Market Overview

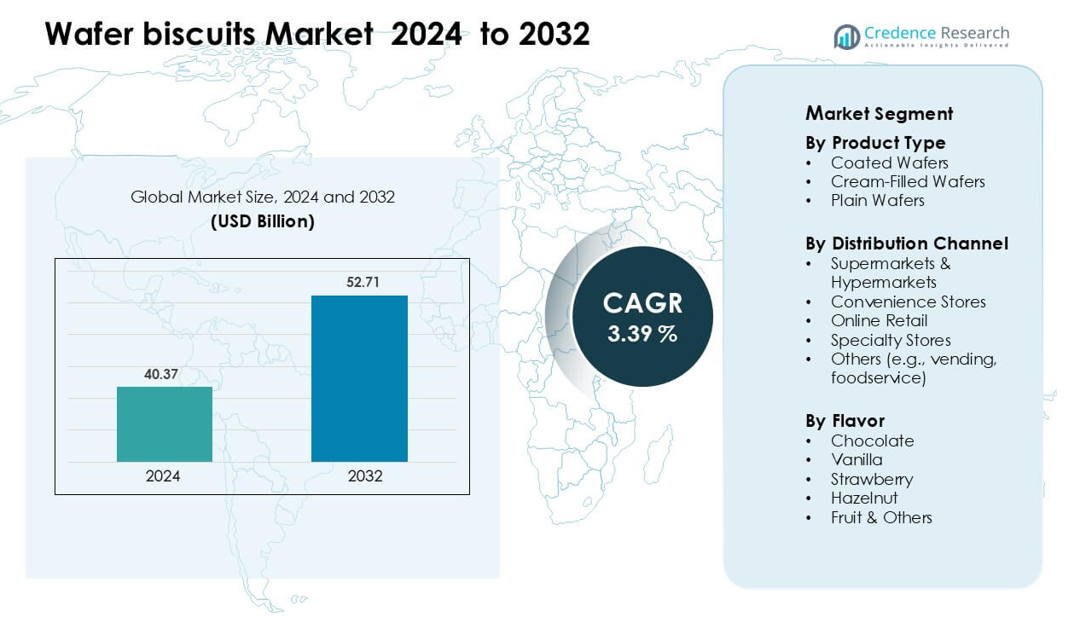

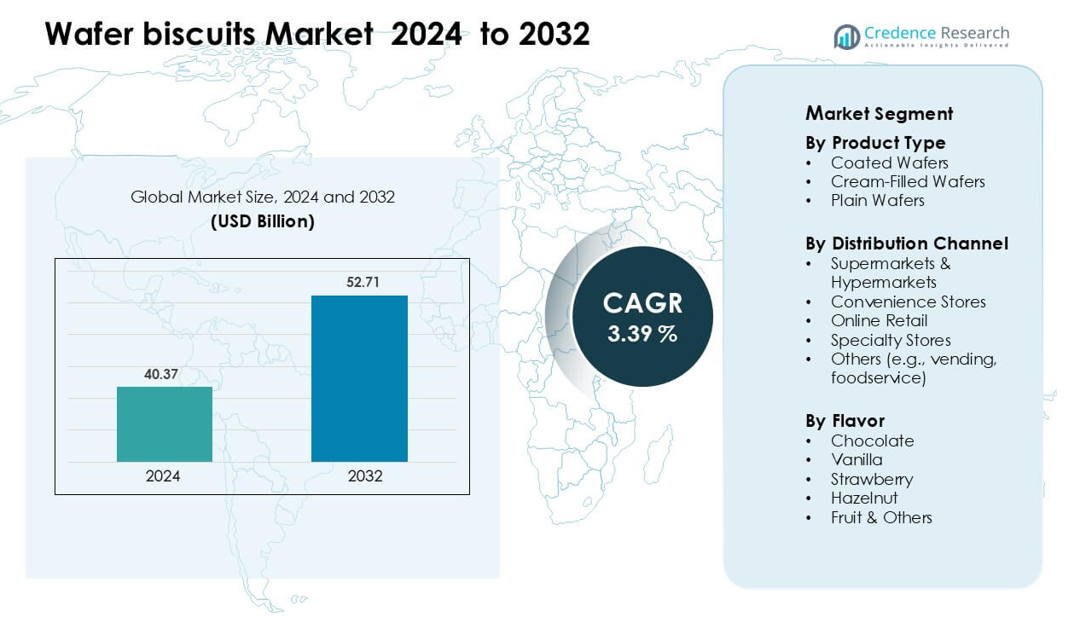

Wafer biscuits Market was valued at USD 40.37 billion in 2024 and is anticipated to reach USD 52.71 billion by 2032, growing at a CAGR of 3.39 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wafer Biscuits Market Size 2024 |

USD 40.37 billion |

| Wafer Biscuits Market, CAGR |

3.39% |

| Wafer Biscuits Market Size 2032 |

USD 52.71 billion |

The wafer biscuits market is shaped by major players such as Mars, Mondelez International, Nestlé, Kellogg, Hershey Company, Dukes, Bolero, Antonelli Bros, Lago Group, and Artisan Biscuits. These companies compete through strong flavor portfolios, premium coated variants, and wide retail reach across supermarkets, convenience stores, and e-commerce platforms. Product innovation in chocolate-filled, hazelnut, and multi-layer formats strengthens brand appeal, while affordable family packs support high-volume sales in developing markets. Europe remained the leading region in 2024 with roughly 32% share, supported by a mature snacking culture, strong bakery heritage, and extensive retailer networks.

Market Insights

- The Wafer Biscuits Market was valued at USD 37 billion in 2024 and is projected to reach USD 52.71 billion by 2032, growing at a CAGR of 3.39 %.

- Growing demand for affordable, convenient snacks drives higher consumption of coated and cream-filled wafers, which together hold the largest product share and support strong retail rotation.

- Rising trends such as premium chocolate coatings, nut-based fillings, and single-serve on-the-go packs boost innovation, supported by clean-label and low-sugar product development.

- Competition intensifies as global players expand flavor portfolios while regional brands rely on low-cost production and localized tastes, creating strong price pressure across segments.

- Europe led the market with about 32% share in 2024, followed by Asia-Pacific at roughly 27%, while coated wafers dominated product type with around 41% share, reflecting strong global preference for richer and layered wafer formats.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Coated wafers led the wafer biscuits market in 2024 with about 41% share. Buyers preferred coated formats due to richer taste, better texture, and strong appeal in impulse buying. Brands expanded chocolate-coated and premium glaze lines, which pushed higher repeat sales. Cream-filled wafers grew steadily as mid-priced snacks gained demand in urban areas. Plain wafers held a smaller share but stayed relevant in kids’ snacks and private-labl ranges. Rising focus on premium coatings and seasonal launches continued to support coated wafer dominance across global markets.

- For instance, Nestlé’s KitKat (a chocolate-coated wafer bar) continues to be a very strong performer: KitKat can now be found in more than 85 countries worldwide, according to Nestlé, helping maintain its global footprint.

By Distribution Channel

Supermarkets and hypermarkets dominated the distribution landscape with roughly 48% share in 2024. Large chains offered wider flavor choices, strong promotions, and bundled deals that boosted wafer biscuit turnover. Convenience stores saw rising traction due to quick-grab formats and higher footfall near transit zones. Online retail expanded fast as buyers shifted toward bulk packs and value boxes. Specialty stores held niche demand for gourmet or imported wafers. Strong retail placement and aggressive in-store promotions kept supermarkets in the leading position.

- For instance, the online distribution channel for wafer biscuits grew by 25% year-on-year in 2024, driven by evolving consumer purchasing behavior and the availability of single-serving value packs.

By Flavor

Chocolate flavor remained the largest flavor segment with nearly 45% share in 2024. Chocolate’s broad age appeal, strong pairing with coatings, and year-round demand supported the category’s dominance. Vanilla and strawberry flavors grew well in regions with strong bakery culture. Hazelnut attracted premium buyers due to rising interest in indulgent blends. Fruit and other flavors served niche demand driven by seasonal launches and regional taste profiles. Continuous innovation in chocolate-based coatings and filled variants helped maintain the strong lead of the chocolate flavor segment.

Key Growth Drivers

Rising Demand for Convenient and Affordable Snacks

Growing consumer preference for quick, low-cost snacks remains a major driver for the wafer biscuits market. Buyers choose wafers because the product offers a light texture, long shelf life, and easy consumption across age groups. Urban families and working individuals purchase multi-packs for daily use, while children drive strong demand through school snacking and impulse buys. Manufacturers release new pack sizes and value offerings to meet rising affordability needs in emerging markets. Expanding retail penetration in supermarkets, convenience stores, and e-commerce strengthens the product’s reach. This broad consumer base keeps wafers positioned as a preferred everyday snack option.

- For instance, Nestlé’s Munch wafer‑filled chocolate bar is designed to be a low‑price, grab‑and‑go snack: it’s widely distributed in India and contributes to Nestlé’s snack‑portfolio sales.

Strong Innovation in Flavors, Fillings, and Coatings

Rapid flavor innovation supports consistent category growth, especially in premium and indulgent wafer formats. Brands introduce chocolate-coated, hazelnut-filled, vanilla cream, and fruit-based variants to attract diverse tastes. Limited-edition flavors and regional fusion concepts help brands engage younger consumers who seek novelty. Companies also focus on texture upgrades, including double-layer fillings and crispier wafer sheets, which raise repeat purchases. Premium coatings and multi-crunch layers boost appeal in higher-income markets. Continuous product innovation strengthens brand differentiation and drives strong competition across global and local players.

- For instance, Loacker launched its Chocolaterie line in 2024 with three variants — Dark, Milk, and White. These products feature fragrant wafers enhanced with a pinch of cocoa and two layers of cream filling, all enrobed in a matching chocolate coating.

Expansion of Modern Retail and E-Commerce Platforms

The growing presence of supermarkets, hypermarkets, and online platforms significantly boosts wafer biscuit visibility and volume sales. Large retailers promote bulk packs, combo deals, and seasonal discounts that increase product rotations. Online channels accelerate adoption through convenient delivery, subscription models, and wider flavor availability. Digital promotions and influencer marketing further push brand engagement among urban consumers. Retail chains also support private-label wafer growth by offering competitive pricing with attractive packaging. This strong retail ecosystem ensures consistent consumer access and supports high shelf turnover, reinforcing long-term demand growth.

Key Trends & Opportunities

Premiumization and Health-Focused Product Expansion

Premium wafer biscuits gain strong traction as buyers show interest in richer coatings, artisanal fillings, and high-quality ingredients. Dark chocolate, nut-based blends, and gourmet flavors create a strong value proposition in developed markets. At the same time, rising health awareness opens opportunities for low-sugar, high-fiber, gluten-free, and organic wafer formats. Manufacturers invest in clean-label recipes and reduced preservatives to attract health-conscious consumers. This dual movement premium indulgence and better-for-you snacking—creates new market layers and pushes brands toward product diversification, helping companies capture wider income segments.

- For instance, Mondelez’s belVita Breakfast Biscuits provide 14–20 g of whole grains per 50 g serving and 2–4 g of dietary fiber, combining slow‑release carbohydrates with a health-focused formulation.

Growth of Single-Serve Packs and On-the-Go Formats

Single-serve and mini-pack wafers continue to rise as busy consumers seek portable snack options. Schoolchildren, office workers, and travelers choose these packs due to portion control and convenience. Retailers promote small units near checkout counters, increasing impulse purchases. Travel retail, vending machines, and foodservice outlets also adopt wafer-based items, opening new distribution opportunities. Growing demand for hygienic, individually wrapped snacks further supports the trend. This shift encourages manufacturers to redesign packaging formats and create compact, budget-friendly SKUs that attract high-frequency buyers.

- For instance, Loacker has reported that its Classic Minis format containing 20 to 30 individually wrapped mini wafers is a key driver in its travel-retail sales in APAC.

Rising Penetration in Emerging Economies

Rapid population growth, improved retail infrastructure, and rising disposable incomes strengthen wafer biscuit expansion in Asia-Pacific, Africa, and Latin America. Local manufacturers scale output with low-cost production units, making wafers one of the most accessible packaged snacks. Global brands enter new markets through localized flavors and competitive pricing. Urbanization increases exposure to modern retail, where wafers enjoy strong shelf presence. This growing footprint offers significant long-term opportunities for both established players and private-label brands seeking volume-driven growth.

Key Challenges

Volatility in Raw Material and Packaging Costs

The wafer biscuits market faces margin pressure due to unstable prices of wheat flour, sugar, cocoa, palm oil, and packaging materials. Price spikes disrupt production planning, especially for manufacturers operating in competitive and price-sensitive markets. Smaller producers struggle to absorb cost increases without raising retail prices. Fluctuating transportation costs and global supply chain disruptions further complicate sourcing. As consumers remain highly price-sensitive, companies must balance cost control with maintaining product quality and competitive pricing. This challenge continues to influence profitability across global players.

High Competition and Low Product Differentiation

The market experiences intense competition, with numerous regional, private-label, and international brands offering similar wafer types. Low differentiation makes it difficult for companies to maintain premium pricing or build strong loyalty. Frequent promotions and discounts reduce margins and push brands into price wars. New entrants easily replicate flavors and formats, increasing saturation. As consumers often switch brands based on price or availability, companies must invest heavily in innovation, marketing, and packaging improvements to stand out. This competitive pressure remains a major hurdle for sustained brand leadership.

Regional Analysis

North America

North America held about 28% share of the wafer biscuits market in 2024, supported by strong demand for premium coated wafers and convenient single-serve packs. Consumers prefer indulgent flavors like chocolate and hazelnut, which drive higher spending across supermarkets and convenience chains. Growing interest in clean-label and reduced-sugar wafers boosts innovation. The U.S. leads the region due to wide product availability and strong private-label participation. Expanding online grocery platforms further strengthen market access. Steady demand for on-the-go snacks keeps the region a key contributor to global revenue.

Europe

Europe accounted for nearly 32% share in 2024, making it the leading region in the wafer biscuits market. High consumption in Italy, Germany, the U.K., and France supports strong category performance. Buyers favor premium cream-filled and coated wafers due to established bakery culture. Seasonal varieties and artisanal formats attract consistent interest. Retailers expand private-label offerings that cater to value-sensitive shoppers. Strong penetration of supermarkets and specialty stores enhances product reach. Growing popularity of nut-based and chocolate-rich wafers continues to reinforce Europe’s dominant position.

Asia-Pacific

Asia-Pacific captured about 27% share in 2024 and remained the fastest-growing region driven by rising urbanization, population growth, and expanding modern retail. India, China, Indonesia, and Vietnam fuel strong volume sales through affordable cream-filled and plain wafers. Local producers offer competitive pricing, while global brands expand distribution through supermarkets and e-commerce. Flavor diversity, including fruit and regional tastes, boosts repeat purchases. Increasing disposable incomes and demand for school snacks strengthen long-term growth. The region’s large youth population ensures sustained consumption momentum.

Latin America

Latin America held close to 7% share in 2024, supported by strong demand in Brazil, Mexico, and Argentina. Consumers prefer chocolate and vanilla cream wafers sold through supermarkets and neighborhood stores. Competitive pricing and family-size packs drive higher household purchases. Economic variability influences spending, but steady snack demand keeps wafers resilient. Growth in online channels and improved retail penetration support broader access. Local brands maintain strong presence through affordable multi-pack offerings, helping sustain category expansion across the region.

Middle East & Africa

The Middle East & Africa region accounted for around 6% share in 2024, with rising interest in flavored and coated wafer varieties. Growth is driven by young populations, expanding retail networks, and increasing adoption of packaged snacks. Countries such as Saudi Arabia, the UAE, South Africa, and Egypt show strong demand for chocolate-based and premium wafer formats. E-commerce platforms and convenience stores widen product reach. Affordability remains crucial, encouraging the success of local and private-label wafers. The region’s improving distribution systems continue to support steady market growth.

Market Segmentations:

By Product Type

- Coated Wafers

- Cream-Filled Wafers

- Plain Wafers

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Others (e.g., vending, foodservice)

By Flavor

- Chocolate

- Vanilla

- Strawberry

- Hazelnut

- Fruit & Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the wafer biscuits market features established global brands and strong regional manufacturers competing through flavor innovation, pricing strategies, and distribution expansion. Leading players such as Mondelez International, Mars, Nestlé, Kellogg, Hershey Company, Dukes, Lago Group, Bolero, Antonelli Bros, and Artisan Biscuits focus on premium coatings, multi-layer cream formats, and diverse flavor portfolios to attract a wide consumer base. Companies invest in modern packaging, small-serve formats, and affordable family packs to address both premium and value-driven segments. E-commerce growth encourages firms to strengthen digital promotions and bundle offerings. Regional players compete aggressively through low-cost production and localized flavors, while global brands enhance retail visibility through strong supermarket placement and in-store promotions. Continuous R&D efforts, product reformulations, and clean-label innovations further shape competition, keeping the market dynamic and highly responsive to shifting consumer preferences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, British ‘free from’ snacks specialist Crave expanded its biscuit portfolio with the launch of what it claimed to be the ‘UK’s first’ gluten-free and vegan pink wafer biscuits, Pink Cheetah Wafers. The new product, featuring pink wafers filled with vanilla cream, tapped into the rising consumer trend of nostalgia-driven purchases and the growth of the sweet biscuits market.

- In January 2025, Mars Wrigley announced the relaunch of the iconic MILKY WAY® Crispy Rolls and introduced two new variants, TWIX® Crispy Rolls and BOUNTY® Crispy Rolls, in the chocolate wafer category.

- In September 2024, Hostess’s Voortman brand, a U.S. purveyor of crème wafers, had recently launched a new snack-size version of its fan-favorite wafer cookies, available in vanilla and chocolate. The new Voortman Snack Size Wafers featured the brand’s classic, crispy vanilla- and chocolate-flavored crème wafers packaged in a convenient on-the-go snacking format. The new Voortman Snack Size Wafers came in a 2.4-ounce pack with six wafers per pack and were available at select grocery retailers including Albertsons and Walmart.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Distribution channel, Flavor and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as consumers continue to prefer convenient and quick snack options.

- Premium coated and multi-layer wafer formats will gain higher traction across global markets.

- Health-focused wafers with low sugar and clean-label ingredients will expand rapidly.

- Online retail and quick-commerce platforms will play a larger role in wafer distribution.

- Packaging innovation will increase, with more single-serve, travel-friendly, and eco-friendly options.

- Emerging markets in Asia-Pacific and Africa will drive strong volume growth.

- Manufacturers will invest more in flavor diversification and seasonal limited-edition launches.

- Private-label wafer brands will strengthen their presence through competitive pricing.

- Automation and modern manufacturing technologies will boost production efficiency and consistency.

- Sustainability initiatives will push companies to adopt recyclable materials and greener supply chains.