Market Overview:

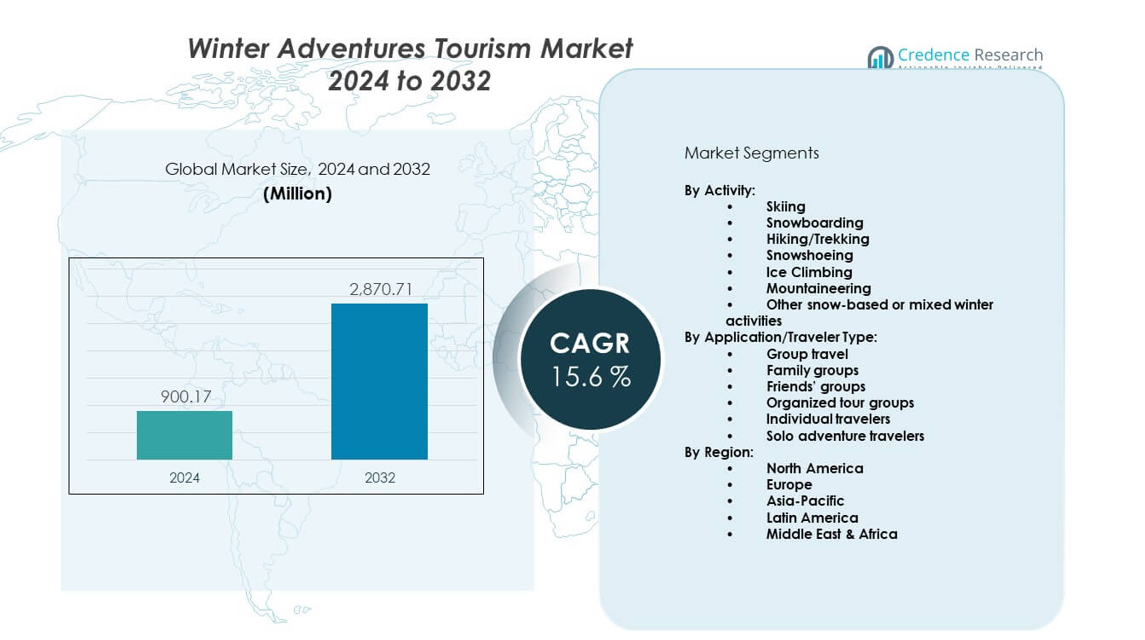

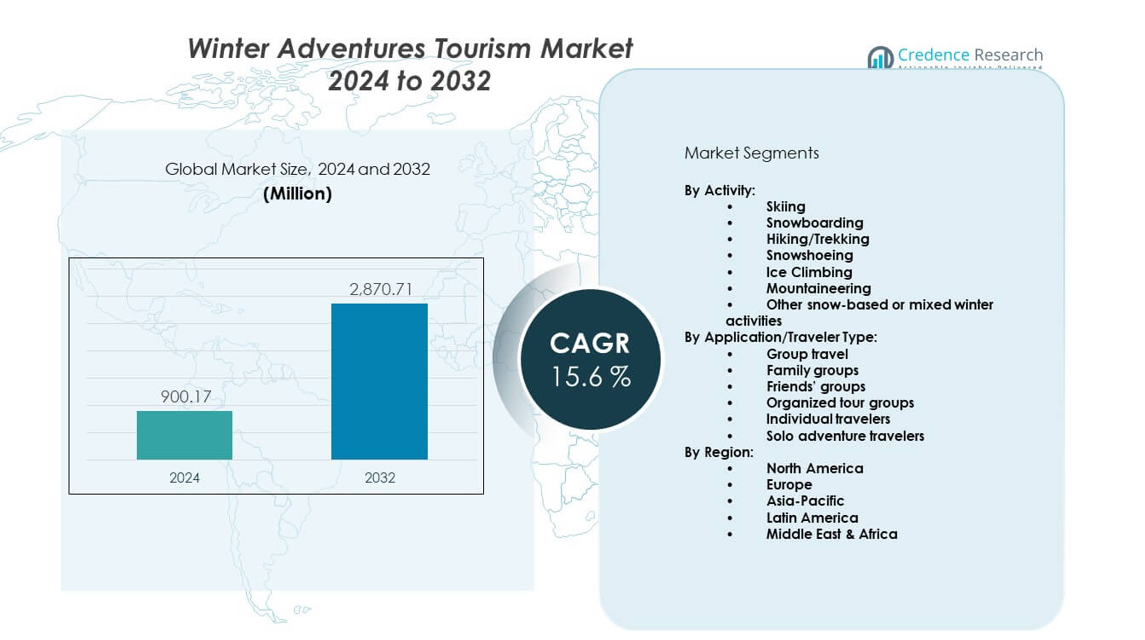

The Winter Adventures Tourism Market is projected to grow from USD 900.17 million in 2024 to an estimated USD 2,870.71 million by 2032, with a compound annual growth rate (CAGR) of 15.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Winter Adventures Tourism Market Size 2024 |

USD 900.17 million |

| Winter Adventures Tourism Market, CAGR |

15.6% |

| Winter Adventures Tourism Market Size 2032 |

USD 2,870.71 million |

Growing demand comes from travelers who prefer unique cold-season experiences across diverse terrains. Adventure operators expand service quality by offering guided trails, safer gear, and flexible packages. Winter sports gain wide attention due to social media visibility and rising wellness travel habits. Younger groups choose snow trekking, ice climbing, and ski training due to higher access to equipment rentals. Tour agencies design bundled packages that include lodging, local culture, and transport support. It helps travelers explore remote landscapes with structured safety standards. Rising interest in seasonal events also boosts global bookings.

North America leads due to strong ski infrastructure, established winter resorts, and high adventure participation. Europe follows with Alpine destinations that attract global visitors seeking premium snow activities and guided expeditions. Asia Pacific emerges due to rapid development of mountain sports hubs and rising interest among young travelers in countries like Japan, China, and South Korea. Latin America shows growing traction with expanding adventure zones in southern regions. The Middle East and Africa gain attention through niche cold-climate destinations and curated travel packages that support experiential tourism growth.

Market Insights:

- The Winter Adventures Tourism Market is projected to grow from USD 900.17 million in 2024 to USD 2,870.71 million by 2032, registering a strong CAGR of 15.6% driven by rising demand for seasonal, experience-focused winter travel.

- North America (38–40%), Europe (32–34%), and Asia-Pacific (18–20%) hold the highest shares due to advanced ski infrastructure, strong Alpine tourism, and rapid development of mountain sports hubs.

- Asia-Pacific, with an 18–20% share, stands as the fastest-growing region due to youth-driven interest, expanding winter resorts, and rising participation in snow sports.

- Skiing leads activity distribution with an estimated 40–42% share, supported by mature global resort networks and structured training programs.

- Group travel dominates traveler type distribution with a 45–48% share, driven by family, friends, and organized tour groups seeking guided and safe winter adventure packages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Experiential and Adventure-Focused Travel Experiences

The Winter Adventures Tourism Market grows through rising interest in unique winter experiences that attract young and seasoned travelers. People seek fresh outdoor challenges that create stronger emotional value. Many travelers prefer winter sports because these activities offer skill development and personal achievement. Tour operators respond by upgrading safety gear across major adventure routes. Resort owners design immersive programs that appeal to beginners and advanced users. Social media exposure strengthens global curiosity around winter escapes. It pushes travelers to explore remote destinations that feature snow trails and guided expeditions. Strong global travel intent supports steady business expansion.

- For instance, the Black Diamond JetForce Pro avalanche airbag uses a 200-liter deployable balloon. The system’s jet-fan inflates the airbag to 100% capacity in approximately 3.5 seconds and then runs continuously for a total of 9 seconds before cycling periodically for three minutes to ensure the bag stays fully inflated and can recover from potential tears.

Rising Influence of Wellness, Fitness, and Outdoor Lifestyle Engagement

Growing focus on wellness encourages more travelers to join winter fitness activities that improve stamina and balance. People follow healthier lifestyles and want active holidays that deliver clear physical benefits. Resorts expand wellness sessions to support recovery after intense winter sports. Guided snow trails help users gain confidence while learning controlled movement. Many travelers seek nature immersion to escape crowded city environments. Rising awareness around mental health supports interest in calm winter landscapes. It attracts groups that choose slow adventure formats for better relaxation. The Winter Adventures Tourism Market benefits from broader leisure goals that promote active living.

- For instance, Vail Resorts integrates MyFitness technology across training centers, tracking heart-rate zones with sensors accurate to ±1 bpm. Guided snow trails help users gain confidence while learning controlled movement.

Improved Infrastructure Development Across Winter Destinations and Adventure Routes

Governments and private developers invest in modern resorts that enhance visitor flow and experience. New lift systems reduce wait times and improve access to high-altitude trails. Resorts upgrade snow-making machines to ensure stable activity schedules despite weather shifts. Better transport networks help travelers reach remote adventure spots faster. Operators improve lodging facilities for safe, warm, and comfortable stays. Investment in rescue technology increases traveler trust during demanding activities. It boosts participation among first-time users who need strong support systems. The Winter Adventures Tourism Market gains momentum through reliable infrastructure growth.

Growing Adoption of Digital Platforms That Improve Trip Planning and Adventure Safety

Digital tools improve booking accuracy and support smooth travel planning for winter trips. Apps display trail conditions, resort updates, and gear availability in real time. Travelers use online guides to compare skill-based activities before selecting winter packages. Safety platforms share quick alerts that help people manage sudden weather changes. GPS-enabled mapping tools support navigation across long snow routes. Interactive content increases traveler confidence by offering stepwise adventure guidance. It helps service providers engage users with tailored itineraries. Wider digital reach expands access for new adventure seekers.

Market Trends:

Rising Popularity of Hybrid Winter Experiences That Blend Culture, Food, and Adventure Activities

Travelers want winter experiences that blend sport activities with cultural events. Local cuisine tours add depth to winter itineraries by offering regional flavor. Resorts plan hybrid programs that mix night trails with heritage festivals. Younger travelers prefer multi-theme trips that expand their exposure to new traditions. It drives demand for curated packages that link adventure with culture. Many destinations market local crafts to elevate traveler interest. Communities support unique events that highlight regional identity. The Winter Adventures Tourism Market gains new visibility through these layered offerings.

- For instance, Norway’s Røros Winter Festival records annual attendance above 25,000 visitors, merging cultural showcases with outdoor winter experiences. The Winter Adventures Tourism Market gains new visibility through these layered offerings.

Expansion of Sustainable Tourism Practices and Low-Impact Winter Adventure Models

Environmental awareness pushes operators to design low-impact adventure formats that reduce land stress. Resorts adopt renewable energy systems to power lifts and support base camps. Waste-control programs ensure cleaner mountain zones during peak winter use. Refillable gear stations reduce plastic consumption across adventure hubs. Many travelers prefer eco-certified trails that protect natural habitats. It motivates operators to follow strict sustainability rules. Climate-sensitive management shapes new business plans across winter zones. Sustainable practices support long-term market appeal.

- For instance, Aspen Skiing Company runs its Elk Creek Mine methane-to-energy plant generating 3 MW of clean power annually. Waste-control programs ensure cleaner mountain zones during peak winter use.

Growing Demand for Technology-Enhanced Adventure Experiences and Smart Gear Adoption

Smart gear improves performance tracking and safety during winter activities. Wearable devices measure speed, altitude, and heart rate during ski sessions. Travelers adopt safety sensors that alert teams during sudden route changes. Interactive goggles stream navigation guidance to help users manage steep paths. Virtual training tools allow beginners to learn technique before real-world practice. It improves participation among new users who fear injury. Resorts promote intelligent gear packages that support advanced learning. The Winter Adventures Tourism Market embraces tech integration to elevate experience quality.

Increasing Interest in Niche Winter Sports and Lifestyle-Driven Micro-Adventure Segments

Niche sports gain attention from travelers who want uncommon winter challenges. Ice climbing attracts users who seek high-skill environments. Snowshoe trails appeal to people who want calm walks across remote areas. Fat biking gains traction in cold regions that support stable snow surfaces. Winter running events attract fitness groups that follow endurance goals. It builds community interest in compact travel formats. Destinations use these niche categories to stand out in a competitive space. Rising micro-adventure culture expands seasonal activity choices.

Market Challenges Analysis:

Weather Variability, Safety Concerns, and Uneven Infrastructure Development Across Winter Regions

Climate uncertainty disrupts winter schedules and reduces predictable sport conditions. Many regions face shorter snow cycles that limit organized activities. Resorts struggle to maintain snow cover without heavy infrastructure support. Safety concerns rise when conditions shift faster than expected. Travelers hesitate when routes lack proper rescue systems. Operators face high investment needs to match global safety standards. It creates operational pressure during peak travel months. The Winter Adventures Tourism Market must manage these weather and safety gaps with stronger planning.

High Travel Costs, Limited Accessibility, and Strong Season Dependency Across Key Destinations

Rising travel costs reduce access for budget travelers seeking winter activities. Remote adventure zones need long transport routes that increase spending. Limited airport access restricts visitor flow across high-altitude regions. Strong season dependency leads to revenue variation across the year. Operators struggle to maintain full-time staff outside peak months. It affects training cycles and service quality during early winter. Supply chains face stress during heavy snowfall periods. Many regions need new policies to support wider accessibility.

Market Opportunities:

Expansion of Experiential Tourism Programs and Wider Participation in Skill-Based Winter Activities

Destinations can develop structured training modules that attract new adventure groups. Resorts can add tiered skill paths that support steady learning and repeat visits. Guided programs can target families, solo travelers, and corporate groups. Cultural add-ons can elevate visitor time spent at winter hubs. It helps operators build loyalty across diverse traveler types. The Winter Adventures Tourism Market can unlock new revenue streams through these curated offerings. Many regions can introduce winter festivals to strengthen engagement. Cross-season programming can grow demand for off-peak periods.

Advancement of Digital Connectivity, Smart Gear Ecosystems, and Sustainable Tourism Models

Digital tools can expand reach by supporting real-time guidance and quick booking features. Smart gear can help travelers explore advanced trails without fear. Data-supported safety systems can improve rescue response times. Sustainable development can attract eco-focused travelers who prefer clean tourism models. It allows regions to promote long-term value creation. Resorts can shift toward renewable energy to strengthen brand appeal. Green certifications can build trust among global travelers. The Winter Adventures Tourism Market can scale through these future-ready models.

Market Segmentation Analysis:

By Activity

The Winter Adventures Tourism Market expands through strong participation across core winter activities. Skiing leads due to established resort ecosystems and structured training programs. Snowboarding attracts younger travelers who prefer freestyle terrains and flexible learning styles. Hiking and trekking across winter trails gain traction among groups that seek scenic exploration. Snowshoeing supports broader adoption because this activity suits various fitness levels. Ice climbing appeals to skilled users who want technical challenges. Mountaineering draws adventure travelers who favor multi-day expeditions. Other mixed winter activities help operators design diverse packages that fit changing traveler goals.

By Application/Traveler Type

Traveler diversity shapes steady growth across key categories in the Winter Adventures Tourism Market. Group travel remains dominant because families and friends prefer shared experiences during winter holidays. Family groups select safer guided routes and structured programs. Friends’ groups choose adventure-focused itineraries that offer stronger engagement. Organized tour groups depend on fixed schedules that simplify planning. Individual travelers explore flexible routes that match personal pace. Solo adventure travelers rely on guided safety systems while seeking independence. It supports broader market reach by meeting varied travel preferences across regions.

- For instance, G Adventures’ small-group format caps departures at 12–16 travelers to ensure guided support for solo users. It supports broader market reach by meeting varied travel preferences across regions.

Segmentation:

By Activity:

- Skiing

- Snowboarding

- Hiking/Trekking

- Snowshoeing

- Ice Climbing

- Mountaineering

- Other snow-based or mixed winter activities

By Application/Traveler Type:

- Group travel

- Family groups

- Friends’ groups

- Organized tour groups

- Individual travelers

- Solo adventure travelers

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Winter Adventures Tourism Market with an estimated 40% share. Strong ski infrastructure supports heavy participation across major resort clusters. Canada and the United States attract travelers who seek structured winter programs and guided expeditions. Advanced safety systems improve trust among international visitors. Stable demand across family and group travel segments shapes consistent seasonal traffic. It benefits from broad domestic interest in winter sports and high spending on adventure travel. Regional operators invest in digital tools that support booking and trail updates.

Europe

Europe accounts for roughly 34% of global share due to its established Alpine destinations. Countries such as France, Switzerland, Austria, and Italy lead with world-class resorts and strong snow reliability. Cultural tourism blends with winter sports to attract long-stay travelers. Multi-country access across the Schengen region supports easy movement for adventure seekers. It benefits from dense ski towns that offer structured programs for all skill levels. Growing demand from Nordic regions strengthens interest in snowshoeing, cross-country trails, and niche winter sports. Tour operators expand curated packages that mix sport, tradition, and lifestyle experiences.

Asia-Pacific, Latin America, and Middle East & Africa

Asia-Pacific holds an emerging share of 20% supported by rapid infrastructure growth in Japan, China, and South Korea. Rising youth participation drives demand for snowboarding, trekking, and winter photography trails. Latin America maintains a smaller share of 5%, led by Chile and Argentina with strong Andean adventure routes. Middle East & Africa capture roughly 4%, driven by niche cold-climate destinations that appeal to premium travelers. It gains traction in developing markets where interest in seasonal experiences continues to rise. Regional governments promote winter adventure zones to diversify tourism. The Winter Adventures Tourism Market strengthens global reach through expanding access across new winter corridors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Winter Adventures Tourism Market features strong competition among global and regional operators that specialize in guided tours, resort-based activities, and multi-day expeditions. Companies expand service portfolios to attract diverse travelers seeking ski sessions, cultural events, and hybrid winter experiences. Many operators invest in digital tools that improve booking accuracy and enhance route planning. Partnerships with local communities strengthen access to remote trails. It gains value from firms that integrate sustainability practices into travel programs. Market leaders differentiate through safety systems, skilled guides, and curated adventure packages. Strong brand credibility helps operators secure repeat travelers and long-stay bookings.

Recent Developments:

- In June 2025, Mountain Travel Sobek appointed Seth Heald as its new CEO. Heald brings over 20 years of entrepreneurial and operational experience, including founding Arizona Outback Adventures and leading REI’s North America adventure operations. He succeeded Massimo Prioreschi, who guided MT Sobek through a transformative era. Additionally, in January 2025, MT Sobek capitalized on REI Adventures’ exit from the adventure travel market by offering to accommodate rebooking customers, presenting itself as a trusted alternative with risk-free booking until January 31, 2025.

- In February 2025, Intrepid Travel acquired leading Dutch tour operator Sawadee Reizen from Travelopia in a landmark acquisition that completed on January 31, 2025. The deal added $100 million (€60 million) in revenue and an additional 20,000 customers a year to Intrepid, boosting EBITDA by an extra $5 million (€3 million). Additionally, in August 2025, Intrepid Travel fully acquired 100% of New Zealand-based Haka Tours, completing its acquisition which was initially announced in October 2021. Haka Tours now operates as Intrepid DMC New Zealand Limited, with Simon Mckearney appointed as Intrepid’s first New Zealand Country Manager.

- In September 2024, Exodus Adventure Travels announced a strategic partnership with Priority Pass, making it the first adventure travel company to provide travelers with complimentary Priority Pass lounge access benefits at major North American airports. North American travelers who book guided Exodus Adventure Travels hiking, biking, cultural, or wildlife trips receive a complimentary one-year Priority Pass membership, including two complimentary visits to Priority Pass’ 1,600+ airport lounges. Exodus also launched partnerships with Byway, the first 100 percent flight-free travel platform, as part of its climate action plan.

Report Coverage:

The research report offers an in-depth analysis based on By Activity and By Application/Traveler Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market. [replace all segments in report coverage].

Future Outlook:

- Demand for multi-activity winter programs will increase across major adventure destinations.

- Digital tools will enhance booking speed and route planning for global travelers.

- Safety technologies will support higher participation from beginner-level users.

- Sustainable tourism models will attract eco-focused travelers seeking low-impact trips.

- Resorts will expand hybrid cultural and winter sports programs for wider appeal.

- Group travel will remain strong due to family-oriented and social travel behavior.

- Solo travel demand will grow among young adventure seekers with flexible schedules.

- Operators will add niche sports to diversify winter activity portfolios.

- Partnerships with local communities will expand access to remote trails.

- The Winter Adventures Tourism Market will benefit from stronger global promotion of seasonal adventure experiences.