Market Overview

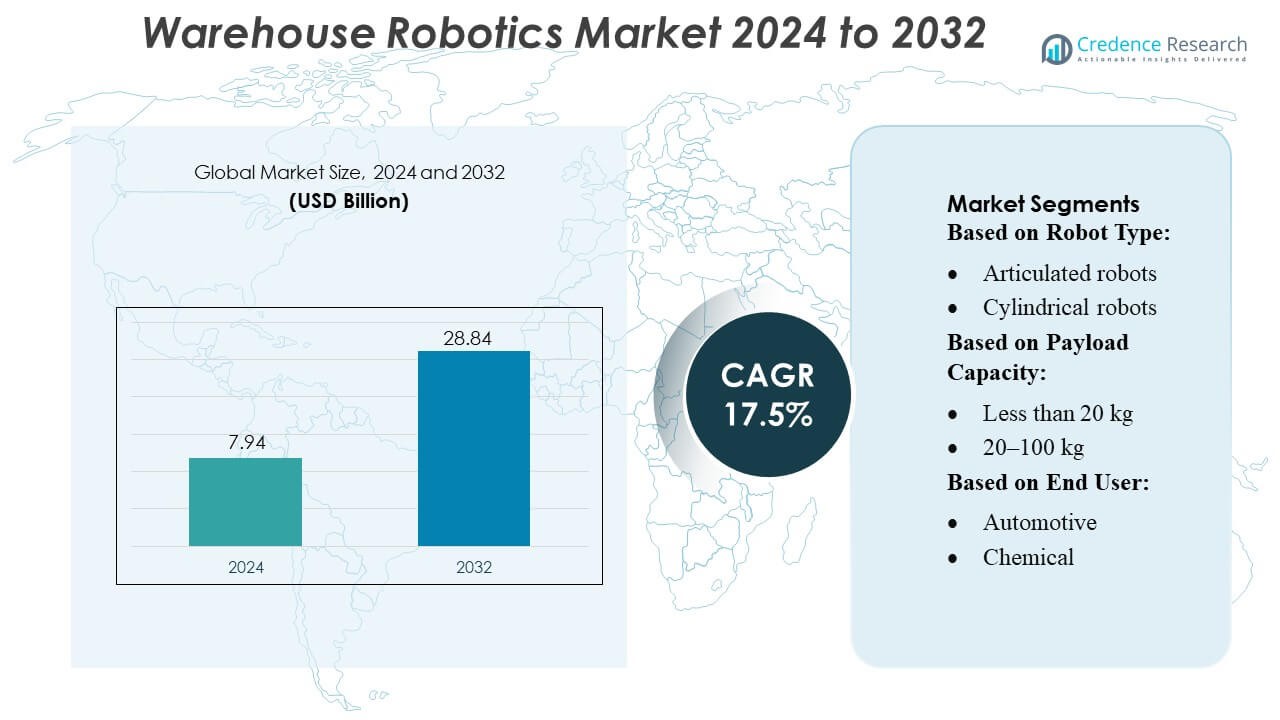

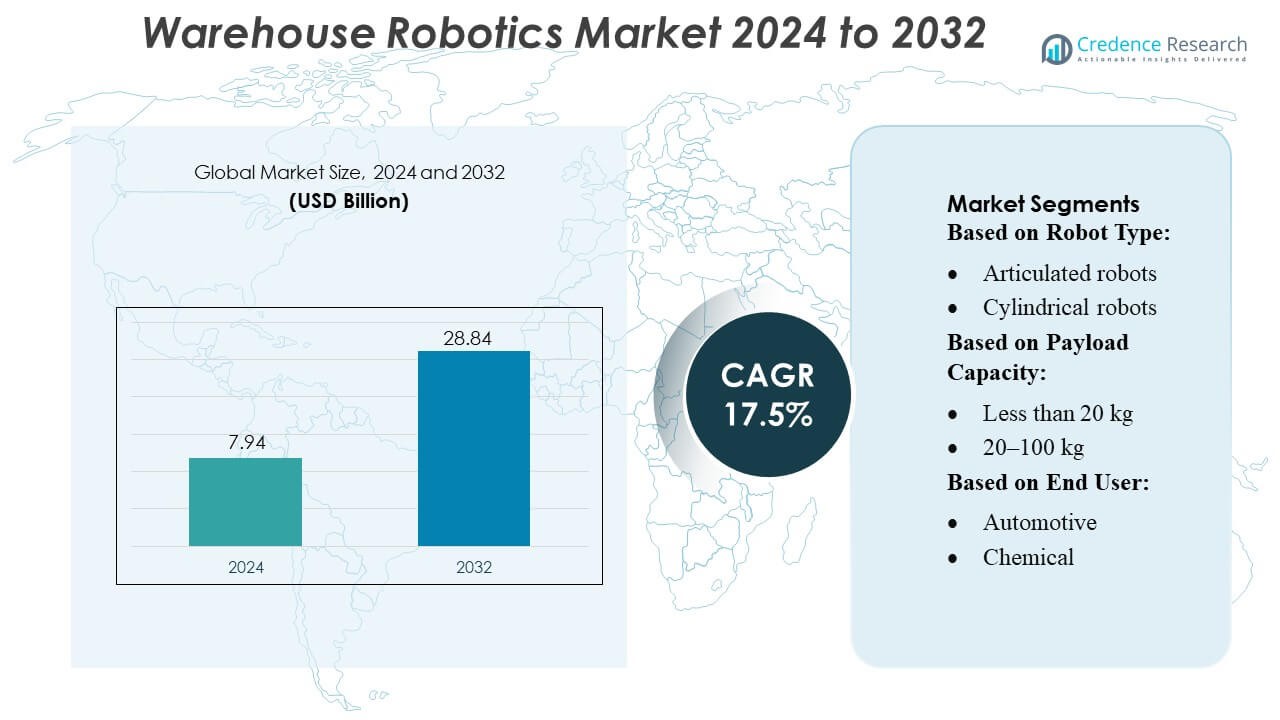

Warehouse Robotics Market size was valued USD 7.94 billion in 2024 and is anticipated to reach USD 28.84 billion by 2032, at a CAGR of 17.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Warehouse Robotics Market Size 2024 |

USD 7.94 Billion |

| Warehouse Robotics Market, CAGR |

17.5% |

| Warehouse Robotics Market Size 2032 |

USD 28.84 Billion |

The Warehouse Robotics Market features a number of well-established automation providers offering advanced robotic solutions and integrated logistics systems. These companies compete intensely on technology innovation, service breadth, and global footprint — supplying autonomous mobile robots, automated guided vehicles, storage and retrieval systems, and full warehouse-management automation platforms. Vendors continuously enhance software intelligence, fleet orchestration, and AI-based navigation to deliver higher throughput, accuracy, and flexibility for diverse industries including e-commerce, manufacturing, and retail. The increasing demand for efficient fulfillment, rising labor costs, and globalization of supply chains drive widespread adoption worldwide. Regionally, the leading market is the Asia‑Pacific region, which commanded approximately 39.9 % of global warehouse robotics revenue in 2024, reflecting strong growth momentum and large-scale deployment in populous, manufacturing-intensive countries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Warehouse Robotics Market was valued at USD 7.94 billion in 2024 and is projected to reach USD 28.84 billion by 2032, reflecting a 17.5% CAGR throughout the forecast period.

- Strong market growth is driven by rising e-commerce fulfillment needs, higher labor costs, and increasing adoption of autonomous mobile robots and automated guided vehicles to improve warehouse productivity.

- Key trends include rapid integration of AI-based navigation, robotic picking, and advanced fleet management software, enabling faster throughput and greater operational accuracy across complex warehouse environments.

- Competitive intensity continues to rise as global automation vendors expand robotics portfolios and new entrants introduce modular, scalable systems, while restraints emerge from high upfront deployment costs and workforce skill gaps.

- Asia Pacific leads the market with a 39.9% regional share, driven by manufacturing expansion, while automated storage and retrieval systems hold a dominant segment share due to widespread use in high-volume fulfillment centers.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Robot Type

Autonomous Mobile Robots (AMRs) dominate the warehouse robotics market, capturing a significant share due to their flexibility and advanced navigation capabilities. Unlike traditional Automated Guided Vehicles (AGVs), AMRs leverage LiDAR, AI, and real-time path planning to adapt dynamically to warehouse environments. Articulated and SCARA robots remain relevant for precision pick-and-place tasks, but their deployment is often limited to specific zones. Growth drivers include the increasing need for real-time inventory management, labor shortage mitigation, and enhanced operational efficiency, particularly in e-commerce and retail warehouses where high-speed, autonomous material handling is critical.

- For instance, KUKA AG’s KMP 1500P AMR can carry loads up to 1,500 kg and travels at speeds up to 1.5 m/s, with autonomous 2D and 3D obstacle detection and avoidance.

By Payload Capacity

Robots with a payload capacity of 20–100 kg hold the largest share of the market, balancing flexibility with the ability to handle a wide range of goods. Units below 20 kg are primarily used for small item sorting, while higher payload robots above 100 kg are deployed for heavy machinery and pallet movement. The segment’s growth is driven by warehouse operations that require scalable solutions for medium-weight materials, enabling efficient storage, transport, and automation of repetitive tasks while maintaining safety and precision. Operational efficiency and reduced labor dependency remain key adoption motivators.

- For instance, the Fetch100 Shelf AMR supports a maximum payload weight of 78 kg and travels at speeds up to 1.75 m/s, carrying shelf-loads continuously for about 9 hours on a single battery cycle.

By End User

The e-commerce sector leads adoption, commanding a dominant share due to high-volume order fulfillment and the demand for rapid delivery. Automotive and food & beverage industries follow, leveraging robotics for assembly, packaging, and material handling in complex production environments. Growth drivers include the surge in online retail, labor shortages, and the need for cost-effective, scalable warehouse operations. Semiconductor, healthcare, and chemical industries are increasingly investing in specialized robotics solutions to enhance precision, hygiene, and safety standards, further expanding market penetration across diversified end-user applications.

Key Growth Drivers

Rising E-commerce and Omnichannel Fulfillment

The rapid expansion of e-commerce has significantly increased demand for automated warehouse solutions. Companies are adopting robotics to manage high-volume order fulfillment, optimize storage, and accelerate delivery timelines. Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs) help streamline inventory handling, reduce labor dependency, and improve accuracy. This growth is further fueled by omnichannel retail strategies, where warehouses must efficiently handle returns, pick-and-pack operations, and real-time order processing to maintain customer satisfaction and operational efficiency.

- For instance, the Honeywell Intelligrated “Smart Flexible Depalletizer” can lift loads up to 80 lb (≈ 36 kg) and process up to 650 cartons per hour, boosting inbound pallet depalletizing productivity substantially.

Labor Shortages and Cost Optimization

The global shortage of skilled warehouse workers has driven investments in robotics to maintain consistent operations and reduce reliance on manual labor. Robots automate repetitive tasks such as picking, sorting, and transporting goods, lowering labor costs and minimizing human error. By integrating AI and machine learning, warehouse robotics enable predictive maintenance, dynamic routing, and energy efficiency. Companies adopting these technologies gain operational resilience and cost predictability, making robotics an essential solution for long-term warehouse sustainability and scalability.

- For instance, ABB’s AI-enabled Robotic Item Picker achieves over 99.5% picking accuracy and can process up to 1,400 unsorted items per hour, automating high-volume picking tasks that typically rely on manual labor.

Technological Advancements and Integration

Advances in robotics, AI, and IoT are enhancing warehouse efficiency, accuracy, and safety. AMRs and collaborative robots now feature real-time navigation, adaptive task execution, and seamless integration with warehouse management systems (WMS). Innovations such as cloud-based fleet management, edge computing, and smart sensors optimize workflows and data-driven decision-making. These technological improvements reduce downtime, increase throughput, and support scalable automation. The ability to integrate robotics with other digital systems presents a compelling growth driver, particularly for complex warehouses with diverse product categories.

Key Trends & Opportunities

Collaborative and Flexible Automation

Collaborative robots (cobots) are gaining popularity in warehouses for their ability to work safely alongside human operators. These robots enhance productivity in areas such as packing, assembly, and quality inspection without requiring extensive infrastructure changes. The trend toward flexible automation supports rapid reconfiguration of workflows, enabling warehouses to respond quickly to seasonal demand fluctuations, product variety, and customized fulfillment needs, presenting significant opportunities for scalable, hybrid human-robot operations.

- For instance, Exotec’s Skypod® robots move at up to 4 m/s (13 ft/s) and climb racks to heights of up to 14 m (46 ft) while carrying loads up to 30 kg (66 lbs). Manufacturing, logistics, and automotive industries use handling robots for precise operations in warehouses and production lines.

Expansion into Emerging Markets

Emerging markets in Asia-Pacific, Latin America, and the Middle East are increasingly adopting warehouse robotics due to rising e-commerce, industrialization, and government initiatives supporting automation. These regions provide opportunities for manufacturers to deploy cost-effective robotics solutions tailored to smaller warehouses or mid-sized enterprises. Expansion into such geographies not only drives revenue growth but also enables companies to develop region-specific innovations, such as lightweight AMRs for limited warehouse spaces or modular robots suitable for diverse logistics requirements.

- For instance, Intuitive’s latest platform, the da Vinci 5, incorporates over 150 design innovations and claims 10,000 × the computing power versus its predecessor. Companies use subscription-style RaaS solutions to improve efficiency, reduce costs, and enhance production speed.

Integration with AI and Data Analytics

The integration of AI, machine learning, and advanced analytics with warehouse robotics is transforming operations. Predictive analytics optimize routing, reduce bottlenecks, and improve inventory management. Robotics platforms now provide actionable insights for workforce allocation, energy consumption, and process optimization. This convergence creates opportunities for service providers to offer intelligent, end-to-end solutions that increase operational efficiency, reduce costs, and improve decision-making, enhancing the overall competitiveness of warehouses adopting advanced robotics technologies.

Key Challenges

High Initial Investment and Maintenance Costs

The adoption of warehouse robotics requires substantial capital expenditure for hardware, software, and integration. Maintenance, system upgrades, and training also contribute to high operational costs. Smaller warehouses or mid-sized enterprises often face budget constraints, limiting large-scale deployment. Additionally, the complexity of integrating multiple robot types with existing warehouse management systems (WMS) and legacy infrastructure can create technical and financial hurdles, slowing adoption despite the long-term benefits of automation.

Workforce Adaptation and Skill Gaps

The transition to automated warehouses necessitates upskilling existing employees to operate, program, and maintain robotics systems. Resistance to change, lack of technical expertise, and inadequate training can hinder smooth implementation. Workforce adaptation challenges are particularly pronounced in regions with limited access to robotics training or a traditional labor-intensive culture. Overcoming these barriers requires targeted workforce development programs, collaboration with educational institutions, and continuous skill-building initiatives to ensure effective human-robot collaboration.

Regional Analysis

North America

North America holds approximately 35–38% of the global warehouse robotics market. The region benefits from a mature logistics infrastructure, widespread adoption of e‑commerce, and strong investments in automation technologies, including autonomous mobile robots, automated guided vehicles (AGVs), and advanced warehouse management systems. Companies are increasingly adopting robotics to reduce labor costs, improve operational efficiency, and meet growing customer expectations for fast delivery. The US leads the market with high-tech implementations, followed by Canada, where both manufacturing and retail sectors drive demand for automated warehousing solutions.

Asia Pacific

Asia Pacific is the largest and fastest-growing market, accounting for roughly 40–50% of the global share. Growth is driven by rapid industrialization, increasing labor costs, and the expansion of e‑commerce and manufacturing sectors. China and Japan lead in technology adoption, deploying autonomous mobile robots, automated storage and retrieval systems (AS/RS), and collaborative robots to enhance warehouse efficiency. India and South Korea are emerging hubs for warehouse automation, with investments aimed at optimizing supply chains and meeting rising consumer demand. Government initiatives supporting industrial automation further accelerate regional growth.

Europe

Europe contributes around 22–27% to the warehouse robotics market. Strong adoption is fueled by mature industrial bases, stringent supply chain efficiency requirements, and sustainability-focused policies. Germany, the UK, and France are leading countries implementing robotics technologies such as AGVs, automated pallet systems, and AI-powered warehouse management software. Companies prioritize automation to reduce operational costs, improve inventory accuracy, and comply with environmental regulations. The region also benefits from significant technological innovation and collaboration between logistics providers and automation technology companies, which enhances the overall market growth trajectory.

Latin America

Latin America holds about 6% of the global warehouse robotics market. Growth is relatively moderate due to economic volatility and infrastructure constraints, but the region is gradually adopting automation in logistics and warehousing. Brazil, Mexico, and Argentina are key markets, with companies implementing robotics solutions to improve efficiency, reduce dependency on labor, and streamline supply chains. Increasing cross-border trade, e-commerce expansion, and growing awareness of automation benefits are driving investments in robotic systems. Although adoption lags behind North America, Europe, and Asia Pacific, the region shows steady growth potential in automated warehousing.

Middle East & Africa (MEA)

The Middle East & Africa account for approximately 7–8% of the warehouse robotics market. Growth is emerging, particularly in logistics hubs such as the Gulf Cooperation Council (GCC) countries, South Africa, and Egypt. Investments in modern logistics infrastructure, warehouse modernization, and automation technologies like AGVs and robotic picking systems are driving market expansion. Rising trade activities, e-commerce growth, and government initiatives to diversify economies beyond oil are encouraging adoption. Although the market is smaller compared to North America and Asia Pacific, MEA presents strong growth opportunities for companies deploying warehouse automation solutions to enhance efficiency and reduce operational costs.

Market Segmentations:

By Robot Type:

- Articulated robots

- Cylindrical robots

By Payload Capacity:

- Less than 20 kg

- 20–100 kg

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Warehouse Robotics Market features prominent players such as KUKA AG, Fetch Robotics Inc., Honeywell International Inc., ABB, OMRON Corporation, YASKAWA Electric Corporation, Bastian Solutions LLC, Daifuku Co. Ltd., KNAPP AG, and Dematic. the Warehouse Robotics Market is characterized by rapid technological advancement, increasing automation demand, and strong investments in intelligent robotic systems. Companies competing in this space focus on delivering solutions that improve operational accuracy, reduce labor dependency, and enhance fulfillment speed in modern warehouses. The market features a mix of established automation providers and emerging innovators that prioritize autonomous mobile robots, robotic picking technologies, and integrated warehouse management platforms. Competition intensifies as vendors adopt strategies such as product innovation, technology partnerships, and expansion into high-growth regions. Many firms invest heavily in artificial intelligence, machine vision, and advanced sensing technologies to develop robots capable of complex navigation and high-precision tasks. Additionally, the shift toward scalable and modular automation solutions enables wider adoption across warehouses of varying sizes. As supply chain digitization accelerates globally, companies differentiate themselves by offering flexible, energy-efficient, and interoperable robotic systems that support real-time decision-making and streamlined warehouse operations.

Key Player Analysis

- KUKA AG

- Fetch Robotics Inc.

- Honeywell International Inc

- ABB

- OMROM Corporation

- YASKAWA Electric Corporation

- Bastian Solutions LLC

- Daifuku Co. Ltd.

- KNAPP AG

- Dematic

Recent Developments

- In July 2025, Bedrock Robotics, a startup founded by veterans from Waymo and Segment, announced an funding round led by investors Eclipse and 8VC. The company is developing a retrofittable self-driving kit, including sensors, compute hardware, and software, to make existing construction and worksite vehicles autonomous.

- In May 2024, Mitsubishi Electric Corporation made a strategic investment in Realtime Robotics, a company specializing in collision-free autonomous motion planning for industrial robots. This investment was the lead funding for Realtime Robotics’ Series B funding round and will be used to help refine and scale its robot workcell and runtime systems.

- In January 2024, Honeywell partnered with Hai Robotics to integrate Hai’s autonomous case- and tote-handling robots with Honeywell’s Momentum Warehouse Execution Software. This collaboration aims to provide flexible, high-density storage and retrieval solutions for distribution centers, which will optimize space, improve productivity, and address labor shortages by leveraging Honeywell’s software, cybersecurity, and integration expertise.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Robot Type, Payload Capacity, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt autonomous mobile robots to enhance flexibility and reduce manual handling.

- Robotics systems will integrate more AI and machine-learning capabilities for smarter navigation and real-time decision-making.

- Warehouses will expand the use of robotic picking and sorting systems to improve order accuracy.

- Collaborative robots will gain wider acceptance as businesses seek safer and more efficient human–robot interaction.

- Cloud-connected robotic platforms will support remote monitoring and predictive maintenance.

- Demand for modular and scalable automation solutions will rise as small and mid-sized warehouses adopt robotics.

- Growth in e-commerce fulfillment centers will accelerate investment in high-speed robotic systems.

- Energy-efficient robotics designs will gain importance as sustainability becomes a key operational priority.

- Integration between warehouse robotics and digital twins will enhance workflow optimization.

- Robotics-as-a-service models will expand, allowing businesses to deploy automation with lower upfront costs.

Market Segmentation Analysis:

Market Segmentation Analysis: