| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Electrocardiogram Devices Market Size 2024 |

USD 2,529.15 Million |

| U.S. Electrocardiogram Devices Market, CAGR |

7.30% |

| U.S. Electrocardiogram Devices Market Size 2032 |

USD 4,625.09 Million |

Market Overview

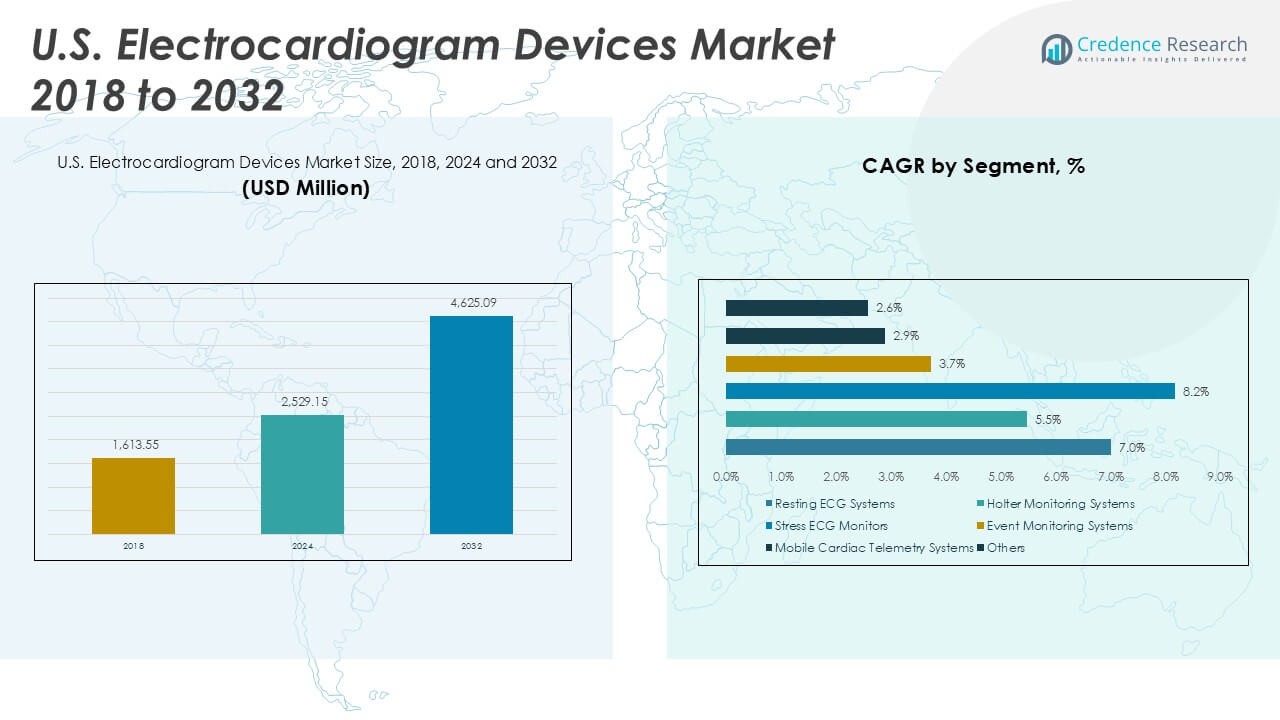

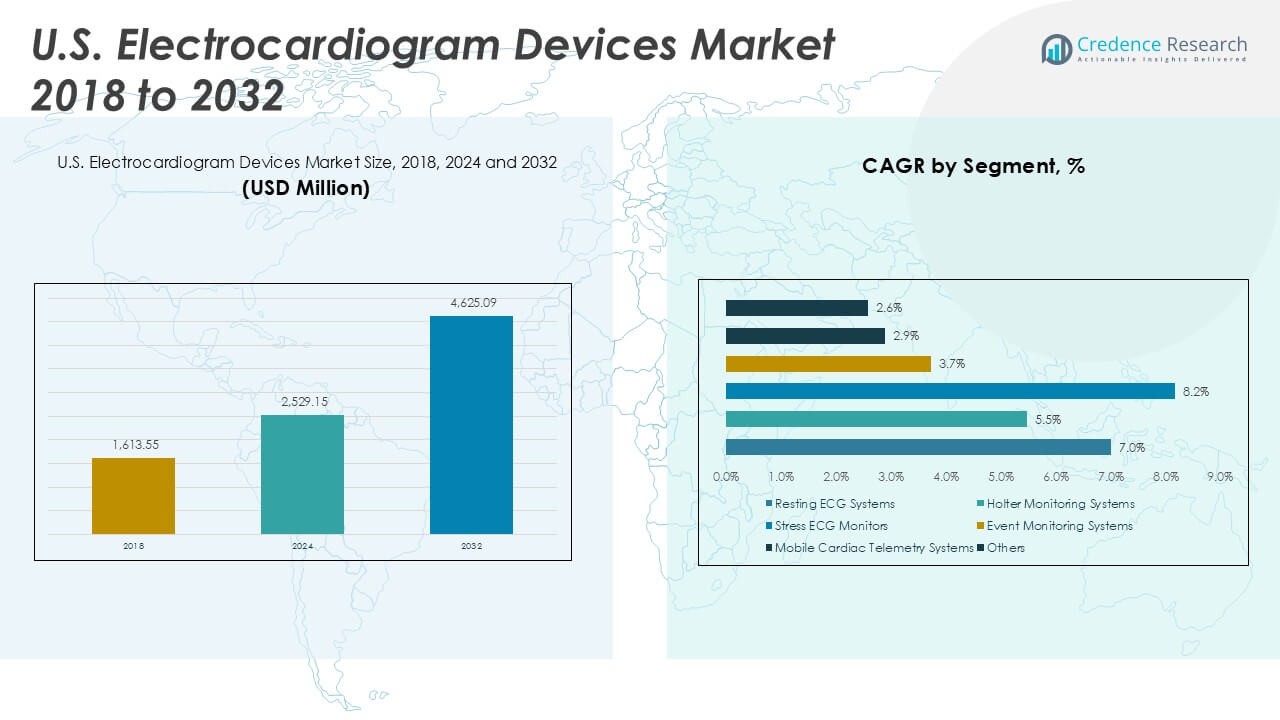

The U.S. Electrocardiogram Devices Market size was valued at USD 1,613.55 million in 2018, reached USD 2,529.15 million in 2024, and is anticipated to reach USD 4,625.09 million by 2032, at a CAGR of 7.30% during the forecast period.

The U.S. Electrocardiogram Devices Market is driven by the rising prevalence of cardiovascular diseases, a growing geriatric population, and increased awareness about early cardiac diagnosis. Technological advancements such as wireless and portable ECG devices, coupled with expanding telemedicine adoption, are accelerating market growth. The integration of artificial intelligence and cloud-based data management further enhances diagnostic accuracy and real-time monitoring, supporting more efficient patient care. Market expansion is also supported by favorable reimbursement policies and government initiatives focused on preventive healthcare. However, high costs of advanced ECG systems and data privacy concerns remain notable challenges. Trends indicate a shift toward compact, user-friendly devices and home-based monitoring solutions, enabling continuous cardiac assessment and empowering patients to proactively manage heart health. The combination of innovation, regulatory support, and evolving patient needs is expected to sustain robust growth in the U.S. electrocardiogram devices market over the forecast period.

The U.S. Electrocardiogram Devices Market demonstrates strong regional diversity, with major urban centers in the Western, Southern, Midwestern, and Northeastern United States acting as key hubs for technology adoption and clinical innovation. Urban hospitals and specialized cardiac centers drive high demand for advanced ECG systems, while suburban and rural regions increasingly adopt portable and home-based monitoring solutions to improve patient access and continuity of care. Regional healthcare policies, investment in telehealth infrastructure, and a focus on preventive cardiology influence purchasing trends and product adoption across the country. Key players shaping the competitive landscape include AliveCor, known for its pioneering mobile ECG technology; Medtronic, a global leader in medical devices; and Abbott Laboratories, recognized for its comprehensive cardiovascular portfolio. These companies, along with emerging innovators, continue to expand their presence by introducing user-friendly, AI-enabled ECG solutions that address evolving clinical needs in diverse healthcare settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Electrocardiogram Devices Market was valued at USD 2,529.15 million in 2024 and is expected to reach USD 4,625.09 million by 2032, growing at a CAGR of 7.30%.

- Rising incidence of cardiovascular diseases and an expanding geriatric population are major factors fueling demand for advanced ECG devices across hospitals, clinics, and home care settings.

- Rapid adoption of wireless, portable, and AI-integrated ECG devices reflects a strong trend toward remote monitoring and telehealth, meeting the need for real-time, accessible cardiac diagnostics.

- Key players such as AliveCor, Medtronic, and Abbott Laboratories maintain a competitive edge through continuous innovation, diverse product portfolios, and strategic partnerships with healthcare providers.

- High costs of advanced ECG systems, coupled with limited reimbursement for certain diagnostic procedures, act as significant restraints, particularly for small clinics and underserved populations.

- The Western United States leads in adoption of next-generation ECG technologies, supported by advanced healthcare infrastructure and large metropolitan centers, while the Midwest and South see rising uptake driven by chronic disease prevalence and telehealth investments.

- The market is characterized by ongoing investments in AI-enabled diagnostics, strong competition among established and emerging companies, and a growing focus on personalized, patient-centric cardiac care throughout diverse regional markets.

Market Drivers

Increasing Burden of Cardiovascular Diseases Fuels Demand

The U.S. Electrocardiogram Devices Market benefits significantly from the rising incidence of cardiovascular diseases, including arrhythmias, heart failure, and coronary artery disorders. A large proportion of the adult population faces elevated risks due to lifestyle changes, high rates of obesity, diabetes, and hypertension. These health challenges necessitate early detection and monitoring, making electrocardiogram devices critical in routine clinical practice and emergency settings. Physicians rely on these devices for prompt identification and management of cardiac abnormalities. The ongoing focus on preventive healthcare across the country amplifies the adoption of ECG technology in hospitals, clinics, and even at home. This strong demand base positions the market for sustained growth in the coming years.

- For instance, Medtronic has deployed over 2 million implantable cardiac monitoring devices worldwide, supporting timely detection and intervention for patients with undiagnosed arrhythmias.

Technological Advancements Accelerate Market Growth

Continuous innovation in electrocardiogram technology remains a powerful growth driver for the U.S. market. Manufacturers introduce wireless, portable, and wearable ECG devices that enhance patient mobility and comfort while maintaining diagnostic accuracy. These advancements allow for seamless data transfer, enabling remote consultations and supporting the expansion of telehealth services. Artificial intelligence integration increases the precision of cardiac event detection and enables automated analysis, reducing the burden on healthcare providers. The market witnesses robust investments in research and development, focusing on user-friendly interfaces and faster data interpretation. This wave of technological improvement helps meet the needs of both healthcare professionals and patients.

- For instance, AliveCor’s KardiaMobile 6L device provides six-lead ECG readings in just 30 seconds, with over 100 million ECGs recorded through its platform to date.

Aging Population and Home-Based Care Boost Adoption

The expanding geriatric population in the U.S. creates a substantial need for ongoing cardiac monitoring, since older adults face greater risk for cardiovascular events. The shift toward home-based care models encourages the adoption of portable and easy-to-use ECG devices that support independent living. Home monitoring reduces hospital readmissions, improves patient compliance, and supports early intervention strategies. Healthcare providers recommend these devices for post-acute care and long-term disease management, further increasing their popularity. This trend strengthens the relevance of electrocardiogram devices in the continuum of care, supporting both clinical and consumer health objectives. The market responds by offering solutions tailored for elderly and at-risk populations.

Regulatory Support and Reimbursement Policies Promote Market Expansion

Favorable regulatory frameworks and comprehensive reimbursement policies play a vital role in supporting the U.S. Electrocardiogram Devices Market. The U.S. Food and Drug Administration continues to streamline approval processes for innovative ECG technologies, encouraging manufacturers to bring advanced solutions to market. Insurance coverage for diagnostic procedures involving electrocardiogram devices reduces the financial barrier for both providers and patients. Government initiatives aimed at improving access to cardiac care stimulate adoption across healthcare settings. The industry benefits from collaborative efforts between public agencies and private companies focused on preventive health strategies. Clear guidance and supportive policies help foster an environment conducive to technological advancement and widespread ECG utilization.

Market Trends

Rapid Shift Toward Portable and Wearable ECG Solutions

The U.S. Electrocardiogram Devices Market is experiencing a strong shift toward portable and wearable ECG solutions. Consumer demand for convenient and accessible cardiac monitoring has prompted manufacturers to launch compact devices that integrate with smartphones and wearable health platforms. These technologies allow users to record, store, and share ECG data from any location, supporting both clinical and personal use cases. The popularity of smartwatches with built-in ECG functionality demonstrates a growing preference for real-time, user-controlled health monitoring. It creates new opportunities for early detection and ongoing management of heart conditions outside traditional healthcare settings. Portable and wearable ECGs support the trend of patient empowerment and self-care.

- For instance, Apple’s ECG app, available on Apple Watch Series 4 and later, enabled users to record more than 430,000 ECGs in a single clinical study, identifying 2,161 users with irregular heart rhythms.

Integration of Artificial Intelligence and Cloud-Based Platforms

Integration of artificial intelligence (AI) and cloud-based platforms stands out as a defining trend in the U.S. Electrocardiogram Devices Market. AI-driven ECG analysis improves accuracy and enables rapid identification of subtle cardiac events, reducing diagnostic errors. Cloud connectivity ensures seamless data storage and accessibility for healthcare providers, patients, and caregivers. It supports remote monitoring, telehealth expansion, and collaborative care models. The ability to share patient data securely across networks increases efficiency in clinical workflows. Providers leverage advanced analytics and automated interpretation tools to optimize patient outcomes. The market benefits from these advancements, which align with the growing need for value-based healthcare solutions.

- For instance, Eko Health’s AI-powered ECG platform can detect atrial fibrillation with a sensitivity of 99% and is currently used by over 3,000 healthcare organizations across the U.S.

Growing Emphasis on Home-Based Cardiac Monitoring

A clear trend in the market centers on the rising importance of home-based cardiac monitoring. Patients and providers recognize the advantages of early detection and continuous surveillance for those with chronic or high-risk conditions. It encourages adoption of user-friendly ECG devices that simplify operation and data transmission for non-clinical settings. The shift aligns with national efforts to reduce hospital admissions and promote proactive care. Healthcare systems invest in remote monitoring programs that utilize advanced ECG devices for post-discharge and chronic disease management. This approach supports cost containment and improves quality of care for diverse patient populations.

Focus on User Experience, Design, and Patient Engagement

Manufacturers in the U.S. Electrocardiogram Devices Market prioritize intuitive design, enhanced user experience, and patient engagement. Devices feature simplified interfaces, wireless connectivity, and visual feedback to encourage routine monitoring and adherence to care plans. It drives innovation in aesthetics and ergonomics, making devices appealing to both older adults and tech-savvy consumers. Companies introduce educational resources and mobile applications that guide patients through self-monitoring and symptom tracking. The emphasis on engagement and usability increases device acceptance and supports better long-term cardiac outcomes. User-focused advancements will continue to shape the competitive landscape in the coming years.

Market Challenges Analysis

High Costs and Accessibility Barriers Limit Adoption

The U.S. Electrocardiogram Devices Market faces significant challenges due to the high cost of advanced ECG technologies and the financial burden on healthcare systems and patients. The price of state-of-the-art portable and wearable ECG devices often limits access for uninsured or underinsured populations. Smaller clinics and rural healthcare providers may struggle to afford regular upgrades or integration with existing health IT infrastructure. Limited reimbursement for certain diagnostic procedures can further restrict adoption, particularly for newer or less-established device models. It creates disparities in the availability of high-quality cardiac monitoring across regions and demographics. Market growth depends on more affordable solutions and expanded insurance coverage to bridge this gap.

Data Privacy Concerns and Technical Limitations Hinder Progress

Data privacy and cybersecurity issues present another significant challenge in the U.S. Electrocardiogram Devices Market. Increased reliance on cloud-based platforms and wireless data transmission raises the risk of unauthorized access or data breaches, making both providers and patients cautious about device adoption. Regulatory requirements for secure data storage and patient confidentiality can complicate device development and increase compliance costs. Technical limitations, such as inconsistent wireless connectivity or data integration issues with electronic health records, can disrupt workflow efficiency and diagnostic reliability. The market must address these concerns through robust security protocols, seamless interoperability, and ongoing updates to maintain user trust and ensure regulatory compliance.

Market Opportunities

Expansion of Remote Monitoring and Telehealth Services Presents Growth Potential

The U.S. Electrocardiogram Devices Market stands to benefit from the rapid expansion of remote monitoring and telehealth services. Increasing demand for accessible, continuous cardiac assessment drives investment in wearable and home-based ECG technologies. Healthcare providers recognize the potential of remote monitoring to reduce hospital visits, streamline chronic disease management, and improve patient engagement. It enables proactive intervention and real-time decision-making, enhancing clinical outcomes for high-risk populations. The integration of ECG data into telehealth platforms creates new business models and opportunities for partnerships across the healthcare ecosystem. These advances position the market for accelerated adoption and broader reach.

Rising Adoption in Preventive and Personalized Medicine

A growing emphasis on preventive and personalized medicine presents significant opportunities for the U.S. Electrocardiogram Devices Market. Health systems and payers increasingly prioritize early detection and tailored treatment strategies for cardiac patients. It drives demand for advanced ECG devices capable of continuous monitoring, predictive analytics, and integration with digital health records. Manufacturers can capitalize on this trend by developing solutions that address both clinical and consumer health needs. Opportunities exist to design devices that support wellness programs, employee health initiatives, and population health management. The market can leverage these trends to foster innovation and achieve sustainable, long-term growth.

Market Segmentation Analysis:

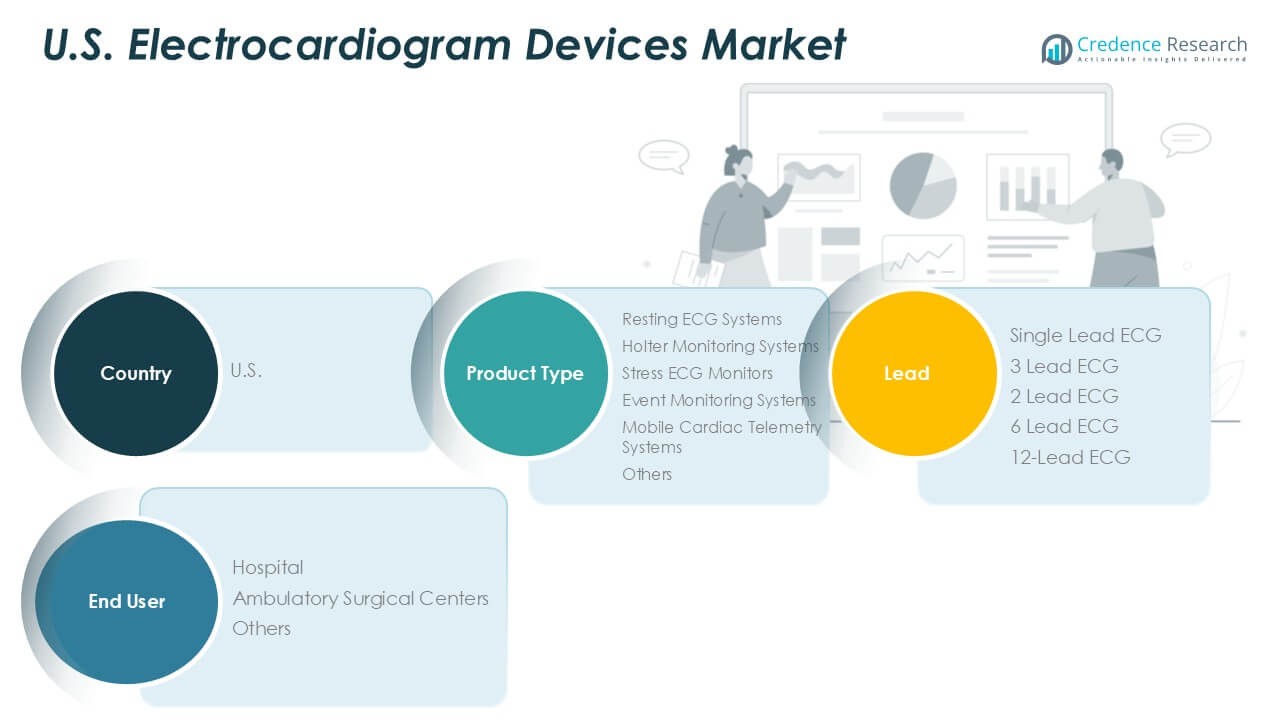

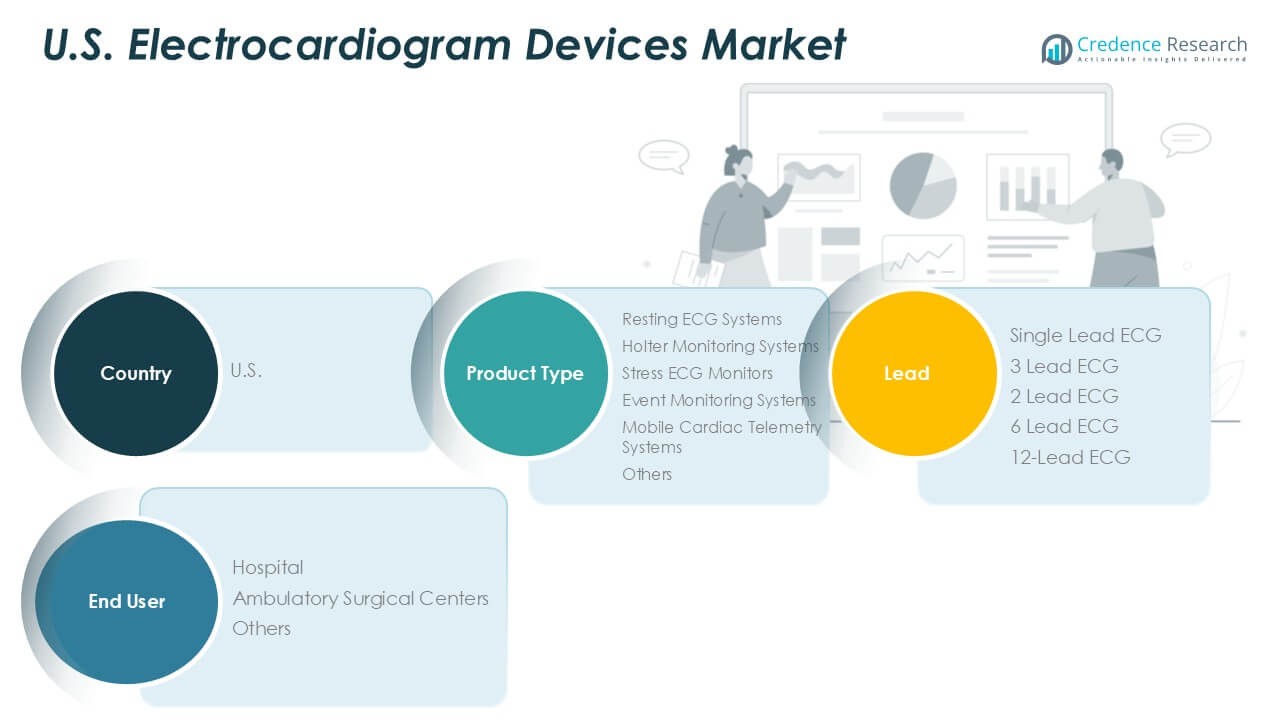

By Product Type:

The U.S. Electrocardiogram Devices Market demonstrates a diverse product landscape driven by technological advancements and evolving clinical requirements. Among product types, resting ECG systems account for a significant share, widely adopted for routine cardiac assessments and baseline evaluations. Holter monitoring systems play a crucial role in continuous, long-term monitoring, capturing arrhythmic events that may not be detected in short clinical visits. Stress ECG monitors support diagnosis during exercise or physical exertion, providing vital information for patients with suspected ischemic heart disease. Event monitoring systems and mobile cardiac telemetry systems offer real-time, ambulatory cardiac surveillance, aligning with trends toward outpatient care and early intervention. The “others” category comprises advanced wearable solutions and emerging diagnostic technologies that address specialized use cases and patient preferences.

- For instance, Bio Telemetry, now part of Philips, remotely monitors more than 1 million cardiac patients each year through its mobile cardiac telemetry solutions.

By Lead:

The market features several options to accommodate different diagnostic needs. Single-lead and 2-lead ECG devices prioritize portability and are popular in remote and home-based settings. 3-lead and 6-lead systems serve intermediate monitoring needs, balancing usability with enhanced diagnostic information. The 12-lead ECG segment remains the gold standard for comprehensive cardiac assessment, extensively used in hospitals and specialty cardiac centers. It enables healthcare professionals to evaluate complex arrhythmias, myocardial infarction, and conduction abnormalities with greater precision. Each lead configuration finds adoption based on specific clinical objectives, workflow integration, and patient risk profiles.

- For instance, GE Healthcare has delivered over 500,000 12-lead ECG systems worldwide, supporting advanced cardiac diagnostics in diverse healthcare settings.

By End User:

End-user analysis highlights hospitals as the primary consumers of ECG devices, driven by high patient volumes, acute care needs, and the presence of advanced diagnostic infrastructure. Ambulatory surgical centers and outpatient clinics represent a growing segment, reflecting the shift toward decentralized care and minimally invasive cardiac evaluations. The “others” category encompasses physician offices, urgent care centers, and home healthcare providers, where demand for compact, easy-to-use ECG devices continues to rise. The U.S. Electrocardiogram Devices Market responds to these diverse end-user needs by offering tailored solutions that optimize diagnostic accuracy, operational efficiency, and patient outcomes across healthcare settings.

Segments:

Based on Product Type:

- Resting ECG Systems

- Holter Monitoring Systems

- Stress ECG Monitors

- Event Monitoring Systems

- Mobile Cardiac Telemetry Systems

- Others

Based on Lead:

- Single Lead ECG

- 3 Lead ECG

- 2 Lead ECG

- 6 Lead ECG

- 12-Lead ECG

Based on End User:

- Hospital

- Ambulatory Surgical Centers

- Others

Based on the Geography:

- Western United States

- Midwestern United States

- Southern United States

- Northeastern United States

Regional Analysis

Western United States

The Western United States holds the largest share in the U.S. Electrocardiogram Devices Market, accounting for 31% of total revenue. This region’s dominance is attributed to its advanced healthcare infrastructure, high adoption rate of innovative medical technologies, and concentration of leading academic medical centers. Major metropolitan areas such as Los Angeles, San Francisco, Seattle, and San Diego drive market growth through strong demand for state-of-the-art cardiac diagnostics and continuous monitoring solutions. The prevalence of lifestyle-related cardiovascular risk factors in urban populations and the presence of a tech-savvy patient base support robust uptake of portable and wearable ECG devices. Healthcare providers in the West invest in research and clinical trials, fostering rapid integration of AI-driven ECG systems and telemedicine platforms. The focus on preventive care and early intervention further cements the region’s leadership, making it a key target for both multinational manufacturers and domestic device startups seeking market expansion.

Midwestern United States

The Midwestern United States represents 24% of the U.S. Electrocardiogram Devices Market, underscored by a network of large healthcare systems and prominent academic institutions in cities like Chicago, Minneapolis, Cleveland, and St. Louis. The Midwest benefits from substantial investments in cardiovascular care, particularly through regional health alliances and collaborative care networks. Many states in this region face higher-than-average rates of chronic cardiac diseases, driving sustained demand for resting ECG systems, Holter monitors, and mobile telemetry solutions. Rural and semi-urban communities present unique challenges and opportunities for device manufacturers focused on improving accessibility and affordability. The market here responds well to initiatives promoting telehealth adoption, remote patient monitoring, and integration of ECG data into electronic health records. Strategic partnerships between technology vendors and healthcare providers support the Midwest’s transition toward value-based care and population health management.

Southern United States

The Southern United States accounts for 28% of the U.S. Electrocardiogram Devices Market, supported by its large, diverse population and rising burden of cardiovascular risk factors. States such as Texas, Florida, Georgia, and North Carolina report higher incidences of hypertension, diabetes, and obesity, fueling the need for early cardiac detection and regular monitoring. Urban hubs offer strong market potential for advanced ECG solutions, while rural areas often require cost-effective, user-friendly devices that facilitate decentralized care. The South has witnessed substantial investments in telemedicine infrastructure, especially in response to broader healthcare access initiatives. Hospitals, ambulatory surgical centers, and community clinics across the region increasingly utilize portable and wireless ECG technologies for both acute and chronic disease management. Strong collaboration among health systems, insurers, and local governments drives continuous market growth and encourages the integration of AI-enhanced diagnostic platforms.

Northeastern United States

The Northeastern United States captures 17% of the U.S. Electrocardiogram Devices Market, leveraging its concentration of world-renowned hospitals, research centers, and biotechnology firms in cities like Boston, New York, and Philadelphia. This region excels in clinical innovation and early adoption of next-generation ECG technologies, including AI-enabled and cloud-connected devices. High levels of healthcare expenditure and an aging population with complex cardiac needs contribute to consistent demand for comprehensive diagnostic solutions, particularly 12-lead ECG systems. The Northeast has pioneered integration of ECG data into advanced electronic health records, supporting coordinated care and precision medicine initiatives. Competitive pressure among health systems drives investments in cutting-edge diagnostics and personalized monitoring solutions. While the market is mature, ongoing research, academic collaboration, and focus on outcome-based care continue to generate new opportunities for product differentiation and market penetration.

Key Player Analysis

- AliveCor

- Medtronic

- Abbott Laboratories

- QT Medical

- Embra Medical

- Eko Health

- ScottCare Cardiovascular Solutions

- Spacelabs Healthcare

- Mortara Instrument (Hill-Rom)

- CardioNet (BioTelemetry, Inc.)

- Hill-Rom Services, Inc. (Baxter)

Competitive Analysis

The U.S. Electrocardiogram Devices Market features intense competition among leading players including AliveCor, Medtronic, Abbott Laboratories, QT Medical, Embra Medical, and Eko Health. These companies set the industry benchmark by consistently investing in research and development to launch innovative, user-friendly, and highly accurate ECG solutions. Market leaders focus on enhancing the accuracy, connectivity, and user experience of their devices, prioritizing AI integration, wireless technology, and advanced data analytics. Companies invest significantly in research and development to launch compact, portable, and wearable ECG systems that meet the rising demand for remote and home-based monitoring. Strategic collaborations with healthcare networks, technology firms, and telehealth platforms expand distribution channels and accelerate digital transformation. Manufacturers also emphasize regulatory compliance, cybersecurity, and interoperability to build trust and support adoption across various healthcare settings. Competitive dynamics are fueled by rapid product launches, the introduction of intuitive interfaces, and comprehensive after-sales support. This focus on patient-centric solutions and seamless integration with digital health systems ensures that the market remains dynamic, innovative, and responsive to the evolving needs of both clinicians and patients.

Recent Developments

- In December 2024, DocGo Inc. broadened its partnership with SHL Telemedicine to integrate the SmartHeart® portable 12-lead ECG device across DocGo mobile health care units. Initially launched in New York, this extended partnership will now provide cutting-edge cardiovascular diagnostics to patients’ homes and underserved areas in other markets.

- In September 2024, OMRON Healthcare Korea introduced OMRON Complete, its new home-use medical device that can simultaneously measure ECG and blood pressure. The device helps in preventing the risk of complications like heart failure and stroke among individuals at risk for cardiovascular diseases.

- In May 2024, OMRON Healthcare India collaborated with AliveCor India to provide AI-based handheld ECG technology. This collaboration marked an important milestone in the former’s ‘Going for Zero’ vision to improve cardiovascular health awareness.

- In February 2024, Thyracore acquires Think Health a key industry player in home ECG services. As a result, Thyrocare has now positioned itself as one of the leading providers of at-home healthcare services in India.

- In January 2024, Omron Healthcare launched a portable ECG AliveCor’s KardiaMobile in Italy and France to advance fibrillation awareness and stroke prevention in alignment with its ‘Going for zero’ vision.

Market Concentration & Characteristics

The U.S. Electrocardiogram Devices Market demonstrates a moderate to high level of market concentration, with a mix of established medical technology firms and innovative new entrants shaping its competitive landscape. It features a strong emphasis on technological advancement, with companies prioritizing the development of portable, wireless, and AI-enabled ECG systems that support remote monitoring and digital integration. The market responds quickly to evolving healthcare needs, regulatory shifts, and growing demand for home-based diagnostics. Product differentiation relies on features such as user-friendly interfaces, data accuracy, cloud connectivity, and seamless interoperability with electronic health records. The U.S. Electrocardiogram Devices Market values reliability, compliance with stringent healthcare standards, and comprehensive after-sales support. Buyers include large hospital networks, outpatient centers, and home healthcare providers, driving demand for both advanced clinical-grade systems and consumer-oriented solutions. The focus on continuous innovation, strategic partnerships, and expanding telehealth infrastructure defines its dynamic and patient-centric character.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Lead, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. Electrocardiogram Devices Market will witness greater adoption of wearable ECG systems for continuous, real-time cardiac monitoring.

- Integration of artificial intelligence algorithms will drive improvements in early detection and diagnostic accuracy.

- Telehealth platforms will incorporate ECG data more seamlessly, strengthening remote patient care.

- More user-friendly ECG devices designed for home use will empower patients to self-monitor cardiac health.

- Cloud-based ECG data management will become standard, enabling secure sharing among providers and caregivers.

- Developers will enhance device interoperability with electronic health records and other healthcare systems.

- Regulatory bodies will update guidelines to support innovation while emphasizing data privacy and device security.

- Partnerships between device makers and healthcare providers will expand access to diagnostic solutions in underserved areas.

- Miniaturized sensors and flexible electronics will enable the next generation of compact cardiac monitoring devices.

- Focus on value-based care will encourage adoption of ECG solutions that demonstrate cost-effectiveness and improved outcomes.