Market Overview:

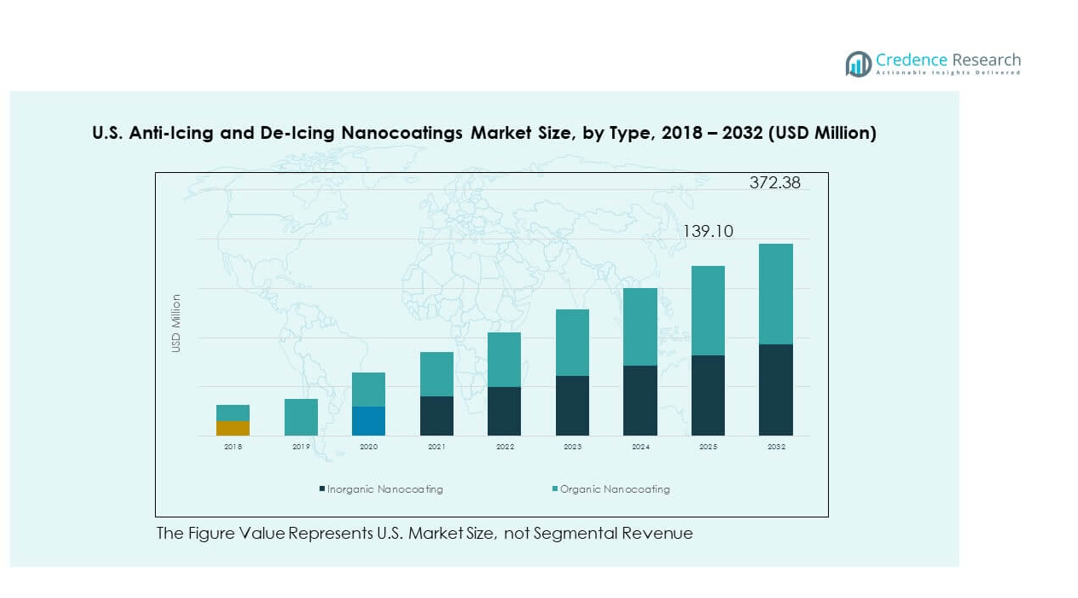

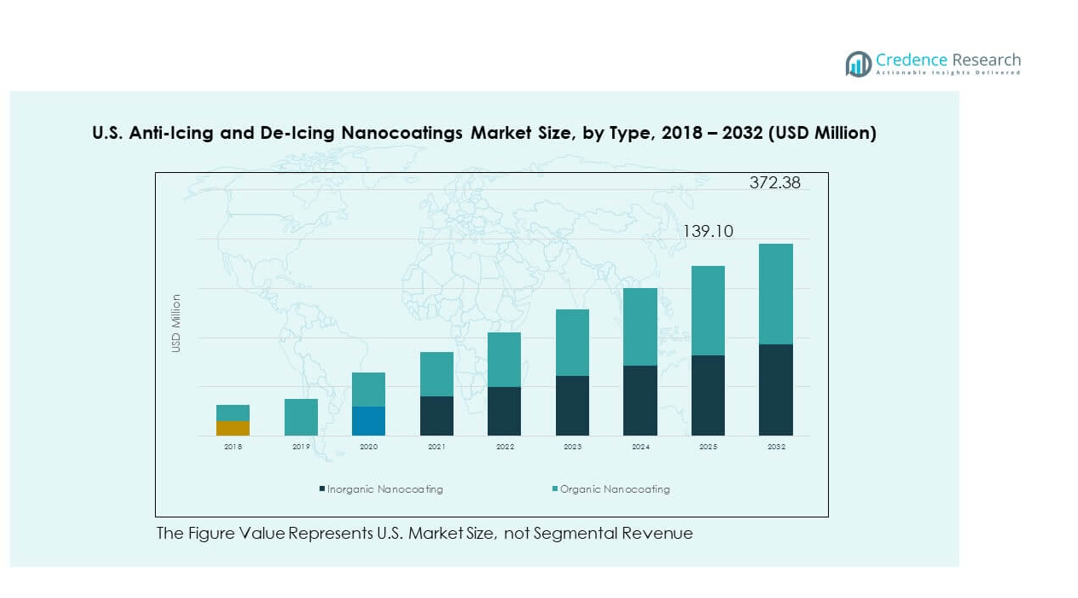

The U.S. Anti-Icing and De-Icing Nanocoatings Market size was valued at USD 52.21 million in 2018 to USD 121.68 million in 2024 and is anticipated to reach USD 372.38 million by 2032, at a CAGR of 15.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Anti-Icing and De-Icing Nanocoatings Market Size 2024 |

USD 121.68 million |

| U.S. Anti-Icing and De-Icing Nanocoatings Market, CAGR |

15.1% |

| U.S. Anti-Icing and De-Icing Nanocoatings Market Size 2032 |

USD 372.38 million |

Growth in this market is driven by rising demand for advanced coatings across aviation, automotive, and energy industries. Aviation operators rely on nanocoatings to prevent ice accumulation on critical components, ensuring safety and efficiency. Automotive manufacturers integrate these coatings to improve winter driving performance and reduce maintenance costs. The energy sector, especially wind power, uses them to minimize downtime and performance losses caused by ice on turbines. Increasing focus on sustainability and cost-effective solutions also strengthens adoption. Continuous R&D and material innovation expand product effectiveness and drive further deployment across industries.

The U.S. Anti-Icing and De-Icing Nanocoatings Market shows varied growth across subregions. The Northeast holds 32% share, supported by severe winters and strong adoption in aviation and energy. The Midwest accounts for 27% share, benefiting from large aviation hubs, extreme cold, and wind power projects. The South contributes 21% share, with demand from aviation hubs in Texas and Florida, along with textiles and packaging. The West holds 20% share, driven by aerospace, defense, and renewable energy, supported by California and Washington’s strong innovation ecosystem.

Market Insights:

- The S. Anti-Icing and De-Icing Nanocoatings Market was valued at USD 52.21 million in 2018, reached USD 121.68 million in 2024, and is projected to hit USD 372.38 million by 2032, growing at a CAGR of 15.1%.

- The Northeast (32%), Midwest (27%), and South (21%) hold the largest regional shares, supported by harsh winters, aviation hubs, and expanding infrastructure, making them dominant growth centers.

- The West (20%) is the fastest-growing region, driven by aerospace, defense, and renewable energy projects in California and Washington, supported by advanced research ecosystems.

- By type, inorganic nanocoatings account for 62% share due to their durability and performance in aviation, defense, and energy applications.

- Organic nanocoatings hold 38% share, gaining traction in textiles, packaging, and consumer goods because of their flexibility, ease of application, and cost efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Aviation Sector Demand for Ice-Resistant Surfaces Enhances Market Growth

The aviation industry drives strong demand for advanced nanocoatings that prevent ice accumulation on aircraft wings, fuselages, and sensors. Ice formation compromises safety, increases drag, and reduces fuel efficiency. Airlines adopt nanocoatings to reduce reliance on chemical de-icers, cutting operational costs and environmental impact. Regulatory standards for aviation safety also accelerate the adoption of these solutions. The U.S. Anti-Icing and De-Icing Nanocoatings Market benefits from the presence of major aerospace companies investing in innovative materials. Continuous research ensures these coatings withstand harsh flight conditions. It supports extended aircraft service life by limiting structural stress. Expanding passenger and cargo flights further reinforce demand for effective anti-icing technologies.

- For example, NEI’s NANOMYTE® SuperAi nanocomposite coating delivers durable anti-ice performance reducing ice adhesion by up to 80%. It supports both retrofit and OEM uses, offers erosion resistance, and helps lower power use by reducing dependence on active de-icing systems.

Expanding Wind Energy Projects Strengthen Use of Ice-Resistant Nanocoatings

The renewable energy sector leverages nanocoatings to improve turbine efficiency and uptime in icy conditions. Ice build-up on blades reduces energy output and raises maintenance costs for operators. Coatings provide a protective layer that reduces adhesion, supporting consistent performance. U.S. expansion in onshore and offshore wind energy boosts coating adoption. State-level renewable energy targets push developers toward advanced ice-prevention solutions. The U.S. Anti-Icing and De-Icing Nanocoatings Market gains momentum through strategic collaborations between material developers and energy companies. Research centers work on enhancing durability to meet long-term turbine deployment. It drives a competitive edge in sustaining clean energy output during winter months.

- For example, Phazebreak’s PCM-based coating expands at 32 °F to prevent ice from anchoring, forming a durable shell up to 4 mm thick that also repels debris and insects—boosting turbine uptime and efficiency in cold climates.

Increasing Automotive Integration of Advanced Coatings to Improve Safety and Efficiency

Automotive manufacturers deploy nanocoatings to maintain windshield clarity, sensor accuracy, and vehicle safety in winter conditions. Ice accumulation reduces visibility and disrupts performance of advanced driver assistance systems. Coatings support safer driving by limiting frost formation and simplifying defrosting. Growing consumer preference for winter-ready vehicles fuels demand for these solutions. Automakers incorporate nanocoatings in luxury and mass-market models alike to expand adoption. The U.S. Anti-Icing and De-Icing Nanocoatings Market grows steadily due to strong automotive R&D investment. It benefits from rising electric vehicle adoption, where energy efficiency is critical. Broader integration aligns with industry goals for safety, convenience, and sustainability.

Regulatory Push and Sustainability Goals Encourage Market Expansion

Government regulations on chemical de-icers motivate industries to transition to safer alternatives. Environmental concerns about glycol and salt-based de-icing agents accelerate adoption of nanocoatings. These coatings provide eco-friendly options that reduce chemical discharge into ecosystems. Federal and state authorities encourage aviation, automotive, and infrastructure operators to adopt sustainable solutions. The U.S. Anti-Icing and De-Icing Nanocoatings Market benefits from policies that promote clean technologies. It aligns with broader sustainability commitments across industries. Corporate ESG strategies drive investments in nanocoating innovation. Strong alignment of environmental regulations and technological readiness ensures steady market expansion.

Market Trends

Advanced Material Innovations Create Next-Generation Performance Standards

Nanocoating developers focus on multifunctional formulations with enhanced hydrophobicity, UV resistance, and durability. Research in composite nanostructures delivers coatings that perform across varying climates. Companies test nanocoatings that self-heal minor surface damage, extending lifecycle performance. The U.S. Anti-Icing and De-Icing Nanocoatings Market leverages advancements from universities and private labs. It positions nanocoatings as high-value solutions for critical applications. Manufacturers explore hybrid solutions combining anti-icing with anti-corrosion benefits. Ongoing trials validate coatings for long-term exposure on aircraft and infrastructure. This trend raises product reliability and adoption across diverse sectors.

- For example, FEYNLAB developed ceramic nano-coatings that blend SiO₂, Si₃N₄, and SiC instead of relying on SiO₂ alone. This hybrid nanoceramic formulation offers exceptional hardness, UV and chemical resistance, and a highly hydrophobic surface.

Expansion of Smart Surface Applications in High-Tech Industries

Smart surfaces integrate nanocoatings with sensing capabilities to detect and manage ice build-up. Aerospace and automotive sectors explore coatings that trigger real-time monitoring systems. This integration supports predictive maintenance and safety alerts. Electronics and defense industries test nanocoatings with conductivity features, combining ice resistance with signal functionality. The U.S. Anti-Icing and De-Icing Nanocoatings Market evolves by aligning with broader smart material adoption. It unlocks new value streams for industries seeking advanced surface intelligence. Partnerships between coating firms and sensor manufacturers enhance innovation. This trend strengthens market competitiveness and technology leadership.

Growing Infrastructure Applications Across Cold Climate Regions

Infrastructure operators increasingly adopt nanocoatings to protect bridges, powerlines, and rail systems from ice damage. Ice accumulation causes operational risks, delays, and costly repairs. Coatings offer long-lasting solutions that minimize maintenance demands. U.S. transportation agencies explore pilot projects using nanocoatings on road surfaces and overhead structures. The U.S. Anti-Icing and De-Icing Nanocoatings Market benefits from these trials gaining wider interest. It reflects the shift toward sustainable infrastructure solutions for extreme weather resilience. Large contractors evaluate integration for cost efficiency. This trend signals broader acceptance beyond aerospace and energy.

Rising Collaborations Between Academia, Industry, and Government Programs

Collaborative programs accelerate innovation and testing of advanced nanocoatings. Research institutions conduct field trials with government support to validate performance. Federal funding supports technology transfer into commercial applications. The U.S. Anti-Icing and De-Icing Nanocoatings Market expands through public-private partnerships. It creates platforms for scaling laboratory innovations into industrial deployment. Aerospace and energy firms partner with universities to refine formulations. These alliances ensure quicker adoption of next-generation coatings. Growing collaboration strengthens industry standards and accelerates global competitiveness.

- For example, The U.S. National Nanotechnology Initiative (NNI) received a record fiscal year 2025 budget request exceeding $2.2 billion. Funding supports nanoscale science, research infrastructure, and commercialization of advanced technologies, including nanocoatings.

Market Challenges Analysis

High Cost of Nanocoating Development and Limited Scalability

High R&D costs pose barriers to widespread nanocoating adoption. Development requires advanced labs, skilled scientists, and extensive testing for extreme conditions. Limited scalability raises production costs, restricting availability for smaller operators. The U.S. Anti-Icing and De-Icing Nanocoatings Market faces pricing pressures from conventional chemical alternatives. It struggles to convince cost-sensitive industries to adopt premium solutions. Variability in performance across environments creates doubts about consistency. Manufacturers must address these concerns to expand acceptance. Building large-scale production capacity remains a critical challenge.

Regulatory and Adoption Barriers Across Industries

Complex certification processes delay adoption in aerospace and defense applications. Strict safety standards demand years of validation, slowing commercialization timelines. Automotive adoption faces integration challenges with existing vehicle systems. The U.S. Anti-Icing and De-Icing Nanocoatings Market encounters slower growth in infrastructure due to budget limits. It must also overcome end-user awareness gaps about nanotechnology benefits. Industry hesitance to replace known de-icing chemicals further complicates expansion. Navigating diverse regulatory frameworks across states adds complexity. Stronger education and demonstration programs are needed to address these challenges.

Market Opportunities

Rising Commercialization Across Automotive and Infrastructure Sectors

Growing adoption of nanocoatings in mass-market vehicles opens significant revenue opportunities. Automakers seek cost-effective solutions that improve winter safety and convenience. Infrastructure projects create demand for coatings that reduce maintenance in icy climates. The U.S. Anti-Icing and De-Icing Nanocoatings Market capitalizes on these trends through industry collaborations. It benefits from testing programs that validate coatings for large-scale projects. Expanding electric vehicle adoption strengthens coating opportunities due to efficiency needs. Wider infrastructure modernization drives acceptance. These combined factors create favorable commercialization prospects.

Expanding Role in Renewable Energy and Advanced Materials Market

The renewable energy industry continues to adopt nanocoatings for wind and solar projects. Turbine operators prioritize coatings that sustain performance in extreme winters. Coatings extend the lifecycle of expensive assets by reducing ice damage. The U.S. Anti-Icing and De-Icing Nanocoatings Market gains from strong government support for clean energy. It aligns with investment in advanced materials to strengthen industrial competitiveness. Research into hybrid nanocoatings expands functionality for diverse applications. Collaboration with energy companies accelerates product validation. Market opportunities expand through integration into renewable energy ecosystems.

Market Segmentation Analysis:

The U.S. Anti-Icing and De-Icing Nanocoatings Market is segmented

By type into inorganic nanocoating and organic nanocoating. Inorganic nanocoatings dominate due to their strong durability, chemical resistance, and proven performance in extreme environments. They are widely used in aerospace, defense, and energy industries where long-term reliability is critical. Organic nanocoatings, on the other hand, are gaining ground for their flexibility, ease of application, and cost efficiency. It finds strong use in textiles, packaging, and consumer products where adaptability and lightweight properties are valued. Together, both segments present balanced opportunities with continuous innovation expanding their scope across industries.

- For example, Plasma-assisted organic nanocoatings incorporating titanium-oxide suspensions can enhance textiles with improved water repellency and stain resistance. These treatments are compatible with scalable inline processes such as the PlasmaPlus® system using atmospheric plasma jets which enable efficient, continuous application of functional layers during production.

By application, transportation represents the largest demand share, driven by aviation and automotive industries that prioritize safety and efficiency under icy conditions. Energy stands as another key segment, where wind turbines require coatings to reduce downtime and sustain performance in cold climates. Textiles are growing in relevance as manufacturers adopt nanocoatings to create weather-resistant and protective fabrics. Electronics also contribute steadily, using these coatings to safeguard sensors and delicate components against frost. Food and packaging benefit from coatings that enhance product protection in storage and distribution. Others include infrastructure and defense applications where resilience against ice formation is essential. It reflects a diverse adoption pattern across sectors, reinforcing steady growth momentum for the market.

- For example, in electronics packaging, nanocoatings are applied to provide moisture resistance and protect sensors and circuitry from corrosion and frost, helping extend device reliability and lifespan.

Segmentation:

By Type

- Inorganic Nanocoating

- Organic Nanocoating

By Application

- Transportation

- Textiles

- Energy

- Electronics

- Food & Packaging

- Others

Regional Analysis:

The U.S. Anti-Icing and De-Icing Nanocoatings Market demonstrates strong demand across distinct regions, with each contributing unique growth drivers. The Northeast region holds 32% share, supported by harsh winters and heavy snowfall that increase adoption in transportation and energy sectors. States like New York and Massachusetts are prioritizing nanocoatings for infrastructure durability and public safety. The Midwest accounts for 27% share, where extreme cold and large aviation hubs drive steady use in aircraft, automotive, and wind energy. It benefits from strong research programs at regional universities and partnerships with manufacturers.

The South captures 21% share of the U.S. Anti-Icing and De-Icing Nanocoatings Market, with growth led by states experiencing variable weather patterns. Aviation maintenance facilities in Texas and Florida are integrating advanced coatings for fleet safety and cost efficiency. Rising demand in textiles and packaging applications also supports regional expansion. The South is steadily investing in innovation, though adoption rates remain lower compared to snow-intensive regions. It presents opportunities in construction and transportation where unpredictable storms are common.

The West accounts for 20% share, with its demand shaped by aviation, defense, and renewable energy projects. California and Washington are integrating nanocoatings into aerospace and wind turbine operations to improve performance. The region also emphasizes sustainable solutions, aligning with green technology initiatives. It benefits from strong R&D activity and collaborations with defense contractors, supporting continuous product improvements. The West faces fewer seasonal extremes, but its focus on high-performance industries drives consistent uptake. It stands as a key contributor to overall growth through advanced applications and innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- PPG

- DowDuPont

- Fraunhofer

- Hygratek

- Nanosonic

- Luna Innovations

- Nanovere Technologies

- NEI Corporation

- Cytonix

- Other Key Players

Competitive Analysis:

The U.S. Anti-Icing and De-Icing Nanocoatings Market is highly competitive, driven by a mix of established corporations and specialized innovators. Leading players such as PPG, DowDuPont, and NEI Corporation dominate through their strong manufacturing capabilities, advanced R&D investments, and diverse product portfolios. Companies including Luna Innovations, Nanovere Technologies, and Nanosonic focus on niche advancements, often targeting multifunctional coatings that combine anti-icing performance with durability and environmental benefits. It creates a landscape where both large corporations and smaller technology-driven firms actively compete to address industry-specific needs in aviation, automotive, energy, and infrastructure. Strategic collaborations with universities, government agencies, and research institutes further enhance credibility and accelerate product validation. Competition emphasizes constant innovation, regulatory alignment, and sustainability. Firms invest heavily in improving hydrophobic properties, adhesion strength, and long-term weather resistance to meet the operational demands of end users. Eco-friendly nanocoatings are gaining traction, reflecting the industry’s shift toward reducing chemical de-icers and aligning with green standards. Companies also pursue regional expansion and form alliances with aerospace and renewable energy operators to strengthen market presence. Mergers, acquisitions, and targeted product launches remain common tools to consolidate position.

Recent Developments:

- In February 2025, PPG introduced its non-BPA HOBA Pro 2848 coatings for aluminum bottles at Paris Packaging Week, reinforcing its commitment to sustainable and innovative coating solutions while strengthening its position in advanced coatings markets.

- In January 2025, a Riga-based nanocoating startup, Naco Technologies, secured €1.5 million in a pre-Series A funding round co-led by Radix Ventures. It will use the funding to build a production facility in Poland and accelerate its international expansion, especially for coatings that improve hydrogen production efficiency.

- In October 2024, PPG announced a strategic portfolio shift by agreeing to sell its US and Canada architectural coatings business to American Industrial Partners, with the deal expected to close by early 2025. The move allows PPG to redirect resources toward high-growth segments such as advanced coatings, including anti-icing nanocoatings designed for Nordic climates.

Report Coverage:

The research report offers an in-depth analysis based on Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Advancements in nanotechnology will improve coating performance, enabling wider adoption across industries.

- The aviation sector will remain a critical driver, with airlines adopting coatings for safety and cost efficiency.

- Automotive applications will expand, particularly with electric vehicles requiring energy-efficient ice prevention solutions.

- Renewable energy projects, especially wind power in cold regions, will accelerate adoption to enhance turbine output.

- Infrastructure modernization will create opportunities in bridges, rail networks, and highways exposed to extreme weather.

- Research collaborations with universities and defense contractors will drive innovation and product validation.

- Eco-friendly formulations will gain prominence as industries move away from chemical de-icers toward sustainable solutions.

- Regional growth will be strongest in the Northeast and Midwest, supported by severe winters and large aviation hubs.

- Competitive intensity will rise as established firms and niche innovators launch specialized nanocoating products.

- Long-term demand will position the U.S. Anti-Icing and De-Icing Nanocoatings Market as a vital enabler of safety, efficiency, and sustainability.