Market Overview

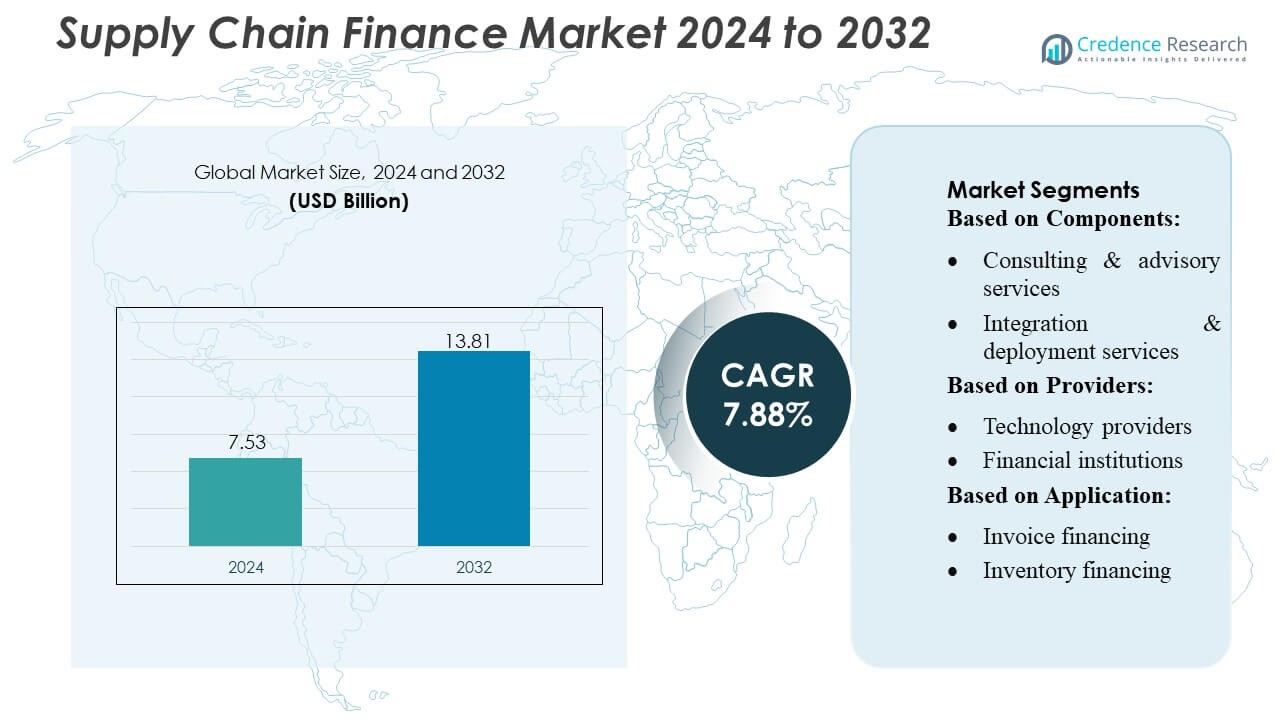

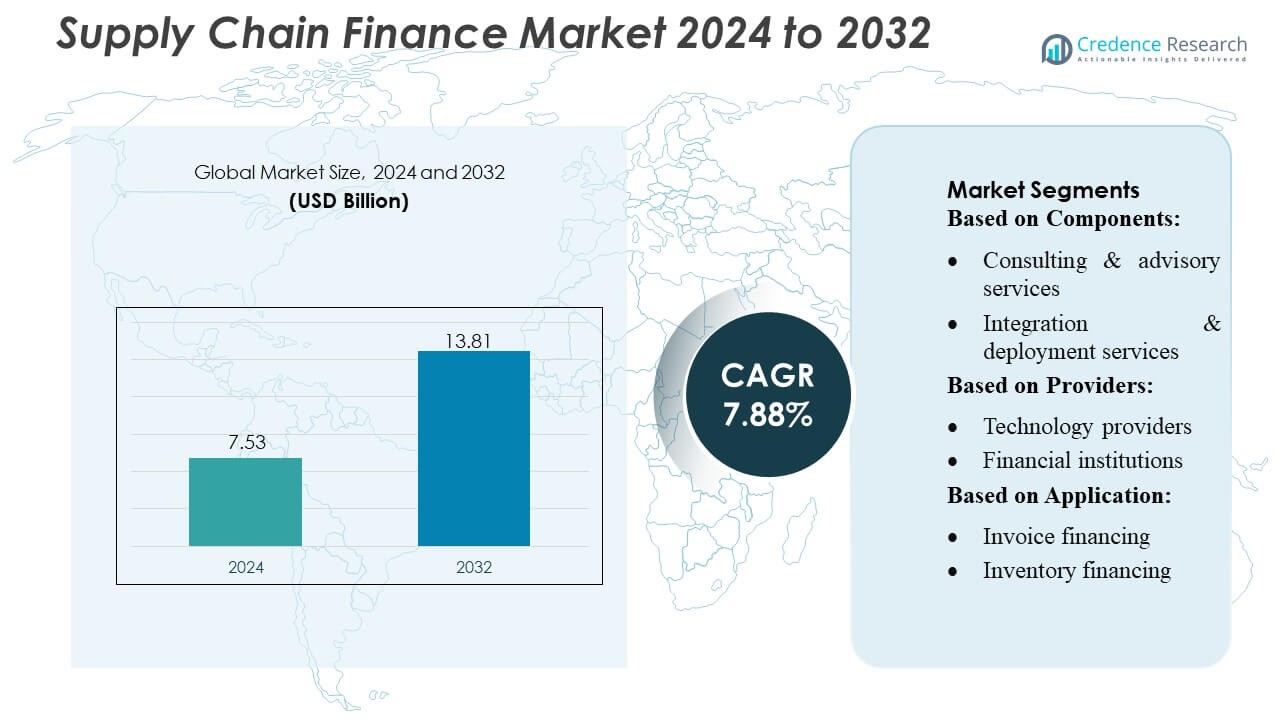

Supply Chain Finance Market size was valued USD 7.53 billion in 2024 and is anticipated to reach USD 13.81 billion by 2032, at a CAGR of 7.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Supply Chain Finance Market Size 2024 |

USD 7.53 Billion |

| Supply Chain Finance Market, CAGR |

7.88% |

| Supply Chain Finance Market Size 2032 |

USD 13.81 Billion |

The supply chain finance market is highly competitive, with key players driving innovation and expanding global reach. Companies such as Kinaxis, Maersk Group, Genpact Limited, Lockheed Martin Corporation, Aera Technology, Capgemini SA, JDA Software Group, Inc., International Business Machines Corporation, Birst, Inc., and Accenture PLC are at the forefront, offering advanced digital platforms, AI-driven analytics, and blockchain-enabled solutions to optimize working capital, automate processes, and enhance supplier relationships. These players focus on strategic partnerships, product innovation, and geographic expansion to strengthen their market positions. North America leads the global market, accounting for approximately 35% of the total share, supported by high adoption of cloud-based supply chain finance solutions, robust financial infrastructure, and the presence of major multinational corporations seeking efficient liquidity management and risk mitigation across complex supply chains.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The supply chain finance market was valued at USD 7.53 billion in 2024 and is projected to reach USD 13.81 billion by 2032, growing at a CAGR of 7.88% during the forecast period.

- Growth is driven by rising demand for working capital optimization, adoption of AI-enabled platforms, and increased digitalization across enterprises to improve cash flow and supplier relationships.

- Key trends include integration of blockchain for secure trade finance, dynamic discounting adoption, and ESG-linked financing gaining traction among corporates, while SMEs increasingly access digital supply chain finance solutions.

- The market is highly competitive, with major players focusing on AI-driven analytics, cloud-based platforms, strategic partnerships, product innovation, and geographic expansion to strengthen their positions.

- North America leads with a 35% market share due to strong financial infrastructure and high adoption of digital solutions, followed by Europe and Asia-Pacific, with invoice financing and dynamic discounting as dominant application segments.

Market Segmentation Analysis:

By Components

The supply chain finance market by components is primarily segmented into platforms and services, with services further divided into consulting & advisory, integration & deployment, and support & maintenance. Platforms dominate this segment, capturing an estimated 55–60% market share due to increasing adoption of cloud-based solutions that streamline transaction visibility and improve liquidity management. The growth is driven by enterprises seeking automated, scalable platforms to enhance supply chain efficiency and reduce operational costs, while services support seamless implementation, customization, and ongoing system optimization.

- For instance, Kinaxis’ cloud‑based RapidResponse® platform recently reported a 17% increase in its SaaS revenue during Q4, highlighting how scalable platform solutions attract enterprises seeking automated, real-time supply chain orchestration.

By Providers

In the provider segment, technology providers, financial institutions, and supply chain solution providers cater to different ecosystem needs. Financial institutions hold the dominant share, accounting for approximately 50% of the market, as they leverage their lending capabilities and risk management expertise to facilitate invoice financing and trade finance. The segment’s growth is fueled by rising demand for credit-backed supply chain solutions, stronger partnerships between banks and corporates, and advancements in fintech platforms that enhance financing speed and transparency.

- For instance, Genpact’s AI‑driven finance suite recently enabled a global distributor to process more than 3 million invoices annually, with over 40% of those now handled with zero human intervention — underscoring how supply‑chain solution providers can deliver credit‑backed and finance‑enabled services that mirror traditional banking capabilities.

By Application

The supply chain finance market by application includes invoice financing, inventory financing, trade & export finance, dynamic discounting, and factoring & reverse factoring. Invoice financing leads this segment with around 40–45% market share, driven by enterprises’ need to improve cash flow, reduce working capital gaps, and maintain supplier relationships. Rising global trade volumes, integration of AI-based credit assessment tools, and the preference for early payment programs support widespread adoption, while dynamic discounting and reverse factoring gain traction among corporates aiming to optimize procurement costs and supplier engagement.

Key Growth Drivers

- Increasing Demand for Working Capital Optimization:

Enterprises are increasingly adopting supply chain finance solutions to optimize working capital and enhance liquidity. Rising trade volumes and complex global supply chains have created a need for better cash flow management, reducing reliance on traditional financing. Organizations leverage solutions like invoice financing and dynamic discounting to accelerate receivables, improve supplier relationships, and maintain operational efficiency. This driver is further supported by the growing emphasis on real-time visibility into payables and receivables, enabling faster decision-making and minimizing financial bottlenecks.

- For instance, Lockheed Martin generated 6,972 million in net cash from operating activities during 2024, which resulted in 5,287 million of free cash flow — demonstrating how efficient working‑capital and cash‑flow management can generate substantial liquidity.

- Digital Transformation and Technological Advancements:

The adoption of advanced technologies, including AI, blockchain, and cloud-based platforms, is fueling market growth. These innovations enable automation, enhanced transparency, and improved risk assessment across supply chain financing processes. Real-time data analytics help institutions monitor financial health, optimize credit limits, and reduce fraud risks. Additionally, seamless integration with ERP systems and digital onboarding tools enhances user experience and operational efficiency, attracting both large corporates and SMEs to deploy technology-driven supply chain finance solutions.

- For instance, Aera Technology’s cloud‑native platform Aera Decision Cloud recently enabled a global consumer packaged goods company to boost inventory performance by 20% through real‑time demand sensing and supply‑demand balancing — improving working capital utilization and reducing waste.

- Strong Financial Institution Participation:

Financial institutions continue to play a critical role in driving supply chain finance adoption. Banks and non-bank lenders provide credit-backed solutions, enabling suppliers to access early payments while ensuring risk mitigation for buyers. Strategic partnerships between banks and technology providers expand service reach, streamline onboarding, and offer competitive financing rates. This active involvement enhances trust, encourages wider adoption across industries, and stimulates investment in innovative solutions that support trade finance, factoring, and reverse factoring.

Key Trends & Opportunities

- Growing Adoption of Dynamic Discounting:

Dynamic discounting is emerging as a key trend, allowing buyers to offer early payment discounts to suppliers in exchange for reduced invoice amounts. This approach benefits both parties by improving supplier cash flow and enabling buyers to optimize procurement costs. Increasing awareness of early payment programs and integration with automated platforms is driving adoption. Companies are exploring AI-based discount optimization tools to balance liquidity needs and savings, presenting significant opportunities for technology providers to innovate and capture market share.

- For instance, Capgemini’s AI.Payables solution automated invoicing for a multinational client, raising automated invoice processing rates by 90% and enabling a 25% uplift in early‑payment discount utilization.

- Expansion into Emerging Markets:

Emerging markets in Asia-Pacific, Latin America, and Africa present lucrative opportunities for supply chain finance providers. Rapid industrialization, growing trade volumes, and limited access to traditional credit in these regions increase demand for financing solutions. Corporates and financial institutions are expanding their footprint to support SMEs and mid-sized enterprises, fostering financial inclusion and strengthening supply chain resilience. This trend is expected to accelerate market penetration and revenue growth, particularly in sectors such as manufacturing, retail, and logistics.

- For instance, Birst’s cloud‑native analytics platform powers the digital supply-chain of a major client, enabling a five‑fold increase in inventory turns and achieving a 99% on-time delivery rate while consolidating data from over 300 disparate sources every seven minutes.

- Integration of ESG and Sustainable Financing Practices:

Sustainability-linked supply chain finance is gaining traction as companies focus on ESG compliance and responsible sourcing. Buyers increasingly prefer suppliers with sustainable practices and are incentivizing them through favorable financing terms. This trend drives innovation in green financing solutions and enhances corporate social responsibility initiatives. Integrating ESG criteria into supply chain finance not only strengthens supplier relationships but also creates new opportunities for financial institutions and technology providers to develop eco-friendly products that align with global sustainability goals.

Key Challenges

- Regulatory Compliance and Cross-Border Complexity:

Supply chain finance providers face challenges related to evolving regulations, especially in cross-border trade. Diverse legal frameworks, tax compliance, and varying credit reporting standards complicate financing processes. Ensuring adherence to local and international regulations increases operational costs and slows implementation. Financial institutions and corporates must navigate complex trade finance rules, anti-money laundering laws, and data privacy requirements, which may hinder scalability and delay solution deployment across global supply chains.

- Integration and Technological Barriers:

Integrating supply chain finance platforms with existing ERP systems and corporate processes remains a challenge, particularly for SMEs with limited IT infrastructure. Legacy systems, data inconsistencies, and lack of standardized protocols can impede automation and real-time analytics. Moreover, adoption of advanced technologies like AI and blockchain requires substantial investment and skilled personnel. These technological and integration barriers may restrict market growth, especially among smaller enterprises seeking cost-effective, seamless, and user-friendly supply chain finance solutions.

Regional Analysis

North America

North America dominates the supply chain finance market with a market share of approximately 35%, driven by strong adoption of digital platforms, robust financial infrastructure, and high trade volumes. The United States leads the region, fueled by large multinational corporations seeking efficient working capital management and supplier financing solutions. Technological advancements, including AI-driven risk assessment and blockchain-based trade finance, accelerate adoption across sectors such as manufacturing, retail, and logistics. Growth is further supported by active participation from financial institutions and fintech providers offering innovative solutions, enabling enhanced transparency, faster transactions, and optimized liquidity management.

Europe

Europe holds around 28% of the global supply chain finance market, supported by stringent regulatory frameworks and widespread corporate adoption of structured financing solutions. Countries such as Germany, France, and the UK are key contributors, leveraging advanced platforms and trade finance solutions to optimize cash flow and strengthen supplier relationships. The region emphasizes sustainability-linked financing, ESG compliance, and dynamic discounting programs, creating opportunities for technology providers. Increasing cross-border trade within the European Union and robust collaboration between financial institutions and corporates further drive market growth, enabling streamlined supply chain operations and reduced financing risks.

Asia-Pacific

Asia-Pacific is emerging as a high-growth region with an estimated market share of 25%, fueled by rapid industrialization, increasing trade volumes, and expanding SME networks. China, India, Japan, and Southeast Asian countries are key markets where corporates adopt supply chain finance solutions to manage working capital and support supplier liquidity. Digital transformation, fintech innovations, and mobile-enabled platforms accelerate adoption. Governments and financial institutions actively promote credit access for SMEs, while e-commerce and manufacturing sectors increasingly leverage invoice financing, dynamic discounting, and reverse factoring, driving both market penetration and technological innovation in supply chain finance across the region.

Latin America

Latin America accounts for approximately 7% of the global supply chain finance market, driven by growing trade activities and rising demand for structured financing solutions among SMEs. Brazil, Mexico, and Chile lead adoption, focusing on invoice financing, factoring, and trade finance to address liquidity challenges and optimize cash flow. Increasing collaborations between local banks, fintech firms, and corporates are expanding access to automated financing platforms. The region’s market growth is supported by digitalization initiatives, regulatory improvements, and the need to mitigate financial risks in cross-border trade, creating opportunities for scalable supply chain finance solutions across industries.

Middle East & Africa (MEA)

The MEA region holds around 5% of the supply chain finance market, with growth driven by infrastructure development, trade expansion, and corporate demand for working capital optimization. The UAE, Saudi Arabia, and South Africa are key markets adopting invoice financing, trade finance, and dynamic discounting solutions. Financial institutions and supply chain solution providers are collaborating to deploy digital platforms and enhance liquidity management across sectors such as logistics, energy, and manufacturing. Market growth is also supported by government initiatives promoting financial inclusion, cross-border trade facilitation, and adoption of fintech solutions, enabling corporates to manage cash flow efficiently while mitigating supply chain risks.

Market Segmentations:

By Components:

- Consulting & advisory services

- Integration & deployment services

By Providers:

- Technology providers

- Financial institutions

By Application:

- Invoice financing

- Inventory financing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The supply chain finance market include Kinaxis, Maersk Group, Genpact Limited, Lockheed Martin Corporation, Aera Technology, Capgemini SA, JDA Software Group, Inc., International Business Machines Corporation, Birst, Inc., and Accenture PLC. The supply chain finance market is highly competitive, driven by technological innovation, strategic partnerships, and service differentiation. Companies focus on developing AI-enabled platforms, blockchain-based trade finance solutions, and cloud-integrated systems to enhance operational efficiency, transparency, and risk management. Providers also offer consulting, advisory, and implementation services to deliver end-to-end financing solutions tailored to both large enterprises and SMEs. Competitive strategies include mergers and acquisitions, expansion into emerging markets, and the introduction of dynamic discounting, invoice financing, and reverse factoring solutions. Continuous investment in digital transformation, product innovation, and customer-centric services enables market participants to maintain a competitive edge and capitalize on the growing demand for efficient, technology-driven supply chain finance solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kinaxis

- Maersk Group

- Genpact Limited

- Lockheed Martin Corporation

- Aera Technology

- Capgemini SA

- JDA Software Group, Inc.

- International Business Machines Corporation

- Birst, Inc.

- Accenture PLC

Recent Developments

- In May 2025, Manhattan Associates Inc. introduced comprehensive Agentic AI capabilities within its Manhattan Active solutions, featuring intelligent, autonomous digital agents designed to transform supply chain commerce execution, enhance optimization, and elevate user experiences.

- In February 2024, Logility, Inc. launched a generative AI (GenAI) capability to enhance its supply chain management platform. This feature, built on their AI-native platform, helps companies manage complex supply chain data through a conversational interface, aiming to enable faster decision-making and improve productivity.

- In May 2023, Accenture and Blue Yonder, Inc. announced the expansion of their strategic partnership to enhance organizations’ supply chains by leveraging Accenture’s technology and industry expertise. Accenture’s cloud-native platform engineers and industry experts likely to collaborate with Blue Yonder to develop new solutions on the Blue Yonder Luminate Platform, offering end-to-end supply chain synchronization.

Report Coverage

The research report offers an in-depth analysis based on Components, Providers, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of digital and AI-driven platforms will accelerate across enterprises globally.

- Integration of blockchain technology will enhance transparency and security in trade finance.

- SMEs will increasingly access supply chain finance solutions due to easier onboarding and digital access.

- Dynamic discounting and reverse factoring will gain wider acceptance among buyers and suppliers.

- Financial institutions will expand partnerships with technology providers to offer innovative solutions.

- Cloud-based platforms will drive scalability, flexibility, and real-time visibility for corporates.

- Cross-border trade finance adoption will grow, fueled by globalization and emerging markets.

- ESG and sustainable financing practices will influence supplier selection and financing terms.

- Automation and data analytics will optimize credit risk assessment and working capital management.

- Regulatory compliance and standardization efforts will support secure, efficient, and scalable market growth.