| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wastewater Recovery System Market Size 2024 |

USD 42,396.70 Million |

| Wastewater Recovery System Market, CAGR |

8.92% |

| Wastewater Recovery System Market Size 2032 |

USD 88,137.83 Million |

Market Overview

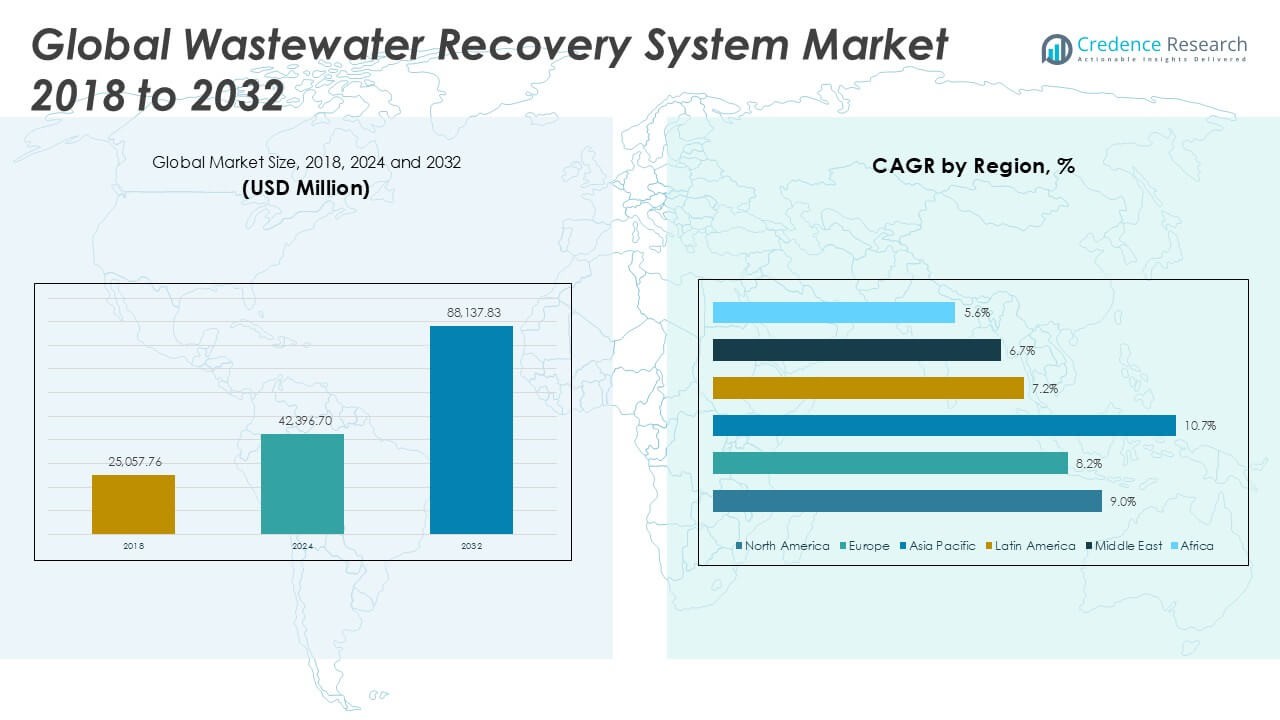

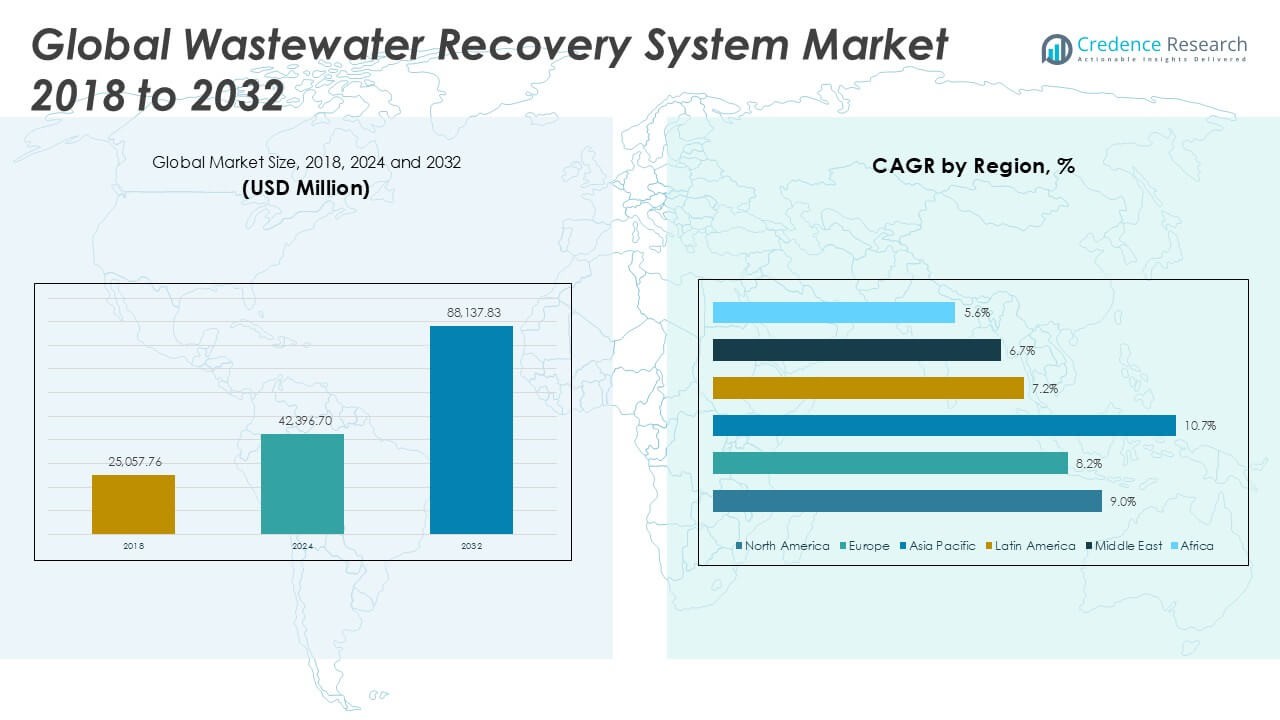

The Wastewater Recovery System Market size was valued at USD 25,057.76 million in 2018, reached USD 42,396.70 million in 2024, and is anticipated to reach USD 88,137.83 million by 2032, at a CAGR of 8.92% during the forecast period.

The Wastewater Recovery System Market experiences robust growth driven by increasing water scarcity, stringent environmental regulations, and a global emphasis on sustainable water management. Industries and municipalities prioritize advanced recovery systems to reduce freshwater consumption, minimize discharge, and comply with tightening effluent standards. Rising industrialization and urbanization further propel demand, as sectors such as pharmaceuticals, food and beverage, and chemicals seek efficient solutions for water reuse and cost optimization. Adoption of innovative technologies—including membrane bioreactors, reverse osmosis, and IoT-enabled monitoring—enhances operational efficiency and system reliability. Market trends highlight the integration of automation, smart controls, and real-time analytics, allowing users to maximize resource utilization and ensure regulatory compliance. Growing investments in infrastructure development and public-private partnerships also support market expansion, while heightened awareness about the economic and environmental benefits of wastewater recovery continues to encourage adoption across both developed and emerging economies.

The geographical analysis of the Wastewater Recovery System Market highlights strong demand across North America, Europe, and Asia Pacific, each region driven by distinct regulatory, industrial, and environmental factors. North America and Europe benefit from robust infrastructure and strict compliance requirements, with the United States, Germany, and the United Kingdom leading adoption of advanced recovery solutions. Asia Pacific, led by China, India, and Japan, experiences rapid market growth fueled by industrial expansion, water scarcity, and government-backed conservation initiatives. Latin America, the Middle East, and Africa show rising investments in wastewater management to address water shortages and pollution. Key players such as Evoqua Water Technologies LLC, Calgon Carbon Corporation, and Koch Separation Solutions maintain strong regional and global presence through continuous innovation and a broad technology portfolio. Their efforts to deliver scalable, efficient solutions enable industries and municipalities worldwide to meet sustainability and regulatory goals.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Wastewater Recovery System Market was valued at USD 42,396.70 million in 2024 and is expected to reach USD 88,137.83 million by 2032, registering a CAGR of 8.92% during the forecast period.

- Growing water scarcity and tightening environmental regulations drive strong adoption of advanced wastewater recovery solutions across industrial and municipal sectors.

- Rapid advancements in digitalization, IoT-enabled monitoring, and energy-efficient technologies set new standards for operational efficiency and system reliability in wastewater recovery.

- Key players such as Evoqua Water Technologies LLC, Calgon Carbon Corporation, and Koch Separation Solutions strengthen market competition through diverse portfolios and continuous innovation.

- High initial investment requirements and complex integration processes restrain smaller organizations and developing regions from widespread system adoption.

- North America and Europe show strong market activity due to regulatory frameworks and high industry standards, while Asia Pacific emerges as the fastest-growing region, driven by industrial expansion and government incentives.

- Regional differences in infrastructure, funding availability, and local regulations influence the rate and scale of wastewater recovery system deployments globally.

Market Drivers

Rising Water Scarcity and Growing Demand for Sustainable Water Management

Global water scarcity continues to intensify due to rapid industrialization, urban population growth, and the depletion of freshwater resources. Governments and private organizations recognize the urgent need for sustainable water management solutions to ensure long-term water security. The Wastewater Recovery System Market addresses these challenges by offering advanced technologies that enable water recycling and reuse in multiple sectors. The demand for wastewater recovery systems grows as industries seek to reduce freshwater withdrawal and optimize operational costs. Regions experiencing drought and water stress, such as the Middle East, North Africa, and parts of Asia-Pacific, witness higher adoption rates. Companies invest in robust recovery infrastructure to mitigate operational risks and support business continuity.

- For instance, Evoqua Water Technologies commissioned a recovery facility in California that processes over 56 million liters of wastewater per day, directly supporting regional water reuse goals.

Stringent Environmental Regulations and Compliance Requirements Drive Adoption

Environmental agencies worldwide impose strict discharge and effluent standards to protect water bodies and public health. Regulatory frameworks mandate the implementation of advanced wastewater treatment and recovery systems across industrial and municipal sectors. The Wastewater Recovery System Market benefits from these evolving policies, prompting end users to upgrade or install efficient recovery solutions. Compliance requirements compel industries to minimize pollutant discharge, recycle process water, and demonstrate environmental stewardship. Regulatory support, including tax incentives and funding initiatives, further accelerates market growth. Companies that align with these mandates enhance their corporate image and minimize the risk of legal penalties.

- For instance, Calgon Carbon Corporation supplied more than 1,000 activated carbon adsorption systems across U.S. municipalities in 2023 to comply with new federal PFAS discharge regulations.

Technological Advancements Fuel Efficiency and Market Growth

Continuous technological advancements improve the performance and cost-effectiveness of wastewater recovery systems. Innovative solutions such as membrane bioreactors, ultrafiltration, reverse osmosis, and smart automation technologies enable precise monitoring, lower energy consumption, and higher recovery rates. The Wastewater Recovery System Market leverages digitalization and IoT-driven controls to optimize operations and provide predictive maintenance capabilities. These advancements make recovery solutions viable for a broader range of applications and industries. Market players focus on R&D investments to develop customizable, scalable systems that meet diverse end-user requirements.

Rising Awareness of Economic and Environmental Benefits Encourages Adoption

Organizations increasingly recognize the economic value of wastewater recovery, including reduced water procurement costs and lower wastewater disposal fees. Environmental awareness drives businesses to adopt circular water practices, supporting sustainability goals and resource conservation. The Wastewater Recovery System Market gains traction as users realize the long-term savings and reputational benefits linked to efficient water reuse. Educational campaigns, industry collaborations, and knowledge-sharing platforms contribute to growing awareness and widespread market adoption. Both public and private sector initiatives encourage greater investment in water recovery technologies.

Market Trends

Integration of Smart Technologies and Digital Solutions Transforms Water Recovery

The adoption of smart technologies and digital solutions continues to reshape the Wastewater Recovery System Market. IoT-enabled sensors, cloud-based monitoring, and data analytics provide operators with real-time insights into system performance, energy use, and water quality. Remote monitoring and automated controls allow for proactive maintenance, reduced downtime, and optimized operations. The integration of artificial intelligence and machine learning enhances predictive analytics, improving decision-making and maximizing efficiency. Companies develop digital platforms to centralize control and reporting, making system management more streamlined and transparent. These innovations enable facilities to meet regulatory requirements and sustainability targets with greater confidence.

- For instance, Pall Corporation’s Aria™ SMARTBOX enables remote diagnostics for over 250 industrial installations globally, reducing system downtime by up to 15% per year.

Shift Toward Decentralized and Modular Wastewater Recovery Solutions

A growing trend in the market is the move toward decentralized and modular wastewater recovery solutions. Industries and municipalities increasingly deploy compact, scalable systems to address site-specific needs, especially in regions with limited infrastructure or rapidly changing requirements. Modular designs allow for easier expansion and customization, supporting phased implementation and lower upfront costs. The Wastewater Recovery System Market responds with flexible systems that adapt to varying capacities and types of wastewater streams. Decentralized solutions enable communities and industrial parks to achieve self-sufficiency in water management. The trend reflects the market’s adaptability to evolving user preferences and resource constraints.

- For instance, CLEARAS Water Recovery installed modular nutrient recovery systems in Idaho, each processing up to 1.2 million liters per day, with expansion capacity built into every unit.

Rising Focus on Energy-Efficient and Low-Carbon Technologies

Market participants prioritize the development of energy-efficient and low-carbon wastewater recovery technologies. Companies invest in membrane filtration, advanced oxidation processes, and energy recovery systems to minimize environmental impact and operational expenses. The Wastewater Recovery System Market emphasizes solutions that lower energy consumption, reduce greenhouse gas emissions, and promote sustainable practices. Stakeholders seek certifications for environmental performance and implement renewable energy integration in recovery operations. The demand for eco-friendly solutions aligns with global efforts to combat climate change and achieve net-zero targets.

Expansion of Water Reuse Across New Industrial and Municipal Applications

Water reuse initiatives extend beyond traditional industrial applications, gaining traction in municipal, agricultural, and commercial sectors. Municipalities incorporate treated wastewater for landscaping, irrigation, and even potable purposes, addressing urban water challenges. The Wastewater Recovery System Market adapts by offering systems that meet rigorous health and safety standards for a range of uses. Market trends indicate rising collaborations between public and private sectors to fund and implement large-scale reuse projects. New applications for recovered water support sustainable urbanization and contribute to resource resilience.

Market Challenges Analysis

High Capital Investment and Complex Implementation Processes Limit Market Growth

Significant upfront capital investment remains a primary challenge for organizations considering wastewater recovery systems. Costs associated with system design, engineering, installation, and integration with existing infrastructure can deter small and mid-sized enterprises from adopting advanced solutions. The complexity of customizing systems to suit varying wastewater compositions and industry requirements increases project timelines and risk of delays. The Wastewater Recovery System Market must address these financial and technical barriers to accelerate widespread adoption. Limited access to funding, especially in developing regions, restricts the ability of many stakeholders to pursue large-scale water recovery projects. Navigating permitting processes and regulatory compliance further complicates the implementation phase.

Operational and Maintenance Concerns Impact System Performance

Ongoing operational and maintenance requirements present persistent challenges for end users of wastewater recovery systems. Facilities often require skilled personnel to manage advanced technologies and ensure consistent performance. Inadequate operator training and lack of specialized expertise can lead to suboptimal system operation, increased downtime, and higher maintenance costs. The Wastewater Recovery System Market faces pressure to develop user-friendly solutions and comprehensive support services to mitigate these issues. Variability in influent quality, fouling of membranes, and wear on mechanical components contribute to increased service demands and potential disruptions. Ensuring reliability and long-term cost-effectiveness remains a critical priority for market participants.

Market Opportunities

Expansion of Industrial Applications and Customized Solutions Creates New Growth Avenues

The diversification of industrial applications presents significant opportunities for the Wastewater Recovery System Market. Industries such as pharmaceuticals, textiles, power generation, and food and beverage actively seek tailored recovery solutions to address their unique process requirements. Customized systems that handle varying contaminant loads and fluctuating water volumes can help manufacturers achieve operational efficiency and regulatory compliance. The market stands to benefit from partnerships between technology providers and end users focused on designing and delivering industry-specific recovery technologies. This approach drives product innovation and encourages greater market penetration across both established and emerging sectors. Companies offering adaptable and scalable systems are well-positioned to capture untapped demand.

Government Incentives and Infrastructure Investment Stimulate Market Development

Government incentives and large-scale investments in water infrastructure create robust opportunities for market expansion. Policy initiatives supporting water reuse, sustainable resource management, and the adoption of green technologies encourage businesses and municipalities to implement advanced wastewater recovery systems. The Wastewater Recovery System Market gains momentum from funding programs, tax benefits, and grants that lower financial barriers and de-risk capital investment. Strategic alliances with public agencies and private investors further accelerate the deployment of innovative recovery solutions. Market participants that align offerings with government priorities and infrastructure projects can leverage significant growth potential in both developed and developing economies.

Market Segmentation Analysis:

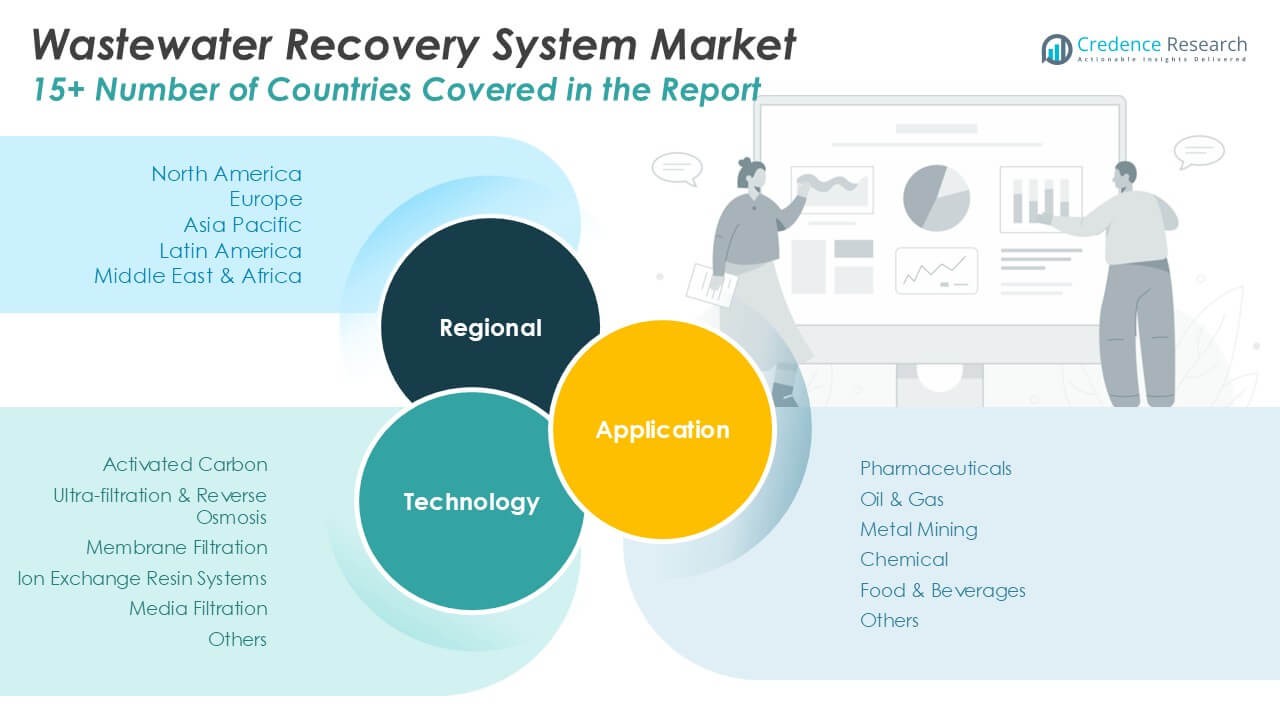

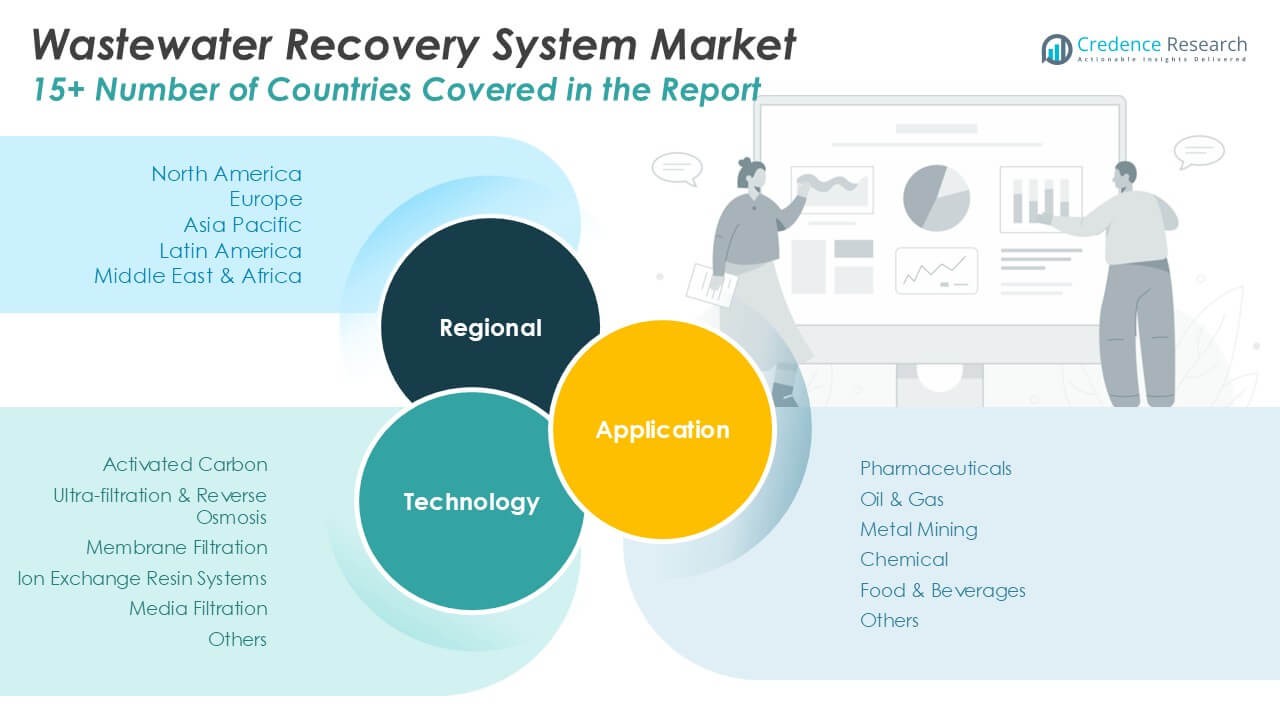

By Technology:

The Wastewater Recovery System Market segments by technology to address a diverse range of industrial and municipal needs. Activated carbon systems hold a strong presence due to their efficiency in removing organic contaminants and trace pollutants, making them a preferred choice for industries seeking reliable purification methods. Ultra-filtration and reverse osmosis technologies drive significant growth within the market, offering high removal rates of dissolved solids, pathogens, and micropollutants. Membrane filtration solutions are gaining traction for their precision and ability to meet strict water quality standards, appealing to sectors with rigorous compliance requirements. Ion exchange resin systems play a crucial role in applications that demand selective ion removal and water softening, especially in the pharmaceutical and power industries. Media filtration remains relevant for pre-treatment and coarse contaminant removal, supporting the overall efficiency of downstream processes. The segment labeled as “Others” covers emerging and hybrid technologies designed to address complex or specialized wastewater streams.

- For instance, Koch Separation Solutions installed more than 5,000 ion exchange and membrane units worldwide, with a single system in Texas recovering 13,000 cubic meters of water daily from refinery effluent.

By Application:

The Wastewater Recovery System Market demonstrates strong demand from several key industries. The pharmaceutical sector relies on advanced recovery systems to meet strict regulatory guidelines and manage complex effluents containing high-value compounds. Oil and gas applications require robust solutions to manage produced water, reduce environmental impact, and recover valuable resources during extraction and refining processes. Metal mining operations utilize wastewater recovery technologies to treat large volumes of water contaminated with heavy metals and other hazardous substances, ensuring regulatory compliance and environmental protection. The chemical industry adopts tailored recovery systems to handle aggressive contaminants, optimize water use, and support sustainable production practices. Food and beverage companies invest in advanced treatment solutions to meet stringent hygiene standards, recycle process water, and reduce wastewater disposal costs. The “Others” application segment captures sectors such as textiles, power generation, and municipal utilities, each seeking solutions for efficient water reuse and resource management. The versatility of available technologies and their adaptability to industry-specific challenges position the market for continued growth and innovation.

- For instance, ENCON Evaporators provided a zero liquid discharge solution to a European food processor, eliminating over 2,000 tons of wastewater annually and supporting full water loop closure.

Segments:

Based on Technology:

- Activated Carbon

- Ultra-filtration & Reverse Osmosis

- Membrane Filtration

- Ion Exchange Resin Systems

- Media Filtration

- Others

Based on Application:

- Pharmaceuticals

- Oil & Gas

- Metal Mining

- Chemical

- Food & Beverages

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Wastewater Recovery System Market

North America Wastewater Recovery System Market grew from USD 10,304.50 million in 2018 to USD 17,242.52 million in 2024 and is projected to reach USD 35,950.98 million by 2032, reflecting a compound annual growth rate (CAGR) of 9.0%. North America is holding a 41% market share. The United States and Canada serve as the primary growth engines in the region, supported by substantial investments in industrial wastewater treatment, regulatory mandates, and infrastructure upgrades. Key players adopt advanced technologies to enhance efficiency and sustainability, meeting high standards for water reuse and discharge. Ongoing research and public-private partnerships strengthen market development. North American industries, including pharmaceuticals, oil and gas, and food processing, continue to drive the adoption of advanced wastewater recovery systems.

Europe Wastewater Recovery System Market

Europe Wastewater Recovery System Market grew from USD 7,926.77 million in 2018 to USD 12,978.17 million in 2024 and is expected to reach USD 25,569.90 million by 2032, with a CAGR of 8.2%. Europe captures a 29% market share. Germany, France, and the United Kingdom lead the region, driven by strict environmental policies and a strong emphasis on circular water management. The European Union’s regulatory framework compels industries to adopt resource-efficient technologies and promote water reuse initiatives. Investments in innovative recovery solutions help industries meet evolving compliance standards. The food and beverage and chemical sectors display a high level of adoption for advanced water recovery technologies.

Asia Pacific Wastewater Recovery System Market

Asia Pacific Wastewater Recovery System Market grew from USD 4,619.15 million in 2018 to USD 8,499.48 million in 2024 and is set to reach USD 20,105.56 million by 2032, registering the highest CAGR of 10.7%. Asia Pacific holds a 23% market share. China, India, and Japan dominate the regional landscape, with industrial growth and urban expansion fueling demand for wastewater recovery solutions. Government initiatives supporting water conservation and stricter regulations push both public and private sectors to invest in advanced systems. Rapid industrialization and the need for sustainable resource management position Asia Pacific as a key growth driver for the global market.

Latin America Wastewater Recovery System Market

Latin America Wastewater Recovery System Market grew from USD 1,133.46 million in 2018 to USD 1,892.88 million in 2024 and will reach USD 3,462.65 million by 2032, at a CAGR of 7.2%. Latin America represents a 4% market share. Brazil and Mexico are the primary markets, focusing on improving industrial water management and expanding municipal wastewater treatment infrastructure. The region addresses challenges related to water scarcity and pollution by adopting cost-effective and scalable recovery solutions. Local governments and international organizations collaborate to boost infrastructure investment, fostering market growth in urban and industrial centers.

Middle East Wastewater Recovery System Market

Middle East Wastewater Recovery System Market grew from USD 712.89 million in 2018 to USD 1,104.16 million in 2024 and is forecast to reach USD 1,942.87 million by 2032, with a CAGR of 6.7%. The Middle East accounts for a 2% market share. Countries such as Saudi Arabia, the United Arab Emirates, and Qatar prioritize large-scale water reuse and desalination initiatives to address chronic water scarcity. Significant investments in advanced recovery technologies support economic diversification and sustainable growth. Public sector leadership and strict regulatory frameworks underpin high-value projects, especially in industrial and municipal segments.

Africa Wastewater Recovery System Market

Africa Wastewater Recovery System Market grew from USD 360.98 million in 2018 to USD 679.49 million in 2024 and is projected to reach USD 1,105.87 million by 2032, registering a CAGR of 5.6%. Africa holds a 1% market share. South Africa, Egypt, and Nigeria are leading adopters, focusing on upgrading infrastructure and promoting sustainable water reuse practices. Efforts to expand access to clean water and reduce pollution drive investment in advanced wastewater recovery solutions. International support and public-private partnerships are critical in overcoming financial and technical barriers, expanding the market’s presence in urban and peri-urban regions.

Key Player Analysis

- BioChem Technology

- Calgon Carbon Corporation

- CECO Environmental

- CLEARAS Water Recovery

- ClearBlu Environmental

- DYNATEC SYSTEMS, INC.

- ENCON Evaporators

- Evoqua Water Technologies LLC

- Koch Separation Solutions

- Pall Corporation

Competitive Analysis

The Wastewater Recovery System Market features a competitive landscape dominated by leading players such as Evoqua Water Technologies LLC, Calgon Carbon Corporation, Koch Separation Solutions, Pall Corporation, CLEARAS Water Recovery, and CECO Environmental. Leading companies focus on expanding their technology portfolios and investing in research and development to address evolving customer needs for efficiency, sustainability, and compliance. These players prioritize innovation in advanced membrane filtration, digital monitoring, and modular system design to capture diverse industrial and municipal applications. Strategic collaborations, mergers, and acquisitions help companies broaden their market reach and integrate complementary technologies into their offerings. Robust after-sales support, training services, and digital integration enable firms to maintain strong client relationships and differentiate themselves in a crowded market. The drive for continuous improvement in system performance, energy consumption, and regulatory compliance pushes companies to enhance value propositions. Market participants also emphasize sustainability and total lifecycle cost reduction, aligning their strategies with global trends and customer expectations for reliable and efficient wastewater recovery solutions.

Recent Developments

- In March 2025, Zimmer America Recycling Solutions introduced a new wastewater recycling system for plastics recycling wash lines, designed to reduce freshwater use. Announced via industry channels, this development shows the industry’s move toward integrating recovery systems into specific manufacturing processes for environmental and cost benefits.

- During the Maha Kumbh 2025 in India, temporary wastewater treatment systems like the Hybrid Granular Sequencing Batch Reactor were deployed to manage high organic loads from millions of visitors. Despite treating significant volumes, ongoing pollution in the Ganga and Yamuna rivers prompted calls for improved systems, illustrating the industry’s real-world testing and adaptation to mass-scale demands.

- In February 2024, Veolia launched its decarbonizing, depolluting and resource regenerating strategy for the period 2024-2027, which is aimed at three key growth areas through an investment of approximately USD 2 billion. This measure is aimed at consolidating Veolia’s position in the global market of wastewater recovery systems.

- In January 2023, Koch Separation Solutions (KSS) and Aqana announced their strategic cooperation regarding the use of anaerobic wastewater treatment technology for industrial purposes throughout North America. This union will bring together the expertise of KSS & Aqana for their clients, including MBR, MBBR and RO systems for industrial aww applications. KSS’s growth plans include serving & improving the service of ozone wastewater treatment systems.

Market Concentration & Characteristics

The Wastewater Recovery System Market displays moderate to high concentration, with a few prominent global manufacturers holding significant market share alongside several specialized regional players. It features a broad spectrum of technologies, including advanced membrane filtration, ion exchange, and activated carbon systems, designed to address varying industry needs. Market participants differentiate offerings by integrating automation, digital monitoring, and energy-efficient features, appealing to industries with strict regulatory and operational requirements. The market responds to demand from diverse end-use sectors, including pharmaceuticals, oil and gas, chemicals, and food and beverages, each seeking customized solutions for water reuse and compliance. Barriers to entry remain notable due to high initial investment, complex system integration, and the need for advanced technical expertise. Product innovation, service reliability, and strong after-sales support define market competition, while sustainability and cost-efficiency guide purchasing decisions across developed and emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Global investments in water reuse programs will drive higher adoption of wastewater recovery systems.

- Technological breakthroughs in membrane efficiency and energy recovery will enhance system performance.

- Integration of AI and IoT will enable smarter, predictive maintenance and improve operational uptime.

- Decentralized and modular system designs will support flexible deployment across varied site conditions.

- Stricter environmental regulations will push industries toward advanced recovery solutions.

- Public–private partnerships will expand infrastructure funding and accelerate deployment.

- Growing demand from emerging economies will open new markets and diversification opportunities.

- Focus on carbon neutrality will encourage solutions that reduce energy consumption and emissions.

- Expansion into non-industrial sectors like agriculture and municipal parks will broaden application scope.

- Vendor emphasis on service excellence and digital platforms will enhance customer retention and market loyalty.