Market Overview:

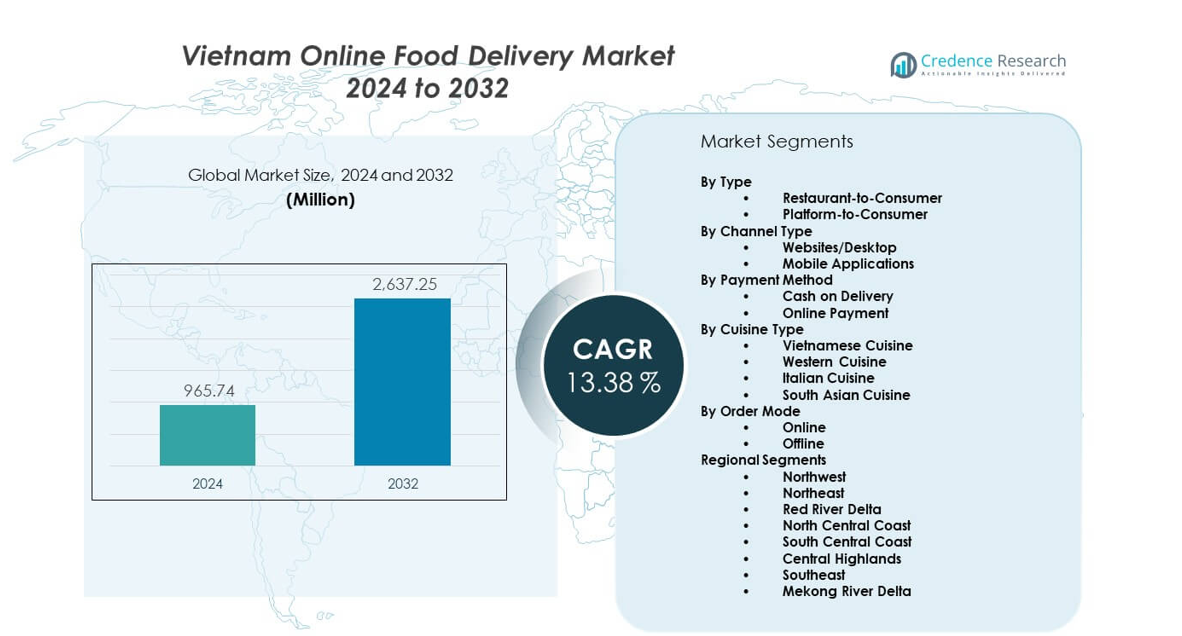

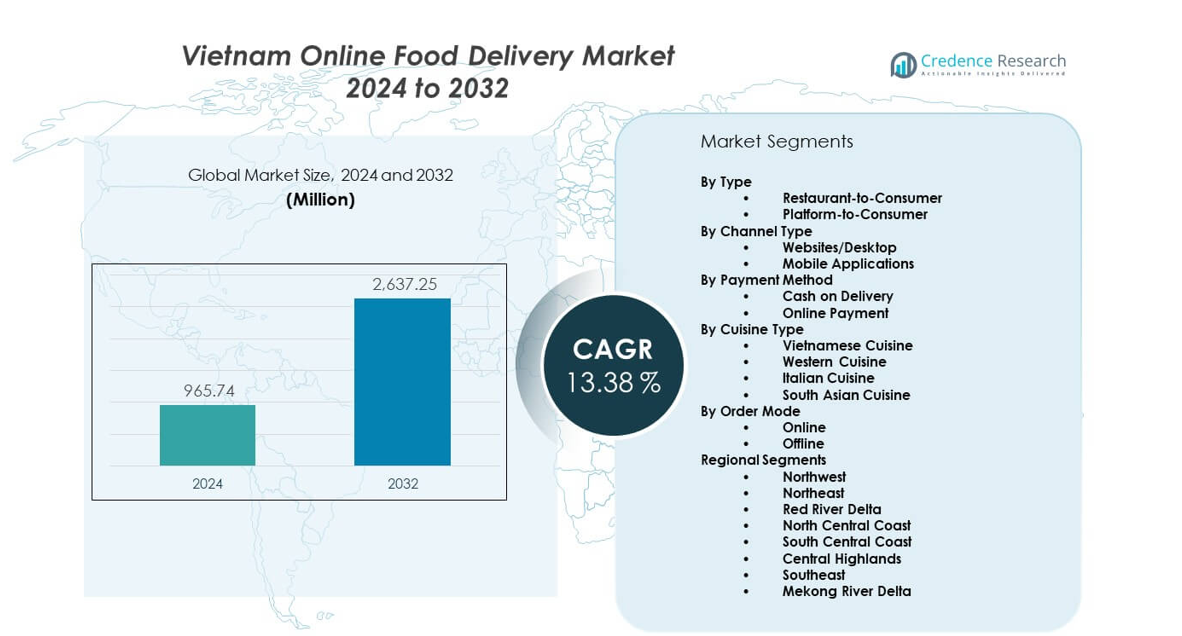

The Vietnam Online Food Delivery Market is projected to grow from USD 965.74 million in 2024 to an estimated USD 2,637.25 million by 2032, with a compound annual growth rate (CAGR) of 13.38% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vietnam Online Food Delivery Market Size 2024 |

USD 965.74 million |

| Vietnam Online Food Delivery Market, CAGR |

13.38% |

| Vietnam Online Food Delivery Market Size 2032 |

USD 2,637.25 million |

Rising demand for fast delivery drives growth across the Vietnam Online Food Delivery Market. Busy lifestyles shape reliance on doorstep meals across major cities. Aggregators improve service speed through route optimization and stronger restaurant partnerships. Consumers prefer digital menus that offer flexible pricing and broad cuisine access. Young users adopt app-based ordering due to ease and cashback options. Restaurants gain wider reach through marketplace visibility. The sector grows with better logistics support and rising trust in online transactions.

Regional growth shows strong activity in major Vietnamese cities where dense populations support high order frequency. Ho Chi Minh City leads due to advanced digital habits and strong restaurant networks. Hanoi follows with fast platform adoption driven by young consumers and expanding cloud kitchen presence. Emerging cities such as Da Nang and Can Tho record rising demand as delivery fleets expand and local restaurants join online platforms. Broader internet reach strengthens adoption across developing regions.

Market Insights:

- The Vietnam Online Food Delivery Market is projected to grow from USD 965.74 million in 2024 to USD 2,637.25 million by 2032, supported by a 38% CAGR driven by expanding digital adoption and rising platform activity across major cities.

- Southern Vietnam leads with 42% share, driven by Ho Chi Minh City’s dense population and strong restaurant networks. Northern Vietnam holds 34%, supported by high digital usage in Hanoi. Central Vietnam follows with 14%, helped by tourism activity and growing app adoption in Da Nang and Hue.

- Central Vietnam is the fastest-growing region with an 18% share, supported by rapid cloud-kitchen expansion, wider delivery fleet coverage, and rising digital engagement among young consumers in tier-2 cities.

- The Online Order Mode leads with 78% share, driven by smartphone availability and preference for fast, app-based ordering. Offline ordering holds 22%, supported by local eateries that still manage direct delivery.

- Within service models, Platform-to-Consumer accounts for 61% due to wide merchant coverage and strong promotional ecosystems, while Restaurant-to-Consumer holds 39%, supported by established chains with loyal customer bases.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Strong Digital Adoption and Expanding App Ecosystem Supporting Higher Delivery Volumes

The Vietnam Online Food Delivery Market gains strong momentum through rapid digital use in major cities. Consumers shift toward mobile-based ordering due to better access and simple interfaces. Platforms expand menus that attract young users seeking convenient meal options. It improves delivery speed through real-time tracking and fleet upgrades. Restaurants depend on apps to widen customer reach across busy districts. Users prefer bundled offers that reduce effort during peak hours. Growth strengthens with trust in digital payments. Rising mobile connectivity drives consistent order frequency.

- For instance, Grab’s GrabKitchen model operates multi-brand cloud kitchens hosting 10–25 restaurant brands per site across Southeast Asia, improving fulfillment speed through shared cooking infrastructure.

Growing Need for Quick Meal Access Across Dense Urban Lifestyles and Work Patterns

Urban lifestyles push broader use of delivery apps across crowded zones. Office workers depend on quick meal support during short breaks. It improves service coverage through optimized delivery routes. Platforms record higher retention from users seeking predictable service quality. Restaurants upgrade packaging to keep food secure during transport. Demand rises from students who choose budget-friendly digital menus. Platforms gain value from broader restaurant onboarding efforts. Strong urban density supports steady volume growth.

- For instance, McDonald’s global operations prioritize the use of sustainably sourced, fiber-based packaging and specific packaging designs to minimize moisture buildup and prevent contamination during transit, ensuring food safety and quality for customers in markets like Vietnam.

Expansion of Restaurant Partnerships and Cloud Kitchens Strengthening Service Capacity Nationwide

Restaurant networks join major platforms to improve visibility. Cloud kitchens support faster meal preparation across targeted zones. It improves order accuracy using digital workflow integration. Consumers choose brands offering stable delivery performance. Platforms enhance menu variety to meet diverse taste profiles. Growth rises from small eateries that seek digital revenue streams. Faster onboarding tools support quick merchant activation. Increased competition drives stronger customer experience upgrades.

Rise of Digital Payments and Loyalty Programs Encouraging Repeat Usage Across All User Segments

Digital payment tools support smoother order processing for new users. Wallet discounts push higher adoption across young groups. It offers reward points that reinforce platform loyalty. Banks partner with apps to introduce meal-linked cashback. Restaurants gain predictable order flows from loyal customers. Platforms track user behavior to improve personalized menus. Growth rises through expanded discount coverage during festivals. Seamless payment flow improves user satisfaction.

Market Trends:

Rapid Growth of Cloud Kitchens and Delivery-Optimized Food Brands Transforming Urban Meal Supply Models

Cloud kitchens expand across major cities to meet delivery-only demand. Operators design menus that travel well and maintain taste. It supports batch-based cooking that improves consistency. Platforms promote virtual brands that target niche taste groups. Restaurants use data insights to refine digital menus. Buyers respond well to stable pricing across delivery brands. Growth rises through flexible kitchen setups in dense zones. Faster preparation cycles strengthen delivery speed.

Integration of AI, Automation, and Predictive Systems Reshaping Delivery Efficiency and Customer Experience

AI tools forecast peak demand to improve driver availability. Predictive routing shortens delivery time across high-traffic areas. It optimizes meal preparation using smart order sequencing. Platforms test automated dispatch to reduce manual planning. Restaurants adopt AI menus to improve combination choices. Consumers receive better accuracy in estimated delivery time. Fleet systems improve fuel planning through data insights. Tech upgrades support stronger user confidence.

- For instance, Grab’s AI-powered ETA system—publicly detailed by Grab Engineering—improves predicted delivery arrival accuracy through machine learning models trained on millions of regional datapoints.

Health-Focused, Diet-Aligned, and Customizable Food Options Expanding Demand Across Young Consumer Groups

Consumers prefer cleaner meals that fit personal nutrition goals. Healthy brands design menus built for delivery safety. It improves order selection through clear ingredient visibility. Platforms create sections for fitness-focused categories. Restaurants engage diet-conscious users with calorie-listed meals. Custom meal bowls gain traction across office clusters. Younger buyers adopt subscription-based healthy plans. Strong lifestyle shifts support steady trend growth.

Rising Influence of Social Commerce, Food Influencers, and App-Based Discovery Tools on Ordering Behavior

Food influencers shape strong demand through short-form content. Viral dishes increase traffic on delivery platforms. It improves menu visibility for small restaurants. Social commerce pushes impulse ordering during peak hours. Apps highlight trending cuisines to guide user choices. Buyer decisions shift toward visually promoted meals. Restaurants leverage influencer tie-ups to boost brand value. Discovery tools create higher engagement among new users.

Market Challenges Analysis:

High Competitive Pressure, Cost Burdens, and Profitability Constraints Affecting Delivery Platforms and Restaurant Partners

The Vietnam Online Food Delivery Market faces intense pricing pressure across major players. Platforms spend heavily to retain users with promotions. It raises cost challenges that reduce long-term profitability. Drivers demand better wages that increase operating costs. Restaurants struggle with commission fees that lower margins. Users expect fast delivery that strains logistics teams. Fuel costs influence overall pricing models. Profit stability remains a core challenge.

Operational Limitations, Infrastructure Constraints, and Service Quality Issues Across Expanding Urban and Emerging Regions

Delivery teams face traffic congestion that slows order cycles. Poor road conditions affect service consistency in outer regions. It challenges the ability to maintain promised delivery times. Restaurants lack uniform packaging standards that impact food quality. Users report delays during heavy rain seasons. Platforms struggle to scale fleets that match peak demand. Merchant onboarding quality varies across new cities. Service reliability requires sustained investment.

Market Opportunities:

Expansion into Emerging Cities and Underserved Communities with Scalable Logistics and Localized Menu Strategies

The Vietnam Online Food Delivery Market holds strong potential across rising urban clusters. Platforms expand delivery fleets to reach new districts. It builds partnerships with local eateries to support regional taste demand. Cloud kitchens enter smaller cities to stabilize supply. Growth improves through targeted promotions for first-time users. Apps strengthen delivery coverage with micro-hub models. Wider reach shapes new revenue streams.

Growth Potential in Premium Segments, Healthy Meals, Subscription Models, and Value-Added Digital Services

Premium meal kits gain traction among young professionals. Healthy menus attract fitness-oriented groups across cities. It supports subscription-based plans that bring predictable usage. Digital services such as priority delivery enhance user loyalty. Restaurants launch signature menus tailored for digital buyers. Platforms gain new value through curated food bundles. Rising lifestyle upgrades push demand for specialized meal formats.

Market Segmentation Analysis:

By Type

The Vietnam Online Food Delivery Market shows strong growth across both major service models. Restaurant-to-consumer delivery expands through direct partnerships with leading chains and local eateries. Platform-to-consumer delivery strengthens market reach with broad menus and faster fleet support. It captures diverse user demand through flexible delivery choices. Aggregators drive higher engagement through structured promotions. Restaurants gain steady order flow from marketplace visibility. Both segments support rising digital adoption across cities.

- For instance, KFC Vietnam operates on both direct delivery channels and aggregator platforms, with over 140 outlets using integrated ordering systems to widen digital reach.

By Channel Type

Mobile applications dominate user preference due to simple interfaces and quick order steps. Apps record high retention across young consumers who rely on smartphones for daily tasks. Website or desktop channels maintain use among office workers. It supports structured browsing for larger group orders. Platforms optimize both channels to improve traffic. Growth trends favor app-first delivery behavior.

- For instance, GrabFood reports that over 70% of its Southeast Asian transactions come through mobile devices, confirming strong app-first behavior in Vietnam.

By Payment Method

Online payment adoption increases due to growing trust in digital wallets and bank-linked options. Cash on delivery remains active in selected regions where users prefer physical exchange. It supports choice for first-time users exploring digital platforms. Promotions linked to online payments push higher conversion. Both modes sustain wide coverage across customer groups.

By Cuisine Type

Vietnamese cuisine leads due to strong local preference and wide restaurant availability. Western, Italian, and South Asian cuisines expand reach through branded chains and cloud kitchens. It diversifies menus to attract mixed taste groups. Rising exposure to global flavors strengthens category growth.

By Order Mode

Online orders dominate due to ease, speed, and strong platform visibility. Offline orders persist across small eateries that engage local buyers. It shows clear movement toward digital-first consumption. Platforms gain volume from wider online use.

Segmentation:

By Type

- Restaurant-to-Consumer

- Platform-to-Consumer

By Channel Type

- Websites/Desktop

- Mobile Applications

By Payment Method

- Cash on Delivery

- Online Payment

By Cuisine Type

- Vietnamese Cuisine

- Western Cuisine

- Italian Cuisine

- South Asian Cuisine

By Order Mode

Regional Segments

- Northwest

- Northeast

- Red River Delta

- North Central Coast

- South Central Coast

- Central Highlands

- Southeast

- Mekong River Delta

Alternative Regional View

- Northern Vietnam (led by Hanoi)

- Central Vietnam (includes Da Nang and Hue)

- Southern Vietnam (led by Ho Chi Minh City)

Regional Analysis:

Northern Vietnam

Northern Vietnam holds the largest share of the Vietnam Online Food Delivery Market due to strong digital habits in Hanoi. The region leads with the highest order frequency supported by dense urban zones. It benefits from advanced platform penetration and strong rider networks. Restaurants adopt online channels faster in Hanoi, which lifts overall volume share across the region. Users show high trust in app-based transactions, which strengthens platform competition. The region maintains leadership due to stable demand from office clusters and student populations.

Central Vietnam

Central Vietnam records a moderate share driven by growing adoption in Da Nang and Hue. The region expands its digital base as younger consumers shift toward app ordering. It gains visibility through cloud kitchen investments that support menu variety and faster delivery cycles. Restaurants in tourism-heavy areas rely on platforms to reach domestic travelers. The share rises with deeper market penetration in emerging districts. Central Vietnam strengthens its position through improving logistics and better delivery coverage across coastal cities.

Southern Vietnam

Southern Vietnam holds a significant share driven by Ho Chi Minh City, which stands as the most active digital commerce hub. The region captures strong demand due to high population density and long operating hours across food service outlets. It benefits from rapid fleet expansion and strong merchant integration. The share grows as users adopt mobile payments at faster rates. It gains competitive strength through advanced platform ecosystems and large restaurant networks. Southern Vietnam remains a core growth engine due to fast service cycles and high customer engagement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ShopeeFood

- GrabFood

- BeFood

- Xanh SM Ngon

- Loship

- Baemin

- Foody Corporation

- Now

- Bach Hoa Xanh

- The Coffee House

- BeChef

- Jollibee Vietnam

- Mio

Competitive Analysis:

The Vietnam Online Food Delivery Market features strong competition among major platforms that target high user engagement and wide merchant integration. ShopeeFood and GrabFood lead through strong brand presence and large delivery fleets. It expands service quality by improving app experience and strengthening restaurant partnerships. BeFood holds a smaller share yet gains traction with local positioning. New players explore curated menus and localized delivery models. Platforms compete through loyalty programs, faster delivery windows, and high service reliability. Intense rivalry pushes continuous innovation across payment systems and fleet management technologies.

Recent Developments:

- In July 2025, ShopeeFood solidified its dominance alongside GrabFood, with the two platforms collectively controlling over 90% of the Vietnamese market. To cater to changing consumer behaviors, the company launched a “Solo Meal” collection targeting individual diners and Gen Z users seeking affordable options. By November 2025, ShopeeFood further integrated artificial intelligence to power its affiliate marketing and livestreaming features, aiming to optimize demand generation and personalize user recommendations.

- In June 2025, Bach Hoa Xanh reached a record network size of 2,180 stores, following an aggressive expansion that saw 410 new locations open in the first five months of the year alone. The grocery chain reported that its e-commerce and delivery arm is targeting an IPO in the near future, driven by improved profitability in its fresh food and FMCG segments.

- In May 2025, Xanh SM (the electric taxi operator owned by GSM) officially entered the food delivery fray by launching Xanh SM Ngon. The service debuted with a network of over 2,000 vetted restaurants in Hanoi, emphasizing food safety and eco-friendly delivery via its electric vehicle fleet. The platform plans a rapid nationwide expansion to challenge the existing duopoly of Grab and Shopee.

- In April 2025, GrabFood introduced new affordable dining options, including “GrabFood for One” and “Shared Saver,” to improve accessibility for budget-conscious users. By mid-2025, the platform expanded its service suite to include group ordering features and in-store dining vouchers, leveraging its “super app” ecosystem to retain users. Following the market exit of competitors like Baemin (and Gojek in late 2024), GrabFood has focused on strengthening unit economics and expanding its merchant partner network.

Report Coverage:

The research report offers an in-depth analysis based on By Type, By Channel Type, By Payment Method, By Cuisine Type, By Order Mode. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market. [replace all segments in report coverage]

Future Outlook:

- Strong digital adoption will expand platform usage across all major cities.

- Cloud kitchens will grow and support faster menu scaling.

- Electric delivery fleets will increase to improve cost efficiency and reduce emissions.

- Loyalty programs will shape stronger user retention across core groups.

- AI-driven routing will push shorter delivery cycles and higher accuracy.

- Healthy and premium meal categories will gain broader demand.

- Regional expansion will strengthen platform presence in emerging cities.

- Payment innovations will improve user trust and conversion rates.

- Restaurants will invest more in delivery-first menus and packaging standards.

- Competitive pressure will drive continuous upgrades across service quality.