Market Overview:

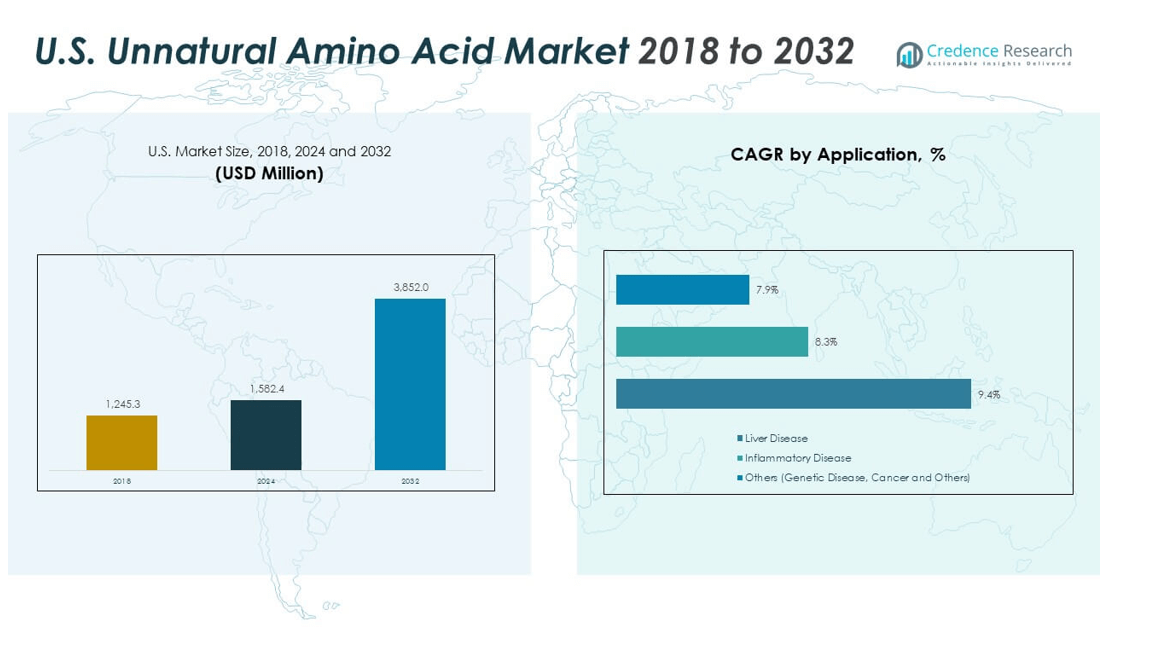

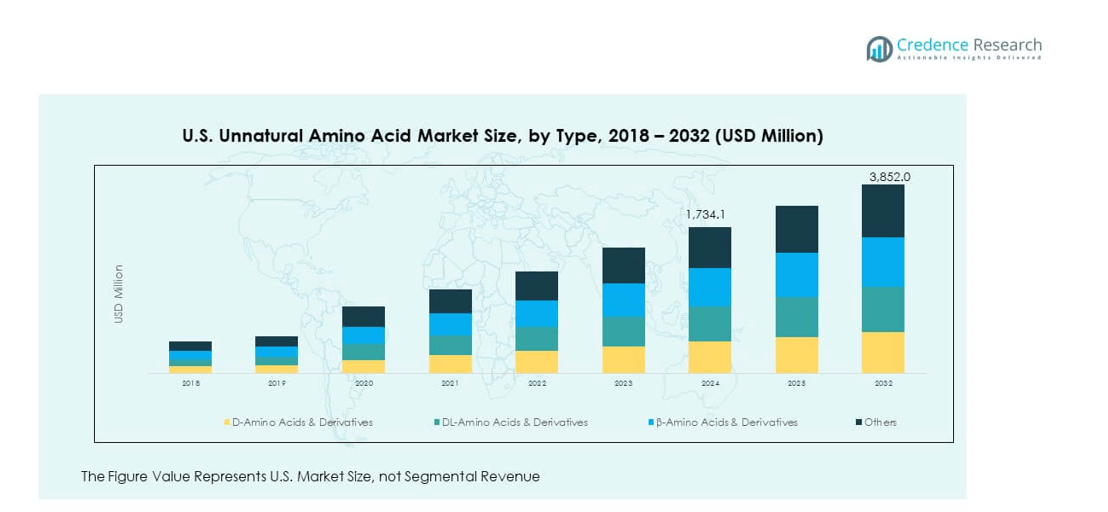

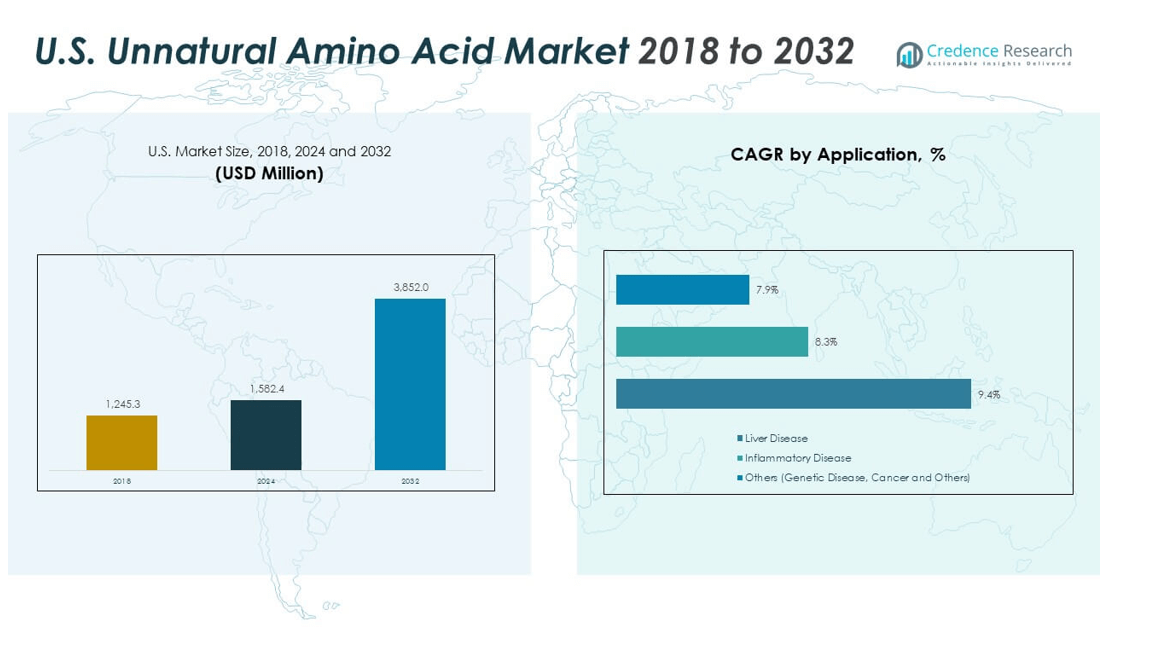

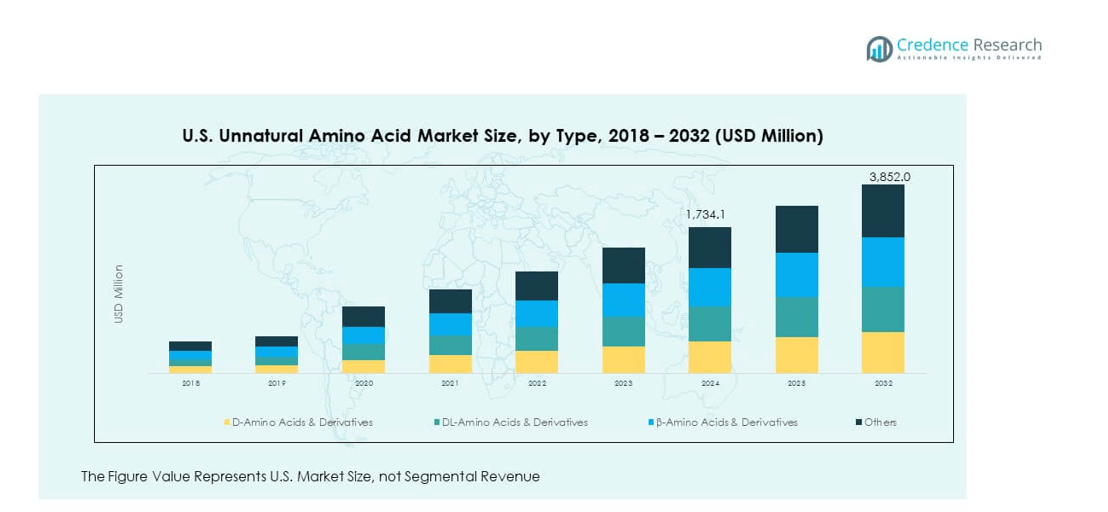

The U.S. Unnatural Amino Acid Market size was valued at USD 1,245.3 million in 2018 to USD 1,734.1 million in 2024 and is anticipated to reach USD 3,852.0 million by 2032, at a CAGR of 10.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Unnatural Amino Acid Market Size 2024 |

USD 1,734.1 million |

| U.S. Unnatural Amino Acid Market, CAGR |

10.49% |

| U.S. Unnatural Amino Acid Market Size 2032 |

USD 3,852.0 million |

The market is growing due to increasing demand for specialized compounds in drug development and biologics. Rising adoption in protein engineering and genetic code expansion technologies further strengthens its use across pharmaceutical research. Advancements in biotechnology enable efficient synthesis, reducing production challenges and costs. Expanding applications in rare disease therapies, oncology, and industrial biotechnology enhance the market’s scope. Government and private funding in R&D also encourage innovation, supporting long-term adoption across multiple sectors.

Geographically, the U.S. dominates the market with its advanced pharmaceutical and biotechnology industries driving large-scale adoption. Europe follows, supported by strong research frameworks and rising healthcare investments. Asia Pacific emerges as a high-growth region, benefiting from growing biotechnology clusters, favorable government initiatives, and increasing collaborations with global pharmaceutical firms. Latin America and the Middle East are gradually developing, supported by healthcare expansion and growing interest in advanced therapies, though adoption remains concentrated in developed economies.

Market Insights:

- The U.S. Unnatural Amino Acid Market was valued at USD 1,245.3 million in 2018, reached USD 1,734.1 million in 2024, and is projected to hit USD 3,852.0 million by 2032, growing at a CAGR of 10.49%.

- The Northeast accounted for 35% share in 2024, driven by strong pharmaceutical clusters and leading academic institutions, while the Midwest held 22% due to its manufacturing and research strength.

- The West represented 28% share, supported by California’s biotechnology ecosystem, making it a central contributor to innovation and commercialization in this market.

- The South, with 15% share, is the fastest-growing subregion, fueled by increasing investments in Texas and North Carolina’s biotech and pharmaceutical sectors.

- In 2024, D-Amino Acids & Derivatives contributed 40% of segment share, DL-Amino Acids & Derivatives accounted for 30%, β-Amino Acids & Derivatives held 20%, and others represented 10%, highlighting dominance of pharmaceutical-focused applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Focus on Protein Engineering and Pharmaceutical Innovation

The U.S. Unnatural Amino Acid Market is gaining traction due to its role in protein engineering and drug discovery. Pharmaceutical companies are using these compounds to enhance the precision of biologics and expand the range of therapeutic targets. It is creating new possibilities for the development of advanced drugs and therapies that conventional amino acids cannot achieve. Researchers are increasingly investing in synthesis methods that provide higher yield and better scalability. Growing collaborations between universities, research institutes, and pharmaceutical firms support innovation pipelines. The demand for targeted cancer therapies is also accelerating adoption in clinical research. It is contributing to more effective treatment options for genetic and rare disorders. Government funding and private capital flow further stimulate the innovation ecosystem. This driver highlights the importance of biotechnology infrastructure in supporting sustained growth.

- For example, Ambrx developed ARX788, a site-specific anti-HER2 antibody-drug conjugate (ADC) using unnatural amino acid-enabled conjugation technology, achieving a precise drug-to-antibody ratio of 1.9. Preclinical studies confirmed strong serum stability with a half-life of about 12.5 days in mice. Interim results from the phase III ACE-Breast-02 trial showed that ARX788 significantly improved progression-free survival in patients with HER2-positive metastatic breast cancer.

Strong Adoption in Biotechnology and Industrial Applications

Biotechnology industries are significantly expanding the use of unnatural amino acids beyond pharmaceuticals. It is applied in enzyme modification, metabolic pathway engineering, and production of advanced biomaterials. The U.S. Unnatural Amino Acid Market benefits from increasing industrial biotechnology applications focused on sustainability and efficiency. Companies are exploring ways to reduce reliance on petrochemical-based inputs through engineered biosynthetic pathways. Demand for renewable chemical production enhances opportunities for scaling usage. Industrial players recognize the potential of these compounds in creating next-generation enzymes for biofuels and specialty chemicals. It is strengthening ties between healthcare research and industrial technology. Growing investment in biotech start-ups supports commercialization of innovative processes. Industrial adoption ensures growth across non-medical sectors, broadening long-term market stability.

Expanding Role in Rare Disease Research and Therapeutics

Rare disease treatment requires specialized compounds that can target unique molecular pathways. The U.S. Unnatural Amino Acid Market is supported by rising demand in this therapeutic space. It is being incorporated into precision medicine frameworks to design novel drugs for small patient populations. Biotech firms see strong potential in using these compounds to improve drug stability and performance. Clinical research shows increasing interest in incorporating amino acid derivatives into experimental therapies. Growing advocacy for orphan drug development further enhances adoption. Regulatory support and funding programs encourage pharmaceutical companies to pursue innovation in this segment. It is reinforcing the link between unmet medical needs and advanced biotechnology solutions. Patient-focused innovation strengthens long-term market growth in rare and complex disease treatments.

- For example, Sanofi’s THOR-707 (now SAR-444245 or Pegenzileukin) is an engineered IL-2 variant created through site-specific incorporation of a non-canonical amino acid. This design extends half-life and reduces IL-2Rα binding, helping expand CD8⁺ T cells and NK cells while limiting regulatory T cell activity. Preclinical studies showed improved stability and immune activation, and Phase 1 data confirmed increases in CD8⁺ T and NK cells with minimal Treg expansion, supporting its potential in advanced cancer treatment.

Technological Advancements Driving Cost Efficiency and Scalability

Technology innovations in synthesis methods and automation are reducing production costs. The U.S. Unnatural Amino Acid Market benefits from breakthroughs in computational biology and AI-assisted design. It is enabling companies to streamline R&D and reduce time-to-market for new products. Automated systems allow higher throughput screening of new derivatives. Improved efficiency in large-scale production is addressing cost barriers that limited early adoption. Advances in bioinformatics and digital modeling enhance accuracy in protein engineering. It is supporting pharmaceutical companies with tools that improve drug design processes. Technology-driven cost optimization is attracting new entrants into the market. The ongoing evolution of digital and laboratory platforms ensures long-term commercial viability.

Market Trends

Growing Integration with Synthetic Biology Platforms

The U.S. Unnatural Amino Acid Market is observing a surge in integration with synthetic biology platforms. It is being used to expand genetic code systems and develop proteins with non-natural functions. Companies are leveraging these innovations to produce advanced therapeutics and biomaterials. The expansion of CRISPR and gene-editing technologies supports broader experimentation. Synthetic biology labs are increasingly incorporating these compounds in high-throughput applications. It is accelerating the design of customized proteins and novel biologics. Investors recognize the importance of synthetic biology in expanding adoption. Collaborations between startups and academic research groups strengthen this trend. It highlights a future where engineered biology reshapes multiple industries.

Rising Demand in Academic and Research Institutions

Universities and research centers are driving early-stage applications of unnatural amino acids. The U.S. Unnatural Amino Acid Market benefits from increasing government grants directed toward biotechnology. It is supporting young scientists in protein engineering and molecular biology research. Academic studies explore new therapeutic possibilities and expand the scientific understanding of cellular processes. The focus on education and training is creating a skilled workforce for industry. It is fostering innovation cycles that lead to commercial opportunities. International partnerships are expanding the reach of U.S.-based academic discoveries. The steady flow of published studies enhances confidence among investors. This trend ensures that basic research translates into applied solutions.

Increasing Application in Advanced Diagnostics and Imaging

The U.S. Unnatural Amino Acid Market is evolving with new applications in diagnostic imaging. It is being integrated into molecular probes for precise tracking of biological processes. Researchers are developing targeted markers for cancer and neurological disorders. The expansion of personalized medicine frameworks encourages adoption in diagnostic tools. Imaging specialists see value in compounds that improve sensitivity and reduce false readings. It is enhancing the accuracy of disease detection and monitoring. Pharmaceutical and diagnostic firms are collaborating to develop joint solutions. Clinical adoption of these markers is gaining momentum across advanced hospitals. This trend showcases a pathway where research innovation aligns with healthcare delivery.

- For instance, Blue Earth Diagnostics through clinical trials such as the Phase 3 REVELATE study (NCT04410133) has advanced 18F-fluciclovine, a synthetic amino acid PET tracer, for imaging recurrent brain metastases after radiation therapy. This FDA-approved PET imaging agent, originally developed for prostate cancer, is a strictly synthetic amino acid demonstrating verifiable clinical utility in oncology diagnostics in the U.S.

Expansion of Customization and Contract Research Services

The U.S. Unnatural Amino Acid Market is influenced by growing demand for contract research services. It is driven by pharmaceutical firms outsourcing early-stage discovery and testing. Contract research organizations (CROs) are expanding capabilities in amino acid synthesis and protein modification. Companies are requesting tailored solutions that meet specific project requirements. It is enabling smaller biotech players to access advanced resources without heavy investment. The customization trend supports rapid prototyping and flexible innovation cycles. Partnerships between CROs and global pharmaceutical companies are strengthening this trend. It highlights the importance of scalable, project-specific services in the biotechnology landscape. Customization ensures a wider adoption base across both small and large organizations.

- For example, WuXi Biologics (WuXi XDC) has developed the WuXiDARx™ platform, enabling site-specific ADC conjugation with flexible DAR values of 2, 4, or 6. The technology delivers high homogeneity, improved pharmacokinetics, and safety, with six WuXiDAR4-based ADCs already advancing into phase I clinical trials.

Market Challenges Analysis

High Production Costs and Complex Manufacturing Processes

The U.S. Unnatural Amino Acid Market faces significant challenges due to high production costs and complex synthesis methods. It is difficult to scale production efficiently while maintaining quality and stability. Manufacturing requires advanced facilities and skilled workforce, increasing overall expenses. Smaller companies struggle to compete due to high entry barriers. Supply chain limitations and reliance on advanced raw materials also restrict widespread adoption. Regulatory compliance in pharmaceutical applications further increases production complexity. It is creating hurdles for both established players and new entrants. Without cost optimization, long-term growth could face constraints. Addressing these barriers remains essential for sustained progress.

Regulatory Uncertainty and Limited Awareness Among End Users

The U.S. Unnatural Amino Acid Market experiences regulatory challenges that slow product approval processes. It is impacted by lengthy clinical validation and strict compliance frameworks. End users in healthcare and industrial sectors still lack full awareness of applications. Limited knowledge reduces confidence in adoption outside specialized research groups. High upfront investment requirements discourage broader commercial exploration. Regulatory fragmentation across regions complicates market entry strategies. It is restricting the pace of commercialization despite strong innovation potential. Bridging regulatory gaps and increasing industry education will be critical. These factors highlight the need for structured awareness-building initiatives.

Market Opportunities

Expanding Potential in Personalized Medicine and Precision Therapeutics

The U.S. Unnatural Amino Acid Market holds strong opportunities in personalized medicine. It is increasingly used to design tailored therapies for oncology and genetic disorders. Pharmaceutical firms see value in expanding treatment options where traditional molecules fail. The precision-focused nature of personalized medicine aligns well with amino acid derivatives. Regulatory agencies are supporting innovation with funding and accelerated review processes. It is opening avenues for niche therapeutics that target small patient populations. Collaborations between biotech startups and large pharma companies are growing. Market expansion in this area can redefine long-term treatment paradigms.

Emerging Role in Sustainable Industrial Biotechnology Solutions

The U.S. Unnatural Amino Acid Market is positioned to benefit from demand for sustainable solutions. It is playing a role in enzyme modification for renewable fuels and specialty chemicals. Industrial biotechnology firms are adopting these compounds to optimize processes. The shift toward eco-friendly materials supports integration into bio-based production. Startups focusing on green chemistry are showing interest in innovative applications. It is enabling industries to reduce carbon dependency while improving efficiency. Partnerships with energy and materials firms expand the commercial scope. Sustainable biotechnology offers a pathway to growth beyond healthcare.

Market Segmentation Analysis:

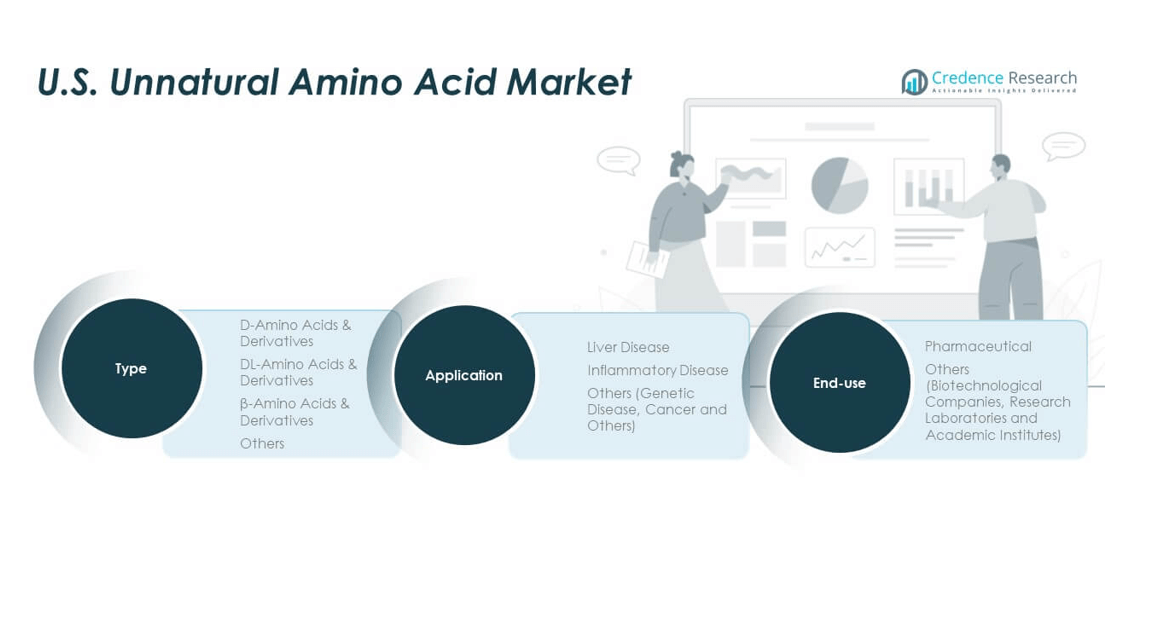

By type, the U.S. Unnatural Amino Acid Market is segmented into D-amino acids and derivatives, DL-amino acids and derivatives, β-amino acids and derivatives, and others. D-amino acids and derivatives account for strong demand due to their wide use in pharmaceuticals and biochemical research. DL-amino acids and derivatives follow with applications in peptide synthesis and specialized therapies. β-amino acids and derivatives are gaining attention for their role in developing novel drugs and biomaterials. Other categories contribute steadily, serving niche research and industrial applications.

- For example, Difelikefalin (marketed as KORSUVA by Cara Therapeutics and Vifor Pharma) is a U.S. FDA-approved peptide drug for pruritus in chronic kidney disease that contains four D-amino acids. Incorporating D-amino acids increases drug stability and extends half-life in plasma, making it effective as a kappa-opioid receptor agonist for systemic use in adults with CKD.

By application, the market is classified into liver disease, inflammatory disease, and others including genetic disease, cancer, and related disorders. Liver disease treatment remains a key driver of demand, supported by innovation in therapeutic solutions. Inflammatory diseases demonstrate rising adoption of unnatural amino acids for drug formulation. The segment covering genetic diseases and cancer is emerging strongly with significant research investments in precision medicine. It is expected to hold a vital role in expanding clinical applications in the future.

- For example, D-amino acid–modified peptide drugs have demonstrated superior resistance to enzymatic degradation, allowing effective oral or injectable administration in preclinical inflammatory disease models.

By end-use, the U.S. Unnatural Amino Acid Market is divided into pharmaceutical and others such as biotechnological companies, research laboratories, and academic institutes. Pharmaceutical companies dominate due to large-scale drug development programs and integration into biologics. Research laboratories and academic institutions maintain steady demand, supported by growing funding in biotechnology and molecular biology. Biotechnological companies strengthen the market with applications in enzyme engineering, synthetic biology, and specialty chemical production. It is creating balanced growth across medical and industrial landscapes.

Segmentation:

By Type

- D-Amino Acids & Derivatives

- DL-Amino Acids & Derivatives

- β-Amino Acids & Derivatives

- Others

By Application

- Liver Disease

- Inflammatory Disease

- Others (Genetic Disease, Cancer, and Others)

By End-Use

- Pharmaceutical

- Others (Biotechnological Companies, Research Laboratories, and Academic Institutes)

Regional Analysis:

The Northeast holds 35% of the U.S. Unnatural Amino Acid Market, supported by the strong presence of pharmaceutical headquarters and leading academic institutions. States such as Massachusetts, New Jersey, and New York drive demand through advanced research in drug development and protein engineering. It benefits from a concentration of biotech startups, established pharma firms, and high R&D spending. Strategic partnerships between universities and corporations accelerate innovation pipelines. Government funding and private investment in oncology and rare disease treatments further strengthen the region. The Northeast continues to serve as the central hub for clinical trials and high-value therapeutics.

The Midwest accounts for 22% of the market, with Illinois, Indiana, and Ohio leading activity. It is recognized for its pharmaceutical manufacturing base and strong academic research networks. Midwestern institutions focus on applied biotechnology, synthetic biology, and enzyme modification studies. The region benefits from industrial biotechnology adoption in specialty chemicals and renewable fuel applications. Investment in university-linked research parks supports commercialization of discoveries. Pharmaceutical supply chains across the Midwest also provide a stable foundation for growth. It demonstrates consistent momentum in connecting research innovation with industrial demand.

The South and West together represent 43% of the U.S. Unnatural Amino Acid Market, with strong contributions from California and Texas. The West Coast, holding 28%, benefits from a vibrant biotechnology cluster in California that emphasizes genetic research, precision medicine, and contract research services. The South, with 15%, is growing through expanding academic research centers and pharmaceutical investments in Texas and North Carolina. It leverages favorable business environments and funding initiatives to attract biotech startups. Both subregions demonstrate increasing integration of amino acid derivatives into therapeutic and industrial applications. Their combined growth highlights broader geographic expansion of market adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bayer AG

- BASF SE

- AnaSpec Inc.

- AstraZeneca

- Pfizer

- Enzo Life Sciences, Inc.

- Nippon Rika

- Senn Chemicals

- Fufeng Group

- Hanhong Group

Competitive Analysis:

The U.S. Unnatural Amino Acid Market is defined by the presence of global pharmaceutical leaders, specialized biotech firms, and niche chemical producers. Companies such as Bayer AG, BASF SE, AstraZeneca, and Pfizer maintain strong positions through broad portfolios and extensive R&D capabilities. It benefits from their focus on expanding therapeutic applications, particularly in oncology, rare disease treatments, and biologics. Enzo Life Sciences, AnaSpec Inc., and Senn Chemicals contribute by supplying specialized derivatives and supporting custom synthesis for research laboratories. Nippon Rika, Fufeng Group, and Hanhong Group extend competition by targeting industrial biotechnology and academic research needs. Strategic activities such as mergers, acquisitions, and regional expansions shape the competitive landscape. Companies pursue partnerships with academic institutions to strengthen innovation pipelines and accelerate clinical trial progress. It reflects a market where collaborations bridge gaps between large pharmaceutical firms and emerging biotech startups. Product innovation, including tailored amino acid derivatives, supports differentiation and customer retention. Competitive intensity is high, driven by demand for precision medicine and advanced biologics. Market leaders rely on strong intellectual property, regulatory expertise, and advanced production methods to secure advantages. The landscape demonstrates a balance of established multinational corporations and agile niche players.

Recent Developments:

- In September 2025, Enlaza Therapeutics entered a collaboration with Vertex Pharmaceuticals, centered on its War-Lock platform that incorporates non-natural amino acids to create covalent-acting protein drugs. The partnership aims to develop immune therapies for autoimmune diseases and improve treatment conditioning for sickle cell disease and thalassemia, with USD 45 million upfront and up to USD 2 billion in potential milestones.

- In July 2025, AstraZeneca announced a $50 billion investment to expand its US-based manufacturing and R&D capabilities by 2030. This expansion includes establishing a Virginia facility dedicated to cutting-edge drug substances such as peptides and small molecules—crucial for advancing APIs and biopharmaceutical manufacturing, indirectly supporting innovations in unnatural amino acids.

- In June 2025, Argenx partnered with Unnatural Products, agreeing on a collaboration worth up to USD 1.5 billion to develop oral macrocyclic peptides targeting inflammatory and immunological diseases. The deal aims to deliver once-daily oral alternatives to current infused antibody treatments, leveraging the advantages of macrocyclic peptides such as stability without cold storage and resistance to protease degradation.

- In June 2025, BASF SE reinforced its footprint in North America’s biopharmaceutical sector by inaugurating a new Good Manufacturing Practice (GMP) Solution Center in Wyandotte, Michigan. The facility, launched on June 17, 2025, is dedicated to advancing pharmaceutical ingredient quality, collaborative product development, and production innovation, thereby strengthening BASF’s ability to serve the growing demand for high-quality excipients and bioprocessing ingredients in the unnatural amino acid market.

- In January 2025, Pfizer expanded its partnership with PostEra, a startup specializing in AI-driven medicinal chemistry, to accelerate the design of novel small molecules and antibody-drug conjugates. This $350 million collaboration focuses on optimizing payloads for advanced medicines, which often utilize unnatural amino acid derivatives, thus fostering innovation in North American drug design.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and End-Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion in protein engineering will reinforce adoption in biologics research, supporting advanced therapeutic development.

- Rising demand for rare disease therapies will strengthen the role of precision medicine across healthcare.

- Integration into oncology pipelines will enhance both clinical impact and commercial value of amino acid derivatives.

- Advances in synthesis technology will lower production costs and improve scalability for broader adoption.

- Growth in synthetic biology will create new opportunities in pharmaceutical innovation and customized protein solutions.

- Partnerships between biotech startups and pharmaceutical leaders will accelerate discovery cycles and product development.

- Regulatory frameworks and targeted funding will support adoption in experimental therapies and specialized treatments.

- Academic research institutions will contribute through scientific advancements and training of skilled professionals.

- Industrial biotechnology applications will expand in enzyme design, renewable chemicals, and bio-based processes.

- Expansion of clinical trials across U.S. subregions will increase patient access to advanced therapies.