Market Overview

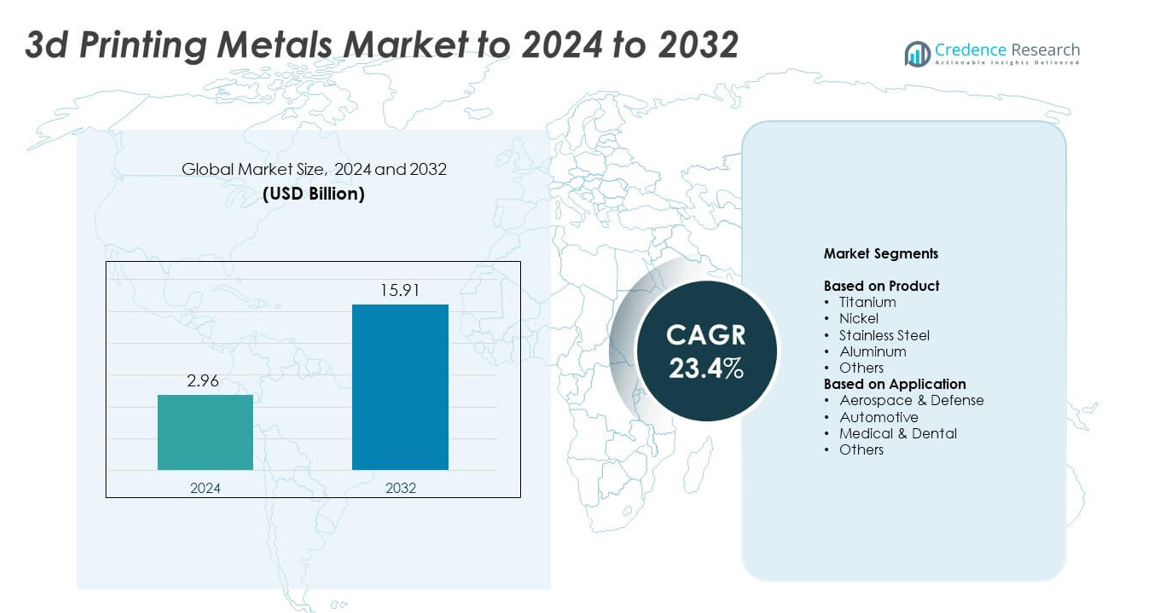

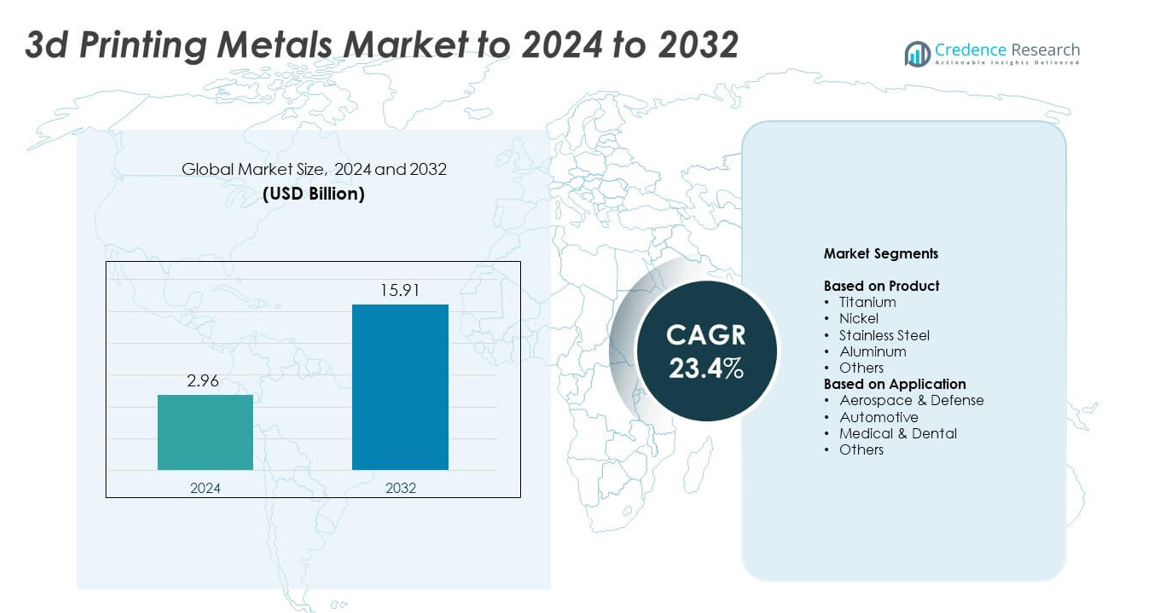

3D printing metals market size was valued at USD 2.96 billion in 2024 and is anticipated to reach USD 15.91 billion by 2032, at a CAGR of 23.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 3D Printing Metals Market Size 2024 |

USD 2.96 billion |

| 3D Printing Metals Market, CAGR |

23.4% |

| 3D Printing Metals Market Size 2032 |

USD 15.91 billion |

The 3D printing metals market features major participants such as INDO-MIM, ATI, Outokumpu, Colibrium Additive (GE Aerospace), Höganäs AB, POLEMA, Materialise NV, GKN Powder Metallurgy, CNPC Powders, CRS Holdings, LLC., and OC Oerlikon Management AG. These companies shape the competitive environment through advances in metal powders, precision alloys, and industrial additive systems. North America leads the market with about 38% share due to strong aerospace and medical adoption, followed by Europe with nearly 32% share supported by advanced automotive and industrial manufacturing. Asia Pacific holds around 24% share, driven by rapid expansion in production hubs across China, Japan, and South Korea.

Market Insights

- The 3D printing metals market reached USD 2.96 billion in 2024 and is expected to hit USD 15.91 billion by 2032, growing at a CAGR of 23.4%.

- Growth is driven by rising demand from aerospace, which held about 41% share in 2024, as manufacturers use titanium and nickel alloys to cut weight and improve performance.

- Key trends include the shift toward titanium, which led the product segment with nearly 34% share, supported by high strength, biocompatibility, and wider use in medical and aerospace parts.

- Competition intensifies as major producers invest in high-purity metal powders, AI-enabled process control, and larger printing systems to strengthen capabilities and reduce production costs.

- North America led the market with about 38% share, followed by Europe at nearly 32% and Asia Pacific at around 24%, while Latin America and Middle East & Africa held smaller shares but continue to expand through industrial upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Titanium held the dominant share in 2024 with about 34% of the 3D printing metals market. Titanium stayed ahead due to its strong strength-to-weight ratio, biocompatibility, and corrosion resistance, which made the metal ideal for aerospace components and medical implants. Demand increased as aircraft manufacturers adopted titanium powders for lightweight structural parts and fuel-efficient designs. Stainless steel and aluminum also expanded as industries used these metals for prototypes, fixtures, and end-use custom parts that require durability and cost control.

- For instance, Rolls-Royce 3D printed a titanium front bearing housing for its Trent XWB-97 engine. The structure measures 1.5 meters in diameter and 0.5 meters thick and contains 48 aerofoils.

By Application

Aerospace and defense led the application segment in 2024 with nearly 41% share of the 3D printing metals market. Growth rose as aircraft and defense suppliers shifted toward additive manufacturing for engine parts, structural brackets, and complex components that reduce weight and improve performance. Adoption accelerated because 3D-printed metal parts cut material waste and shorten production cycles. The medical and dental sector also gained traction as hospitals and device makers used metal printing to produce custom implants and surgical tools.

- For instance, Airbus produced over 1,000 3D-printed flight parts for its first A350 XWB. These parts supported serial aircraft production by replacing conventionally manufactured components on the delivered aircraft.

Key Growth Drivers

Rising Adoption in Aerospace and Defense

Aerospace and defense companies boosted demand for 3D printing metals because the process supports lightweight structures and complex geometries. Aircraft makers used titanium and nickel alloys to reduce weight and improve fuel efficiency. Defense programs adopted metal additive manufacturing to speed part production and cut supply delays. Growing interest in on-demand manufacturing strengthened the segment’s expansion. These factors made aerospace and defense a major driver of market growth.

- For instance, GE Aviation shipped its 100,000th 3D-printed fuel nozzle tip for the LEAP engine.

Expansion of Medical and Dental Applications

Hospitals and device makers increased their use of metal 3D printing to create patient-specific implants and surgical instruments. Titanium’s biocompatibility improved implant performance and reduced recovery time, which encouraged wider adoption. Dental labs adopted metal printing for crowns, bridges, and orthodontic components with higher accuracy and lower material waste. Strong demand for personalized healthcare supported the rapid rise of metal additive manufacturing in medical settings, establishing this field as a key growth driver.

- For instance, Stryker reported producing well over 2,000,000 3D-printed Tritanium implants cumulatively since 2013

Shift Toward Lightweight Automotive Components

Automakers accelerated their use of metal additive manufacturing to reduce component weight and improve fuel efficiency. Stainless steel and aluminum powders gained popularity for prototype parts, custom brackets, and structural elements. The industry used 3D printing to shorten development cycles and reduce tooling costs, which supported faster model launches. Interest in electric vehicles increased demand for optimized metal components with improved strength. These factors positioned automotive innovation as a key growth driver.

Key Trends and Opportunities

Growth of High-Performance Metal Powders

Manufacturers increased investment in advanced metal powders with tighter grain control and improved purity. These powders enhanced the reliability of aerospace and medical components, which boosted adoption in regulated industries. Titanium, nickel, and aluminum powders saw major upgrades that improved part density and mechanical strength. This shift created opportunities for specialized powder suppliers and expanded the market for high-performance materials.

- For instance, Höganäs supplies forAM TS-CF1 tool steel powder with 15 to 45 micrometer particles. Heat-treated parts from this powder can reach hardness values up to 52 HRC.

Advances in Large-Format Metal 3D Printers

Producers introduced large-format metal printers to support bigger aerospace, defense, and industrial components. These systems enabled manufacturers to produce complex structures in fewer steps, reducing assembly needs and production time. Growth in this area opened opportunities for companies offering large-scale manufacturing solutions. Industries used these machines to redesign heavy parts with lighter lattice structures, expanding adoption across high-value sectors.

- For instance, Titomic operates a metal 3D printer in Melbourne for large-format builds using its proprietary Titomic Kinetic Fusion (TKF) technology. The system’s build envelope measures 9 meters long, 3 meters wide, and 1.5 meters high.

Integration of AI-Driven Process Optimization

AI-enabled software improved print accuracy, reduced defects, and optimized powder usage. Manufacturers adopted automated monitoring systems to ensure consistent quality in metal parts. This trend helped companies cut production costs and increase throughput. Wider use of AI tools created opportunities for software and hardware providers supporting advanced quality control in additive manufacturing.

Key Challenges

High Cost of Metal Powders and Equipment

Metal additive manufacturing remained costly due to the high price of titanium, nickel, and specialized alloy powders. Industrial metal printers required large upfront investments and regular maintenance, which limited adoption for smaller manufacturers. The cost barrier slowed market penetration in price-sensitive industries and restricted large-scale deployment. Companies struggled to balance performance benefits with budget constraints, making cost pressure a major challenge.

Quality Variability and Certification Barriers

Manufacturers faced difficulties in achieving consistent part quality across batches, especially in aerospace and medical applications. Strict regulatory requirements demanded extensive testing, documentation, and certification, which slowed production timelines. Variability in powder quality and machine calibration created reliability concerns. These challenges limited the pace of adoption in highly regulated sectors and increased operational complexity for many producers.

Regional Analysis

North America

North America held the largest share in 2024 with about 38% of the 3D printing metals market. Strong adoption came from aerospace and defense companies that used titanium and nickel alloys for lightweight and high-performance parts. The medical sector also expanded metal printing for implants and orthopedic devices. Growth increased as manufacturers invested in advanced printers, powder production, and design optimization tools. Supportive regulatory standards and strong R&D activity helped the region maintain leadership. Rising demand for large-format systems and customized production continued to strengthen market growth across the United States and Canada.

Europe

Europe accounted for nearly 32% share in 2024, supported by strong industrial adoption in aerospace, automotive, and medical device manufacturing. Countries such as Germany, France, and the United Kingdom advanced metal printing through investments in research centers and production facilities. Automotive suppliers used aluminum and steel powders to reduce vehicle weight and improve component efficiency. Medical companies broadened their use of titanium implants, which increased demand for high-purity metal powders. Sustainability programs and strict quality requirements encouraged development of advanced additive technologies, helping Europe sustain its position as a leading regional market.

Asia Pacific

Asia Pacific captured about 24% share in 2024, driven by rapid expansion in manufacturing hubs across China, Japan, South Korea, and India. Aerospace and automotive sectors adopted metal additive manufacturing to improve part precision and reduce tooling costs. Medical and dental applications grew as hospitals increased the use of patient-specific implants. Regional governments supported investment in advanced manufacturing parks and metal powder facilities. Rising demand for cost-efficient production and strong growth in industrial machinery strengthened the region’s momentum. Expanding domestic printer manufacturers also helped Asia Pacific emerge as a fast-growing market.

Latin America

Latin America held nearly 4% share in 2024, with growing adoption in automotive, aerospace maintenance, and medical applications. Brazil and Mexico led regional demand as manufacturers explored metal printing to reduce import dependence and shorten production cycles. Interest grew in stainless steel and aluminum powders for industrial equipment and custom parts. Limited availability of large-scale printers slowed expansion, yet ongoing investments in manufacturing modernization supported gradual growth. Training programs and partnerships with global additive manufacturing firms helped build technical capabilities across key industries in the region.

Middle East and Africa

Middle East and Africa accounted for around 2% share in 2024, supported by early adoption in aerospace, energy, and healthcare sectors. The UAE and Saudi Arabia invested in additive manufacturing centers focused on metal materials and industrial components. Demand increased for lightweight printed parts in aviation and oil and gas equipment. Hospitals in the region also explored titanium implants, boosting medical usage. Market expansion remained steady but moderate due to limited local manufacturing capacity. Ongoing diversification efforts and government-backed technology programs continued to encourage adoption of metal 3D printing solutions.

Market Segmentations:

By Product

- Titanium

- Nickel

- Stainless Steel

- Aluminum

- Others

By Application

- Aerospace & Defense

- Automotive

- Medical & Dental

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the 3D printing metals market includes INDO-MIM, ATI, Outokumpu, Colibrium Additive (GE Aerospace), Höganäs AB, POLEMA, Materialise NV, GKN Powder Metallurgy, CNPC Powders, CRS Holdings, LLC., and OC Oerlikon Management AG. The market features strong competition driven by advancements in metal powders, expansion of large-format printers, and rising demand from aerospace, medical, and automotive sectors. Companies focus on high-purity alloys, improved powder consistency, and standardized certification processes to meet strict industry requirements. Investments in automation, AI-driven quality monitoring, and distributed production networks strengthen their global presence. Strategic mergers, technology partnerships, and capacity expansions support faster delivery of complex metal components. The shift toward lightweight structures, custom implants, and rapid prototyping continues to shape competitive strategies across major suppliers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- INDO-MIM

- ATI

- Outokumpu

- Colibrium Additive (GE Aerospace)

- Höganäs AB

- POLEMA

- Materialise NV

- GKN Powder Metallurgy

- CNPC Powders

- CRS Holdings, LLC.

- OC Oerlikon Management AG

Recent Developments

- In February 2025, ATI commissioned a new Additive Manufacturing Products facility in Margate, Florida, which integrates design, printing, heat treatment, machining, and inspection phases for metal additive manufacturing.

- In 2025, INDO-MIM filed for an IPO to expand its metal operations including 3D printing technologies at its Bangalore.

- In 2025, Outokumpu launched a new stainless steel powder grade specifically designed for aerospace additive manufacturing applications.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as aerospace and defense increase use of titanium and nickel alloys.

- Medical and dental adoption will rise with stronger demand for patient-specific implants.

- Automotive companies will use metal printing to reduce weight and enhance component strength.

- High-performance metal powders will gain traction due to improved purity and reliability.

- Large-format metal printers will support production of bigger industrial and aerospace parts.

- AI-driven optimization will improve print accuracy and reduce material waste.

- Costs will decline as powder production and printer technologies become more efficient.

- Certification frameworks will evolve to support wider use in regulated sectors.

- Defense agencies will expand on-demand printing capabilities for mission-critical components.

- Global supply chains will integrate metal additive manufacturing to reduce dependency on traditional tooling.