Market Overview

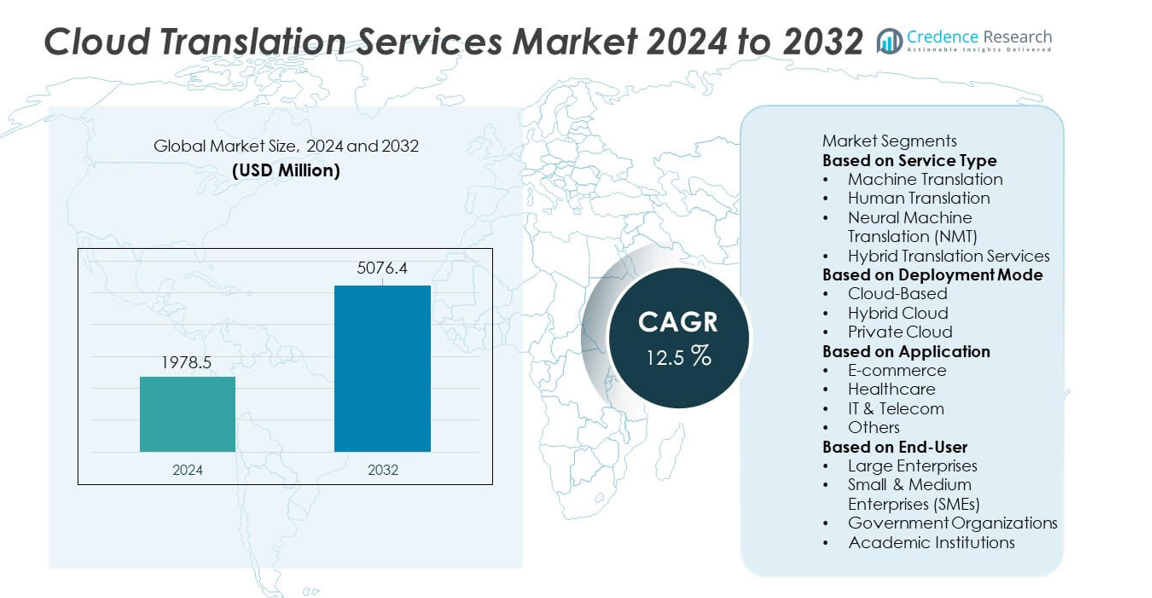

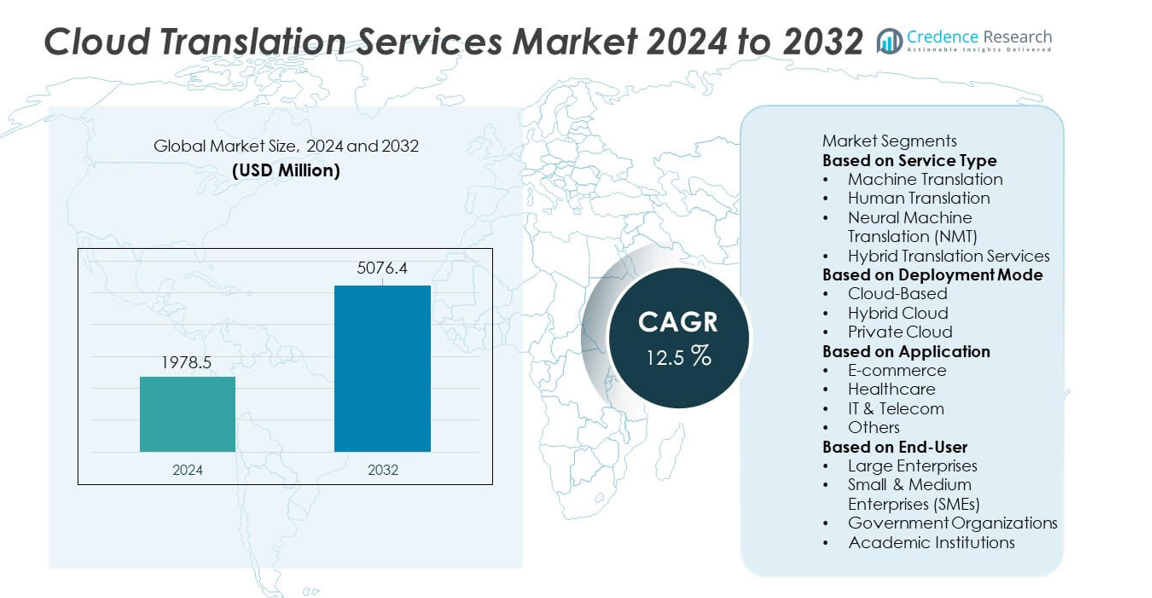

The Cloud Translation Services market was valued at USD 1,978.5 million in 2024 and is projected to reach USD 5,076.4 million by 2032, registering a CAGR of 12.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Translation Services Market Size 2024 |

USD 1,978.5 million |

| Cloud Translation Services Market, CAGR |

12.5% |

| Cloud Translation Services Market Size 2032 |

USD 5,076.4 million |

The top players in the Cloud Translation Services market—Google Cloud, Amazon Web Services, Microsoft Azure, IBM Watson Language Translator, SDL (RWS Group), Smartling, Lionbridge, TransPerfect, SYSTRAN, and DeepL—drive growth through advanced neural machine translation, scalable cloud platforms, and strong integration capabilities. These companies enhance accuracy, support real-time translation, and expand APIs for enterprise localization workflows. North America leads the market with a market share of 38%, supported by high cloud adoption and strong technological investment. Europe holds 29%, driven by strict data compliance and diverse language needs, while Asia Pacific follows with 24%, fueled by rapid digital expansion and rising multilingual consumer bases.

Market Insights

- The Cloud Translation Services market reached USD 1,978.5 million in 2024 and is set to reach USD 5,076.4 million by 2032 at a CAGR of 12.5%, reflecting strong global adoption.

- Demand strengthens as enterprises expand digital content and adopt scalable cloud-based translation tools, with Machine Translation holding a 46% segment share due to rising automation needs.

- Key trends include the rise of neural machine translation, real-time speech translation, and API-based integration across e-commerce, IT, healthcare, and enterprise workflows, improving accuracy and speed.

- Competition increases as major players such as Google Cloud, AWS, Microsoft Azure, DeepL, and RWS Group enhance AI models, security features, and domain-trained engines to gain a larger enterprise share.

- North America leads with a 38% regional share, followed by Europe at 29% and Asia Pacific at 24%, supported by rising multilingual content, digital maturity, and strong cloud adoption across these markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service Type

Machine Translation holds the leading position in this segment with a market share of 46%, driven by rising demand for automated, high-speed translation across digital platforms. Neural Machine Translation also gains traction as enterprises seek improved contextual accuracy and natural language output. Human Translation remains essential for legal, medical, and high-precision content, while Hybrid Translation Services combine automated engines with expert review to enhance quality. Growth accelerates as companies integrate AI-based engines, custom language models, and domain-trained datasets to support large-volume translation needs across global businesses.

- For instance, Google expanded its language modeling capabilities using the PaLM (Pathways Language Model) model, which had over 500 billion (specifically 540 billion) trainable parameters within its Pathways-based architecture, demonstrating strong performance across many multilingual tasks.

By Deployment Mode

Cloud-Based solutions dominate the deployment landscape with a market share of 58%, supported by scalable infrastructure, reduced setup costs, and on-demand access. Hybrid Cloud options expand as organizations balance data privacy with flexible processing across distributed environments. Private Cloud adoption grows in regulated sectors that require controlled data environments and enhanced security measures. Drivers include rising digital transformation initiatives, multilingual content growth, and enterprise demand for secure, always-available translation engines optimized for global operations.

- For instance, Microsoft Azure Translator supports over 60 regional data centers with low-latency translation routing for enterprise workloads.

By Application

E-commerce leads the application segment with a market share of 39%, supported by cross-border retail expansion and the need for localized product listings, customer support, and marketing content. Healthcare adopts translation tools to meet compliance, telehealth expansion, and multilingual patient communication needs. IT & Telecom relies on translation engines to support global software rollouts and technical documentation. Others include BFSI, education, and government agencies seeking faster multilingual content delivery. Key drivers include rising digital customer engagement, demand for accurate real-time translation, and increased adoption of AI-enabled localization workflows.

Key Growth Drivers

Rising Demand for Multilingual Digital Content

Global businesses expand digital footprints, increasing the need for localized websites, applications, and support platforms. Cloud translation services help enterprises deliver consistent multilingual experiences across markets, improving customer engagement and brand reach. Companies adopt AI-driven engines to manage large content volumes efficiently. Growth accelerates as e-commerce, media, and software platforms generate continuous translation needs. The expanding number of global users accessing online content fuels strong adoption of cloud-based translation tools.

- For instance, IBM Watson Language Translator uses advanced Neural Machine Translation (NMT) technology, a deep learning approach, to provide high-accuracy multilingual output for various applications and industries.

Advancements in AI and Neural Machine Translation

Improved neural machine translation models enhance translation accuracy, context handling, and language fluency. Enterprises adopt cloud-based NMT systems to automate workflows, reduce turnaround time, and support real-time communication. AI-enabled translation platforms integrate speech, text, and image recognition, expanding their role in diverse applications. Continuous model training strengthens domain-specific output for industries such as healthcare, legal, and IT. These advancements position AI-powered translation engines as core enablers of scalable and fast localization strategies.

- For instance, DeepL operates high-capacity NMT clusters capable of processing large volumes of text, with genuinely unlimited monthly translation volume available for API Pro and Business plan users, supporting real-time outputs for enterprise platforms.

Growing Enterprise Focus on Cost Efficiency and Scalability

Organizations shift to cloud platforms to avoid the high cost of traditional translation workflows and on-premise setups. Cloud models offer pay-as-you-go pricing, instant scalability, and automated processing, supporting large-scale projects with reduced operational burden. Enterprises streamline localization pipelines by integrating cloud APIs into content management systems and software development cycles. This shift strengthens productivity and supports continuous localization for global product releases. The need for flexible, low-maintenance translation infrastructure drives rapid adoption across sectors.

Key Trends & Opportunities

Expansion of Real-Time Translation and Speech Integration

Businesses adopt real-time translation for customer support, global meetings, and cross-border communication. Cloud platforms integrate speech-to-text, text-to-speech, and multilingual voice translation capabilities, enabling efficient use across devices and applications. This trend supports conversational AI tools, virtual assistants, and interactive platforms. Opportunities rise as enterprises deploy voice-enabled services to improve engagement and reduce language barriers. Growing demand for instant translation in travel, e-commerce, and remote work environments strengthens this trend.

- For instance, Meta’s SeamlessM4T model handles speech and text translation across 100 languages using more than 500 million training segments.

Rising Adoption Across Highly Regulated Industries

Sectors such as healthcare, BFSI, and government adopt cloud translation tools to improve compliance and secure multilingual communication. Platforms offering encrypted data handling, audit trails, and domain-trained models gain strong traction. Opportunities increase as organizations modernize workflows and digitize documentation. Vendors providing specialized terminology management and secure cloud environments capture higher demand. This trend supports the expansion of tailored translation services aligned with sector-specific regulatory requirements.

- For instance, SAP Language Services maintains an extensive terminology database, SAPterm, which contains hundreds of thousands of technical and business terms to support ERP-specific translations.

Key Challenges

Data Security and Privacy Concerns

Organizations hesitate to adopt cloud translation platforms due to concerns around data exposure and cross-border transfers. Sensitive information in healthcare, legal, or financial documents requires strict controls, increasing demand for secure architectures. Providers must ensure encryption, zero-trust models, and compliance with regulations such as GDPR. Any breach or mismanaged data flow can affect trust and slow market growth. Ensuring secure processing remains a critical challenge for broader enterprise adoption.

Quality Variability in Automated Translation Output

Despite advancements, machine-generated translations may still struggle with idiomatic language, cultural context, and industry-specific terminology. Errors in technical or legal content can impact brand credibility or create compliance risks. Enterprises often require human post-editing to ensure accuracy, increasing workflow complexity. Vendors must enhance AI training datasets and domain customization to improve reliability. Maintaining consistent quality across diverse languages remains a key barrier for full automation.

Regional Analysis

North America

North America leads the Cloud Translation Services market with a market share of 38%, driven by strong digital transformation, high adoption of AI-enabled tools, and widespread use of cloud-based platforms across enterprises. Technology providers integrate advanced machine translation engines into business applications, supporting large-scale localization needs. The region benefits from strong investments in multilingual customer engagement across e-commerce, IT, healthcare, and media sectors. Vendor presence and continuous innovation in neural machine translation models strengthen regional growth. Demand rises as companies expand cross-border operations and require fast, reliable, and scalable translation solutions.

Europe

Europe holds a market share of 29%, supported by rising demand for multilingual communication across diverse languages and strict regulatory requirements for secure data handling. Enterprises in BFSI, government, and healthcare adopt cloud translation platforms to meet compliance standards and enhance accessibility. Strong uptake of digital business models accelerates the need for real-time translation and AI-enabled localization workflows. Vendors offering GDPR-compliant and sector-specific solutions gain traction. The region’s expanding cross-border trade and multilingual workforce further increase the adoption of cloud translation services across key industries.

Asia Pacific

Asia Pacific accounts for a market share of 24%, fueled by rapid internet expansion, rising e-commerce growth, and strong demand for localization across China, India, Japan, and Southeast Asia. Businesses adopt cloud translation tools to support multilingual consumer bases and regional market expansion. The rise of digital payments, online retail, and cross-border services increases demand for automated translation workflows. Investments in AI, growing mobile usage, and expanding SME digitalization contribute to strong adoption. Regional enterprises prioritize fast content translation to compete in diverse linguistic environments.

Latin America

Latin America captures a market share of 6%, supported by increasing digital adoption and growing localization needs in e-commerce, telecom, and financial services. Businesses invest in cloud-based translation platforms to serve multilingual users across Spanish and Portuguese markets. Regional companies expand digital communication strategies, driving demand for automated translation tools. Cloud providers strengthen presence through localized language support and AI-driven services. The rise of remote work and digital service platforms further increases adoption, though infrastructure gaps and cost considerations still affect growth in several countries.

Middle East & Africa

The Middle East & Africa region holds a market share of 3%, driven by growing digital transformation efforts across government, education, and corporate sectors. Countries in the Gulf region adopt translation technologies to support tourism, international business, and multilingual public services. Cloud-based tools gain traction as organizations modernize workflows and expand digital content delivery. Increasing adoption of AI-enabled translation supports communication across diverse linguistic groups. However, limited digital infrastructure in parts of Africa and slower enterprise adoption present challenges, though ongoing investments continue to strengthen regional growth potential.

Market Segmentations:

By Service Type

- Machine Translation

- Human Translation

- Neural Machine Translation (NMT)

- Hybrid Translation Services

By Deployment Mode

- Cloud-Based

- Hybrid Cloud

- Private Cloud

By Application

- E-commerce

- Healthcare

- IT & Telecom

- Others

By End-User

- Large Enterprises

- Small & Medium Enterprises (SMEs)

- Government Organizations

- Academic Institutions

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape or analysis features major players such as Google Cloud, Amazon Web Services, Microsoft Azure, IBM Watson Language Translator, SDL (RWS Group), Smartling, Lionbridge, TransPerfect, SYSTRAN, and DeepL GmbH. These companies compete by offering advanced AI-driven translation engines, customizable language models, and scalable cloud architectures that support high-volume multilingual content processing. Vendors invest in neural machine translation, real-time speech translation, and API-based integrations to strengthen accuracy and workflow automation. Partnerships with enterprises, CMS platforms, and software providers enhance market reach and expand application coverage across e-commerce, IT, healthcare, and government. Many players focus on improving data security, domain adaptation, and compliance capabilities to meet rising demand from regulated industries. Innovation in hybrid translation workflows and context-aware models drives differentiation. As global digital communication grows, competitors emphasize speed, reliability, and continuous training of language models to capture a larger share of enterprise localization spending.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Google Translate integrated advanced AI models for better live translation and language learning features, leveraging its Gemini models for improved translation quality and multimodal capabilities.

- In July 2024, Google Cloud enhanced its Cloud Translation service by expanding adaptive translation to handle longer paragraph-level context and by upgrading its translation LLM to accept HTML input and support glossaries in text translation requests, improving customization and formatting preservation for cloud-based workflows.

- In August 2023, Amazon Web Services (AWS) added language auto-detection for real-time document translation in Amazon Translate, allowing the service to automatically detect the dominant language of uploaded documents before translating them through the cloud API or console.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Deployment Mode, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for real-time translation will rise as global digital communication expands.

- Neural machine translation models will gain adoption due to improved accuracy.

- Enterprises will integrate translation APIs deeper into software and content workflows.

- Voice and speech translation services will support growth in conversational platforms.

- Secure cloud environments will attract regulated sectors seeking compliant solutions.

- Hybrid translation models will grow as companies balance speed with quality.

- Custom domain-trained engines will become standard for industry-specific accuracy.

- SMEs will adopt cloud translation tools as costs decline and scalability improves.

- Multilingual customer support platforms will drive higher usage across e-commerce and IT.

- Regional markets in Asia Pacific and Europe will strengthen as businesses expand cross-border operations.