supply chain solutions continues to rise, this trend is expected to shape the future of RFID technology in the UK.

Rise of RFID in Healthcare for Patient Safety and Asset Management

A notable trend in the UK RFID Market is the increasing use of RFID technology in healthcare applications. Healthcare organizations are adopting RFID to improve patient safety, optimize asset management, and streamline operational workflows. Leading hospitals in the UK have deployed RFID-enabled wristbands for over 1 million patients to ensure accurate identification and minimize medical errors. Additionally, healthcare facilities are leveraging RFID to track medical equipment, with over 500,000 medical assets monitored using RFID systems. By monitoring the location of devices in real time, hospitals can ensure that critical equipment is available when needed, reducing inefficiencies and improving patient care. This growing reliance on RFID is expected to continue as the UK healthcare sector embraces digital solutions to enhance patient safety and operational efficiency.

Growth of RFID in Retail for Enhanced Customer Experience

The UK retail sector is increasingly adopting RFID technology to improve customer experience and streamline operations. Retailers are utilizing RFID for inventory management, which enables more accurate stock levels, reduces out-of-stock situations, and optimizes restocking processes. Furthermore, RFID improves the in-store experience by enabling faster checkout through self-service kiosks or automated checkouts. Shoppers can also benefit from enhanced product information via RFID-enabled smart shelves or in-store displays. Retailers are embracing RFID as part of their digital transformation strategies, enhancing both operational efficiency and the customer journey. The ability to manage inventory more effectively and enhance customer engagement is driving the growing use of RFID technology in UK retail.

Adoption of RFID for Sustainability and Waste Reduction

Sustainability is a major focus in the UK RFID Market, with many companies adopting RFID technology to reduce waste and improve environmental responsibility. RFID enables better inventory management, allowing businesses to accurately track stock levels, minimize overstocking, and reduce waste from unsold goods. In industries like retail and manufacturing, RFID helps improve demand forecasting, leading to more efficient production and distribution processes. This not only helps in minimizing environmental impact but also contributes to economic savings by reducing losses from expired or unsold products. As sustainability becomes a key priority for both consumers and businesses, the demand for RFID technology is expected to increase, particularly as companies seek more eco-friendly solutions to optimize their supply chains and operations.

Market Challenges

High Initial Implementation Costs and ROI Concerns

One of the primary challenges facing the UK RFID market is the high initial cost of implementing RFID systems, which includes the cost of hardware, software, and system integration. For many businesses, particularly small and medium-sized enterprises (SMEs), the upfront investment in RFID technology can be prohibitive. While RFID offers long-term operational benefits such as increased efficiency, improved accuracy, and better inventory management, the return on investment (ROI) may take time to materialize, making it a challenging decision for organizations with limited budgets. For instance, the UK has been a pioneer in RFID adoption within the retail industry, where major retailers have integrated RFID technology to improve inventory accuracy and optimize business processes. RFID-enabled automated checkout systems and smart shelving solutions are being tested to enhance customer experience and streamline operations. Additionally, cloud-based RFID systems are gaining traction among UK businesses, providing scalability and real-time visibility across multiple locations without requiring large upfront investments in IT infrastructure.Additionally, the complexity of integrating RFID with existing enterprise resource planning (ERP) systems and other digital infrastructure adds to the financial burden. Companies must carefully evaluate the long-term benefits and potential cost savings before committing to RFID adoption. The challenge of balancing high initial costs with the promise of future savings and efficiency gains remains a significant barrier for many organizations considering RFID technology in the UK market.

Data Privacy and Security Concerns

Another key challenge in the UK RFID Market is related to data privacy and security. RFID systems generate large volumes of data, including information about product movements, inventory levels, and even consumer behavior. While this data can provide valuable insights for businesses, it also poses significant risks in terms of data protection. Unauthorized access to RFID data or the possibility of hacking into RFID systems could expose sensitive information, such as customer details or confidential product data. The UK’s strict data privacy regulations, such as the General Data Protection Regulation (GDPR), require businesses to ensure that RFID systems comply with legal requirements for data security and privacy. Failure to implement robust security measures could result in regulatory penalties, reputational damage, and a loss of customer trust. As RFID adoption grows, businesses must address these security concerns by adopting encryption, secure data transmission protocols, and other protective measures to safeguard RFID-generated data from cyber threats.

Market Opportunities

Expansion of RFID Applications in Retail and E-commerce

The UK RFID Market presents a significant opportunity for growth, particularly within the retail and e-commerce sectors. As the demand for seamless shopping experiences continues to rise, retailers are increasingly turning to RFID technology to enhance inventory management, improve supply chain transparency, and boost customer satisfaction. RFID enables real-time tracking of products, reducing stock-outs and overstocking issues, and improving the accuracy of inventory data. With the growing trend of omnichannel retailing, where customers expect consistency across physical and online shopping experiences, RFID adoption provides a solution for integrating store and warehouse systems, allowing for quicker fulfillment and better stock visibility. Additionally, RFID-driven innovations such as automated checkout systems and personalized customer experiences create new avenues for retailers to differentiate themselves in a highly competitive market. As e-commerce continues to dominate the UK retail landscape, there is a significant opportunity for RFID to be leveraged further to optimize operations and deliver superior customer service.

Healthcare Sector’s Increasing Demand for RFID Solutions

Another key opportunity for the UK RFID Market lies in the healthcare sector. With the increasing need for patient safety, asset management, and supply chain optimization, healthcare providers are turning to RFID solutions to improve operational efficiency and reduce errors. RFID technology is particularly valuable in tracking medical equipment, medications, and patient identities, which enhances accuracy in diagnostics, minimizes the risk of misidentification, and ensures the proper use of medical devices. As the UK’s healthcare system becomes more digitized, the integration of RFID in hospitals and clinics offers substantial potential for streamlining processes, improving patient outcomes, and reducing costs associated with manual tracking. The ongoing digital transformation in healthcare provides a growing market opportunity for RFID technology, making it an attractive area for investment and innovation.

Market Segmentation Analysis

By Product Type

The RFID market in the UK can be categorized into three primary product types: tags, readers, and software/services. RFID tags account for a significant portion of the market, as they are the core component used in tracking assets and inventory. These tags can vary in form, including passive, active, and semi-passive types, depending on the requirements of the application. RFID readers, which capture data from the tags, are another vital segment, supporting industries like logistics, retail, and healthcare. The third segment, software and services, encompasses the platforms and solutions required for data collection, analysis, and integration, enabling businesses to make data-driven decisions. As the demand for seamless and efficient data management increases, software and services are expected to play an increasingly important role in the UK RFID market.

By Frequency

The frequency segment of the RFID market in the UK is categorized into low frequency (LF), high frequency (HF), and ultra-high frequency (UHF). Each frequency type has distinct characteristics suited to different applications. LF RFID systems are typically used for applications requiring shorter read ranges, such as animal tracking and access control. HF RFID, often used in applications like contactless payments and ticketing, operates at a mid-range read distance, offering reliable data transmission. UHF RFID, with the longest range, is highly effective for logistics, inventory management, and retail applications. As industries demand faster and more accurate tracking, UHF RFID is seeing rapid adoption, particularly in supply chain and retail sectors.

Segments

Based on Product Type

- Tags

- Readers

- Software and Services

Based on Frequency

- Low Frequency

- High Frequency

- Ultra-High Frequency

Based on Material

- Plastic

- Glass

- Paper

- Others

Based on End User

- Commercial

- Animal Tracking

- Transportation

- Agriculture

- Security and Access Control

- Healthcare

- Retail

- Others

Based on Region

- London

- South East

- Midlands

Regional Analysis

London and the South East (45%)

The London and South East region holds the largest market share, accounting for approximately 45% of the UK RFID market. This is due to London’s status as a financial and business hub, where RFID solutions are increasingly adopted for asset tracking, inventory management, and access control across industries like retail, logistics, and finance. The region also benefits from a well-developed infrastructure and a high concentration of healthcare facilities, which have adopted RFID systems for patient and medical equipment tracking. The continuous growth of e-commerce and retail operations in this region further boosts the demand for RFID, with a focus on improving supply chain visibility and inventory management.

Midlands and North West (30%)

The Midlands and North West regions represent about 30% of the market share, driven primarily by manufacturing and automotive sectors, which are rapidly adopting RFID technology for inventory management, production line automation, and asset tracking. These regions are home to numerous large manufacturing facilities that rely on RFID to streamline operations, reduce downtime, and enhance supply chain efficiency. The North West, with its established logistics infrastructure, has seen growing interest in RFID for managing warehouse operations and enhancing the traceability of goods moving through the supply chain.

Key players

- Zebra Technologies Corporation

- Honeywell International Inc

- GAO RFID Inc.

- Avery Dennison Corporation

- HID Global Corporation

- Microchip Technology

- NXP Semiconductors

- ORBCOMM Inc

- Fargo Electronics

- Alien Technology LLC

- ID Tech

- Impinj

- Smartrac

- Data Capture Solutions

- Nedap

Competitive Analysis

The UK RFID market is highly competitive, with several key players dominating the landscape. Zebra Technologies Corporation and Honeywell International Inc. are leaders in the market, offering comprehensive RFID solutions spanning hardware and software. Both companies leverage their extensive product portfolios to cater to industries such as retail, logistics, and healthcare. GAO RFID Inc., Avery Dennison Corporation, and HID Global Corporation are also prominent players, specializing in advanced RFID tags, readers, and solutions that optimize inventory management and security systems. Microchip Technology and NXP Semiconductors focus on providing cutting-edge semiconductor technologies, powering RFID solutions with enhanced performance and cost-effectiveness. Impinj and Smartrac stand out for their innovative approaches in RFID tag development and data analytics. Other players like ORBCOMM Inc., Alien Technology LLC, and Nedap emphasize niche markets, offering specialized solutions tailored to specific applications such as asset tracking, animal management, and healthcare. These players continue to intensify competition by advancing their technology and expanding their market reach.

Recent Developments

- In June 2024, GlobeRanger released iMotion Data Orchestration, a solution that helps businesses manage edge devices such as IoT sensors, RFID readers, and other digital devices, capturing and processing data they generate.

- In February 2023, HID Global highlighted its support for an array of IoT technologies, emphasizing its role in developing RFID devices for various sectors including automotive, manufacturing, logistics, aerospace, and energy.

- On September 27, 2023, Zebra Technologies released its 2023 Global Warehousing Study, revealing that 58% of warehouse decision-makers plan to deploy RFID technology by 2028 to enhance inventory visibility and reduce out-of-stocks.

- In March 2024, Impinj settled a longstanding patent-infringement dispute with NXP Semiconductors, resulting in a one-time payment of $45 million and an annual license fee starting at $15 million in 2024, with incremental increases. Both companies withdrew any ongoing proceedings and signed a patent cross-licensing agreement.

- In April 2024, Identiv announced an agreement to sell certain operations and assets to security solutions provider Vitaprotech for $145 million. This includes divesting its physical security, access card, and identity reader operations. The transaction is expected to close in the third quarter.

- In November 2023, Avery Dennison completed the acquisition of Silver Crystal Group, a company specializing in customized jerseys and apparel for sports organizations.

Market Concentration and Characteristics

The UK RFID market is moderately concentrated, with a mix of global technology giants and specialized players competing for market share. Leading companies such as Zebra Technologies, Honeywell International, and Avery Dennison dominate the market through their extensive product portfolios and strong brand recognition. These companies offer comprehensive RFID solutions that cater to a wide range of industries, including retail, logistics, healthcare, and manufacturing. However, the market also features several niche players like Impinj, GAO RFID, and Alien Technology, which focus on specific applications such as asset tracking and inventory management. The market is characterized by a high level of innovation, with ongoing advancements in RFID technology, such as integration with IoT and AI, driving product development. While major players control a significant portion of the market, the growing demand for specialized solutions allows smaller, innovative companies to carve out their niche, contributing to a competitive landscape with opportunities for both consolidation and collaboration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Frequency, Material, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- As the UK retail and e-commerce industries continue to grow, RFID will become an integral tool for inventory management and customer experience optimization. This technology will enable faster stock replenishment and seamless omnichannel integration.

- RFID adoption in healthcare will expand, improving patient safety, asset tracking, and supply chain management. Hospitals will increasingly rely on RFID for real-time tracking of medical equipment and pharmaceuticals.

- The future of RFID will be marked by deeper integration with the Internet of Things (IoT) and Artificial Intelligence (AI). This convergence will create smarter supply chains and more predictive operational models for businesses across various sectors.

- The growing demand for contactless solutions, especially post-pandemic, will boost RFID adoption in sectors like retail, transportation, and access control, driven by its ability to enhance convenience and reduce physical touchpoints.

- Ultra-high-frequency (UHF) RFID systems will see continued advancements in range and accuracy, making them even more suitable for large-scale logistics and asset management applications in the UK.

- RFID will play a critical role in sustainable practices by reducing waste through better inventory management and enabling traceability in supply chains, particularly in industries like food and agriculture.

- The UK government’s push towards digital transformation, including smart cities and automation, will increase the adoption of RFID solutions in public services, transportation, and urban management.

- As RFID technology evolves, enhanced security measures, including encryption and anti-counterfeit features, will address privacy concerns, enabling greater acceptance across industries like healthcare and finance.

- With the increasing need for real-time data and automation in supply chains, RFID will become a vital technology for improving operational efficiency, tracking goods in transit, and enhancing warehouse management in logistics.

- RFID will see growth in agriculture and animal tracking applications, allowing for more efficient livestock management, traceability, and monitoring of farming assets, which is expected to drive market expansion in these sectors.