Market Overview

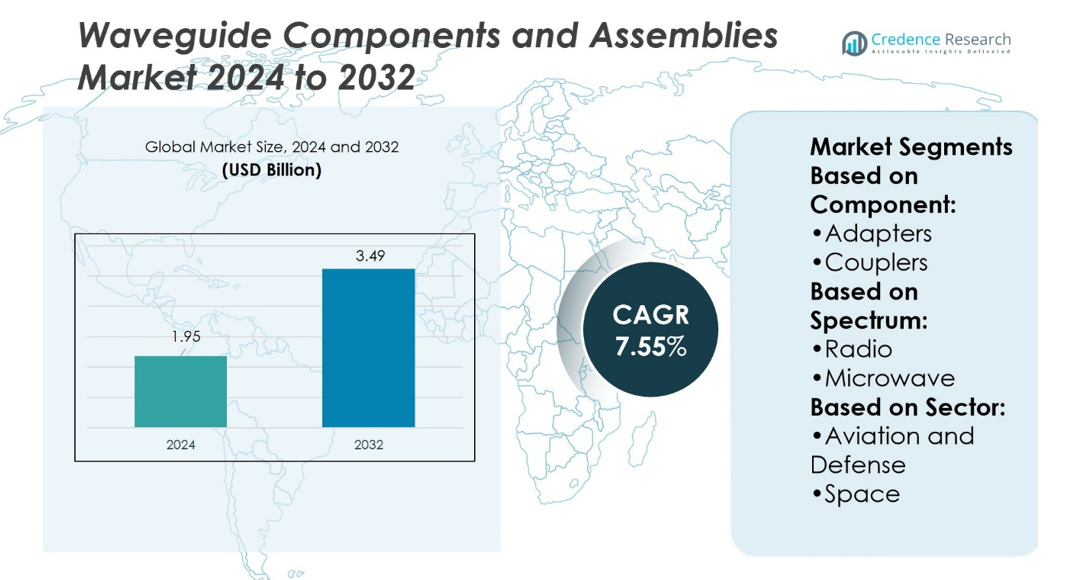

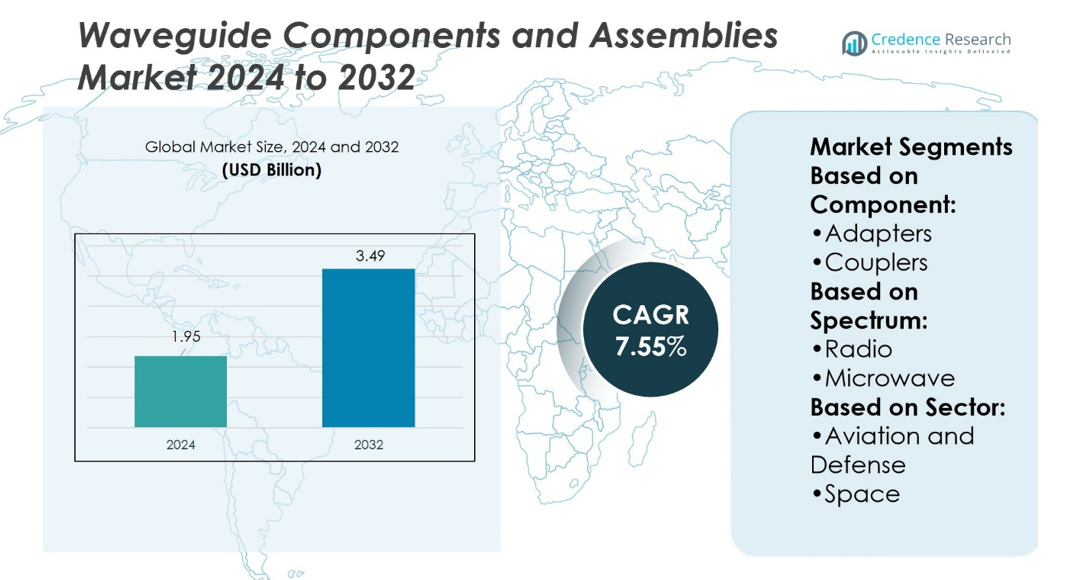

Waveguide Components and Assemblies Market size was valued at USD 1.95 billion in 2024 and is anticipated to reach USD 3.49 billion by 2032, at a CAGR of 7.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Waveguide Components and Assemblies Market Size 2024 |

USD 1.95 billion |

| Waveguide Components and Assemblies Market, CAGR |

7.55% |

| Waveguide Components and Assemblies Market Size 2032 |

USD 3.49 billion |

The Waveguide Components and Assemblies Market grows with rising demand for high-frequency communication, defense radar, and satellite systems. Drivers include increasing deployment of 5G networks, expansion of space programs, and adoption of advanced radar for surveillance and navigation. It supports secure, low-loss signal transmission in critical aerospace and defense operations. Trends highlight miniaturization, lightweight materials, and adoption of 3D printing to design complex geometries. Manufacturers focus on high-power and high-bandwidth solutions to meet growing data needs. Expanding use in industrial automation and medical imaging further strengthens market opportunities across diverse sectors with emphasis on precision and reliability.

North America leads the Waveguide Components and Assemblies Market with strong defense and satellite programs, while Europe follows with aerospace and industrial applications. Asia Pacific shows rapid growth driven by 5G expansion, space missions, and defense modernization. Latin America and the Middle East & Africa contribute steadily through telecom upgrades and radar investments. Key players include ETL Systems, Ferrite Microwave Technologies, Globes Elektronik GmbH, Millimeter Wave Products Inc., European EMC Products Ltd., Logus Microwave, Kete Microwave Electronics, Amplitech, Anello Photonics, and Space Machine & Engineering.

Market Insights

- Waveguide Components and Assemblies Market size was valued at USD 1.95 billion in 2024 and is expected to reach USD 3.49 billion by 2032, at a CAGR of 7.55%.

- Rising demand for high-frequency communication, defense radar, and satellite systems drives market growth.

- Miniaturization, lightweight materials, and 3D printing adoption shape product development trends.

- Strong competition exists with companies focusing on innovation, high-power assemblies, and global expansion strategies.

- High manufacturing costs and complex design requirements act as restraints for smaller players.

- North America leads with defense and satellite adoption, while Europe follows with aerospace and industrial growth.

- Asia Pacific records rapid expansion with 5G and space missions, while Latin America and Middle East & Africa sustain steady demand through telecom and radar investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for High-Frequency Communication in Aerospace and Defense Applications

The Waveguide Components and Assemblies Market benefits from rising demand in aerospace and defense sectors. Military radar, satellite links, and electronic warfare systems require precise, low-loss transmission paths. It ensures high performance under harsh conditions and delivers stable signals across wide frequency bands. Waveguide assemblies provide superior power handling compared to coaxial alternatives. Defense programs expand their radar coverage and invest in advanced signal detection, increasing demand. Manufacturers strengthen supply chains to support military-grade specifications.

- For instance, Ferrite Microwave Technologies offers high-power waveguide components from 50 W up to 50 MW, covering frequencies from 50 MHz to 50 GHz—spanning UHF to Ka-band bands—enabling integration with both sub-6 GHz and millimeter-wave 5G infrastructure.

Expansion of 5G Infrastructure and Next-Generation Wireless Networks

The deployment of 5G networks drives adoption of advanced waveguide components. High-frequency millimeter-wave applications require low-loss connectors, bends, and filters. The Waveguide Components and Assemblies Market grows with increasing base station installations worldwide. It supports reliable communication in densely populated areas with rising data traffic. Telecom operators deploy waveguide assemblies to enable efficient backhaul and fronthaul networks. Growth in smart devices and IoT ecosystems further increases need for robust signal transmission.

- For instance, Millimeter Wave Products Inc. (Mi-Wave) operates a 25,000 sq ft manufacturing facility in St. Petersburg, Florida, equipped with advanced labs, test rooms, and a specialized anechoic chamber.

Technological Advancements in Satellite Communication and Space Exploration

Satellite operators demand compact, lightweight, and efficient waveguide assemblies to improve bandwidth. The Waveguide Components and Assemblies Market benefits from the launch of new communication satellites and space missions. It enables high-capacity data transmission between ground stations and orbiting platforms. Companies invest in miniaturized waveguide solutions to optimize payload space. New satellite constellations for broadband internet create continuous demand. Government agencies and private firms expand investments to support global connectivity goals.

Rising Industrial Automation and Medical Imaging Applications

Waveguide components play a critical role in industrial and healthcare sectors. The Waveguide Components and Assemblies Market supports precision in imaging systems, process monitoring, and non-destructive testing. It ensures low-interference data transfer in automated manufacturing lines. Medical imaging devices such as MRI scanners integrate waveguide assemblies for signal accuracy. Expanding industrial IoT systems increase demand for efficient transmission hardware. Companies adopt high-quality assemblies to reduce downtime and strengthen productivity.

Market Trends

Integration of Waveguide Components in Millimeter-Wave Technologies

The Waveguide Components and Assemblies Market shows strong adoption in millimeter-wave systems. It supports high-frequency bands required for advanced radar, automotive sensors, and wireless backhaul. Millimeter-wave applications demand precise waveguide filters, couplers, and terminations. Manufacturers introduce compact designs to improve system integration without reducing efficiency. Research on 28 GHz and 39 GHz bands drives development of specialized assemblies. Market participants focus on precision machining and advanced coatings to maintain performance.

- For instance, Logus Microwave’s WR28 series waveguide switch covers a frequency range of 26.5 to 40 GHz, with a maximum insertion loss of just 0.15 dB and isolation of 55 dB, enabling efficient, low-loss switching in dense mm-wave systems.

Shift Toward Miniaturization and Lightweight Materials

Manufacturers emphasize smaller and lighter assemblies to meet aerospace, defense, and satellite needs. The Waveguide Components and Assemblies Market benefits from demand for compact solutions in payload-constrained environments. It enables efficient performance without adding significant weight. Lightweight alloys and advanced composites improve durability under vibration and thermal stress. Companies enhance designs to maintain low insertion loss in reduced footprints. Demand rises for hybrid components combining strength with space efficiency.

- For instance, Amplitech’s APTW6-06700775-50K10-112-D6 is a high-gain waveguide amplifier in a compact package (2.5 in × 3.75 in). It covers 6.7 to 7.75 GHz, delivers 60 dB gain (minimum), with a noise figure of 0.7 dB.

Growing Use of 3D Printing and Advanced Manufacturing Methods

Producers adopt additive manufacturing to design complex waveguide geometries. The Waveguide Components and Assemblies Market leverages 3D printing to reduce prototyping costs and speed product development. It allows creation of intricate bends and twists with high accuracy. Manufacturers optimize production cycles by reducing material waste and lead times. Advanced processes support customized assemblies for niche frequencies. Broader adoption of additive techniques improves scalability across multiple end-use industries.

Increased Focus on High-Power and High-Bandwidth Applications

Rising demand for high-power radar and broadband satellite communication drives product innovation. The Waveguide Components and Assemblies Market addresses requirements for higher bandwidth and stronger thermal stability. It supports transmission of large data volumes with minimal loss. Engineers design assemblies capable of handling several kilowatts of power. New materials improve resistance against heat and electromagnetic interference. Market players introduce reinforced connectors and flanges to ensure reliability in critical operations.

Market Challenges Analysis

High Manufacturing Costs and Complex Design Requirements

The Waveguide Components and Assemblies Market faces challenges linked to high production costs and complex design standards. Precision machining and specialized materials increase expenses, especially for aerospace and defense applications. It requires strict adherence to tolerance levels to ensure minimal signal loss. Custom designs for satellite, radar, and telecom sectors further add to development costs. Smaller manufacturers struggle to compete with large firms that maintain advanced facilities. Limited scalability of complex components slows mass adoption in cost-sensitive markets.

Supply Chain Limitations and Maintenance Constraints

Global supply chain disruptions create barriers in sourcing critical metals and alloys. The Waveguide Components and Assemblies Market experiences delays in delivery of connectors, flanges, and other subcomponents. It raises costs for end-users and affects long-term contracts. Maintenance is also challenging due to the delicate structure of waveguides. Specialized skills are required to repair or replace damaged assemblies in high-frequency systems. Limited availability of trained personnel in emerging regions restricts faster adoption across industrial and medical applications.

Market Opportunities

Expanding Role of Satellite Communication and Space Programs

The Waveguide Components and Assemblies Market holds strong opportunities in satellite communication and space exploration. Government agencies and private firms launch constellations that require compact and durable assemblies. It supports high-data transmission across intercontinental and remote regions. Lightweight designs with advanced thermal stability address payload constraints in orbital platforms. Companies that deliver miniaturized, reliable solutions gain access to new contracts. Growing demand for broadband connectivity from space opens pathways for rapid adoption.

Adoption in Emerging Industrial and Healthcare Applications

Industrial automation and medical imaging create promising opportunities for waveguide suppliers. The Waveguide Components and Assemblies Market enables precise signal transfer in MRI scanners, non-destructive testing, and factory IoT systems. It ensures uninterrupted performance in demanding environments with strict accuracy requirements. Industries adopt high-quality assemblies to reduce interference and improve efficiency. Healthcare equipment manufacturers integrate specialized components to meet rising diagnostic needs. Expanding use across non-traditional applications increases the addressable market for global players.

Market Segmentation Analysis:

By Component

The Waveguide Components and Assemblies Market is segmented by component into adapters, couplers, loads and filters, isolators and circulators, duplexers, phase shifters, power combiners, pressure windows, and others. Adapters and couplers remain essential for flexible system integration in aerospace, defense, and telecom applications. It supports precise connectivity between different devices while minimizing signal losses. Isolators and circulators protect sensitive equipment and ensure stable signal flow, particularly in high-frequency radar systems. Loads and filters manage unwanted frequencies, while phase shifters play a critical role in phased-array radar technology. Power combiners and duplexers improve efficiency in transmitting and receiving systems, while pressure windows maintain performance under demanding environmental conditions.

- For instance, Quantic M-Wave delivered WR28 high-power circulators that integrate a termination and waveguide run into a single assembly, designed for operation at 35 GHz. These custom components streamline system integration while maintaining performance in compact form factors.

By Spectrum

The market is divided by spectrum into radio, microwave, EO/IR, ultraviolet, X-ray, and gamma ray. Radio and microwave segments dominate with widespread use in communication, radar, and navigation systems. It ensures reliable data transmission across civilian and military platforms. EO/IR systems expand adoption in surveillance and targeting solutions for defense and space. Ultraviolet, X-ray, and gamma ray applications find use in scientific research, imaging, and specialized industrial processes. Rising reliance on high-frequency bands strengthens demand for advanced assemblies that deliver low-loss performance.

- For instance, Ducommun’s PCC series crossguide directional couplers operate across 18 to 110 GHz. They offer a standard coupling level of 20 dB, and deliver shorter insertion length with lower insertion loss than multi-hole alternatives.

By Sector

The Waveguide Components and Assemblies Market is segmented by sector into aviation and defense, and space. Aviation and defense hold a strong share due to heavy deployment in radar, missile guidance, and secure communication systems. It supports mission-critical operations by delivering high reliability and minimal interference. Space emerges as a high-growth sector with demand for lightweight, durable, and thermally stable assemblies. Satellite constellations, broadband services, and deep-space exploration programs expand opportunities for waveguide suppliers. The focus on compact, miniaturized assemblies strengthens adoption across both segments, making them vital to the industry’s future growth.

Segments:

Based on Component:

Based on Spectrum:

Based on Sector:

- Aviation and Defense

- Space

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 34% share of the Waveguide Components and Assemblies Market in 2024, driven by strong demand in defense, aerospace, and communication systems. The United States leads the region with extensive investments in radar, electronic warfare, and 5G network infrastructure. It supports high adoption of waveguide assemblies in military programs, satellite communication, and air traffic control systems. Canada contributes through demand for satellite broadband and aviation applications, while defense contractors in both countries procure advanced components meeting strict specifications. Leading manufacturers in the region strengthen their supply chains to deliver precision products aligned with military standards. Continuous funding for space exploration projects such as NASA’s deep-space missions further expands opportunities for high-frequency waveguide solutions.

Europe

Europe captured 27% share of the Waveguide Components and Assemblies Market in 2024, supported by aerospace, satellite, and industrial automation sectors. Countries such as Germany, France, and the United Kingdom drive adoption through strong defense programs and satellite communication initiatives. It benefits from the European Space Agency’s projects that require lightweight, compact, and durable assemblies. Defense modernization programs focus on radar upgrades, secure communications, and electronic countermeasure systems. Industrial users adopt waveguide components for advanced imaging and non-destructive testing solutions. Local suppliers collaborate with research institutions to develop innovative designs suited for both defense and commercial aerospace. Increasing emphasis on secure connectivity and industrial automation supports continuous regional demand.

Asia Pacific

Asia Pacific held 29% share of the Waveguide Components and Assemblies Market in 2024, making it a critical growth region. China, Japan, South Korea, and India invest heavily in defense, satellite launches, and high-speed communication networks. It experiences rising adoption in 5G infrastructure, military radar, and space exploration programs. China expands satellite communication networks while India’s ISRO advances its space missions, fueling demand for compact and reliable assemblies. Japan and South Korea contribute through adoption in automotive radar and industrial automation. Regional manufacturers innovate in lightweight materials to support payload optimization in satellites. Expanding government budgets for defense and space programs continue to strengthen the role of Asia Pacific in the market.

Latin America

Latin America represented 6% share of the Waveguide Components and Assemblies Market in 2024, supported by growing demand in aerospace and communication applications. Brazil leads with investments in satellite programs and defense modernization, while Mexico focuses on expanding telecom infrastructure. It faces challenges of limited local manufacturing capabilities, driving dependence on imports from North America and Europe. Regional demand remains steady with growth in broadcasting, radar surveillance, and aviation systems. Partnerships with global suppliers help Latin American countries access advanced assemblies tailored to local requirements. Continuous efforts to expand satellite connectivity and defense capabilities provide long-term opportunities for suppliers.

Middle East and Africa

The Middle East and Africa accounted for 4% share of the Waveguide Components and Assemblies Market in 2024, driven by defense procurement and communication projects. Gulf countries invest in radar surveillance, secure communications, and space exploration programs. It benefits from partnerships with international firms that supply advanced assemblies for military and aerospace systems. Africa’s demand is rising slowly, supported by telecommunication upgrades and early adoption of satellite-based connectivity. Regional governments emphasize strengthening defense capabilities and improving secure communication networks. Limited local production capabilities create opportunities for international suppliers to expand their presence in the region. Growing reliance on defense and satellite services continues to sustain market demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ETL Systems

- Ferrite Microwave Technologies

- Globes Elektronik GmbH

- Millimeter Wave Products Inc.

- European EMC Products Ltd.

- Logus Microwave

- Kete Microwave Electronics Co. Ltd.

- Amplitech

- Anello Photonics Inc.

- Space Machine & Engineering

Competitive Analysis

The competitive landscape of the Waveguide Components and Assemblies Market features including ETL Systems, Ferrite Microwave Technologies, Globes Elektronik GmbH, Millimeter Wave Products Inc., European EMC Products Ltd., Logus Microwave, Kete Microwave Electronics Co. Ltd., Amplitech, Anello Photonics Inc., and Space Machine & Engineering. The Waveguide Components and Assemblies Market remains highly competitive with a strong focus on technological advancement and application-specific solutions. Companies prioritize research and development to improve signal transmission, reduce insertion loss, and enhance durability under high-frequency conditions. The market shows a clear trend toward miniaturization and lightweight designs to support aerospace, defense, and satellite applications. Suppliers emphasize customization to meet the precise needs of telecom operators, military programs, and space agencies. Strategic partnerships with defense contractors, satellite providers, and industrial firms expand access to global markets. Continuous innovation, efficient manufacturing practices, and strong distribution networks remain critical factors that shape competition in this sector.

Recent Developments

- In February 2025, Climeon commissioned its first land-based HeatPower genset at Landmark Power Holdings’ Rhodesia plant in the UK, demonstrating the potential of ORC-based waste heat recovery for efficient, low-carbon power generation in flexible gas engine plants.

- In February 2025, Siemens Energy, and NEM Energy signed a new deal in order to deliver two horizontal Heat Recovery Steam Generators (HRSGs) for a new combined cycle power plant in Texas, USA. An estimated 1.2 GW will be produced by the facility when it is finished.

- In May 2024, Quantic Electronics acquired M Wave Design, enhancing its capabilities in the market. M Wave Design’s expertise in advanced waveguide systems strengthens Quantic’s portfolio, supporting growth in telecommunications, aerospace, and defense sectors. This acquisition aims to drive innovations in signal transmission and component performance.

- In 2024, Northrop Grumman shipped satellites for Space Norway’s Arctic Satellite Broadband Mission, featuring their GEOStar-3 platform. This mission highlights the growing importance of advanced waveguide components in ensuriIng efficient satellite communications, crucial for both commercial and military applications in polar regions.

Report Coverage

The research report offers an in-depth analysis based on Component, Spectrum, Sector and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-frequency waveguide assemblies will grow with advanced radar and 5G expansion.

- Miniaturized and lightweight designs will gain importance in aerospace and satellite applications.

- Adoption of 3D printing will accelerate production of complex waveguide components.

- Defense modernization programs will strengthen investments in secure communication systems.

- Satellite constellations for global broadband will expand opportunities for compact assemblies.

- Industrial automation will increase usage of waveguide components in testing and monitoring systems.

- Medical imaging equipment will integrate more precise assemblies to improve diagnostic accuracy.

- Research on high-power and high-bandwidth applications will drive product innovation.

- Global supply chains will shift toward regionalized production for critical microwave components.

- Sustainability goals will encourage the use of advanced materials with higher energy efficiency.