Market Overview:

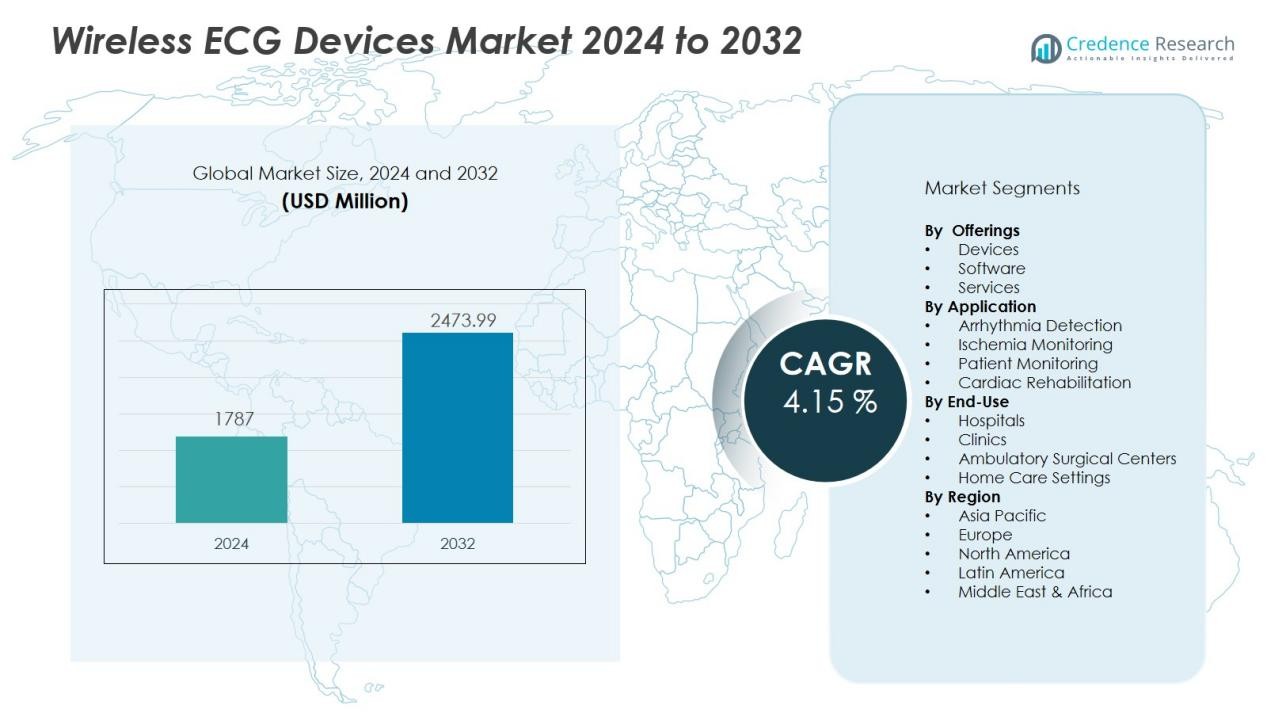

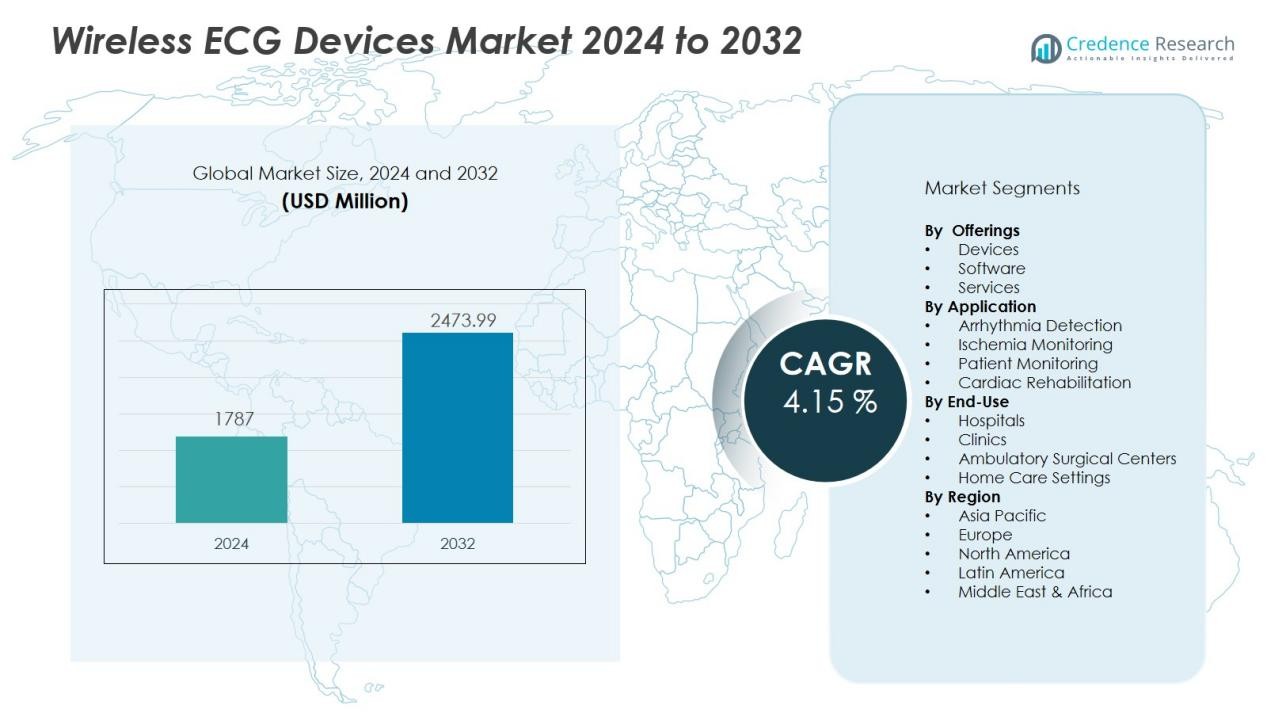

The wireless ecg devices market size was valued at USD 1787 million in 2024 and is anticipated to reach USD 2473.99 million by 2032, at a CAGR of 4.15 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wireless ECG Devices Market Size 2024 |

USD 1787 Million |

| Wireless ECG Devices Market, CAGR |

4.15 % |

| Wireless ECG Devices Market Size 2032 |

USD 2473.99 Million |

Key drivers accelerating demand for wireless ECG devices include the rising global burden of cardiovascular diseases, increased emphasis on remote patient monitoring, and a shift toward early detection and preventive care. Healthcare providers prioritize wearable ECG solutions for their ability to deliver continuous, real-time data and improve patient outcomes. Increasing consumer awareness, integration with mobile health platforms, and supportive regulatory policies contribute to broader market acceptance and ongoing innovation.

Regionally, North America leads the wireless ECG devices market, supported by advanced healthcare systems, high adoption of digital health technologies, and robust reimbursement frameworks. Europe maintains a significant market share due to strong government initiatives and growing telemedicine usage, while Asia-Pacific is poised for the fastest growth, driven by expanding healthcare access, urbanization, and rising chronic disease prevalence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The wireless ECG devices market reached USD 1,787 million in 2024 and is projected to grow to USD 2,473.99 million by 2032 at a CAGR of 4.15%.

- Rising cardiovascular disease prevalence and increasing demand for early detection drive adoption of wireless ECG devices in both clinical and home settings.

- Remote patient monitoring and telemedicine expansion support strong market growth, with real-time data integration becoming standard in care delivery.

- Technological advancements such as miniaturization, improved battery life, and smartphone connectivity enhance device usability and patient compliance.

- Stringent regulatory requirements and complex approval processes create barriers for new entrants and may slow the pace of product launches.

- North America holds nearly 40% market share, benefiting from advanced healthcare infrastructure and rapid telehealth adoption, while Europe commands nearly 30% share due to robust policies and expanding telemedicine.

- Asia-Pacific captures nearly 20% share and posts the highest growth rate, supported by expanding healthcare access, rising digital literacy, and strong government investment in health technology.

Market Drivers:

Rising Prevalence of Cardiovascular Diseases Fuels Market Demand:

The global surge in cardiovascular diseases drives consistent demand for advanced diagnostic and monitoring technologies. The wireless ECG devices market benefits from increased screening of at-risk populations and a growing focus on early detection. Healthcare providers now rely on portable ECG systems to monitor patients outside traditional clinical environments. This trend supports continuous monitoring and improved patient outcomes, fueling market expansion.

- For instance, AliveCor’s KardiaMobile 6L, a portable FDA-cleared ECG device, enabled over 1 million users in 2021 to record medical-grade ECGs at home, which contributed to early detection of arrhythmias and reduced the need for unnecessary emergency visits.

Expansion of Remote Patient Monitoring and Telemedicine:

Healthcare systems worldwide prioritize remote patient monitoring to reduce hospital readmissions and manage chronic conditions. The wireless ECG devices market supports this shift by enabling real-time cardiac data collection and seamless integration with digital health platforms. Patients and physicians benefit from instant data sharing, early intervention, and fewer physical visits. It accelerates the transition toward patient-centric, technology-driven care models.

- For instance, KardiaMobile 6L has enabled users to reduce outpatient office visits from 525 to 382 and unplanned arrhythmia admissions from 34 to 11 in a single year, demonstrating a substantial positive clinical impact in remote management settings.

Technological Advancements and Wearable Innovation Accelerate Adoption:

Rapid innovation in wearable medical devices strengthens the wireless ECG devices market by improving device accuracy, user comfort, and data security. Miniaturization and longer battery life enhance device usability and encourage patient compliance. It enables continuous, unobtrusive cardiac monitoring for both ambulatory and high-risk patients. Integration with smartphones and cloud-based platforms supports broader adoption across diverse healthcare settings.

Supportive Regulatory Landscape and Increasing Healthcare Investments:

Governments and regulatory bodies encourage the adoption of digital health technologies through updated standards and reimbursement policies. The wireless ECG devices market benefits from rising public and private investments in healthcare infrastructure, particularly in developed regions. It leverages funding to develop advanced, compliant devices that address evolving patient and provider needs. This support ensures ongoing innovation and widespread access to wireless ECG solutions.

Market Trends:

Integration of Artificial Intelligence and Cloud-Based Analytics Enhances Diagnostic Capabilities:

Rapid advancements in artificial intelligence and cloud computing are reshaping the wireless ECG devices market. Leading manufacturers now incorporate AI-powered algorithms to deliver faster, more accurate arrhythmia detection and predictive analytics. Cloud-based platforms facilitate seamless data sharing between patients and healthcare professionals, supporting continuous monitoring and timely interventions. These innovations allow for real-time, remote diagnostics, reducing the burden on traditional healthcare infrastructure. The market sees rising demand for solutions that combine machine learning with wearable ECG devices to optimize clinical decision-making. It benefits from partnerships between medtech firms and digital health companies focused on next-generation data analytics.

- For instance, AliveCor’s Kardia 12L ECG System—powered by KAI 12L AI trained on 1.75 million ECGs—detects 35 cardiac conditions in under 30 seconds.

Personalization and Consumerization Drive Growth in Wearable ECG Technology:

Shifts toward personalized healthcare and consumer-oriented device design continue to transform the wireless ECG devices market. Device manufacturers introduce user-friendly wearables that offer tailored health insights, empowering individuals to manage cardiac health proactively. The market responds to patient demand for comfortable, discreet, and connected monitoring solutions compatible with smartphones and fitness platforms. Manufacturers prioritize battery longevity, miniaturization, and intuitive interfaces to improve user adoption. It leverages rising health awareness and digital literacy among consumers, making advanced ECG monitoring accessible beyond clinical environments. This trend accelerates the adoption of wireless ECG devices in both preventive and chronic disease management.

- For instance, the Apple Watch Series 10 ECG app achieves 98.5% sensitivity and 99.3% specificity in detecting atrial fibrillation during a 30-second recording session.

Market Challenges Analysis:

Regulatory Complexities and Compliance Hurdles Slow Market Expansion:

Stringent regulatory requirements and complex approval processes challenge growth in the wireless ECG devices market. Companies must meet rigorous safety and performance standards, which can delay product launches and increase development costs. Regulatory bodies demand robust clinical validation and comprehensive data security measures for device approval. These factors create barriers for new entrants and smaller firms seeking market access. It faces ongoing pressure to comply with evolving global standards and adapt quickly to regional regulatory shifts. Failure to meet compliance can result in costly recalls or limited market reach.

Data Privacy Concerns and Technical Limitations Impact User Adoption:

Heightened concerns over data privacy and cybersecurity present significant challenges for the wireless ECG devices market. End users and healthcare providers require strong safeguards to protect sensitive health data during transmission and storage. Technical limitations, such as inconsistent connectivity or limited battery life, can affect device reliability and patient trust. Integration issues with existing electronic health record (EHR) systems further complicate deployment in clinical environments. It must address these challenges to ensure seamless, secure, and user-friendly solutions. Persistent concerns may hinder adoption rates and limit the overall market potential.

Market Opportunities:

Expansion of Remote Patient Monitoring and Home Healthcare Solutions Creates New Revenue Streams:

Widespread adoption of telemedicine and home healthcare services unlocks significant growth opportunities for the wireless ECG devices market. Providers and patients increasingly seek remote cardiac monitoring solutions that enable real-time data sharing and early intervention. Demand rises for portable, easy-to-use devices that support chronic disease management and post-acute care outside hospital settings. It benefits from expanding healthcare infrastructure in emerging economies and greater access to digital health technologies. Market players can capture new segments by developing affordable, scalable solutions tailored for home and community care. This trend accelerates overall market penetration and revenue growth.

Integration with Digital Health Platforms and Artificial Intelligence Drives Innovation:

The shift toward integrated digital health ecosystems drives innovation within the wireless ECG devices market. Device manufacturers explore partnerships with software developers to enable seamless data exchange with electronic health records, mobile health apps, and telehealth platforms. Integration of artificial intelligence and predictive analytics into wireless ECG devices unlocks advanced diagnostic capabilities and personalized care pathways. It positions market leaders to differentiate offerings and meet evolving clinical and consumer expectations. Opportunities grow for companies that deliver interoperable, secure, and intelligent ECG solutions tailored for diverse healthcare environments.

Market Segmentation Analysis:

By Offerings:

The wireless ECG devices market includes devices, software, and services, each contributing to its value chain. Devices hold the largest share, driven by advancements in wearable and portable technologies. Software solutions support real-time data analysis and seamless integration with digital health platforms. Services such as remote monitoring, technical support, and maintenance gain momentum, appealing to both healthcare providers and end users seeking comprehensive solutions.

- For instance, the Bittium Faros 180L wireless ECG device enables at least 14 consecutive days of ECG measurement on a single battery charge, significantly improving the duration and reliability of patient monitoring.

By Application:

The market addresses applications such as arrhythmia detection, ischemia monitoring, patient monitoring, and cardiac rehabilitation. Arrhythmia detection leads adoption, reflecting the need for accurate, continuous cardiac rhythm assessment. Patient monitoring and ischemia monitoring gain traction with the rise of chronic disease management and emphasis on early intervention. Cardiac rehabilitation benefits from wireless ECG devices, enabling remote progress tracking and personalized care plans.

By End-Use:

Hospitals, clinics, ambulatory surgical centers, and home care settings represent key end-use segments. Hospitals command a dominant share due to integration with electronic health records and demand for advanced diagnostics. It records rapid growth in home care settings as telemedicine adoption and consumer self-monitoring rise. Clinics and ambulatory surgical centers leverage wireless ECG devices to support outpatient cardiac monitoring and streamline care delivery.

- For instance, AliveCor’s KardiaMobile device generated 22 million ECG recordings by May 2025 among home users.

Segmentations:

By Offerings:

- Devices

- Software

- Services

By Application:

- Arrhythmia Detection

- Ischemia Monitoring

- Patient Monitoring

- Cardiac Rehabilitation

By End-Use:

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Home Care Settings

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America holds nearly 40% share of the wireless ECG devices market, supported by advanced healthcare infrastructure and high digital literacy. The region benefits from rapid adoption of telehealth solutions and robust reimbursement frameworks that encourage use of wireless cardiac monitoring. Leading companies invest heavily in research and development to maintain a competitive edge and drive product innovation. It experiences steady demand growth, fueled by the rising prevalence of cardiovascular diseases and proactive government health initiatives. The United States drives regional market expansion with widespread clinical integration and consumer uptake of connected health devices. Cross-industry collaborations strengthen the ecosystem for digital health and remote patient management.

Europe :

Europe accounts for nearly 30% share of the wireless ECG devices market, driven by supportive government policies and expanding telemedicine services. Regional demand benefits from well-established healthcare systems and increasing awareness of preventive cardiac care. Leading countries such as Germany, the United Kingdom, and France invest in digital health infrastructure and continuous professional training. It leverages robust regulatory frameworks and funding to accelerate adoption of wearable ECG solutions in both clinical and home settings. The market sees growth in both public and private healthcare sectors, supported by collaborative research and cross-border health initiatives. Strong focus on data protection and interoperability enhances confidence in digital cardiac monitoring.

Asia-Pacific :

Asia-Pacific captures nearly 20% share of the wireless ECG devices market and demonstrates the highest CAGR globally. Rising urbanization, expanding healthcare access, and growing chronic disease incidence drive market expansion across China, India, Japan, and Southeast Asian countries. The region benefits from large, underserved patient populations and increasing government investment in health technology. It experiences rapid adoption of wireless ECG devices in both metropolitan and rural areas, supported by affordable device options and rising digital literacy. Local manufacturers and international players compete to address diverse market needs and regulatory requirements. Strategic partnerships and localization of product offerings further accelerate regional growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The wireless ECG devices market features a competitive landscape shaped by technological innovation, strategic partnerships, and global expansion initiatives. Key players such as SCHILLER, BPL Medical Technologies, NIHON KOHDEN CORPORATION, Medtronic, MediBioSense, General Electric Company, and AliveCor Inc. invest heavily in research and development to launch advanced, user-friendly solutions. It rewards companies that deliver high-accuracy monitoring, seamless connectivity, and strong data security. Leading firms compete by integrating artificial intelligence and cloud-based analytics, improving device portability, and expanding compatibility with digital health platforms. Mergers, acquisitions, and collaborations strengthen distribution networks and broaden product portfolios. The market values agile players that quickly adapt to regulatory changes and evolving consumer needs, ensuring continued leadership and sustained growth.

Recent Developments:

- In January 2025, BPL Medical Technologies unveiled new ultrasound systems (BPL Alpinion XCUBE 60 and XCUBE i8) and AI-enhanced digital radiography solutions at the AOCR conference.

- In February 2025, Medtronic acquired nanotechnology from Nanovis to develop advanced interbody spine fusion devices.

- In March 2025, Launched a strategic alliance with MIT, committing $50 million over five years to accelerate energy innovation.

Market Concentration & Characteristics:

The wireless ECG devices market demonstrates moderate concentration, with a mix of established multinational players and emerging innovators competing for market share. Leading companies invest in research and development to introduce advanced wearable technologies, improve device interoperability, and enhance user experience. It features a dynamic landscape shaped by rapid technological advancements, shifting regulatory standards, and evolving consumer preferences. Strategic collaborations, mergers, and acquisitions further intensify competition while enabling access to new distribution channels and digital health platforms. The market rewards companies that deliver accurate, secure, and user-friendly solutions tailored for diverse healthcare settings.

Report Coverage:

The research report offers an in-depth analysis based on Offerings, Application, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for wireless ECG devices will continue to rise with the global increase in cardiovascular disease incidence.

- Market players will accelerate product innovation to deliver devices with improved accuracy, longer battery life, and user-friendly interfaces.

- Integration with mobile health applications and digital health platforms will become standard, enabling seamless data sharing and remote care.

- Artificial intelligence and advanced analytics will enhance diagnostic capabilities and support real-time clinical decision-making.

- Adoption of wireless ECG devices in home healthcare and outpatient monitoring will expand as telemedicine services become more widespread.

- Regulatory focus on data privacy and device interoperability will shape product development and market access strategies.

- Partnerships between device manufacturers, software developers, and healthcare providers will drive end-to-end cardiac monitoring solutions.

- Emerging markets in Asia-Pacific and Latin America will see accelerated adoption, driven by improving healthcare infrastructure and digital literacy.

- Consumer demand for personalized and preventive healthcare will encourage the design of discreet, comfortable, and connected ECG devices.

- Investment in cybersecurity and data protection will remain a priority to maintain user trust and regulatory compliance across all regions.