| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vietnam Plastic Welding Equipment Market Size 2024 |

USD 31.99 Million |

| Vietnam Plastic Welding Equipment Market, CAGR |

7.88% |

| Vietnam Plastic Welding Equipment Market Size 2032 |

USD 58.67 Million |

Market Overview

Vietnam Plastic Welding Equipment market size was valued at USD 31.99 million in 2024 and is anticipated to reach USD 58.67 million by 2032, at a CAGR of 7.88% during the forecast period (2024-2032).

The Vietnam plastic welding equipment market is driven by the rapid growth of the manufacturing and construction sectors, supported by increased government investment in infrastructure and industrial development. Rising demand for durable and cost-effective plastic products in automotive, electronics, and packaging industries is fueling the adoption of advanced welding technologies. The shift towards automation and precision manufacturing is prompting businesses to invest in modern plastic welding solutions, enhancing efficiency and product quality. Additionally, environmental regulations encouraging the use of recyclable plastics are increasing the need for reliable welding equipment. Technological advancements, such as ultrasonic and laser welding methods, are gaining traction due to their ability to deliver high precision and minimal material waste. Furthermore, the expansion of Vietnam’s export-driven economy is pushing manufacturers to adopt international standards, boosting demand for high-performance welding tools. These combined factors are shaping a dynamic and steadily growing market landscape for plastic welding equipment in Vietnam.

The geographical landscape of the Vietnam plastic welding equipment market is shaped by the industrial growth and infrastructure development across key regions including Southeast, Northern, Central, and Southern Vietnam. Each region contributes uniquely to the market, with industrial zones and export-driven manufacturing clusters fueling demand for efficient plastic welding solutions. Southeast Vietnam, with its strong manufacturing base, leads in technology adoption, while Northern Vietnam shows rapid expansion in electronics and precision industries. Central and Southern regions, though developing, are witnessing increasing adoption of plastic welding technologies in sectors like packaging and consumer goods. In terms of key players, the market is competitive with the presence of both international and domestic companies. Notable global manufacturers such as Emerson Electric Co., Leister Technologies AG, and Dukane Corporation are actively supplying advanced equipment, while regional players are expanding their capabilities to cater to localized demand. These companies are focusing on innovation, automation, and strategic partnerships to strengthen their market positions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Vietnam plastic welding equipment market was valued at USD 31.99 million in 2024 and is projected to reach USD 58.67 million by 2032, growing at a CAGR of 7.88% from 2024 to 2032.

- The global plastic welding equipment market was valued at USD 11,340.00 million in 2024 and is projected to reach USD 19,842.36 million by 2032, growing at a CAGR of 7.24% from 2024 to 2032.

- Rising demand for lightweight and durable materials, especially in automotive manufacturing, is driving market growth.

- Increasing applications of plastic welding in medical device production are boosting the adoption of advanced equipment.

- Technological advancements, particularly in laser welding, are a key trend, enabling more efficient and precise operations.

- The market faces challenges such as high initial investment costs for advanced equipment and a shortage of skilled technicians.

- Southeast Vietnam leads the market with strong manufacturing hubs, followed by Northern Vietnam, which is growing rapidly in electronics and precision manufacturing.

- Key players like Emerson Electric Co., Leister Technologies AG, and Dukane Corporation are leading the competitive landscape with innovative offerings.

Report Scope

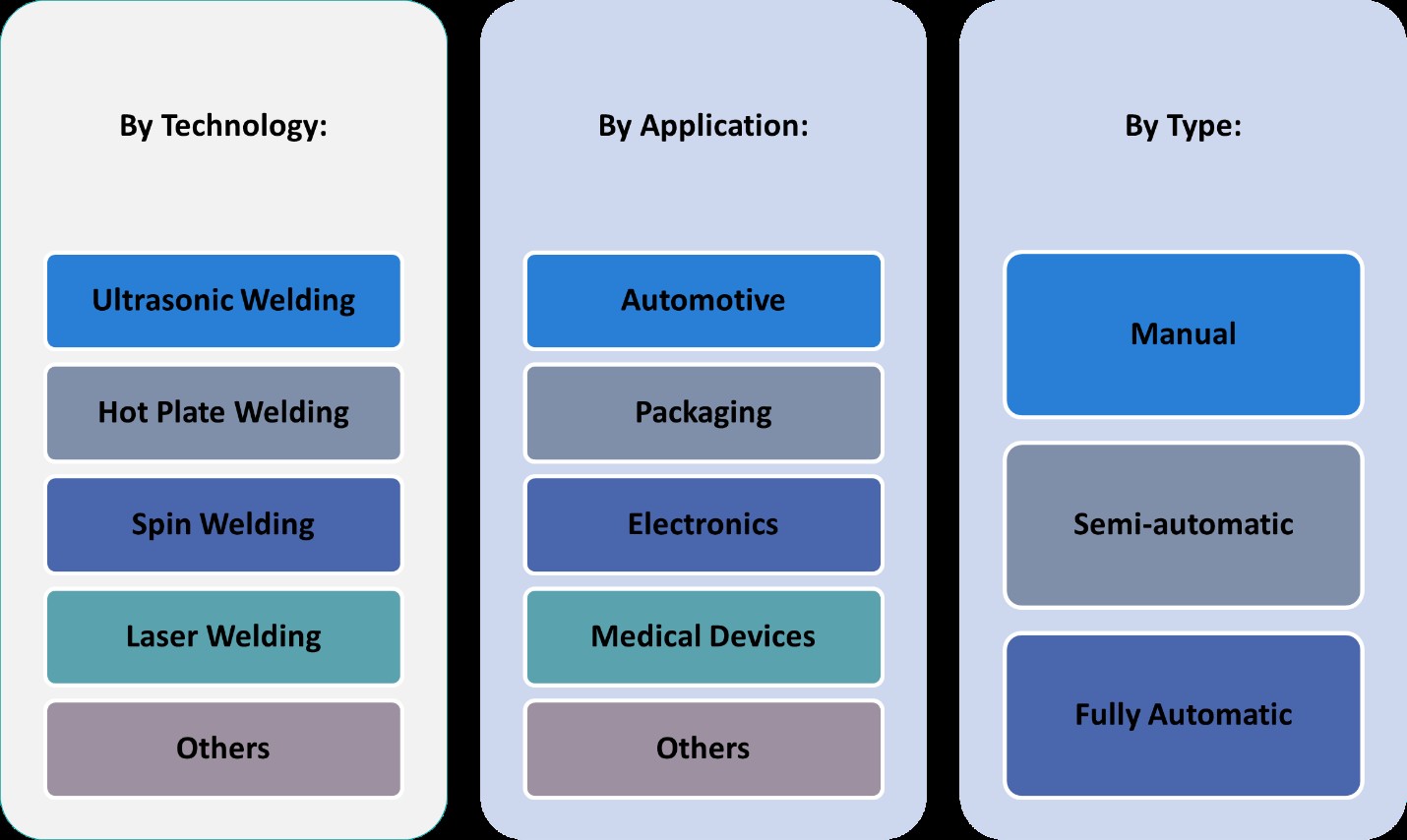

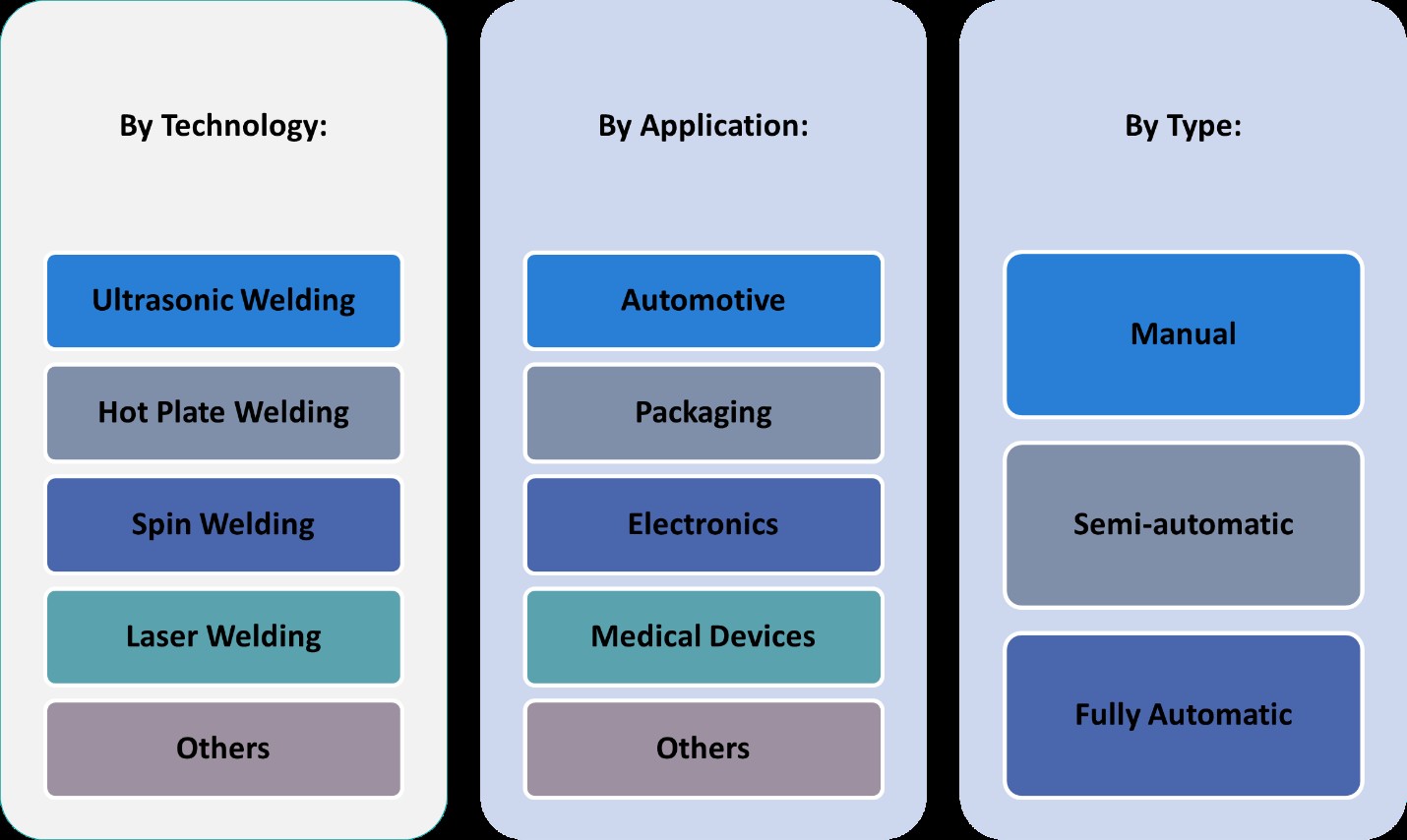

This report segments the Vietnam Plastic Welding Equipment Market as follows:

Market Drivers

Industrial Growth and Infrastructure Development

Vietnam’s rapid industrialization and expanding infrastructure projects are significant drivers for the plastic welding equipment market. For instance, Vietnam’s government has allocated substantial funding for infrastructure projects, including transportation networks and water supply systems, which require extensive use of plastic piping. The manufacturing sector, particularly automotive, electronics, and consumer goods, is also witnessing robust growth, creating a strong need for advanced plastic welding solutions. As local and foreign investments pour into industrial parks and manufacturing hubs, the demand for reliable and efficient plastic welding equipment is expected to grow steadily.

Increasing Demand from End-Use Industries

The growing application of plastics in key industries such as automotive, packaging, electrical, and construction has led to a surge in demand for plastic welding equipment in Vietnam. For instance, Vietnam’s automotive sector is increasingly adopting lightweight plastic components to enhance fuel efficiency and performance, aligning with global sustainability goals. This trend is driving the need for high-quality welding techniques that ensure strength and durability. Similarly, the packaging industry is transitioning to plastic materials due to their versatility and cost-efficiency, creating further opportunities for welding equipment suppliers. As these industries continue to expand and evolve, so does their requirement for advanced, industry-specific welding technologies.

Technological Advancements and Automation

The adoption of advanced technologies and automation in manufacturing processes is another key market driver. Manufacturers are increasingly integrating cutting-edge plastic welding techniques such as ultrasonic, hot plate, and laser welding to improve accuracy, reduce production time, and minimize material waste. Automation in plastic welding not only enhances production efficiency but also ensures consistent quality—critical for sectors with stringent product standards. As Vietnam’s industries strive to remain competitive in the global supply chain, the demand for smart, automated welding systems is rising. This trend is pushing equipment providers to innovate and deliver more technologically sophisticated solutions to meet the market’s evolving needs.

Supportive Policies and Environmental Considerations

Vietnam’s government is actively promoting sustainable development, encouraging the use of recyclable and eco-friendly plastic materials. This shift is boosting the demand for plastic welding equipment that supports efficient recycling and reuse processes. Additionally, the country’s favorable trade policies, free trade agreements, and efforts to streamline business regulations have attracted foreign investments, especially in high-tech and manufacturing sectors. These supportive measures are creating a conducive environment for the plastic welding equipment market to flourish. As companies aim to align with global environmental standards and production efficiencies, the market is likely to witness continued growth driven by both policy incentives and sustainability goals.

Market Trends

Emphasis on Sustainability and Eco-Friendly Practices

Environmental concerns and the push for sustainable manufacturing practices are influencing the plastic welding equipment market in Vietnam. For instance, Vietnam’s National Action Plan on Sustainable Consumption and Production emphasizes reducing waste and promoting eco-friendly manufacturing. There is a growing emphasis on adopting eco-friendly welding processes that reduce waste and energy consumption. Manufacturers are focusing on developing energy-efficient machines and processes that align with environmental regulations and consumer demand for greener products. The integration of biodegradable and recyclable materials in manufacturing further necessitates advanced welding equipment capable of handling these new materials effectively.

Government Initiatives and Foreign Investments

Vietnam’s government initiatives aimed at promoting industrialization and manufacturing are creating a conducive environment for the plastic welding equipment market. For instance, Vietnam’s Industrial Development Strategy through 2025 focuses on mobilizing resources for manufacturing growth and infrastructure development. Policies supporting infrastructure development and favorable trade agreements have attracted foreign investments, leading to the establishment of new manufacturing facilities. This influx of investments not only boosts the demand for plastic welding equipment but also encourages the adoption of international standards and advanced technologies in manufacturing processes.

Technological Advancements and Automation

Vietnam’s plastic welding equipment market is experiencing significant growth due to the adoption of advanced technologies and automation. Manufacturers are increasingly integrating cutting-edge welding techniques such as ultrasonic, hot plate, and laser welding to enhance precision, reduce production time, and minimize material waste. The incorporation of Industry 4.0 technologies, including IoT and machine learning, enables real-time monitoring and optimization of production processes, leading to improved efficiency and product quality. These advancements not only streamline manufacturing operations but also ensure consistent quality, which is critical for sectors with stringent product standards.

Rising Demand from Key End-Use Industries

The expansion of end-use industries such as automotive, electronics, and construction is a significant driver for the plastic welding equipment market in Vietnam. In the automotive sector, the shift towards lightweight components to improve fuel efficiency has increased the reliance on plastic welding techniques. Similarly, the electronics industry demands high-precision welding for assembling intricate components. The construction industry’s growth, fueled by urbanization and infrastructure development, has led to increased use of plastic materials, thereby boosting the demand for efficient welding equipment.

Market Challenges Analysis

High Initial Investment and Limited Technical Expertise

One of the primary challenges in the Vietnam plastic welding equipment market is the high initial investment required for advanced welding machinery and automation systems. For instance, JASIC has introduced laser welding machines in Vietnam, highlighting the growing trend of high-tech welding solutions. While the long-term benefits of adopting modern equipment include higher productivity and product quality, the upfront costs can be prohibitive for small and medium-sized enterprises (SMEs), which make up a significant portion of Vietnam’s industrial sector. Moreover, the integration of sophisticated technologies such as laser or ultrasonic welding demands skilled technicians and operators. However, there is a notable shortage of technically trained professionals in the country, which limits the effective implementation and operation of such equipment. This skills gap not only slows down the adoption of advanced technologies but also increases dependency on foreign expertise and training services, further raising operational costs.

Inconsistent Raw Material Quality and Regulatory Hurdles

Another critical challenge lies in the inconsistency of raw material quality and the evolving regulatory landscape. Plastic welding requires uniform and high-quality plastic materials to ensure reliable joints and optimal performance. However, the availability of consistent, industry-grade plastics remains limited in the domestic market, often leading to variability in production outcomes. Additionally, the regulatory environment in Vietnam is becoming more stringent, particularly concerning environmental compliance and product safety standards. While these regulations aim to align Vietnam with international trade requirements, they also impose additional pressure on manufacturers to upgrade their processes and technologies, sometimes without clear guidance or support. Navigating these regulatory changes can be complex, especially for smaller players lacking dedicated compliance teams, ultimately hampering growth and innovation in the sector.

Market Opportunities

The Vietnam plastic welding equipment market presents promising opportunities fueled by the country’s accelerating industrialization and expanding export-oriented manufacturing base. As Vietnam continues to position itself as a key player in the global supply chain, particularly in sectors like automotive, electronics, packaging, and consumer goods, the demand for high-performance plastic components is on the rise. This trend creates a favorable environment for the growth of plastic welding technologies that can deliver strength, precision, and efficiency. Additionally, the government’s proactive efforts to attract foreign direct investment through improved infrastructure, favorable trade policies, and industrial zone development are drawing multinational manufacturers into the country. These investments often come with a demand for advanced, internationally compliant welding systems, opening up new avenues for equipment suppliers and technology providers to introduce innovative solutions tailored to local market needs.

Furthermore, the growing awareness of sustainable practices and circular economy models presents a unique opportunity for the plastic welding equipment industry. With increasing regulatory and consumer focus on eco-friendly production, manufacturers are exploring technologies that support the recycling and reuse of plastic materials. This shift creates demand for welding equipment that can work efficiently with recycled plastics while maintaining product integrity. Moreover, the rise of Industry 4.0 and digital transformation in manufacturing is encouraging companies to adopt smart welding systems integrated with automation, data analytics, and remote monitoring. Vendors who offer equipment compatible with these trends are well-positioned to capture a growing segment of the market. As the Vietnamese workforce becomes increasingly skilled and the demand for high-quality, cost-effective plastic products grows, the market is likely to see continued expansion, offering long-term growth opportunities for both domestic and international stakeholders.

Market Segmentation Analysis:

By Type:

The Vietnam plastic welding equipment market can be segmented into manual, semi-automatic, and fully automatic systems, each catering to specific industrial needs and operational capacities. Manual welding equipment remains prevalent among small-scale manufacturers and workshops due to its low cost and ease of use. However, its limitations in precision and scalability make it less suitable for large-scale production. Semi-automatic systems are gaining popularity as they strike a balance between affordability and improved efficiency, making them ideal for mid-sized enterprises looking to upgrade from manual methods without a substantial capital investment. The fully automatic segment is witnessing the fastest growth, driven by increasing demand for high-speed, precision manufacturing and minimal human intervention. Large manufacturers, especially in export-oriented industries, are adopting automated systems to meet international quality standards and improve throughput. As Vietnam’s industrial sector continues to modernize and integrate Industry 4.0 practices, demand for semi-automatic and fully automatic plastic welding equipment is expected to rise significantly over the coming years.

By Application:

In terms of application, the plastic welding equipment market in Vietnam is segmented into electronics, packaging, automotive, medical devices, and others. The automotive sector leads the demand due to the growing use of plastic components for lightweight vehicle manufacturing, which requires robust and precise welding techniques. The electronics industry follows closely, where miniaturization and the use of high-performance plastics necessitate accurate welding solutions like ultrasonic and laser welding. The packaging industry is also witnessing steady growth, as plastic welding ensures leak-proof seals in food and consumer goods packaging. In the medical device segment, stringent hygiene and safety standards drive demand for specialized welding equipment capable of producing sterile and durable joins. The “others” category includes construction and consumer goods, which also contribute to market demand on a smaller scale. As technological advancement continues and the need for reliable, application-specific solutions grows, these segments offer diversified growth opportunities across Vietnam’s industrial landscape.

Segments:

Based on Type:

- Manual

- Semi-automatic

- Fully Automatic

Based on Application:

- Electronics

- Packaging

- Automotive

- Medical Devices

- Others

Based on Technology:

- Ultrasonic Welding

- Hot Plate Welding

- Spin Welding

- Laser Welding

- Others

Based on the Geography:

- Southeast Vietnam

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

Regional Analysis

Southeast Vietnam

Southeast Vietnam holds the largest share of the plastic welding equipment market, accounting for approximately 38% of the total market in 2024. This region, home to major industrial hubs like Ho Chi Minh City, Binh Duong, and Dong Nai, is the epicenter of Vietnam’s manufacturing and export activities. It hosts a high concentration of electronics, automotive, and consumer goods manufacturing facilities, all of which require precise and efficient plastic welding solutions. The region benefits from well-developed infrastructure, access to skilled labor, and strong foreign direct investment, particularly from South Korea, Japan, and Taiwan. As factories increasingly modernize and adopt Industry 4.0 technologies, demand for semi-automatic and fully automatic welding equipment is growing rapidly. The combination of industrial density and technological adoption positions Southeast Vietnam as the dominant force driving innovation and consumption in this market.

Northern Vietnam

Northern Vietnam contributes approximately 27% to the plastic welding equipment market, making it the second-largest regional player. Anchored by Hanoi and neighboring provinces such as Bac Ninh and Hai Phong, the region is a rising manufacturing powerhouse, particularly for electronics and precision machinery. Major global brands have established production bases here, fueling demand for high-performance plastic welding solutions in components assembly. Northern Vietnam also benefits from its proximity to China, facilitating smoother supply chains and access to raw materials. With increasing emphasis on quality control and regulatory compliance, manufacturers in this region are shifting from manual processes to automated and semi-automated systems. Government incentives to attract foreign investment into high-tech sectors further amplify the potential for long-term growth in plastic welding equipment demand.

Central Vietnam

Central Vietnam represents a smaller but steadily growing share, accounting for approximately 18% of the market. Cities such as Da Nang and Quang Nam are emerging industrial centers, supported by improved logistics and strategic investments in infrastructure. The region’s economy is driven by mid-sized enterprises in construction materials, packaging, and consumer goods—all of which require plastic welding applications. Although still in the early stages of automation, Central Vietnam is seeing gradual adoption of modern equipment, particularly among firms seeking to scale operations or expand into export markets. The government’s regional development policies and incentives are expected to boost industrial activities and increase the adoption of advanced manufacturing technologies over time.

Southern Vietnam

Southern Vietnam contributes around 17% to the market, characterized by a mix of traditional industries and growing manufacturing clusters in provinces like Can Tho and Long An. While this region currently lags behind in technological sophistication compared to its northern and southeastern counterparts, there is growing interest in upgrading production capabilities. The local economy, driven by agriculture-related packaging, light manufacturing, and small-scale automotive assembly, presents opportunities for manual and semi-automatic plastic welding systems. With rising demand for durable and cost-effective plastic components, and the increasing participation of local businesses in national and regional supply chains, Southern Vietnam is poised for gradual growth. As infrastructure improves and private investment rises, the region may see a steady transition toward more advanced equipment solutions in the coming years.

Key Player Analysis

- Emerson Electric Co.

- Leister Technologies AG

- Dukane Corporation

- Herrmann Ultraschalltechnik GmbH & Co. KG

- Branson Ultrasonics Corporation

- Frimo Group GmbH

- Bielomatik Leuze GmbH & Co. KG

- CHN-TOP Machinery Group

- Haitian International Holdings Ltd.

- Xinpoint Corporation

Competitive Analysis

The competitive landscape of the Vietnam plastic welding equipment market is dominated by both global and regional players, with key international companies leading in innovation and market share. Prominent players include Emerson Electric Co., Leister Technologies AG, Dukane Corporation, Herrmann Ultraschalltechnik GmbH & Co. KG, Branson Ultrasonics Corporation, Frimo Group GmbH, Bielomatik Leuze GmbH & Co. KG, CHN-TOP Machinery Group, Haitian International Holdings Ltd., and Xinpoint Corporation. Leading companies focus on advanced welding technologies such as ultrasonic, laser, and hot plate welding to cater to the growing demand for high-precision and efficient equipment. These players emphasize product quality, technological integration, and customization to meet the specific needs of industries such as automotive, electronics, medical devices, and packaging. The market is increasingly driven by the demand for automation and Industry 4.0-compatible systems, with a strong focus on reducing production costs and increasing efficiency. Additionally, companies are competing by expanding their local presence, forming strategic partnerships, and offering training and after-sales support to enhance customer loyalty. With Vietnam’s growing industrial base, manufacturers are continuously improving product offerings, adopting the latest technologies, and focusing on customer satisfaction to secure a competitive advantage. Regional players are also strengthening their foothold by offering cost-effective solutions tailored to local needs while competing against established global brands.

Recent Developments

- In March 2025, Leister transferred its laser plastic welding business to Hymson Novolas AG, a subsidiary of Hymson Laser Technology Group Co. Ltd. The transition ensures continuity and further development of existing product lines, with a new Laser Technology Center established in Switzerland. Leister will now focus more on its core competencies: plastic welding (hot air, infrared) and industrial process heat.

- In February 2025, Herrmann continues to set industry standards with its ultrasonic welding solutions, particularly for medical devices and sensitive components. The company emphasizes individualized process development, intelligent process control, and digital quality monitoring for reproducible, high-strength welds. Herrmann will showcase new applications and integration options at K 2025, focusing on automation and sustainability in medical and packaging industries.

- In January 2025, Dukane highlighted its patented Q-Factor, Melt-Match®, Low Amplitude Preheat, and Ultra-High Frequency (260–400 Hz) vibration welding technologies, emphasizing their leadership in process control and diagnostics.

- In May 2024, Emerson launched the Branson™ GLX-1 Laser Welder, designed for the automated assembly of small, intricate plastic parts. The GLX-1 features a compact, modular design suitable for cleanroom environments, advanced servo-based actuation, and the ability to “un-weld” plastics for closed-loop recycling. It uses Simultaneous Through-Transmission Infrared® (STTlr) laser-welding technology for high efficiency, weld strength, and aesthetics. Enhanced connectivity, security, and data collection features support Industry 4.0 integration.

Market Concentration & Characteristics

The Vietnam plastic welding equipment market exhibits a moderate level of market concentration, with a blend of well-established global players and emerging regional manufacturers. Global companies with advanced technology and strong brand recognition dominate the higher-end segments, particularly in industries such as automotive, medical, and electronics. These players tend to offer cutting-edge solutions like laser welding and ultrasonic welding, which cater to the demand for precision and automation. On the other hand, regional manufacturers focus on providing more affordable, customized equipment to meet the needs of small and medium-sized enterprises (SMEs), especially in sectors like packaging and consumer goods. As the market evolves, competition is intensifying, driven by technological advancements and increasing demand for automation in manufacturing. The characteristics of the market reflect a growing shift toward high-efficiency, low-maintenance, and smart welding solutions, with an increasing emphasis on offering cost-effective yet reliable alternatives to meet diverse industry needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The plastic welding equipment market in Vietnam is expected to experience steady growth due to rising industrial demand.

- Increased adoption of automation and advanced technology will drive innovation in plastic welding machinery.

- As Vietnam’s manufacturing sector expands, the need for efficient and precise welding solutions will continue to grow.

- The demand for eco-friendly and energy-efficient plastic welding equipment will rise, aligning with global sustainability trends.

- Vietnam’s growing automotive and electronics industries will fuel the need for high-quality plastic welding technologies.

- The plastic welding market will see increased investments from local and international players looking to capitalize on the country’s industrial growth.

- Integration of smart technologies, such as IoT and AI, will improve the efficiency and monitoring capabilities of plastic welding equipment.

- Vietnamese businesses are likely to increasingly prefer cost-effective and reliable welding equipment, driving competitive pricing.

- Government policies focused on industrial development and technological upgrades will further support the growth of the market.

- The plastic welding equipment market in Vietnam is projected to benefit from the country’s expanding export activities and international trade relationships.